Global States Building Thermal Insulation Material Market By Material Type (Fiberglass, Mineral Wool, Polystyrene, Polyurethane, Polyisocyanurate, Cellulose, and Other Material Types), By Product Type (Rolls & Batts, Boards & Panels, Spray Foam, and Other Product Types), By Application, By Building Type, By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 111441

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

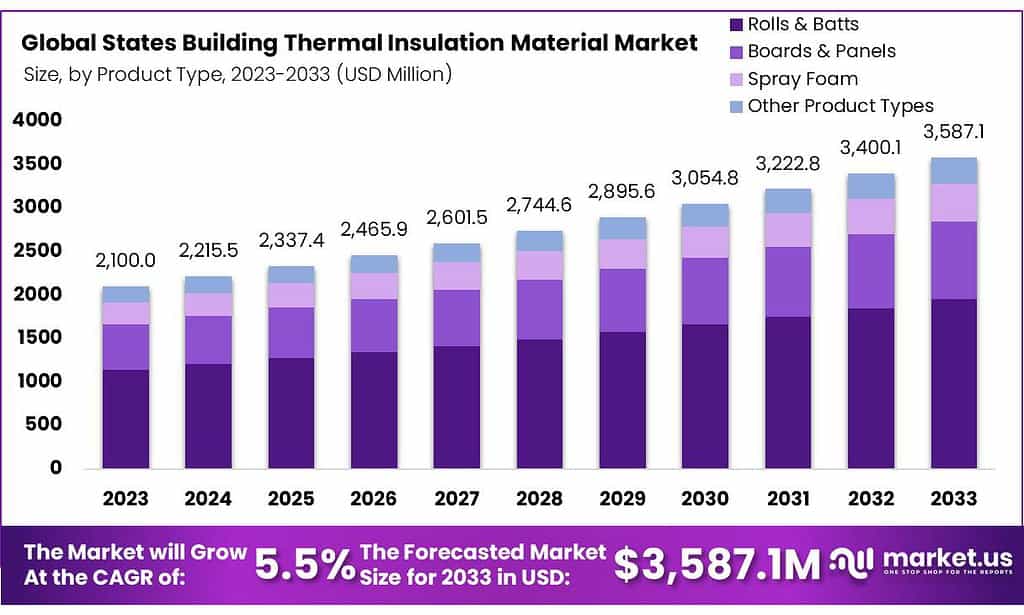

The Global States Building Thermal Insulation Material Market size is expected to be worth around USD 3,587.1 Million by 2032 from USD 2,100.0 Million in 2023, this market is estimated to register a CAGR of 5.5%.

The Global State Building Thermal Insulation Materials Industry is at the forefront of enhancing building energy efficiency and environmental sustainability. This sector is fundamentally involved in the development and application of materials designed to reduce heat flow through key structural elements such as walls, roofs, and floors.

The primary mission of this industry is to improve the thermal performance of buildings, significantly reducing the need for extensive heating and cooling systems. This endeavor is not only pivotal for energy conservation but also plays a crucial role in environmental protection by lowering greenhouse gas emissions and conserving finite natural resources, thereby addressing climate change challenges.

Presently, the industry is evolving with significant trends and innovations. Research and development are intensely focused on producing advanced insulation materials that offer superior performance while minimizing environmental impacts. This includes exploring eco-friendly materials and cutting-edge technologies like aerogels.

Moreover, the industry is increasingly engaging in retrofitting existing buildings with these innovative materials, which not only elevates their energy performance but also contributes to noise reduction, increased property value, and overall environmental benefits.

Key Takeaways

- The global States Building Thermal Insulation Material market was valued at US$ 2,100.0 Million in 2023.

- The global States Building Thermal Insulation Material market is projected to reach US$ 3,587.1 Million by 2033.

- The polystyrene segment held a major market share of 37.4% among the material type segment.

- Among Product types, the rolls & batts segment accounted for the majority of the market share with 54.5%.

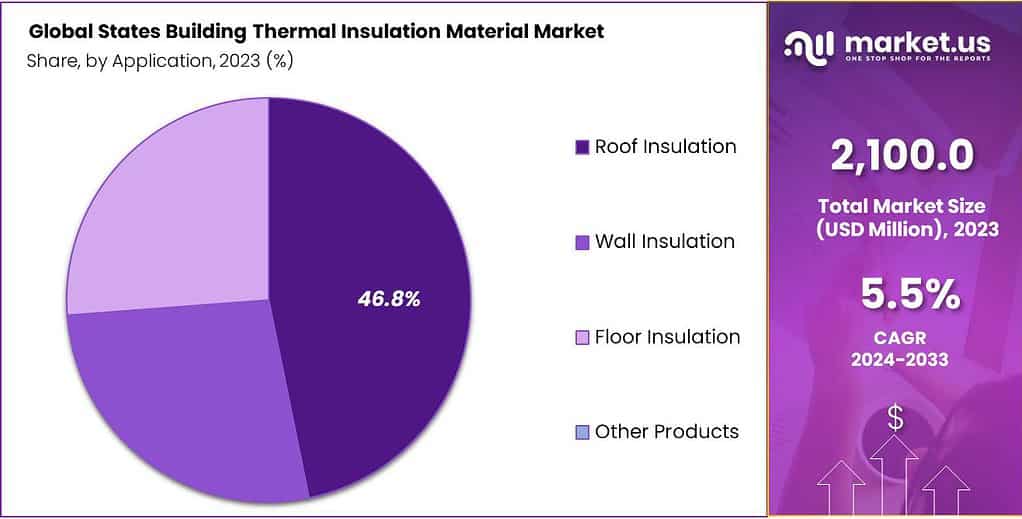

- Based on applications wall Insulation accounted for the largest market share in 2023 with 46.8%.

- Based on the Building Type Administrative buildings held 31.6% revenue share in 2023.

- New constructions accounted for 51.5% of the market revenue in 2023.

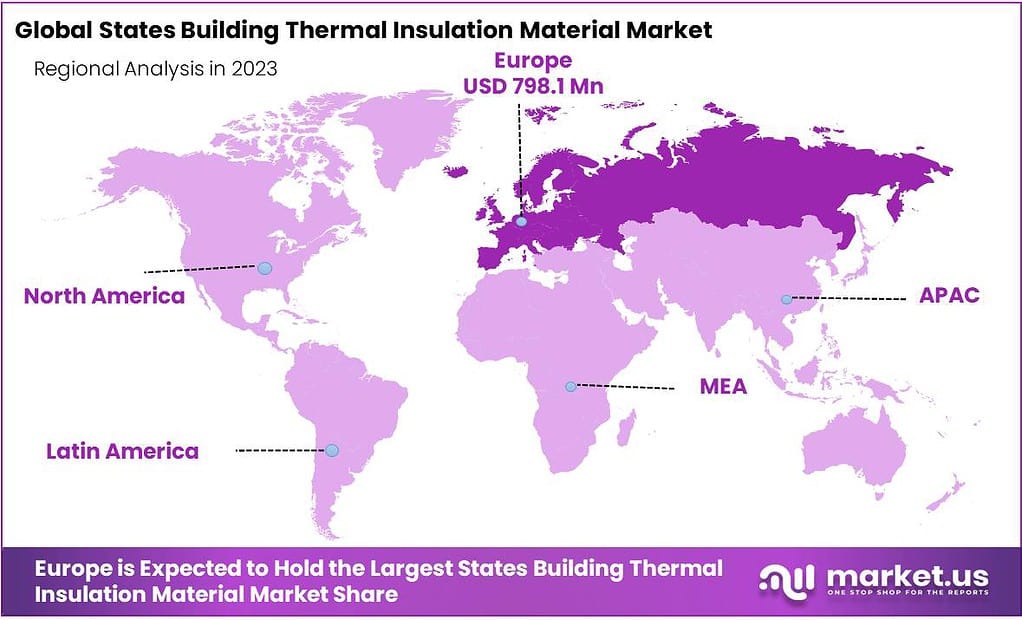

- Europe Held a major market share of 38.0% in 2023.

Actual Numbers Might Vary in the Final Report

Material Type Analysis

Polystyrene Leads to the state’s Building Thermal Insulation Market due to its Superior Insulation Properties, Lightweight Design, and Affordability.

The States Building Thermal Insulation Material market is segmented based on material type into fiberglass, mineral wool, polystyrene, polyurethane, polyisocyanurate, cellulose, and other material types. Among these, the Polystyrene segment held the major market share of 37.4% in 2023 and it is estimated to register a CAGR of 6.2% during the forecasted period.

Polystyrene dominates the States Building Thermal Insulation Material market due to its superior insulation properties, lightweight design, and affordability. It minimizes energy consumption for heating and cooling, meeting energy efficiency standards and sustainability goals.

Its versatility and adaptability to various building designs contribute to its popularity. Additionally, ongoing innovations in polystyrene manufacturing aim to enhance environmental friendliness and performance, and further bolster its market appeal.

Polyisocyanurate registered a CAGR of 5.8% during the estimated period; this can be attributed to its exceptional thermal performance, offering higher R-values per inch compared to other materials. Its low thermal conductivity efficiently reduces heat transfer, enhancing building energy efficiency.

Furthermore, polyisocyanurate is moisture-resistant, adding to its durability and making it suitable for various climates. Its lightweight nature eases installation and transportation.

Product Type Analysis

Rolls & Batts Dominates the Market Due to Their Wide Range of Applications

Based on the product type, the market is segmented into rolls & batts, boards & panels, spray foam, and other product types. Among these rolls & batts segment dominated the market with a market share of 54.5% in 2023. Rolls & batts are a leading market segment due to their ease of installation, affordability, and effective thermal insulation.

They come in convenient pre-cut sizes, making them suitable for a wide range of applications. These materials maintain comfortable indoor temperatures and reduce energy consumption, aligning with environmental awareness and energy efficiency regulations. Their combination of convenience, affordability, and performance has led to their market leadership.

Application Analysis

Wall Insulation Led the Segment Due to Energy Efficiency, Sustainability, and Regulatory Support

Based on applications, the market is further divided into roof insulation, wall insulation, and floor insulation. Among these applications, wall insulation led the market in 2023 with a market share of 46.8%. Wall insulation is gaining prominence due to its role in energy-efficient construction practices, reducing heating and cooling costs.

The growing environmental consciousness has increased the demand for insulation materials, and regulatory incentives and building codes have encouraged their use in new construction and renovation projects. This focus on energy conservation, cost savings, and compliance with regulations has made wall insulation the preferred choice for builders and property owners.

Building Type Analysis

Administrative Buildings Lead in Thermal Insulation Material Demand due to Large Surface Area, Regulations, and Aging Infrastructure

Based on building type the market is segmented into administrative buildings, educational buildings, museums and cultural centers, hospitals and healthcare, legislative buildings, and other building types. Among these, the administrative building dominates the market with a market share of 31.6% in 2023.

Administrative buildings often have larger surface areas compared to other building types, which results in higher heat loss or gain, making insulation crucial. Moreover, government regulations and policies often prioritize energy efficiency in public buildings, driving the demand for thermal insulation materials in administrative structures.

Additionally, the need for comfortable working environments in administrative offices further fuels the demand for insulation materials. The aging infrastructure of many government buildings also necessitates retrofitting with thermal insulation. These factors combined make administrative buildings the leading segment in the thermal insulation material market.

End-Use Analysis

The New Construction Segment Dominated the Market because of the Continuous Expansion of Government Buildings

The market for States Building Thermal Insulation Material is further divided into new construction and retrofit & renovation based on end-use. Among these, the new construction segment led the market in 2023 with a market share of 51.5%, the dominance of new construction is attributed to the continuous expansion and development of infrastructure projects, including administrative buildings, educational facilities, and healthcare centers in rural and urban areas, have spurred the demand for thermal insulation materials.

Moreover, stringent energy efficiency regulations and sustainability initiatives have encouraged builders to incorporate thermal insulation into new construction designs to reduce energy consumption and operational costs. Additionally, the adoption of innovative and advanced insulation materials and technologies in new buildings has further boosted this segment’s growth.

Key Market Segments

By Material Type

- Fiberglass

- Mineral Wool

- Polystyrene

- Polyurethane

- Polyisocyanurate

- Cellulose

- Other Material Types

By Product Type

- Rolls & Batts

- Boards & Panels

- Spray Foam

- Other Product Types

By Application

- Roof Insulation

- Wall Insulation

- Floor Insulation

By Building Type

- Administrative Buildings

- Educational Buildings

- Museums and Cultural Centers

- Hospitals and Healthcare

- Legislative Buildings

- Other Building Types

By End-Use

- New Construction

- Retrofit & Renovation

Drivers

Rising Energy Efficiency Regulations to Drive the Global States Building Thermal Insulation Materials Market

The global States Building Thermal Insulation Materials market is poised for growth, primarily driven by the increasing emphasis on energy efficiency regulations. These regulations are acting as a significant market driver across various building types, including administrative buildings, educational facilities, museums, hospitals, legislative buildings, and more.

One of the key reasons behind this driver is the growing awareness of the environmental impact of energy consumption in buildings. Governments and regulatory bodies are implementing stringent energy efficiency standards and codes to reduce greenhouse gas emissions. This, in turn, has led to a surge in demand for thermal insulation materials that can enhance a building’s energy performance.

Rising Government Spending on Construction Driving Market Growth

Governments are allocating significant budgets to construct diverse building types, including administrative buildings, educational institutions, museums, cultural centers, hospitals, and healthcare facilities. This surge in public investment is driven by the recognition of infrastructure as a cornerstone of economic growth and societal progress. As a result, governments are actively engaging in constructing or renovating these vital structures to meet the evolving needs of their populations.

The expansion of healthcare infrastructure is a global trend, particularly in response to events like the COVID-19 pandemic. Governments are building new healthcare facilities and retrofitting existing ones to meet the growing demand for medical services. Thermal insulation is essential in healthcare buildings to maintain a sterile and comfortable environment.

Restraints

High Initial Cost of Insulation Materials Hinder the Market Growth

A notable restraint in the market for States Building Thermal Insulation Materials is the high initial cost associated with these insulation materials. Budget constraints can be a significant impediment to the widespread adoption of thermal insulation materials.

One prominent impact is the delay or reluctance to initiate insulation projects due to the substantial upfront expenditure required. State budgets are often tightly regulated and subject to approval processes, making it challenging to allocate significant funds for insulation materials immediately.

As a result, the retrofit and renovation of existing state-owned buildings may be postponed, hindering the overall market growth. Moreover, the high initial cost of insulation materials can deter government agencies from pursuing energy-efficient initiatives.

Despite the long-term benefits, including reduced energy consumption and lower operational costs, the immediate financial burden can discourage investment in thermal insulation. These factors are affecting the rate of adoption in government-owned state buildings and potentially slowing down the market’s growth trajectory.

Opportunity

Retrofitting of Existing Buildings Expected to Create Significant Scope in the Global State Building Thermal Insulation Material Market

The State Building Thermal Insulation Material market presents a substantial opportunity for growth, particularly through retrofitting existing government-owned buildings. Retrofitting these state-owned buildings with thermal insulation materials offers several compelling advantages such as, it aligns with government initiatives to enhance energy efficiency and reduce carbon emissions, thereby meeting sustainability goals.

Additionally, retrofitting is a cost-effective solution compared to constructing entirely new buildings, making it an attractive option for governments aiming to optimize their real estate assets.

Moreover, the retrofitting of state buildings can lead to substantial energy savings, resulting in reduced operational costs for government agencies. This, in turn, allows for a more efficient allocation of public funds. Furthermore, the retrofit market fosters innovation and competition among thermal insulation material manufacturers, driving advancements in technology and affordability.

As governments worldwide prioritize sustainable practices, the retrofitting of state-owned buildings is expected to create significant scope in the global State Building Thermal Insulation Material market, offering both environmental and economic benefits.

Trends

Growing Emphasis on Sustainable Materials

The trend toward sustainable thermal insulation materials reflects a broader societal concern for environmental impact. Builders and governments are increasingly prioritizing eco-friendly construction practices.

This has led to a surge in demand for insulation materials made from recycled or renewable sources, such as recycled fiberglass, natural fibers like cotton or wool, and cellulose insulation derived from recycled paper.

These materials not only provide effective thermal insulation but also reduce the carbon footprint associated with construction. Additionally, sustainable insulation materials often have the advantage of being non-toxic and contributing to healthier indoor air quality.

Rising Demand for Retrofit Insulation

Retrofitting existing buildings with improved insulation has become a significant trend driven by the need to reduce energy consumption and operational costs. Escalating energy prices and environmental concerns have incentivized property owners and businesses to invest in retrofit projects. Insulation materials designed for retrofit applications, such as blown-in insulation and reflective insulation, are being widely adopted.

Geopolitical Impact Analysis

Geopolitical Factors and Energy Prices Influence States Building Thermal Insulation Material Market

The geopolitical landscape plays a crucial role in shaping the prospects of the States Building Thermal Insulation Material market, primarily due to the government ownership of state buildings. As nations focus on infrastructure and public building projects for economic recovery, there’s a growing emphasis on sustainability and energy efficiency in government-owned structures.

However, geopolitical tensions between countries, such as trade wars and Brexit, can have significant ramifications for the market. Import tariffs and export restrictions on key raw materials used in insulation products can inflate costs and disrupt supply chains. To mitigate these risks, businesses must diversify their supply chains, consider forward contracts, and explore local sourcing options.

Moreover, the market is sensitive to global energy prices, as they impact the cost structure of thermal insulation materials. Fluctuations in petroleum-based product prices, like foam boards, can affect production costs and demand. To navigate these challenges, companies should adopt agile pricing strategies and invest in sustainable materials to counter the volatility in fossil fuel prices.

Additionally, governments worldwide are tightening building codes and standards to meet climate goals, requiring advanced thermal insulation materials. Companies must ensure compliance with evolving norms to enhance brand value and customer loyalty, as well as participate in green certification programs to secure government contracts.

Regional Analysis

Europe is estimated to be the Most Lucrative Market in the Global States Building Thermal Insulation Material Market

Europe held the largest market share of 38.0% in 2023, making it the most lucrative market due to Europe has been at the forefront of stringent energy efficiency regulations and sustainable building practices. Government initiatives have placed a strong emphasis on reducing carbon emissions and minimizing energy consumption in state buildings.

This regulatory framework has propelled the demand for thermal insulation materials to an all-time high, as these materials play a pivotal role in achieving energy efficiency goals.

Moreover, the European region boasts a rich legacy of architectural heritage, including historic government-owned buildings. Retrofitting these structures with modern thermal insulation materials not only enhances energy efficiency but also preserves the cultural and historical significance of these landmarks.

Furthermore, the commitment to sustainability has driven substantial investments in research and development, leading to the availability of advanced and eco-friendly thermal insulation solutions. This has further solidified Europe’s position as the epicenter of the States Building Thermal Insulation Material market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Global States Building Thermal Insulation Material Market is characterized by the presence of several key players, each contributing to the industry’s growth and competition. These prominent players include Owens Corning, BASF SE, Saint-Gobain, Johns Manville, Knauf Insulation, Rockwool International A/S, Kingspan Group, Dow Chemical Company, Huntsman International LLC, Armacell International S.A., GAF Materials Corporation, URSA Insulation S.A., CertainTeed Corporation, Paroc Group, and Lapolla Industries Inc.

Owens Corning, BASF SE, and Saint-Gobain are among the frontrunners in this competitive landscape. Their market dominance can be attributed to a combination of factors, including product innovation, a strong global presence, and a commitment to delivering solutions that meet the evolving needs of state-owned buildings.

Market Key Players

The global States-Building Thermal Insulation Material market is highly fragmented, with key players including BASF SE, The Mosaic Company, Nutrien, Solvay S.A., and Aurubis AG. These companies dominate the market, though they are sorted in no particular order of market share or influence.

Efficient supply chain management is crucial, especially in a market dependent on raw material availability. Companies are investing in securing raw material sources or enhancing their logistics and distribution networks to ensure timely delivery and reduce costs.

- Owens Corning

- BASF SE

- Saint-Gobain

- Johns Manville

- Knauf Insulation

- Rockwool International A/S

- Kingspan Group

- Dow Chemical Company

- Huntsman International LLC

- Armacell International S.A.

- GAF Materials Corporation

- URSA Insulation S.A.

- CertainTeed Corporation

- Paroc Group

- Lapolla Industries Inc.

- Other Key Players

Recent Development

- In December 2022: ROCKWOOL started commercial production of stone wool insulation products at its manufacturing facilities in North America and China.

- In March 2022: ACC Ltd. introduced the ACC Atrium, a better thermal temperature control concrete system produced using based insulating technology. This unique technology insulates the ceiling while it is being built.

Report Scope

Report Features Description Market Value (2023) US$ 2,100.0 Mn Forecast Revenue (2033) US$ 3,587.1 Mn CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material Type (Fiberglass, Mineral Wool, Polystyrene, Polyurethane, Polyisocyanurate, Cellulose, and Other Material Types), By Product Type (Rolls & Batts, Boards and panels, Spray Foam, and Other Product Types), By Application (wall insulation, and floor insulation), By Building Type (administrative buildings, educational buildings, museums and cultural centers, hospitals and healthcare, legislative buildings, and other building types), By End-Use (new construction and retrofit & renovation) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Owens Corning, BASF SE, Saint-Gobain, Johns Manville, Knauf Insulation, Rockwool International A/S, Kingspan Group, Dow Chemical Company, Huntsman International LLC, Armacell International S.A., GAF Materials Corporation, URSA Insulation S.A., CertainTeed Corporation, Paroc Group, Lapolla Industries Inc., and other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is building thermal insulation material?Building thermal insulation materials are used to reduce heat transfer between the interior and exterior of buildings. They help maintain consistent temperatures, improve energy efficiency, and reduce heating and cooling costs.

What are the key benefits of using thermal insulation in buildings?Insulation helps in conserving energy by reducing heat transfer, maintaining comfortable indoor temperatures, lowering utility bills, dampening sound, and improving overall building durability and comfort.

Where are thermal insulation materials typically installed in buildings?Insulation is installed in various areas, including walls, roofs, floors, attics, basements, and around pipes or ductwork. Specific areas depend on the building's design and energy efficiency goals.

States Building Thermal Insulation Material MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

States Building Thermal Insulation Material MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Owens Corning

- BASF SE

- Saint-Gobain

- Johns Manville

- Knauf Insulation

- Rockwool International A/S

- Kingspan Group

- Dow Chemical Company

- Huntsman International LLC

- Armacell International S.A.

- GAF Materials Corporation

- URSA Insulation S.A.

- CertainTeed Corporation

- Paroc Group

- Lapolla Industries Inc.

- Other Key Players