Global Supply Chain Security Market Report By Component (Hardware, Software, Services), By Security Type (Data Visibility and Governance, Data Locality and Protection, Other Security Types), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (Retail and E-Commerce, Manufacturing, Pharmaceutical and Healthcare, Logistics and Transportation, Automotive, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 129047

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

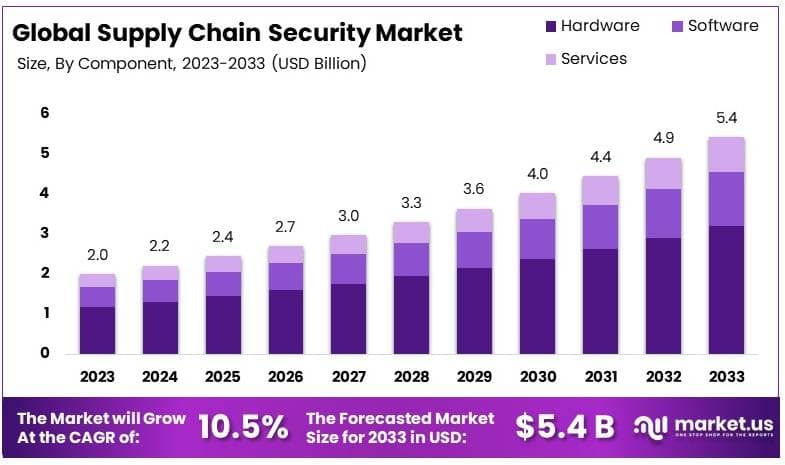

The Global Supply Chain Security Market size is expected to be worth around USD 5.4 Billion by 2033, from USD 2.0 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2024 to 2033.

Supply chain security refers to the efforts and measures taken to protect the supply chain from various risks like theft, fraud, terrorism, and natural disasters. It involves securing the movement of goods from manufacturers to consumers, ensuring that every step in the process is safeguarded against disruptions. This security not only protects physical goods but also the data involved in managing the supply chain.

The supply chain security market is rapidly expanding due to the increasing awareness of vulnerabilities in global supply chains. Companies across various industries, including manufacturing, retail, and logistics, are investing in advanced security solutions to protect their supply networks. These solutions range from physical security measures, like surveillance and access control, to digital security, such as cybersecurity tools and blockchain for tracking and authentication.

The growth of the supply chain security market is driven by several factors. The rise of e-commerce and global trade has increased the complexity of supply chains, making them more susceptible to threats. The growing number of cyberattacks targeting supply chains has also pushed companies to adopt advanced security technologies. Additionally, regulations in industries like pharmaceuticals and food and beverage have increased demand for secure supply chain solutions. Businesses are now focusing more on end-to-end visibility, tracking, and authentication to ensure the safety of their operations.

The supply chain security market offers significant opportunities for growth. With the expansion of the Internet of Things (IoT) and artificial intelligence, companies can automate security processes and gain real-time insights into their supply chains. There is also potential in developing countries where supply chain infrastructure is still being established. As more companies adopt digital transformation strategies, the demand for robust supply chain security solutions will continue to rise.

The supply chain security market is experiencing significant growth as organizations become more aware of the vulnerabilities in their supply networks. In 2024, the formation of the Supply Chain Resilience Cooperation Group (SCRCG) between the U.S., U.K., and Australia highlights the increasing focus on protecting critical supply chains, especially telecommunications infrastructure.

The SCRCG’s aim to develop early warning systems for potential disruptions reflects the need for stronger safeguards against both cyber and physical threats. This cooperation signals the global importance of supply chain security as more industries rely on complex and interconnected systems.

Several factors drive growth in this market. Rising cyber threats, such as the 2020 SolarWinds breach, exposed vulnerabilities in the supply chain, showing that vendors often lack sufficient cybersecurity. This breach affected 18,000 customers, including U.S. federal agencies, underscoring the risk posed by unprotected supply chain nodes.

The demand for better security is fueled by companies seeking to prevent such attacks. Additionally, supply chain visibility has become a priority, with 55% of manufacturing businesses focusing on improving transparency, creating opportunities for technological solutions to enhance data collection and monitoring.

Governments worldwide are implementing stricter regulations to secure supply chains. New laws like Germany’s Supply Chain Due Diligence Act and Canada’s Forced and Child Labour in Supply Chains Act are pushing businesses to ensure compliance with labor and human rights standards.

Germany’s law affects businesses with over 1,000 employees, expanding compliance requirements by 500%, which creates a greater need for tools that ensure transparency and adherence to these regulations. These regulations are critical growth drivers, as companies are compelled to invest in technologies and processes to meet evolving standards.

Despite the increasing investment, supply chain disruptions remain a major concern. In 2024, 57% of businesses reported that supply chain disruptions significantly affected their revenue, while 62% of companies experienced financial losses due to these issues. Natural disasters, geopolitical conflicts, and changing regulations compound these challenges.

Moreover, only 53% of supply chain leaders have sufficient data quality to make optimal decisions, which hampers efforts to streamline operations and reduce vulnerabilities. This gap presents a clear opportunity for companies offering data and analytics solutions to address these deficiencies and improve decision-making capabilities.

Key Takeaways

- The Supply Chain Security Market was valued at 2.0 Billion in 2023 and is expected to reach 5.4 Billion by 2033, with a CAGR of 10.5%.

- In 2023, Hardware dominates the component segment with 59.1%, reflecting the high demand for physical security solutions.

- In 2023, Data Locality and Protection led the security type with 42.5%, driven by data protection concerns.

- In 2023, Large Enterprises held 64.6% market share due to their extensive supply chain networks.

- In 2023, Pharmaceutical and Healthcare led the industry vertical with 23.0%, underscoring its critical need for secure supply chains.

- In 2023, North America dominated with 36.1% share, benefiting from advanced security technologies.

Type Analysis

Software dominates with 59.1% due to comprehensive functionality and integration capabilities.

The Supply Chain Security market is segmented by various components, including hardware, software, and services. Among these, the software segment leads with a 59.1% market share. This dominance is driven by the critical need for comprehensive security solutions that can be easily integrated into existing supply chain systems.

Software solutions offer robust data visibility and governance capabilities, which are essential for preventing breaches and ensuring data integrity across the supply chain analytics.

The role of hardware, though significant, is somewhat overshadowed by the software segment. Hardware components such as sensors, RFID tags, and security devices play a foundational role in monitoring and physically securing goods. However, their effectiveness is considerably enhanced when combined with software that analyzes the data they collect.

Services also play a crucial role, providing the necessary support, maintenance, and updates required for the effective deployment of hardware and software solutions. This segment includes professional and managed services that ensure the supply chain security solutions are up-to-date and functioning optimally.

Security Type Analysis

Data Locality and Protection dominates with 42.5% due to stringent regulatory compliance requirements.

In the industry of Security Types within the Supply Chain Security market, Data Locality and Protection emerges as the leading segment with a 42.5% share. This segment’s growth is primarily fueled by increasing global regulations like GDPR in Europe and CCPA in California, which require companies to manage and protect data within specific geographic boundaries.

Data Visibility and Governance is another critical segment that involves tracking data access and usage within the supply chain to prevent unauthorized access and data breaches. This segment, although smaller, is crucial for compliance and maintaining the integrity of sensitive information.

The “Other Security Types” segment encompasses a variety of emerging and ancillary security measures, including blockchain and artificial intelligence-driven solutions. These technologies are gaining traction for their potential to further secure supply chains against sophisticated cyber threats.

Organization Size Analysis

Large Enterprises dominate with 64.6% due to their capacity to invest in advanced security solutions.

Large Enterprises hold the largest share in the Supply Chain Security market by organization size, standing at 64.6%. Their dominance is largely attributed to their significant financial and operational capabilities, which allow for the adoption of advanced and comprehensive security measures.

These enterprises often operate on a global scale, necessitating robust security solutions that can protect complex and extensive supply chain networks.

Small and Medium-Sized Enterprises (SMEs), while holding a smaller market share, are increasingly adopting supply chain security solutions. Their growth is spurred by rising awareness and gradually increasing regulatory pressures. Moreover, advancements in technology are making these solutions more accessible and affordable to smaller players, fostering their adoption rate.

Industry Vertical Analysis

Pharmaceutical and Healthcare dominates with 23.0% due to high stakes in product integrity and regulatory compliance.

The Pharmaceutical and Healthcare industry is the most significant vertical in the Supply Chain Security market, accounting for a 23.0% share. The critical nature of products in this sector, combined with stringent regulatory requirements, drives the need for impeccable supply chain security.

Protecting against counterfeit products and ensuring the integrity of goods from manufacture to delivery are paramount concerns that bolster the adoption of sophisticated security solutions.

Other industry verticals such as Retail and E-commerce, Manufacturing, Logistics and Transportation, and Automotive also significantly contribute to the market. Each of these sectors faces unique challenges that dictate their security needs, such as the high volume of goods and complex logistics networks in Retail and E-commerce, and the valuable, often proprietary components in the Automotive industry.

The robust growth in these segments underscores a widespread recognition of the risks associated with supply chain vulnerabilities and the overarching need to protect against them through targeted security solutions.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Security Type

- Data Visibility and Governance

- Data Locality and Protection

- Other Security Types

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Industry Vertical

- Retail and E-Commerce

- Manufacturing

- Pharmaceutical and Healthcare

- Logistics and Transportation

- Automotive

- Other Industry Verticals

Driver

Rising Cybersecurity Threats Drives Market Growth

The rise in cybersecurity threats is one of the most significant factors driving the growth of the supply chain security market. As companies face increasing risks from cyber-attacks, there is a higher demand for security solutions that can mitigate potential breaches. Businesses are focusing on securing their networks and data to prevent disruptions in their operations.

Alongside this, the globalization of supply chains has amplified the risk of cyber threats. As supply chains become more complex and international, the vulnerability to attacks rises, pushing companies to invest in more advanced security tools.

Moreover, the growing use of cloud-based solutions in supply chain management has also heightened security concerns. Cloud managed services provide immense benefits, but they can also be a target for cyber-attacks. Companies are now adopting more secure cloud practices to safeguard their operations.

Finally, there is increasing demand for transparency and visibility in supply chain operations. Customers and regulatory bodies alike are pushing for greater traceability. This has led businesses to adopt technologies that enhance security while also providing more insight into their supply chain activities.

Restraint

High Implementation Costs Restraints Market Growth

One of the major restraining factors in the supply chain security market is the high implementation cost. Many businesses find the upfront costs of deploying comprehensive security solutions prohibitive, especially smaller companies that operate on limited budgets.

Another key restraint is the complexity of integrating new security systems with existing supply chain infrastructures. Companies often face technical challenges that delay or complicate the implementation process, affecting overall adoption rates.

In addition, the market is experiencing a shortage of skilled professionals capable of managing and maintaining these advanced security systems. This talent gap makes it harder for businesses to fully capitalize on the available technology.

Data privacy concerns also pose a significant restraint. As supply chain security solutions often require access to sensitive information, many businesses are hesitant to adopt them due to fears of data breaches or misuse of their information.

Opportunity

Expansion into Emerging Markets Provides Opportunities

The supply chain security market is poised to benefit from the expansion into emerging markets. As developing economies continue to grow, they are increasingly integrating into global supply chains, which creates a rising demand for security solutions to safeguard their operations.

In addition, the growth of the e-commerce sector is opening new opportunities for supply chain security providers. With more businesses transitioning to online platforms, the need for robust cybersecurity measures to protect customer data and transactions is growing rapidly.

Moreover, the development of AI in supply chain solutions presents significant opportunities for the market. AI can enhance the efficiency of security systems by identifying threats faster and more accurately, allowing companies to respond proactively.

Finally, increased collaboration between industry players is providing opportunities for innovation. As businesses work together to develop new technologies and solutions, the overall market benefits from faster advancements and broader adoption.

Challenge

Rapid Technological Changes Challenges Market Growth

One of the primary challenges in the supply chain security market is the rapid pace of technological change. Companies are struggling to keep up with the constant evolution of security technologies, making it difficult to stay updated and protect their supply chains.

The fragmented nature of global supply chains also poses a challenge. With different regions using various technologies and processes, ensuring uniform security measures across all levels of the supply chain is highly complex.

In addition, the shortage of cybersecurity experts is a critical issue. The demand for skilled professionals far exceeds the supply, leading to a gap that hampers the growth and implementation of security solutions.

Regulatory variations across regions further complicate matters. Businesses must navigate different legal requirements in each country they operate in, making it difficult to implement consistent security practices across global supply chains.

Growth Factors

Increasing Investment in Cybersecurity Is Growth Factor

The supply chain security market is experiencing significant growth due to increasing investment in cybersecurity. Companies across various industries are recognizing the need to protect their supply chains from cyber threats, and as a result, they are allocating more resources to secure their systems.

Another key factor is the growing awareness of supply chain risks. As supply chains become more complex and interconnected, businesses are increasingly focused on mitigating vulnerabilities that could disrupt operations.

Accelerated digital transformation is also boosting the supply chain security market. As companies digitize their operations and integrate more technologies like IoT, AI, and blockchain into their supply chains, they face new security challenges. This shift to digital operations requires advanced security tools to safeguard data and ensure operational continuity, further driving market growth.

Additionally, the growth in global trade plays a significant role in the market’s expansion. As businesses operate across borders, they encounter more complex supply chain networks, which increases the need for robust security measures.

Emerging Trends

Adoption of Blockchain Is Latest Trending Factor

Blockchain technology is emerging as a major trend in the supply chain security market. It offers secure, transparent, and decentralized data management, which helps companies track every step of their supply chain with greater accuracy and security.

Predictive analytics is another trending factor. Businesses are increasingly adopting analytics tools that help them forecast risks and address potential issues before they become significant problems. This proactive approach to security is gaining traction.

Automation in supply chains is also on the rise. Automated systems reduce human error and streamline operations, while enhancing security by minimizing potential vulnerabilities caused by manual processes.

The focus on sustainability in supply chains is gaining momentum. Businesses are looking for ways to not only secure their supply chains but also ensure that they are sustainable and environmentally friendly, aligning with global efforts to combat climate change.

Regional Analysis

North America Dominates with 36.1% Market Share

North America leads the supply chain security market with a 36.1% share, amounting to USD 0.72 billion. This dominance is driven by high investments in cybersecurity and advanced technology integration across industries. The region’s focus on securing complex supply chains, coupled with strict regulatory standards, ensures a robust demand for supply chain security solutions.

North America’s strong digital infrastructure and large-scale adoption of IoT and AI technologies in supply chain management play a pivotal role in shaping the market. The presence of leading tech companies and supply chain innovation hubs further strengthens its market position, allowing businesses to safeguard against increasing cyber threats and disruptions.

North America’s influence is set to grow, as companies continue prioritizing supply chain security in response to global risks and increasing digitalization. The region’s strong regulatory framework and focus on technological advancement will further enhance its market presence, potentially boosting its market share in the future.

Regional Mentions:

- Europe: Europe shows steady growth in the supply chain security market, driven by strict data protection regulations like GDPR. The region’s focus on sustainability and ethical supply chain practices fosters the demand for secure and transparent solutions.

- Asia Pacific: Asia Pacific is rapidly expanding in the supply chain security market, fueled by industrial growth and complex global trade networks. Major economies like China and Japan are increasingly investing in digital security to protect their supply chains.

- Middle East & Africa: Middle East and Africa are gradually adopting supply chain security solutions, particularly in sectors like energy and logistics. The region’s focus on infrastructure and trade expansion is driving demand for secure supply chain systems.

- Latin America: Latin America is witnessing growing interest in supply chain security, particularly due to its increasing involvement in global trade. The region is focused on modernizing its logistics and supply chain management systems to mitigate risks.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the supply chain security market, IBM Corporation, Siemens AG, and Zebra Technologies Corporation stand out as the top three companies due to their strong strategic positioning and significant market influence. These companies lead the industry by offering advanced technological solutions that address the growing demand for supply chain security and risk mitigation.

IBM Corporation plays a pivotal role in the market through its innovative use of AI and blockchain technology. IBM’s supply chain security solutions are designed to provide real-time visibility and transparency across complex global networks, making it a key player for businesses seeking to safeguard their supply chains from cyber threats and disruptions. Its strategic focus on integrating AI-driven insights has strengthened its market position, allowing it to serve a wide range of industries.

Siemens AG leverages its expertise in automation and digitalization to enhance supply chain security. Siemens offers comprehensive solutions that combine IoT with advanced analytics to monitor and secure supply chain operations in real time. Siemens’ strong presence in industrial and manufacturing sectors has positioned it as a key player, driving its market influence through its end-to-end solutions that ensure operational security and efficiency.

Zebra Technologies Corporation is another influential player in the supply chain security market, specializing in real-time tracking and monitoring solutions. Zebra’s use of RFID, barcode technology, and cloud-based software enables companies to track goods throughout the supply chain, reducing the risk of theft or loss. Its strategic partnerships and focus on providing data-driven insights have made it a crucial player for companies looking to optimize their supply chain security.

These top players continue to shape the supply chain security market with their advanced technologies, strategic collaborations, and focus on innovation, driving the industry’s growth and competitive landscape.

Top Key Players in the Market

- Siemens AG

- IBM Corporation

- Zebra Technologies Corporation

- tempmate GmbH

- Intel Corporation

- Sensitech Inc.

- DHL Group

- Dickson

- ORBCOMM

- Monnit Corporation

- Other Key Players

Recent Developments

- DHS Supply Chain Resilience Group: On September 2024, the U.S. Department of Homeland Security, along with the U.K. and Australia, launched the Supply Chain Resilience Cooperation Group (SCRCG). This group will enhance cooperation to identify vulnerabilities and prevent disruptions in critical supply chains, particularly in telecommunications.

- Synopsys Software Supply Chain Security Offering: On April 2024, Synopsys introduced the Black Duck Supply Chain Edition to safeguard software supply chains by monitoring open-source and third-party components. The tool includes a Software Bill of Materials (SBOM) and provides automated insights into vulnerabilities and licensing risks, enabling organizations to protect their software development processes more effectively.

- CDK Global Cyberattack: On June 2024, a cyberattack on CDK Global exposed the company’s vulnerabilities and underscored the broader risks associated with third-party software providers in supply chains. This incident highlights the need for stronger security practices and the importance of thoroughly assessing vendors’ cybersecurity protocols to prevent future breaches.

- Scribe Security and Illustria Partnership: On September 2024, Scribe Security partnered with Illustria to strengthen software supply chain security, with a focus on open-source dependency management. This collaboration combines Scribe’s comprehensive security tools and Illustria’s real-time risk analysis, offering enhanced risk mitigation throughout the software lifecycle.

Report Scope

Report Features Description Market Value (2023) USD 2.0 Billion Forecast Revenue (2033) USD 5.4 Billion CAGR (2024-2033) 10.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Security Type (Data Visibility and Governance, Data Locality and Protection, Other Security Types), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (Retail and E-Commerce, Manufacturing, Pharmaceutical and Healthcare, Logistics and Transportation, Automotive, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens AG, IBM Corporation, Zebra Technologies Corporation, tempmate GmbH, Intel Corporation, Sensitech Inc., DHL Group, Dickson, ORBCOMM, Monnit Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Supply Chain Security MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Supply Chain Security MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens AG

- IBM Corporation

- Zebra Technologies Corporation

- tempmate GmbH

- Intel Corporation

- Sensitech Inc.

- DHL Group

- Dickson

- ORBCOMM

- Monnit Corporation

- Other Key Players