Global Steel Drum Market Size, Share, Growth Analysis By Material Type (Carbon Steel, Stainless Steel), By Capacity (Below 10 Gallons, 10–30 Gallons, 30–55 Gallons, Above 55 Gallons), By End-Use Industry, By Closure Type, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135970

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

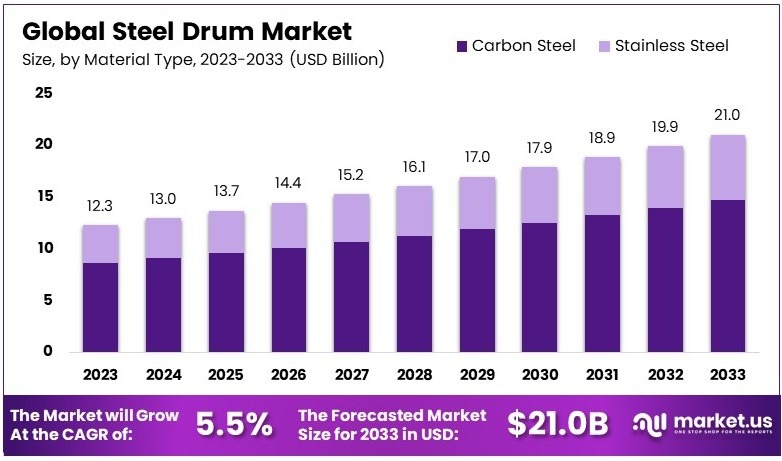

The Global Steel Drum Market size is expected to be worth around USD 21.0 Billion by 2033, from USD 12.3 Billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

A steel drum is a durable cylindrical container made of steel, primarily used for storing and transporting liquids, chemicals, and industrial products. It is known for its strength, recyclability, and resistance to damage, making it ideal for industrial and commercial applications.

The steel drum market refers to the industry focused on manufacturing, distributing, and selling steel drums for various applications. It caters to sectors like chemicals, food, and oil, emphasizing durability, eco-friendliness, and safety standards for packaging and transportation solutions.

Steel drums are widely used for transporting chemicals, food, and industrial goods, owing to their durability and recyclability. Notably, steel is 100% recyclable, making steel drums environmentally sustainable. Additionally, global industrial production grew by 1.5% in July 2024, indicating rising demand for steel-based packaging in industrial and manufacturing sectors.

The steel drum market shows moderate saturation but significant opportunities in emerging economies. For instance, manufacturing grew by 3.2% globally, reflecting increased industrial activity. Consequently, the demand for steel drums is expected to rise. Moreover, eco-conscious businesses prefer recyclable packaging, offering growth potential for green steel drum production.

On a broader scale, the inclusion of ‘Specialty Steel’ under India’s Production Linked Incentive Scheme provides a ₹6,322 crore boost to domestic manufacturing. This move promotes capital investment and employment. Meanwhile, such initiatives enhance global competitiveness and strengthen the supply chain in the steel drum market.

Locally, steel drum production supports industries and employment in manufacturing hubs. Furthermore, the recyclability of steel drums aligns with global sustainability goals, reducing environmental impact. Governments investing in green industrial practices foster economic growth while promoting eco-friendly packaging solutions.

Key Takeaways

- The Steel Drum Market was valued at USD 12.3 billion in 2023 and is expected to reach USD 21.0 billion by 2033, with a CAGR of 5.5%.

- In 2023, 55-Gallon Drums led capacity usage due to their versatility in transporting industrial goods.

- In 2023, Carbon Steel was the preferred material, known for its durability and cost-efficiency.

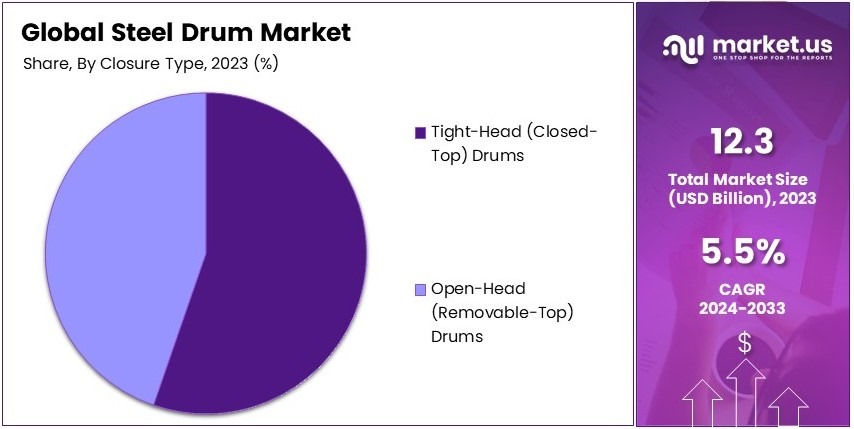

- In 2023, Tight-Head Drums were dominant due to their secure design for liquid transportation.

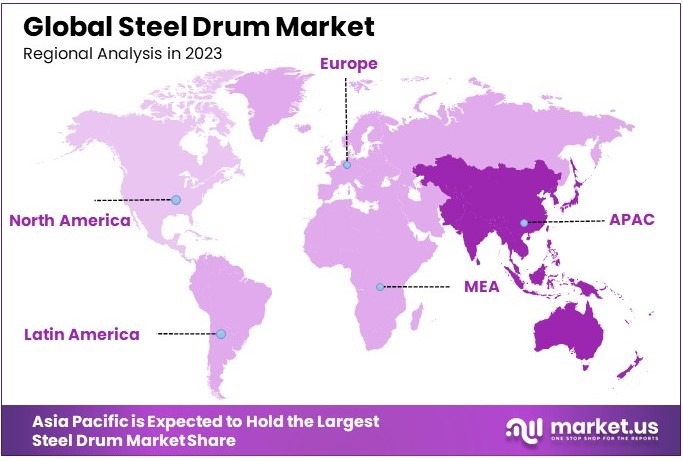

- In 2023, Asia Pacific was the largest regional market, driven by industrial expansion.

Business Environment Analysis

The steel drum market exhibits moderate saturation, particularly in established industrial sectors. However, rising demand in emerging economies continues to create opportunities. According to the World Steel Association (June 2024), global steel product exports reached 402.8 million metric tons in 2023, a 6.4% year-on-year increase, indicating robust supply chain dynamics.

Steel drums primarily cater to industries handling chemicals, food, and oil. High-demand sectors often align with global industrial growth. For example, the association projects steel demand to grow by 2.2% in 2023, reaching 1,881.4 million tonnes. Consequently, the market benefits from industrial expansion and packaging needs for bulk materials.

Product differentiation is crucial as sustainability becomes a key factor. Steel drums are 100% recyclable, offering eco-conscious solutions that align with regulations. For instance, the demand for reusable packaging rises as industries seek to reduce environmental impact, giving steel drums a competitive edge over alternatives like plastic.

Efficient value chains improve market profitability. Integration with steel production and recycling systems ensures consistent supply and cost advantages. The 75.6 million metric tons of hot-rolled sheets and coils exported globally in 2023 reflect strong production capabilities, benefiting steel drum manufacturers by ensuring reliable packaging material availability.

Investment opportunities in the steel drum market are driven by government policies promoting industrialization. Emerging economies increasingly focus on manufacturing expansion. For example, India’s Production Linked Incentive Scheme includes ₹6,322 crore for specialty steel, supporting local production and driving downstream industries such as drum manufacturing.

Export-import dynamics influence global steel drum trade. According to the World Steel Association, the export of 53.2 million metric tons of semi-finished material in 2023, up 19.3% year-on-year, indicates growing international trade. This highlights the interconnected nature of the global steel and steel drum supply chains.

Material Type Analysis

Carbon Steel dominates with 62% due to its durability and cost-effectiveness.

In the Steel Drum Market, the choice of material plays a critical role. Carbon Steel, leading with a 62% market share, is favored for its robustness and affordability, making it an ideal choice for storing and transporting a wide range of goods, from harsh chemicals to oils and lubricants.

Its high resistance to physical impacts and lower cost compared to alternatives solidify its position as the preferred material in various industries. This dominance is further supported by innovations in protective coatings and linings that enhance the carbon steel drums’ resistance to corrosion, extending their usability even in demanding environments.

Stainless Steel, although less prevalent, holds a significant place in the market, valued for its corrosion resistance and purity. This material is particularly important in the food and beverage and pharmaceutical sectors, where maintaining the integrity of contents is crucial. Despite its higher cost, stainless steel drums are essential for applications demanding stringent hygiene standards and for substances that are reactive with lesser metals.

Capacity Analysis

The 55 Gallon drum is the most popular, dominating with 70% due to its standardization across industries.

The capacity of steel drums is a defining feature in their market segmentation, with the 55 Gallon drums leading overwhelmingly. This size is the industry standard for a myriad of applications, from bulk chemical storage to shipping liquids internationally.

Its popularity stems from the balance it offers between volume efficiency and manageable weight, making it ideal for both storage and transport. Standardization across industries for this size allows for uniformity in handling equipment and storage facilities, simplifying operations and reducing costs.

Smaller capacities, including drums below 10 gallons and those between 10–30 gallons, cater to niche markets that require smaller quantities of materials, such as specialty chemicals or retail products. Drums above 55 gallons are less common and are typically used for large-scale storage and processes where volume matters more than transport logistics.

End-Use Industry Analysis

Chemicals & Solvents industry leads with 58% due to extensive use of steel drums for safe chemical transport and storage.

Steel drums are indispensable in the Chemicals & Solvents industry, which dominates their usage with a 58% share of the market. This industry relies on steel drums for the safe and effective storage and transportation of chemicals and solvents, which often require robust and secure containment solutions due to their hazardous nature.

The integrity of steel drums ensures that these materials are kept in controlled environments, reducing the risk of leaks and spills that can lead to environmental and health hazards.

Other significant industries include Petroleum & Lubricants, which utilizes these drums for their durability and leak-proof properties.

Food & Beverage, which values the non-reactive nature of certain steel drums for preserving flavor and quality; and Paints & Coatings, where drums are essential for bulk handling and long-term storage. The Pharmaceuticals industry also depends on steel drums, particularly those made from stainless steel, for maintaining the purity and quality of pharmaceutical products.

Closure Type Analysis

Tight-Head (Closed-Top) Drums dominate with 65% due to their security and leak prevention capabilities.

In the market for steel drums, the type of closure is crucial, especially considering the safety requirements for transporting and storing liquids. Tight-Head (Closed-Top) drums are preferred by a majority, holding a 65% share.

Their design, which typically includes a non-removable top with gaskets and secure closure mechanisms, makes them ideal for liquids that require airtight and leak-proof conditions. This type of drum is particularly favored in industries like Chemicals and Petroleum, where spill prevention is critical.

Open-Head (Removable-Top) drums, while essential in their own right, are generally used for solids or viscous liquids that need frequent access for filling and dispensing. These drums are important in industries such as Paints and Coatings and Food and Beverage, where their ease of access facilitates operations.

Key Market Segments

By Material Type

- Carbon Steel

- Stainless Steel

By Capacity

- Below 10 Gallons

- 10–30 Gallons

- 30–55 Gallons

- Above 55 Gallons

By End-Use Industry

- Chemicals & Solvents

- Petroleum & Lubricants

- Food & Beverage

- Paints & Coatings

- Pharmaceuticals

- Others (Agriculture, Waste Management, etc.)

By Closure Type

- Tight-Head (Closed-Top) Drums

- Open-Head (Removable-Top) Drums

Driving Factors

Growing Industrialization and Manufacturing Activities Drives Market Growth

The Steel Drum Market is propelled by the ongoing industrialization and the expansion of manufacturing activities globally. As industries such as chemicals, petroleum, and food & beverage continue to grow, the demand for reliable bulk storage solutions increases.

Steel drums offer durability and safety, making them essential for storing and transporting a wide range of products. Additionally, regulatory standards have become more stringent, ensuring that steel drums meet high-quality benchmarks, which in turn boosts their adoption across various sectors.

The oil and gas sector, in particular, has seen significant growth, driving the need for robust storage containers that can handle hazardous materials securely. Moreover, advancements in manufacturing technologies have improved the efficiency and cost-effectiveness of steel drum production, making them more accessible to a broader market.

Restraining Factors

Fluctuating Steel Prices Restraints Market Growth

Despite the strong demand, the Steel Drum Market faces several challenges that hinder its growth. One major restraint is the fluctuating steel prices, which can significantly impact production costs and profit margins for manufacturers.

Volatile raw material costs make it difficult to maintain consistent pricing for steel drums, potentially reducing their competitiveness compared to alternative materials. Additionally, the availability of alternative packaging materials such as plastic and composite drums presents a challenge, as these alternatives can offer lower costs and specific benefits like lighter weight or corrosion resistance.

Strict environmental regulations also pose a hurdle, as steel drum manufacturers must comply with various standards aimed at reducing environmental impact, which can increase operational costs and complicate production processes. Furthermore, logistic challenges related to the material handling and transportation of heavy steel drums can limit their practicality in certain applications, especially in regions with underdeveloped infrastructure.

Growth Opportunities

Adoption of Eco-Friendly and Recyclable Drums Provides Opportunities

The Steel Drum Market is ripe with growth opportunities driven by the increasing adoption of eco-friendly and recyclable drums. As environmental sustainability becomes a priority for businesses and consumers alike, there is a growing demand for steel drums that can be easily recycled and reused, reducing the overall environmental footprint.

Innovations in drum design are enabling manufacturers to create more sustainable products without compromising on durability or functionality. Additionally, rising demand in emerging economies presents a significant opportunity for market expansion, as these regions continue to industrialize and require robust storage solutions for various industries.

The push towards eco-friendly practices is further supported by regulatory incentives and corporate sustainability goals, encouraging the use of recyclable materials like steel. Moreover, expanding into specialized industries such as pharmaceuticals and electronics, which require high standards of storage and transportation, opens new avenues for steel drum manufacturers.

Emerging Trends

Integration of RFID and Tracking Technologies Is Latest Trending Factor

The Steel Drum Market is embracing several trending factors that are shaping its future trajectory. One of the latest trends is the integration of RFID and tracking technologies, which enhances the management and traceability of steel drums throughout the supply chain.

Additionally, there is a noticeable shift towards lightweight steel alloys, which offers the benefits of reduced transportation costs and easier handling without compromising the strength and durability of the drums. Customization and personalization of steel drums are also becoming increasingly popular, as businesses seek tailored solutions to meet specific storage and transportation needs.

Furthermore, there is a growing focus on supply chain optimization, where steel drum manufacturers are leveraging advanced logistics and inventory management systems to streamline operations and enhance overall productivity.

Regional Analysis

Asia Pacific Dominates the Steel Drum Market

Asia Pacific leads the Steel Drum Market, accounting for the largest share. This dominance is driven by robust industrial growth, expanding manufacturing activities, and rising demand for secure packaging solutions. Major economies like China and India contribute significantly due to their large-scale production and export-oriented industries.

Asia Pacific benefits from its high industrial output, particularly in chemicals, pharmaceuticals, and food processing. The region’s competitive labor costs, coupled with advancements in steel drum manufacturing, support its leadership. Increasing demand for durable and eco-friendly packaging further strengthens its position.

The region’s industrial hubs in China, India, and Japan rely heavily on steel drums for safe transportation and storage. High export activity in these nations drives consistent demand. Government initiatives to modernize industrial practices and promote sustainable packaging also play a key role in market growth.

Regional Mentions:

- North America: North America is a strong player, with demand driven by the chemical and oil industries. High standards for product safety and quality drive consistent growth in the steel drum market.

- Europe: Europe focuses on sustainable packaging solutions. The region’s strong regulatory environment and advanced manufacturing capabilities contribute to steady market performance.

- Middle East & Africa: This region shows growing demand due to expanding oil and gas industries. Investments in industrial development and export logistics are boosting the steel drum market.

- Latin America: Latin America is an emerging market, with demand driven by agriculture and food industries. The region’s focus on improving supply chain efficiency is enhancing its steel drum market share.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Steel Drum Market is dominated by key companies known for their quality, durability, and reliability in industrial packaging solutions. These players drive the market with advanced manufacturing processes, strong distribution networks, and a focus on sustainability.

Mauser Group B.V. is a global leader in industrial packaging, offering a wide range of steel drums for various industries. The company emphasizes innovation and sustainability, incorporating recycled materials and eco-friendly practices in its production processes.

Greif, Inc. is a prominent name in the market, providing high-quality steel drums with exceptional durability and safety standards. Its extensive global network and customer-centric approach make it a preferred choice across diverse industries such as chemicals, oil, and food products.

North Coast Container Corp. specializes in manufacturing customized steel drums. Its flexibility in design and focus on customer-specific solutions differentiate it in the market. The company is recognized for its consistent quality and commitment to meeting industry regulations.

Rahway Steel Drum Co Inc. is a key player known for its robust production capabilities and diverse product offerings. With decades of experience, the company focuses on delivering cost-effective and reliable steel drum solutions for industrial applications.

These companies lead the Steel Drum Market with their focus on quality, innovation, and sustainability. They cater to increasing demand for secure and durable packaging in industries such as chemicals, pharmaceuticals, and food processing. Their strong market positions are reinforced by their global reach, adherence to environmental standards, and ability to meet evolving customer needs. Together, these leaders continue to set the benchmark for growth and innovation in the Steel Drum Market.

Major Companies in the Market

- Mauser Group B.V.

- Greif, Inc.

- North Coast Container Corp.

- Rahway Steel Drum Co Inc.

- General Steel Drum LLC

- Skolnik Industries Inc.

- Metal Drum Co Ltd/The

- Clouds Drums Dubai LLC

- James G Carrick & Co Ltd

- Chicago Steel Container Corp.

- Izvar Ambalaj Sanayi VE Ticaret AS

- Industrial Container Services, Inc.

Recent Developments

- North Coast Container: In December 2023, North Coast Container consolidated Myers Container, General Steel Drum, North Coast Container, and Chicago Steel Container under one name. This move aims to streamline operations and improve service delivery across the United States.

- Novvia Group: In December 2022, Novvia Group acquired Rahway Steel Drum Company, a New Jersey-based distributor of drums, pails, IBCs, and other rigid packaging solutions. The financial terms of this private transaction were not disclosed.

- Nippon Steel: In December 2023, Nippon Steel announced a $14.9 billion acquisition of U.S. Steel. This merger has sparked discussions regarding national security, economic implications, and the future of American manufacturing.

Report Scope

Report Features Description Market Value (2023) USD 12.3 Billion Forecast Revenue (2033) USD 21.0 Billion CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Carbon Steel, Stainless Steel), By Capacity (Below 10 Gallons, 10–30 Gallons, 30–55 Gallons, Above 55 Gallons), By End-Use Industry (Chemicals and Solvents, Petroleum and Lubricants, Food and Beverage, Paints and Coatings, Pharmaceuticals, Others [Agriculture, Waste Management, etc.]), By Closure Type (Tight-Head [Closed-Top] Drums, Open-Head [Removable-Top] Drums) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mauser Group B.V., Greif, Inc., North Coast Container Corp., Rahway Steel Drum Co Inc., General Steel Drum LLC, Skolnik Industries Inc., Metal Drum Co Ltd/The, Clouds Drums Dubai LLC, James G Carrick & Co Ltd, Chicago Steel Container Corp., Izvar Ambalaj Sanayi VE Ticaret AS, Industrial Container Services, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mauser Group B.V.

- Greif, Inc.

- North Coast Container Corp.

- Rahway Steel Drum Co Inc.

- General Steel Drum LLC

- Skolnik Industries Inc.

- Metal Drum Co Ltd/The

- Clouds Drums Dubai LLC

- James G Carrick & Co Ltd

- Chicago Steel Container Corp.

- Izvar Ambalaj Sanayi VE Ticaret AS

- Industrial Container Services, Inc.