Global Spintronics Market By Technology (Giant Magnetoresistance (GMR), Tunnel Magnetoresistance (TMR), Spin-Transfer Torque (STT), Spin Hall Effect, Other Technologies), By Application (Data Storage, Magnetic Random Access Memory (MRAM), Sensors, Semiconductor Devices, Spintronic Logic and Quantum Computing, Other Applications), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 115338

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

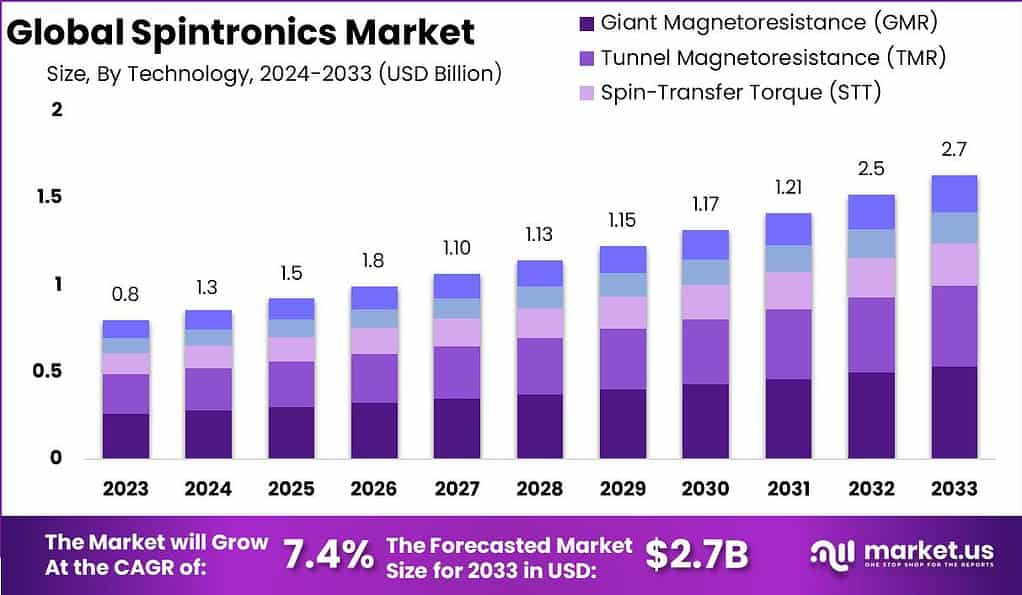

The Global Spintronics Market size is expected to be worth around USD 2.7 Billion by 2033, from USD 0.8 Billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

Spintronics, or spin electronics, represents a branch of technology that exploits the intrinsic spin of the electron, along with its fundamental electronic charge, in solid-state devices. This field of research and application bridges the gap between magnetic and electronic properties of materials, aiming to develop electronic devices that achieve greater efficiency, higher data processing speeds, and reduced energy consumption compared to traditional semiconductor devices.

The spintronics market is driven by the increasing demand for advanced computing technologies, the growth in data storage requirements, and the continuous push for smaller, faster, and more energy-efficient electronic components. Innovations in spintronics have significant implications for a wide range of applications, including non-volatile magnetic memory, quantum computing, and spin-based transistors.

The market’s expansion is facilitated by substantial investments in research and development by both public and private sectors, aiming to unlock new functionalities and commercial opportunities in the electronics industry. The growth of the spintronics market can be attributed to its potential to revolutionize the field of electronics by offering a new paradigm for information processing and storage.

According to the Semiconductor Industry Association (SIA), the global semiconductor industry sales reached $526.8 billion in 2023, marking an 8.2% decrease compared to the previous year’s record-high of $574.1 billion. However, there was a notable recovery in sales during the second half of 2023. The fourth-quarter sales of $146.0 billion showed an 11.6% increase compared to the same period in 2022 and an 8.4% increase compared to the third quarter of 2023.

Moreover, December 2023 sales amounted to $48.6 billion, representing a 1.5% increase compared to November 2023. These figures, compiled by the World Semiconductor Trade Statistics (WSTS) organization, are based on a three-month moving average.

According to the GSM Association, China is projected to have 1.6 billion 5G connections by 2030, representing almost a third of the global total. This surge in 5G connections will create a massive demand for advanced semiconductor components, including processors, memory chips, and communication modules.

In the context of regional market dynamics for 2023, Japan experienced a decrease in annual sales by 3.1%, while the Americas saw a more pronounced contraction of 5.2%. The decline was even more significant in the Asia-Pacific/All Other region and China, with sales dropping by 10.1% and 14.0%, respectively.

The deployment of 5G networks will enable faster data speeds, lower latency, and support emerging technologies such as Internet of Things (IoT), autonomous vehicles, and smart cities. This increased connectivity and digital transformation across various industries will drive the demand for semiconductors in the coming years.

Key Takeaways

- The global Spintronics Market is anticipated to reach a value of USD 2.7 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.4% from 2024 to 2033.

- Giant Magnetoresistance (GMR) emerged as the dominant technology in 2023, capturing over 32.6% market share, driven by its exceptional performance in data storage applications such as MRAM and HDDs.

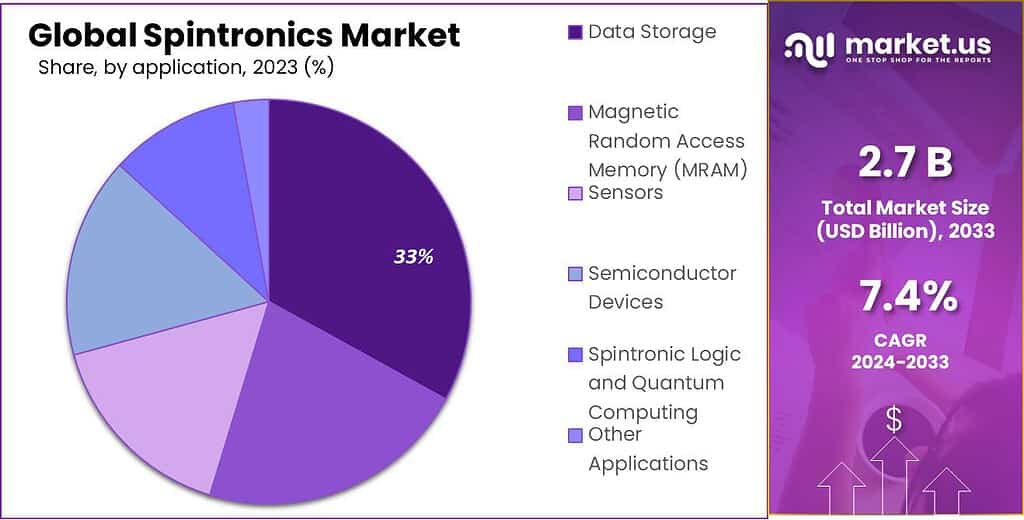

- Data Storage segment holds a significant market share, exceeding 35% in 2023, driven by increasing demand for higher storage capacities and faster access speeds across various sectors like consumer electronics, enterprise storage, and cloud computing services.

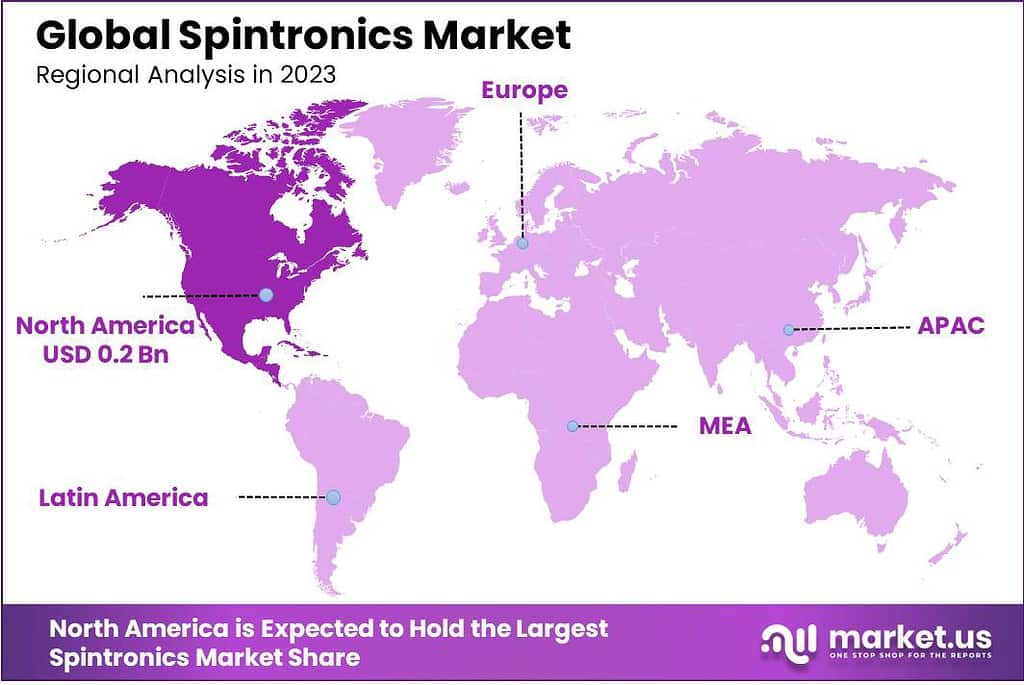

- In 2023, North America held a dominant market position in the spintronics market, capturing more than a 35.4% share.

Technology Analysis

In 2023, the Giant Magnetoresistance (GMR) segment emerged as the dominant technology in the spintronics market, capturing a significant market share of more than 32.6%. The strong foothold of GMR can be attributed to several key factors driving its adoption and success.

GMR technology utilizes the phenomenon of electron spin-dependent scattering to achieve high sensitivity and precision in magnetoresistive devices. This technology has gained prominence in various applications, including magnetic sensors, magnetic random-access memory (MRAM), and hard disk drives (HDD).

One of the primary reasons behind GMR’s leading position is its exceptional performance in data storage applications. GMR-based MRAM offers non-volatile memory capabilities, fast read and write speeds, and high endurance, making it an attractive alternative to traditional memory technologies such as Flash and DRAM. The increasing demand for high-speed, low-power, and reliable memory solutions in sectors such as automotive, aerospace, and consumer electronics has propelled the adoption of GMR technology.

Additionally, GMR technology has found widespread use in the HDD market. The ability of GMR sensors to accurately detect and read magnetic fields has revolutionized the storage capacity and performance of hard disk drives. With the growing demand for data storage in cloud computing, big data analytics, and data centers, the reliance on GMR-based HDDs has increased significantly.

Application Insights

In 2023, the Data Storage segment held a dominant market position in the spintronics market, capturing more than a 35% share. This significant market share is primarily due to the ever-increasing demand for higher data storage capacities and faster data access speeds across various sectors, including consumer electronics, enterprise storage, and cloud computing services.

Spintronics technology, particularly through advancements in Giant Magnetoresistance (GMR) and Tunnel Magnetoresistance (TMR), has been pivotal in developing hard disk drives (HDDs) and solid-state drives (SSDs) that offer substantial improvements in storage density and efficiency. The leadership of the Data Storage segment is further reinforced by the ongoing digital transformation in businesses and the exponential growth of data generated by digital activities.

As organizations and individuals continue to generate vast amounts of data, the need for reliable, high-capacity storage solutions becomes critical. Spintronics-based storage devices meet these demands by providing faster read-write speeds, enhanced durability, and reduced power consumption compared to traditional storage technologies. These benefits are essential for supporting the infrastructure of data-centric applications, such as big data analytics, artificial intelligence (AI), and the Internet of Things (IoT).

Moreover, the Data Storage segment’s dominance is expected to continue as the technology evolves to meet the requirements of emerging applications. Innovations in spintronics are paving the way for next-generation data storage solutions, like Magnetic Random Access Memory (MRAM), which offers non-volatility, high-speed operation, and infinite endurance.

Key Market Segments

By Technology

- Giant Magnetoresistance (GMR)

- Tunnel Magnetoresistance (TMR)

- Spin-Transfer Torque (STT)

- Spin Hall Effect

- Other Technologies

By Application

- Data Storage

- Magnetic Random Access Memory (MRAM)

- Sensors

- Semiconductor Devices

- Spintronic Logic and Quantum Computing

- Other Applications

Driver

Increasing Demand for High-Density Data Storage

The exponential growth in data generation, driven by advancements in digital technologies, social media, IoT devices, and cloud computing, has significantly increased the demand for high-density data storage solutions. Spintronics technology, with its superior data storage capabilities, offers a promising solution to meet this demand. Unlike traditional electronic devices that rely on the charge of electrons, spintronic devices utilize the spin of electrons, enabling higher data storage density and faster data processing speeds.

This characteristic is particularly beneficial for the development of advanced storage devices like Magnetic Random Access Memory (MRAM), which offers non-volatility, durability, and high-speed operation. As the digital economy continues to expand, the need for efficient and high-capacity data storage systems becomes more critical, positioning spintronics as a key driver of the next generation of data storage solutions.

Restraint

High Cost of Spintronic Devices Production

The production of spintronic devices involves sophisticated materials and complex manufacturing processes, leading to higher costs compared to traditional semiconductor devices. The integration of spin-based materials and the requirement for precision in layering and patterning at the nanoscale level necessitate advanced fabrication techniques and specialized equipment.

This complexity not only increases the initial investment in research and development but also affects the overall production costs, making spintronic devices more expensive for consumers and businesses. Such cost considerations can restrain the adoption of spintronics technology, particularly in cost-sensitive markets and applications where the price plays a critical role in the decision-making process. Overcoming this restraint requires ongoing efforts in cost reduction through innovation in manufacturing processes and materials science to make spintronic devices more economically viable.

Opportunity

Expansion in Quantum Computing

Spintronics presents a significant opportunity in the realm of quantum computing, a field that promises to revolutionize computing by performing operations at speeds unfathomable with today’s technology. Spintronic devices, with their ability to manipulate electron spins, are ideally suited for quantum bits (qubits), the basic units of quantum information. This compatibility opens up new avenues for developing more stable and scalable quantum computers.

As the demand for quantum computing grows across industries such as pharmaceuticals, aerospace, and finance for applications ranging from drug discovery to cryptography, the role of spintronics in enabling these advanced computational capabilities becomes increasingly important. The integration of spintronics in quantum computing not only expands its market potential but also positions it at the forefront of the next technological revolution, offering vast opportunities for innovation and growth.

Challenge

Technological Complexity and Integration Issues

The integration of spintronic devices into existing electronic systems poses a significant challenge due to their technological complexity. Spintronic devices require precise control over electron spin, necessitating new materials, device architectures, and fabrication techniques that are compatible with spin properties. This complexity introduces difficulties in seamlessly integrating spintronic components with conventional semiconductor devices, which are designed around charge-based operations.

Additionally, the nascent stage of spintronics in commercial applications means that industry standards and protocols for spintronic integration are still under development. Overcoming these integration issues requires multidisciplinary efforts in materials science, engineering, and information technology to develop compatible interfaces and ensure that spintronic devices can be effectively incorporated into the broader ecosystem of electronic products and systems.

Regional Analysis

In 2023, North America held a dominant market position in the spintronics market, capturing more than a 35.4% share. This substantial market share can be attributed to the region’s robust technological infrastructure and a strong emphasis on research and development activities in the field of spintronics. The demand for Spintronics in North America was valued at US$ 0.2 billion in 2023 and is anticipated to grow significantly in the forecast period.

North America, especially the United States, is home to several leading technology firms and research institutions that are at the forefront of developing spintronics applications, including quantum computing, advanced memory storage solutions, and magnetic sensors. The region’s market leadership is further bolstered by significant investments in semiconductor technology and a well-established ecosystem supporting the advancement of nanotechnology and materials science.

The presence of key market players and startups dedicated to spintronics innovations has fostered a conducive environment for growth and development in this sector. These entities are actively engaged in collaborations and partnerships, aiming to explore and expand the potential applications of spintronics, which range from energy-efficient computing devices to revolutionary data storage technologies.

Furthermore, government and private sector funding in research initiatives have played a pivotal role in advancing the technological capabilities of the region, ensuring its premier position in the global spintronics market. Europe follows North America in terms of market share, driven by its strong focus on research and development, particularly in countries like Germany, France, and the UK.

The European Union’s commitment to funding technological advancements has significantly contributed to the growth of the spintronics market in the region. Initiatives aimed at fostering innovation and technological breakthroughs in spintronics have facilitated the development of advanced computing and electronic devices, underscoring Europe’s critical role in the global market landscape.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the rapidly evolving domain of Spintronics, several key players have distinguished themselves through innovative solutions and strategic market positioning. NVE Corporation and Everspin Technologies, Inc., stand at the forefront, leveraging their expertise in magnetoresistive random-access memory (MRAM) technologies to drive advancements in non-volatile memory applications. Spintronics International Pte. Ltd. and QuantumWise A/S contribute significantly to the market by developing tools and materials that enhance the computational efficiency and storage capabilities of spintronics devices.

Crocus Technology and Organic Spintronics S.A. have made noteworthy strides in the integration of spintronics with traditional and organic electronics, respectively, opening new avenues for flexible and wearable electronics. Intel Corporation and IBM Corporation, with their vast resources and research capabilities, are pivotal in the transition from conventional electronics to spin-based computing, underscoring the potential for substantial improvements in processing power and energy efficiency.

Top Market Leaders

- NVE Corporation

- Everspin Technologies, Inc.

- Spintronics International Pte. Ltd.

- QuantumWise A/S

- Crocus Technology

- Organic Spintronics S.A.

- Intel Corporation

- IBM Corporation

- Advanced MicroSensors Corporation (AMS)

- Rhomap Ltd.

- Spin Transfer Technologies, Inc.

- Spin Memory, Inc.

- Toshiba Corporation

- Samsung Electronics Co., Ltd.

- Avalanche Technology, Inc.

- Other Key Players

Recent Developments

1. Spin Transfer Technologies, Inc. (STT)

- STT collaborated with Imec, a research institute, in February 2023 to develop next-generation MRAM technology offering higher density and improved energy efficiency. STT announced a licensing agreement with Everspin Technologies in May 2023 for its Perpendicular STT-MRAM technology for various applications

2. Toshiba Corporation

- Toshiba unveiled its concept for a spintronic neuromorphic chip in January 2023, aiming to achieve brain-like processing capabilities. In September 2023, Toshiba announced a collaboration with Cambridge University to develop next-generation spintronic devices for neuromorphic computing.

Report Scope

Report Features Description Market Value (2023) US$ 0.8 Bn Forecast Revenue (2033) US$ 2.7 Bn CAGR (2024-2033) 7.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Giant Magnetoresistance (GMR), Tunnel Magnetoresistance (TMR), Spin-Transfer Torque (STT), Spin Hall Effect, Other Technologies), By Application (Data Storage, Magnetic Random Access Memory (MRAM), Sensors, Semiconductor Devices, Spintronic Logic and Quantum Computing, Other Applications) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape NVE Corporation, Everspin Technologies Inc., Spintronics International Pte. Ltd., QuantumWise A/S, Crocus Technology, Organic Spintronics S.A., Intel Corporation, IBM Corporation, Advanced MicroSensors Corporation (AMS), Rhomap Ltd., Spin Transfer Technologies, Inc., Spin Memory Inc., Toshiba Corporation, Samsung Electronics Co. Ltd., Avalanche Technology Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Spintronics?Spintronics, short for spin transport electronics, is a field of physics that explores the intrinsic spin of electrons and its associated magnetic moment, in addition to its fundamental electronic charge, in solid-state devices. It aims to develop devices that exploit both the intrinsic spin of the electron and its associated magnetic moment, in addition to its fundamental electronic charge, in solid-state devices.

How big is Spintronics Market?The Global Spintronics Market size is expected to be worth around USD 2.7 Billion by 2033, from USD 0.8 Billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

Who are the key players in the Spintronics market?Some of the key players in the Spintronics market include NVE Corporation, Everspin Technologies Inc., Spintronics International Pte. Ltd., QuantumWise A/S, Crocus Technology, Organic Spintronics S.A., Intel Corporation, IBM Corporation, Advanced MicroSensors Corporation (AMS), Rhomap Ltd., Spin Transfer Technologies, Inc., Spin Memory Inc., Toshiba Corporation, Samsung Electronics Co. Ltd., Avalanche Technology Inc., Other Key Players

Which region has the biggest share in Spintronics Market?In 2023, North America held a dominant market position in the spintronics market, capturing more than a 35.4% share.

What are the opportunities prevailing in the global Spintronics market?The global Spintronics market is ripe with opportunities, driven by the increasing demand for high-speed, low-power electronic devices. As the need for faster and more efficient data processing continues to grow, Spintronics offers a promising solution.

What are the major drivers for the global Spintronics market growth?Several factors are driving the growth of the global Spintronics market. Firstly, the increasing demand for high-speed, low-power electronic devices is driving the adoption of Spintronics. Secondly, the development of new materials and fabrication techniques is enabling the production of more efficient Spintronic devices.

-

-

- NVE Corporation

- Everspin Technologies, Inc.

- Spintronics International Pte. Ltd.

- QuantumWise A/S

- Crocus Technology

- Organic Spintronics S.A.

- Intel Corporation

- IBM Corporation

- Advanced MicroSensors Corporation (AMS)

- Rhomap Ltd.

- Spin Transfer Technologies, Inc.

- Spin Memory, Inc.

- Toshiba Corporation

- Samsung Electronics Co., Ltd.

- Avalanche Technology, Inc.

- Other Key Players