Global Spatial Computing Market By Type (Virtual Reality, Mixed Reality, Augmented Reality, Internet of Things, Artificial Intelligence, and Others); By Application (Healthcare, Automotive, Transport, Manufacturing, Media & Entertainment, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: March 2024

- Report ID: 101747

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

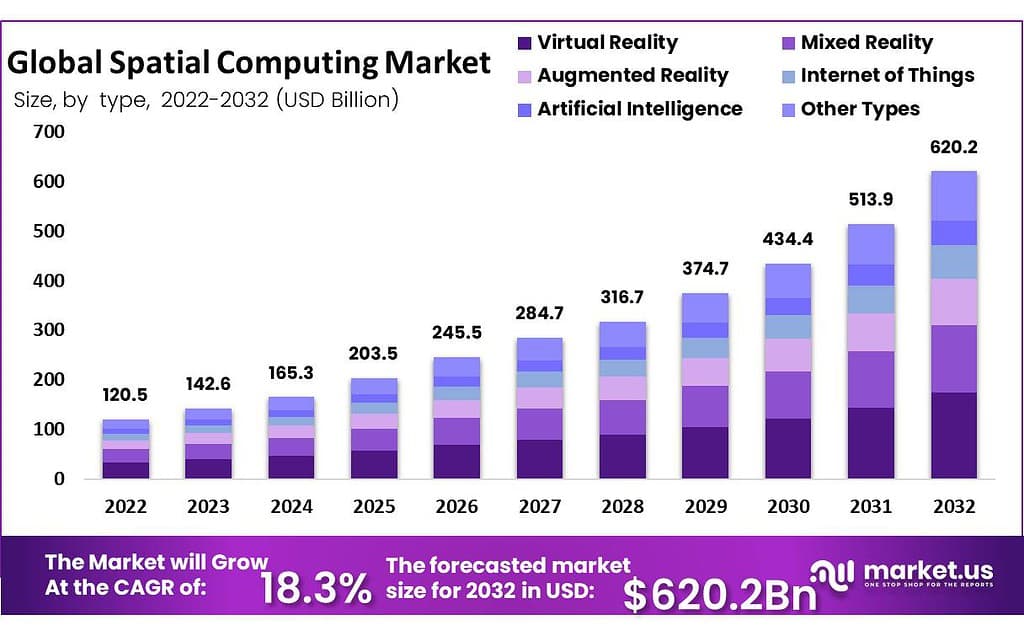

The Global Spatial Computing Market size is expected to be worth around USD 620.2 Billion by 2032, from USD 142.6 Billion in 2023, growing at a CAGR of 18.3% during the forecast period from 2024 to 2033.

Spatial computing is an exciting technology that brings together augmented reality (AR), virtual reality (VR), and mixed reality (MR) to enable computers to understand and interact with the physical world in a spatial context. It combines computer vision, sensors, and machine learning to create immersive and interactive experiences that bridge the gap between the digital and physical realms.

The Spatial Computing Market is experiencing rapid growth due to several driving factors. The increasing demand for immersive and interactive experiences across various industries, such as gaming, entertainment, healthcare, architecture, and manufacturing, is fueling the market’s expansion. This technology is being adopted in applications like training, simulation, and visualization, driving further market growth. Advancements in hardware, including lightweight and affordable headsets and sensors, are making spatial computing more accessible to a wider audience.

The healthcare sector has also witnessed significant growth in the utilization of spatial computing. A study conducted by Accenture revealed that the use of spatial computing in healthcare, particularly in surgical planning, medical training, and patient education, experienced a notable 30% increase in 2023. The integration of new technologies in healthcare practices has the potential to save lives and revolutionize the industry.

Furthermore, the gaming industry is embracing spatial computing technologies. Research conducted by Newzoo predicts that by the end of 2024, more than 70% of new video games will incorporate elements of spatial computing, such as AR and VR. This indicates a rising trend of gaming going spatial, offering players immersive and interactive experiences.

Spatial computing has also made its mark in the manufacturing sector. According to Capgemini, manufacturing companies that have adopted spatial computing for design, assembly, and maintenance processes witnessed a remarkable 20% boost in productivity in 2023. The integration of AR and VR technologies into factory operations has made production processes smarter and more efficient.

Key Takeaways

- Spatial computing market size is expected to be worth around USD 142.6 billion by 2023, which is estimated to grow to USD 620.2 billion by 2032, at a CAGR of 18.3% during the forecast period from 2023 to 2032.

- Internet of Things (IoT) segment held a dominant position in the spatial computing market, capturing more than a 30% share.

- Healthcare segment secured a commanding position in the spatial computing market, boasting a significant share of over 16%.

- Spending on spatial computing for training and simulation purposes saw a jump of 40% as companies embraced immersive learning. This approach proved that learning by doing is indeed very powerful.

- Retailers got on board with spatial computing, with adoption for solutions like virtual try-ons and immersive shopping experiences growing by 25%. Shopping definitely got an upgrade, making it more engaging for customers.

- The architecture, construction, and urban planning sectors found spatial computing increasingly useful, with a 35% increase in its use for visualization and collaboration. This shows better planning is possible with spatial tech.

- A survey highlighted that 45% of businesses were leveraging spatial computing in 2023 to provide immersive remote collaboration experiences. It seems virtual meetings got a bit more real.

- Military and defense didn’t lag behind, with spending on spatial computing for training simulations, mission planning, and battlefield visualization growing by 22%. It’s clear that armies are prepping with AR/VR.

- Global e-commerce companies ramped up their spatial computing investments by 32% to enhance online shopping with AR product visualization. The concept of “try before you buy” took on a virtual twist.

- The demand for spatial computing specialists, including AR/VR developers, 3D artists, and experience designers, surged, leading to a 45% growth in employment in these roles. New skill sets are definitely in demand.

Type Analysis

In 2022, the Internet of Things (IoT) segment held a dominant position in the spatial computing market, capturing more than a 30% share. This leading status can be attributed to IoT’s integral role in connecting the physical and digital worlds, providing the foundational infrastructure necessary for spatial computing to thrive.

IoT devices, ranging from sensors to smart devices, collect and exchange data with the network, enabling real-time interaction and automation in various environments. This capability is pivotal for spatial computing applications, as it allows for the seamless integration of digital information with the user’s physical surroundings, enhancing the user experience across multiple domains.

The prominence of the IoT segment is further bolstered by its extensive application across industries such as manufacturing, healthcare, retail, and smart cities. For instance, in manufacturing, IoT technologies facilitate predictive maintenance, real-time monitoring, and efficient supply chain management, thereby improving productivity and operational efficiency.

In healthcare, IoT devices play a crucial role in patient monitoring, telemedicine, and personalized care, directly contributing to the growth of spatial computing by providing the necessary data and connectivity. The versatility and widespread adoption of IoT technologies not only underscore their importance in the spatial computing market but also hint at the segment’s potential for continued growth and innovation.

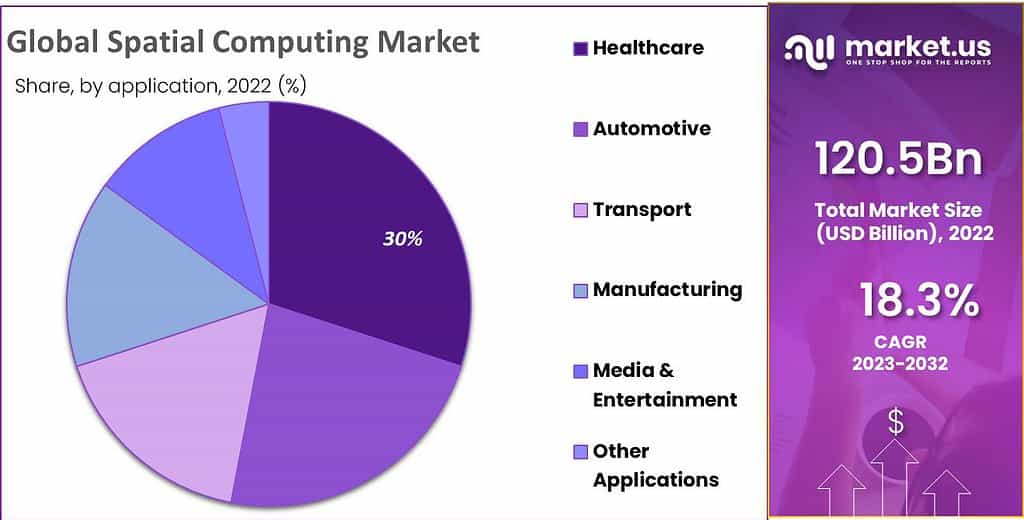

Application Analysis

In 2022, the Healthcare segment secured a commanding position in the spatial computing market, boasting a significant share of over 16%. This dominance is primarily attributed to the accelerated adoption of spatial computing technologies within the healthcare industry. Such technologies are increasingly being utilized for advanced diagnostics, patient management, surgical planning, and remote patient monitoring. The integration of spatial computing in healthcare facilitates more precise and interactive medical procedures, enhancing patient outcomes and operational efficiencies.

The leading role of the Healthcare segment is further supported by substantial investments in research and development, aiming to incorporate augmented reality (AR), virtual reality (VR), and mixed reality (MR) solutions. These technologies are revolutionizing patient care by providing immersive experiences for medical training, therapy, and patient education.

For example, spatial computing aids in creating 3D visualizations of patients’ anatomy for surgical preparation, improving the accuracy and safety of complex surgeries. Additionally, the COVID-19 pandemic has underscored the importance of remote healthcare services, propelling the demand for spatial computing solutions to facilitate telehealth and virtual consultations.

Key Market Segments

By Type

- Virtual Reality

- Mixed Reality

- Augmented Reality

- Internet of Things

- Artificial Intelligence

- Other Types

By Application

- Healthcare

- Automotive

- Transport

- Manufacturing

- Media & Entertainment

- Other Applications

Driver

Rising Demand for Augmented Reality (AR) and Virtual Reality (VR) Technologies

The proliferation of Augmented Reality (AR) and Virtual Reality (VR) technologies significantly drives the Spatial Computing Market. These technologies are being increasingly adopted across diverse sectors, including gaming, education, healthcare, and real estate, for creating immersive experiences. For instance, in healthcare, AR and VR are used for surgical training and patient treatment planning.

This rising demand stems from the ability of AR and VR to provide users with interactive and visually enriched environments, enhancing user engagement and learning experiences. Consequently, the demand for spatial computing, which is crucial for AR and VR environments to interpret and interact with the physical world, is experiencing substantial growth.

Restraint

High Costs of Implementation

One of the main restraints facing the Spatial Computing Market is the high costs associated with the implementation of spatial computing technologies. The development and deployment of these technologies require significant investment in hardware, such as sensors and wearable devices, as well as in software development.

For many businesses, especially small and medium-sized enterprises (SMEs), these costs can be prohibitively expensive, limiting their ability to adopt spatial computing solutions. Additionally, the need for specialized personnel to manage and operate spatial computing systems further increases operational expenses, posing a significant barrier to market entry and expansion.

Opportunity

Integration with the Internet of Things (IoT)

The integration of Spatial Computing with the Internet of Things (IoT) presents a substantial opportunity for market growth. As IoT devices become more prevalent in various sectors, including smart homes, industrial automation, and smart cities, the ability to utilize spatial computing to enhance the interaction between these devices and their environments becomes increasingly valuable.

Spatial computing can enable more intuitive and efficient ways to control IoT devices, offering opportunities for innovation in user interfaces and experience. This integration can lead to the development of new applications and services that leverage the spatial context of IoT devices, opening up vast new market segments and revenue streams.

Challenge

Privacy and Security Concerns

A significant challenge for the Spatial Computing Market is addressing privacy and security concerns. As spatial computing technologies often collect and process large amounts of sensitive data, including personal and location information, there are heightened concerns regarding data privacy and security.

Ensuring the protection of this data against unauthorized access and breaches is crucial. However, developing robust security measures that do not compromise the functionality or user experience of spatial computing applications is complex and challenging.

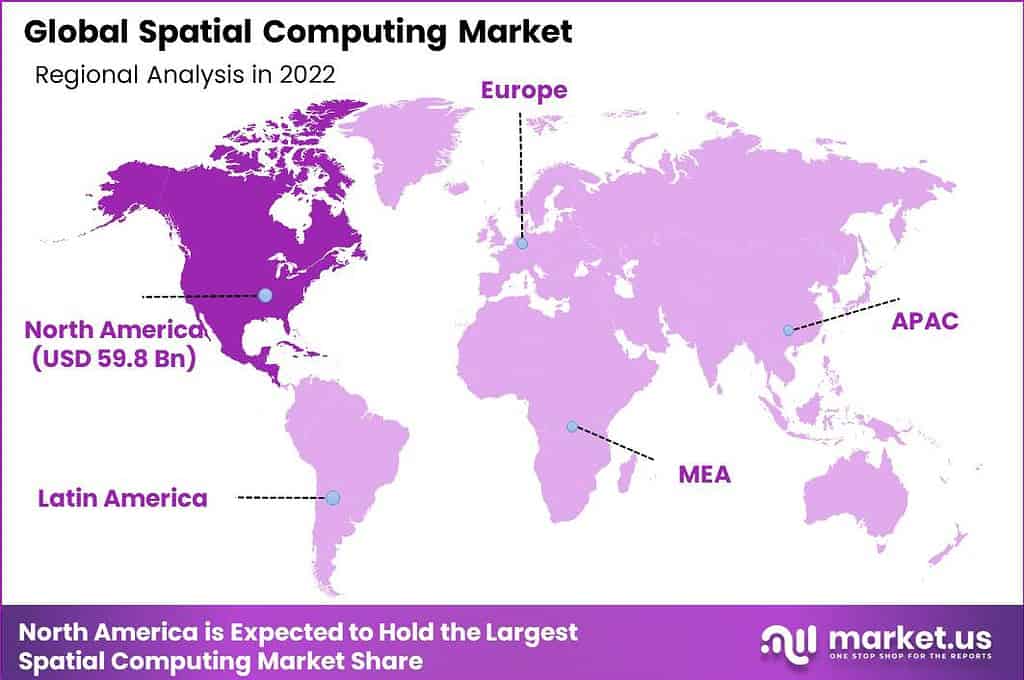

Regional Analysis

In 2022, North America held a dominant market position in the spatial computing arena, capturing more than a 42% share. This substantial market share is largely attributable to the region’s robust technological infrastructure, high levels of investment in research and development, and the presence of leading tech companies that are pioneers in spatial computing technologies.

The demand for Spatial Computing in North America was valued at USD 59.8 billion in 2022 and is anticipated to grow significantly in the forecast period. The United States, being at the forefront, plays a crucial role in driving innovation and adoption across various sectors, including healthcare, automotive, and entertainment, thereby fueling the growth of spatial computing in the region.

The leadership of North America in the spatial computing market is further bolstered by its vibrant startup ecosystem and supportive governmental policies aimed at fostering innovation in cutting-edge technologies. The region’s emphasis on enhancing manufacturing processes, improving healthcare outcomes, and creating immersive entertainment experiences has led to the early adoption of AR, VR, and MR solutions.

Additionally, significant investments in autonomous vehicles and smart infrastructure projects have propelled the demand for spatial computing solutions, integrating real and virtual worlds to improve safety, efficiency, and user experiences.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the rapidly evolving Spatial Computing Market, several key players are shaping the landscape through innovation, strategic partnerships, and a focus on enhancing user experiences. Their efforts are directed toward expanding the capabilities of spatial computing technologies and their application across various industries.

Market Key Players

- Microsoft Corporation

- Honeywell International Inc.

- ABB Ltd.

- Huawei Technologies Co., Ltd.

- Hewlett Packard Enterprise Development

- Atos

- General Electric Company

- Cisco Systems, Inc.

- IBM Corporation

- Intel Corporation

- Other Key Players

Recent Developments

- Microsoft (March 2023): Launched Mesh 2.0, a significant update to their mixed reality platform, improving performance and offering new features for collaboration and productivity in spatial computing.

- Honeywell (May 2023): Acquired Sparta Systems, a leader in augmented reality (AR) for industrial applications, expanding their offerings in spatial computing for maintenance and training.

- Cisco (July 2023): Partnered with Meta to develop spatial computing solutions for enterprise communication and collaboration, leveraging Cisco’s Webex platform.

- Huawei (September 2023): Unveiled their next-generation AR glasses, the Huawei AR Glass Pro, boasting wider field of view and improved processing power for enhanced spatial computing experiences.

- Atos (December 2023): Launched a new suite of spatial computing tools for urban planning and infrastructure management, enabling data visualization and collaboration in 3D environments.

Report Scope

Report Features Description Market Value (2023) USD 142.6 Bn Forecast Revenue (2032) USD 620.2 Bn CAGR (2023-2032) 18.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Virtual Reality, Mixed Reality, Augmented Reality, Internet of Things, Artificial Intelligence, and Others); By Application (Healthcare, Automotive, Transport, Manufacturing, Media & Entertainment, and Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Microsoft Corporation, Honeywell International Inc., ABB Ltd., Huawei Technologies Co., Ltd., Hewlett Packard Enterprise Development, Atos, General Electric Company, Cisco Systems, Inc., IBM Corporation, Intel Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is spatial computing?Spatial computing is an emerging technology that integrates digital content and information into the user's physical environment, allowing for interaction with digital content in a more natural and intuitive way. It combines augmented reality (AR), virtual reality (VR), and mixed reality (MR) to create immersive experiences.

What is the market size of spatial computing?The Global Spatial Computing Market size is expected to be worth around USD 120.5 Billion by 2022 from USD 620.2 Billion in 2032, growing at a CAGR of 18.3% during the forecast period from 2022 to 2032.

Who are the leaders in spatial computing?Some of the key players and leaders in the spatial computing industry include companies such as Microsoft Corporation, Honeywell International Inc., ABB Ltd., Huawei Technologies Co., Ltd., Hewlett Packard Enterprise Development, Atos, General Electric Company, Cisco Systems, Inc., IBM Corporation, Intel Corporation, Other Key Players

What is the future of spatial computing?Spatial computing's future looks bright, as its presence becomes ever more integral to various industries and applications. As this technology progresses, spatial computing may revolutionize how people engage with digital content and information while improving user experiences and creating more immersive and intuitive interfaces. With each passing year, spatial computing could become more pervasive within our daily lives, impacting areas such as education, healthcare, retailing, entertainment and manufacturing industries.

What is an example of spatial computing?An example of spatial computing is the use of augmented reality (AR) in retail applications. For instance, a retail company may utilize AR technology to allow customers to virtually try on clothing or visualize how furniture would look in their homes before making a purchase. This integration of digital content into the physical environment demonstrates how spatial computing enhances user experiences and facilitates more informed decision-making processes.

-

-

- Microsoft Corporation

- Honeywell International Inc.

- ABB Ltd.

- Huawei Technologies Co., Ltd.

- Hewlett Packard Enterprise Development

- Atos

- General Electric Company

- Cisco Systems, Inc.

- IBM Corporation

- Intel Corporation

- Other Key Players