Global Sports Technology Market By Technology (Devices, Smart Stadiums, Esports, Sports Analytics), By Sports (American Football and Rugby, Baseball, Basketball, Cricket, Golf, Ice Hockey, Tennis, Soccer, Others), By End-user (Sports Clubs, Sports Associations, Sports Leagues, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 45478

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Sports Technology Market size is expected to be worth around USD 105.6 Billion by 2033, from USD 18.7 Billion in 2023, growing at a CAGR of 18.9% during the forecast period from 2024 to 2033.

Sports technology encompasses the integration of advanced technological solutions within sports to enhance player performance, improve safety, facilitate accurate officiating, and enrich the fan experience. This includes wearables, video analytics, smart stadiums, and virtual reality training.

The sports technology market refers to the economic sector that combines sports and technology, focusing on the development, production, and implementation of technological tools and platforms that contribute to the sports industry’s advancement. This market is driven by the growing demand for data-driven sports strategies, enhanced viewer engagement, and innovative health and fitness solutions.

The expansion of the sports technology market is propelled by increasing investments in sports analytics and the integration of IoT devices for real-time data tracking, which optimizes team performance and coaching strategies.

Rising demand stems from the sports industry’s need for injury prevention solutions and fan engagement platforms that utilize AR and VR technologies to provide immersive viewing experiences.

Significant opportunities lie in developing AI and machine learning models to predict player injuries and outcomes, enhancing both player performance and audience engagement, while opening avenues for personalized fan experiences and e-sports integrations.

The Sports Technology Market is poised for substantial growth, driven by a confluence of increased governmental funding and technological advancements in sports analytics and performance monitoring. A pivotal example is the Indian government’s recent allocation of ₹470 crore towards athlete preparation for the Paris Olympics 2024, spanning 16 sports disciplines.

This strategic investment is designed to enhance training facilities and augment support systems, underscoring the growing integration of technology in sports development. Notably, athletics received the lion’s share of the budget with ₹96.08 crore, reflecting the prioritization of foundational sports disciplines that show high potential for technological infusion.

Further financial commitments include a rise in the budget for National Sports Federations (NSFs) from ₹325 crore to ₹340 crore, alongside an increase in the Sports Authority of India’s (SAI) budget from ₹795.77 crore to ₹822.60 crore. These increments facilitate improved sports infrastructure and athlete training programs, integral to leveraging sports technology solutions such as data analytics and biomechanical analysis.

Additionally, funding for the National Anti-Doping Agency (NADA) and the National Dope Testing Laboratory (NDTL) saw modest increases to ₹22.30 crore and ₹22 crore, respectively, enhancing the integrity and fairness of sports through advanced testing technologies.

This influx of financial resources, paired with a heightened focus on technology, presents lucrative opportunities for the sports technology sector, suggesting a robust trajectory for market expansion and innovation.

Companies in this space are well-positioned to capitalize on these developments, offering solutions that enhance athlete performance and optimize training outcomes, all while ensuring compliance and ethical standards in sports practices.

Key Takeaways

- The Global Sports Technology Market size is expected to be worth around USD 105.6 Billion by 2033, from USD 18.7 Billion in 2023, growing at a CAGR of 18.9% during the forecast period from 2024 to 2033.

- In 2023, Smart Stadiums held a dominant market position in the By Technology segment of the Sports Technology Market, with a 55.3% share.

- In 2023, Soccer held a dominant market position in the By Sports segment of the Sports Technology Market, with a 16.2% share.

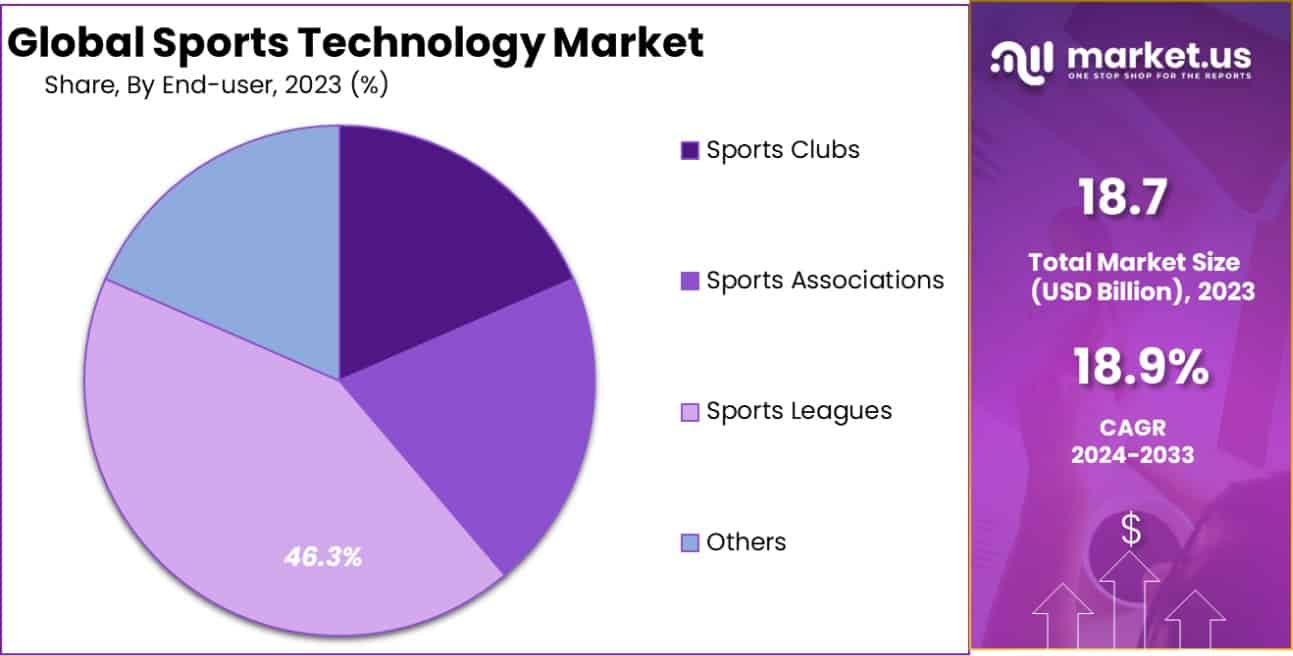

- In 2023, Sports Leagues held a dominant market position in the end-user segment of the Sports Technology Market, with a 46.3% share.

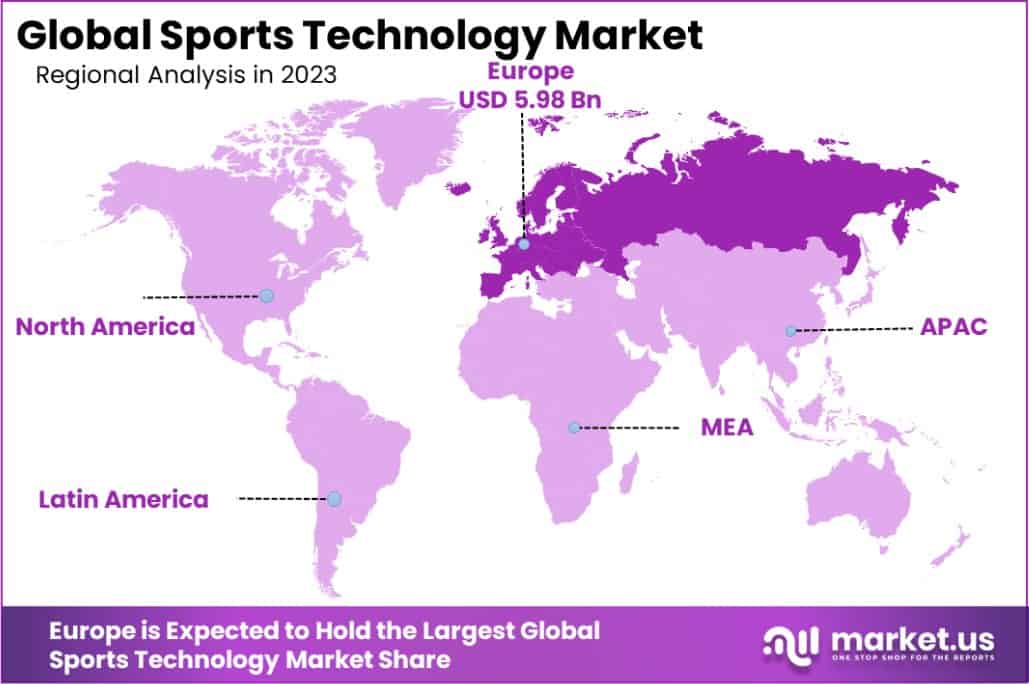

- Europe dominated a 32% market share in 2023 and held USD 5.98 Billion revenue of the Sports Technology Market.

By Technology Analysis

In 2023, Smart Stadiums held a dominant market position in the “By Technology” segment of the Sports Technology Market, with a 55.3% share. This segment encompasses a variety of subcategories including devices, wearables, digital signage, sports cameras, digital content management, stadium and public security, building automation, and others.

Within this broad technology spectrum, smart stadiums have emerged as central hubs for integrating these technologies to enhance the fan experience and operational efficiencies.

Smart stadiums leverage digital content management systems to deliver personalized content and advertisements, supported by robust Wi-Fi networks and digital signage. Security technologies, both in terms of physical and cyber measures, ensure safe and seamless experiences for attendees. The integration of building automation systems further underscores a commitment to sustainability and operational efficiency, reducing energy usage and costs.

Additionally, the smart stadium experience is enriched through advanced wearables and sports cameras that provide real-time data and analytics, enhancing both player performance and audience engagement.

These technological advancements not only elevate the spectator experience but also open new revenue streams through sponsorships and targeted advertisements, thereby solidifying the economic viability of sports technology investments.

By Sports Analysis

In 2023, Soccer held a dominant market position in the “By Sports” segment of the Sports Technology Market, with a 16.2% share. This segment includes various sports such as American Football/Rugby, Baseball, Basketball, Cricket, Golf, Ice Hockey, Tennis, and others.

Soccer’s leading position is largely due to its global popularity and the significant investments in technology that enhance both player performance and fan engagement.

The application of sports technology in soccer spans from advanced wearable devices that monitor athletes’ physical and health metrics to video analysis systems that refine game strategies and player positioning.

Innovations like goal-line technology and VAR (Video Assistant Referee) have not only improved the accuracy of officiating but also the integrity of the game. These technologies are complemented by digital platforms that offer real-time data analytics, enhancing coaching decisions and tactical adjustments during matches.

Moreover, soccer’s vast fan base has driven demand for engaging fan experiences, such as interactive apps and virtual reality platforms, which allow fans to experience games in immersive new ways.

The integration of these technologies into soccer stadiums and broadcasts helps maintain and grow global viewership, providing ample opportunities for revenue through sponsorships, advertisements, and merchandise sales. This underscores soccer’s pivotal role in propelling the sports technology market forward.

By End-user Analysis

In 2023, Sports Leagues held a dominant market position in the “By End-user” segment of the Sports Technology Market, with a 46.3% share. This segment also includes sports clubs, sports associations, and other entities involved in organizing and managing sports events.

The preeminence of sports leagues is attributed to their expansive infrastructure and substantial financial resources, which enable widespread adoption of advanced technologies to enhance competitive play, operational efficiency, and fan engagement.

Sports leagues have increasingly embraced technologies such as player tracking systems, AI-enhanced analytics, and digital fan engagement platforms. These tools not only improve the spectator experience through personalized content and interactive applications but also optimize team performance with real-time data.

The extensive use of video replay and analytics technology in leagues enhances game integrity and coaching strategies, offering a deeper analytical perspective on player performance and game dynamics.

Moreover, sports leagues are pivotal in driving technological adoption across the broader ecosystem, influencing trends in sports clubs and associations. Their significant investment in technology paves the way for innovations that trickle down to lower levels of play, expanding the overall market for sports technology.

This strategic focus on technology integration highlights the role of sports leagues as key drivers in the growth and evolution of the sports technology landscape.

Key Market Segments

By Technology

- Devices

- Wearables

- Digital Signage

- Sports Cameras

- Smart Stadiums

- Digital Content Management

- Stadium and Public Security

- Building Automation

- Others

- Esports

- Media Rights

- Ticket Sales and Merchandise

- Sponsorships and Advertisements

- Publisher Fees (Downloadable Content, In-game Purchases)

- Sports Analytics

- Player Analysis

- Team Performance Analysis

- Video Analysis

- Others

By Sports

- American Football/Rugby

- Baseball

- Basketball

- Cricket

- Golf

- Ice Hockey

- Tennis

- Soccer

- Others

By End-User

- Sports Clubs

- Sports Associations

- Sports Leagues

- Others

Drivers

Key Drivers of Sports Tech Growth

The Sports Technology Market is experiencing rapid expansion driven by several key factors. Firstly, the increasing demand for enhanced athletic performance and fan engagement is pushing teams and leagues to adopt advanced technologies. Wearables that monitor athlete health in real-time, analytics platforms that provide deeper insights into game strategies, and interactive fan apps are becoming standard.

Secondly, the growth of online streaming and digital media offers new avenues for fan interaction and revenue through targeted advertising and enhanced viewer experiences. The proliferation of eSports and virtual sports also contributes to the market’s growth, appealing to a tech-savvy, younger audience.

Additionally, sports organizations are investing heavily in technologies to ensure fairness and integrity in competitions, including video refereeing and sensor technologies. These drivers underscore a vibrant sector poised for continued innovation and growth.

Restraint

Barriers to Sports Tech Adoption

Despite the rapid growth of the sports technology market, several restraints hinder its broader adoption. High costs associated with implementing and maintaining cutting-edge technologies pose a significant barrier, especially for smaller sports organizations and clubs with limited budgets.

Additionally, the complexity of some technologies can deter adoption, as they require specialized training and significant time investment to be effectively integrated into existing systems. Privacy concerns also play a crucial role, as the extensive collection of personal data through wearables and tracking devices raises issues around data security and athlete privacy.

Moreover, the varying regulations and standards across different regions and sports disciplines can complicate the deployment and acceptance of new technologies. These challenges must be addressed to enable more widespread use and maximize the benefits of sports technology across the industry.

Opportunities

Expanding Horizons in Sports Tech

The sports technology market presents numerous opportunities for growth and innovation, driven by the evolving demands of both athletes and fans. As global interest in health and fitness continues to surge, there is a growing market for sports technologies that enhance training, performance, and health monitoring.

The integration of AI and machine learning offers unprecedented insights into player performance and health, enabling personalized training programs and injury prevention strategies. The rise of fan-centric innovations, such as AR and VR experiences, opens up new avenues for engaging audiences, particularly among younger demographics.

Furthermore, the expansion of eSports provides fertile ground for technological integration, from live streaming to interactive viewer platforms. These opportunities not only propel the sports technology sector forward but also foster cross-industry collaborations, paving the way for a more interconnected and technologically advanced sports ecosystem.

Challenges

Navigating Challenges in Sports Tech

The sports technology market faces several challenges that could impede its growth. A primary concern is the resistance to change among traditional sports institutions, where cultural and organizational inertia can slow the adoption of new technologies.

Privacy and data security issues also present significant hurdles, as increasing use of tracking and performance monitoring raises concerns about the handling and protection of sensitive athlete information. Technological disparities between developed and developing regions create uneven market penetration, limiting the global reach and benefits of sports technologies.

Additionally, the rapid pace of technological change requires constant updates and investments, posing a challenge for organizations to keep up without substantial financial resources. Addressing these challenges requires strategic planning, education, and policies that promote safe, equitable, and effective use of technology in sports.

Growth Factors

Driving Forces in Sports Tech

The Sports Technology Market is propelled by several compelling growth factors. Enhanced fan engagement through immersive experiences like virtual reality and augmented reality is significantly boosting demand, as fans seek more interactive and personalized ways to enjoy sports.

The emphasis on athlete performance and safety is driving the adoption of wearables and analytics that provide real-time feedback and predictive insights, aiding in injury prevention and training optimization. The globalization of sports events also fuels the need for technologies that can scale across diverse markets and manage large volumes of data efficiently.

Moreover, the integration of AI and machine learning is revolutionizing game strategies and broadcasting, creating new growth opportunities. These factors collectively drive the continued expansion of the sports technology sector, ensuring its relevance and vibrancy in the evolving sports landscape.

Emerging Trends

Emerging Trends in Sports Tech

Emerging trends in the sports technology market are shaping the future of sports and enhancing the experience for all stakeholders involved. One significant trend is the growing use of artificial intelligence (AI) and machine learning for real-time decision-making and performance analytics, providing coaches and athletes with detailed insights for improved strategies and outcomes.

Another trend is the increased adoption of wearable technology, which tracks health metrics and biomechanics to optimize athlete training and prevent injuries. Additionally, there’s a rising focus on fan engagement through digital platforms that offer virtual reality (VR) experiences, allowing fans to experience games from new perspectives.

Blockchain technology is also becoming prominent, offering secure, transparent ticketing and merchandise transactions. These trends not only cater to current market demands but are also setting the stage for a technologically advanced sports industry.

Regional Analysis

The Sports Technology Market exhibits robust growth across various global regions, with Europe emerging as the dominant region, commanding a 32% market share and valued at USD 5.98 billion. This prominence is fueled by significant investments in sports infrastructure and the adoption of digital innovations by major football and basketball leagues.

North America closely follows, leveraging advanced technologies in major sports leagues such as the NFL and NBA, which are pioneers in incorporating analytics and fan engagement technologies.

The Asia Pacific region is witnessing rapid growth, driven by increasing investments in sports technologies in countries like China, Japan, and Australia, particularly in areas of e-sports and mobile sports applications.

Meanwhile, the Middle East & Africa, and Latin America are experiencing steady growth. The Middle East, with events like the FIFA World Cup in Qatar, is focusing on smart stadium technologies, whereas Latin America is gradually adopting sports analytics to enhance football performance.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Sports Technology Market for 2023, three key players—Apple Inc., ChyronHego Corporation, and Cisco Systems, Inc.—stand out for their innovative contributions and strategic market positioning.

Apple Inc. has significantly influenced the sports technology landscape through its advanced wearable technologies and health monitoring applications. The Apple Watch, with its sophisticated fitness tracking features, caters to both casual fitness enthusiasts and professional athletes.

This integration of health metrics into everyday wearables not only promotes a healthier lifestyle but also feeds valuable data back to users to enhance their performance and well-being. Apple’s continual software updates and incorporation of augmented reality (AR) capabilities further cement its role as a leader in consumer-focused sports technology.

ChyronHego Corporation, a specialist in digital broadcasting technology, has made substantial strides in enhancing live sports broadcasts with its graphics and data visualization tools. Their technology allows for real-time display of complex sports analytics and data, enriching the viewer experience during live events.

This capability is crucial as audiences increasingly demand more immersive and informative content. ChyronHego’s solutions are pivotal in transforming how sports events are produced and consumed, especially in an era where virtual advertising and player tracking become more sophisticated.

Cisco Systems, Inc. plays a crucial role in the infrastructure that supports sports technology. Their networking solutions are integral to the operation of smart stadiums and arenas, ensuring seamless connectivity and security.

Cisco’s efforts in providing robust wireless solutions and secure data handling are essential for the proliferation of IoT devices in sports, ranging from ticketing systems to athlete performance tracking sensors.

Together, these companies not only shape the current sports technology market but also define future trends through their continued innovation and strategic market engagements. Each brings a unique element to the table, from consumer wearables and broadcast enhancements to foundational tech infrastructure, driving forward the integration of technology in sports globally.

Top Key Players in the Market

- Apple Inc.

- ChyronHego Corporation

- Cisco Systems, Inc.

- HCL Technologies Limited

- IBM Corporation

- Infosys Limited

- Modern Times Group MTG

- Oracle Corporation

- Panasonic Corporation

- SAP SE

- Sony Corporation

- Stats LLC

- Telefonaktiebolaget LM Ericsson

- Other Key Players

Recent Developments

- In June 2023, Infosys Limited introduced a mobile app designed to provide enhanced fan experiences through AR during live sports events, boosting interaction and viewer satisfaction.

- In May 2023, IBM Corporation secured a partnership with a major sports league to implement its cloud solutions for better game data analysis, aiming to improve team strategies and fan engagement.

- In April 2023, HCL announced the launch of a new AI-driven platform aimed at enhancing athlete performance analytics. The tool uses real-time data to optimize training.

Report Scope

Report Features Description Market Value (2023) USD 18.7 Billion Forecast Revenue (2033) USD 105.6 Billion CAGR (2024-2033) 18.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology(Devices(Wearables, Digital Signage, Sports Cameras), Smart Stadiums(Digital Content Management, Stadium and Public Security, Building Automation, Others), Esports(Media Rights, Ticket Sales and Merchandise, Sponsorships and Advertisements, Publisher Fees (Downloadable Content, In-game Purchases)), Sports Analytics(Player Analysis, Team Performance Analysis, Video Analysis, Others)), By Sports(American Football/Rugby, Baseball, Basketball, Cricket, Golf, Ice Hockey, Tennis, Soccer, Others), By End-user(Sports Clubs, Sports Associations, Sports Leagues, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., ChyronHego Corporation, Cisco Systems, Inc., HCL Technologies Limited, IBM Corporation, Infosys Limited, Modern Times Group MTG, Oracle Corporation, Panasonic Corporation, SAP SE, Sony Corporation, Stats LLC, Telefonaktiebolaget LM Ericsson, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Apple Inc.

- ChyronHego Corporation

- Cisco Systems, Inc.

- HCL Technologies Limited

- IBM Corporation

- Infosys Limited

- Modern Times Group MTG

- Oracle Corporation

- Panasonic Corporation

- SAP SE

- Sony Corporation

- Stats LLC

- Telefonaktiebolaget LM Ericsson

- Other Key Players