Global Subscription-Based Drone Security Market Size, Share, Industry Analysis Report By Type (Hardware, Software, Services); By Deployment Mode (Cloud-based, On-premises); By Drone Type(Fixed-wing Drones, Rotary-wing Drones, Hybrid Drones); By Application (Military & Defense, Commercial, Infrastructure Monitoring, Emergency Services, Agriculture, Others); By End User (Government Agencies, Private Enterprises, Security Service Providers, Individual Consumers), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163628

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Impact and Adoption

- US Market Size

- By Type

- By Deployment Mode

- By Drone Type

- By Application

- By End User

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

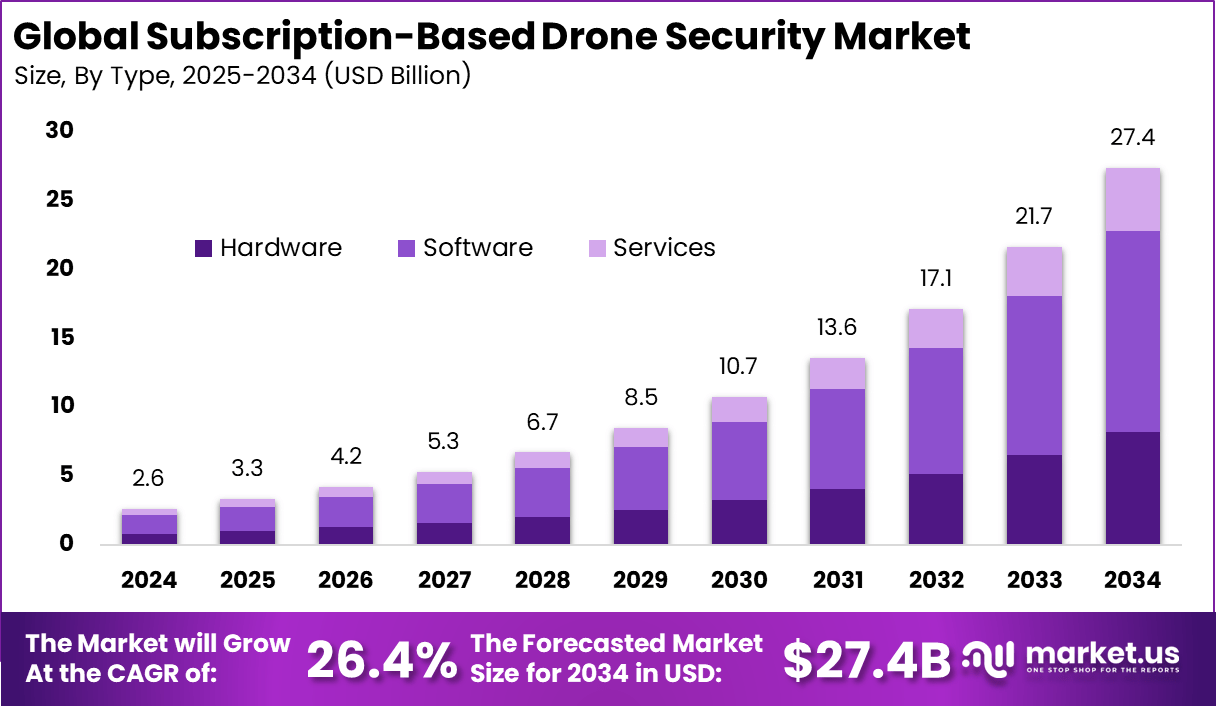

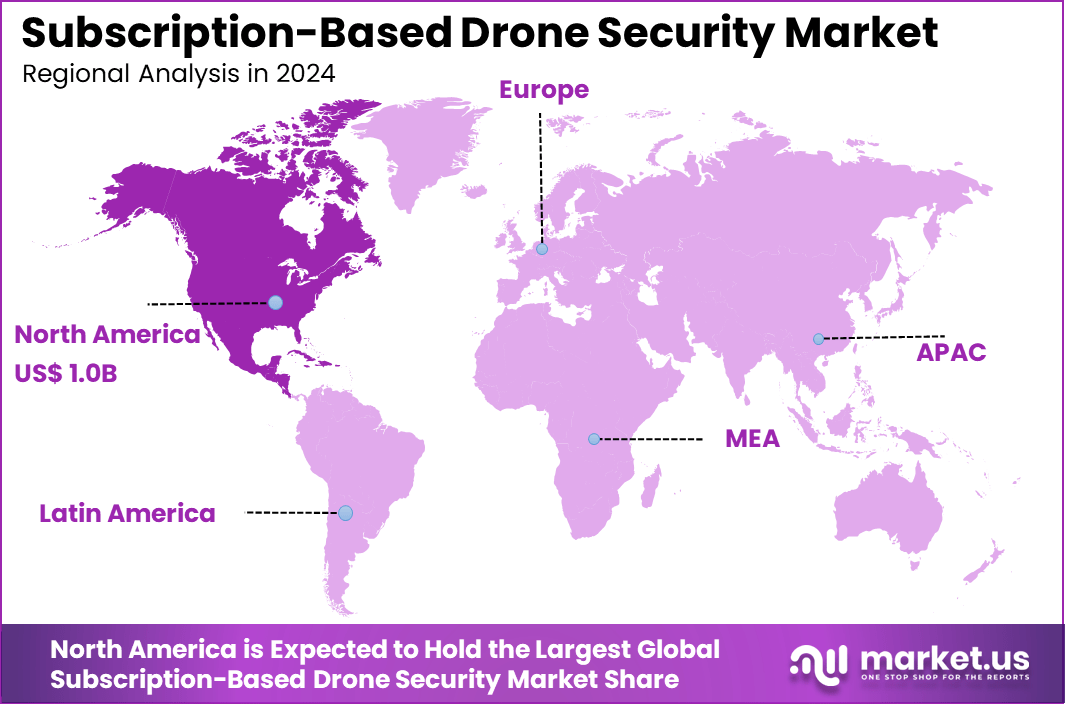

The Global Subscription-Based Drone Security Market generated USD 2.6 billion in 2024 and is predicted to register growth from USD 3.3 billion in 2025 to about USD 27.4 billion by 2034, recording a CAGR of 26.4% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.5% share, holding USD 1.0 Billion revenue.

The subscription-based drone security market refers to recurring-revenue services in which unmanned aerial vehicles (UAVs) and associated software/hardware are made available under a subscription model to monitor, detect and respond to security threats on a continuous basis. These services often include drone deployment, real-time video or sensor data, analytics, remote monitoring, maintenance and updates as part of a single package.

Top driving factors for this market include heightened global security concerns stemming from terrorism, smuggling, unauthorized surveillance, and natural disasters. Governments, law enforcement, and private businesses are adopting drone subscriptions to enhance situational awareness and safeguard assets more effectively. Drones cover large areas faster and at lower costs than traditional methods such as manned patrols and fixed CCTV cameras.

Top Market Takeaways

- By type, software dominates with 53.4%, reflecting the growing demand for AI-driven surveillance analytics and real-time threat monitoring.

- By deployment mode, cloud-based solutions lead with 64.2%, favored for scalability, remote accessibility, and cost efficiency.

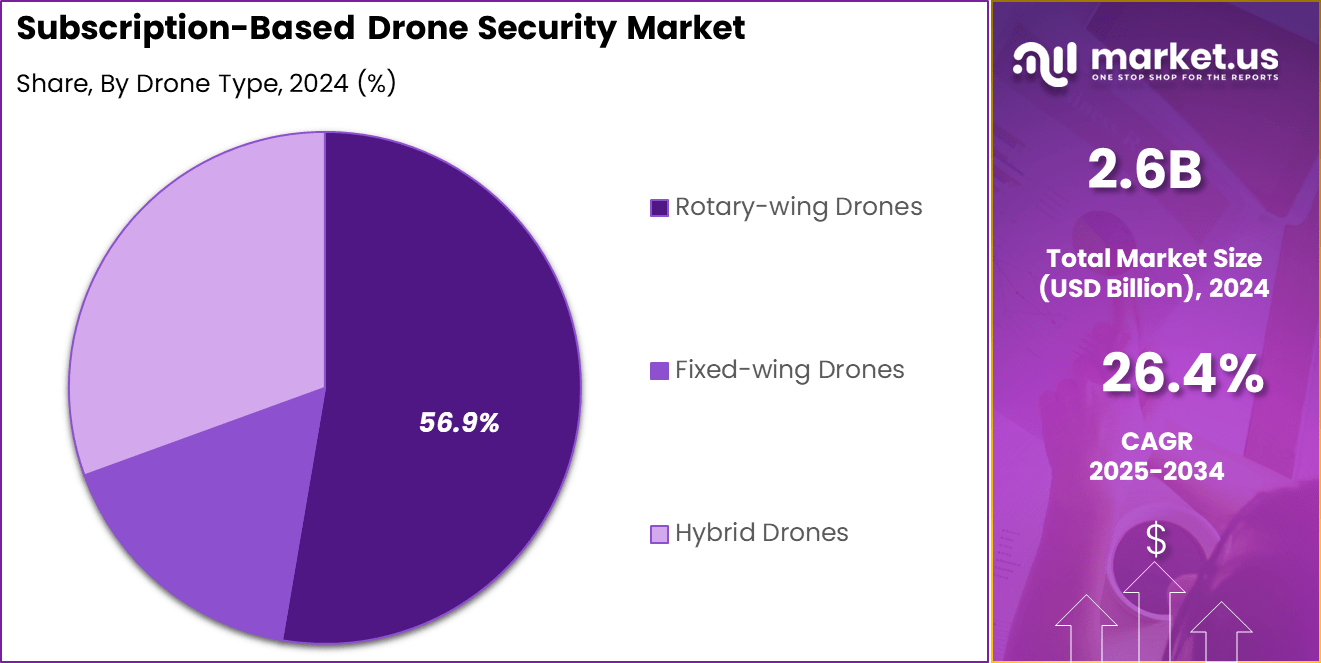

- By drone type, rotary-wing drones hold 56.9%, due to their flexibility, maneuverability, and suitability for close-range security operations.

- By application, the commercial segment accounts for 41.8%, driven by use in infrastructure monitoring, logistics, and event surveillance.

- By end user, private enterprises represent 52.1%, as businesses increasingly adopt subscription-based drone services for facility security and asset protection.

- North America contributes 38.5%, supported by robust drone regulations, early technology adoption, and enterprise-level deployments.

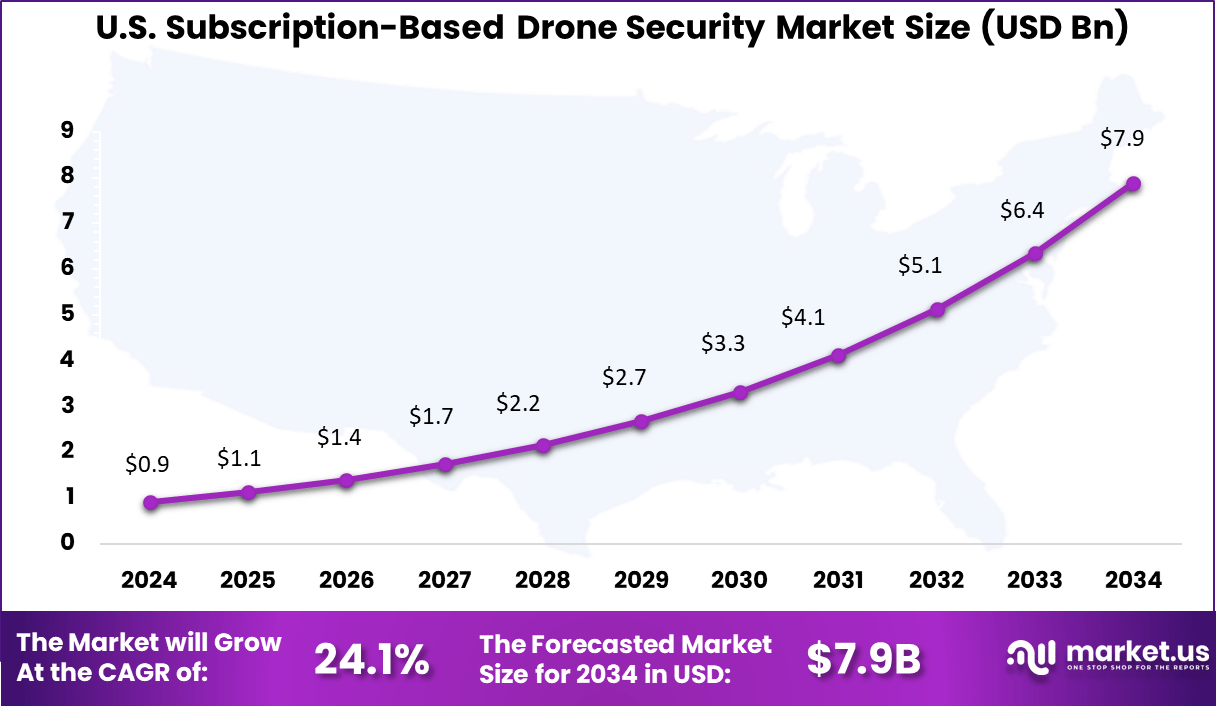

- The US market reached USD 0.91 billion and is expanding at a strong CAGR of 24.1%, underscoring rapid growth in drone-based security-as-a-service solutions.

Impact and Adoption

- Operational impact: Businesses that have adopted comprehensive drone-based surveillance systems report an average 37% reduction in security incidents within the first year of implementation. This highlights the effectiveness of drones in enhancing situational awareness and incident prevention.

- Adoption drivers: The increasing need to monitor large areas, detect potential threats, and respond rapidly to security breaches is driving the adoption of drone surveillance solutions across industries such as manufacturing, logistics, and critical infrastructure.

- Cost efficiency: Drone-enabled security operations help organizations optimize resources by reducing reliance on on-site personnel for full-area monitoring. This approach not only improves coverage but also lowers operational costs compared to traditional manpower-based surveillance models.

US Market Size

The United States contributes about USD 0.91 billion and continues to record a strong 24.1% CAGR. New applications in real estate surveillance, energy facility monitoring, and event security are increasing service adoption. U.S. providers are leveraging AI, cloud data, and extended flight capabilities to deliver personalized, subscription-based security packages.

In 2024, North America dominates with 38.5% of the global market, thanks to advanced drone regulation frameworks and high adoption of AI-based surveillance systems. The region’s focus on infrastructure protection and smart city development encourages investment in managed aerial monitoring solutions. Businesses in North America are also benefiting from the integration of drones with security analytics platforms and automated dispatch systems.

By Type

In 2024, Software holds about 53.4% of the subscription-based drone security market. Its dominance comes from the growing demand for AI-driven surveillance analytics, route optimization, and automated threat detection systems. Many organizations are shifting from hardware ownership to software-focused models that deliver updates and real-time insights through subscription platforms.

These systems help reduce manual intervention while improving response accuracy during security operations. Continuous upgrades and flexible licensing options make software models more appealing for cost management and scalability.

Cloud subscriptions allow companies to access advanced analytics, manage multiple drones remotely, and integrate with broader security infrastructures. This shift toward software-centric security is creating new opportunities for developers specializing in machine vision, flight pattern prediction, and anomaly detection.

By Deployment Mode

In 2024, Cloud-based deployment leads the market with 64.2%, as businesses prioritize remote data management and centralized monitoring. Cloud platforms allow subscribers to store video streams, flight data, and AI-based analysis securely while accessing them from any location. This setup is particularly useful for enterprises managing large surveillance networks or operating across multiple sites.

Cloud systems also support faster algorithm updates and easier integration with existing enterprise software. Another advantage driving cloud adoption is scalability. Organizations can easily increase drone fleet coverage without major infrastructure investments.

The cloud model also enhances collaboration between operators and security teams through shared dashboards and live data feeds. Regular enhancements in cybersecurity frameworks are helping increase confidence in cloud-based operations for sensitive areas like industrial parks, logistics centers, and critical infrastructure.

By Drone Type

In 2024, Rotary-wing drones account for roughly 56.9% of this market because of their ability to hover, maneuver in tight areas, and conduct focused inspections. These drones are particularly suitable for perimeter surveillance, facility monitoring, and rapid-response security tasks. Their vertical takeoff and landing capability makes them useful for urban and confined environments where fixed-wing drones have limited utility.

Their structural flexibility supports the integration of advanced sensors, AI cameras, and long-endurance batteries under subscription-based maintenance plans. The growing use of autonomous rotary drones for smart surveillance solutions has raised their operational reliability. Developers are now improving propeller efficiency and noise reduction features, further expanding their use in both commercial and enterprise security scenarios.

By Application

In 2024, the commercial segment represents 41.8% of the market, driven by the rising use of drones in logistics centers, shopping complexes, and industrial monitoring. Businesses use subscription-based drone services to monitor property and assets, ensuring 24-hour coverage at lower cost than traditional guards. This model allows companies to access high-end hardware and analytics without large upfront investment.

The increased emphasis on real-time alerts and automatic reporting is enhancing uptake among commercial users. Many facilities are deploying drones equipped with AI vision tools capable of detecting unauthorized movement, fire risks, or structural hazards. The demand for flexible contracts and continuous support services has made subscription models the preferred approach for reliable aerial security in dynamic commercial environments.

By End User

In 2024, Private enterprises lead with 52.1%, adopting drone security subscriptions to safeguard critical infrastructure, industrial assets, and remote field operations. These organizations appreciate the efficiency of leasing managed security fleets that include hardware, software, and data analytics in one subscription. It helps them maintain strong aerial surveillance capabilities without heavy maintenance or ownership burdens.

Enterprises across energy, construction, and logistics sectors are increasingly relying on managed drone fleets for predictive monitoring and compliance inspections. The need for multisite visibility and proactive risk management is pushing companies to invest in subscription-based autonomous surveillance. With growing regulatory support for commercial drone operations, this user group is expected to expand its share further in the coming years.

Emerging Trends

Emerging trends in subscription-based drone security focus on advanced technologies like swarm intelligence, edge computing, and cloud-based data management. Swarm drones, which operate collaboratively using AI coordination, are gaining traction for complex surveillance tasks that demand synchronized coverage of extensive or challenging areas.

Reports show that adoption of such swarm-based solutions is contributing to a growing portion of drone deployments in security, with real-time processing at the edge becoming standard to reduce latency and enhance responsiveness. Additionally, the industry is witnessing a move toward drone-in-a-box solutions that allow for autonomous launches, patrols, and data reporting without human intervention.

These trends align with increasing demand for scalable and integrated security systems that leverage drones’ mobility and real-time data analytics. Approximately 35-40% of clients are willing to pay a premium for subscription services that incorporate these high-tech features, highlighting market acceptance of these advancements.

Growth Factors

Growth factors for subscription-based drone security are strongly tied to rising security concerns worldwide and the operational benefits drones offer against traditional surveillance methods. The increase in violent incidents globally has heightened the need for persistent and efficient aerial monitoring, driving subscription models that enable frequent and flexible drone patrols.

The market is also propelled by regulatory support for drone operations and technological improvements in sensor accuracy and communication protocols. Furthermore, expanding applications across sectors such as transportation, industrial complexes, and public venues contribute to the rising subscriptions in drone security services.

Data from recent studies reveal that over 65% of commercial drone service providers have shifted towards subscription-based models, reflecting clients’ preference for consistent surveillance and predictable service costs. These factors combine to fuel ongoing market adoption and innovation within drone security subscriptions.

Key Market Segments

By Type

- Hardware

- Software

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Drone Type

- Fixed-wing Drones

- Rotary-wing Drones

- Hybrid Drones

By Application

- Military & Defense

- Commercial

- Infrastructure Monitoring

- Emergency Services

- Agriculture

- Others

By End User

- Government Agencies

- Private Enterprises

- Security Service Providers

- Individual Consumers

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing Cyber Threats to Drone Operations

The rise in drone usage across sectors such as defense, agriculture, logistics, and surveillance has led to increased cyber vulnerabilities. Drones often carry sensitive data and critical operational functions that cybercriminals can target to disrupt services or steal information.

This growing risk has pushed organizations to invest in subscription-based drone security services that offer continuous monitoring, threat detection, and real-time response capabilities. These services help protect drone systems from hacking, GPS spoofing, and data breaches, ensuring operational integrity and safety.

With drones becoming integral to many industries, the urgency to secure these systems generates strong demand for subscription models that provide scalable, cost-effective cybersecurity solutions. This model allows clients ongoing protection without heavy upfront costs, facilitating adoption and ongoing updates against emerging threats.

Restraint Analysis

High Implementation Costs

One significant restraint to the broader adoption of subscription-based drone security is the high cost of implementing advanced cybersecurity technologies. These solutions often require specialized hardware, software, artificial intelligence, and skilled personnel to install and maintain.

Such costs can be prohibitive, especially for smaller companies or startups and in emerging markets, where budget constraints limit investment. Ongoing maintenance and frequent updates add to the financial burden, reducing the attractiveness of these services despite the clear security benefits.

This economic barrier slows widespread market penetration and can lead some organizations to delay adopting necessary protections, further complicating the security landscape. The need for affordable yet robust drone cybersecurity remains a challenge that vendors and service providers must address.

Opportunity Analysis

Expansion through 5G-Enabled Drones

The growing use of 5G technology in drone communications creates substantial opportunities for subscription-based drone security providers. 5G networks enable faster, low-latency data transmission, allowing drones to perform more complex, real-time operations such as live surveillance, mapping, and package delivery.

However, these benefits come with increased exposure to cyber risks such as data interception or unauthorized remote control via the expanded connectivity footprint. Security providers can capitalize on this trend by developing specialized subscription services tailored to protect drones operating on 5G networks.

These solutions need to be adaptive, scalable, and capable of securing vast amounts of data in real time. As the adoption of 5G drones grows, so too does the need for integrated cybersecurity frameworks, offering a promising growth area for subscription-based drone security.

Challenge Analysis

Regulatory and Compliance Complexity

Navigating the regulatory environment poses a primary challenge for subscription-based drone security providers. Governments and aviation authorities continuously update flight and cybersecurity regulations to ensure safety and privacy, but this landscape often lacks standardization across regions.

Providers must invest considerable effort to ensure their services comply with varying and evolving legal requirements, which can delay product deployment and increase costs. Additionally, smaller market players may struggle with compliance due to resource limitations, affecting overall market growth.

Competitive Analysis

PatrolDrones Inc., DroneSec Solutions, and TerraDrones lead the Subscription-Based Drone Security Market with advanced drone-as-a-service models that offer continuous aerial surveillance and data-driven threat detection. Their platforms integrate AI analytics, autonomous flight systems, and subscription-based monitoring to ensure reliable protection for industrial and infrastructure assets.

AirWatch, CyberHawk, and SkyPatrol are strengthening the market by offering specialized inspection and surveillance services for energy, construction, and logistics sectors. Their subscription models include thermal imaging, LiDAR scanning, and automated patrol scheduling. These firms focus on integrating aerial analytics with enterprise control systems, ensuring compliance, predictive maintenance, and incident response.

Sentinel Drones, DroneSecurix, GlobalSecurity Drones, and others such as AerialShield and SecureAir emphasize scalable and connected drone networks. They combine edge AI, cloud platforms, and secure communication systems to deliver end-to-end security subscriptions. Their focus on flexibility, automation, and multi-site management is transforming drone-based security into a reliable, service-driven model.

Top Key Players in the Market

- PatrolDrones Inc.

- DroneSec Solutions

- TerraDrones

- AirWatch

- CyberHawk

- SkyPatrol

- Sentinel Drones

- DroneSecurix

- GlobalSecurity Drones

- AerialShield

- AeroDefense

- DroneShield

- FlySafe Security

- NightVision Drones

- SkyGuard Technologies

- SecureAir

- Others

Recent Developments

- October 2025, ZenaTech continued its aggressive expansion through a series of acquisitions and strategic partnerships, positioning itself as a major force in the drone services sector. In October, ZenaTech acquired multiple land-surveying firms, integrating them into a Drone-as-a-Service platform aimed at scalable, subscription-based aerial intelligence services.

- April 2025, TerraDrones signed a strategic MOU with Aramco to drive innovation and localization in drone technology, focusing on AI-driven solutions for the oil and gas sector. This partnership aims to enhance safety and operational efficiency in the energy industry, supporting Saudi Arabia’s Vision 2030 goals

Report Scope

Report Features Description Market Value (2024) USD 2.6 Bn Forecast Revenue (2034) USD 27.4 Bn CAGR(2025-2034) 26.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Hardware, Software, Services); By Deployment Mode (Cloud-based, On-premises); By Drone Type(Fixed-wing Drones, Rotary-wing Drones, Hybrid Drones); By Application (Military & Defense, Commercial, Infrastructure Monitoring, Emergency Services, Agriculture, Others); By End User (Government Agencies, Private Enterprises, Security Service Providers, Individual Consumers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PatrolDrones Inc., DroneSec Solutions, TerraDrones, AirWatch, CyberHawk, SkyPatrol, Sentinel Drones, DroneSecurix, GlobalSecurity Drones, AerialShield, AeroDefense, DroneShield, FlySafe Security, NightVision Drones, SkyGuard Technologies, SecureAir, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Subscription-Based Drone Security MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Subscription-Based Drone Security MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- PatrolDrones Inc.

- DroneSec Solutions

- TerraDrones

- AirWatch

- CyberHawk

- SkyPatrol

- Sentinel Drones

- DroneSecurix

- GlobalSecurity Drones

- AerialShield

- AeroDefense

- DroneShield

- FlySafe Security

- NightVision Drones

- SkyGuard Technologies

- SecureAir

- Others