Global Steerable Needle Market By Product Type (Bevel-Tip Flexible Needles, Tendonactuated Tips and Symmetric-Tip Needles), By Application (Biopsy, Tumor Ablation, Neurosurgery, Pain Management and Others), By End-user (Hospitals, Specialty Clinics and Ambulatory Surgical Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171331

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

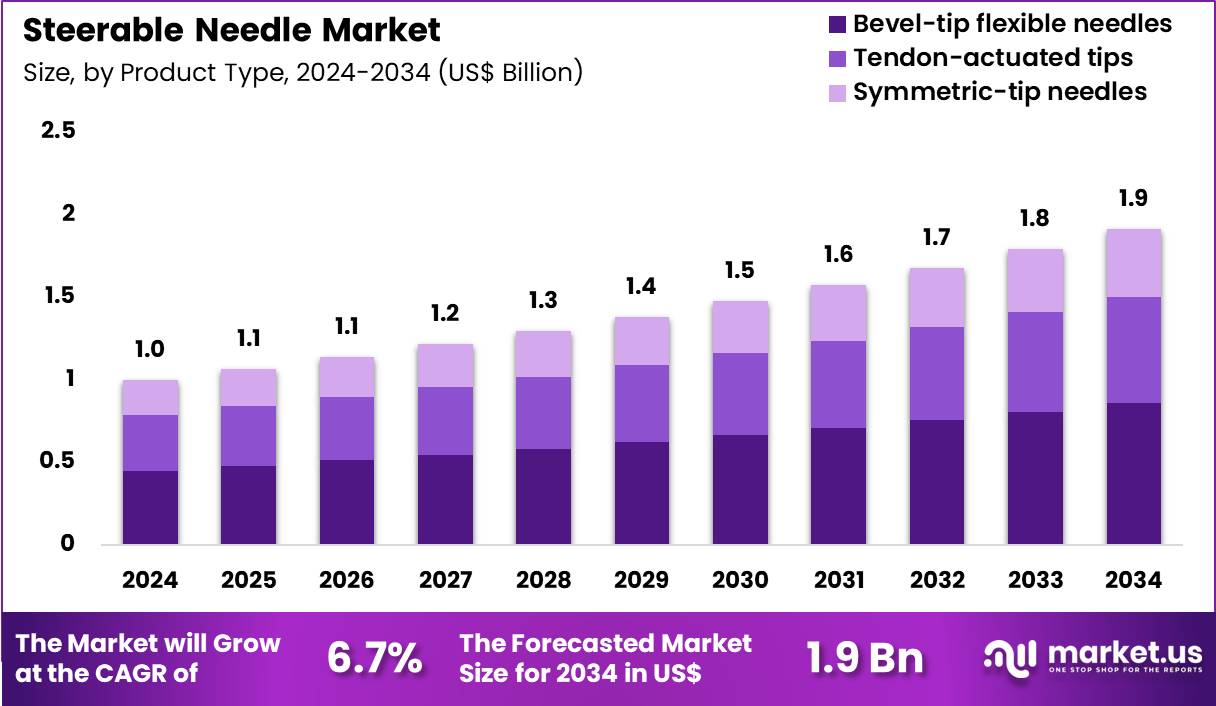

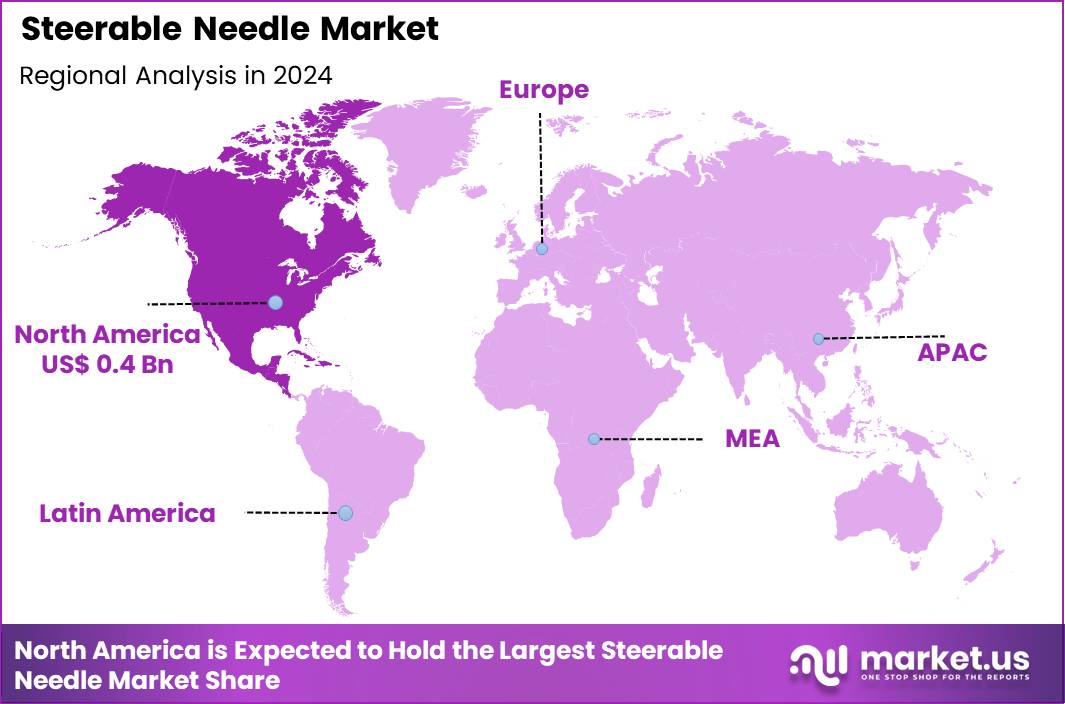

The Global Steerable Needle Market size is expected to be worth around US$ 1.9 Billion by 2034 from US$ 1.0 Billion in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.4% share with a revenue of US$ 0.4 Billion.

Increasing demand for precision in minimally invasive procedures propels the Steerable Needle market, as interventionalists require controllable devices to navigate complex anatomy and reduce complications in delicate tissue environments. Manufacturers engineer tendon-driven and pre-curved needles with real-time tip articulation that respond to clinician input via handle mechanisms or robotic interfaces.

These instruments apply in transbronchial lung biopsies to access peripheral nodules under EBUS guidance, prostate saturation mapping for accurate cancer grading, renal tumor ablation with trajectory optimization around critical vessels, and spinal nerve root targeting for selective diagnostic blocks. Technological advancements in imaging integration create opportunities for closed-loop systems that enhance first-pass success rates.

In May 2024, Olympus Corporation released the BF-UC190F endobronchial ultrasound bronchoscope, specifically designed to improve precision and comfort during minimally invasive lung cancer biopsies with compatible steerable needles. This launch directly elevates diagnostic yield and patient tolerance, accelerating adoption of steerable technology in pulmonary oncology.

Growing adoption of robotic-assisted interventions accelerates the Steerable Needle market, as surgeons integrate flexible, actively controlled needles into da Vinci and similar platforms for enhanced dexterity beyond human limitations. Companies develop magnetically or piezoelectrically actuated tips that enable multi-degree-of-freedom movement inside confined spaces.

Applications encompass cardiac epicardial injections for stem cell delivery in ischemic myocardium, neurosurgical deep brain stimulation lead placement through curved trajectories, pancreatic cyst fenestration avoiding ductal injury, and transgastric natural orifice procedures for peritoneal access.

Robotic compatibility opens avenues for teleoperated interventions and AI-guided path planning that minimize radiation exposure. Clinical trials increasingly validate steerable needles against conventional rigid counterparts, demonstrating superior lesion reach and reduced procedure time. This synergy with robotics positions the market at the forefront of next-generation surgical innovation.

Rising focus on outpatient and office-based procedures invigorates the Steerable Needle market, as physicians perform diagnostic and therapeutic interventions under local anesthesia using compact, disposable steerable systems. Innovators launch single-use needles with integrated fiber-optic visualization and haptic feedback for intuitive control.

These devices serve thyroid nodule fine-needle aspiration with real-time tip adjustment to avoid vascular structures, breast lesion sampling in dense tissue via curved paths, musculoskeletal joint injections for precise intra-articular delivery, and ENT sinus access for balloon sinuplasty guidance.

Cost-effective designs create opportunities for expanded reimbursement in ambulatory settings and training simulators that shorten learning curves. Regulatory bodies actively streamline clearance pathways for combination diagnostic-therapeutic steerable devices. This shift toward office-based care establishes steerable needles as essential tools for efficient, patient-centered minimally invasive medicine.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.0 billion, with a CAGR of 6.7%, and is expected to reach US$ 1.9 billion by the year 2034.

- The product type segment is divided into bevel-tip flexible needles, tendonactuated tips and symmetric-tip needles, with bevel-tip flexible needles taking the lead in 2024 with a market share of 44.9%.

- Considering application, the market is divided into biopsy, tumor ablation, neurosurgery, pain management and others. Among these, biopsy held a significant share of 48.3%.

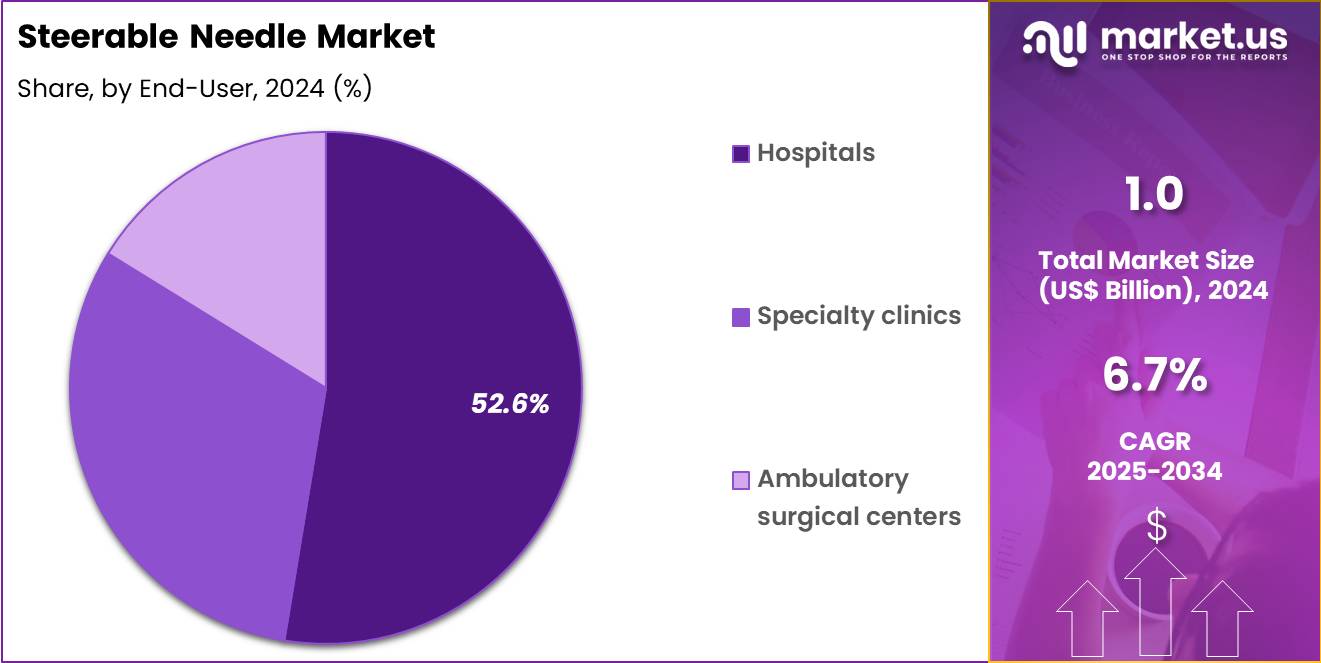

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, specialty clinics and ambulatory surgical centers. The hospitals sector stands out as the dominant player, holding the largest revenue share of 52.6% in the market.

- North America led the market by securing a market share of 38.4% in 2024.

Product Type Analysis

Bevel-tip flexible needles, holding 44.9%, are expected to dominate because their curved trajectory capability allows precise navigation through delicate or obstructed anatomical pathways. Surgeons and interventional radiologists increasingly rely on bevel-tip technology for procedures requiring accuracy near sensitive structures, including tumors or deep-tissue lesions.

Advances in needle flexibility and steerability improve real-time responsiveness under ultrasound, CT, or MRI guidance. Minimally invasive procedures continue expanding, strengthening preference for needles that reduce complication risks and enhance procedural control. Clinical studies demonstrate improved targeting success rates with bevel-tip designs, reinforcing their adoption in high-precision interventions. These factors keep bevel-tip flexible needles anticipated to remain the leading product type in this market.

Application Analysis

Biopsy, holding 48.3%, is projected to dominate because steerable needles significantly enhance tissue sampling accuracy, especially in hard-to-reach or small lesions. Early cancer diagnosis efforts increase reliance on image-guided biopsy techniques that benefit from improved needle control. Rising cancer incidence globally drives biopsy procedure volume across oncology departments.

The ability to redirect the needle path mid-procedure improves sample adequacy, reducing repeat interventions and patient discomfort. Advancements in imaging compatibility strengthen biopsy performance in complex anatomical regions. Precision medicine initiatives depend on high-quality biopsy samples for genomic and molecular analysis. These dynamics keep biopsy expected to remain the dominant application segment.

End-User Analysis

Hospitals, holding 52.6%, are anticipated to dominate because they perform the majority of complex image-guided procedures requiring advanced steerable needle systems. Hospitals maintain specialized imaging technologies, including MRI and CT, which support accurate needle navigation. Growing adoption of minimally invasive surgeries increases procedure volumes conducted in hospital settings.

Multidisciplinary teams within hospitals streamline decision-making for high-risk biopsy and ablation cases. Investments in robotic-assisted and computer-guided surgical platforms further encourage the use of steerable needle technology. Increasing patient preference for hospital-based care in critical cases reinforces utilization. These factors keep hospitals expected to remain the dominant end-user segment in the steerable needle market.

Key Market Segments

By Product Type

- Bevel-Tip Flexible Needles

- Tendonactuated Tips

- Symmetric-Tip Needles

By Application

- Biopsy

- Tumor Ablation

- Neurosurgery

- Pain Management

- Others

By End-user

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

Drivers

The surge in robotic-assisted surgeries is driving the market

The proliferation of robotic-assisted surgical procedures has significantly elevated the demand for steerable needles, which enhance precision in navigating complex anatomical structures during minimally invasive interventions. These needles enable operators to adjust trajectories in real time, reducing collateral tissue damage and improving outcomes in fields such as oncology and cardiology. Healthcare institutions are increasingly incorporating robotic platforms, necessitating compatible steerable tools to optimize procedural efficiency and safety.

Regulatory endorsements for integrated systems further accelerate adoption, as they validate combined technologies for clinical use. The economic benefits, including shorter recovery times and lower complication rates, justify substantial investments in advanced needle designs. Collaborative efforts between device manufacturers and surgical societies promote standardized protocols that leverage steerable capabilities.

As procedural volumes expand, supply chains adapt to meet the requirements for high-performance, biocompatible materials in needle construction. Educational programs focused on robotic proficiency indirectly bolster the market by preparing clinicians for steerable applications. Global disparities in access are narrowing through technology transfers, extending benefits to emerging healthcare systems. In totality, this driver establishes steerable needles as integral to the evolution of robotic surgery paradigms.

Restraints

Technical complexity requiring specialized training is restraining the market

The intricate mechanics of steerable needles demand extensive operator training, which poses barriers to widespread clinical integration and slows market penetration. Variability in device handling across different robotic platforms complicates skill transfer, leading to prolonged onboarding periods for medical teams. This expertise gap results in selective use within high-volume centers, limiting deployment in smaller facilities with constrained resources.

Simulation-based training modules, while beneficial, incur additional costs that strain departmental budgets. Inconsistent performance during initial learning curves raises concerns over procedural risks, fostering hesitancy among conservative practitioners. Standardization of training curricula remains elusive, exacerbating regional inconsistencies in proficiency levels.

The need for multidisciplinary collaboration further extends preparation timelines, delaying full operational readiness. Liability considerations tied to operator errors amplify institutional caution in procurement decisions. These factors collectively hinder scalability, as potential users prioritize familiar, less complex alternatives. Ultimately, this restraint highlights the necessity for intuitive designs to democratize access and confidence.

Opportunities

Integration with artificial intelligence for enhanced navigation is creating growth opportunities

Artificial intelligence algorithms are revolutionizing steerable needle guidance by predicting tissue deformations and optimizing insertion paths, thereby expanding applications in delicate procedures like tumor biopsies. This synergy enables autonomous adjustments, minimizing human error and broadening utility in remote or telesurgery contexts. Compatibility with existing imaging modalities unlocks hybrid systems for real-time feedback, appealing to precision-focused specialties.

Collaborative R&D initiatives between tech firms and medical device entities are yielding prototypes with embedded AI sensors for adaptive control. Cost reductions from fewer procedural revisions position these innovations as economically attractive for ambulatory settings. Regulatory frameworks are evolving to accommodate AI validations, streamlining pathways for market entry. Scalability through cloud-based analytics supports data-driven refinements, enhancing predictive accuracy over time.

Opportunities extend to underserved regions via portable AI-enabled kits, promoting global equity in interventional care. Validation studies underscore superior targeting efficiency, informing insurance coverage expansions. Collectively, this integration heralds a transformative era for steerable technologies in intelligent healthcare delivery.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends energize the steerable needle market as expanding healthcare investments and surging demand for minimally invasive procedures compel hospitals and surgeons to adopt advanced navigation tools for precise biopsies and drug deliveries. Manufacturers aggressively innovate with flexible, bevel-tip designs, capitalizing on aging populations and chronic disease prevalence to drive adoption in oncology and neurology applications.

Persistent inflation and uneven economic recoveries, however, tighten procurement budgets for clinics, forcing providers to delay upgrades and extend legacy equipment use in cost-pressured environments. Geopolitical tensions, including U.S.-China trade disputes and regional conflicts, frequently disrupt global supplies of precision components like stainless steel and electronics, leading to production delays and heightened sourcing risks for device makers.

Current U.S. tariffs impose a baseline 10 percent duty on imported medical devices alongside up to 50 percent on Chinese-origin needles, elevating acquisition costs for American facilities and straining margins across the distribution network. These tariffs provoke retaliatory measures in overseas markets that restrict U.S. exports of innovative steerable technologies and complicate international R&D partnerships.

Nevertheless, the policies accelerate investments in domestic manufacturing hubs and localized supply strategies, forging more secure ecosystems that will enhance innovation and ensure sustained market expansion for years ahead.

Latest Trends

Successful in vivo demonstration of autonomous steerable needle is a recent trend

In February 2024, researchers at Johns Hopkins University achieved a milestone by successfully demonstrating an autonomous steerable needle navigating through living porcine lung tissue to reach a designated target while avoiding anatomical obstacles. This proof-of-concept utilized a robotic system integrated with real-time imaging and control algorithms to execute the procedure without human intervention.

The experiment highlighted the needle’s ability to adjust its bevel tip for controlled deflection, achieving sub-millimeter precision in a dynamic biological environment. Conducted under the auspices of the National Institute of Biomedical Imaging and Bioengineering, the study validated safety parameters, including minimal tissue trauma. This advancement addresses longstanding challenges in accessing peripheral lung lesions, potentially revolutionizing biopsy and ablation techniques.

Early analyses confirmed the system’s robustness against respiratory motion, a common procedural confound. The trend signals a shift toward fully automated interventional tools, with implications for scaling in clinical trials. Stakeholder collaborations are accelerating translations to human applications, focusing on regulatory alignments. Performance metrics exceeded manual benchmarks, underscoring feasibility for high-risk scenarios. This 2024 demonstration exemplifies the maturation of autonomous steerable systems, paving the way for enhanced procedural autonomy.

Regional Analysis

North America is leading the Steerable Needle Market

North America accounted for 38.4% of the overall market in 2024, and the region experienced strong growth as minimally invasive procedures became more widely adopted across interventional radiology, oncology, and pain-management specialties. Hospitals increasingly deployed steerable needle systems to improve navigation precision during biopsies, ablations, and targeted drug delivery, reducing procedural complications and enhancing clinical outcomes.

Rising cancer incidence, especially in hard-to-access organs, accelerated demand for advanced needle technologies that enable accurate tissue sampling. The American Cancer Society reported 2,001,140 new cancer cases in the United States in 2023, creating substantial procedural volume requiring high-precision tools for diagnosis and treatment.

Surgical centers also expanded image-guided interventions using ultrasound, CT, and MRI, further supporting adoption. These combined advancements strengthened North America’s market performance in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to witness significant growth during the forecast period as healthcare systems increase investment in minimally invasive surgical capabilities and modern imaging infrastructure. Hospitals across China, India, Japan, and South Korea enhance interventional radiology departments to meet rising cancer and chronic-disease burdens.

Growing clinical emphasis on early, accurate biopsies drives adoption of navigable needle technologies that improve tissue targeting. Training programs in advanced interventional procedures expand, enabling broader integration of these devices into routine care.

The World Health Organization reported that Asia accounts for nearly 50% of global cancer cases as of 2022, underscoring the urgent need for precision diagnostic tools. Improving reimbursement frameworks and rapid growth in private healthcare further accelerate uptake. These factors collectively position Asia Pacific for robust expansion in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading manufacturers in the steerable-needle segment drive growth by engineering flexible, precision-guided devices that navigate complex anatomies and improve accuracy in biopsies, ablations, and targeted drug delivery. They strengthen adoption by collaborating with interventional radiologists, oncologists, and robotic-surgery platforms to integrate steerable access tools into advanced image-guided procedures.

Product-development teams enhance control mechanisms, tip designs, and compatibility with ultrasound, CT, and MRI systems to reduce procedural risk and increase clinician confidence. Commercial organizations expand global reach through partnerships with tertiary hospitals and specialty clinics, offering training programs that accelerate proficiency and standardize outcomes.

Strategy teams secure competitive advantage by validating clinical performance through peer-reviewed studies and by aligning with regulatory pathways that support rapid market entry. Boston Scientific illustrates this approach with its broad interventional oncology and access-device portfolio, strong R&D capabilities, and deep provider relationships that position the company as a trusted partner for precision-guided needle technologies.

Top Key Players

- Medtronic

- Boston Scientific

- Teleflex Medical

- Cook Medical

- Merit Medical Systems

- Stryker Corporation

- Becton Dickinson (BD)

- Olympus Corporation

Recent Developments

- In September 2022, Serpex Medical received FDA 510(k) clearance for its Compass Steerable Needles. Designed to navigate into lung nodules located deep within the pulmonary region, these needles improve the accuracy of tissue acquisition, supporting more reliable diagnostic pathways for lung cancer.

- In March 2023, Merit Medical Systems expanded its SwiftNinja steerable microcatheter portfolio. Although microcatheters serve a different function, the expansion underscores a broader trend toward highly maneuverable devices that improve navigation through complex anatomical pathways—a design philosophy that also underpins advances in next-generation steerable needles used in oncology and interventional radiology.

Report Scope

Report Features Description Market Value (2024) US$ 1.0 Billion Forecast Revenue (2034) US$ 1.9 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Bevel-Tip Flexible Needles, Tendonactuated Tips and Symmetric-Tip Needles), By Application (Biopsy, Tumor Ablation, Neurosurgery, Pain Management and Others), By End-user (Hospitals, Specialty Clinics and Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Medtronic, Boston Scientific, Teleflex Medical, Cook Medical, Merit Medical Systems, Stryker Corporation, Becton Dickinson (BD), Olympus Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Medtronic

- Boston Scientific

- Teleflex Medical

- Cook Medical

- Merit Medical Systems

- Stryker Corporation

- Becton Dickinson (BD)

- Olympus Corporation