Global Stem Cell Therapy Market By Type (Allogeneic and Autologous), By Cell Source (Adipose Tissue, Placenta/Umbilical Cord, Bone Marrow, and Others), By Therapeutic Application (Oncology, Musculoskeletal, Inflammatory & Autoimmune, Wounds & Surgeries, Cardiovascular, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 12272

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

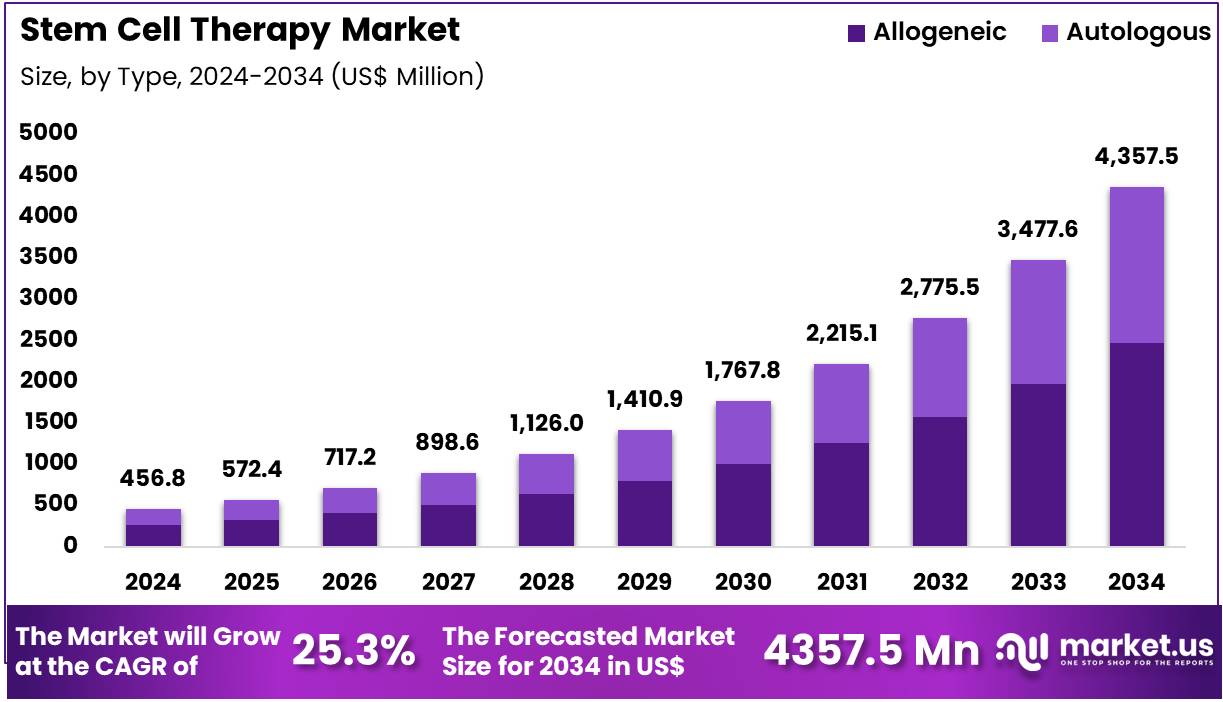

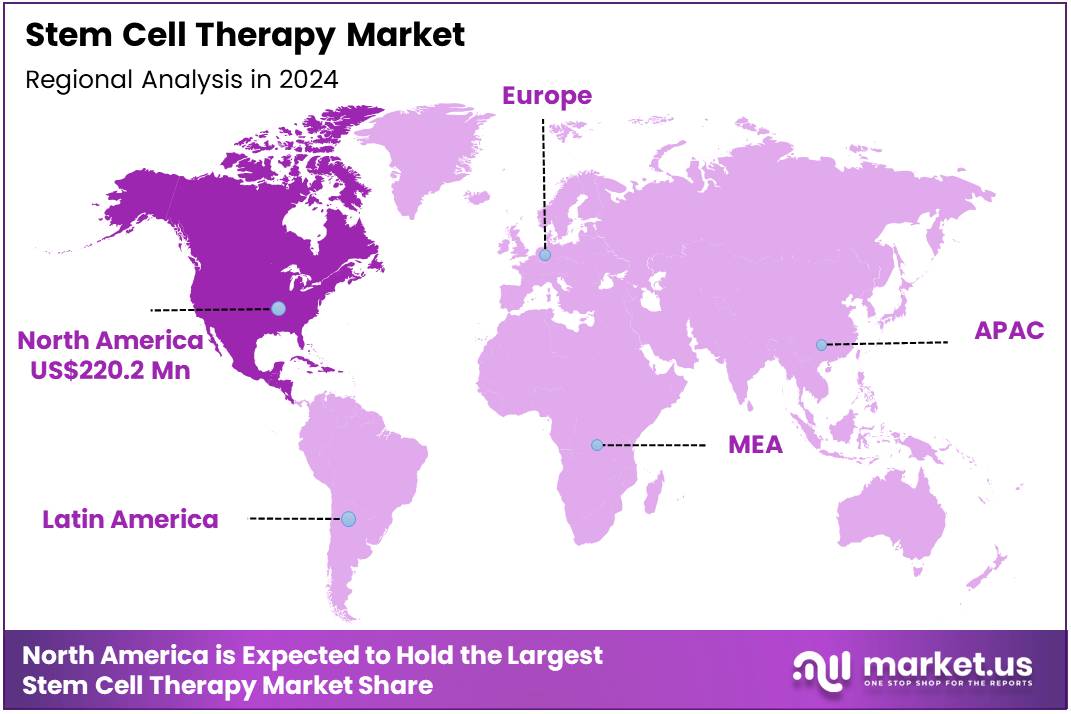

Global Stem Cell Therapy Market size is expected to be worth around US$ 4357.5 Million by 2034 from US$ 456.8 Million in 2024, growing at a CAGR of 25.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.8% share with a revenue of US$ 220.2 Million.

Increasing prevalence of chronic degenerative diseases propels the Stem Cell Therapy market, as patients and physicians actively seek regenerative alternatives to conventional symptom management. Biotechnology companies advance allogeneic and autologous platforms that demonstrate durable engraftment and tissue restoration, driving clinical confidence across multiple indications. Stem cell therapies now address orthopedic conditions through cartilage regeneration, cardiovascular disorders via myocardial repair, neurological diseases with neuronal replacement, and autoimmune disorders by immune modulation.

Expanding opportunities emerge from combination strategies that pair stem cells with gene editing or biomaterials for enhanced potency and persistence. A landmark collaboration in January 2024 between Cellcolabs AB and REPROCELL Inc. significantly improved global supply of GMP-grade mesenchymal stem cells, ensuring consistent quality and availability for both research and therapeutic-grade programs. This strategic alliance directly strengthens the foundation for scalable, standardized stem cell deployment worldwide.

Growing investment in self-renewing hematopoietic and pluripotent stem cell technologies accelerates the Stem Cell Therapy market, as venture capital targets platforms capable of generating universal, off-the-shelf products. Innovative companies leverage substantial funding to derisk pipelines and advance candidates from rare blood disorders into broader oncological and metabolic applications. Therapies derived from induced pluripotent stem cells now target diabetes through beta-cell replacement, Parkinson’s disease via dopaminergic neuron transplantation, and spinal cord injury with oligodendrocyte progenitors for remyelination.

Capital-raising milestones create new opportunities to vertically integrate discovery, manufacturing, and clinical execution under single entities. Garuda Therapeutics exemplified this momentum in February 2023 by securing an additional USD 62 million, instantly expanding its disease target portfolio from 70 to 120 indications and markedly accelerating multi-disease regenerative programs. Such financial firepower catalyzes the transition from niche to mainstream therapeutic relevance.

Rising demand for specialized contract manufacturing expertise invigorates the Stem Cell Therapy market, as emerging biotechs increasingly outsource complex Advanced Therapy Medicinal Product (ATMP) production to experienced CDMOs. Service providers rapidly build dedicated facilities that comply with stringent regulatory standards for living cell products, thereby removing critical bottlenecks in clinical progression.

Stem cell-based ATMPs find expanding applications in wound healing through dermal regeneration, ocular surface reconstruction using limbal stem cells, and critical limb ischemia via angiogenic progenitor therapy. Strategic CDMO partnerships unlock opportunities for smaller players to advance candidates without massive capital expenditure on infrastructure.

In May 2023, EPROCELL’s launch of comprehensive CDMO services for MSC-derived ATMPs in collaboration with Histocell directly addressed this industry need, providing end-to-end process development, scale-up, and GMP manufacturing capabilities. This development significantly enhances industrial readiness and accelerates the translation of promising stem cell therapies into approved medicines.

Key Takeaways

- In 2024, the market generated a revenue of US$ 456.8 million, with a CAGR of 25.3%, and is expected to reach US$ 4357.5 million by the year 2034.

- The type segment is divided into allogeneic and autologous, with allogeneic taking the lead in 2023 with a market share of 56.8%.

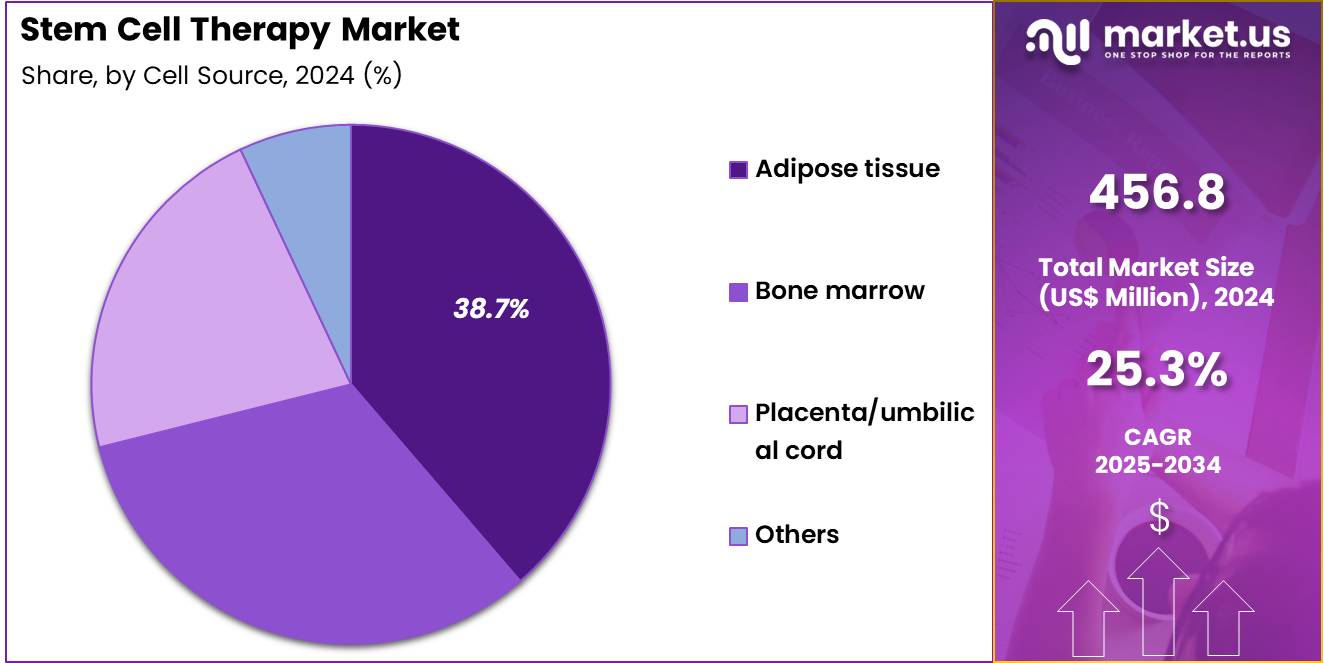

- Considering cell source, the market is divided into adipose tissue, placenta/umbilical cord, bone marrow, and others. Among these, adipose tissue held a significant share of 38.7%.

- Furthermore, concerning the therapeutic application segment, the market is segregated into oncology, musculoskeletal, inflammatory & autoimmune, wounds & surgeries, cardiovascular, and others. The oncology sector stands out as the dominant player, holding the largest revenue share of 42.5% in the market.

- North America led the market by securing a market share of 48.2% in 2023.

Type Analysis

Allogeneic stem cell therapy accounts for 56.8% of the Stem Cell Therapy market and is expected to dominate due to its scalable manufacturing process and applicability across multiple patient populations. The availability of donor-derived stem cells enables standardized therapeutic production and immediate treatment access without requiring invasive harvesting from the patient. Advancements in cryopreservation and HLA-matching technologies are improving graft compatibility and minimizing immune rejection risks.

Pharmaceutical and biotech companies are increasingly investing in off-the-shelf allogeneic cell lines to support large-scale commercialization. Ongoing clinical trials across oncology, autoimmune disorders, and orthopedic applications continue validating the safety and efficacy of allogeneic therapies. Regulatory approvals for allogeneic stem cell products in Japan, the US, and Europe are expanding adoption in clinical settings.

Moreover, hospitals and research institutes are developing biobanks for donor cell storage, further supporting consistent supply chains. As healthcare systems shift toward standardized regenerative medicine approaches, allogeneic stem cell therapy is anticipated to remain the preferred model for clinical use.

Cell Source Analysis

Adipose tissue-derived stem cells represent 38.7% of the Stem Cell Therapy market and are projected to lead the cell source category due to their abundance, accessibility, and regenerative versatility. Adipose tissue provides a rich reservoir of mesenchymal stem cells (MSCs) with high differentiation potential and immunomodulatory properties. The minimally invasive harvesting procedure, typically through liposuction, makes adipose tissue a preferred source for clinical and research applications.

Ongoing advancements in stem cell isolation and processing technologies are improving cell yield and viability. Researchers are increasingly exploring adipose-derived stem cells for applications in wound healing, musculoskeletal repair, and cardiovascular regeneration. The growing number of clinical studies validating their role in tissue engineering and anti-inflammatory therapy drives further adoption..

Additionally, cosmetic and reconstructive surgery applications are expanding demand in aesthetic medicine. The global shift toward personalized regenerative therapies positions adipose-derived stem cells as a key enabler of next-generation medical treatments.

Therapeutic Application Analysis

Oncology dominates the therapeutic application segment with 42.5% of the Stem Cell Therapy market and is anticipated to continue growing as cancer research increasingly integrates stem cell-based approaches. The use of stem cells in oncology focuses on bone marrow regeneration, immune modulation, and delivery of targeted therapies. Hematopoietic stem cell transplantation remains a cornerstone for treating leukemia, lymphoma, and multiple myeloma. Allogeneic and autologous stem cell transplants are showing improved patient outcomes when combined with immunotherapy and gene editing technologies.

The rapid evolution of cancer stem cell research is also shaping personalized treatment strategies aimed at targeting tumor microenvironments. Pharmaceutical companies are investing heavily in clinical trials exploring mesenchymal and induced pluripotent stem cells (iPSCs) for cancer treatment and drug resistance management.

Increasing government funding for regenerative oncology and collaborations between oncology centers and biotech firms strengthen market momentum. As cancer incidence continues to rise globally, stem cell-based oncology therapies are expected to experience sustained clinical and commercial expansion.

Key Market Segments

By Type

- Allogeneic

- Autologous

By Cell Source

- Adipose Tissue

- Placenta/Umbilical Cord

- Bone Marrow

- Others

By Therapeutic Application

- Oncology

- Musculoskeletal

- Inflammatory & Autoimmune

- Wounds & Surgeries

- Cardiovascular

- Others

Drivers

Increasing Number of Clinical Trials is Driving the Market

The proliferation of clinical trials for stem cell therapies has emerged as a key driver for the market, reflecting heightened scientific interest and investment in regenerative treatments for diverse conditions. This surge facilitates the transition from preclinical research to therapeutic applications, validating safety and efficacy profiles essential for commercialization. Academic institutions and pharmaceutical entities are collaborating to explore stem cell potential in neurological disorders, cardiovascular diseases, and orthopedic injuries.

Such trials not only generate robust data but also attract venture capital, accelerating product development pipelines. Regulatory bodies encourage trial registrations to ensure transparency, fostering public trust in emerging modalities. The momentum builds on prior successes, prompting sponsors to initiate phase II and III studies for broader indications. Infrastructure enhancements in biomanufacturing support larger cohort enrollments, reducing barriers to scale.

Patient advocacy groups promote participation, expanding recruitment pools and diversity in study populations. This driver enhances market confidence, as positive interim results often lead to stock appreciations for involved companies. In China, the number of cell therapy clinical trials peaked at 43 in 2022 and rose to 61 in 2023, demonstrating rapid escalation in research activity.

Consequently, global trial initiations inspire analogous efforts elsewhere, amplifying overall sector growth. This trajectory positions stem cell therapy as a cornerstone of future healthcare innovations.

Restraints

Stringent Regulatory Scrutiny and Enforcement Actions is Restraining the Market

Heightened regulatory oversight and enforcement actions by authorities continue to constrain the stem cell therapy market, imposing rigorous compliance requirements that delay product launches. Unapproved interventions often trigger investigations, leading to clinic closures and financial penalties that deter smaller developers. Ethical considerations surrounding cell sourcing and manipulation add layers of review, prolonging approval timelines. Variability in international standards complicates multinational trials, increasing administrative burdens.

Manufacturers must invest heavily in quality control systems to meet good manufacturing practices, elevating operational costs. Publicized adverse events from rogue providers erode consumer confidence, indirectly affecting legitimate enterprises. Harmonization initiatives by global regulators aim to streamline processes, yet progress remains incremental. This restraint underscores the need for proactive compliance strategies to mitigate risks.

Investors exhibit caution, favoring established players over startups amid enforcement uncertainties. The U.S. Food and Drug Administration issued a warning letter to Safari Stem Cell, LLC on April 5, 2024, citing promotion of unapproved stem cell products for various conditions. Similarly, a warning was sent to Mother Stem Institute, Corp. on August 20, 2024, for analogous violations. These actions highlight ongoing vigilance, tempering market expansion until broader standardization occurs.

Opportunities

Advancements in Asian Regulatory Frameworks are Creating Growth Opportunities

Progressive regulatory reforms in Asia are forging significant growth avenues for the stem cell therapy market, enabling faster market entry for innovative treatments tailored to regional health needs. Conditional approval pathways allow conditional marketing authorizations based on preliminary data, expediting access for unmet needs like age-related degenerative diseases. Local manufacturing incentives reduce import dependencies, lowering costs and enhancing supply chain resilience.

Cross-border collaborations with Western regulators facilitate technology transfers, bolstering domestic capabilities. Government subsidies for research hubs attract international partnerships, diversifying funding sources. This environment encourages autologous and allogeneic product developments, addressing high-prevalence conditions such as diabetes and spinal cord injuries. Educational programs for clinicians ensure safe adoption, minimizing post-market risks.

The opportunity extends to export potential, as Asian-approved therapies gain traction in emerging economies. As of March 2024, Japan had approved 20 regenerative medical products, primarily comprising tissue and cell transplants, signaling a maturing ecosystem. Such milestones catalyze investment inflows, positioning Asia as a pivotal hub for scalable stem cell solutions.

Impact of Macroeconomic / Geopolitical Factors

Global economic headwinds, characterized by contracting R&D budgets and healthcare reimbursement squeezes, force biotech companies to scale back ambitious stem cell therapy programs, delaying patient access in underfunded markets. Thriving innovation ecosystems and climbing venture funding, however, empower startups to pioneer affordable autologous treatments, broadening therapeutic reach to diverse demographics.

Geopolitical flashpoints, including export bans on biological materials from sanctioned regions, snarl global collaboration networks, escalating timelines for cross-border clinical validations. These barriers, in turn, ignite domestic biorepository expansions and policy incentives, streamlining approvals and embedding therapies deeper into national health frameworks.

Fresh U.S. tariffs slapping 100% duties on imported branded biologics spike procurement overheads for American providers sourcing advanced stem cell modalities. Industry leaders navigate this by qualifying for waivers via U.S. facility builds, which not only trims costs but also amplifies local expertise. At core, these forces hone supply chain fortitude and strategic agility.

Latest Trends

FDA Approval of First Mesenchymal Stromal Cell Therapy is a Recent Trend

The U.S. Food and Drug Administration’s approval of the inaugural mesenchymal stromal cell therapy in late 2024 signifies a landmark trend, marking a shift toward mainstream integration of off-the-shelf regenerative options. This development validates decades of research, paving the way for similar biologics in immunology and beyond. Developers are now prioritizing scalable production methods to meet demand, focusing on cryopreserved formulations for logistical ease. The approval influences guideline updates, incorporating stromal cells into treatment algorithms for refractory conditions.

Pharmaceutical giants are acquiring complementary assets, consolidating the competitive landscape. This trend coincides with heightened trial completions, providing real-world evidence for expanded labels. Global regulators are monitoring outcomes to inform their frameworks, potentially accelerating parallel approvals. Patient registries will track long-term safety, informing iterative improvements.

The milestone boosts sector valuations, drawing renewed venture interest. On December 18, 2024, the FDA approved RYONCIL (chemical name – remestemcel-L-rknd) for treating steroid-refractory acute graft versus host ailment in pediatric patients aged 2 months and older. This event exemplifies the trend’s transformative impact on therapeutic paradigms.

Regional Analysis

North America is leading the Stem Cell Therapy Market

The Stem Cell Therapy market in North America captured 48.2% of the global share in 2024, reflecting substantial expansion driven by accelerated regulatory approvals and heightened investor confidence in regenerative technologies. Biopharmaceutical firms intensified research collaborations with academic institutions, fostering innovations in hematopoietic stem cell transplantation for hematological disorders and mesenchymal stem cell applications for autoimmune conditions.

Government-backed initiatives, including enhanced funding from the National Institutes of Health, supported over 1,000 active research projects targeting tissue regeneration and neurological repair. The region’s advanced healthcare infrastructure enabled seamless integration of these therapies into clinical practice, particularly for chronic ailments like diabetes and spinal cord injuries. Venture capital inflows surged, with major players channeling resources into scalable manufacturing processes to reduce costs and improve accessibility.

Clinical trial enrollments rose markedly, as sponsors leveraged diverse patient cohorts to validate efficacy across demographic groups. Partnerships between entities such as Vertex Pharmaceuticals and CRISPR Therapeutics exemplified breakthroughs in gene-edited stem cells, addressing previously untreatable genetic disorders.

Policy reforms streamlined investigational new drug applications, shortening timelines from submission to market entry. This ecosystem not only bolstered therapeutic outcomes but also positioned North America as a hub for exporting expertise to emerging markets. The U.S. Food and Drug Administration approved seven new cell and gene therapy products in 2024, underscoring the momentum in commercialization efforts.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the regenerative medicine sector in Asia Pacific to experience robust expansion during the forecast period, propelled by proactive government policies that prioritize biotechnology as a national priority. China accelerates its 14th Five-Year Plan investments in induced pluripotent stem cell research, enabling domestic firms to pioneer treatments for cardiovascular diseases. Japan advances its Moonshot Research and Development Program, which targets iPS cell-derived organoids for transplantation, attracting international collaborations.

India bolsters its Ayushman Bharat scheme with incentives for clinical validations of stem cell interventions in orthopedics and oncology. South Korea’s Ministry of Health and Welfare expands grants for mesenchymal stem cell therapies, addressing an aging population’s musculoskeletal needs. These nations cultivate bio-clusters in cities like Shanghai, Tokyo, and Seoul, drawing multinational investments and talent migration. Medical tourism flourishes as affordable, high-quality procedures draw patients from affluent regions, generating ancillary economic benefits.

Educational reforms integrate stem cell biology into curricula, building a skilled workforce for sustained innovation. Cross-border alliances with Western developers facilitate technology transfers, enhancing local manufacturing capabilities. The Alliance for Regenerative Medicine reports 387 ongoing clinical trials in the Asia Pacific region as of the third quarter of 2023, highlighting the pipeline’s depth and potential for therapeutic breakthroughs.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key contenders in the regenerative cellular arena drive expansion by fast-tracking allogeneic, gene-edited universal donor platforms that eliminate matching requirements and enable true off-the-shelf deployment at scale. They secure dominant positions through exclusive, indication-specific alliances with global pharma leaders, locking in substantial upfront payments, milestones, and tiered royalties on blockbuster indications. Executives concentrate manufacturing into singular, highly automated facilities that produce hundreds of thousands of doses annually with full traceability and potency retention post-thaw.

Companies aggressively acquire complementary enabling technologies advanced bioreactors, closed-system fillers, and potency assay innovators to vertically integrate and slash cost of goods below $50,000 per treatment. They simultaneously build proprietary real-world evidence networks with premier transplant centers to generate outcomes data that compel payer coverage and accelerate guideline inclusion. This tightly integrated strategy transforms once-experimental interventions into commercially viable, globally accessible standards of care.

Vertex Pharmaceuticals Incorporated, headquartered in Boston, has established unequivocal leadership in the sector through its VX-880 and VX-264 programs encapsulated islet cell replacements that have already delivered the first insulin-independent patients with type 1 diabetes in history. The company commands end-to-end control from hypoimmune edited stem cell masters through fully differentiated, functional pancreatic clusters produced in its own cGMP facilities.

Vertex funds the entire franchise from its massive cystic fibrosis cash engine, eliminating dependency on dilutive capital raises while advancing multiple solid organ programs in parallel. With clear FDA alignment on registrational pathways and a market exclusivity moat exceeding a decade, Vertex stands alone as the only enterprise positioned to capture the multi-tens-of-billions diabetes cure opportunity.

Top Key Players

- Vertex Pharmaceuticals, Inc.

- Pharmicell Co., Ltd.

- NIPRO

- Kyowa Kirin

- Holostem S.r.l.

- Highbridge Capital Management

- CorestemChemon Inc.

- Cleveland Cord Blood Center

- Bluebird bio, Inc.

- CO., LTD.

Recent Developments

- In March 2024, Gamida Cell Ltd.’s restructuring agreement with Highbridge Capital Management strengthened the Stem Cell Therapy Market by ensuring financial continuity for the commercialization of Omisirge. This restructuring stabilized the company’s operations, preserving critical resources for advancing allogeneic cell therapy production and maintaining investor confidence in the regenerative medicine sector.

- In April 2023, the FDA’s approval of Gamida Cell’s Omisirge marked a major regulatory milestone for allogeneic stem cell therapy. The approval validated the clinical efficacy and safety of umbilical cord blood transplantation, encouraging broader adoption of advanced stem cell treatments and fostering further investment into next-generation hematologic and regenerative therapies.

Report Scope

Report Features Description Market Value (2024) US$ 456.8 Million Forecast Revenue (2034) US$ 4357.5 Million CAGR (2025-2034) 25.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Allogeneic and Autologous), By Cell Source (Adipose Tissue, Placenta/Umbilical Cord, Bone Marrow, and Others), By Therapeutic Application (Oncology, Musculoskeletal, Inflammatory & Autoimmune, Wounds & Surgeries, Cardiovascular, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vertex Pharmaceuticals, Inc., Pharmicell Co., Ltd., NIPRO, Kyowa Kirin, Holostem S.r.l., Highbridge Capital Management, CorestemChemon Inc., Cleveland Cord Blood Center, Bluebird bio, Inc., ANTEROGEN.CO., LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Vertex Pharmaceuticals, Inc.

- Pharmicell Co., Ltd.

- NIPRO

- Kyowa Kirin

- Holostem S.r.l.

- Highbridge Capital Management

- CorestemChemon Inc.

- Cleveland Cord Blood Center

- Bluebird bio, Inc.

- CO., LTD.