Global Specialty Crops for Cosmetics Market Size, Share, And Enhanced Productivity By Product Format (Essential Oil Crops, Carrier Oil Crops, Tree Nuts and Seed Oils, Medicinal and Aromatic Plants, Floriculture Crops), By Consumer Segment (Steam Distilled Essential Oils, Cold-Pressed and Expeller Oils, Botanical Extracts and Concentrates, Solvent-Extracted Materials, Natural Pigments and Colorants), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174816

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

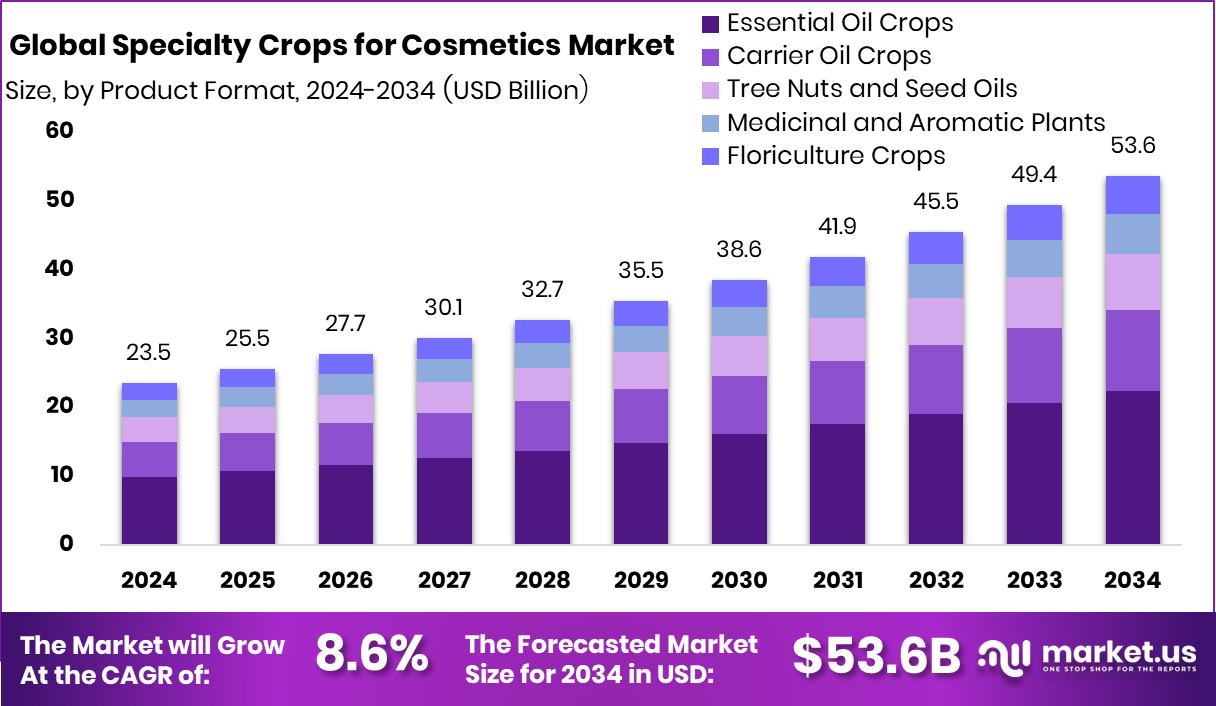

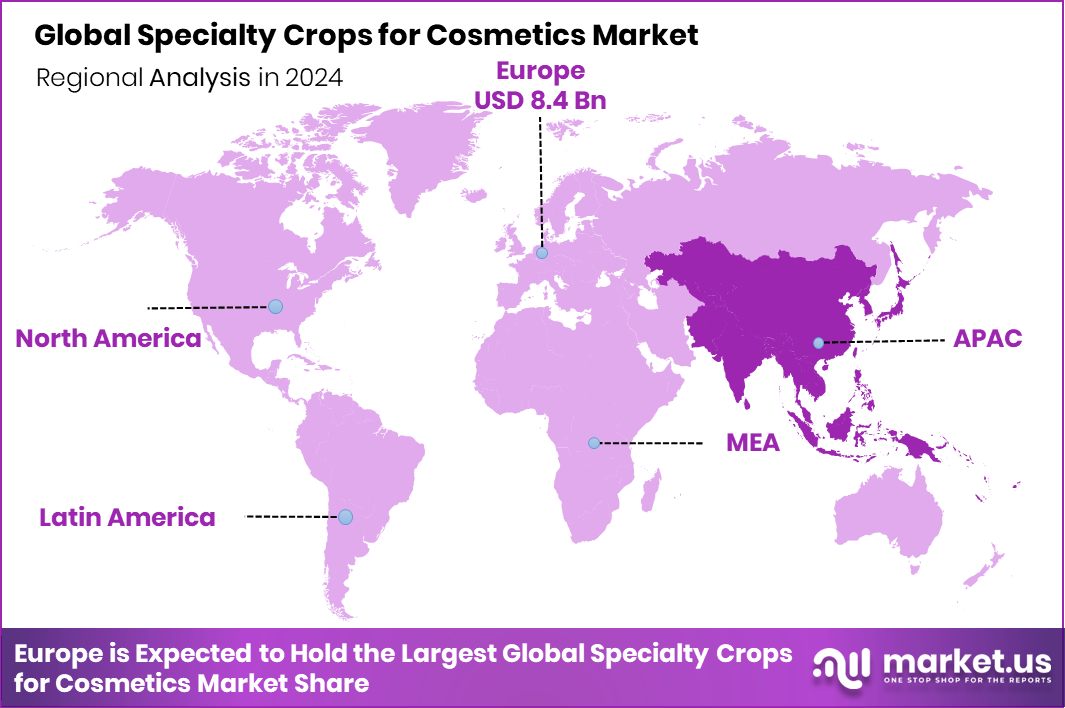

The Global Specialty Crops for Cosmetics Market is expected to be worth around USD 53.6 billion by 2034, up from USD 23.5 billion in 2024, and is projected to grow at a CAGR of 8.6% from 2025 to 2034. The region of Europe captured 36.1% of the value, reaching USD 8.4 Bn overall.

Specialty crops for cosmetics include botanicals, essential oils, plant extracts, and seed-based ingredients that are cultivated specifically for beauty and personal care products. These crops provide natural fragrance, texture, nourishment, and therapeutic benefits used in skincare, haircare, and aromatherapy formulations. They are valued for being clean-label, traceable, and aligned with the growing preference for plant-powered cosmetics.

The Specialty Crops for Cosmetics Market represents the commercial ecosystem that grows, processes, and supplies these natural ingredients to cosmetic manufacturers. It includes farming, extraction, formulation, and innovation around plant-derived compounds. The market continues to expand as brands shift toward sustainable and ethically sourced ingredients.

Growth is supported by rising consumer interest in natural beauty products and safer formulations. New funding is also encouraging product development, such as Secret Alchemist securing $500K in seed funding, which helps expand natural ingredient research. These investments create stronger sourcing networks and open opportunities for cleaner botanical extracts.

Demand is influenced by the push for high-performance plant ingredients. Funding like Colipi raising EUR 1.8 million helps advance bio-based ingredient technologies, while Cano-ela securing €1.6 million, boosts seed-based ingredient development that supports future cosmetic applications. Such progress improves supply reliability and widens ingredient diversity.

Opportunities are also emerging from academic partnerships. For example, Ole Miss striking a $5 million research deal highlights increasing scientific interest in essential-oil-based actives, even in cases where regulatory caution exists. This type of research accelerates innovation, enhances validation of plant compounds, and strengthens pathways for specialty crops to enter premium cosmetic formulations.

Key Takeaways

- The Global Specialty Crops for Cosmetics Market is expected to be worth around USD 53.6 billion by 2034, up from USD 23.5 billion in 2024, and is projected to grow at a CAGR of 8.6% from 2025 to 2034.

- Essential oil crops dominate specialty cosmetic ingredients, driving natural formulations with their strong 41.8% market share.

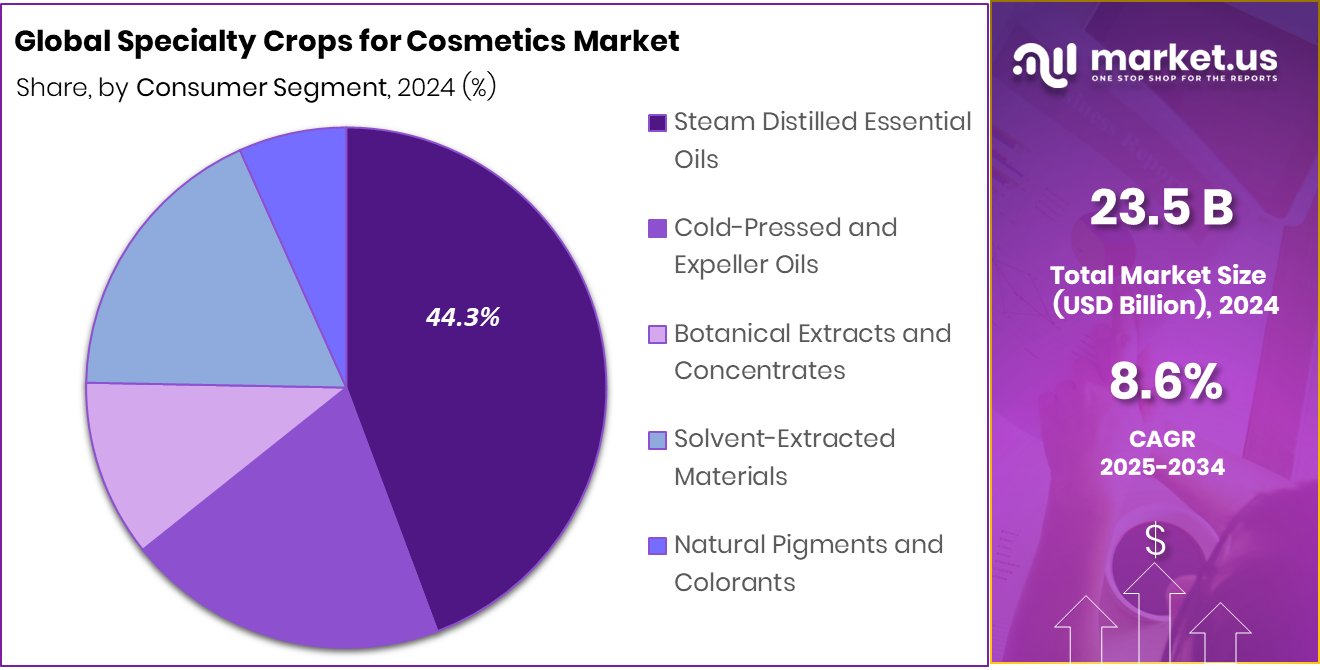

- Steam-distilled essential oils lead cosmetic applications, reflecting rising demand for pure extracts at 44.3% share.

- In 2024, Europe maintained 36.1% dominance, generating USD 8.4 Bn revenue.

By Product Format Analysis

In the Specialty Crops for Cosmetics Market, essential oil crops capture a 41.8% share.

In 2024, Essential Oil Crops held a dominant 41.8% share in the specialty crops for the Cosmetics Market, driven by rising consumer demand for natural, plant-derived ingredients in skincare, haircare, and aromatherapy products. Brands are increasingly integrating botanical oils such as lavender, rosemary, chamomile, and tea tree due to their proven antimicrobial, antioxidant, and soothing properties.

Manufacturers are also shifting toward sustainably sourced oil crops as clean-label preferences grow across global beauty markets. The expanding premium cosmetics segment is heavily investing in cold-pressed oils and organic formulations, boosting long-term demand. Moreover, wellness-centric lifestyles and the popularity of holistic beauty routines continue to encourage the use of essential oil crops in serums, oils, and treatment-based products.

By Consumer Segment Analysis

Steam-distilled essential oils dominate the specialty crops for the cosmetics market with a 44.3% share.

In 2024, Steam Distilled Essential Oils accounted for 44.3% of the consumer segment within the Specialty Crops for Cosmetics Market, mainly due to their high purity, stable fragrance profile, and strong suitability for premium cosmetic formulations. Steam distillation remains the most preferred extraction method for flowers, herbs, and aromatic crops used in perfumes, cleansers, creams, and therapeutic skincare lines.

As consumers increasingly choose toxin-free, minimally processed beauty ingredients, steam-distilled oils are gaining traction for their clean processing and higher safety standards. Additionally, luxury personal care brands are leveraging these oils to enhance sensory appeal, while manufacturers benefit from consistent quality and improved yield. This strong adoption is expected to accelerate specialty crop cultivation for cosmetic-grade essential oils.

Key Market Segments

By Product Format

- Essential Oil Crops

- Carrier Oil Crops

- Tree Nuts and Seed Oils

- Medicinal and Aromatic Plants

- Floriculture Crops

By Consumer Segment

- Steam Distilled Essential Oils

- Cold-Pressed and Expeller Oils

- Botanical Extracts and Concentrates

- Solvent-Extracted Materials

- Natural Pigments and Colorants

Driving Factors

Growing Demand for Clean Botanical Ingredients Rising

The top driving factor for the Specialty Crops for Cosmetics Market is the strong global shift toward clean, plant-based cosmetic ingredients. Consumers now prefer natural extracts, botanical oils, and plant-derived actives instead of synthetic chemicals. This rising demand is further supported by growing investments in sustainable ingredient development. For example, Zeus Hygia raises $2.5 Mn from NABVENTURES, helping expand research on safe plant-based compounds suitable for skincare and haircare.

At the same time, Phytolon closes $14.5 million Series A led by DSM Venturing, strengthening natural colorant innovation that aligns with cosmetic companies seeking transparent, eco-friendly formulations. These developments make plant-sourced specialty crops more accessible, improving product availability and encouraging wider adoption across beauty segments.

Restraining Factors

High Production Costs Limit Ingredient Expansion

A key restraining factor for the Specialty Crops for Cosmetics Market is the high production cost of specialty plants, natural extracts, and advanced bio-based ingredients. Growing, processing, and stabilizing botanical materials require significant investment, and small producers often struggle to meet large-scale cosmetic demand. These cost pressures reduce the speed at which manufacturers can innovate or reformulate with natural inputs.

The situation becomes more challenging when companies redirect finances toward urgent needs, such as Matrix Gas scrapping its IPO plan and raising Rs 300 crore in fresh funding, illustrating how market uncertainties can shift capital away from ingredient development. Such financial redirections limit growth, slow supply expansion, and make naturally sourced cosmetic ingredients more expensive for brands.

Growth Opportunity

Rising Scope for Bio-Based Cosmetic Materials

The biggest growth opportunity in the Specialty Crops for Cosmetics Market lies in bio-engineered plant materials and alternative natural inputs. Cosmetic brands are searching for innovative, sustainable ingredients that reduce environmental impact while delivering high performance. Strong investments are supporting this shift, such as Cambridge biomaterials startup PACT scooping £16M to scale collagen-based leather alternatives, showcasing how plant-derived materials can replace traditional animal-based resources.

Additionally, Phytolon raises $4.1M to fund natural food coloring technology, which can be adapted into cosmetic-grade pigments and botanical tints. These advancements open doors for new specialty crops, improved extraction techniques, and high-value plant materials suitable for premium skincare, wellness beauty, and eco-focused cosmetic applications.

Latest Trends

Growing Shift Toward Functional Botanical Innovations

A major trend shaping the Specialty Crops for Cosmetics Market is the rising popularity of functional botanical ingredients designed for wellness-based beauty. Consumers increasingly want products that combine skincare benefits with natural therapeutic properties, driving demand for advanced plant-based formulations. This trend is supported by active investments that boost ingredient innovation, including The Emerald Corp. closing a $2M funding round and launching Emerald Nutraceutical, strengthening development of natural wellness-driven actives.

Similarly, Phytolon sealing $14.5M in funding highlights continued interest in natural color alternatives that fit clean-label cosmetic expectations. These trends reflect a broader move toward high-performance plant inputs, transparent sourcing, and multifunctional beauty solutions powered by specialty crops.

Regional Analysis

Europe led the market with a strong 36.1% share worth USD 8.4 Bn.

In the Specialty Crops for Cosmetics Market, Europe emerged as the leading region with a dominant 36.1% share valued at USD 8.4 Bn, supported by strong consumer preference for natural formulations and a mature cosmetic manufacturing base. North America continued to show steady demand, driven by clean beauty trends and wider acceptance of plant-derived ingredients across skincare and personal care brands.

The Asia Pacific region reflected rising adoption of specialty botanical crops due to expanding beauty industries and growing interest in herbal and traditional plant extracts among consumers. Markets in the Middle East & Africa also experienced a gradual uptake as premium cosmetic products gained traction, while Latin America showed consistent growth supported by the increasing use of native botanical resources in regional beauty formulations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, International Flavors & Fragrances Inc plays a strategic role in the Specialty Crops for Cosmetics Market through its deep expertise in natural ingredients and sensory solutions. The company has consistently focused on botanical extracts, essential oils, and fermentation-derived actives that align with cosmetic brands’ shift toward clean, traceable, and performance-driven formulations. Its integrated approach, combining agriculture sourcing with formulation science, allows cosmetic manufacturers to maintain consistency, quality, and regulatory compliance across global markets.

Symrise AG stands out for its strong capabilities in plant-based cosmetic ingredients, particularly those derived from specialty crops and renewable sources. The company emphasizes sustainability, circular sourcing, and long-term partnerships with growers, which strengthens its supply chain resilience. Symrise’s focus on skin-relevant actives and natural fragrances supports cosmetic brands seeking differentiation through efficacy and sensory appeal while maintaining ethical sourcing standards.

Meanwhile, Givaudan SA brings advanced innovation in natural cosmetic ingredients, leveraging botanical science and biotechnological processes. Its expertise in transforming specialty crops into high-value cosmetic actives positions the company as a preferred partner for premium and mass-market beauty brands. Givaudan’s strong collaboration with formulators enhances product customization and accelerates the adoption of plant-based cosmetic solutions worldwide.

Top Key Players in the Market

- International Flavors & Fragrances Inc

- Symrise AG

- Givaudan SA

- Firmenich SA

- Mane SA

- Robertet Group

- Sensient Technologies Corporation

- Desert King International

- Berje Inc.

- Biolandes

Recent Developments

- In January 2026, Mane announced the acquisition of Belgian biotech firm ChemoSensoryx Biosciences, which specializes in technologies that help understand and modulate smell and sensory perception. This move strengthens Mane’s scientific research capabilities, enabling more advanced fragrance and sensory ingredient solutions for cosmetics.

- In July 2024, DSM-Firmenich launched AROMActive, a new line of well-being rituals made with scent and care that focuses on natural aromatic ingredients relevant for personal care and beauty applications. This launch highlights the company’s focus on botanical and sensory cosmetics innovations.

Report Scope

Report Features Description Market Value (2024) USD 23.5 Billion Forecast Revenue (2034) USD 53.6 Billion CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Format (Essential Oil Crops, Carrier Oil Crops, Tree Nuts and Seed Oils, Medicinal and Aromatic Plants, Floriculture Crops), By Consumer Segment (Steam Distilled Essential Oils, Cold-Pressed and Expeller Oils, Botanical Extracts and Concentrates, Solvent-Extracted Materials, Natural Pigments and Colorants) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape International Flavors & Fragrances Inc, Symrise AG, Givaudan SA, Firmenich SA, Mane SA, Robertet Group, Sensient Technologies Corporation, Desert King International, Berje Inc., Biolandes Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Specialty Crops for Cosmetics MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Specialty Crops for Cosmetics MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- International Flavors & Fragrances Inc

- Symrise AG

- Givaudan SA

- Firmenich SA

- Mane SA

- Robertet Group

- Sensient Technologies Corporation

- Desert King International

- Berje Inc.

- Biolandes