Global Surgical Clips Market By Product Type (Ligating Clips and Aneurysm Clips), By Material (Titanium, Polymer and Others), By Surgery (General Surgery and Automated & Robotic Assisted Surgery), By End-Use (Hospitals & Clinics and Ambulatory Surgical Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177314

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

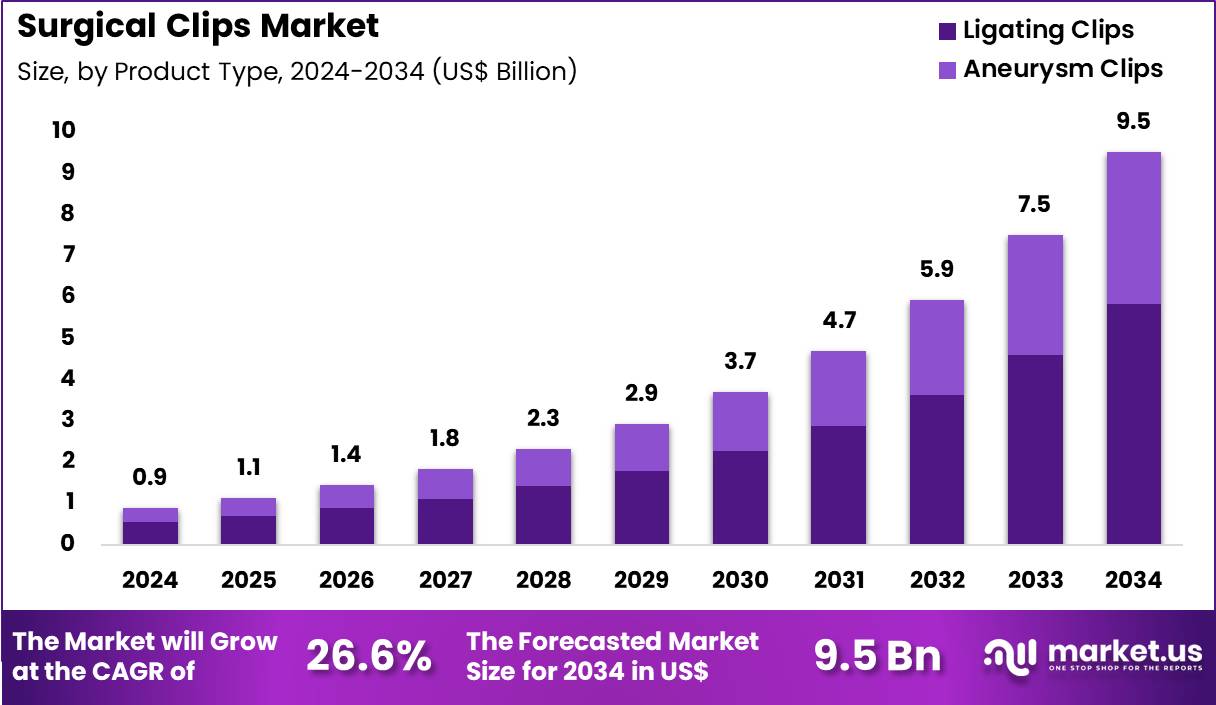

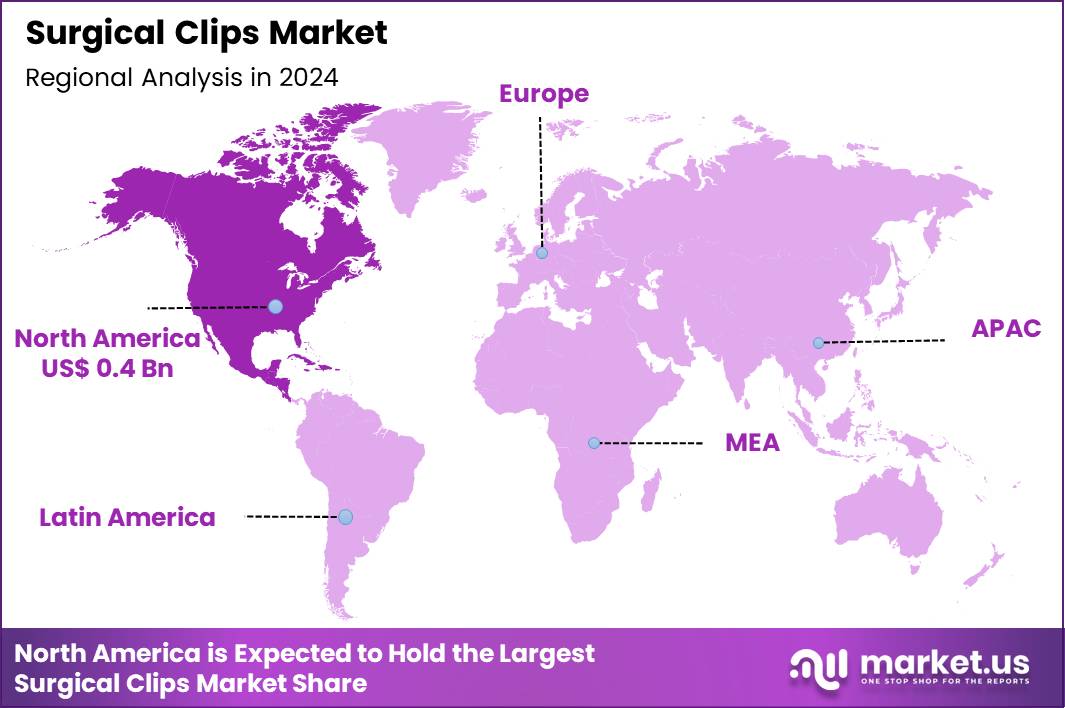

Global Surgical Clips Market size is expected to be worth around US$ 9.5 Billion by 2034 from US$ 0.9 Billion in 2024, growing at a CAGR of 26.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 44.4% share with a revenue of US$ 0.4 Billion.

Increasing volume of minimally invasive surgeries drives the surgical clips market as surgeons prioritize reliable ligation tools that minimize tissue trauma and enhance procedural efficiency. Surgeons increasingly apply titanium and polymer clips in laparoscopic cholecystectomies to secure the cystic duct and artery, preventing bile leakage and reducing postoperative complications.

These devices support vascular procedures by occluding blood vessels during aneurysm repairs or bypass grafts, ensuring hemostasis without suture-related risks. Clinicians utilize absorbable clips in gastrointestinal surgeries to ligate bowel segments temporarily, allowing natural resorption that avoids long-term foreign body reactions.

Orthopedic applications involve clips for soft tissue approximation in joint reconstructions, stabilizing tendons and ligaments during healing. Gynecologists employ these tools in tubal ligation and hysterectomy, providing secure vessel closure that shortens operating time and promotes faster recovery.

Manufacturers pursue opportunities to develop bioresorbable clips with enhanced tensile strength, expanding applications in pediatric surgeries where permanent implants risk growth interference. Developers advance smart clips embedded with sensors for real-time occlusion monitoring, broadening utility in robotic-assisted interventions that demand precision feedback.

These innovations facilitate hybrid materials combining metal and polymer for customizable degradation rates, optimizing outcomes in colorectal and thoracic procedures. Opportunities emerge in antimicrobial-coated clips that reduce infection rates, appealing to high-risk vascular and abdominal cases.

Companies invest in 3D-printed designs tailored to anatomical variations, improving fit and functionality. Recent trends emphasize sustainable manufacturing practices and integration with digital surgical platforms, positioning the market for growth in value-based care focused on safety and procedural innovation.

Key Takeaways

- In 2024, the market generated a revenue of US$ 0.9 Billion, with a CAGR of 26.6%, and is expected to reach US$ 9.5 Billion by the year 2034.

- The product type segment is divided into ligating clips and aneurysm clips, with ligating clips taking the lead with a market share of 61.3%.

- Considering material, the market is divided into titanium, polymer and others. Among these, titanium held a significant share of 54.8%.

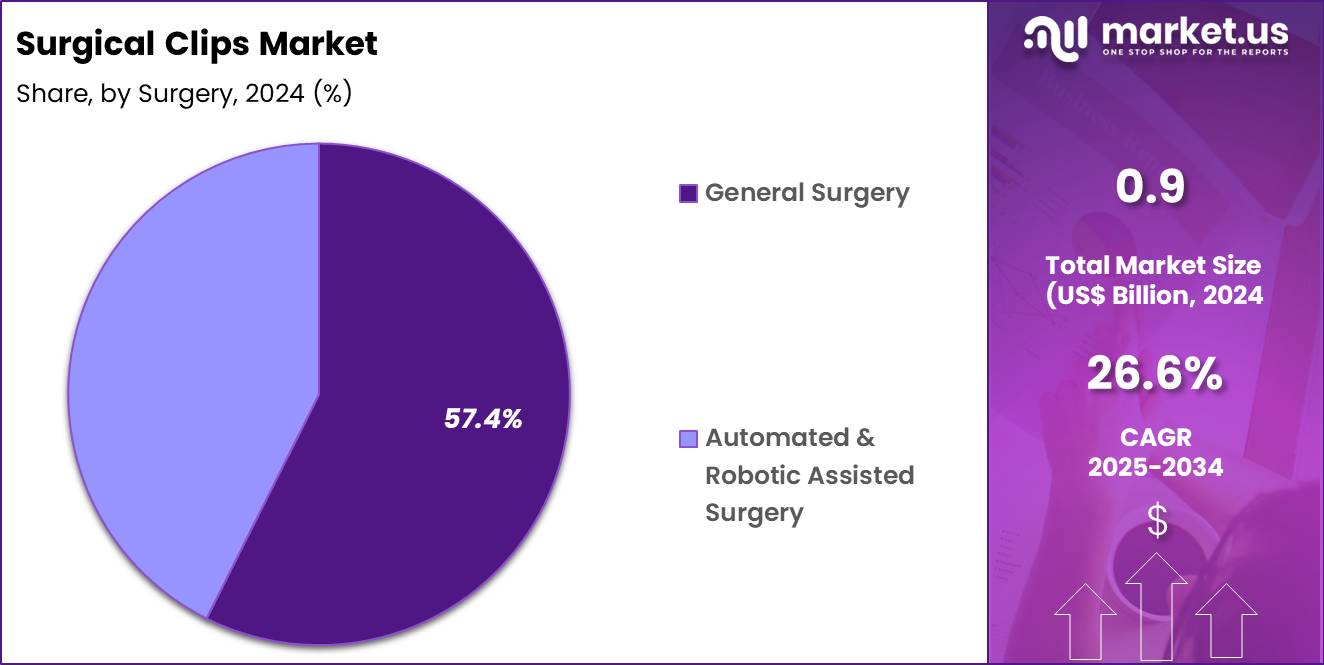

- Furthermore, concerning the surgery segment, the market is segregated into general surgery and automated & robotic assisted surgery. The general surgery sector stands out as the dominant player, holding the largest revenue share of 57.4% in the market.

- The end-use segment is segregated into hospitals & clinics and ambulatory surgical centers, with the hospitals & clinics segment leading the market, holding a revenue share of 69.1%.

- North America led the market by securing a market share of 44.4%.

Product Type Analysis

Ligating clips contributed 61.3% of growth within product type and led the surgical clips market due to their routine use in vessel and duct closure across a wide range of procedures. Surgeons rely on ligating clips for consistent hemostasis during laparoscopic and open surgeries, which supports high procedural volumes.

Their compatibility with minimally invasive techniques increases usage in cholecystectomy, colorectal, and urological procedures. Ease of deployment and reduced operative time strengthen preference among surgical teams.

Growth strengthens as minimally invasive surgery adoption expands across healthcare systems. Clip appliers designed for precision and ergonomics improve procedural efficiency. Training familiarity and standardized protocols reinforce repeat usage. Increasing elective surgery volumes further elevate demand. The segment is expected to remain dominant as ligating clips continue to serve as a core consumable in everyday surgical practice.

Material Analysis

Titanium accounted for 54.8% of growth within material and dominated the surgical clips market due to its strength, biocompatibility, and imaging compatibility. Surgeons prefer titanium clips because they provide reliable closure without corrosion or tissue reaction. Compatibility with MRI and CT imaging reduces postoperative complications and follow-up concerns. Consistent performance across diverse anatomical sites reinforces clinical confidence.

Growth accelerates as surgical safety standards emphasize material reliability and long-term stability. Titanium supports sterilization requirements and maintains integrity under physiological conditions. Hospitals standardize procurement around titanium to reduce variability in outcomes. Expansion of advanced imaging-guided surgeries further supports adoption. The segment is anticipated to maintain leadership as safety and compatibility remain critical selection criteria.

Surgery Analysis

General surgery generated 57.4% of growth within surgery and emerged as the leading segment due to the high volume of procedures requiring vessel ligation and tissue closure. Common operations such as appendectomy, hernia repair, and gallbladder removal routinely use surgical clips. Broad patient demographics and elective surgery growth increase procedural frequency. Surgeons value clips for their efficiency in both open and laparoscopic settings.

Growth strengthens as outpatient and short-stay surgical models expand general surgery throughput. Standardized surgical pathways increase consumable usage per case. Rising prevalence of gastrointestinal and abdominal conditions sustains procedure demand. Training emphasis on clip-based techniques reinforces utilization. The segment is projected to remain dominant as general surgery continues to account for a large share of operative interventions.

End-Use Analysis

Hospitals and clinics contributed 69.1% of growth within end-use and dominated the surgical clips market due to their concentration of surgical volume and procedural complexity. These settings manage both routine and high-risk surgeries that require dependable hemostatic solutions. Centralized operating theaters and multidisciplinary teams increase clip consumption across departments. Procurement scale and standardized inventory practices support consistent demand.

Growth continues as hospitals expand surgical capacity and modernize operating rooms. Accreditation and safety protocols reinforce use of proven closure devices. Teaching hospitals further increase usage through training and research activity. Referral networks concentrate complex cases within hospitals. The segment is expected to remain the primary growth driver as hospitals and clinics continue to anchor surgical care delivery.

Key Market Segments

By Product Type

- Ligating Clips

- Aneurysm Clips

By Material

- Titanium

- Polymer

- Others

By Surgery

- General Surgery

- Automated & Robotic Assisted Surgery

By End-Use

- Hospitals & Clinics

- Ambulatory Surgical Centers

Drivers

Increasing prevalence of valvular heart diseases is driving the market.

The escalating incidence of valvular heart diseases worldwide has substantially boosted the demand for surgical clips used in minimally invasive repairs to restore proper valve function and prevent complications. Enhanced diagnostic imaging and screening programs have led to earlier detection of conditions like tricuspid regurgitation, expanding the patient population requiring clip-based interventions.

Healthcare providers are increasingly utilizing these clips to offer less invasive alternatives to open-heart surgery for affected individuals. According to the Centers for Disease Control and Prevention, in 2023, heart disease remained the leading cause of death in the United States, with valvular disorders contributing significantly to cardiovascular morbidity. This ongoing health challenge underscores the critical role of durable clips in managing structural heart issues.

Surgical clips enable precise tissue approximation, reducing procedural times and improving outcomes in electrophysiology labs. The association between aging populations and higher valvular degeneration rates further amplifies the need for reliable fixation devices.

Public health initiatives emphasize preventive cardiology, supporting the integration of clip technologies in treatment protocols. Leading manufacturers are refining clip designs to address this growing clinical imperative. This driver sustains investments in interventional cardiology infrastructure globally.

Restraints

High cost of advanced surgical clip systems is restraining the market.

The premium pricing of innovative surgical clip systems, including delivery catheters and deployment tools, limits their adoption in hospitals with constrained budgets. Complex engineering for biocompatibility and precision deployment contributes to elevated manufacturing expenses for these devices. Smaller medical centers often prioritize basic equipment over high-end clip variants due to financial constraints.

Regulatory requirements for extensive clinical testing add to the overall cost structure in product development. In public healthcare frameworks, procurement decisions favor cost-effective alternatives, delaying widespread use. Providers may opt for traditional suturing methods to manage operational finances in resource-limited settings. This restraint affects scalability, particularly in developing economies with limited reimbursement.

Industry attempts to introduce mid-range models aim to alleviate pricing pressures partially. Despite procedural benefits, the cost factor hinders universal accessibility and adoption rates. Consequently, addressing economic barriers is essential for overcoming this market limitation.

Opportunities

Growth in structural heart revenues is creating growth opportunities.

The upward trajectory in revenues from structural heart products signals potential for expanded deployment of surgical clips in valve repair procedures. Increased investments in cardiovascular innovation support the integration of clip technologies in high-volume centers.

Abbott reported worldwide structural heart sales of $ 2.1 billion in 2024, reflecting an 18.0 % increase on an organic basis from the previous year. This performance demonstrates sustained demand for devices that enhance interventional efficacy in heart valve therapies. Alliances with electrophysiologists facilitate tailored solutions for emerging arrhythmia treatments.

The large procedural base in developed economies amplifies prospects for clip upgrades. Reforms in reimbursement policies bolster infrastructure enhancements for structural interventions. Primary corporations are establishing regional operations to leverage efficient distribution. This opportunity aligns with efforts to bridge gaps in advanced cardiac care. Strategic expansions can capture substantial shares in dynamic markets.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the surgical clips market through hospital operating budgets, procedure volumes, and purchasing discipline across surgical departments. Inflation and higher interest rates increase pressure on supply costs, which heightens price sensitivity for consumables such as ligating and aneurysm clips.

Geopolitical tensions disrupt supplies of medical grade metals, polymers, and sterilization services, creating sourcing risk and longer lead times. Current US tariffs on imported clips and raw materials raise manufacturing and procurement costs, which compress margins and complicate contract negotiations. These factors challenge smaller suppliers and can delay inventory expansion at cost constrained hospitals.

On the positive side, trade pressure encourages domestic production, recycled material use, and supplier diversification. Continued growth in minimally invasive and robotic assisted surgeries sustains consistent demand. With disciplined sourcing, surgeon friendly designs, and efficient distribution, the market remains positioned for stable and confident growth.

Latest Trends

Approval of novel clip systems for valve repair is a recent trend in the market.

In 2024, the authorization of advanced clip systems has transformed treatment options for tricuspid regurgitation through minimally invasive approaches. These devices incorporate flexible delivery mechanisms to accommodate varied anatomies during transcatheter procedures. Abbott received U.S. Food and Drug Administration approval in April 2024 for its TriClip transcatheter edge-to-edge repair system.

This approval provides a dedicated solution for patients unsuitable for open-heart surgery. Manufacturers are emphasizing durability testing to ensure long-term efficacy in valve leaflet approximation. Clinical trials in 2024 confirmed reduced regurgitation grades with these systems. The trend prioritizes patient-centered designs for improved procedural safety.

Regulatory pathways have adapted to expedite reviews for structural heart innovations. Industry collaborations refine deployment techniques for broader applicability. These developments aim to minimize complications in high-risk cardiac populations.

Regional Analysis

North America is leading the Surgical Clips Market

North America accounted for a 44.4% share of the Surgical Clips market in 2024, driven by sustained growth in minimally invasive and elective surgical procedures. Hospitals continued to favor mechanical closure solutions to reduce operating time and improve procedural consistency across general, cardiovascular, and laparoscopic surgeries.

Surgeons increasingly preferred clips over sutures in high-volume procedures because they support precision and lower variability in closure outcomes. A steady rebound in elective surgeries after earlier disruptions further strengthened procedural volumes. Ambulatory surgical centers expanded their case loads, which increased routine consumption of disposable closure devices.

Training standards and familiarity among surgeons also supported repeat usage across specialties. A clear indicator of procedural intensity comes from the Centers for Medicare and Medicaid Services, which reported over 34 million inpatient hospital discharges in the US in 2023, a volume level that directly supports demand for surgical closure products.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Surgical Clips market in Asia Pacific is expected to grow strongly during the forecast period as healthcare access and surgical capacity continue to expand. Governments across the region invest in hospital infrastructure and universal health coverage, which raises the number of treatable surgical cases.

Surgeons increasingly adopt minimally invasive techniques, driving preference for standardized closure tools that improve efficiency. Medical tourism growth in countries such as India, Thailand, and South Korea further adds to procedure volumes. Local manufacturing improves supply availability and pricing, encouraging wider adoption across public hospitals.

Rising surgeon training programs strengthen familiarity with modern closure methods. A verifiable signal of this trend appears in India’s official data, where the Ministry of Health and Family Welfare reported more than 60 million hospital admissions authorized under the Ayushman Bharat scheme by 2023, reflecting rapid expansion in surgical care delivery that supports sustained demand for closure devices across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the surgical clips market grow by enhancing alloy composition, delivery mechanisms, and clip designs that improve handling precision and reduce procedure time for surgeons across general surgery, endoscopy, and minimally invasive procedures. They also strengthen customer engagement through comprehensive training programs, responsive field support, and integrated supply solutions that align with hospital inventory management goals.

Firms expand distribution networks with global medical distributors and direct hospital contracts to secure preferred supplier status and capture stable volume demand. Strategic alliances with device innovators and clinical opinion leaders help shape product roadmaps that address evolving procedural requirements.

Ethicon Inc., a subsidiary of Johnson & Johnson, exemplifies a leading medical technology company with a robust portfolio of surgical instruments, strong global commercial operations, and deep clinical education capabilities that support operating room performance.

The company advances its strategic agenda through disciplined investment in R&D, targeted acquisitions that broaden its procedural reach, and coordinated commercialization that translates clinician insights into market-relevant offerings.

Top Key Players

- Medtronic

- Johnson & Johnson

- B. Braun

- Teleflex

- CooperSurgical

- Meril Life Sciences

- Grena Ltd

- Purple Surgical

- Scanlan International

- Ackermann Instrumente

Recent Developments

- In 2025, Johnson & Johnson reported that its MedTech segment, which includes the Ethicon surgical technology business and its extensive ligation clip portfolio, achieved total annual sales of US$ 33.79 billion. As per the recent year-end financial disclosures, the company noted that this growth was supported by over 40 regulatory approvals across major global markets and a strategic focus on expanding its presence in high-growth surgical end markets.

- In 2025, Teleflex Incorporated announced that its Surgical segment—encompassing specialized ligation systems such as the Hem-o-lok and titanium clips—generated US$ 342.7 million in revenue during the first nine months of the year. According to the company’s third-quarter financial filing, this performance was driven by consistent clinical demand for its core surgical products and expansion within the Americas and Asia regions.

Report Scope

Report Features Description Market Value (2024) US$ 0.9 Billion Forecast Revenue (2034) US$ 9.5 Billion CAGR (2025-2034) 26.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ligating Clips and Aneurysm Clips), By Material (Titanium, Polymer and Others), By Surgery (General Surgery and Automated & Robotic Assisted Surgery), By End-Use (Hospitals & Clinics and Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Medtronic, Johnson & Johnson, B. Braun, Teleflex, CooperSurgical, Meril Life Sciences, Grena Ltd, Purple Surgical, Scanlan International, Ackermann Instrumente Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Medtronic

- Johnson & Johnson

- B. Braun

- Teleflex

- CooperSurgical

- Meril Life Sciences

- Grena Ltd

- Purple Surgical

- Scanlan International

- Ackermann Instrumente