Global Tank Container Market By Type (Refrigerated Tank Containers, Non-Refrigerated Tank Containers, Lined Tank Containers, Cryogenic Tank Containers), By End-User Industry (Chemical and Petrochemical, Oil & Gas, Food & Beverage, Pharmaceuticals, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Oct 2024

- Report ID: 22030

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

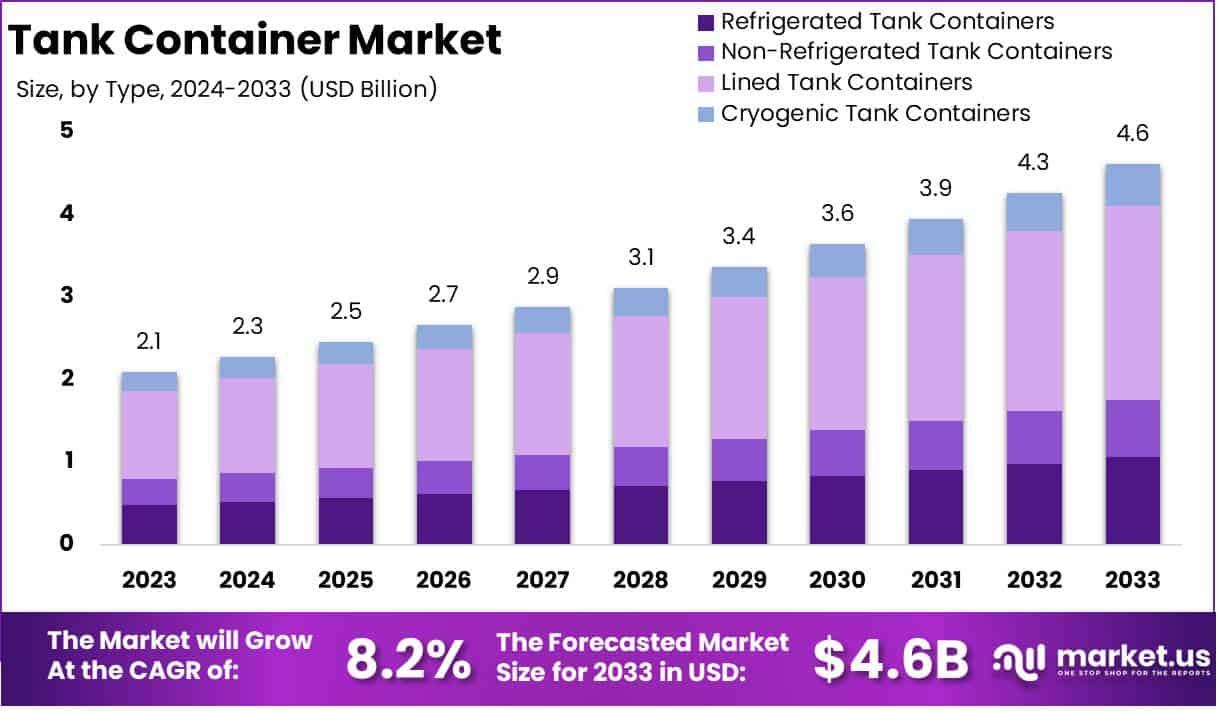

The Global Tank Container Market size is expected to be worth around USD 4.6 billion by 2033 from USD 2.1 billion in 2023, growing at a CAGR of 8.2% during the forecast period 2024 to 2033.

A tank container is a standardized, cylindrical, and reinforced container designed for the safe transportation of liquid or gaseous substances. These containers are constructed using robust materials such as stainless steel and are lined with insulation or protective coatings to handle both hazardous and non-hazardous chemicals, food-grade liquids, and gases.

The tank container market refers to the global industry that revolves around the manufacturing, sales, and leasing of these specialized containers. It caters to sectors such as chemicals, oil & gas, food & beverage, and pharmaceuticals, emphasizing efficient and secure liquid logistics.

The market also encompasses services like maintenance, repair, and tracking solutions, reflecting the growing need for operational efficiency in liquid transportation.

The growth of the tank container market can be attributed to the increasing global trade of chemicals, oil derivatives, and food-grade liquids. Additionally, the implementation of stringent regulations for the safe transport of hazardous materials drives the demand for tank containers, as they offer a secure solution compliant with international safety standards.

The adoption of intermodal transport, which promotes efficient transfer between different modes of transportation (rail, road, and sea), further supports market expansion.

Demand for tank containers is fueled by expanding industrial activities in developing economies, coupled with the growing focus on sustainability in logistics. Their versatility in transporting both bulk liquids and gases has made them essential in the logistics chain. The demand is particularly strong in sectors like food & beverage and chemicals, where secure and contamination-free transportation is critical.

Key opportunities in the tank container market lie in the adoption of advanced technologies like Internet of things (IoT) for real-time monitoring, ensuring higher safety and efficiency. Expanding geographical reach in emerging markets of Asia-Pacific, Latin America, and Africa also presents significant growth potential.

Companies focusing on innovative tank designs, offering improved insulation, enhanced safety features, and lower maintenance requirements, can gain a competitive edge. Additionally, the shift towards green logistics creates an opportunity for eco-friendly and sustainable tank containers, aligning with global carbon reduction goals.

According to ITCO, the global tank container fleet reached 801,800 units by January 1, 2023, marking a growth of 8.65% compared to 2022’s 7.3% rise. This surge reflects robust demand for bulk liquid and liquefied gas transport globally.

Additionally, ITCO’s survey shows 67,865 new tank containers built in 2022, up from 53,285 in 2021 a significant increase of 14,580 units, demonstrating industry resilience.

Notably, the top 10 operators control over 281,160 tanks, representing over 49% of the operator fleet, while top leasing firms account for 299,300 tanks, or about 83% of the leasing sector, highlighting concentrated market leadership.

According to Siemens, over US$500 million will be invested in U.S. manufacturing in 2023 to support growth in sectors like data centers, EV charging, and rail transportation. This includes a new US$150 million facility in Dallas-Fort Worth for AI infrastructure and a US$220 million rail manufacturing plant, collectively creating 1,700 jobs. These initiatives align with Siemens’ €2 billion global strategy to enhance growth, innovation, and resilience.

Key Takeaways

- The Global Tank Container Market is set to grow from USD 2.1 billion in 2023 to USD 4.6 billion by 2033, driven by a robust 8.2% CAGR over the forecast period (2024-2033).

- Non-Refrigerated Tank Containers dominate with a 51% market share in 2023, attributed to their cost-effectiveness and versatility.

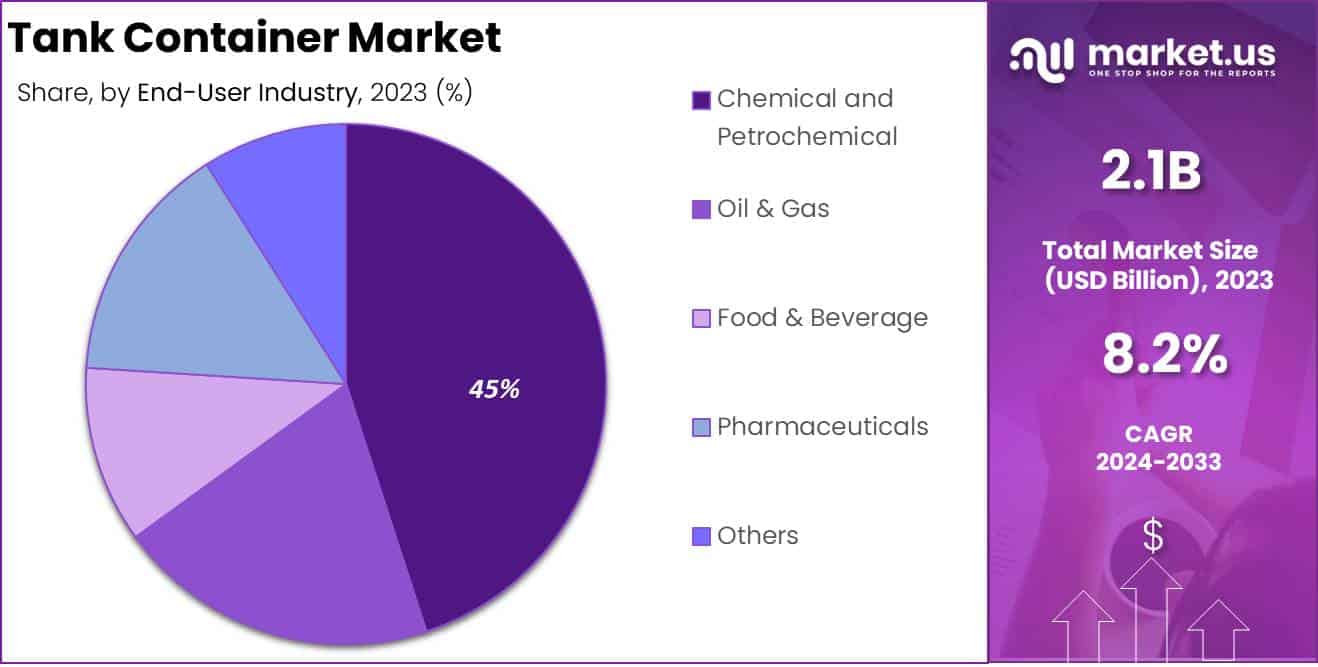

- Chemical & Petrochemical sector leads with a 45% market share, fueled by rising international chemical trade.

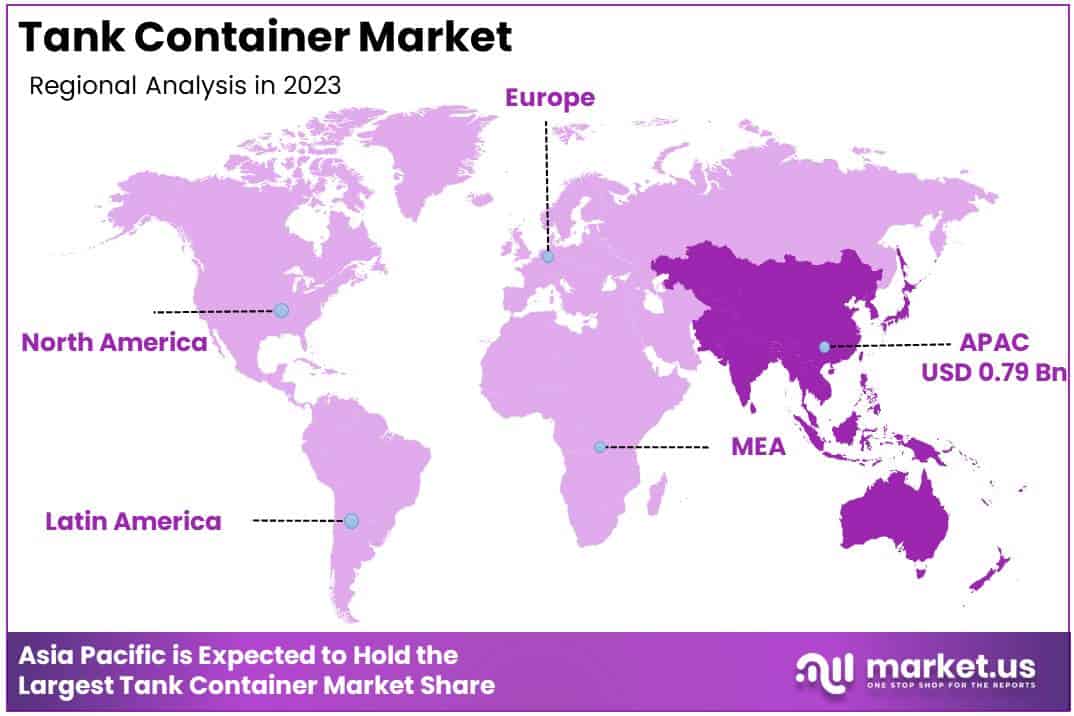

- Asia Pacific leads regionally with a 38% share, driven by industrialization and infrastructure investments.

By Type Analysis

Non-Refrigerated Tank Containers Dominating Segment with 51% Market Share

In 2023, Non-Refrigerated Tank Containers held a dominant market position in the tank container market by type segment, capturing more than 51% of the total market share. This segment’s strength is primarily attributed to its broad application across various industries, including chemicals, oil & gas, and food-grade liquids, where temperature control is not a requirement.

Non-refrigerated tank containers offer a cost-effective solution, making them highly attractive for transporting bulk liquids over long distances. Their versatility in accommodating a wide range of products, coupled with lower maintenance and operational costs compared to specialized containers, contributes to their strong demand globally.

As industries like chemicals and petroleum focus on expanding international trade, non-refrigerated tank containers have emerged as the preferred choice due to their adaptability across multimodal transport systems enabling seamless transit via road, rail, and sea.

The segment is expected to maintain its leading position, driven by rising trade volumes and increasing demand from developing regions where infrastructure for specialized containers is still evolving.

Refrigerated Tank Containers represent a rapidly expanding segment within the global tank container market, fueled by growing demand for the transportation of temperature-sensitive goods like pharmaceuticals, food products, and specialty chemicals.

In recent years, the segment has experienced a steady rise in adoption, supported by advancements in refrigeration technology that ensure precise temperature control and longer product shelf life.

The increasing focus on maintaining product integrity during long-haul transportation, especially in the pharmaceutical and food & beverage industries, has driven interest in refrigerated tank containers.

The segment’s growth is also propelled by stricter international regulations that require adherence to controlled temperatures during the transit of sensitive cargo. With the ongoing expansion of cold chain logistics globally, refrigerated tank containers are anticipated to gain a larger market share.

The adoption of smart technologies, including real-time temperature monitoring and IoT-based tracking, further enhances the efficiency and reliability of refrigerated tank containers, making them a critical component in the evolving landscape of global logistics.

Lined Tank Containers hold a specialized but vital position in the tank container market, catering primarily to industries that require extra protection against contamination, such as food & beverage, pharmaceuticals, and chemicals. These containers feature interior linings made of materials like rubber, glass, or epoxy resin, designed to prevent product interaction with the container walls.

Lined tank containers are particularly popular in the chemical industry, where they are used to transport aggressive or corrosive liquids safely. As safety and product purity become top priorities across industries, the demand for lined tank containers is experiencing steady growth.

This segment’s growth is further driven by increasing awareness regarding product integrity and the need to meet stringent safety standards. Additionally, industries like food processing and pharmaceuticals are focusing on compliance with regulatory standards, boosting demand for lined containers.

Although lined tank containers represent a smaller market share compared to non-refrigerated and refrigerated segments, their specialized use and rising demand in specific sectors contribute to a stable growth trajectory.

Cryogenic Tank Containers represent a niche yet growing segment within the global tank container market, primarily used for transporting liquefied gases like LNG, liquid oxygen, and liquid nitrogen at extremely low temperatures. The segment is characterized by its specialized construction that ensures the safe transport of cryogenic substances over long distances.

Increasing global demand for LNG, along with rising investments in the gas and energy sectors, is driving the adoption of cryogenic tank containers. Additionally, advancements in insulation technologies have enhanced the safety, efficiency, and reliability of these containers, making them crucial for industries dealing with cryogenic logistics.

The growth of this segment is further supported by the expansion of the gas infrastructure in developing regions, where cryogenic containers play a vital role in meeting energy needs. The rising focus on clean energy sources, particularly in Asia-Pacific and the Middle East, has fueled the demand for LNG, directly boosting the adoption of cryogenic tank containers.

While this segment currently holds a smaller market share compared to other types, its potential for growth is strong, given the increasing global emphasis on gas-based energy solutions and the development of new LNG projects worldwide.

By End-User Industry Analysis

Chemical and Petrochemical Dominating Segment with 45% Market Share

In 2023, Chemical and Petrochemical emerged as the leading end-user industry in the tank container market, capturing over 45% of the total market share. This segment’s dominance is driven by the extensive global trade of chemicals, which necessitates reliable and safe transport solutions.

Tank containers are crucial for the movement of hazardous and non-hazardous chemicals, providing enhanced safety and compliance with international regulations.

With industries focusing on expanding production and cross-border trade, the demand for tank containers in the chemical and petrochemical sector has seen substantial growth. Additionally, the versatility of tank containers to transport various chemical grades, including corrosive and flammable liquids, supports this segment’s strong market position.

The segment’s growth is further propelled by the increased adoption of tank containers in emerging markets, where industrialization and infrastructure development are rising. The chemical industry’s preference for tank containers, due to their ability to reduce risks of contamination and spillage, makes them an integral part of global logistics.

As the sector continues to grow, particularly in Asia-Pacific and the Middle East, this segment is expected to maintain its leading market position.

The Oil & Gas segment represents an expanding segment in the tank container market, driven by rising global demand for fuel and lubricants. Tank containers are extensively used in the oil & gas industry to transport refined products and specialized chemicals used in exploration and production activities.

As the energy sector shifts toward a more integrated supply chain, the reliability and multimodal adaptability of tank containers make them essential for moving various liquid products efficiently. The segment’s growth is fueled by increased oil production and global trade, with major exporting regions like the Middle East, North America, and Russia driving demand for tank containers.

This segment’s expansion is also supported by advancements in container design, enabling safer handling of high-value and hazardous liquids across diverse geographies. With ongoing exploration projects and investments in oil & gas infrastructure, the demand for tank containers in this sector is anticipated to remain robust.

The Food & Beverage segment is a growing segment within the tank container market, driven by the increasing need to transport food-grade liquids, such as edible oils, juices, and syrups, in a safe and hygienic manner.

In 2023, this segment experienced a notable increase in demand, largely due to stricter regulations regarding food safety during transport and the rising global consumption of liquid food products.

Tank containers, designed to prevent contamination and ensure product integrity, are becoming the preferred choice for food manufacturers and exporters looking for reliable transportation solutions.

Growth in this segment is further supported by the expansion of global trade networks, particularly in regions like Asia-Pacific, where the export of food-grade liquids is rising. As consumer demand for ready-to-consume liquid products grows, the adoption of tank containers by the food & beverage industry is set to increase, making it a key contributor to the market’s overall expansion.

The Pharmaceuticals segment holds a high potential in the tank container market, driven by the stringent requirements for transporting liquid pharmaceutical products safely. Tank containers are increasingly favored in this sector for their ability to maintain the integrity and purity of sensitive pharmaceutical ingredients during transit.

With growing global demand for vaccines, medical liquids, and other pharmaceutical products, the adoption of specialized tank containers has gained momentum. In 2023, the segment showed a marked increase in demand, reflecting the sector’s focus on maintaining product quality throughout the supply chain.

The rising emphasis on cold chain logistics for temperature-sensitive pharmaceuticals, such as vaccines and biologics, further supports this segment’s growth. As pharmaceutical companies enhance their global distribution networks, the adoption of tank containers is projected to rise, particularly in regions like North America and Europe, where regulatory compliance and safety standards are stringent.

Niche Segment with Steady Demand The Others segment encompasses various industries that utilize tank containers, including agriculture, water treatment, and specialty chemicals. In 2023, this segment maintained a steady demand, driven by the need for safe and efficient transport of non-conventional liquid cargo, such as fertilizers, industrial chemicals, and wastewater.

While it holds a smaller share of the market compared to other segments, the Others category remains vital, given its role in supporting diverse industrial requirements. The demand in this segment is largely driven by the growing focus on industrial safety, compliance with transportation regulations, and the expansion of supply chains in emerging markets.

Key Market Segments

By Type

- Refrigerated Tank Containers

- Non-Refrigerated Tank Containers

- Lined Tank Containers

- Cryogenic Tank Containers

By End-User Industry

- Chemical and Petrochemical

- Oil & Gas

- Food & Beverage

- Pharmaceuticals

- Others

Driver

Increasing Demand for Safe and Efficient Transportation of Liquid Bulk Chemicals

The primary driver for the global tank container market in 2024 is the growing need for safe, efficient, and cost-effective transportation of liquid bulk chemicals across industries. The chemical sector, which is a significant consumer of tank containers, is experiencing robust growth.

As companies strive for safe handling and transit of hazardous materials, tank containers offer a secure alternative, meeting stringent international safety and environmental standards.

The demand is further fueled by the expanding global trade of chemicals, as emerging economies increase production and export volumes, necessitating a reliable logistics framework. This dynamic is prompting a shift toward tank containers, which minimize spillage risks and ensure compliance with global transportation norms.

Additionally, the versatility of tank containers to transport not only chemicals but also food-grade liquids, gases, and pharmaceutical products enhances their appeal. These containers are designed for multimodal transport, offering flexibility across road, rail, and sea logistics chains.

With rising concerns around sustainability and operational efficiency, tank containers present a compelling solution, enabling operators to streamline supply chains and reduce turnaround times.

This capability is particularly critical for industries seeking to optimize delivery timelines while adhering to safety regulations. The increasing preference for standardized containers facilitating easy maintenance and fast loading/unloading processes further strengthens market growth prospects.

Restraint

High Initial Investment and Maintenance Costs

Despite the positive outlook, the global tank container market faces a significant restraint: the high initial investment and maintenance costs associated with these containers. Acquiring tank containers requires substantial upfront capital, which can be a deterrent for small- and medium-sized logistics operators or companies with limited budgets.

The cost factor includes not only the purchase of the containers but also expenses related to outfitting, regulatory compliance, and potential customization to meet specific client needs.

Moreover, ongoing maintenance, cleaning, and periodic inspections add to operational costs, making it challenging for some firms to sustain competitive pricing while managing these overheads.

The financial burden is compounded by the complex regulatory environment governing tank container operations, particularly in terms of hazardous material transportation. Compliance with international standards often necessitates costly upgrades, specialized handling equipment, and skilled personnel training, further increasing operational costs.

These challenges may limit adoption rates, particularly in emerging markets where logistics budgets are often constrained. As such, the market could experience slower growth in regions where cost-effective alternatives, such as traditional bulk shipping, still dominate.

This restraint underscores the need for innovative financing models or leasing options to make tank container solutions more accessible to a wider range of users.

Opportunity

Technological Advancements in Smart Tank Container Solutions

Technological advancements represent a significant opportunity for the tank container market in 2024, particularly with the rise of smart tank containers. Innovations like IoT integration, real-time tracking, and automated monitoring systems are transforming traditional tank container logistics into more transparent, data-driven operations.

Smart tank containers equipped with sensors can monitor temperature, pressure, and location, providing real-time insights into the status of transported goods. This advancement not only improves safety and efficiency but also enhances customer satisfaction by ensuring timely and accurate information about cargo conditions.

The adoption of smart tank containers also aligns with the broader digital transformation occurring across supply chains. As companies increasingly leverage data analytics to enhance decision-making, the integration of smart technologies into tank containers allows for predictive maintenance, optimized routing, and reduced downtime.

This digital shift is attracting more investments, as it offers a potential reduction in operational costs and the ability to meet stricter regulatory requirements. The growing interest in these technologies presents a significant growth opportunity, particularly in regions like Europe and North America, where digital logistics infrastructure is already more established.

The shift toward automated and smart tank container solutions not only meets industry demand for greater efficiency but also aligns with evolving regulatory frameworks, making it a key catalyst for market expansion.

Trends

Increasing Adoption of Sustainable and Eco-Friendly Tank Containers

A prominent trend shaping the global tank container market in 2024 is the increasing focus on sustainability and eco-friendly transport solutions. As environmental regulations become stricter, there is growing pressure on industries to adopt greener logistics practices.

Tank containers, known for their reusability and lower carbon footprint compared to other bulk transport methods, are emerging as a preferred choice for companies aiming to enhance their environmental credentials.

This trend is evident in the rising adoption of lightweight, durable materials for tank containers that reduce fuel consumption and emissions during transport, supporting sustainability goals.

Additionally, manufacturers are focusing on innovations that further enhance the eco-friendliness of tank containers, such as improved insulation for better energy efficiency and the use of recyclable materials in container construction. These advancements are in response to increasing demand from end-users who prioritize sustainable supply chains.

The trend aligns with broader industry shifts toward green logistics, supported by government incentives and initiatives encouraging low-emission transport solutions. Companies adopting sustainable tank container strategies are not only meeting regulatory demands but also positioning themselves favorably in the eyes of environmentally conscious consumers and partners.

This growing emphasis on sustainability is expected to be a crucial driver of market growth, influencing both purchasing decisions and long-term strategic investments in the sector.

Regional Analysis

Asia Pacific Leads the Tank Container Market with Largest Market Share at 38% in 2023

In 2023, the Asia Pacific region held a commanding 38% share of the global tank container market, establishing itself as the leading region in this sector. The market in this region reached a valuation of USD 0.79 billion, driven primarily by rapid industrialization, expanding chemical exports, and robust demand for efficient and safe liquid transportation solutions.

Key contributors include China, India, and Japan, where rising manufacturing outputs and strong logistics networks have further amplified the adoption of tank containers. Additionally, increasing investments in infrastructure development and growing international trade are supporting the regional growth trajectory, making Asia Pacific the dominant force in the global market.

The North American tank container market has experienced steady growth due to the well-developed chemical industry and advanced transportation infrastructure. The presence of major chemical manufacturers and a mature regulatory framework supporting the safe transport of hazardous materials have fueled demand for tank containers.

The U.S., in particular, remains a significant contributor, with ongoing investments in the energy sector, including LNG and petrochemical exports, driving the need for reliable tank container solutions.

Europe represents a significant share of the global tank container market, attributed to its stringent regulatory standards and well-established industrial base. Countries such as Germany, the Netherlands, and Belgium play a key role due to their strong export-oriented economies and focus on sustainable logistics solutions.

The region benefits from a mature infrastructure for both rail and road transportation, which facilitates efficient cross-border trade within the European Union and beyond. Growing focus on environmental compliance has also increased the adoption of tank containers for the transport of chemicals, food-grade liquids, and other industrial liquids.

The Middle East & Africa region is emerging as a promising market for tank containers, primarily driven by increasing petrochemical exports and growing trade activities. Countries like Saudi Arabia and the UAE are key contributors, benefiting from significant investments in logistics infrastructure aimed at supporting the efficient transport of bulk liquids.

Latin America is witnessing moderate growth in the tank container market, driven by the export of agricultural products and chemicals. Brazil, Argentina, and Mexico are the primary markets, benefiting from expanding trade relations and improving logistics capabilities. With a growing emphasis on safety and efficiency in liquid transport, tank containers are becoming a preferred choice for both domestic and international shipments.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global tank container market in 2024 is shaped by several established and emerging players, each contributing to the market’s competitive landscape. China International Marine Containers (CIMC) continues to be a dominant force, leveraging its vast manufacturing capabilities, diversified product portfolio, and strategic global presence to sustain its leadership position.

CIMC’s focus on innovation and cost efficiency keeps it at the forefront of market trends, especially in meeting the demand for sustainable and specialized tank containers.

The HOYER Group, known for its strong logistics expertise, stands out for its emphasis on safety and regulatory compliance, which is critical in transporting hazardous and non-hazardous materials.

Similarly, Welfit Oddy, with its longstanding reputation for engineering quality, is expected to maintain its competitive edge by enhancing its customized tank solutions to cater to varied industry needs.

Suttons Group and Stolt-Nielsen Limited are focusing on global expansion and fleet modernization, investing in advanced tank technologies to support the safe transport of chemicals, food, and gases. Both companies are expected to maintain a robust market presence due to their strong operational frameworks and customer-centric services.

Eurotainer and EXSIF Worldwide are major leasing providers that capitalize on flexible leasing solutions, catering to the diverse requirements of clients across different sectors. TWS Tankcontainer-Leasing GmbH & Co. KG and Tankformator are reinforcing their market positions by offering customized leasing options and technical support.

Other players like Intermodal Tank Transport (ITT) are focused on enhancing logistics efficiency and expanding network reach. These strategies are indicative of a highly competitive market landscape where global players are actively pursuing technological upgrades, sustainability initiatives, and strategic partnerships to gain a competitive edge.

Top Key Players in the Market

- CIMC (China International Marine Containers)

- HOYER Group

- Welfit Oddy

- Suttons Group

- Stolt-Nielsen Limited

- Eurotainer

- EXSIF Worldwide

- TWS Tankcontainer-Leasing GmbH & Co. KG

- Tankformator

- Intermodal Tank Transport (ITT)

- Other Key Players

Recent Developments

- In 2023, Danteco Industries, Tankcon, and Stolt Tankers have emerged as key players in the tank container shipping market. These companies are driving innovation by introducing advanced solutions such as Single Vapor Return (SVOR) systems and telematics technologies. These enhancements are designed to optimize fuel, heat, and light usage, leading to significant reductions in emissions while boosting overall operational efficiency.

- In 2023, The HOYER Group, a global leader in liquid goods transportation, initiated a fleet renewal program, aiming to add approximately 3,000 new tank containers by the end of the year. This update is in response to growing customer demands for specialized equipment, particularly for transporting chemical products and liquid foodstuffs across European roads, intermodal routes, and overseas logistics. The move aligns with HOYER’s strategic focus on upgrading its infrastructure to enhance service along the supply chain.

- In 2023, CIMC Enric Holdings Limited (Hong Kong stock code: 3899.HK), along with its subsidiaries, announced the successful launch of its first 40-foot liquid hydrogen tank container at its Nantong Hydrogen Base. This tank has a capacity of 2,570 kg of hydrogen, equating to the transport ability of 6-8 traditional long-tube hydrogen trailers. This achievement represents a significant advancement in CIMC Enric’s commitment to expanding its capabilities in the hydrogen energy sector, attracting interest from global customers seeking cutting-edge solutions.

- In 2024, Trane Technologies (NYSE: TT), a global climate innovator, along with its Thermo King brand, completed the acquisition of Klinge Corporation on August 1. As a leader in sustainable transport temperature control, this acquisition aligns with Trane Technologies’ broader sustainability strategy, enhancing its capacity to deliver innovative and energy-efficient solutions to the refrigerated transport market.

Report Scope

Report Features Description Market Value (2023) USD 2.1 Billion Forecast Revenue (2033) USD 4.6 Billion CAGR (2024-2033) 8.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Refrigerated Tank Containers, Non-Refrigerated Tank Containers, Lined Tank Containers, Cryogenic Tank Containers), By End-User Industry (Chemical and Petrochemical, Oil & Gas,Food & Beverage, Pharmaceuticals, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape CIMC (China International Marine Containers), HOYER Group, Welfit Oddy, Suttons Group, Stolt-Nielsen Limited, Eurotainer, EXSIF Worldwide, TWS Tankcontainer-Leasing GmbH & Co. KG, Tankformator, Intermodal Tank Transport (ITT), Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CIMC (China International Marine Containers)

- HOYER Group

- Welfit Oddy

- Suttons Group

- Stolt-Nielsen Limited

- Eurotainer

- EXSIF Worldwide

- TWS Tankcontainer-Leasing GmbH & Co. KG

- Tankformator

- Intermodal Tank Transport (ITT)

- Other Key Players