Global Supercapacitors Market by Product Type (Electrochemical Double Layer Capacitors (EDLC), Pseudocapacitors and Hybrid Capacitors), By Material (Activated carbon, Carbide derived carbon, Carbon aerogel, Other Materials), and By End-User (Automotive and Transportation, Industrial, Electronics, Energy and Power, Military and Defense, Aerospace and Aviation, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 18923

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

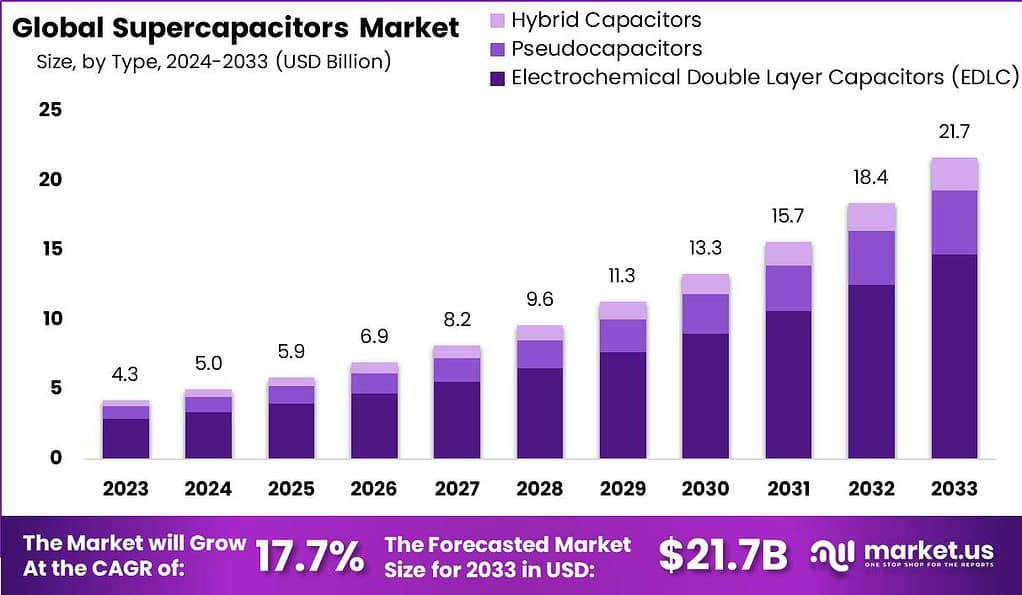

The Global Supercapacitors Market size was projected to be USD 4.3 billion in 2023. By the end of 2024, the industry is likely to reach a valuation of USD 5.0 billion. During the forecast period, the global market for supercapacitors is expected to garner a 17.7% CAGR and reach a size of USD 21.7 billion by 2033.

Supercapacitors, also known as ultracapacitors or electrochemical capacitors, emerge as energy storage solutions distinguished by their high power density and swift energy storage and release features. Unlike their traditional counterparts, supercapacitors leverage electrolytes and specialized electrode materials to significantly enhance their energy storage capacity. This design allows supercapacitors to excel in promptly storing and delivering energy, making them indispensable in scenarios where quick energy transitions are essential.

The global supercapacitors market has witnessed significant growth in recent years and is expected to continue expanding. The market growth is driven by the increasing demand for energy storage solutions with high power density and fast charging capabilities. Factors such as the growing adoption of renewable energy sources, the need for energy-efficient transportation, and advancements in electronics have fueled the demand for supercapacitors.

Analyst Viewpoint

The demand for supercapacitors is surging, primarily due to the global push towards energy efficiency and sustainable technology. This demand is further amplified by the growing adoption of IoT devices and the expansion of 5G infrastructure, where supercapacitors are utilized for their rapid energy delivery and long life cycles. The automotive sector, particularly with the rise of electric vehicles, represents a significant portion of this demand, leveraging supercapacitors for improved performance and energy efficiency.

Technological advancements in material science and manufacturing processes are central to the market’s expansion. Innovations in electrode materials and electrolytes are enhancing the performance of supercapacitors, making them more efficient, durable, and cost-effective. These advancements are crucial in addressing previous limitations related to energy density and operational stability, thereby opening up new application possibilities.

The market is witnessing expansion not just in terms of applications but also geographically. Emerging markets in Asia-Pacific, driven by industrial growth and technological adoption, are becoming key areas of focus. Moreover, established markets in North America and Europe continue to invest heavily in renewable energy and advanced transportation technologies, further fueling growth.

Key Takeaways

- The Supercapacitors Market is projected to grow significantly, with a CAGR of 17.7%. It is expected to jump from USD 5.0 billion in 2024 to USD 21.7 billion by 2033.

- Electrochemical Double Layer Capacitors (EDLC) held a dominant position in the market in 2023, with a share of over 68%.

- Activated carbon was the dominant material in 2023, capturing more than 74% of the market share.

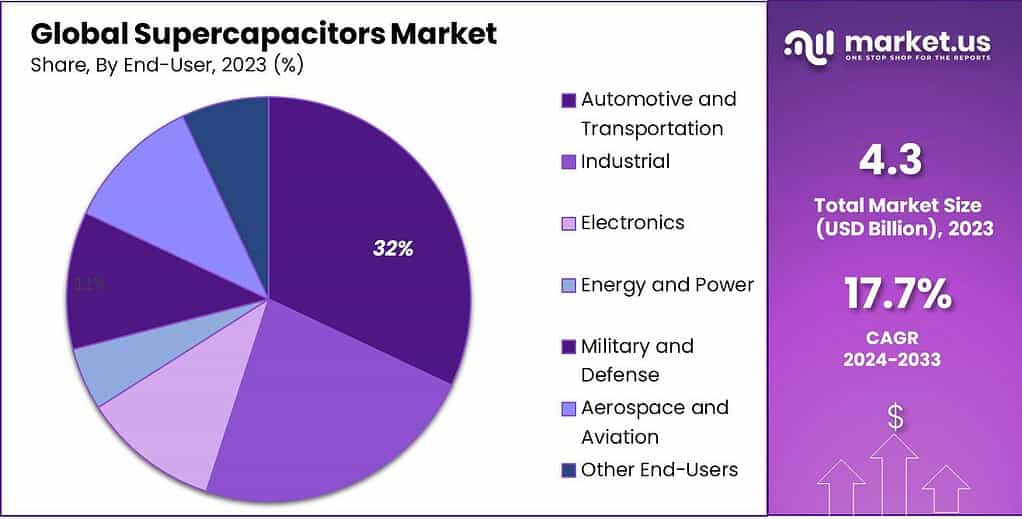

- The Automotive and Transportation segment held a dominant position in 2023, with over 32% market share.

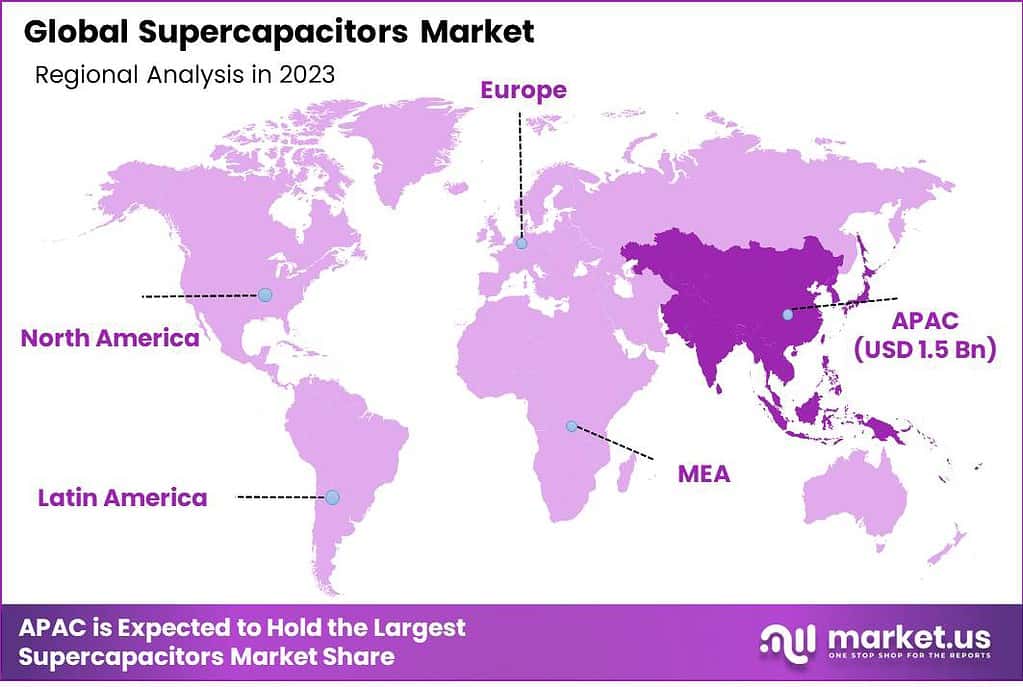

- Asia-Pacific emerged as the dominant region, with more than 36% market share in 2023.

- Prominent companies in the Supercapacitors Market include Maxwell Technologies (acquired by Tesla, Inc.), Nesscap Energy (acquired by Maxwell Technologies), Ioxus, Skeleton Technologies, and others.

Product Type Analysis

In 2023, the Electrochemical Double Layer Capacitors (EDLC) segment held a dominant position in the supercapacitors market, capturing more than a 68% share. This substantial market share can be attributed to several key factors. Firstly, the inherent structural design of EDLCs, which consists of carbon electrodes with a high surface area, contributes to their high energy density and power capabilities. This makes them highly suitable for applications requiring rapid charge and discharge cycles over an extended period.

Additionally, advancements in material science have significantly improved the performance and reduced the cost of EDLCs, further bolstering their adoption across various industries. The versatility of EDLCs in applications ranging from consumer electronics to industrial power management and renewable energy systems has also played a crucial role in their market dominance. Their ability to provide quick bursts of energy makes them ideal for applications such as memory backup systems, power conditioning, and hybrid vehicles.

The robust growth in these application areas, driven by the increasing demand for energy-efficient and environmentally friendly technologies, has consequently fueled the expansion of the EDLC segment. Market data indicates a steady increase in the adoption of EDLCs, with projections suggesting continued growth, underpinned by ongoing technological innovations and increasing investment in renewable energy and electric vehicle sectors.

Material Analysis

In 2023, the Activated carbon segment held a dominant position in the supercapacitors materials market, capturing more than a 74% share. This dominance is largely due to the unique properties of activated carbon that make it highly suitable for supercapacitor applications. Activated carbon is known for its high surface area, which is crucial for the storage of electric charge in supercapacitors. This material provides a large number of pores, allowing for greater energy storage capacity, which is essential for high-performance supercapacitors.

Moreover, the cost-effectiveness of activated carbon compared to other advanced materials significantly contributes to its widespread adoption. Its relatively low production cost, combined with its abundance and accessibility, makes it an attractive option for manufacturers looking to reduce the overall cost of supercapacitors. This factor is particularly important in large-scale industrial and commercial applications where cost efficiency is a key consideration.

The segment’s growth is also driven by the versatility of activated carbon, which can be derived from various carbonaceous sources, allowing for flexibility in sourcing and production. Furthermore, ongoing research and development in enhancing the performance of activated carbon, such as increasing its electrical conductivity and optimizing its pore structure, are expected to further strengthen its market position.

In terms of application, activated carbon-based supercapacitors are extensively used in electronic devices, energy harvesting systems, and automotive applications, among others. The growing demand in these sectors, especially with the surge in renewable energy initiatives and the shift towards electric vehicles, is anticipated to continue fueling the growth of the activated carbon segment in the supercapacitors market.

End-User Analysis

In 2023, the Automotive and Transportation segment held a dominant market position in the supercapacitors market, capturing more than a 32% share. This significant market share is primarily driven by the increasing integration of supercapacitors in automotive applications due to their superior power density, reliability, and longer life cycle compared to traditional batteries. Supercapacitors are particularly advantageous in providing the necessary power for stop-start systems, regenerative braking, and power stabilization in vehicles, contributing to improved fuel efficiency and reduced emissions.

The rise in electric vehicle (EV) production has further bolstered the demand for supercapacitors in this sector. EVs benefit from the rapid charging and discharging capabilities of supercapacitors, enhancing performance and extending battery life. Moreover, the growing focus on sustainability and government incentives for green vehicles has accelerated the adoption of EVs, indirectly propelling the demand for supercapacitors in the automotive industry.

Another factor contributing to the dominance of this segment is the advancement in supercapacitor technology, which has led to more compact, efficient, and cost-effective solutions, making them more viable for a wide range of automotive applications. This includes not just passenger vehicles but also commercial and heavy-duty vehicles, where the demand for efficient energy storage and management systems is consistently high.

Key Market Segments

By Product Type

- Electrochemical Double Layer Capacitors (EDLC)

- Pseudocapacitors

- Hybrid Capacitors

By Material Analysis

- Activated carbon

- Carbide derived carbon

- Carbon aerogel

- Other Materials

End-User

- Automotive and Transportation

- Industrial

- Electronics

- Energy and Power

- Military and Defense

- Aerospace and Aviation

- Other End-Users

Driver

Growing Demand in Energy Storage and Automotive Sectors

The supercapacitors market is experiencing significant growth, primarily driven by escalating demand in the energy storage and automotive sectors. This growth can be attributed to the superior power density and rapid charging capabilities of supercapacitors, compared to traditional batteries. In the energy storage sector, supercapacitors are increasingly employed in power grid stabilization and renewable energy systems, contributing to their market expansion.

The automotive industry, particularly in the realm of electric vehicles (EVs), is another pivotal driver. Supercapacitors enhance the performance of EVs by providing peak power during acceleration and regenerative braking, thereby extending the life of lithium-ion batteries.

The global push for sustainable transportation solutions is further accelerating the adoption of supercapacitors in this sector. Market reports indicate a rising trajectory in the deployment of supercapacitors, underlined by the industries’ ongoing efforts to improve energy efficiency and reduce carbon footprints.

Restraint

Limited use of Supercapacitors as Long-term Energy Storage Solutions

The application of supercapacitors as long-term energy storage solutions faces significant limitations, acting as a restraint on market growth. Primarily, this limitation stems from their lower energy density compared to conventional batteries, which restricts their capacity to store energy over extended periods.

While supercapacitors excel in rapid charging and discharging, their inability to hold large amounts of energy for prolonged durations limits their utility in applications requiring sustained energy output. This inherent characteristic poses a substantial challenge in wider adoption across sectors relying on long-term energy storage, such as residential solar power systems and certain industrial applications. As a result, the market for supercapacitors, while growing in sectors that require short-term high-power delivery, faces a barrier in expanding into areas where long-term energy storage is paramount.

Opportunity

Technological Innovations and Expanding Applications

The supercapacitors market is poised to benefit from a plethora of opportunities, largely stemming from technological innovations and expanding applications. Advancements in material science and engineering are leading to the development of supercapacitors with higher energy densities and longer lifespans, widening their potential application spectrum. Emerging applications in sectors such as consumer electronics, for rapid charging solutions, and in healthcare for high-power medical devices, are opening new avenues for market growth.

Additionally, the integration of supercapacitors with IoT devices and smart grids represents a significant opportunity, driven by the need for efficient, reliable power management solutions in these technologies. These innovations are not only enhancing the performance parameters of supercapacitors but are also enabling their foray into new markets, thereby expanding the overall market potential.

Challenge

Integration and Standardization Issues

The integration and standardization of supercapacitors present notable challenges in the market. One of the primary issues lies in integrating supercapacitors with existing electronic systems and power infrastructures, which are predominantly designed for conventional batteries. This necessitates additional components and circuitry, complicating the design and increasing the cost.

Furthermore, the lack of standardized specifications and performance metrics for supercapacitors across different applications and industries hinders their widespread adoption. This lack of standardization results in compatibility issues and uncertainty in performance expectations, making it challenging for manufacturers to develop universally applicable solutions. Addressing these integration and standardization challenges is crucial for the broader acceptance and deployment of supercapacitors in various applications, which is essential for the continued growth of the market.

Regional Analysis

In 2023, Asia-Pacific emerged as the dominant region in the global supercapacitors market, capturing a significant market share of more than 36%. The region’s strong market position can be attributed to various factors that have contributed to its growth and prominence in the supercapacitors industry.

Asia-Pacific is witnessing rapid industrialization and urbanization, particularly in countries such as China, Japan, and South Korea. This has led to increased demand for energy storage solutions in various sectors, including automotive, electronics, and renewable energy. The automotive industry in Asia-Pacific is experiencing substantial growth, with a rising adoption of electric vehicles (EVs) and hybrid vehicles. Supercapacitors play a crucial role in these vehicles, providing quick bursts of power during acceleration and regenerative braking, thereby enhancing their energy efficiency and performance.

The electronics sector in Asia-Pacific is also a significant driver of the supercapacitors market. The region is a global hub for electronics manufacturing, and the demand for portable electronic devices such as smartphones, tablets, and wearables is consistently increasing. Supercapacitors are employed in these devices to deliver rapid power bursts during peak demand, extend battery life, and enable quick charging. The presence of a large consumer base and technological advancements in the electronics sector further contribute to the market’s growth in the region.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The supercapacitors market is characterized by the presence of several key players, each contributing to the market dynamics through innovation, production capabilities, and market outreach. Analyzing these players involves examining their market share, technological advancements, strategic initiatives, and overall impact on the market landscape

Some of the prominent players in the Supercapacitors market include:

- Maxwell Technologies (acquired by Tesla, Inc.)

- Nesscap Energy (acquired by Maxwell Technologies)

- Ioxus

- Skeleton Technologies

- Panasonic Corporation

- NEC Energy Solutions

- KEMET Corporation

- CAP-XX Limited

- Eaton Corporation

- Nippon Chemi-Con Corporation

- LS Mtron

- Nichicon Corporation

- Other Key Players

Recent Developments

- May 2023 (Launch): Abracon introduced the EDLC-2.7V radial supercapacitor, offering an extended lifespan and eliminating safety concerns linked to lithium batteries. These applications position Abracon ultracapacitors as optimal solutions for wireless networks, energy harvesting, cold start motors, microgrids, and beyond.

- In 2023, Maxwell Technologies, Focused on developing ultracapacitors (high-powered energy storage devices) for electric vehicles (EVs). EVs often have more complex cable systems for managing charging and battery power. Maxwell’s advancements in ultracapacitors could lead to faster charging times and better cable management solutions for EVs.

Report Scope

Report Features Description Market Value (2023) US$ 4.3 Bn Forecast Revenue (2033) US$ 21.7 Bn CAGR (2024-2033) 17.7% Base Year for Estimation 2023 Historic Period 2018-2028 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Electrochemical Double Layer Capacitors (EDLC), Pseudocapacitors and Hybrid Capacitors), By Material (Activated carbon, Carbide derived carbon, Carbon aerogel, Other Materials), and By End-User (Automotive and Transportation, Industrial, Electronics, Energy and Power, Military and Defense, Aerospace and Aviation, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Maxwell Technologies (acquired by Tesla Inc.), Nesscap Energy (acquired by Maxwell Technologies), Ioxus, Skeleton Technologies, Panasonic Corporation, NEC Energy Solutions, KEMET Corporation, CAP-XX Limited, Eaton Corporation, Nippon Chemi-Con Corporation, LS Mtron, Nichicon Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is Supercapacitors Market?The Global Supercapacitors Market size was projected to be USD 4.3 billion in 2023. By the end of 2024, the industry is likely to reach a valuation of USD 5.0 billion. During the forecast period, the global market for supercapacitors is expected to garner a 17.7% CAGR and reach a size of USD 21.7 billion by 2033.

What are the primary drivers influencing the supercapacitor market’s growth?The growth of the supercapacitor market is propelled by several key factors, including increasing demand for energy storage solutions, advancements in technology, and a rising focus on sustainable and efficient power storage. These factors collectively contribute to the positive trajectory of the supercapacitor market.

Who are the leading manufacturers in the supercapacitor industry?Several manufacturers dominate the supercapacitor industry, with notable players including Maxwell Technologies (acquired by Tesla Inc.), Nesscap Energy (acquired by Maxwell Technologies), Ioxus, Skeleton Technologies, Panasonic Corporation, NEC Energy Solutions, KEMET Corporation, CAP-XX Limited, Eaton Corporation, Nippon Chemi-Con Corporation, LS Mtron, Nichicon Corporation, Other Key Players

Which region is anticipated to experience the most rapid growth in the supercapacitor market during the forecast period?In 2023, Asia-Pacific emerged as the dominant region in the global supercapacitors market, capturing a significant market share of more than 36%.

What challenges does the Supercapacitors Market face?Factors such as high initial costs, limited energy density compared to traditional batteries, and manufacturing complexities pose challenges to widespread adoption. Overcoming these challenges requires concerted efforts from industry stakeholders.

-

-

- Maxwell Technologies (acquired by Tesla, Inc.)

- Nesscap Energy (acquired by Maxwell Technologies)

- Ioxus

- Skeleton Technologies

- Panasonic Corporation

- NEC Energy Solutions

- KEMET Corporation

- CAP-XX Limited

- Eaton Corporation

- Nippon Chemi-Con Corporation

- LS Mtron

- Nichicon Corporation

- Other Key Players