Global Spunbond Nonwoven Market By Function(Disposable, Durable), By Material Type(Polypropylene, Polyethylene, Polyester, Others), By Application(Personal Care & Hygiene, Geotextiles, Medical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 78627

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

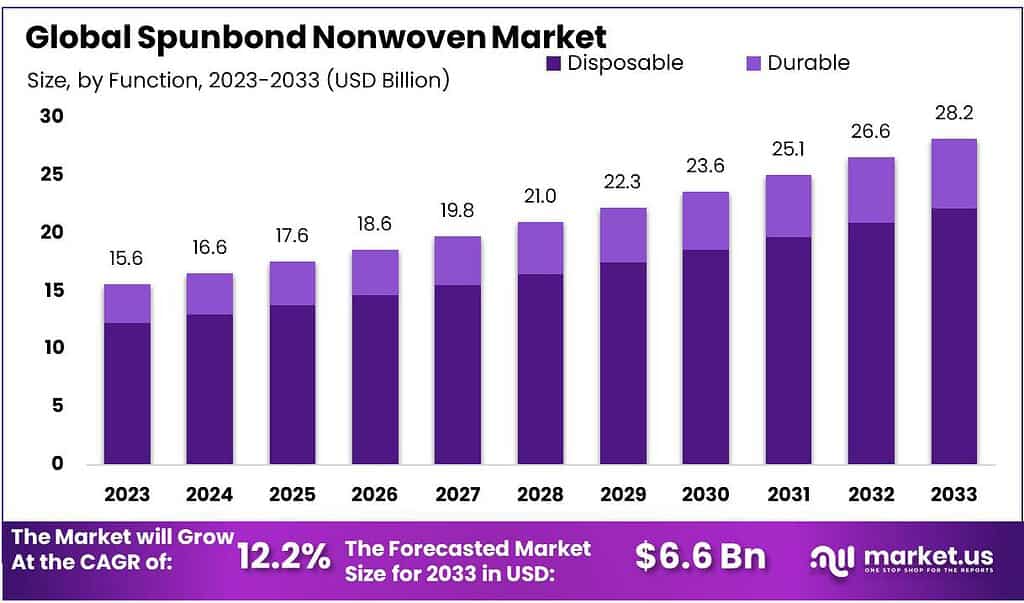

The Spunbond Nonwoven Market size is expected to be worth around USD 28.2 billion by 2033, from USD 15.6 billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

The spunbond nonwoven market refers to the segment within the nonwoven fabric industry that specializes in producing materials through the spunbond process. Spunbond nonwovens are engineered fabrics made from continuous filaments of synthetic materials, usually polypropylene, polyester, or other polymers.

The production of spunbond nonwovens involves extruding molten polymer granules through spinnerets to form continuous filaments. These filaments are randomly laid onto a conveyor belt and then bonded together using heat, pressure, or chemicals to create a fabric without the traditional weaving or knitting processes.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: Expected surge from USD 15.6 billion in 2023 to USD 28.2 billion by 2033, driven by a 6.1% CAGR, primarily due to increased demand across various industries.

- Function Preferences: Disposable applications hold a significant 78.7% share, aligning with hygiene concerns and the need for easily disposable items, especially in the medical, hygiene, and packaging industries.

- Material Dominance: Polypropylene leads with over 52.3% market share in 2023 due to versatility, cost-efficiency, and favorable properties like strength and resistance to moisture and chemicals.

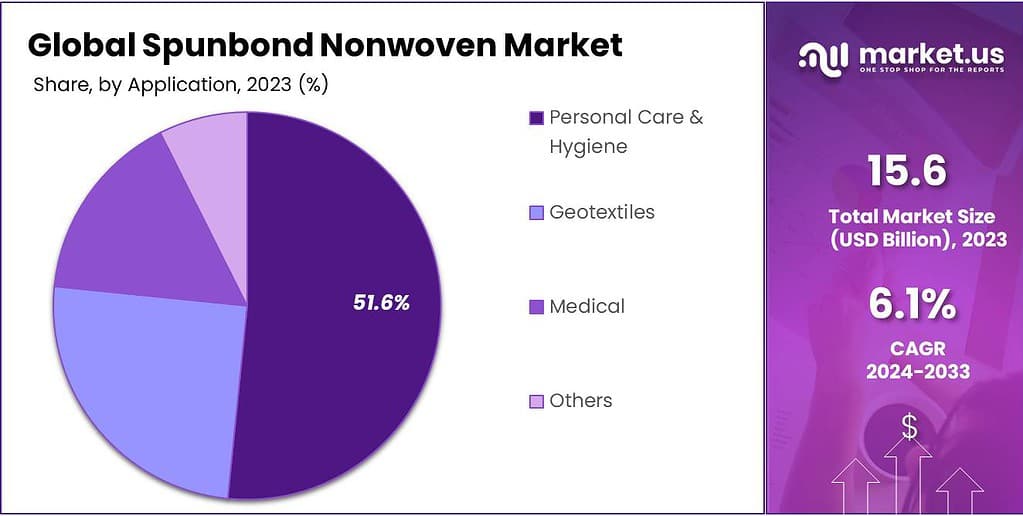

- Application Domination: Personal care and hygiene applications account for a substantial 51.6% market share, highlighting their role in products like diapers, feminine hygiene items, and personal care wipes due to comfort and absorbency.

- Market Drivers: Ease of production, rapid processing, and cost-effectiveness drive growth. Adaptability to create fabrics with diverse functionalities fuels consumer acceptance, especially in disposable segments.

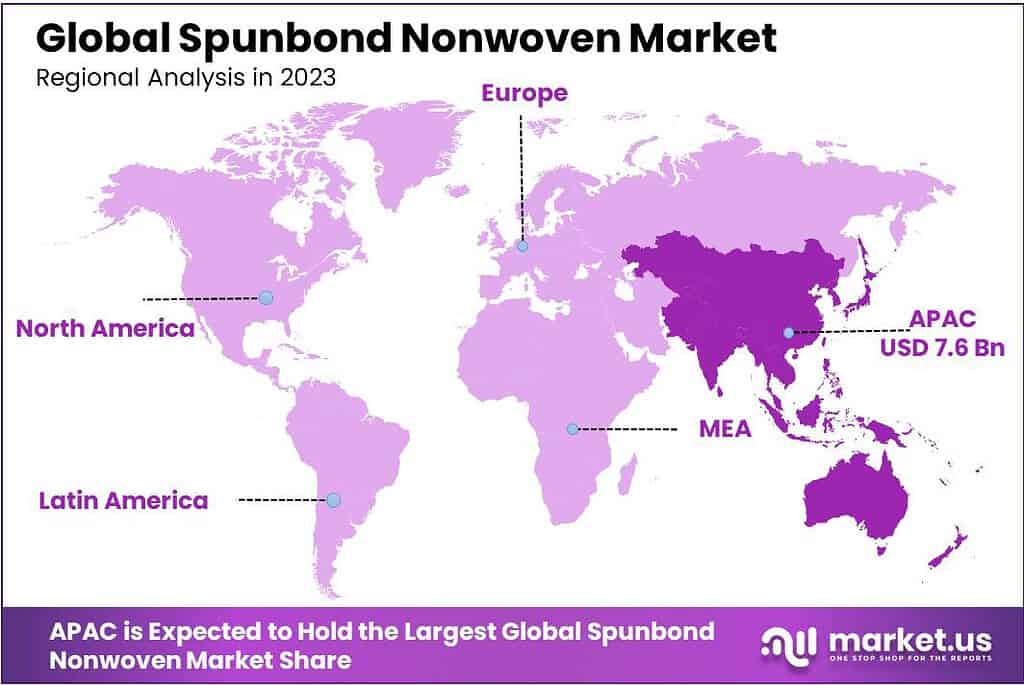

- Regional Analysis: Asia-Pacific dominates with 48.6% market share in 2023, expected to grow due to increased demand for feminine and diaper care products. Europe’s demand is driven by hygiene applications, and Central America sees growth in safety, hygiene, and health awareness.

- Challenges Faced: Volatile raw material prices, particularly polypropylene, polyester, and polyethylene, impact production costs, affecting profit margins for manufacturers.

- Opportunities: Emerging economies in Asia-Pacific offer promising opportunities due to increased demand for advanced technologies and quality products.

- Key Players: Leading companies include DuPont, PFNonwovens Holding, RadiciGroup, MITSUI CHEMICALS AMERICA, and Berry Global Inc., showcasing a competitive landscape with organic growth and mergers.

By Function

In 2023, the dominance of the Disposable function in the Spunbond Nonwoven market signifies a prevailing trend towards single-use applications over more durable functions. This market segment, capturing a significant 78.7% share, indicates a strong preference for disposable nonwoven materials.

Such materials are commonly utilized in various industries and applications, including medical and hygiene products like surgical drapes, face masks, and disposable gowns. Additionally, the disposable function extends to the packaging industry, contributing to the production of single-use packaging materials for food, pharmaceuticals, and other consumer goods.

The substantial market hold of the Disposable function suggests an increasing demand for single-use products, possibly driven by factors such as hygiene concerns, convenience, and the need for easily disposable items.

The surge in demand for disposable applications may also be attributed to the ongoing need for pandemic-related supplies, where single-use items have seen elevated usage to maintain cleanliness and prevent the spread of infections.

Disposable nonwovens continue to dominate the Spunbond Nonwoven market in 2023 due to their lower production costs and easy disposal following one use, leading to lower-cost production processes and disposal after only one application.

Although disposable applications hold a substantial market share, durable nonwovens remain increasingly sought-after applications that offer longer-term or reusable properties; examples of such use cases could include protective apparel, filtration systems, or construction materials.

Regardless of its prevalence within the Spunbond Nonwoven market in 2023, durable applications remain an integral component due to both consumer needs as well as industrial requirements.

By Material Type

In 2023, the Spunbond Nonwoven market witnessed Polypropylene as the dominant material type, commanding a substantial share of more than 52.3%. This prominence signifies Polypropylene’s pivotal role within the market landscape, indicating its widespread usage and preference over other materials. Polypropylene, known for its various properties including strength, durability and cost-efficiency has long been a go-to material in nonwoven fabric production.

Polypropylene’s popularity can be attributed to its diversity across industries and applications. Its use spans a wide spectrum, ranging from medical and hygiene products like surgical gowns, masks, and disposable medical fabrics due to its excellent barrier properties, to industrial applications such as filtration, packaging, and agriculture. The material’s favorable characteristics, including resistance to moisture, chemicals, and abrasion, make it a versatile choice for numerous applications where nonwoven fabrics are required.

Polypropylene’s popularity may also stem from its easy availability and relatively lower production cost compared to alternative materials like Polyethylene or Polyester that are less commonly utilized within the Spunbond Nonwoven market. Polypropylene’s cost-efficiency makes it an attractive option for manufacturers and industries that require cost-efficient yet reliable materials in large-volume applications.

Despite Polypropylene’s significant market hold, other materials like Polyethylene, Polyester, and others maintain their relevance in specific niche applications or for specialized functionalities. However, Polypropylene’s widespread use and multifaceted applicability have ensured its prominence and dominance within the Spunbond Nonwoven market in 2023.

Application analysis

In 2023, the Spunbond Nonwoven market witnessed a significant dominance of Personal Care and hygiene applications, capturing a robust share of over 51.6%. This commanding position reflects the pivotal role of Spunbond Nonwoven fabrics in catering to the vast array of personal care and hygiene products. The substantial market share in this segment underscores the fundamental role these nonwoven fabrics play in addressing essential needs related to personal hygiene and care.

Spunbond Nonwoven materials have become an indispensable component of Personal Care and hygiene applications, used across a range of daily products such as diapers, feminine hygiene products such as sanitary pads and wipes for personal hygiene as well as various personal care items like facial masks and wipes. Their softness, breathability, absorbency, and overall comfort make Spunbond Nonwoven fabrics an ideal material choice to meet these requirements.

The dominance of Personal Care and hygiene within the Spunbond Nonwoven market is indicative of the indispensable nature of these fabrics in fulfilling basic hygiene and personal care needs. The reliability and effectiveness of Spunbond Nonwovens in maintaining hygiene standards and providing comfort in personal care products have led to their widespread use and substantial market capture in this segment.

Spunbond nonwoven materials play a pivotal role in providing products designed to promote personal hygiene and well-being. Their dominance of 51.6% market shares illustrates this trust among users that Spunbond nonwoven fabrics meet essential personal care and hygiene requirements.

Note: Actual Numbers Might Vary In The Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Material

- Polypropylene

- Polyester

- Polyethylene

- Other Materials

By Product

- Disposable

- Durable

By Application

- Personal Care & Hygiene

- Medical & Healthcare

- Geotextiles

- Other Applications

Drivers

The drivers behind the growth of the spunbond nonwoven market are deeply rooted in its manufacturing advantages and the shifting consumer preferences towards disposable products. Spunbond nonwovens stand out due to their ease of production, rapid processing capabilities, and cost-effectiveness. Their versatility allows for the creation of fabrics with varying weights and functionalities, making them highly adaptable to diverse applications.

This adaptability has sparked a surge in consumer acceptance, prompting traditional fabric manufacturers to innovate and modernize their fiber offerings. The increasing adoption of spunbond nonwovens is fueled by the escalating demand for products that offer exceptional flexibility, durability, and superior features like safety, robustness, and lightness.

Among the various types, disposable spunbond nonwovens hold a prominent position, particularly in segments like personal care & hygiene and medical applications. These disposable nonwovens are designed for single-use purposes and feature a limited shelf life. They serve as vital components in various products, including baby care items, adult incontinence products, feminine hygiene essentials, and wipes. Their disposability addresses the growing demand for convenient, hygienic, and single-use products, aligning well with changing consumer preferences for hassle-free and practical solutions.

Restraints

The spunbond nonwoven market faces a significant challenge linked to the volatile nature of raw material prices, particularly polypropylene, polyester, and polyethylene. These materials form the backbone of spunbond nonwoven production. Any disruptions or imbalances in their supply or demand can profoundly impact the industry.

Given that these key raw materials are derived from crude oil, any shifts in crude oil prices directly influence the costs of these materials. As crude oil prices surge, the costs of polypropylene, polyester, and polyethylene tend to follow suit, leading to an increase in raw material expenses for spunbond nonwoven manufacturers. Such fluctuations not only affect production costs but also put pressure on the profit margins of these manufacturers.

The instability in raw material prices poses operational challenges for industry players, making it challenging for them to maintain stability and sustainability in the market. The dependency on these raw materials and their price volatility calls for strategic measures to mitigate the impact of these fluctuations and ensure resilience within the spunbond nonwoven sector.

Opportunities

The emerging economies of Asia Pacific, particularly China, India, and several Southeast Asian nations, present promising opportunities for the spunbond nonwoven market. These regions have attracted substantial attention from global industry players, prompting them to establish manufacturing bases there.

Countries like China and India boast a growing customer base that demands advanced technologies and superior-quality products. This surge in demand has pushed manufacturers to invest significantly in these regions, focusing on technological advancements, infrastructure development, and robust research and development initiatives.

This strategic investment approach has empowered spunbond nonwoven manufacturers to cater to these markets with high-quality products, aligning with the escalating demands. The economic growth in these areas has further intensified the demand across various end-use industries, creating a favorable environment for the expansion and market penetration of spunbond nonwoven products. The opportunities presented by these developing economies underscore their potential to drive substantial growth and market expansion in the industry.

Challenges

The spunbond nonwoven industry poses significant challenges for small and medium-sized enterprises (SMEs), especially in developing countries. Establishing a manufacturing plant in this sector demands substantial capital investment, which can be a considerable hurdle. The technology involved in this industry continually advances, leading to the development of sophisticated and expensive equipment.

Given these high capital requirements and the need for advanced machinery, larger players with substantial financial capabilities have a more accessible entry into the market. They can afford the initial investments and operational costs, foreseeing substantial returns in the long run. Conversely, SMEs face formidable barriers due to their limited financial capacities. This limitation prevents them from reaping the cost-benefit advantages in the long term, making it challenging for them to enter and compete effectively in the spunbond nonwoven market.

Regional Analysis

Asia-Pacific had a market share of 48.6% in 2023, and it is expected that this market will grow at an impressive CAGR over time. This growth can be attributed largely to an increase in the demand for feminine and diaper care products. This positive impact on the industry’s growth can be attributed to an increase in adult continence products used due to an aging population.

Europe’s product demand is dominated by hygiene applications, and this trend will likely continue throughout the forecast period. A growing population, as well as the rising incidence of chronic diseases, has led to a rise in demand for adult and medical incontinence products. This is expected to have a positive effect on market growth.

Due to rising demand from the medical, automotive, and hygiene industries, the demand for spunbond nylon nonwovens in Central America will experience significant growth. The forecast period will see a rise in consumer awareness regarding safety, hygiene, and health.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The market has seen an increase in organic growth and inorganic through mergers and acquisitions. Companies are trying to increase sales through investment, acquisition, and innovation. The companies are increasing their ability to reach their respective markets.

Because of the large number of companies involved in product manufacturing, this market is very competitive. The market is characterized by a large consumer base and companies that operate through dedicated distribution networks. The market leaders in spunbond nonwovens include:

Маrkеt Кеу Рlауеrѕ

- DuPont

- PFNonwovens Holding s.r.o.

- RadiciGroup

- MITSUI CHEMICALS AMERICA, INC.

- DuPont

- Berry Global Inc.

- Asahi Kasei Corporation

- KOLON Industries, Inc.

- Toray Industries, Inc.

- Aktieselskabet Schouw & Co.

- Avgol Industries

Recent Developments

In October 2022, Fitesa, a leading nonwoven producer, recently announced its increased spunbond nonwoven production capacity in Europe to meet growing demands for hygiene and medical applications in this region.

In August 2022, Ahlstrom-Munksjo, another major nonwoven producer, announced the introduction of spunbond nonwovens made entirely out of 100% recycled PET bottles as part of its push towards more eco-friendly solutions for nonwovens. This event showcased an increasing trend towards creating sustainable nonwoven solutions.

In June 2022, INDA recently issued a report projecting that the global spunbond nonwoven market will reach USD 48.7 billion by 2027 – representing an impressive increase from its estimated value of USD 35.7 billion in 2022.

In 29 September 2022, Toray Industries, Inc. recently unveiled their spunbond nonwoven fabric that boasts consistent hydrophilicity and provides a soft touch against skin. This material can be found in applications like disposable diapers, masks, feminine hygiene products and other sanitary uses.

Report Scope

Report Features Description Market Value (2023) USD 15.6 Bn Forecast Revenue (2032) USD 28.2 Bn CAGR (2023-2032) 6.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Function(Disposable, Durable), By Material Type(Polypropylene, Polyethylene, Polyester, Others), By Application(Personal Care & Hygiene, Geotextiles, Medical, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape DuPont, PFNonwovens Holding s.r.o., RadiciGroup, MITSUI CHEMICALS AMERICA, INC., DuPont, Berry Global Inc., Asahi Kasei Corporation, KOLON Industries, Inc., Toray Industries, Inc., Aktieselskabet Schouw & Co., Avgol Industries Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Freudenberg Group

- DuPont

- Ahlstrom-Munksjo Oyj

- Kimberly-Clark Corporation

- Berry Global Group, Inc.

- FITESA

- Johns Manville Corporation

- Other Key Players