Global Surgical Instrument Tracking Systems Market By Component (Hardware, Software and Services), By Technology (Barcode Tracking, Radio Frequency Identification (RFID) and Electronic Tracking), By End User (Hospitals, Ambulatory Surgical Centers (ASCs), Research Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152834

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

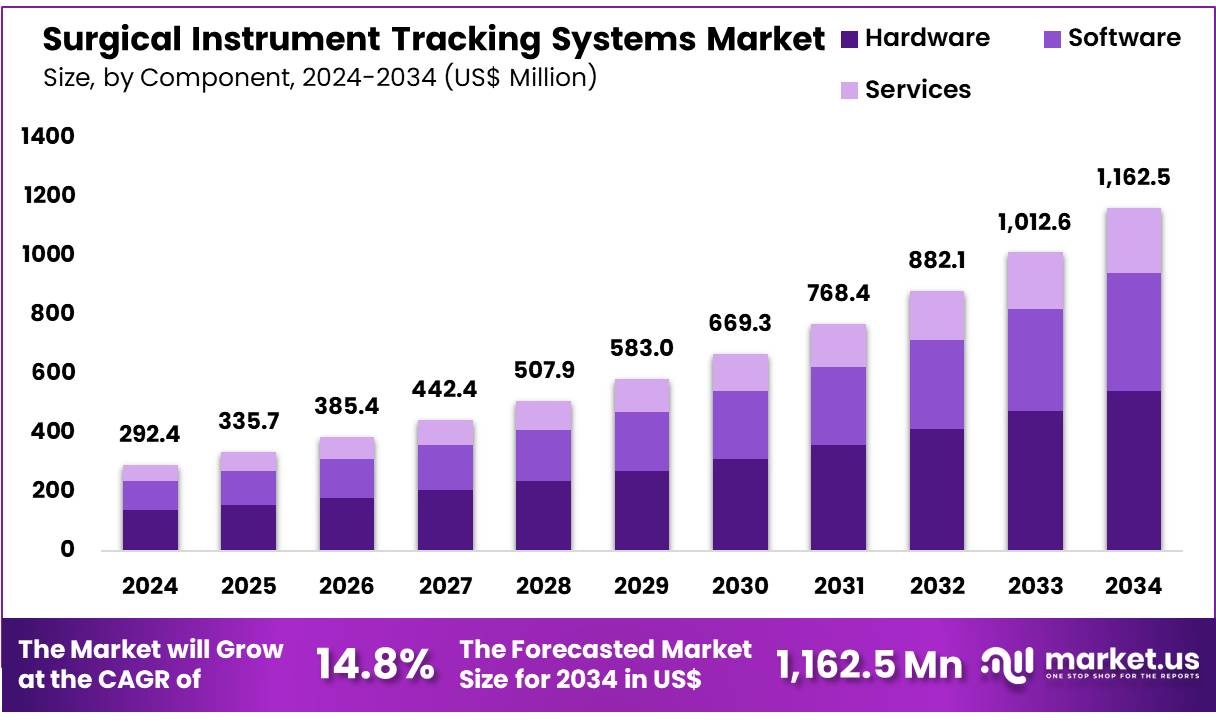

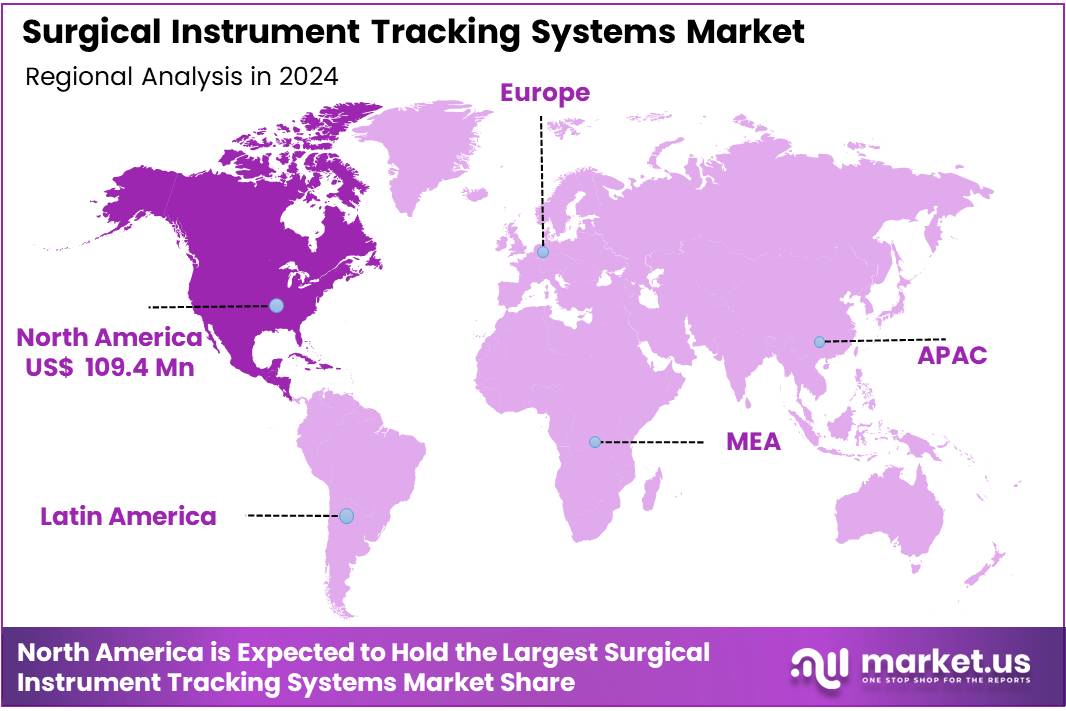

Global Surgical Instrument Tracking Systems Market size is expected to be worth around US$ 1,162.5 million by 2034 from US$ 292.4 million in 2024, growing at a CAGR of 14.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.4% share with a revenue of US$ 109.4 Million.

In the current surgical environment, the availability of instruments, adherence to sterilization protocols, and operational efficiency are paramount. However, many hospitals continue to depend on manual systems for tracking surgical instruments, which can lead to delays, documentation issues, and expensive mistakes. This is where surgical instrument tracking systems play a vital role, offering hospitals and ambulatory surgery centers the ability to digitally track, manage, and document instruments from decontamination through to point-of-use and back to reprocessing.

The Surgical Instrument Tracking Systems (SITS) market has been witnessing significant growth, driven by the increasing demand for patient safety, operational efficiency, and regulatory compliance. These systems utilize technologies like RFID and barcode scanning to track surgical instruments throughout their lifecycle, from sterilization to post-operative use. The primary objective is to ensure that instruments are properly sterilized, maintained, and accounted for to prevent retained surgical items (RSIs) and reduce human errors.

Hospitals and surgical centers are the primary end-users of these systems, as they help streamline operations, enhance inventory management, and minimize the risks associated with surgical procedures. With the growing need for healthcare facilities to maintain compliance with stringent sterilization standards and regulations, the adoption of tracking systems has become essential for reducing operational costs and improving patient outcomes.

Technological advancements, including the integration of Artificial Intelligence (AI) and the Internet of Things (IoT), are further enhancing the capabilities of these systems by enabling real-time monitoring, predictive analytics, and automation.

Emerging markets, especially in Asia-Pacific and Latin America, present substantial growth opportunities as these regions modernize their healthcare infrastructure and prioritize patient safety. As the healthcare sector continues to expand, the SITS market is expected to see continued growth, offering solutions that improve both operational and clinical efficiency.

For instance, in February 2025, Novanta Inc., a global technology provider for the medical device and life sciences sectors, has announced a strategic partnership with Identiv, Inc., a leading innovator in RFID-enabled Internet of Things (IoT) solutions. This collaboration is designed to accelerate the adoption of RFID-powered solutions for medical device OEMs.

By integrating Identiv’s advanced RFID inlays, tags, and labels with Novanta’s top-tier ThingMagic reader modules and APIs, the partnership aims to fill a significant market gap. It will offer comprehensive, end-to-end solutions for access, identification, and traceability, while delivering improved price and performance.

Key Takeaways

- In 2024, the market for Surgical Instrument Tracking Systems generated a revenue of US$ 292.4 Million, with a CAGR of 14.8%, and is expected to reach US$ 1,162.5 Million by the year 2034.

- The Component segment is divided into Hardware, Software and Services with Hardware taking the lead in 2024 with a market share of 46.7%.

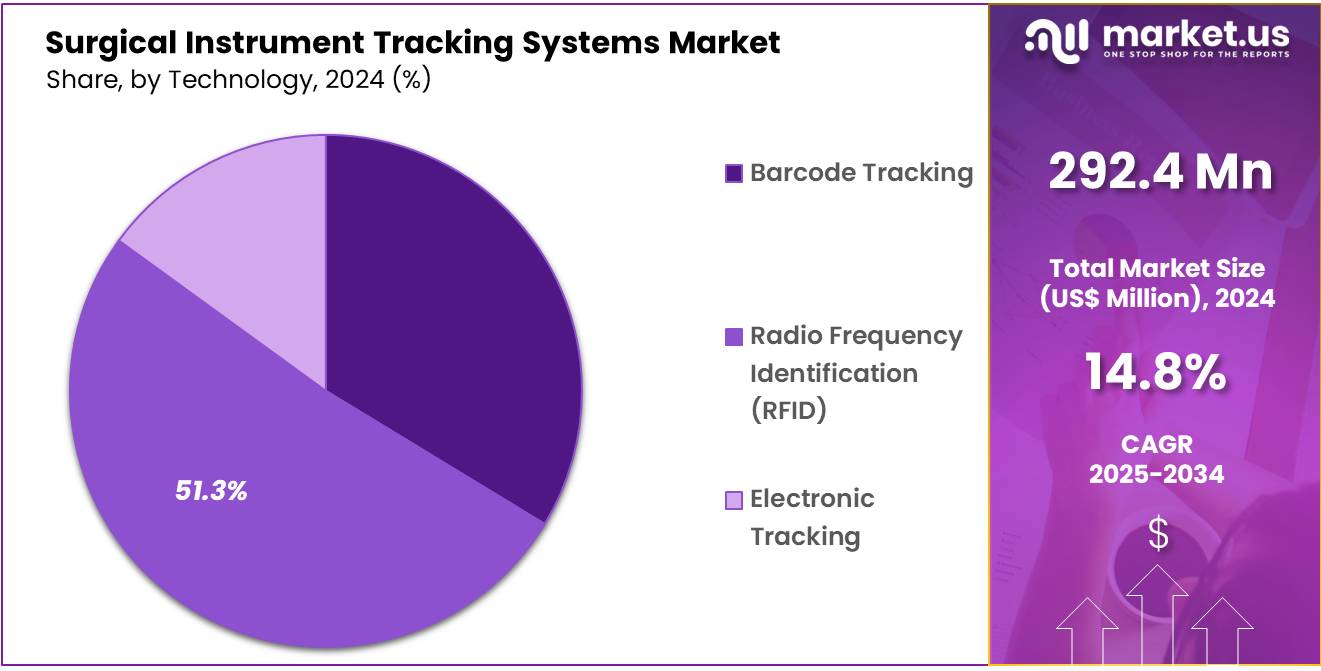

- By Technology, the market is bifurcated into Barcode Tracking, Radio Frequency Identification (RFID), and Electronic Tracking with Radio Frequency Identification (RFID) leading the market with 51.3% of market share.

- Furthermore, concerning the End-User segment, the market is segregated into Hospitals, Ambulatory Surgical Centers (ASCs), Research Centers, and Others. The Hospitals stands out as the dominant segment, holding the largest revenue share of 54.5% in the Surgical Instrument Tracking Systems market.

- North America led the market by securing a market share of 37.4% in 2024.

Component Analysis

In the Surgical Instrument Tracking Systems (SITS) market, the hardware segment dominated with a 46.7% market share due to the critical role that physical components such as RFID tags, barcode labels, readers, and sensors play in enabling instrument tracking. Hardware is the foundation of tracking systems, allowing healthcare facilities to monitor the status and location of surgical instruments in real-time.

RFID tags and readers provide a robust solution for accurate, contactless tracking, essential in preventing retained surgical instruments (RSIs) and ensuring patient safety. The widespread adoption of RFID-based tracking systems across hospitals, surgical centers, and clinics contributes significantly to the hardware segment’s dominance.

Additionally, the increasing focus on improving operational efficiency and reducing costs further fuels the demand for these hardware components, making them indispensable in modern healthcare settings. In October 2023, Fresenius Kabi announced the launch of +RFID smart labels for Diprivan (Propofol) Injectable Emulsion, USP, 200 mg per 20 mL in single-dose vials, available in the United States. These +RFID labels are now fully compatible with all major RFID kit and tray systems in the U.S.

Technology Analysis

In the technology segment of the SITS market, Radio Frequency Identification (RFID) is the dominant technology accounting for 51.3% market share due to its advantages in providing real-time, contactless tracking of surgical instruments. RFID allows hospitals and surgical centers to track instruments throughout their lifecycle, improving efficiency and reducing human error. Unlike barcode tracking, RFID does not require line-of-sight scanning, which speeds up the tracking process and minimizes the risk of misplacement.

RFID-enabled systems can also provide more accurate data, facilitating better inventory management and compliance with sterilization protocols. As the healthcare sector increasingly embraces automation and real-time data monitoring, RFID continues to lead the market due to its scalability and reliability in large healthcare facilities.

For instance, in May 2025, Xerafy’s introduction of its next-generation RAIN RFID tagging solutions at RFID Journal Live 2025 garnered significant attention from integrators, end users, and technology partners, solidifying the company’s position as a leader in high-performance asset tracking. These new solutions are designed to revolutionize how industries implement and scale RFID in real-world environments, pushing the boundaries of rugged and scalable asset tagging.

End-User Analysis

The hospitals segment dominated the end-user category in the SITS market with a market share of 54.5%, driven by the high volume of surgeries performed and the critical need for efficient instrument tracking to ensure patient safety. Hospitals have complex surgical workflows and a high demand for precise instrument management, which makes tracking systems essential.

The integration of SITS in hospitals helps streamline the sterilization process, improve operational efficiency, and reduce the risk of retained surgical instruments (RSIs). Additionally, hospitals face stringent regulations and are under constant pressure to maintain high standards of patient care, making the adoption of tracking systems indispensable for complying with safety and sterilization standards. The large-scale infrastructure and diverse surgical departments within hospitals create a consistent demand for these systems.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Technology

- Barcode Tracking

- Radio Frequency Identification (RFID)

- Electronic Tracking

By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Research Centers

- Others

Drivers

Increasing Demand for Patient Safety and Operational Efficiency

A key driver propelling the growth of the Surgical Instrument Tracking Systems (SITS) market is the rising focus on patient safety and operational efficiency. For instance, in April 2024, the Medicines and Healthcare products Regulatory Agency (MHRA) outlined its strategic approach to artificial intelligence (AI).

The MHRA expressed its support for the Government’s 2023 white paper, A pro-innovation approach to AI regulation, and highlighted the significant progress made over the past 12 months in implementing the paper’s recommendations. This progress is guided by five key strategic principles in their ongoing work.

Hospitals and surgical centers are under growing pressure to maintain strict compliance with regulations and improve patient outcomes. The need to track surgical instruments throughout their lifecycle especially in terms of sterilization and usage has led to the widespread adoption of tracking systems. These systems reduce the risk of retained surgical instruments (RSIs), a significant safety concern.

In addition to improving patient safety, SITS also enhance operational efficiency by providing real-time visibility into the status and location of surgical instruments, reducing downtime and improving staff productivity. Automated tracking systems ensure that instruments are appropriately sterilized, maintained, and returned to the correct surgical trays.

As healthcare facilities continue to face rising demands for patient care and operational costs, the use of advanced tracking solutions enables them to meet both regulatory standards and performance goals. This, in turn, is expected to drive the market for surgical instrument tracking systems, particularly as technology advances and healthcare providers become more inclined to adopt systems that improve their overall service delivery and patient safety protocols.

Restraints

High Initial Setup Costs

While Surgical Instrument Tracking Systems offer numerous benefits, their high initial setup costs remain a significant restraint in the market. Healthcare facilities, especially smaller hospitals and outpatient clinics, may find it challenging to justify the substantial upfront investment required for RFID-based tracking systems. These systems typically involve costs for hardware (such as RFID tags, readers, and sensors), software (for asset and inventory management), and the integration of existing infrastructure with tracking systems.

Additionally, specialized training is needed to ensure that healthcare staff can effectively operate these technologies, which further contributes to the overall cost. For some smaller healthcare providers or those with limited budgets, the high capital expenditure required for implementation might outweigh the perceived long-term benefits, leading to slower adoption.

While the return on investment (ROI) can be significant in the long run due to improved operational efficiency and patient safety, the initial financial burden can deter smaller players from adopting these technologies. Overcoming this cost barrier through more affordable and scalable solutions will be critical for expanding the adoption of Surgical Instrument Tracking Systems in the future.

Opportunities

Growth in Emerging Markets

One of the most promising opportunities for the Surgical Instrument Tracking Systems (SITS) market lies in the rapid growth of healthcare infrastructure in emerging markets. As these regions experience a boom in healthcare spending, there is an increasing focus on modernizing medical facilities, adopting advanced technologies, and improving patient care.

Countries in Asia-Pacific, Latin America, and the Middle East are investing heavily in healthcare infrastructure to meet the demands of their growing populations and increasing prevalence of chronic diseases. In particular, the rising middle class in countries like India, China, and Brazil is demanding better healthcare services, driving the need for more efficient hospital management systems.

Implementing Surgical Instrument Tracking Systems in these regions offers an opportunity to improve patient safety, optimize surgical procedures, and reduce operational costs associated with instrument management. Additionally, governments in these regions are introducing stricter regulatory standards for sterilization and medical device tracking, creating an even more favorable environment for the adoption of SITS.

In June 2022, Fresenius Kabi announced that AmerisourceBergen has joined IntelliGuard and Healthcare Logistics in supporting the compatibility of Fresenius Kabi +RFID products. These products utilize GS1’s Electronic Product Code (EPC) Tag Data Standard, which aims to improve interoperability, enhance patient safety, and provide better supply chain visibility in healthcare.

Impact of Macroeconomic / Geopolitical Factors

The global healthcare sector is heavily affected by economic conditions, particularly healthcare budgets and spending priorities. Economic downturns, inflation, and fiscal constraints often lead to reduced budgets for healthcare facilities, making it challenging for smaller hospitals or outpatient centers to afford advanced technologies like surgical instrument tracking systems. However, during periods of economic stability or growth, increased healthcare expenditure and the rising adoption of technology in hospitals foster the growth of SITS.

Additionally, the pressure to reduce healthcare operational costs drives the demand for solutions that can improve efficiency and reduce human error, such as tracking systems. The growing focus on patient safety and regulatory compliance further accelerates the market’s growth, as healthcare providers aim to adhere to strict sterilization and equipment management protocols.

Geopolitical factors, such as trade policies, regional conflicts, and changes in healthcare regulations, also impact the market. For instance, international trade tensions or conflicts may disrupt the supply chain for essential hardware components, such as RFID tags and readers, leading to delays or increased costs for these technologies.

Conversely, regions with stable political environments, like North America and Europe, experience more robust adoption of tracking systems due to well-established healthcare infrastructures and regulatory frameworks. Additionally, government incentives in developing countries to improve healthcare infrastructure and regulatory standards for sterilization and patient safety can create growth opportunities for SITS providers in emerging markets like Asia-Pacific and Latin America.

Latest Trends

Integration of Artificial Intelligence and IoT

A major trend in the Surgical Instrument Tracking Systems (SITS) market is the increasing integration of Artificial Intelligence (AI) and the Internet of Things (IoT) technologies into tracking solutions. Healthcare facilities are increasingly looking for more sophisticated and intelligent systems that not only track surgical instruments but also analyze data and optimize workflows.

AI enables predictive analytics, allowing hospitals to anticipate when instruments need maintenance, sterilization, or replacement. It can also streamline inventory management by forecasting instrument usage patterns, reducing the risk of shortages or overstocking. IoT, on the other hand, allows devices to be interconnected, providing real-time data on the location and status of surgical instruments across the hospital.

This can improve decision-making, reduce human error, and ensure that instruments are always available and ready for use. By leveraging AI and IoT, surgical instrument tracking systems are evolving from simple tracking solutions to comprehensive asset management systems that provide deeper insights into operational efficiency.

In February 2025, Newland AIDC, a global leader in data capture innovation, expanded its product range for various industries and manufacturing sectors in Indonesia by launching AI-powered barcode scanners, wearables, barcode printers, and scanner guns. These products are intelligent, durable, and highly flexible, offering competitive pricing.

Regional Analysis

North America is leading the Surgical Instrument Tracking Systems Market

The growth of the U.S. surgical instruments tracking systems market is driven by its advanced healthcare infrastructure, high surgical volumes, and stringent regulatory frameworks, including the FDA’s Unique Device Identification (UDI) mandate. Hospitals are quick to adopt new technologies to enhance patient safety and meet infection control standards. The presence of leading market players and continuous product innovations also plays a significant role in the market’s expansion.

The industry benefits from a mature healthcare system, early adoption of technology, and mandatory regulatory requirements. Additionally, large hospital networks and increasing investments in healthcare IT support the widespread implementation of tracking systems. Growing awareness of surgical safety and stringent hospital accreditation standards further fuel the demand.

In March 2025, a Chicago-based company, Zebra Technologies Corporation, which is also a global leader in digitizing and automating frontline workflows, announced new solutions designed to enhance automation and visibility across manufacturing, warehousing, and supply chain operations. Zebra’s updated portfolio of solutions will be showcased at Booth #S637 during ProMat 2025, which will take place from March 17-20 at McCormick Place in Chicago.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Surgical Instrument Tracking Systems market includes Fortive Corporation, Becton, Dickinson and Company (BD), Getinge AB, STERIS plc, STANLEY Healthcare (CenTrak), Mobile Aspects, Censis Technologies (Fortive), Material Management Microsystems, Haldor Advanced Technologies, Key Surgical (Stryker), B. Braun Melsungen AG, Scanlan International, SpaTrack Medical Limited, Xerafy Singapore Pte Ltd., NuTrace, Vizinex RFID, ScanCARE Pty Ltd., TGX Medical Systems, and Other key players.

Fortive Corporation is a diversified industrial technology company that provides advanced tracking solutions, including RFID and barcode systems, through its subsidiary Material Management Microsystems (MMS). Becton, Dickinson and Company (BD) is a global medical technology company renowned for its advanced healthcare solutions, including its innovations in RFID and barcode tracking systems.

BD’s RFID and barcode tracking solutions are used in a variety of healthcare applications, including the tracking of surgical instruments, medical devices, and pharmaceutical products. BD integrates RFID technology into surgical instrument tracking systems to offer enhanced visibility, real-time data on instrument status, and compliance with sterilization processes, which are critical in preventing retained surgical items (RSIs).

Top Key Players

- Fortive Corporation

- Becton, Dickinson and Company (BD)

- Getinge AB

- STERIS plc

- STANLEY Healthcare (CenTrak)

- Mobile Aspects

- Censis Technologies (Fortive)

- Material Management Microsystems

- Haldor Advanced Technologies

- Key Surgical (Stryker)

- Braun Melsungen AG

- Scanlan International

- SpaTrack Medical Limited

- Xerafy Singapore Pte Ltd.

- NuTrace

- Vizinex RFID

- ScanCARE Pty Ltd.

- TGX Medical Systems

- Other key players

Recent Developments

- In July 2024, Fineline Technologies, a leading provider of RFID tagging and unique identification solutions, is thrilled to announce its partnership with Zebra Technologies at ProMat 2025. The event will be held from March 17-20, 2025, at McCormick Place in Chicago, IL.

- In September 2024, Oracle introduced a new replenishment solution within Oracle Fusion Cloud Supply Chain & Manufacturing (SCM) to help healthcare customers optimize inventory management. The RFID for Replenishment solution, part of Oracle Cloud SCM’s Inventory Management, leverages RFID technologies from Avery Dennison, Terso Solutions, and Zebra Technologies. This solution automatically captures usage, updates stock balances, tracks locations, and triggers the restocking of supplies and materials.

- In September 2023, Zebra Technologies Corporation, a leading provider of digital solutions that connect data, assets, and people, has announced that Hull University Teaching Hospitals NHS Trust (The Trust) is utilizing Zebra’s MotionWorks real-time location solution (RTLS) to manage, track, and trace medical equipment across its two major clinical campuses, Hull Royal Infirmary and Castle Hill Hospital.

Report Scope

Report Features Description Market Value (2024) US$ 292.4 Million Forecast Revenue (2034) US$ 1,162.5 Million CAGR (2025-2034) 14.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software and Services), By Technology (Barcode Tracking, Radio Frequency Identification (RFID) and Electronic Tracking), By End User (Hospitals, Ambulatory Surgical Centers (ASCs), Research Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Fortive Corporation, Becton, Dickinson and Company (BD), Getinge AB, STERIS plc, STANLEY Healthcare (CenTrak), Mobile Aspects, Censis Technologies (Fortive), Material Management Microsystems, Haldor Advanced Technologies, Key Surgical (Stryker), B. Braun Melsungen AG, Scanlan International, SpaTrack Medical Limited, Xerafy Singapore Pte Ltd., NuTrace, Vizinex RFID, ScanCARE Pty Ltd., TGX Medical Systems, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Surgical Instrument Tracking Systems MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Surgical Instrument Tracking Systems MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fortive Corporation

- Becton, Dickinson and Company (BD)

- Getinge AB

- STERIS plc

- STANLEY Healthcare (CenTrak)

- Mobile Aspects

- Censis Technologies (Fortive)

- Material Management Microsystems

- Haldor Advanced Technologies

- Key Surgical (Stryker)

- Braun Melsungen AG

- Scanlan International

- SpaTrack Medical Limited

- Xerafy Singapore Pte Ltd.

- NuTrace

- Vizinex RFID

- ScanCARE Pty Ltd.

- TGX Medical Systems

- Other key players