Global Suture Needles Market By Product Type(Conventional Needles, Swaged (Eyeless) Needles, Cutting Needles, Taper Point Needles, Blunt Needles, Specialty Needles) By Material( Stainless Steel, Titanium, Alloys) By Application (Cardiovascular, General Surgery, Orthopedic Procedures, Gynecological Procedures, Veterinary Procedures, Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 163877

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

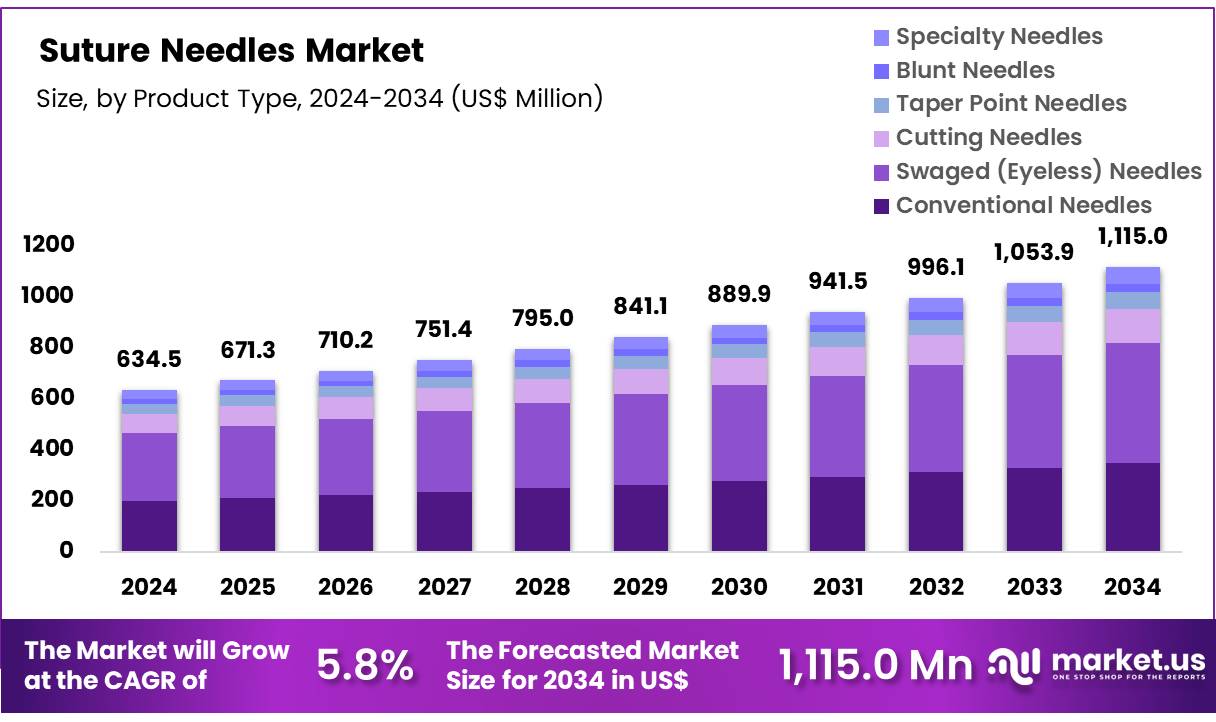

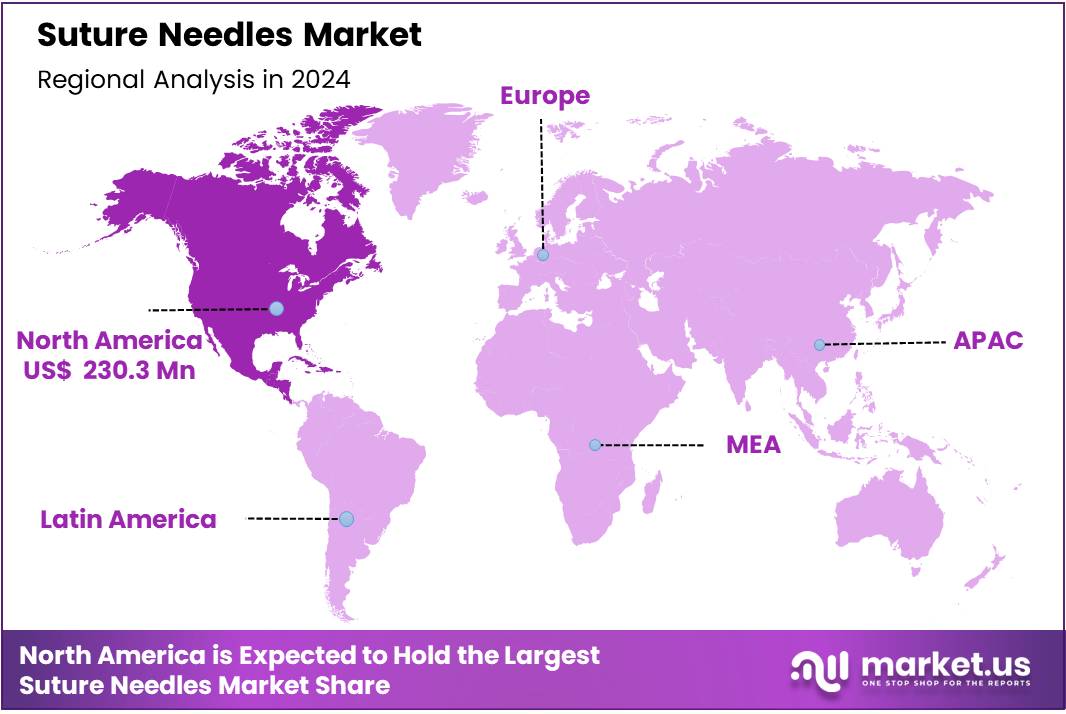

Global Suture Needles Market size is expected to be worth around US$ 1,115.0 Million by 2034 from US$ 634.5 Million in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 36.3% share with a revenue of US$ 230.3 Million.

Growth in the suture needles sector is being driven by the steady rise in surgical procedures. Caesarean sections now account for about 1 in 5 births worldwide, and the rate is projected to reach nearly 1 in 3 by 2030. This trend increases demand for reliable closure devices in obstetrics and gynecology.

An ageing population is adding further pressure on surgical volumes. By 2030, one in six people will be aged 60 years or over, and the number of people aged 80+ will rise sharply. Older adults undergo more operations, including soft-tissue and organ surgeries, which supports sustained use of high-performance needles.

Elective orthopedics is also expanding. OECD data show high and persistent rates of joint replacements, with average hip and knee replacement rates at 172 and 119 per 100,000 population, respectively. Each procedure requires dependable needle–suture combinations for layered closure, reinforcing recurrent demand from hospitals. Trauma care adds to this need: road traffic injuries cause about 1.19 million deaths annually and tens of millions of non-fatal injuries, sustaining surgical workloads in emergency departments.

Health system factors provide additional support. Health spending as a share of GDP remains significant across regions, enabling procurement of single-use sterile devices and premium needles.

Infection-prevention programs in ambulatory and hospital surgery settings maintain strict surveillance for surgical site infections, encouraging purchases of high-quality needles that minimize tissue trauma and support consistent, secure knots. Rising day-surgery capacity and standardized infection control form a stable base for repeat purchases and vendor contracts.

Overall, market expansion can be attributed to growth in births delivered by surgery, the rapid increase in older patients, stable or rising orthopedic and trauma procedures, and continued investment in surgical quality and infection control. These factors point to steady volume growth for atraumatic, precision-engineered suture needles across acute care, ambulatory surgery, and maternity settings over the medium term.

Key Takeaways

- Market Size: Global Suture Needles Market size is expected to be worth around US$ 1,115.0 Million by 2034 from US$ 634.5 Million in 2024.

- Market Growth: The market growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

- Product Type Analysis: waged (eyeless) needles accounted for approximately 42.1% share of the global market in 2024.

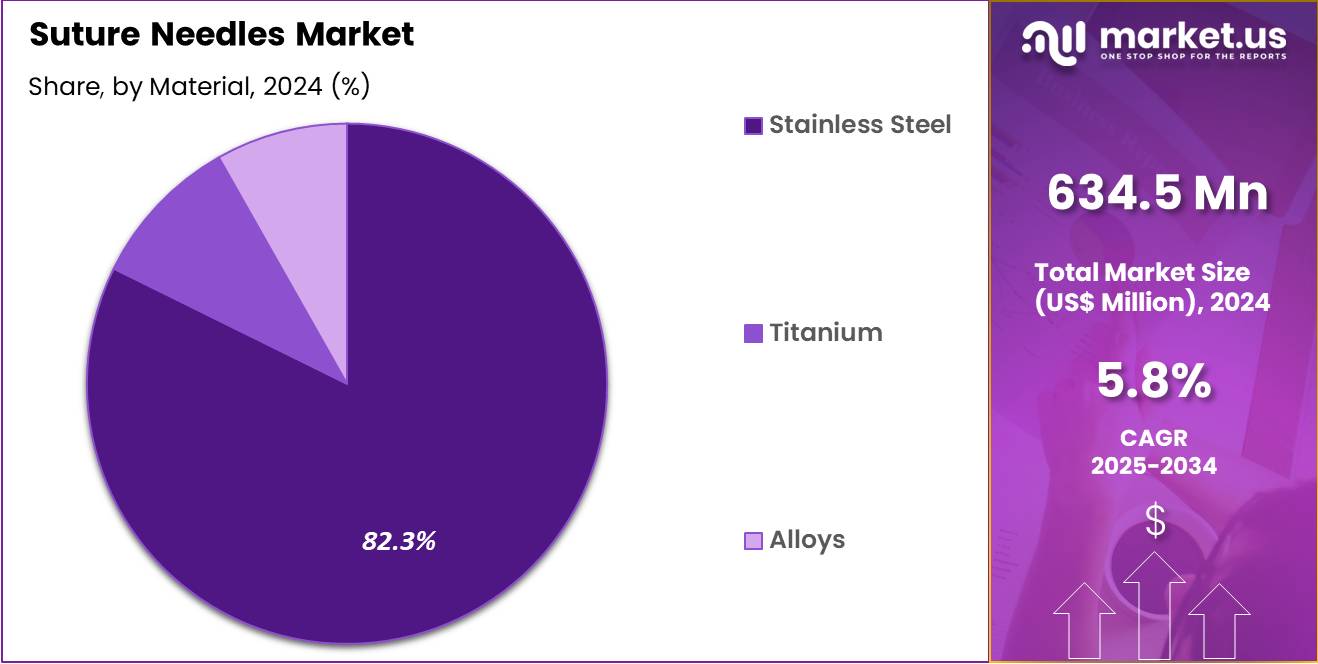

- Material Analysis: Stainless steel held the dominant position in 2024, accounting for approximately 82.3% of total market share.

- Application Analysis: General surgery accounted for approximately 39.6% of the total market share in 2024, establishing its dominant position.

- Regional Analysis: In 2024, North America led the market, achieving over 36.3% share with a revenue of US$ 230.3 Million.

Product Type Analysis

The suture needles market is segmented by product type into swaged (eyeless) needles, conventional needles, cutting needles, blunt needles, and specialty needles. Swaged (eyeless) needles accounted for approximately 42.1% share of the global market in 2024, establishing their dominance due to enhanced surgical efficiency and reduced tissue trauma.

Their pre-attached suture configuration minimizes handling time and improves procedural precision, which has been widely adopted across general surgery, cardiovascular, orthopedic, and minimally invasive procedures. The growth of minimally invasive surgeries and a rising preference for single-use sterile devices continue to support this segment’s expansion.

Conventional needles represent a steady demand segment owing to their cost-effectiveness and flexibility in certain surgical applications, particularly in lower-income healthcare settings. Cutting needles are utilized primarily in tough tissues such as skin and tendons, with their market demand supported by high volumes of trauma and reconstructive surgeries.

Blunt needles maintain relevance in specific applications requiring reduced risk of accidental needle-stick injuries. Specialty needles, tailored for complex and niche surgical procedures, are expected to experience gradual adoption aligned with advancements in surgical techniques and specialty medical fields.

Material Analysis

The market is categorized by material into stainless steel, titanium, and specialty alloys. Stainless steel held the dominant position in 2024, accounting for approximately 82.3% of total market share.

This leadership is attributed to high tensile strength, corrosion resistance, and cost-effective manufacturing, enabling broad use across general surgery, cardiovascular, orthopedic, and cosmetic procedures. Its biocompatibility and consistent performance in perse tissue types further reinforce strong adoption across hospitals and ambulatory surgical centers.

Titanium needles represent a smaller yet steadily expanding segment, driven by advantages including superior biocompatibility, lighter weight, and reduced risk of allergic reactions. Their utilization is particularly observed in advanced microsurgery and ophthalmic procedures.

Alloy-based needles, incorporating materials engineered for enhanced durability and flexibility, remain a niche option, primarily used in high-precision surgical environments. Demand for titanium and alloy categories is likely to increase gradually as specialized surgical needs rise and premium-grade medical instruments gain wider acceptance.

Application Analysis

The suture needles market is segmented by application into general surgery, cardiovascular, orthopedic procedures, gynecological procedures, veterinary procedures, and other specialty interventions. General surgery accounted for approximately 39.6% of the total market share in 2024, establishing its dominant position.

The segment’s leadership is associated with high procedural frequency, broad utilization in wound closure, and increasing surgical volumes driven by trauma cases, abdominal surgeries, and rising demand for minimally invasive interventions. The adoption of advanced surgical tools and growing emphasis on post-operative outcomes have further contributed to sustained use of premium suture needles in this category.

Cardiovascular procedures represent a significant share due to the rising burden of heart disease and growing adoption of complex cardiac surgeries. Orthopedic applications continue to benefit from increasing incidences of fractures and sports injuries, while gynecological procedures gain traction with a rising number of reproductive health surgeries.

Veterinary procedures and other specialty areas account for steady utilization supported by expanding animal healthcare services and niche clinical applications.

Key Market Segments

By Product Type

- Conventional Needles

- Swaged (Eyeless) Needles

- Cutting Needles

- Taper Point Needles

- Blunt Needles

- Specialty Needles

By Material

- Stainless Steel

- Titanium

- Alloys

By Application

- Cardiovascular

- General Surgery

- Orthopedic Procedures

- Gynecological Procedures

- Veterinary Procedures

- Others

Driving Factors

The substantial global volume of surgical procedures constitutes a principal driver for the suture needles market. According to the World Health Organization (WHO), surgery is a major component of global healthcare, with an estimated 234 million major procedures performed annually.

Further, it has been estimated that about 11 % of the global disease burden (in disability-adjusted life years) could be addressed through surgical intervention, underscoring the importance of surgical infrastructure. As surgical volumes increase and as access to surgical care expands in more regions, demand for surgical consumables—including suture needles is naturally elevated.

Trending Factors

A pronounced trend within the suture-needles segment concerns safety-engineered designs and materials tailored to minimize occupational risk and enhance performance. In the United States, a joint safety communication by the Food & Drug Administration (FDA), National Institute for Occupational Safety and Health (NIOSH) and Occupational Safety and Health Administration (OSHA) strongly recommends blunt-tip suture needles to reduce needlestick injuries during fascia and muscle closure (studies show a ~69 % reduction in risk).

The regulatory focus on device performance and safety (via FDA guidance) reinforces adoption of such innovations. Consequently, the market is moving toward needles designed for improved safety, ergonomics, and compatibility with minimally invasive and outpatient surgical settings.

Restraining Factors

Regulatory compliance and device safety requirements constitute a meaningful restraint on the suture-needles market. For example, the FDA’s special-controls guidance for surgical sutures (covering thread plus needle systems) specifies performance criteria and submission pathways that must be met before marketing.

The time and cost associated with demonstrating safety, equivalence and regulatory clearance may hamper product launches or market entry, particularly for smaller manufacturers. Furthermore, the increasing availability of alternative wound-closure technologies (e.g., tissue adhesives, surgical staples) may reduce reliance on conventional suture-and-needle systems in certain applications.

Opportunity

Emerging markets and enhanced surgical infrastructure demonstrate key opportunities for growth in the suture-needles market. Global analyses indicate that in low- and middle-income countries (LMICs), surgical volumes remain substantially below benchmarks: one review found an average of only 877 surgeries per 100,000 population versus benchmark targets of 5,000 per 100,000.

As these regions invest in surgical capacity and expand access to operative care, demand for consumables including suture needles rises. Additionally, procurement of advanced safety-engineered and specialty needles (such as blunt-tip, microsurgery-grade, or robotic-compatible) offers a differentiated value proposition, enabling manufacturers to capture segments aligned with higher specification surgical procedures.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 36.3% share and holds US$ 230.3 Million market value for the year. Strong medical infrastructure supported this leadership. High surgical case volumes also played a key role. Advanced healthcare spending further sustained market expansion. The adoption of innovative surgical instruments was robust across hospitals and ambulatory centers.

The demand for suture needles continued to rise across major global regions. Growth was driven by greater surgical volumes, trauma incidence, and chronic disease-related procedures. The need for precision-based closure tools was observed across general surgery, cardiovascular procedures, and orthopedic interventions.

North America maintained leadership during the period. The market benefited from advanced clinical practices and high adoption of automated suturing systems. Training programs for surgeons and ongoing procedural innovations also supported product utilization. Technological upgrades in surgical devices enhanced performance and safety. As a result, higher-value needle variants experienced steady preference in the region.

Europe followed with strong usage supported by established healthcare systems. Increased emphasis on procedure safety and hospital-acquired infection reduction contributed to steady adoption. Asia Pacific demonstrated rapid expansion due to growing healthcare investments and rising surgical workloads.

Emerging economies observed infrastructure development, expanding access to surgical care. Latin America and Middle East & Africa showed incremental growth with rising medical tourism and gradual improvements in healthcare facilities.

Overall, market progress was supported by continuous clinical advancements, a growing aging population, and a strong shift toward advanced suturing solutions. The future outlook remains positive, with rising emphasis on precision, safety, and minimally invasive intervention driving sustained demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The suture needles market is characterized by the presence of established manufacturers with strong product portfolios and extensive distribution networks. Competitive strength is driven by innovation in needle geometry, surface coating, and materials to enhance penetration efficiency and minimize tissue trauma.

Strategic focus has been placed on expanding minimally invasive surgery solutions and developing specialty needles for specific clinical applications. Market positioning is influenced by regulatory compliance, brand credibility, and long-term partnerships with hospitals and surgical centers. Continuous investment in R&D and automation has been observed to improve product quality and manufacturing efficiency.

New entrants face barriers due to stringent standards and high capital requirements, while existing participants strengthen portfolios through technological advancements, training programs for surgeons, and expansion into emerging healthcare markets, supporting sustainable long-term growth.

Market Key Players

- Johnson & Johnson (Ethicon)

- Medtronic (Covidien)

- B. Braun Melsungen AG

- Smith & Nephew

- Surgical Specialties Corporation

- Boston Scientific Corporation

- Mölnlycke Health Care

- ConMed Corporation

- KAI Medical

- Internacional de Productos Medicos (IPM)

- Demetech Corporation

- Aesculap (Part of B. Braun)

- Dolphin Sutures

- Millennium Surgical

- Other key players

Recent Developments

- Johnson & Johnson (Ethicon) — In May 2023, the firm highlighted advanced surgical-suture innovations including self-anchoring barbed suture technology developed under its wound-closure portfolio.

- Medtronic (Covidien) — In mid-2023, the company published a detailed technical sheet describing its “Surgalloy™” and “NuCoat™” suture-needle technologies aimed at improved penetration and reduced tissue drag.

- B. Braun Melsungen AG — In December 2024, the firm introduced its “Dermaslide® DGMP” needle for veterinary/clinical segment (micro-engraved body for smoother glide), signaling broader capabilities for surgical-needle design

- Smith & Nephew — In November 2024, the company disclosed weaker-than-expected China demand and adjusted its full-year underlying revenue growth forecast to approx. 4.5%.

Report Scope

Report Features Description Market Value (2024) US$ 1,115.0 Million Forecast Revenue (2034) US$ 634.5 Million CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Conventional Needles, Swaged (Eyeless) Needles, Cutting Needles, Taper Point Needles, Blunt Needles, Specialty Needles) By Material( Stainless Steel, Titanium, Alloys) By Application (Cardiovascular, General Surgery, Orthopedic Procedures, Gynecological Procedures, Veterinary Procedures, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Johnson & Johnson (Ethicon), Medtronic (Covidien), B. Braun Melsungen AG, Smith & Nephew, Surgical Specialties Corporation, Boston Scientific Corporation, Mölnlycke Health Care, ConMed Corporation, KAI Medical, Internacional de Productos Medicos (IPM), Demetech Corporation, Aesculap (Part of B. Braun), Dolphin Sutures, Millennium Surgical, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Johnson & Johnson (Ethicon)

- Medtronic (Covidien)

- B. Braun Melsungen AG

- Smith & Nephew

- Surgical Specialties Corporation

- Boston Scientific Corporation

- Mölnlycke Health Care

- ConMed Corporation

- KAI Medical

- Internacional de Productos Medicos (IPM)

- Demetech Corporation

- Aesculap (Part of B. Braun)

- Dolphin Sutures

- Millennium Surgical

- Other key players