Global Telehandler Market Size, Share, And Business Benefits By Type (Compact, High Lift, High Load), By Technology (Less than 5 meters, 5-15 meters, More than 15 meters), By Lift Capacity (Less than 3 tons, 3-10 tons, More than 10 tons), By End-Use (Construction, Forestry, Agriculture, Oil and Gas, Manufacturing Transport and logistics, Power utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148503

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

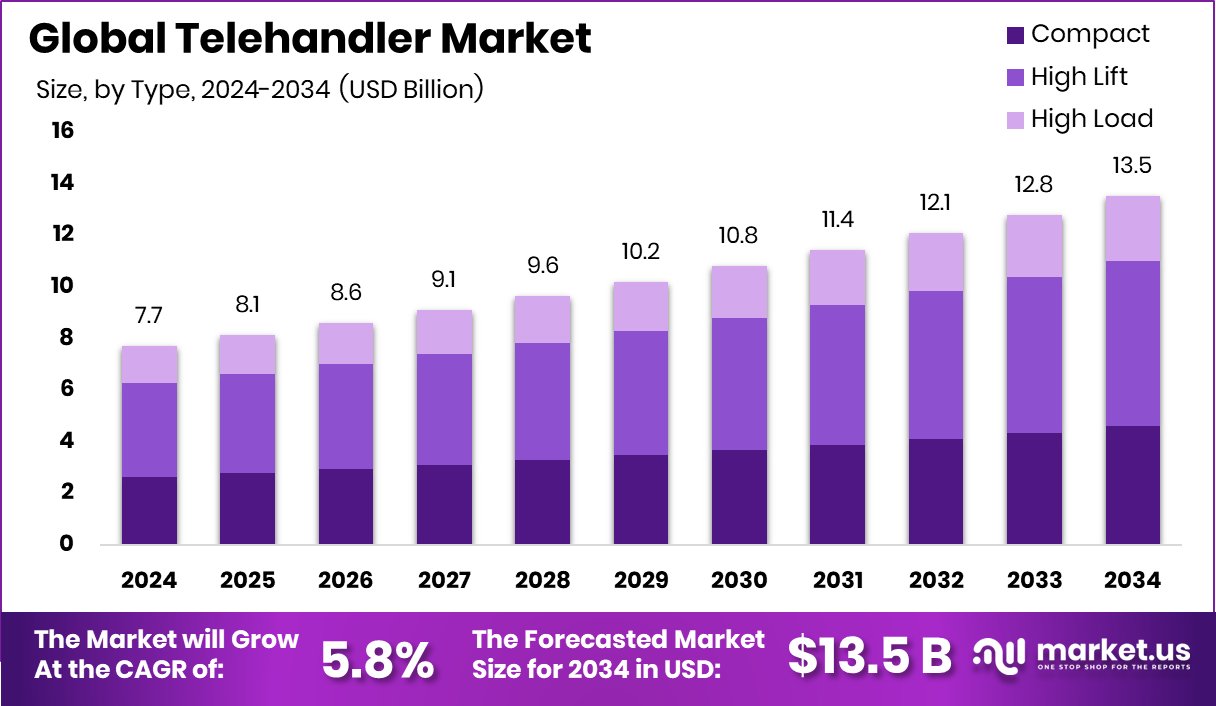

Global Telehandler Market is expected to be worth around USD 13.5 billion by 2034, up from USD 7.7 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034. Asia-Pacific’s industrial expansion propelled the Telehandler Market to a 46.2% share, USD 3.5 Bn.

A telehandler, short for telescopic handler, is a versatile lifting machine equipped with a telescopic boom, capable of lifting, moving, and placing materials in construction, agriculture, and industrial applications. It combines the functions of a crane, forklift, and loader, making it an essential piece of equipment for handling heavy loads at various heights and angles. Its maneuverability and ability to attach various tools, such as buckets, forks, and lifting jibs, make it indispensable for tasks like loading pallets, moving debris, and stacking materials.

The telehandler market is driven by the surge in construction and infrastructure development worldwide. Rapid urbanization and increased investments in commercial and residential projects are fueling demand for advanced lifting equipment that enhances operational efficiency. Additionally, the rising focus on worker safety and the adoption of modern material handling solutions further propel market growth.

Demand for telehandlers is witnessing an upward trend due to their multi-functional capabilities and ability to operate in confined spaces. Industries such as agriculture, logistics, and warehousing increasingly rely on telehandlers for tasks like stacking, loading, and transporting materials, thereby boosting their market demand. Moreover, the integration of eco-friendly and electric-powered models is attracting environmentally conscious customers, expanding the market reach.

SENNEBOGEN has introduced a new telehandler designed to boost operational efficiency in recycling facilities, achieving up to 50% faster work speeds than previous models. Meanwhile, the Maritime Administration (MARAD) has allocated $8.75 million under the Small Shipyard Grant Program, benefiting 15 small shipyards across the United States.

This initiative aims to enhance the capacity and capabilities of smaller shipbuilding facilities nationwide. Additionally, JCB has committed $500 million to expand its manufacturing footprint in North America, a strategic investment poised to bolster production capabilities and drive regional growth.

Key Takeaways

- Global Telehandler Market is expected to be worth around USD 13.5 billion by 2034, up from USD 7.7 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034.

- In the Telehandler Market, high lift models accounted for 47.3%, reflecting strong demand globally.

- Telehandlers with a lifting range of 5-15 meters dominated, capturing 58.4% of market share.

- Models with a lift capacity of 3-10 tons held a significant 51.8% market presence.

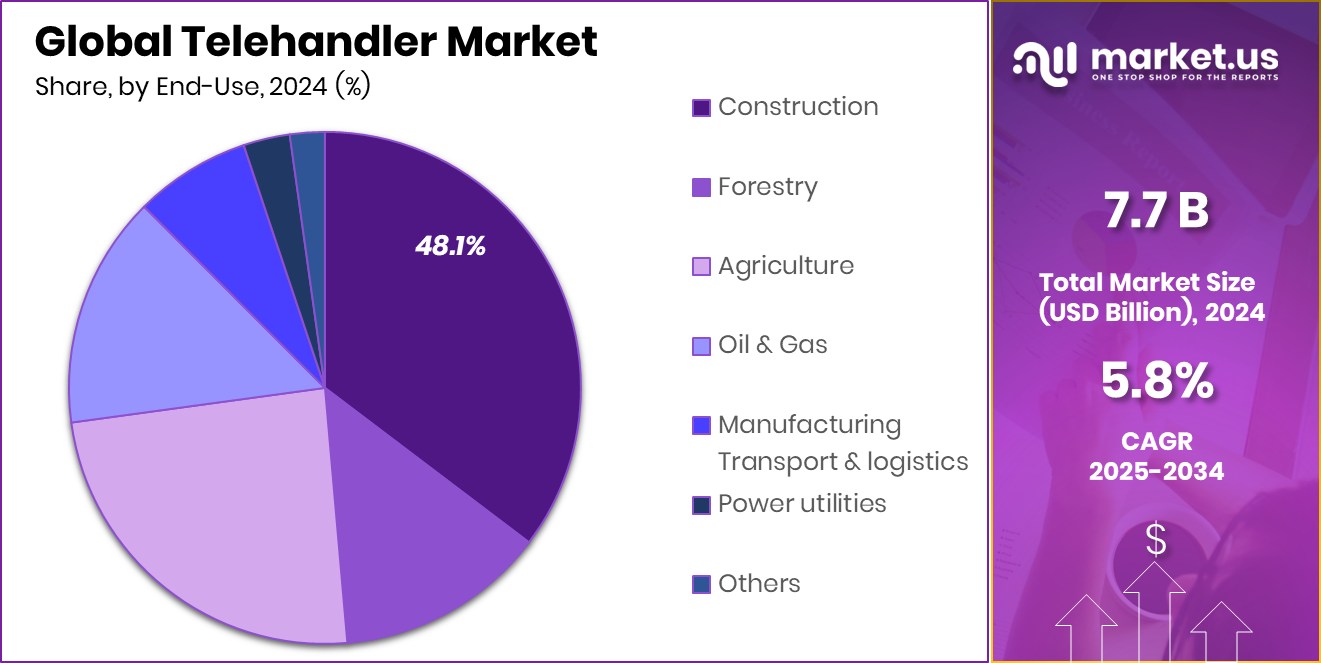

- The construction sector remained the largest end-user, contributing 48.1% to the Telehandler Market.

- Construction projects in Asia-Pacific drove 46.2% Telehandler Market share, USD 3.5 Bn.

By Type Analysis

In the Telehandler Market, High Lift types dominate with a 47.3% share.

In 2024, High Lift held a dominant market position in the By Type segment of the Telehandler Market, with a 47.3% share. This significant share underscores the increasing preference for high lift telehandlers, driven by their extensive reach and superior load-handling capacity. Construction activities heavily rely on these telehandlers for tasks involving material movement at elevated heights, making them a preferred choice in infrastructure projects.

Additionally, the segment’s robust performance is attributed to rising construction investments in urban development and industrial projects, propelling demand for efficient load-lifting equipment. High Lift telehandlers are further favored for their ability to handle heavy materials with enhanced stability and control, aligning with the evolving safety and efficiency standards in construction.

As industries continue to prioritize heavy-duty operations and vertical reach capabilities, the High Lift segment is poised to maintain its leading position, driven by consistent demand from large-scale construction and industrial sectors. The segment’s growth trajectory reflects its pivotal role in enhancing operational efficiency and ensuring safety in high-altitude material handling tasks.

By Technology Analysis

Telehandlers with 5-15 meters technology hold 58.4% market share in 2024.

In 2024, 5-15 meters held a dominant market position in the By Technology segment of the Telehandler Market, with a 58.4% share. This segment’s substantial share underscores its widespread application in construction, logistics, and agriculture, where moderate reach capabilities are essential for material handling and lifting operations. The 5-15 meter telehandlers are particularly favored for their versatility in maneuvering across varying worksite conditions, allowing operators to access mid-level heights effectively.

Additionally, the segment’s prominence is driven by its cost-effectiveness compared to higher reach counterparts, making it an optimal choice for mid-range lifting tasks in small to medium-scale projects. Moreover, the increasing focus on infrastructure development and urban construction has further bolstered demand for 5-15 meter telehandlers, enabling efficient material transportation and site management.

The segment’s dominance is also supported by its compatibility with a broad range of attachments, enhancing operational flexibility across multiple industries. As construction and industrial sectors continue to emphasize productivity and efficiency, the 5-15 meter technology segment is anticipated to maintain its market leadership, driven by its practicality, cost-efficiency, and versatile reach capabilities.

By Lift Capacity Analysis

Lift capacity of 3-10 tons leads with 51.8% market share globally.

In 2024, 3-10 tons held a dominant market position in the By Lift Capacity segment of the Telehandler Market, with a 51.8% share. The segment’s considerable share is driven by its extensive application in construction, logistics, and industrial sectors, where moderate lifting capacities are essential for transporting heavy materials efficiently.

The 3-10 ton telehandlers provide optimal load-handling capabilities, making them a preferred choice for medium-scale operations that require substantial lifting power without compromising maneuverability.

Additionally, the segment’s prominence is reinforced by its adaptability across diverse terrains and worksite conditions, enhancing operational efficiency in complex construction projects. The surge in infrastructure development, coupled with increasing investment in commercial and residential projects, has further propelled the demand for 3-10 ton telehandlers.

Moreover, the segment’s significant market share is also attributed to its cost-effectiveness compared to higher capacity telehandlers, attracting contractors and builders seeking reliable lifting solutions within budget constraints. As the construction sector continues to expand, the demand for mid-range lift capacity telehandlers is expected to remain strong, positioning the 3-10 ton segment as a key contributor to market growth in the foreseeable future.

By End-Use Analysis

The construction end-use sector accounts for 48.1% of the Telehandler Market share.

In 2024, Construction held a dominant market position in the By End-Use segment of the Telehandler Market, with a 48.1% share. This significant share highlights the extensive utilization of telehandlers in construction sites, driven by the need for versatile lifting and material handling equipment capable of operating across varying terrains.

The construction sector’s reliance on telehandlers is underscored by their ability to lift and transport heavy loads efficiently, streamlining workflow processes and enhancing productivity. Additionally, the growing number of infrastructure projects, including commercial buildings, residential complexes, and industrial facilities, has further bolstered the demand for telehandlers within the construction domain.

The segment’s dominance is also fueled by the increasing adoption of telehandlers with advanced attachments, enabling multi-purpose functionality and reducing the need for multiple machines on site. Furthermore, stringent safety regulations and the emphasis on worker safety have accelerated the adoption of telehandlers equipped with enhanced control systems, contributing to the segment’s substantial market share.

As the construction sector continues to expand, particularly in emerging economies, the demand for telehandlers in lifting and material handling operations is anticipated to maintain strong momentum, reinforcing the segment’s market leadership.

Key Market Segments

By Type

- Compact

- High Lift

- High Load

By Technology

- Less than 5 meters

- 5-15 meters

- More than 15 meters

By Lift Capacity

- Less than 3 tons

- 3-10 tons

- More than 10 tons

By End-Use

- Construction

- Forestry

- Agriculture

- Oil and Gas

- Manufacturing, Transport and Logistics

- Power utilities

- Others

Driving Factors

Rising Infrastructure Projects Drive Telehandler Demand

The increasing number of infrastructure projects worldwide is significantly boosting the demand for telehandlers. Governments and private entities are investing heavily in the construction of commercial, residential, and industrial facilities, creating a surge in the need for efficient material handling equipment.

Telehandlers, with their versatile lifting capabilities and ability to navigate challenging terrains, are becoming essential tools in construction sites. Additionally, the growing trend of high-rise building projects has further propelled the demand for telehandlers equipped with extended reach capabilities.

The emphasis on safety and operational efficiency has also led to the adoption of technologically advanced telehandlers, enhancing market growth. As infrastructure development continues, the demand for telehandlers is expected to witness substantial growth in the coming years.

Restraining Factors

High Equipment Costs Limit Telehandler Adoption Rates

The substantial costs associated with purchasing telehandlers pose a significant restraint on market growth. Small and medium-sized construction firms often find it challenging to invest in high-capacity telehandlers due to budget constraints. Additionally, the cost of advanced features, such as extended reach capabilities and modern safety systems, further escalates the overall price, deterring potential buyers.

Moreover, maintenance and repair expenses add to the financial burden, impacting the adoption rates among cost-sensitive end-users. The prevalence of rental services partially offsets this challenge, allowing firms to access telehandlers without the upfront investment.

Growth Opportunity

Electrification Trend Opens New Telehandler Market Avenues

The growing emphasis on sustainable construction practices is creating a significant growth opportunity in the telehandler market through electrification. Manufacturers are increasingly developing electric telehandlers to meet the rising demand for eco-friendly machinery that reduces carbon emissions and operational costs.

These electric models are equipped with advanced battery systems that offer comparable lifting capabilities to conventional diesel-powered telehandlers while minimizing environmental impact. Furthermore, stricter government regulations promoting green construction and the integration of renewable energy solutions are accelerating the shift towards electric telehandlers.

Latest Trends

Smart Technology Integration Enhances Telehandler Efficiency

In 2024, the telehandler market witnessed a significant shift towards the integration of smart technologies, marking a pivotal trend in the industry. Manufacturers are increasingly equipping telehandlers with advanced control systems, safety features, and tracking capabilities. These innovations aim to enhance operational efficiency, reduce accidents, and meet the evolving demands of construction and industrial applications.

The adoption of smart technology not only improves the functionality of telehandlers but also aligns with the industry’s move towards automation and digitalization. As companies prioritize safety and productivity, the incorporation of intelligent systems in telehandlers is becoming a standard, driving the market forward and setting new benchmarks for equipment performance and reliability.

Regional Analysis

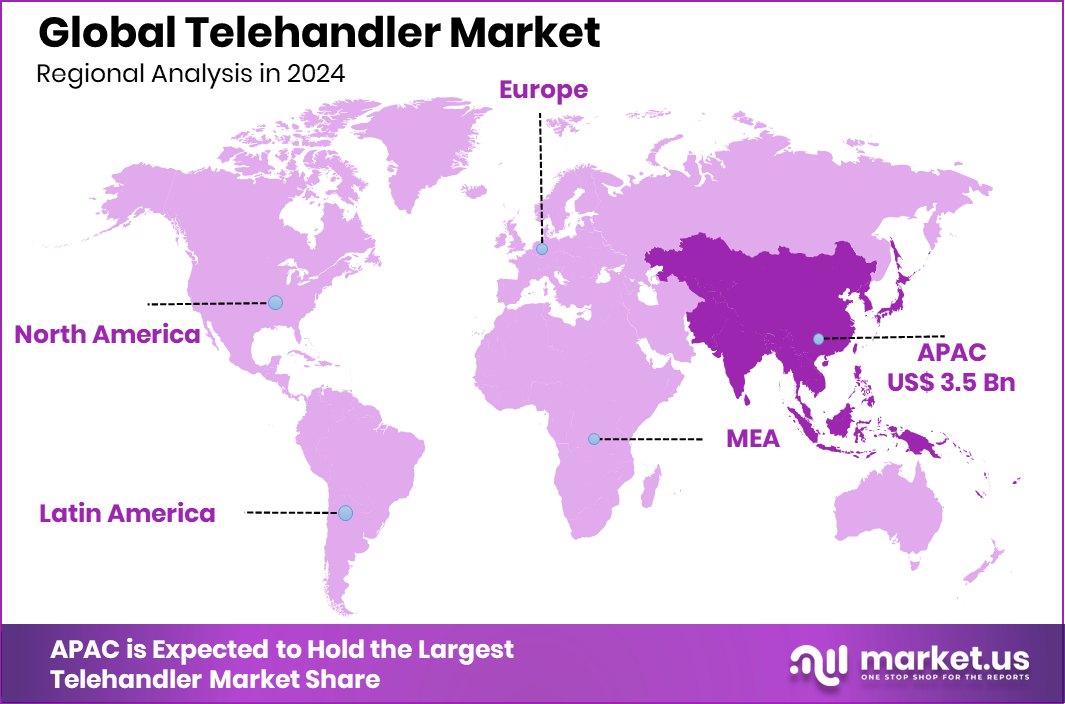

In 2024, Asia-Pacific led the Telehandler Market with 46.2% share, USD 3.5 Bn.

In 2024, Asia-Pacific emerged as the leading region in the Telehandler Market, accounting for a 46.2% share, valued at USD 3.5 billion. This dominance is attributed to robust construction activities across developing economies such as China and India, where rapid infrastructure development continues to drive demand for telehandlers. The region’s substantial market share is further supported by government investments in large-scale construction projects and industrial expansion, propelling the need for efficient material handling equipment.

Meanwhile, North America also witnessed notable growth, driven by the increasing adoption of advanced telehandler technologies in the construction and agricultural sectors. Europe remains a key market, supported by stringent safety regulations and the demand for technologically advanced telehandlers. The Middle East & Africa and Latin America exhibit moderate growth, with rising construction projects and urbanization efforts contributing to the expanding market presence.

However, the Asia-Pacific region’s commanding share underscores its pivotal role in the global Telehandler Market, driven by ongoing construction activities and infrastructure investments. As emerging markets continue to expand, Asia-Pacific is expected to maintain its leadership, supported by increasing demand for high-capacity telehandlers and enhanced operational efficiency.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, JCB maintained its stronghold in the Telehandler Market by leveraging its extensive product range and advanced technological capabilities. The company emphasized the development of fuel-efficient and electric telehandlers, aligning with the increasing demand for sustainable construction equipment. JCB’s commitment to innovation was evident through the launch of new models with enhanced load capacities and safety features, catering to the evolving needs of the construction and industrial sectors.

Caterpillar also strengthened its market position by focusing on expanding its telehandler lineup with robust and durable models designed for high-performance lifting operations. The company capitalized on its global distribution network and after-sales service to secure significant contracts in key markets, particularly in North America and Europe. Caterpillar’s emphasis on operator comfort and safety further positioned it as a preferred choice for large-scale construction projects.

Manitou Group continued to make notable strides in the global Telehandler Market, driven by its strategic focus on compact and electric telehandlers. The company’s efforts to integrate smart technology and remote monitoring systems into its telehandlers resonated well with customers seeking operational efficiency and cost savings.

Top Key Players in the Market

- JCB

- Caterpillar

- Manitou Group

- Haulotte Group

- Dieci Srl

- Merlo S.p.A.

- Bobcat Company

- JLG Industries, Inc.

- Terex Corporation

- Wacker Neuson SE

- CLAAS KGaA mbH

- CNH Industrial

- Liebherr-International AG

- Weidemann GmbH

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Recent Developments

- In November 2024, JCB introduced two new rotating telehandlers with enhanced lifting capacities of 5,800 kg, an increase of 300 kg over previous models. Additionally, they include an Autec radio remote control system and a Stage V JCB Diesel engine paired with a Bosch Rexroth two-speed hydrostatic transmission.

- In November 2023, Merlo launched the Turbofarmer 30.7 and 27.6 models at LAMMA 2024. These compact telehandlers are designed for confined spaces, with the TF30.7 being just 2 meters wide and 2.10 meters high, suitable for traditional farmyard settings.

Report Scope

Report Features Description Market Value (2024) USD 7.7 Billion Forecast Revenue (2034) USD 13.5 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Compact, High Lift, High Load), By Technology (Less than 5 meters, 5-15 meters, More than 15 meters), By Lift Capacity (Less than 3 tons, 3-10 tons, More than 10 tons), By End-Use (Construction, Forestry, Agriculture, Oil and Gas, Manufacturing Transport and logistics, Power utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape JCB, Caterpillar, Manitou Group, Haulotte Group, Dieci Srl, Merlo S.p.A., Bobcat Company, JLG Industries, Inc., Terex Corporation, Wacker Neuson SE, CLAAS KGaA mbH, CNH Industrial, Liebherr-International AG, Weidemann GmbH, Zoomlion Heavy Industry Science & Technology Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- JCB

- Caterpillar

- Manitou Group

- Haulotte Group

- Dieci Srl

- Merlo S.p.A.

- Bobcat Company

- JLG Industries, Inc.

- Terex Corporation

- Wacker Neuson SE

- CLAAS KGaA mbH

- CNH Industrial

- Liebherr-International AG

- Weidemann GmbH

- Zoomlion Heavy Industry Science & Technology Co., Ltd.