Global Steel Sections Market Size, Share, Growth Analysis Process (Hot-Rolled Steel Sections, Cold-Formed Steel Sections, Welded Steel Sections, Seamless Steel Sections), Type (H-Beams, I-Beams, Others), End Use (Industrial, Residential, Commercial), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176903

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

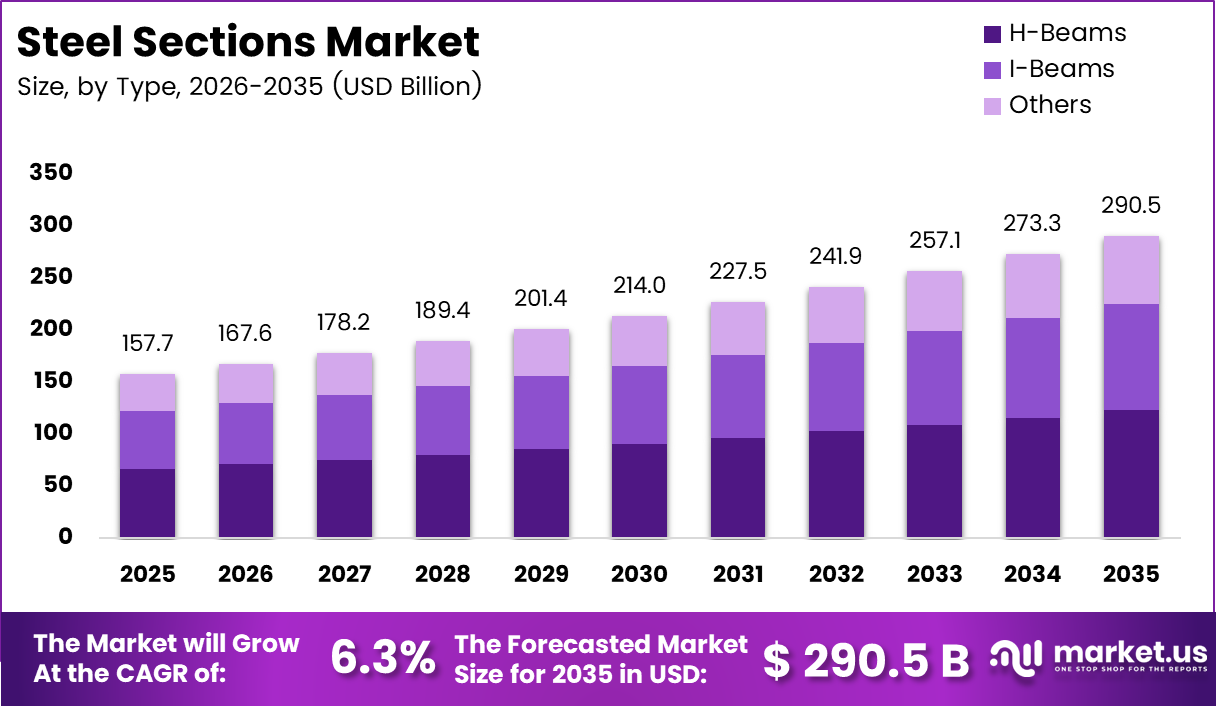

Global Steel Sections Market size is expected to be worth around USD 290.5 Billion by 2035 from USD 157.7 Billion in 2025, growing at a CAGR of 6.3% during the forecast period 2026 to 2035.

Steel sections represent engineered structural steel products manufactured in standardized shapes for construction, infrastructure, and industrial applications. These include H-beams, I-beams, channels, and angles fabricated through various processes. They serve as fundamental building blocks in modern construction projects globally.

The market experiences robust growth driven by infrastructure modernization initiatives worldwide. Governments invest heavily in transportation networks, smart city, and urban development projects. Moreover, industrial expansion across manufacturing sectors creates sustained demand for structural steel components in facility construction.

Renewable energy infrastructure development significantly boosts steel sections consumption. Wind turbine towers, solar panel mounting structures, and power transmission frameworks require specialized high-strength steel grades. Additionally, the electric vehicle manufacturing sector demands precision-engineered steel sections for production facilities and charging infrastructure.

Digital transformation reshapes material selection processes in the construction industry. Advanced software tools enable engineers to optimize steel grade selection based on load requirements and environmental conditions. Consequently, demand shifts toward high-performance, corrosion-resistant steel sections that offer superior durability and lifecycle value.

Sustainability considerations increasingly influence procurement decisions across end-use sectors. Construction companies prioritize steel sections with lower carbon footprints and higher recyclability rates. Furthermore, prefabricated and modular steel components gain traction due to reduced on-site construction time and improved quality control standards.

However, raw material price volatility presents ongoing challenges for market participants. Fluctuations in iron ore and coking coal costs impact steel section pricing and project economics. Therefore, manufacturers focus on operational efficiency improvements and strategic raw material procurement to maintain competitive positioning.

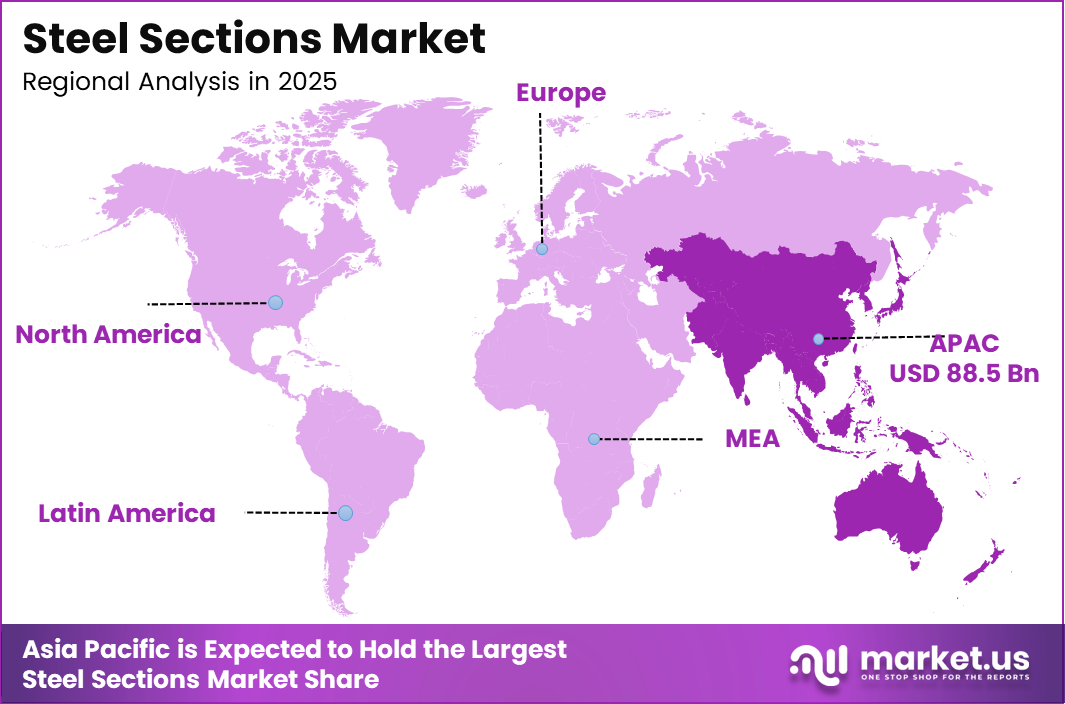

According to industry analysis, Asia Pacific dominates the global market with 56.1% share, valued at USD 88.5 Billion, driven by massive infrastructure investments in China and India. According to Regan Industrial, structural steel sections are manufactured in lengths up to 60 feet, with channels typically ranging between 20 to 40 feet for standard applications.

Key Takeaways

- Global Steel Sections Market projected to reach USD 290.5 Billion by 2035 from USD 157.7 Billion in 2025

- Market expected to grow at a CAGR of 6.3% during the forecast period 2026-2035

- Asia Pacific region dominates with 56.1% market share, valued at USD 88.5 Billion

- Hot-Rolled Steel Sections lead the Process segment with 52.8% market share in 2025

- H-Beams dominate the Type segment, holding 42.5% market share

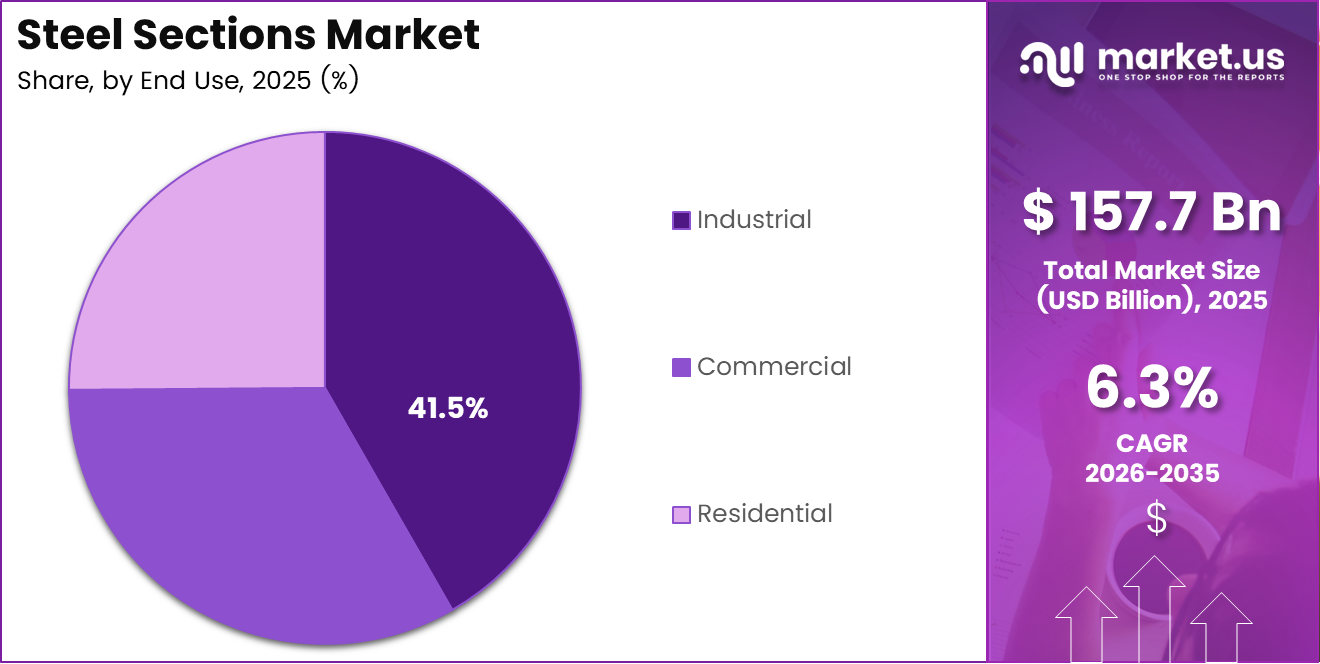

- Industrial end-use sector leads with 41.5% market share in 2025

- Infrastructure modernization and renewable energy projects drive market expansion

- Growing adoption of high-strength, lightweight steel grades reshapes product demand

Process Analysis

Hot-Rolled Steel Sections dominate with 52.8% due to superior formability and cost-effectiveness in large-scale construction applications.

In 2025, Hot-Rolled Steel Sections held a dominant market position in the Process segment of Steel Sections Market, with a 52.8% share. This segment benefits from established manufacturing infrastructure and widespread application across construction, infrastructure, and industrial projects requiring standard dimensional tolerances.

Cold-Formed Steel Sections represent a growing segment driven by demand for lightweight, high-strength components in residential and commercial construction. This process enables precise dimensional control and superior surface finish. Moreover, cold-forming reduces material waste and allows manufacturers to create complex cross-sectional profiles for specialized applications.

Welded Steel Sections offer design flexibility for custom structural components in mega infrastructure projects. Manufacturers fabricate these sections by joining steel plates or strips through advanced welding techniques. Additionally, welded sections accommodate larger dimensions than hot-rolled alternatives, meeting specific engineering requirements in bridge construction and industrial facilities.

Seamless Steel Sections serve critical applications requiring superior strength and pressure resistance, particularly in energy infrastructure and high-stress industrial environments. The seamless manufacturing process eliminates weld seams that could represent potential failure points. Consequently, these sections command premium pricing in specialized markets despite higher production costs.

Type Analysis

H-Beams dominate with 42.5% due to exceptional load-bearing capacity and versatility in multi-story construction projects.

In 2025, H-Beams held a dominant market position in the Type segment of Steel Sections Market, with a 42.5% share. These sections feature parallel flanges and optimized web thickness, providing superior structural efficiency. Their wide flange design distributes loads effectively across building frames and industrial structures.

I-Beams maintain significant market presence in residential and light commercial construction applications. These sections offer cost-effective solutions for moderate span requirements and simplified connection details. Furthermore, I-beams provide excellent strength-to-weight ratios for floor joists, roof trusses, and lightweight framing systems in various building types.

Others category encompasses channels, angles, and specialized profiles serving niche construction and industrial applications. Channels feature C-shaped cross-sections ideal for secondary framing members and support structures. Additionally, angle sections with L-shaped profiles provide versatile connection solutions, bracing elements, and edge reinforcement in diverse structural assemblies.

End Use Analysis

Industrial sector dominates with 41.5% due to extensive factory construction, warehousing facilities, and manufacturing infrastructure development.

In 2025, Industrial held a dominant market position in the End Use segment of Steel Sections Market, with a 41.5% share. This sector requires heavy-duty structural steel for manufacturing plants, logistics centers, and processing facilities. Moreover, industrial automation expansion drives demand for precision-engineered steel frameworks supporting advanced machinery installations.

Residential construction increasingly adopts steel sections for mid-rise and high-rise apartment buildings in urban centers. Steel framing systems offer superior seismic resistance and faster construction timelines compared to traditional materials. Additionally, residential developers utilize lightweight steel sections for roof trusses, floor systems, and load-bearing walls in modern housing projects.

Commercial real estate development consumes substantial steel sections for office buildings, retail complexes, and hospitality infrastructure. These structures demand open floor plans and column-free spaces that steel sections efficiently provide. Furthermore, commercial projects prioritize fire-resistant and sustainable building materials, positioning steel sections as preferred structural solutions.

Key Market Segments

Process

- Hot-Rolled Steel Sections

- Cold-Formed Steel Sections

- Welded Steel Sections

- Seamless Steel Sections

Type

- H-Beams

- I-Beams

- Others

End Use

- Industrial

- Residential

- Commercial

Drivers

Rising Infrastructure Modernization Driving Demand for Precision Steel Sections

Infrastructure modernization initiatives across developed and emerging economies create substantial demand for advanced steel sections. Governments invest billions in transportation networks, including highways, bridges, and railway systems requiring durable structural components. Moreover, smart city developments prioritize resilient infrastructure capable of supporting growing urban populations and technological integration.

Industrial automation expansion necessitates specialized steel sections with precise dimensional tolerances and enhanced load-bearing characteristics. Manufacturing facilities incorporate automated systems requiring robust structural frameworks that maintain stability under dynamic operational conditions. Additionally, warehouse automation and logistics infrastructure development drives consumption of high-performance steel sections designed for heavy equipment installations.

Renewable energy sector growth significantly boosts steel sections demand for wind turbine towers, solar mounting structures, and power transmission infrastructure. These applications require corrosion-resistant steel grades capable of withstanding harsh environmental conditions over extended service lifetimes. Furthermore, construction industry focus on material efficiency and load optimization encourages adoption of high-strength steel sections reducing overall material consumption.

Restraints

Raw Material Price Volatility Affecting Steel Section Production Economics

Fluctuations in iron ore and coking coal prices create uncertainty in steel section manufacturing costs and project budgeting. Market participants face challenges in maintaining consistent pricing structures when raw material expenses vary significantly across quarterly periods. Consequently, construction companies delay procurement decisions during periods of price instability, impacting market growth momentum.

Limited availability of advanced steel grades in emerging markets restricts adoption of high-performance steel sections for specialized applications. Manufacturers in developing regions often lack technical capabilities or production infrastructure for processing premium steel alloys. Moreover, import dependencies for specialized grades increase project costs and extend delivery timelines for construction companies.

Environmental regulations requiring emission reductions in steel production increase manufacturing costs, particularly for carbon-intensive hot-rolling processes. Steelmakers invest heavily in cleaner production technologies to comply with tightening environmental standards. Additionally, carbon pricing mechanisms in various jurisdictions add cost burdens that manufacturers partially transfer to steel section buyers through higher product pricing.

Growth Factors

Digital Transformation Accelerating Advanced Steel Selection and Customization

Adoption of digital material selection tools and artificial intelligence-based steel specification software optimizes structural design processes. Engineers leverage advanced simulation platforms to identify optimal steel grades matching specific load requirements and environmental exposure conditions. Moreover, these technologies reduce material waste and construction costs through precise specification of steel section properties.

Growing demand for customized steel solutions in mega construction projects creates opportunities for specialized manufacturers. Large-scale infrastructure developments require tailored steel sections with unique dimensional characteristics and performance specifications. Additionally, modular construction trends drive demand for prefabricated steel components manufactured to exact project requirements, improving on-site assembly efficiency.

Electric vehicle manufacturing expansion necessitates specialized steel sections for production facility construction and battery assembly line frameworks. Automotive manufacturers invest billions in new EV plants requiring advanced structural steel capable of supporting precision manufacturing equipment. Furthermore, high-speed rail and metro project proliferation across Asia Pacific and Middle East regions substantially increases structural steel consumption for stations, viaducts, and maintenance facilities.

Emerging Trends

Sustainability Integration Reshaping Steel Section Selection Criteria

Construction industry shifts toward high-strength, lightweight steel grades that reduce overall material consumption and structural dead loads. Advanced steel metallurgy enables production of sections with superior strength-to-weight ratios, allowing architects to design more efficient building frames. Moreover, lightweight sections lower foundation requirements and reduce transportation costs throughout the supply chain.

Growing preference for corrosion-resistant and weathering steel extends structural service life while minimizing maintenance requirements. These specialized steel grades develop protective oxide layers preventing further corrosion progression in exposed applications. Additionally, weathering steel eliminates painting requirements, reducing lifecycle costs and environmental impact associated with protective coating systems.

Integration of sustainability criteria in steel selection processes reflects increasing focus on embodied carbon and circular economy principles. Construction companies evaluate steel sections based on recycled content, production carbon footprint, and end-of-life recyclability. Furthermore, prefabricated and modular steel components gain market share due to quality control advantages, reduced construction waste, and accelerated project delivery timelines.

Regional Analysis

Asia Pacific Dominates the Steel Sections Market with a Market Share of 56.1%, Valued at USD 88.5 Billion

Asia Pacific leads global steel sections consumption driven by massive infrastructure investments in China, India, and Southeast Asian nations. The region benefits from established steel manufacturing capacity and proximity to end-use construction markets. Moreover, urbanization trends and industrial expansion create sustained demand across residential, commercial, and industrial building segments.

North America Steel Sections Market Trends

North America experiences steady market growth supported by infrastructure renewal programs and commercial construction activity in major metropolitan areas. The region emphasizes high-performance steel sections meeting stringent building codes and seismic requirements. Additionally, reshoring of manufacturing facilities and warehouse construction for e-commerce logistics drives industrial steel sections demand.

Europe Steel Sections Market Trends

Europe focuses on sustainable construction practices and energy-efficient building designs incorporating advanced steel sections. The region implements strict environmental regulations promoting use of recycled steel and low-carbon manufacturing processes. Furthermore, renovation and modernization of aging infrastructure create replacement demand for structural steel components throughout European markets.

Middle East & Africa Steel Sections Market Trends

Middle East & Africa witnesses growth driven by diversification initiatives reducing oil dependency through infrastructure and tourism development. Gulf Cooperation Council countries invest heavily in transportation networks, commercial real estate, and industrial zones. Moreover, Africa’s urbanization and population growth stimulate residential and commercial construction requiring structural steel sections.

Latin America Steel Sections Market Trends

Latin America shows moderate growth potential with infrastructure development concentrated in Brazil, Mexico, and Chile. The region faces economic challenges affecting construction investment levels and project execution timelines. However, mining industry expansion and agricultural processing facilities create consistent demand for industrial steel sections in specific markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

ArcelorMittal SA maintains global leadership through vertically integrated operations spanning iron ore mining to finished steel sections production across multiple continents. The company leverages advanced manufacturing technologies and extensive distribution networks to serve diverse construction and industrial markets. Moreover, ArcelorMittal invests significantly in sustainable steelmaking processes reducing carbon emissions while maintaining product quality standards for structural applications.

China Baowu Steel Group represents the world’s largest steel producer by volume, dominating Asia Pacific markets through comprehensive product portfolios and cost-competitive manufacturing. The company benefits from proximity to rapidly growing Chinese construction markets and strategic acquisitions expanding international presence. Additionally, Baowu emphasizes technological innovation in high-strength steel development meeting evolving infrastructure requirements across residential, commercial, and industrial segments.

Nippon Steel Corp. delivers premium steel sections to Japanese and global markets, emphasizing quality, precision engineering, and technical customer support services. The company maintains strong positions in automotive, construction, and energy infrastructure sectors through continuous product development. Furthermore, Nippon Steel collaborates with construction partners developing customized steel solutions for seismically resilient structures and advanced architectural applications.

POSCO Holdings Inc. operates integrated steel production facilities in South Korea and international markets, supplying structural sections to shipbuilding, construction, and energy industries. The company prioritizes environmental sustainability through hydrogen-based steelmaking technology development and circular economy initiatives. Moreover, POSCO expands downstream processing capabilities offering value-added steel sections with enhanced surface treatments and dimensional precision for specialized construction applications.

Key Players

- ArcelorMittal SA

- China Baowu Steel Group

- Nippon Steel Corp.

- POSCO Holdings Inc.

- Tata Steel Ltd.

- Nucor Corp.

- JFE Steel Corp.

- Gerdau S.A.

- Hyundai Steel

- Youfa Steel Pipe Group

- Vallourec

- Yuantai Derun Group

- SSAB AB

- APL Apollo Tubes

- Liberty Steel Group

- Other Key Players

Recent Developments

- July 2025 – Atlas completed acquisition of EVRAZ North America, forming Orion Steel with Doug Matthews appointed as CEO. The transaction creates a leading producer of engineered steel products serving rail, energy, infrastructure, and industrial end markets across the United States and Canada.

- February 2026 – Kloeckner Metals Corporation announced acquisition of Camalloy, a non-ferrous service center specializing in stainless steel and aluminum located in Washington, Pennsylvania. The strategic acquisition expands KMC’s non-ferrous capabilities and strengthens its presence in the Pittsburgh metropolitan market.

Report Scope

Report Features Description Market Value (2025) USD 157.7 Billion Forecast Revenue (2035) USD 290.5 Billion CAGR (2026-2035) 6.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Process (Hot-Rolled Steel Sections, Cold-Formed Steel Sections, Welded Steel Sections, Seamless Steel Sections), Type (H-Beams, I-Beams, Others), End Use (Industrial, Residential, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ArcelorMittal SA, China Baowu Steel Group, Nippon Steel Corp., POSCO Holdings Inc., Tata Steel Ltd., Nucor Corp., JFE Steel Corp., Gerdau S.A., Hyundai Steel, Youfa Steel Pipe Group, Vallourec, Yuantai Derun Group, SSAB AB, APL Apollo Tubes, Liberty Steel Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ArcelorMittal SA

- China Baowu Steel Group

- Nippon Steel Corp.

- POSCO Holdings Inc.

- Tata Steel Ltd.

- Nucor Corp.

- JFE Steel Corp.

- Gerdau S.A.

- Hyundai Steel

- Youfa Steel Pipe Group

- Vallourec

- Yuantai Derun Group

- SSAB AB

- APL Apollo Tubes

- Liberty Steel Group

- Other Key Players