Global Succinic Acid Market, By Type (Petro-based and Bio-based), By End-User (Industrial, Coating, Food & Beverage, Pharmaceuticals and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 29454

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

In 2022, the global succinic acid market accounted for USD 181 million and is expected to grow around USD 359.8 million in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 7.3%.

Succinic acid, a dicarboxylic acid, is created from renewable resources including corn, wheat, and sugarcane, making it an attractive substitute for substances derived from petroleum. The chemical, pharmaceutical, food & beverage, and personal care sectors are succinic acid’s main markets.

Succinic acid is a precursor used in the chemical industry to create a variety of chemicals, such as resins, solvents, and polymers. It serves as an excipient in medicine formulations made by the pharmaceutical industry.

Key Takeaways

- Market Size: The world succinic acid industry is predicted to grow to USD 359.8 Million in 2032 at a constant annual increase of 7.3%.

- Analyzing Types: In terms of nature, the succinic acid market is classified into bio-based and petrol-based segments. Of these, the sector based on petro is expected to be the most lucrative within the succinic acid global market. The segment is expected to have the highest revenue share of 57.6% and is predicted to expand at a CAGR of 6.7% over the period forecast.

- Analyzing End-User Demand: In terms of users, succinic acid can be divided into industrial coatings, food & beverages cosmetics, and personal care pharmaceuticals, among others. Of these groups, the industrial sector has the largest market share with 31% and has an annual growth rate of 6.9 percent, which demonstrates its dominant position in the segment for end-users in the market for succinic acids.

- Market drivers: Increased awareness and the adoption of bio-based and sustainable chemicals fuel the demand for succinic acids in various sectors.

- Market Restrictions: A lack of awareness and acceptance of succinic acids in certain areas, usually because of supply chain constraints as well as cost restrictions, hinders the market’s penetration.

- The Market is Trending: An interesting trend is the growing demand for renewable chemicals, leading to the development of succinic acid as a construction element for environmentally sustainable products.

- Market Opportunities: The trend towards sustainability and the demand for environmentally friendly solutions offer significant opportunities for growth for succinic acids, specifically in the industries that seek more sustainable alternatives.

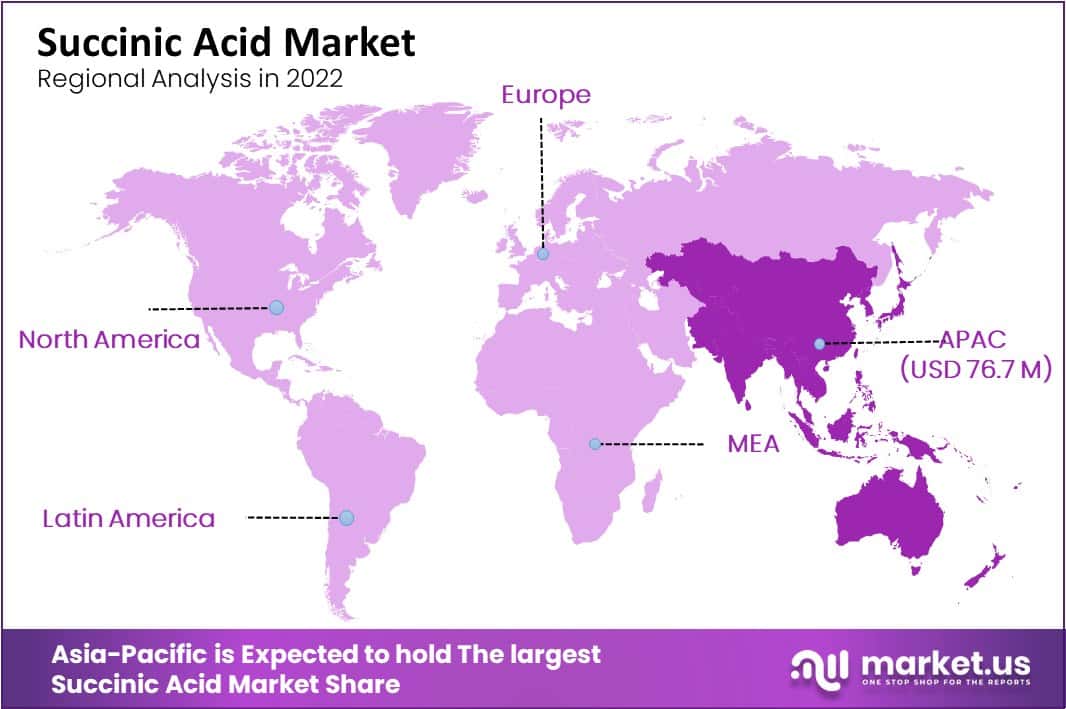

- The Regional Market Dynamics: Asia-Pacific could become the most lucrative market in the succinic acid industry, with the highest market share of 42.4% . Additionally, it is predicted to grow at a rate of 7.3% over the period of projection.

Driving Factors

Growing Demand for Bio-Based Chemicals and Food Additives and the Growth in the Pharmaceutical Industry Drive the Succinic Acid Market.

The demand for bio-based chemical products like succinic acids is increasing because of the growing awareness of the harmful effects synthetic chemicals have on the environment. In recent years, renewable resources like sugarcane & corn have been increasingly used for producing succinic acids. As a food additive, succinic acid can be used in the production of baked goods & dairy products.

The increasing demand for processed foods led to a rise in the use of succinic acid. Succinic acid can be used as a chemical intermediary for making tetrahydrofuran, butanediol, and other chemicals. The chemical industry has grown in importance, especially in emerging nations.

All drugs & medications like antibiotics, anticonvulsants, and sedatives are made up of succinic acids. The pharmaceutical industry has grown and because of that the need for succinic acids has increased.

Restraining Factors

High Production Costs, Limited Availability of Raw Materials, and Stringent Regulations are Restraining the Growth of the Market.

Technology and equipment need to be a heavy investment to produce succinic acid.

This can affect the manufacturing of succinic acid resulting in price volatility and supply chain interruptions. Other bio-based chemicals that can be used in related applications, such as citric acid and lactic acid, compete with succinic acid.

The market share and expansion potential of succinic acid may be constrained by this rivalry. Succinic acid is produced and used under strict guidelines for quality, safety, and environmental effects. These rules may make it more expensive and take longer to introduce succinic acid to the market, which could impede its development.

By Type Analysis

The Petro-based Segment Accounted for the Largest Revenue Share in Succinic Acid Market in 2022.

Based on type, the market is segmented into petro-based and Bio-based. Among these types, the petro-based is expected to be the most lucrative in the global succinic acid market, with the largest revenue share of 57.6% and a projected CAGR of 6.7% during the forecast period.

This is mainly used in the chemical industry for making petro-based succinic acid. This is more effective in comparison with bio-based succinic acid and also it is cost-effective. It is also used in the food and beverage industry as a flavor enhancer. Because of its well-established manufacturing operations, it is used in various industries.

The Bio-based Segment is the Fastest Growing Type Segment in the Succinic Acid Market.

The bio-based segment is projected as the fastest-growing type segment in the succinic acid market from 2022 to 2031. Because of the alternative option for the various chemicals, the bio-based category is forecasted to increase at a CAGR of 7.2%.

Bio-based succinic acid is used in the production of biodegradable plastic. It is an alternative option for the many chemicals like adipic acid for the manufacturing of biodegradable plastic. Several companies are making strategies for the growth of bio-based succinic acid including the use of bacterial strains isolated from the rumen.

By End-User Analysis

The Industrial Segment Holds a Significant Share in End-User Analysis in the Succinic Acid Market.

Based on end-users, the market is divided into industrial, coating, food & beverage, personal care & cosmetics, pharmaceuticals, and other end-users. Among this, the industrial segment is dominant in the end-user segment in the succinic acid market, with a market share of 31% and a CAGR of 6.9%.

The manufacturing of 1,4-butanediol (BDO), a widely utilized chemical that is used in the production of spandex, polyurethane, and other materials, is one of the most significant uses of succinic acid in the chemicals industry.

Food & Beverage is Identified as Fastest Growing End-User Segment in Projected Period.

Food & beverage is also an important end-user segment in the succinic acid market and it is expected to grow faster in the and-user analysis in the succinic acid market with a CAGR of 7.4% and a market value is 25%.

The primary factor driving the succinic acid market in the food and beverage sector is its use as a food additive. Succinic acid is a naturally occurring dicarboxylic acid that is used in a variety of food and beverage items as a flavoring, acidity regulator, and buffering agent.

Key Market Segments

Based on Type

- Petro-based

- Bio-based

Based on End-User

- Industrial

- Coating

- Food & Beverage

- Personal Care & Cosmetics

- Pharmaceuticals

- Other End-Users

Growth Opportunity

Development of New Production Technologies, Expansion of Application, and Strategic Partnerships Creates the Opportunity for Podcasters.

Succinic acid is used extensively in many different sectors, including the pharmaceutical, and chemical intermediate industries and food and beverage. Manufacturers of succinic acid may find new chances to grow their market share as a result of the expansion of these uses, particularly in developing markets.

Succinic acid manufacturing costs can be decreased while efficiency and sustainability are increased through the development of innovative production technologies. The yield and purity of succinic acid can be increased, and the dependence on non-renewable resources can be decreased, through the application of modern fermentation techniques including bioreactor and metabolic engineering design.

Collaborations and partnerships between producers of succinic acid and other businesses can open up fresh possibilities for market growth and innovation. Increasing research and development spending may result in the creation of new succinic acid uses, manufacturing processes, and markets. This can aid succinic acid producers in maintaining their innovation and competitive edge in a market that is transforming quickly.

Latest Trends

Increased Focus on Sustainability, Technological Advancements, and Growing Demand in the Food Industry is the Latest Trends in Succinic Acid Market.

The need for bio-based chemicals like succinic acid is being driven by the global movement toward sustainability. In order to create succinic acid, manufacturers are increasingly turning to renewable resources like sugarcane and corn, which minimizes their carbon footprint and environmental impact.

For succinic acid creation, new technologies are being developed to increase productivity and yield. These developments include metabolic, fermentation optimization, and bio-refining engineering. To tap into emerging markets and reduce their dependence on a single market, manufacturers are spreading their operations to other areas.

Due to the rising demand for bio-based chemicals in the region, succinic acid is seeing increased demand in Asia-Pacific in particular.

Regional Analysis

Asia-Pacific Accounted for the Largest Revenue Share in Succinic Acid Market in 2022.

Asia-Pacific is estimated to be the most lucrative market in the global succinic acid market, with the largest market share of 42.4%, and is expected to register a CAGR of 7.3% during the forecast period.

The succinic acid market is anticipated to develop at the fastest pace in the Asia-Pacific region as a result of rising demand from end-use sectors including pharmaceuticals, chemicals, and food & beverage.

The market in this region has been expanding as a result of the rising population, rising disposable income, and rapid industrialization in nations like China, India, and Japan.

North America is Expected as Fastest Growing Region in Projected Period in Succinic Acid Market.

North America is expected as the fastest-growing region in the forecast period in the succinic acid market with a CAGR of 7.4%. As a result of rising demand from end-use sectors like the pharmaceutical, beverage, and personal care industries. Key market participants like BioAmber, Inc. and Reverdia, Inc. are present here, which helps the market expand.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

As a result of the numerous small and medium-sized firms participating in the industry, it is extremely competitive and fragmented. The market is expanding as a result of factors such as rising demand for bio-based chemicals, expanding applications across different sectors, and improvements in production technology.

The market for succinic acid is dominated by companies like BioAmber Inc., Mitsubishi Chemical Corporation, and BASF SE in terms of market share.

Market Key Players

- BASF SE

- Mitsubishi Chemical Holdings

- Bioamber Inc.

- DSM

- Kawasaki Kasei Chemicals Ltd.

- Purac

- Reverdia

- Other Key Players

Recent Developments

- In 2021, BioAmber leading bio-based succinic acid producer filed for bankruptcy and sold its succinic acid factory to a private equity company.

- In 2020, To increase the production of bio-based succinic acid, Johnson Matthey, a leader in sustainable technologies, and Myriant Corporation have formed a strategic alliance.

Report Scope

Report Features Description Market Value (2022) USD 181 Mn Forecast Revenue (2032) USD 359.8 Mn CAGR (2023-2032) 7.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Type (Petro-based, Bio-based), Based on End-User (Industrial, Coating, Food & Beverage, Personal Care & Cosmetics, Pharmaceuticals, Other End-Users) Regional Analysis North America – The US, Canada Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe APAC- China, Japan, South Korea, India, ASEAN, Rest of APAC Latin America – Brazil, Mexico, Rest of Latin America Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Mitsubishi Chemical Holdings, Bio Amber, DSM, Kawasaki Kasei Chemicals, Purac, Peverdia, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Mitsubishi Chemical Holdings

- Bioamber Inc.

- DSM

- Kawasaki Kasei Chemicals Ltd.

- Purac

- Reverdia

- Other Key Players