Global Specialty Pharmaceutical Market By Application (Oncology, Multiple sclerosis, Inflammatory conditions and Infectious diseases) By Route of Administration (Oral, Parenteral and Transdermal) By Distribution Channel (Offline and Online) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 45468

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

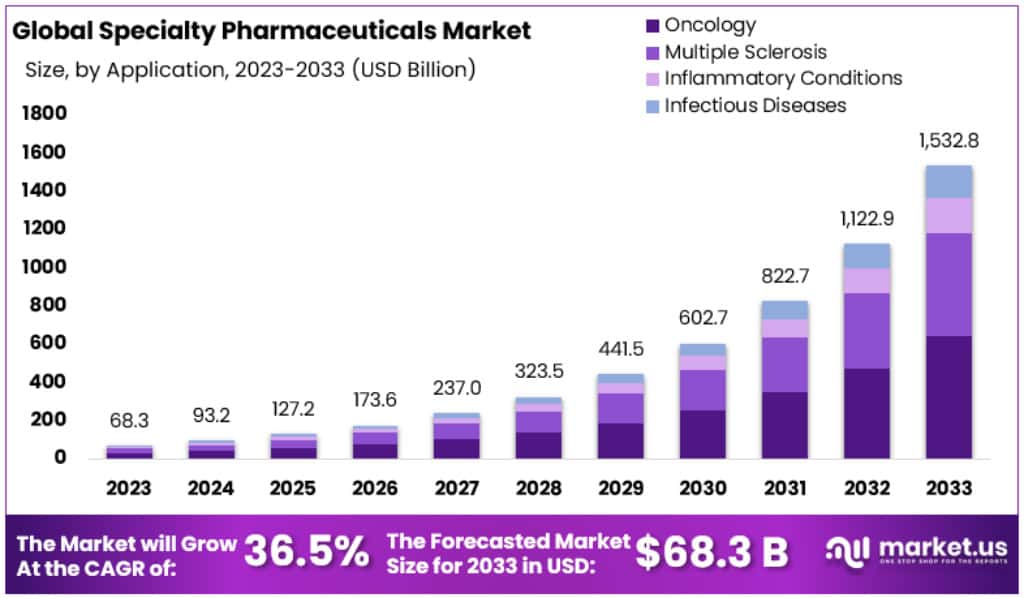

The Global Specialty Pharmaceutical Market size is expected to be worth around USD 1532.8 billion by 2033, from USD 68.3 billion in 2023, growing at a CAGR of 36.5% during the forecast period from 2023 to 2033.

Specialty pharmaceuticals, also known as specialty drugs, are a class of high-cost, high-complexity, and high-touch medications used to treat complex or rare chronic conditions. They often require special handling, administration, or monitoring due to their limited distribution and specific patient populations.

Key Takeaways

- The Specialty Pharmaceutical Market is expected to reach approximately USD 1,532.8 billion by 2033.

- In 2023, the market was valued at around USD 68.3 billion.

- The market’s CAGR, is projected to be 36.5% from 2023 to 2033.

- Oncology accounted for over 42% of the market share in 2023.

- The Multiple Sclerosis (MS) segment is also growing significantly.

- Inflammatory conditions are another key segment in the market.

- The Infectious Diseases segment is evolving due to the COVID-19 pandemic.

- The Oral route of administration held the largest market share at more than 45% in 2023.

- Parenteral administration, including injectable therapies, also had a significant market share.

- Transdermal delivery, a smaller segment, is gaining popularity.

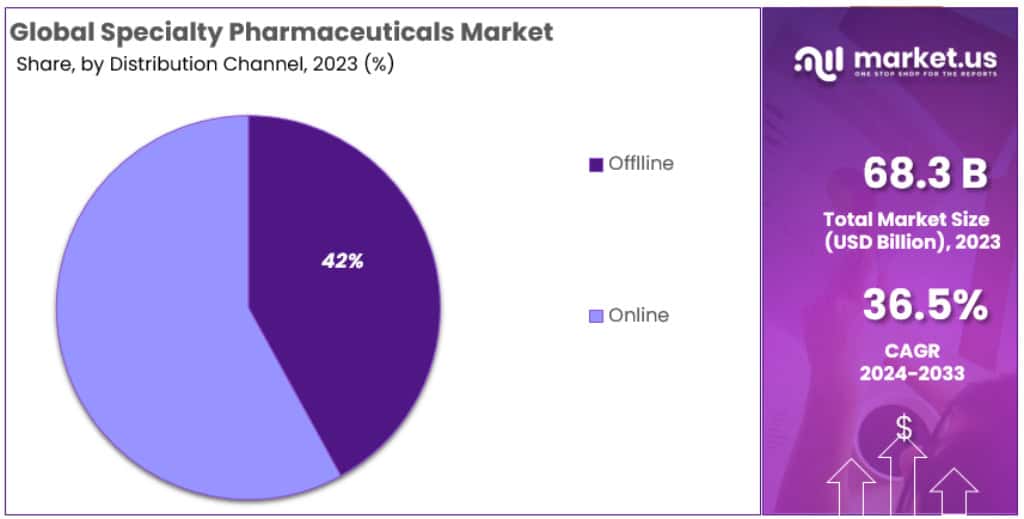

- Offline distribution channels dominated the market in 2023 with over 56% market share.

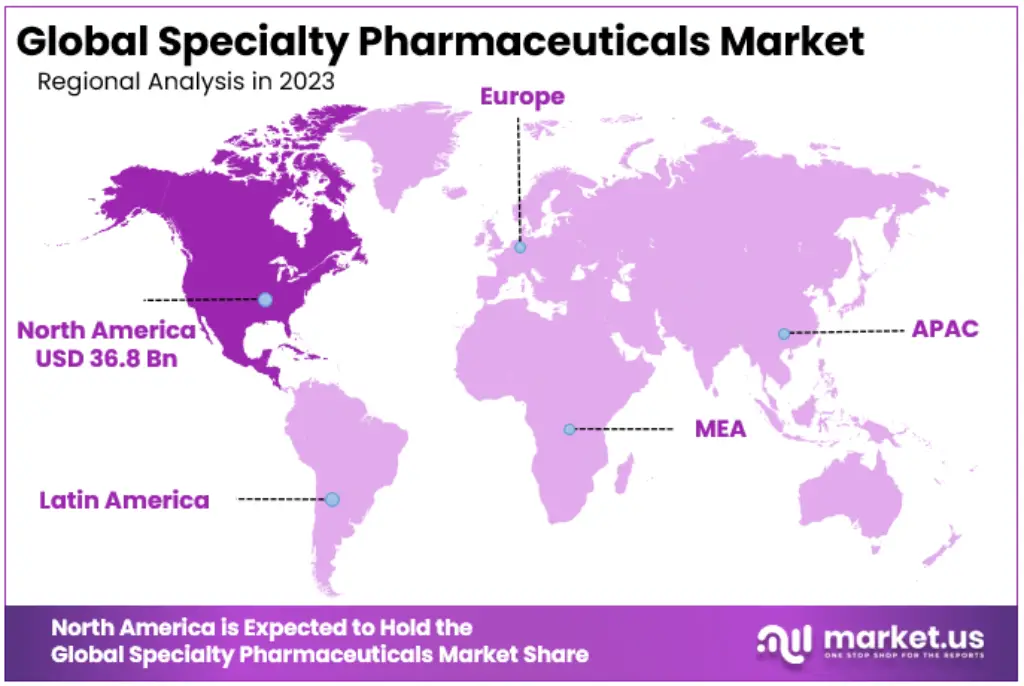

- North America led the market in 2023 with a 54% share, amounting to USD 36.8 billion.

- The specialty pharmaceutical market is concentrated, with the top 10 companies holding about 60% of the global market.

- Teva Pharmaceutical Industries Ltd. controls roughly 40% of the market.

Application Analysis

In 2023, Oncology held a dominant market position, capturing more than a 42% share in the Specialty Pharmaceutical Market. This segment’s growth can be attributed to the increasing prevalence of cancer globally and the rising demand for targeted therapies. Advances in personalized medicine have further fueled the oncology segment, with a focus on developing treatments tailored to individual genetic profiles.

The Multiple Sclerosis (MS) segment also shows significant growth, driven by the rising incidence of the disease and ongoing research and development in disease-modifying therapies. This segment benefits from a strong pipeline of novel treatments, addressing both the relapsing-remitting and progressive forms of MS.

Inflammatory conditions, encompassing a range of autoimmune and chronic inflammation-related diseases, represent another key segment. The demand for specialty pharmaceuticals in this area is propelled by the growing awareness of autoimmune disorders and the introduction of biologics and biosimilars, which offer new treatment options for patients.

The Infectious Diseases segment continues to evolve, especially in the wake of the COVID-19 pandemic. This sector focuses on developing antiviral drugs, vaccines, and novel antibiotics to combat multi-drug-resistant bacteria. Investment in this area is increasing, reflecting the urgent need for effective treatments against emerging and re-emerging infectious diseases.

Route of Administration Analysis

The Oral route of administration held a dominant market position in the Specialty Pharmaceutical Market, capturing more than a 45% share, in 2023. This dominance is largely due to the ease of administration and patient preference for oral medications. Advances in drug formulation have enabled more effective and targeted oral therapies, especially in chronic disease management.

The Parenteral segment, which includes intravenous and injectable therapies, also occupies a significant portion of the market. This route is essential for treatments that require rapid absorption or are not suitable for oral administration. The growth in this segment is driven by innovations in drug delivery systems and a rise in biologic drugs, which are often administered parenterally.

Transdermal delivery, though a smaller segment, is gaining traction due to its non-invasive nature and sustained release capabilities. This route is particularly beneficial for patients requiring continuous medication delivery or those who have difficulties with oral or injectable routes. Developments in transdermal technology, such as advanced patches and new drug formulations, are expanding the possibilities in this area.

Overall, each route of administration in the Specialty Pharmaceutical Market offers unique advantages, catering to diverse patient needs and medical requirements. The market is evolving with technological advancements, improving patient compliance and broadening treatment options across various therapeutic areas.

Distribution Channel Analysis

In 2023, Offline distribution channels held a dominant market position in the Specialty Pharmaceutical Market, capturing more than a 56% share. This segment, comprising brick-and-mortar pharmacies and healthcare facilities, remains crucial due to the need for professional consultation and immediate access to medications, especially for acute conditions and complex therapies.

The Online distribution channel, while holding a smaller market share, is rapidly growing. This growth can be attributed to the convenience of home delivery, the increasing penetration of e-commerce in healthcare, and the broader shift towards digital solutions. Online pharmacies are particularly appealing for the management of chronic conditions, offering ease of access to medications and improved patient adherence.

Despite the growth of online channels, the offline segment’s dominance is underpinned by patient trust in traditional healthcare settings and the necessity for immediate access in certain medical situations. However, the ongoing digital transformation in healthcare suggests a potential shift towards a more balanced market share between offline and online channels in the coming years.

Overall, the Specialty Pharmaceutical Market’s distribution is evolving, reflecting changing consumer behaviors, technological advancements, and the increasing integration of digital solutions in healthcare delivery.

Key Market Segments

Application

- Oncology

- Multiple sclerosis

- Inflammatory conditions

- Infectious diseases

Route of Administration

- Oral

- Parenteral

- Transdermal

Distribution Channel

- Offline

- Online

Drivers

- Rising Demand for Specialty Drugs: There’s an increasing need for drugs that treat complex or chronic conditions. Specialty drugs offer targeted treatment, improving patient outcomes.

- Higher Reimbursements: More coverage from medical and pharmacy benefits makes these drugs more accessible to patients.

- Business and Medical Innovation: Pharmaceutical companies see attractive prospects in specialty drugs, both as a business opportunity and as a way to advance medical science.

Restraints

- High Cost: The cost of specialty pharmaceuticals, sometimes over $600 per month, can be a barrier. These expenses can lead to less use of these drugs, potentially worsening health outcomes.

- Special Handling Needs: The requirement for special handling or delivery of these drugs adds to the complexity and cost.

Opportunities

- Support Programs and Channels: The availability of compliance programs, reimbursement assistance, and effective distribution channels can enhance patient access to these medications.

- Advances in Technology: Enhanced IT systems in the specialty pharmaceuticals sector are improving drug management and distribution.

Challenges

- Limited Focus on Low-Cost Generics: There’s less emphasis on developing affordable generic versions of specialty drugs, which can limit accessibility for some patients.

- Regulatory Hurdles: Strict regulations and the need for extensive drug data can slow down drug approvals, increasing R&D costs.

Trends

- Aging Population: The increasing number of older adults, predicted to double by 2030, is boosting demand for specialty pharmaceuticals to treat age-related conditions.

- National Healthcare Expenditure: Estimated to increase by 25% by 2030, this rise is partly due to the growing need for specialty drugs to manage chronic diseases.

Regional Analysis

In 2023, North America is leading the Specialty Pharmaceutical Market with a 54% share, amounting to USD 36.8 Billion. This significant market presence is driven by the increasing number of chronic and rare diseases, such as cancer, sickle cell disease, and HIV. The United States, a key player in this region, is expected to continue its dominance due to high cancer rates and the prevalence of genetic diseases like sickle cell anemia.

Key Factors Influencing North America’s Market:

- High Disease Prevalence: In the U.S., new cancer cases reached 2,281,658 in 2020, with breast, lung, and prostate cancers being the most common.

- Genetic Disorders: Sickle cell disease is notably prevalent, affecting one in every 500 African Americans, with around 300,000 infants born with it annually.

- Strategic Market Initiatives: Key players are focusing on product launches, partnerships, and innovative programs. For example, in 2022, the FDA granted orphan drug designation to a new therapy for multiple myeloma.

- Investments and Innovations: Investments, like the USD 13.5 million raised by Free Market Health, are enhancing the specialty pharmaceutical sector, particularly in areas like specialty pharmacy services.

Market Drivers in North America:

- Heavy R&D investments, exceeding USD 149.8 billion annually.

- Rapid development in pharmaceutical industries and significant mergers and acquisitions.

- High purchasing power and strong reimbursement policies supporting specialty pharmaceuticals.

Asia Pacific’s Growing Market:

Asia Pacific is poised for robust growth due to its high population, increasing chronic disease prevalence, and adoption of advanced technologies. The WHO reports that chronic diseases and related deaths are surging, particularly in lower and middle-income countries, with nearly 23.6 million expected deaths from cardiovascular diseases by 2030.

The U.S. and Canadian Markets:

The U.S. and Canada are major contributors to North America’s market share. Government funding, like the USD 6.56 billion allocated to the National Cancer Institute in 2021, and advanced healthcare infrastructure are key growth drivers. The presence of numerous specialty pharmaceutical manufacturers also bolsters this growth.

In summary, North America’s strong market position is supported by high disease prevalence, strategic initiatives by pharmaceutical companies, and significant investments in R&D and technology. Asia Pacific is also emerging as a significant player due to its demographic trends and healthcare advancements.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The specialty pharmaceutical market is quite concentrated, with just ten companies holding about 60% of the global market. Leading the pack is Teva Pharmaceutical Industries Ltd., controlling roughly 40% of the market. Their specialty pharmaceuticals are a major source of their income.

Pfizer Inc. is another key player, with a market share of about 35%. They focus mainly on oncology and biopharmaceuticals in their specialty pharma segment.

AbbVie, Inc., known for its biopharmaceutical products, gets around 85% of its revenue from specialty pharmaceuticals. Amgen Inc., a biotech firm, also dedicates nearly all its efforts to specialty pharma, making up almost 100% of its revenue.

Johnson and Johnson, a well-known name in healthcare, has a significant stake in this market too, with specialty pharmaceuticals contributing about 25% to their revenue. Bristol-Myers Squibb Company, focusing on biopharmaceuticals, earns about 65% of its income from this sector.

Key Market Players

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- AbbVie, Inc.

- Amgen Inc.

- Johnson and Johnson

- Bristol-Myers Squibb Company

- Novo Nordisk

- Novartis AG

- Gilead Sciences, Inc.

- Sanofi S.A.

Recent Developments

- October 2023: Pfizer Inc. and BioNTech SE announce that their Omicron BA.4/BA.5 COVID-19 vaccine booster has received FDA Emergency Use Authorization (EUA) for individuals 12 years of age and older.

- October 2023: AbbVie Inc. announces that its Rinvoq (upadacitinib) has received FDA approval for the treatment of moderate to severe ulcerative colitis in adults.

- September 2023: Amgen Inc. announces that its Enbrel (etanercept) has received FDA approval for the treatment of non-radiographic axial spondyloarthritis (nr-axSpA) in adults.

- September 2023: Gilead Sciences, Inc. announces that its Trodelvy (sacituzumab govitecan-hziy) has received FDA approval for the treatment of patients with previously treated locally advanced or metastatic urothelial carcinoma (mUC)

- July 2023: Sanofi S.A. and Regeneron Pharmaceuticals, Inc. announce that their Dupixent (dupilumab) has received FDA approval for the treatment of patients with eosinophilic esophagitis (EoE).

- July 2023: Teva Pharmaceutical Industries Ltd. announces that its Tresiba (insulin glargine) has received FDA approval for the treatment of adults with type 2 diabetes mellitus.

- June 2023: Johnson and Johnson announces that its Tremfya (ixekizumab) has received FDA approval for the treatment of adults with moderate to severe plaque psoriasis.

Report Scope

Report Features Description Market Value (2023) USD 68.3 Billion Forecast Revenue (2033) USD 1532.8 Billion CAGR (2023-2032) 36.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Oncology, Multiple sclerosis, Inflammatory conditions and Infectious diseases) By Route of Administration (Oral, Parenteral and Transdermal) By Distribution Channel (Offline and Online) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Teva Pharmaceutical Industries Ltd, Pfizer Inc, AbbVie, Inc, Amgen Inc, Johnson and Johnson, Bristol-Myers Squibb Company, Novo Nordisk, Novartis AG, Gilead Sciences, Inc, Sanofi S.A. and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Specialty Pharmaceutical MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Specialty Pharmaceutical MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- AbbVie, Inc.

- Amgen Inc.

- Johnson and Johnson

- Bristol-Myers Squibb Company

- Novo Nordisk

- Novartis AG

- Gilead Sciences, Inc.

- Sanofi S.A.