Global Taurine Market By Type(Food Grade, Feed Grade, Pharmaceutical Grade), By Form(Tablets, Liquid Based Serum, Other), By Source(Synthetic, Natural), By Application(Food and Beverages, Animal Feed, Dietary Supplements, Cosmetics and Personal Care, Pharmaceuticals, Others), By Region, And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: April 2024

- Report ID: 63360

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

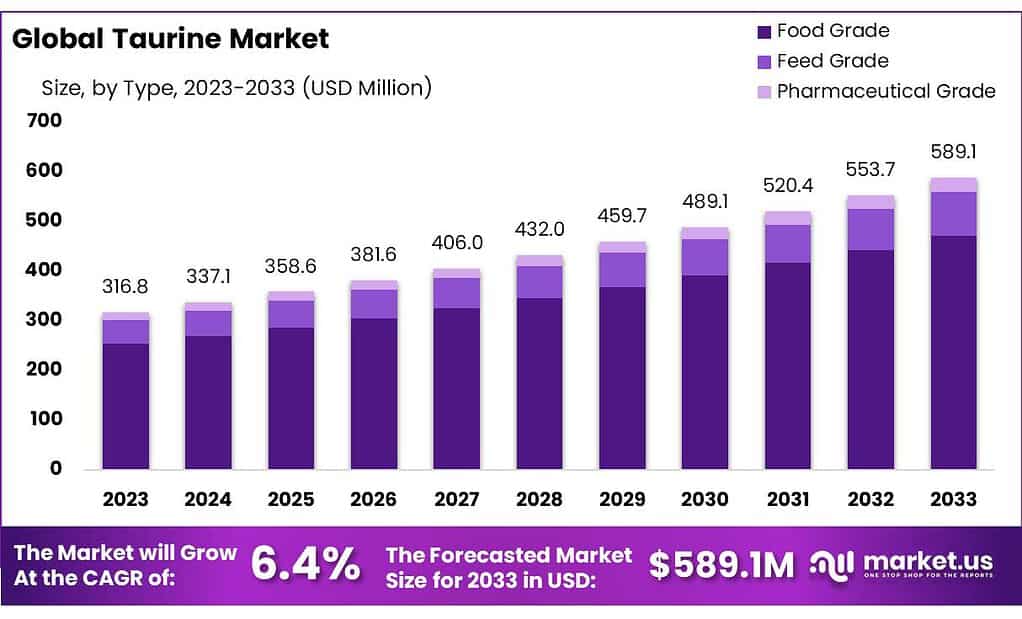

The global Taurine Market size is expected to be worth around USD 589.1 Million by 2033, from USD 316.8 Million in 2023, growing at a CAGR of 6.4% during the forecast period from 2023 to 2033.

The Taurine Market refers to the global industry focused on the production, distribution, and sale of taurine, an amino acid that is important for many bodily functions. Taurine is found naturally in meat, fish, and dairy products, but it is also widely manufactured as a dietary supplement due to its various health benefits. These benefits include supporting cardiovascular health, promoting healthy metabolism, enhancing athletic performance, and contributing to the proper function of the central nervous system and eyes.

In the market, taurine is available in various forms, including powders, capsules, and as an ingredient in energy drinks and functional foods. The demand for taurine has grown significantly, driven by its popularity in the health and wellness sector, the sports nutrition industry, and its inclusion in pet food formulations, particularly for cats, which require taurine in their diets.

The Taurine Market encompasses a range of stakeholders from raw material suppliers and manufacturers to distributors, retailers, and end-users. Market growth is influenced by factors such as rising health consciousness among consumers, the growing popularity of dietary supplements, advancements in food technology, and the expansion of the energy drinks market.

Key Takeaways

- The market expected to reach USD 589.1 Mn by 2033, growing at 6.4% CAGR from USD 316.8 Mn in 2023.

- Food Grade taurine dominates with over 80.4% share in 2023, driven by energy drinks and supplements.

- Tablets lead with 58.5% market share in 2023, followed by Liquid Based Serum and Other forms.

- Synthetic taurine holds over 70.5% market share in 2023 due to cost-effectiveness and consistent quality.

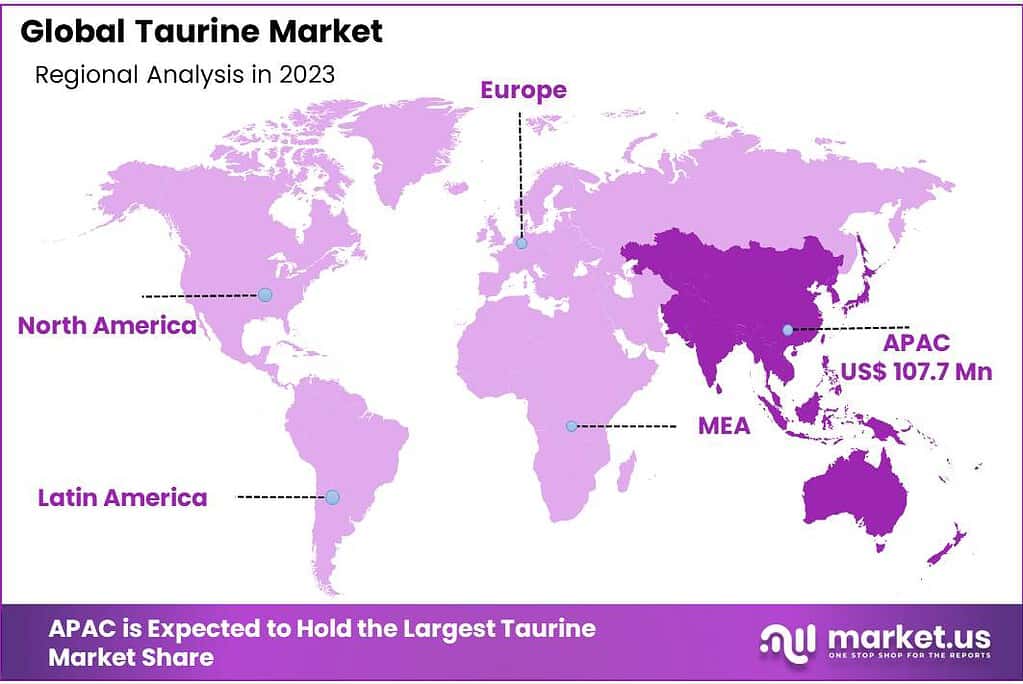

- Asia Pacific leads with 34.6% market share, followed by North America and Europe, driven by rising health consciousness.

By Type

In 2023, Food Grade taurine held a dominant market position, capturing more than an 80.4% share. This significant portion is primarily due to its widespread use in energy drinks, dietary supplements, and functional foods, where taurine is valued for its ability to support metabolic processes and enhance physical performance. The demand in this segment reflects the growing consumer interest in health and wellness products that offer benefits such as improved energy levels and overall well-being.

Feed-grade taurine also occupies a crucial part of the market, especially in pet food formulations for cats and dogs. Taurine is essential for the health of these animals, supporting eye health and heart function. While its market share is smaller compared to food-grade taurine, the importance of feed-grade taurine cannot be understated, with steady demand driven by pet owners’ commitment to providing nutritionally complete diets for their pets.

Pharmaceutical-grade taurine represents a niche but important segment, utilized in medical supplements and therapeutic applications due to its potential benefits in treating conditions such as cardiovascular diseases, diabetes, and neurological disorders. Although this segment has the smallest share, its significance is bolstered by ongoing research and clinical trials exploring new health applications of taurine.

Each of these segments highlights the versatility and essential nature of taurine across different industries, with Food Grade leading the way due to the expanding consumer demand for products that support active and healthy lifestyles.

By Form

In 2023, Tablets held a dominant market position in the Taurine Market, capturing more than a 58.5% share. This form’s popularity stems from its convenience for consumers, offering an easy and precise way to incorporate taurine into their daily health regimen. Tablets are favored for their portability and straightforward dosage, appealing to individuals seeking to benefit from taurine’s health-enhancing properties, such as improved metabolism, enhanced athletic performance, and cardiovascular health.

Liquid Based Serum followed in market share, appealing to those who prefer a more immediate absorption or have difficulty swallowing tablets. This form is particularly popular in the sports and fitness community, where quick absorption can be beneficial for pre-workout and recovery supplements. The liquid form’s versatility also allows it to be mixed into beverages, making it a flexible option for incorporating taurine into diets.

The Other forms category includes powders and capsules, catering to a wide range of consumer preferences and application methods. Powders are versatile and can be easily added to foods and drinks, providing a customizable dosage, while capsules offer a convenient alternative to tablets with similar benefits.

Each of these forms caters to different consumer needs within the Taurine Market, with Tablets leading due to their ease of use, dosage precision, and wide acceptance among health-conscious individuals.

By Source

In 2023, Synthetic taurine held a dominant market position, capturing more than a 70.5% share. This prevalence is largely due to its cost-effectiveness and consistent quality in mass production, making it a go-to source for manufacturers, especially in the energy drinks and dietary supplements sectors. Synthetic taurine’s reliability and availability have ensured its widespread use across various applications, meeting the high demand in markets where natural sources cannot suffice.

Natural taurine, sourced from meat, fish, and dairy, caters to a niche but growing segment of consumers looking for products derived from organic and natural sources. Despite its smaller market share, the demand for natural taurine is on the rise, driven by the growing consumer preference for all-natural and clean-label products. This trend reflects a broader shift towards health and wellness products perceived as being closer to nature.

Both sources of taurine play crucial roles in the market, with Synthetic leading due to its industrial advantages and Natural gaining traction among health-conscious consumers.

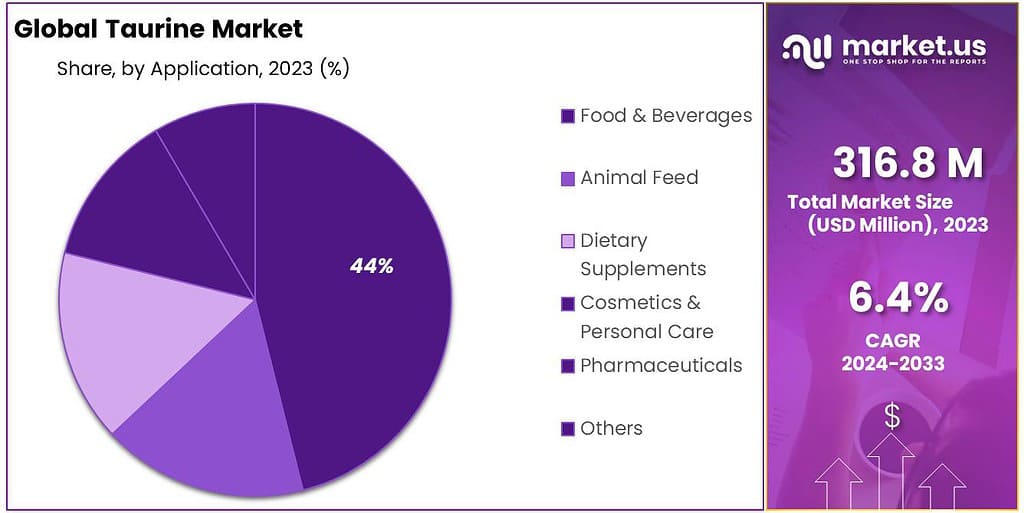

By Application

In 2023, Food and Beverages held a dominant market position in the Taurine Market, capturing more than a 43.6% share. This segment benefits from the widespread use of taurine in energy drinks, functional foods, and sports nutrition products, where taurine is valued for its ability to enhance physical performance and energy levels. The demand in this segment is driven by the growing consumer interest in health and wellness products that support an active lifestyle.

Animal Feed comes next, reflecting taurine’s essential role in pet nutrition, particularly for cats, who require taurine in their diet to prevent health issues. This application underscores the importance of taurine in supporting the health and well-being of domestic animals, with a steady demand fueled by pet owners’ commitment to providing optimal nutrition for their pets.

Dietary Supplements represent another significant segment, where taurine is used for its various health benefits, including cardiovascular health, metabolic support, and as an antioxidant. The popularity of taurine supplements is on the rise, driven by health-conscious consumers seeking to complement their diets with beneficial nutrients.

Cosmetics and Personal Care is a growing segment, utilizing taurine for its hydrating properties and its ability to protect the skin from environmental stressors. Although smaller in market share, the inclusion of taurine in beauty and personal care products highlights the ingredient’s versatility and its appeal in formulations designed to enhance skin health.

Pharmaceuticals also leverage taurine’s therapeutic properties, incorporating it into formulations designed to address specific health conditions, such as heart and eye health. This segment’s growth is influenced by ongoing research into taurine’s potential health benefits and its applications in medical treatments.

Key Market Segments

By Type

- Food Grade

- Feed Grade

- Pharmaceutical Grade

By Form

- Tablets

- Liquid Based Serum

- Other

By Source

- Synthetic

- Natural

By Application

- Food & Beverages

- Animal Feed

- Dietary Supplements

- Cosmetics & Personal Care

- Pharmaceuticals

- Others

Drivers

Surging Demand in Energy Drinks and Dietary Supplements Fuels the Taurine Market

A pivotal driver propelling the Taurine Market forward is the soaring demand for energy drinks and dietary supplements, where taurine is a key ingredient. This surge is underpinned by the global increase in health consciousness and a fast-paced lifestyle that has consumers seeking quick, efficient ways to boost their energy and improve overall wellness. Taurine, known for its various health benefits such as enhancing physical performance, supporting cardiovascular health, and aiding in metabolic processes, has become integral to the formulation of these products.

Energy drinks, popular among young adults and athletes, utilize taurine for its ability to improve endurance and reduce fatigue, making it a staple ingredient in this rapidly growing segment. The market has witnessed a substantial rise in the consumption of energy drinks as consumers increasingly opt for these beverages to meet their lifestyle demands—ranging from prolonged work hours to enhanced physical performance in sports activities. The perception of taurine as a safe and effective energy booster has significantly contributed to its popularity in this sector.

Simultaneously, the dietary supplements market has seen a similar uptrend in the demand for taurine, driven by an expanding base of health-conscious consumers looking to supplement their diet for improved health outcomes. Taurine supplements are marketed for various health-promoting purposes, including supporting heart health, antioxidant protection, and even mood enhancement. This broad spectrum of benefits has made taurine a sought-after component in the supplements industry, appealing to a diverse range of consumers seeking to address specific health concerns or enhance their overall wellbeing.

Moreover, the global shift towards preventive healthcare practices, where individuals proactively incorporate supplements into their lifestyle to prevent health issues, has further fueled the demand for taurine. This trend reflects a deeper understanding of nutritional science and a growing trust in dietary supplements as complementary to a balanced diet and healthy lifestyle.

As manufacturers continue to innovate and expand their product offerings to meet consumer demand, the role of taurine in energy drinks and dietary supplements is expected to remain a key driver for market growth. The ability of taurine to align with the market’s health and wellness trends, coupled with its scientifically backed benefits, positions it as a valuable component in the formulation of products aimed at today’s health-focused consumer.

Restraints

Regulatory Challenges and Health Concern Misconceptions as Restraints in the Taurine Market

A major restraint facing the Taurine Market is the regulatory challenges associated with its use in food and beverages, compounded by misconceptions regarding its health effects. Regulatory bodies worldwide have set stringent guidelines for the inclusion of taurine in consumable products, particularly energy drinks, which are scrutinized due to their caffeine content and target demographic. These regulations vary significantly from one region to another, creating a complex landscape for manufacturers to navigate. The need to comply with diverse regulatory standards can lead to increased production costs and delays in product launches, hindering market growth.

Additionally, there are widespread misconceptions about the health effects of taurine, largely stemming from its association with energy drinks. Public perception often links energy drink consumption to potential health risks, such as heart palpitations and high blood pressure, due to their high caffeine content. However, taurine itself is mistakenly implicated in these concerns, despite scientific evidence supporting its safety and benefits when consumed in appropriate amounts. This misperception can lead to consumer hesitancy, impacting the demand for taurine-containing products.

The impact of these regulatory and perception challenges is further amplified by the growing scrutiny from health organizations and consumer advocacy groups, which call for more research and transparency regarding the effects of long-term taurine consumption. This scrutiny has prompted calls for clearer labeling and marketing practices, placing additional pressure on manufacturers to ensure their products are not only compliant with regulations but also accurately represented to consumers.

Furthermore, the advent of alternative ingredients that offer similar benefits to taurine without the associated regulatory and public perception challenges presents a competitive threat to the taurine market. Manufacturers may opt for these alternatives to streamline regulatory compliance and align with consumer preferences for ingredient transparency and natural product formulations.

Opportunity

Expanding Applications in Health and Wellness Sectors: A Significant Opportunity for the Taurine Market

A notable opportunity for growth within the Taurine Market lies in its expanding applications in the health and wellness sectors, beyond its traditional stronghold in energy drinks. As awareness of taurine’s health benefits continues to grow, there’s a significant potential to broaden its use across various health-focused products, including dietary supplements, functional foods, and even medical applications.

Taurine’s roles in supporting cardiovascular health, enhancing metabolic functions, aiding in the development and function of skeletal muscle, the central nervous system, and the cardiovascular system, alongside its antioxidant properties, position it as a versatile ingredient in the promotion of overall well-being.

The dietary supplements sector, in particular, presents a robust avenue for taurine’s market expansion. With the global rise in preventative health care measures and an increasing number of individuals seeking to supplement their diets with nutrients that support long-term health, taurine can play a pivotal role. Its incorporation into supplements aimed at heart health, diabetes management, weight loss, and even mood stabilization taps into the burgeoning demand for natural and scientifically supported health solutions.

Furthermore, the functional foods market offers another promising opportunity for taurine. As consumers increasingly look for foods that do more than just satiate hunger—seeking out products that offer specific health benefits—formulating foods with added taurine could meet this demand. Whether it’s in fortified breakfast options, health bars, or functional beverages, taurine’s inclusion can enhance the nutritional profile of these products, appealing to health-conscious consumers.

Additionally, the exploration of taurine’s therapeutic potential in pharmaceuticals opens up new horizons for its application. Research into taurine’s efficacy in treating certain medical conditions, such as cardiovascular diseases and diabetes, could lead to its increased use in medical supplements and prescription drugs, further diversifying its market presence.

For market participants, these opportunities underscore the importance of investment in research and development to explore and substantiate new health benefits of taurine. Collaborations with health professionals and regulatory bodies to ensure the safe and effective use of taurine in various applications will also be crucial. By leveraging the growing consumer interest in health and wellness, along with the expanding body of research supporting taurine’s health benefits, the Taurine Market can tap into new sectors, significantly broadening its consumer base and application spectrum.

Trends

The Integration of Taurine in Clean Label and Natural Product Trends

A major trend shaping the Taurine Market is its integration into the burgeoning movement towards clean label and natural products. As consumers increasingly prioritize health and transparency in their dietary choices, there’s a growing demand for products that are not only beneficial to health but also composed of recognizable, minimally processed ingredients.

Taurine, known for its myriad health benefits, including cardiovascular support, metabolic enhancement, and neuroprotective properties, is well-positioned to align with this trend. This amino acid’s natural occurrence in meat, fish, and dairy products lends it an authenticity that resonates with the clean label ethos, appealing to consumers seeking purity and simplicity in their nutrition sources.

The clean label movement, emphasizing products free from artificial additives, colors, flavors, and preservatives, is driving manufacturers to reformulate existing products and innovate new offerings that can meet these consumer expectations. Taurine’s role in this space is twofold: as a naturally derived ingredient, it aligns with the demand for natural products; and as a compound with significant health benefits, it addresses the growing interest in functional foods and supplements that contribute to overall wellness.

Moreover, the trend towards plant-based and vegan diets presents both a challenge and an opportunity for the Taurine Market. While taurine is traditionally sourced from animal products, the development of synthetic taurine offers a way to incorporate this beneficial amino acid into plant-based formulations, making it accessible to a wider range of consumers. This synthetic sourcing must, however, navigate the clean label trend’s emphasis on naturalness, requiring transparent communication and education to reassure consumers of its safety and efficacy.

The demand for natural and clean label products is also prompting regulatory bodies and industry associations to develop clearer definitions and standards for these terms, further shaping the market landscape. For taurine suppliers and manufacturers, staying ahead of these regulatory changes and consumer expectations will be key to capitalizing on this trend.

Regional Analysis

The Asia Pacific region is on track to lead the Taurine Market, capturing an impressive market share of 34.6%. This robust growth is driven by an escalating demand for taurine across a spectrum of applications, including dietary supplements, energy drinks, and pet food, particularly in countries such as China, India, Korea, Thailand, Malaysia, and Vietnam. Factors propelling this market expansion include the dynamic growth of the health and wellness industry, increased economic prosperity, and a growing consumer interest in products that support a healthy and active lifestyle.

In North America, the surge in the health-conscious population and the booming sports nutrition and pet care sectors are expected to significantly boost the demand for taurine. The region’s commitment to innovative health product development, coupled with an increasing inclination towards supplements and foods that promote health and sustainability, positions North America as a key market for taurine.

Europe is also poised for notable growth in the Taurine Market. This upswing is driven by the rising demand for dietary supplements and energy drinks that offer both aesthetic and functional health benefits, in addition to the growing needs of the pet food industry. The stringent European regulations regarding product quality and safety further underscore the importance of taurine in meeting the region’s standards for health and wellness products, enhancing its use in a variety of applications.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Taurine Market is characterized by a competitive landscape with several key players contributing to its growth and innovation. These companies have established significant positions through strategic initiatives, product diversification, and global expansion. Here’s an analysis of some of the notable players in the Taurine Market

Market Key Players

- Qianjiang Yongan Pharmaceutical Co. Ltd.

- Ajinomoto Co., Inc

- AuNutra Industries Inc.

- China grand pharmaceutical

- Foodchem International Corporation

- Fuchi Pharmaceutical Co. Ltd

- Hebi City Hexin Chem Ind. Co., Ltd.

- Jiangsu Yuanyang Pharmaceutical co. ltd.

- Jiangyin Huachang Food Additive Co.Ltd

- Kyowa Hakko Bio Co., Ltd.

- Mitsui Chemicals, Inc.

- MTC Industries Inc.

- New Zealand Pharmaceuticals Ltd.

- Penta Manufacturing Company

- QianjiangYongan Pharmaceutical Co., Ltd.

- Stauber USA.

- Taisho Pharmaceutical Holdings Co. Ltd.

- The Honjo Chemical Corporation

Recent Development

In 2024, Qianjiang Yongan Pharmaceutical Co. Ltd. continued to strengthen its position in the taurine sector, with further investments in production capacity and distribution channels.

In 2024 Ajinomoto, the company sustained its momentum in the taurine sector, with strategic investments in research and development to explore novel applications and market opportunities.

Report Scope

Report Features Description Market Value (2023) USD 316.8 Mn Forecast Revenue (2033) USD 589.1 Mn CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Food Grade, Feed Grade, Pharmaceutical Grade), By Form(Tablets, Liquid Based Serum, Other), By Source(Synthetic, Natural), By Application(Food and Beverages, Animal Feed, Dietary Supplements, Cosmetics and Personal Care, Pharmaceuticals, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Qianjiang Yongan Pharmaceutical Co. Ltd., Ajinomoto Co., Inc, AuNutra Industries Inc., China grand pharmaceutical, Foodchem International Corporation, Fuchi Pharmaceutical Co. Ltd, Hebi City Hexin Chem Ind. Co., Ltd., Jiangsu Yuanyang Pharmaceutical co. ltd., Jiangyin Huachang Food Additive Co.Ltd, Kyowa Hakko Bio Co., Ltd., Mitsui Chemicals, Inc., MTC Industries Inc., New Zealand Pharmaceuticals Ltd., Penta Manufacturing Company, QianjiangYongan Pharmaceutical Co., Ltd., Stauber USA., Taisho Pharmaceutical Holdings Co. Ltd., The Honjo Chemical Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Taurine Market?Taurine Market size is expected to be worth around USD 589.1 Million by 2033, from USD 316.8 Million in 2023

What CAGR is projected for the Taurine Market?The Taurine Market is expected to grow at 6.4% CAGR (2023-2032).Name the major industry players in the Taurine Market?Qianjiang Yongan Pharmaceutical Co. Ltd., Ajinomoto Co., Inc, AuNutra Industries Inc., China grand pharmaceutical, Foodchem International Corporation, Fuchi Pharmaceutical Co. Ltd, Hebi City Hexin Chem Ind. Co., Ltd., Jiangsu Yuanyang Pharmaceutical co. ltd., Jiangyin Huachang Food Additive Co.Ltd, Kyowa Hakko Bio Co., Ltd., Mitsui Chemicals, Inc., MTC Industries Inc., New Zealand Pharmaceuticals Ltd., Penta Manufacturing Company, QianjiangYongan Pharmaceutical Co., Ltd., Stauber USA., Taisho Pharmaceutical Holdings Co. Ltd., The Honjo Chemical Corporation

-

-

- Qianjiang Yongan Pharmaceutical Co. Ltd.

- Ajinomoto Co., Inc

- AuNutra Industries Inc.

- China grand pharmaceutical

- Foodchem International Corporation

- Fuchi Pharmaceutical Co. Ltd

- Hebi City Hexin Chem Ind. Co., Ltd.

- Jiangsu Yuanyang Pharmaceutical co. ltd.

- Jiangyin Huachang Food Additive Co.Ltd

- Kyowa Hakko Bio Co., Ltd.

- Mitsui Chemicals, Inc.

- MTC Industries Inc.

- New Zealand Pharmaceuticals Ltd.

- Penta Manufacturing Company

- QianjiangYongan Pharmaceutical Co., Ltd.

- Stauber USA.

- Taisho Pharmaceutical Holdings Co. Ltd.

- The Honjo Chemical Corporation