Sterility Indicators Market By Type (Chemical (Class 1, Class 2, Class 3, Class 4, and Class 5) and Biological (Spore Suspensions, Self-Contained Vials, Spore Ampoules, and Spore Strips)), By Technique (Heat Sterilization, Radiation, Low Temperature, Filtration, and Liquid), By End-user (Hospitals, Clinical Laboratories/Research Centers, Pharmaceutical Companies, Medical Device Companies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132791

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

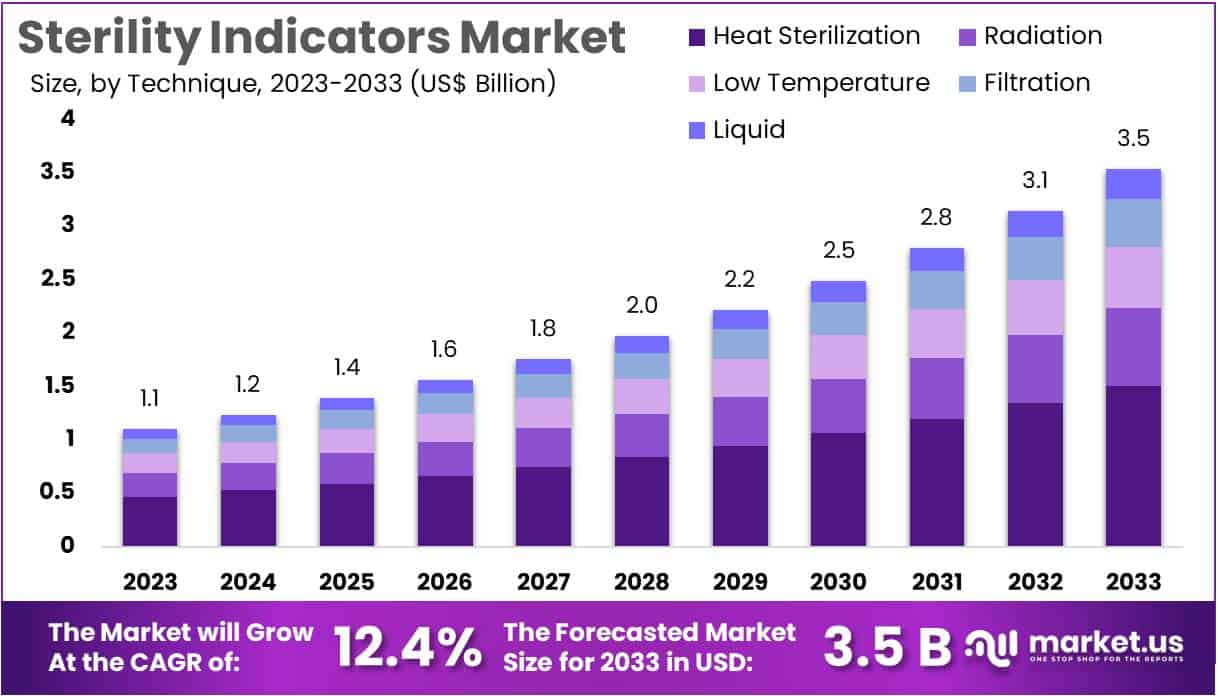

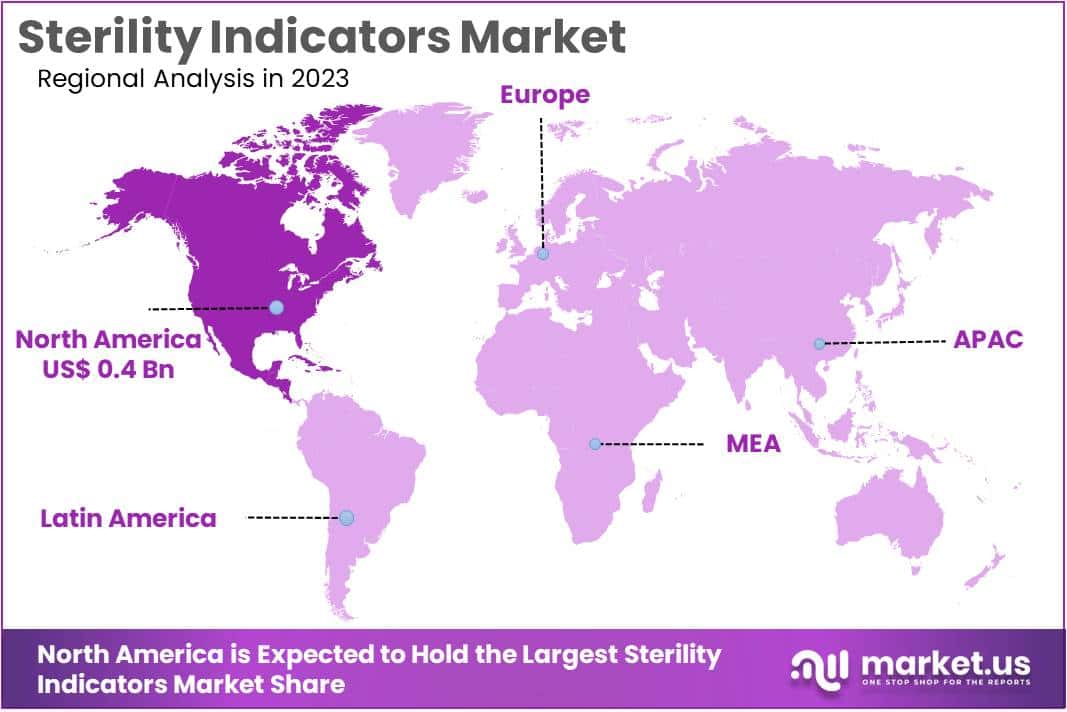

The Sterility Indicators Market size is expected to be worth around US$ 3.5 billion by 2033 from US$ 1.1 billion in 2023, growing at a CAGR of 12.4% during the forecast period 2024 to 2033. North America held the largest market share at 39.4% due to increased awareness of infection control and strict regulatory standards in healthcare settings.

Growing awareness of infection control standards drives the sterility indicators market, as healthcare and laboratory facilities increasingly prioritize patient safety. Sterility indicators, essential for validating sterilization processes, find widespread applications across hospitals, pharmaceutical manufacturing, medical device production, and laboratory settings.

The World Health Organization highlights that in any given year, seven out of every 100 hospitalized patients in developed countries and ten out of every 100 in developing regions contract at least one hospital-acquired infection (HAI), emphasizing the critical need for effective sterilization monitoring solutions.

Furthermore, data from the CDC reveals that annually, approximately one in every 25 patients in U.S. hospitals acquires an HAI, underscoring the importance of reliable sterility assurance protocols. Recent advancements in sterility indicators, including rapid-readout and biological indicators, provide quicker and more accurate results, improving workflow efficiency in high-demand settings.

These innovations, combined with the rising complexity of sterilization requirements in diverse healthcare and industrial applications, present robust growth opportunities. The expansion of regulatory guidelines governing sterilization practices further underscores the need for comprehensive sterility monitoring systems. As new medical devices and treatments enter the market, manufacturers face an increasing demand for sterility assurance in production processes.

Key Takeaways

- In 2023, the market for sterility indicators generated a revenue of US$ 1.1 billion, with a CAGR of 12.4%, and is expected to reach US$ 3.5 billion by the year 2033.

- The type segment is divided into chemical and biological, with biological taking the lead in 2023 with a market share of 60.7%.

- Considering technique, the market is divided into heat sterilization, radiation, low temperature, filtration, and liquid. Among these, heat sterilization held a significant share of 42.6%.

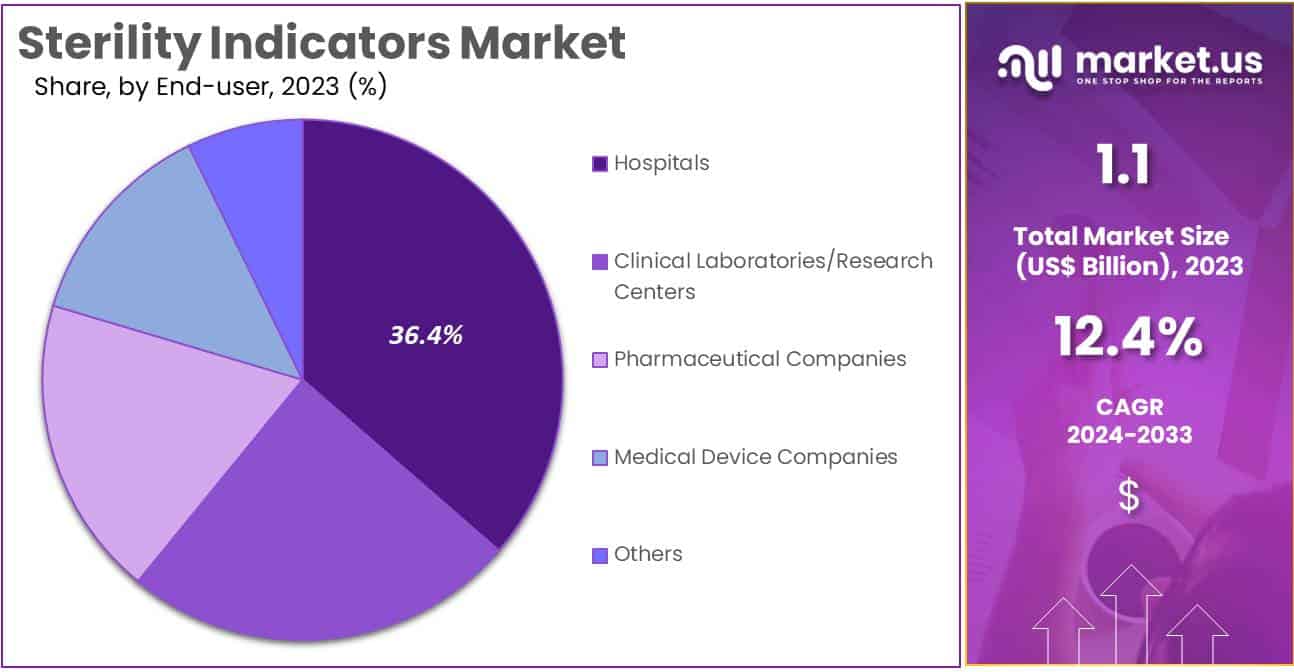

- Furthermore, concerning the end-user segment, the hospitals sector stands out as the dominant player, holding the largest revenue share of 36.4% in the sterility indicators market.

- North America led the market by securing a market share of 39.4% in 2023.

Type Analysis

The biological segment led in 2023, claiming a market share of 60.7% owing to its superior accuracy in detecting microbial contamination. Biological indicators offer a more reliable verification of sterilization efficacy, as they contain highly resistant bacterial spores that closely replicate real-life sterilization conditions.

Rising regulatory standards and stringent guidelines in healthcare and pharmaceutical industries emphasize the use of biological indicators, which further drives demand. Increased adoption of these indicators in critical environments, such as hospitals and pharmaceutical manufacturing facilities, supports the need for high-assurance sterilization verification.

Furthermore, advancements in biological indicator technology have reduced the time required for results, making them more appealing for industries requiring quick, accurate validation. With the rising focus on infection control and contamination prevention, the biological segment in the sterility indicators market is anticipated to expand robustly.

Technique Analysis

The heat sterilization held a significant share of 42.6% due to the effectiveness of heat sterilization in eliminating a wide range of microorganisms, including highly resistant bacterial spores. Heat sterilization remains a preferred method in various healthcare and pharmaceutical applications due to its cost-effectiveness, reliability, and suitability for sterilizing a broad spectrum of materials.

Increasing demand for heat sterilization in hospitals and laboratories, where high-volume sterilization cycles are required, further supports this segment’s expansion. As regulatory bodies continue to emphasize stringent sterilization practices, healthcare facilities are anticipated to rely more on heat-based sterilization techniques, driving the demand for related sterility indicators. Additionally, technological advancements in heat sterilization equipment enhance its efficiency, making it a viable choice for large-scale applications.

End-user Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 36.4% owing to the high volume of sterilization processes required in hospitals to ensure patient safety and infection control. Hospitals increasingly adopt advanced sterility indicators to comply with stringent infection prevention protocols and regulatory requirements.

The rise in surgical procedures, particularly in emerging economies with expanding healthcare infrastructures, also contributes to this segment’s growth. Furthermore, the growing focus on preventing healthcare-associated infections (HAIs) has intensified the use of sterility indicators in hospital settings.

Investments in infection control programs and enhanced awareness among healthcare professionals regarding sterilization quality further bolster demand. With hospitals prioritizing effective sterilization to protect patient health, the segment is anticipated to continue expanding in the coming years.

Key Market Segments

By Type

- Chemical

- Class 1

- Class 2

- Class 3

- Class 4

- Class 5

- Biological

- Spore Suspensions

- Self-Contained Vials

- Spore Ampoules

- Spore Strips

By Technique

- Heat Sterilization

- Radiation

- Low Temperature

- Filtration

- Liquid

By End-user

- Hospitals

- Clinical Laboratories/Research Centers

- Pharmaceutical Companies

- Medical Device Companies

- Others

Drivers

Growing Prevalence of Hospital-Acquired Infections (HAIs)

The rising prevalence of hospital-acquired infections (HAIs) significantly drives demand for sterility assurance solutions, including sterility indicators, across healthcare facilities worldwide. Healthcare settings face a mounting challenge as infections acquired during hospital stays increase patient morbidity and lengthen hospitalization, impacting healthcare costs and patient outcomes. According to a World Health Organization report from May 2022, out of every 100 patients in acute-care hospitals, seven in high-income countries and 15 in low- and middle-income countries are expected to acquire at least one HAI during their hospital stay.

This considerable risk has led hospitals to prioritize strict sterilization protocols to reduce infection rates. Sterility indicators play a crucial role in confirming effective sterilization, especially in high-risk areas such as intensive care units and surgical suites. As awareness of infection control grows, healthcare providers increasingly adopt robust sterilization monitoring processes, fueling the demand for sterility indicators. This demand is anticipated to escalate as hospitals aim to mitigate HAIs, protect patient health, and comply with stringent regulatory standards on sterilization.

Restraints

Increasing Safety Concerns

Growing safety concerns regarding the handling and disposal of sterility indicators are anticipated to hamper the sterility assurance market. Many sterility indicators contain chemical components or biological agents that require careful handling and specific disposal protocols to prevent environmental contamination or accidental exposure. For instance, some indicators release toxic residues that can pose health risks to personnel if not handled properly. As awareness of these safety hazards rises, healthcare facilities may become cautious about adopting certain types of sterility indicators, particularly in regions with stringent waste management regulations.

These concerns extend beyond healthcare providers to regulatory bodies, which are likely to impose stricter guidelines governing the production, usage, and disposal of sterilization tools. High operational costs associated with implementing safe handling protocols for these indicators may further impede market growth, particularly for smaller facilities with limited budgets. Consequently, the demand for alternatives with minimal environmental and health risks is projected to challenge the sterility indicator market, especially in highly regulated regions.

Opportunities

Rising Need for Infection Control in Surgical Procedures

Increasing demand for infection control in surgical procedures presents a promising growth opportunity for the sterility indicators market. Surgical site infections (SSIs) continue to pose significant risks, leading healthcare providers to intensify their focus on maintaining sterility in operating rooms. According to the Centers for Disease Control and Prevention’s Healthcare-Associated Infection Progress Report, approximately 18,416 surgical site infections were recorded in the United States in 2020, with 2,173 linked to hip arthroplasties and 6,094 associated with colon surgeries.

This high rate of SSIs underscores the importance of rigorous sterilization practices, including regular monitoring of sterilization efficacy. Sterility indicators are vital in ensuring effective disinfection of surgical instruments and materials, helping prevent postoperative infections and reducing the associated healthcare burden.

As the frequency of surgical procedures rises with an aging population and increasing prevalence of chronic conditions, the demand for reliable sterility indicators is expected to grow. This demand aligns with the healthcare sector’s goal of minimizing infection risks, improving patient safety, and adhering to regulatory mandates.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a pivotal role in shaping the trajectory of the sterility indicators market. Economic growth in developed regions stimulates healthcare spending, which, in turn, boosts the demand for sterilization processes to maintain patient safety standards.

On the other hand, economic instability, particularly in emerging markets, limits healthcare budgets, restricting market expansion. Fluctuating raw material prices and shifting currency exchange rates create additional cost burdens for manufacturers, potentially impacting profitability.

Geopolitical tensions and trade restrictions further complicate global supply chains, leading to delays and increased costs for essential components. Regulatory changes, especially those promoting stricter infection control, drive innovation and the adoption of advanced indicators. Despite these challenges, rising global awareness regarding infection prevention and an expanding healthcare infrastructure in developing regions present favorable growth opportunities for this market.

Trends

Impact of Innovative Research and Approaches on the Sterility Indicators Market

Growing investment in innovative research and development is anticipated to propel the sterility indicators market. Increasing focus on effective sterilization solutions has led to the introduction of technologically advanced indicators, enhancing process accuracy and reliability. Rising demand for eco-friendly and resource-efficient products has further driven innovation in this field.

In April 2024, MATACHANA introduced an environmentally sustainable format for integrating chemical indicators, setting new standards for resource efficiency and redefining sustainability in the sterilization industry. This trend aligns with broader healthcare goals, as hospitals and clinics increasingly prioritize both efficacy and environmental impact. Furthermore, rising healthcare expenditure and an ongoing emphasis on patient safety are expected to drive the adoption of sterility solutions globally.

Regional Analysis

North America is leading the Sterility Indicators Market

North America dominated the market with the highest revenue share of 39.4% owing to heightened awareness of infection control measures in healthcare settings and stringent regulatory requirements. The growing focus on patient safety and preventing healthcare-associated infections (HAIs) has led to increased adoption of sterility indicators to ensure the efficacy of sterilization processes.

This trend is particularly prominent in hospitals, where, according to recent statistics, one in every 25 patients acquires an HAI each year. The rising demand for sterilization validation has also been fueled by the expansion of surgical procedures and advanced medical device usage, which require thorough sterility assurance.

Additionally, healthcare facilities in the United States and Canada have allocated significant budgets toward infection prevention, further supporting the growth of sterility indicators. This increase aligns with regulatory standards from organizations such as the Centers for Disease Control and Prevention (CDC) and the U.S. Food and Drug Administration (FDA), which emphasize stringent sterilization protocols in healthcare and laboratory settings.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to a surge in healthcare infrastructure development and a rising need for infection control solutions. Rapid urbanization and increasing healthcare access across countries like India, China, and Indonesia have led to a higher incidence of infectious diseases, necessitating effective sterilization practices.

The World Health Organization (WHO) reported that South-East Asia accounted for approximately 43% of global tuberculosis cases, underscoring the need for stringent infection control measures. Government initiatives in Asia Pacific to modernize healthcare facilities and establish quality standards for sterilization are likely to drive the demand for sterility indicators.

Additionally, rising awareness of HAIs and the expansion of the region’s pharmaceutical and biotechnology sectors are expected to support the use of sterility indicators in both clinical and laboratory settings. This market expansion is further projected to benefit from collaborations between international and regional manufacturers aimed at enhancing sterilization protocols across the healthcare industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the sterility indicators market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the sterility indicators market drive growth by diversifying their product offerings to meet the stringent requirements of healthcare and pharmaceutical sectors.

Many companies prioritize research and development to introduce highly sensitive and reliable indicators, addressing the demand for advanced sterility assurance. Strategic acquisitions and partnerships enable them to expand their market share, leveraging established networks and expertise.

Companies also focus on expanding their geographic footprint, particularly in regions with strict regulatory standards and increasing healthcare infrastructure. Enhanced marketing efforts and customer education initiatives help reinforce brand trust and drive adoption among end-users.

Top Key Players in the Sterility Indicators Market

- Mesa Laboratories, Inc.

- Matachana Group

- Getinge Group

- Cardinal Health, Inc.

- Cantel Medical Corp.

- Andersen Products, Inc.

- 3M Company

Recent Developments

- In October 2023: Advanced Sterilization Products expanded its Sterilization Monitoring (SM) portfolio by introducing new Steam Monitoring products. These additions are designed to enhance the efficiency and reliability of sterility assurance within Sterile Processing Departments (SPDs). This product expansion reflects a growing demand for advanced sterility monitoring solutions, which is anticipated to drive growth in the sterility indicators market as healthcare facilities prioritize accuracy and efficiency in sterilization practices.

- In October 2022: STEMart introduced a biological indicator sterility testing service specifically for medical devices. This service conducts testing based on the exposure of biological indicators (BIs) after the sterilization load is completed, providing a qualitative assessment of microbial growth potential. The introduction of this service highlights the increasing focus on robust sterility testing in the medical device industry, which is a key factor fueling growth in the sterility indicators market as regulatory and safety standards in healthcare continue to evolve.

Report Scope

Report Features Description Market Value (2023) US$ 1.1 billion Forecast Revenue (2033) US$ 3.5 billion CAGR (2024-2033) 12.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Chemical (Class 1, Class 2, Class 3, Class 4, and Class 5) and Biological (Spore Suspensions, Self-Contained Vials, Spore Ampoules, and Spore Strips)), By Technique (Heat Sterilization, Radiation, Low Temperature, Filtration, and Liquid), By End-user (Hospitals, Clinical Laboratories/Research Centers, Pharmaceutical Companies, Medical Device Companies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mesa Laboratories, Inc., Matachana Group, Getinge Group, Cardinal Health, Inc., Cantel Medical Corp., Andersen Products, Inc., and 3M Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sterility Indicators MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Sterility Indicators MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Mesa Laboratories, Inc.

- Matachana Group

- Getinge Group

- Cardinal Health, Inc.

- Cantel Medical Corp.

- Andersen Products, Inc.

- 3M Company