Global Soup Market Size, Share, And Industry Analysis Report By Product (Canned, Dried, UHT, Others), By Category (Non-Vegetarian Soup, Vegetarian Soup), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175298

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

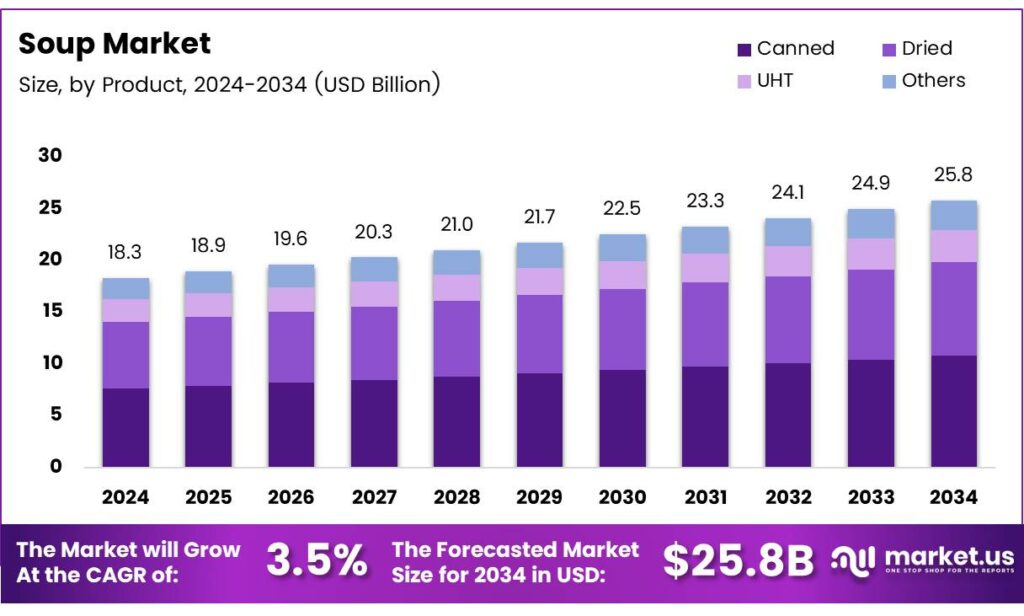

The Global Soup Market size is expected to be worth around USD 25.8 billion by 2034, from USD 18.3 billion in 2024, growing at a CAGR of 3.5% during the forecast period from 2025 to 2034.

The soup market includes packaged and freshly prepared options such as ready-to-drink, dehydrated, refrigerated, and instant varieties, meeting rising demand for convenience, seasonal comfort, and evolving dietary habits across retail, foodservice, and households. The U.S. dietary assessment, 94% of adults aged 19–64 consume soup, with 60% eating it fewer than four times monthly in winter and over 80% doing so in other seasons.

The soup market continues to expand as consumers shift toward comfort foods, healthier formulations, and quick-meal options. Growing urbanization and rising dual-income households encourage higher adoption of ready-made soups, supported by improved supply chains and strong retail penetration across both developed and emerging economies.

- In France, the SU.VI.The MAX cohort indicates more habitual patterns, where 7% of women and 9% of men were heavy consumers, eating soup five to six days out of six. Additionally, 46% of women and 42% of men consumed soup regularly on three to four days out of six.

The category benefits from increasing diversification in flavours, organic ingredients, and plant-based formulations. As consumers prioritize wellness and clean-label products, manufacturers focus on low-sodium, high-protein, and functional variants. These innovations help companies strengthen repeat purchases and attract younger demographics looking for convenient, nutritious meal substitutes.

Additionally, rising foodservice expansion fuels steady demand for bulk soup mixes and pre-prepared bases. Quick-service restaurants and institutional caterers increasingly rely on standardized soup products to reduce labour costs and maintain consistency. This commercial traction complements household consumption, strengthening overall market stability throughout the year.

Key Takeaways

- The Global Soup Market reached USD 18.3 billion in 2024 and is projected to hit USD 25.8 billion by 2034, at a steady CAGR of 3.5% from 2025 to 2034.

- Canned Soup dominated the product segment with a 47.9% share in 2025.

- Non-Vegetarian Soup led the category segment with a strong 63.8% share in 2025.

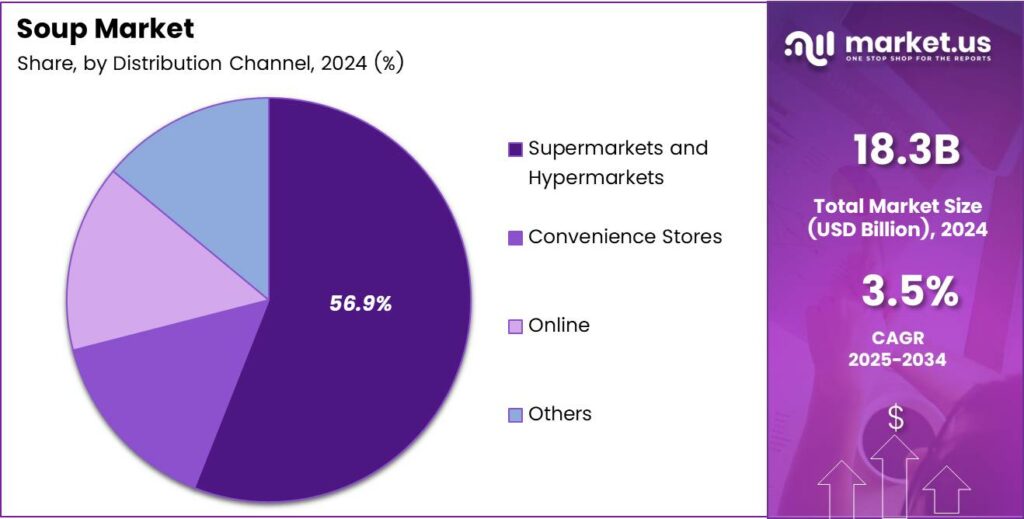

- Supermarkets & Hypermarkets accounted for the highest distribution share at 56.9% in 2025.

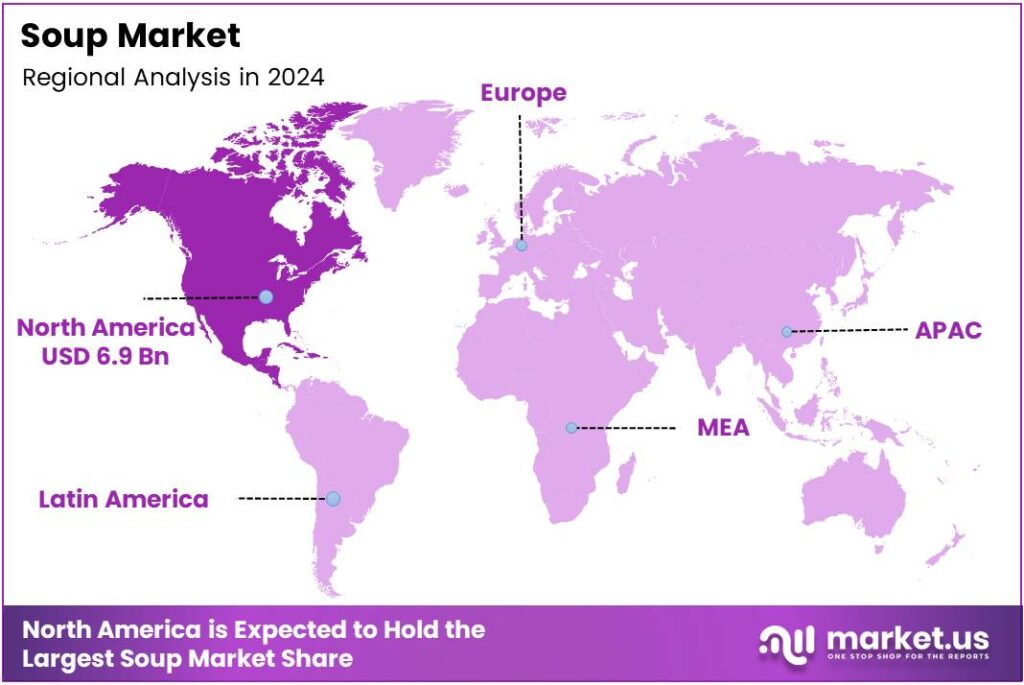

- North America remained the leading region with a 38.1% market share valued at USD 6.9 billion in 2025.

By Product Analysis

Canned Soup dominates with 47.9% due to its long shelf life and easy usage.

In 2025, Canned held a dominant market position in the ‘By Product’ Analysis segment of the Soup Market, with a 47.9% share. This segment grows because consumers prefer ready-to-eat options. The long storage stability and consistent taste further support adoption. Moreover, busy lifestyles continue to boost canned soup demand.

The dried soup segment continues expanding as consumers look for lightweight, easy-to-carry meal solutions. These products offer convenient preparation with minimal cooking needs. Additionally, brands are introducing new dried soup flavours to improve appeal. Their affordability also strengthens their presence in the everyday food basket.

The UHT soup segment benefits from better packaging and longer shelf stability. UHT soups appeal to households seeking fresh-tasting but preserved options. As companies introduce healthier recipes, demand for UHT soups steadily grows. Furthermore, rising urban consumption supports category expansion.

The Others segment includes specialty and niche soup formats, gaining slow but steady traction. These products cater to specific dietary needs or gourmet preferences. Although smaller in scale, innovation within premium and organic soup varieties continues to attract new buyers. Their availability improves gradually across retail channels.

By Category Analysis

Non-Vegetarian Soup dominates with 63.8% due to flavour variety and strong global preference.

In 2025, Non-Vegetarian Soup held a dominant market position in the ‘By Category’ Analysis segment of the Soup Market, with a 63.8% share. This leadership comes from wide consumer acceptance and the availability of chicken, seafood, and meat-based options. The segment also benefits from protein-rich diets and rising comfort-food trends.

The Vegetarian Soup segment continues to grow as plant-based food adoption rises. Consumers increasingly seek lighter, vegetable-rich meals that support wellness goals. Additionally, brands offer innovative combinations of herbs, grains, and vegetables. With expanding retail visibility, vegetarian soups appeal to health-focused and flexitarian consumers.

By Distribution Channel Analysis

Supermarkets and Hypermarkets dominate with 56.9% as they ensure wide product availability.

In 2025, Supermarkets and Hypermarkets held a dominant market position in the ‘By Distribution Channel’ Analysis segment of the Soup Market, with a 56.9% share. These stores offer extensive soup varieties at competitive prices. Their strong supply chains and promotional deals help consumers compare and choose easily, supporting consistent demand.

The Convenience Stores segment grows as shoppers seek quick and nearby food options. Smaller store formats make soup products accessible for immediate household needs. Additionally, the rising number of local outlets supports category expansion. Their strategic presence in urban areas enhances everyday purchase frequency.

The Online segment expands rapidly due to rising e-commerce usage. Consumers value doorstep delivery, product reviews, and wide flavour selections. Furthermore, online discounts and subscription models attract repeat buyers. Growing digital adoption and improved logistics are strengthening this segment significantly.

The Others segment includes local grocery shops and specialty stores with a reliable but limited reach. These outlets support impulse buying and neighbourhood-level sales. Many households continue to depend on nearby stores for regular food purchases. Their presence remains important, especially in developing regions.

Key Market Segments

By Product

- Canned

- Dried

- UHT

- Others

By Category

- Non-Vegetarian Soup

- Vegetarian Soup

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Emerging Trends

Growing Popularity of Plant-Based and Clean-Label Soup Products Shapes Market Trends

One of the strongest trends in the soup market is the shift toward plant-based formulations. With more consumers avoiding meat and dairy, companies are investing in vegetable-rich recipes and vegan broth alternatives. This trend is particularly prominent among younger buyers.

- Most sodium-rich foods, including packaged soups, are purchased for home use, as CDC Vital Signsabout 65% of sodium consumed comes from retail stores, while around 25% comes from restaurants. This split highlights that consumer choices related to lower-sodium soup formulations are influenced more heavily by decisions made at grocery shelves than by away-from-home consumption.

The preference for clean-label ingredients. People want soups with fewer additives, natural seasonings, and familiar kitchen ingredients. Brands highlighting “no preservatives” or “no artificial flavours” are gaining a competitive edge. Flavours like miso, ramen, tom yum, lentil curry, and Mexican tortilla soup are becoming popular as consumers explore international tastes.

Drivers

Rising Demand for Convenient and Ready-to-Eat Meals Drives Market Growth

The soup market is mainly driven by the growing preference for quick and easy meals. As people face busy lifestyles, many consumers look for foods that save time without compromising taste, making packaged soups a natural choice. This shift is especially strong among working adults and students.

The rising awareness of healthy eating. Many brands now offer low-sodium, organic, and nutrient-rich soups. These products appeal to consumers who want affordable meals with better nutritional value. This trend supports steady expansion across both developed and emerging markets.

The increasing use of soups as a light meal replacement is boosting consumption. People are choosing soups for portion control, weight management, and easy digestion. This behaviour continues to support ongoing market demand. Wider product varieties, such as plant-based soups, regional flavours, and protein-rich broths, help companies attract new consumers.

Restraints

High Sodium Concerns Limit Consumer Acceptance in Key Markets

One of the biggest restraints for the soup market is the growing concern around sodium content. Many consumers are becoming more aware of how excessive sodium can affect heart health. This concern makes buyers hesitate to choose canned or packaged soups, especially in health-conscious regions.

- The perception that packaged soups contain artificial preservatives and flavour enhancers. As consumers shift toward clean-label foods, some hesitate to buy instant or ready-to-eat soups unless the brand clearly communicates natural ingredients. In the United States, adults consumed an average of 3,266 mg of sodium per day, with soups contributing about 4.3% of total intake and ten major food categories accounting for roughly 44% overall.

Price fluctuations of raw materials also limit market growth. Vegetables, meat, and dairy ingredients often see seasonal cost changes, which can affect manufacturing expenses and final product pricing. This reduces affordability in price-sensitive markets. Strong competition from fresh meals, home cooking trends, and restaurant options restricts growth.

Growth Factors

Growing Preference for Healthy and Functional Soup Products Creates New Opportunities

A major opportunity arises from the rising demand for healthier soup options. Consumers now prefer soups with high fibre, clean labels, plant-based proteins, and reduced sodium. Brands offering functional benefits such as immunity-boosting or gut-friendly soups can capture strong growth.

Another opportunity lies in expanding into developing markets. Countries in Asia, Latin America, and Africa are experiencing rapid urbanization and rising disposable incomes. As lifestyles shift, convenient packaged foods like soups are becoming more popular, opening large-scale opportunities for global brands.

The foodservice sector presents further opportunities. Hotels, cafeterias, airlines, and quick-service restaurants increasingly incorporate soup options into their menus due to low preparation effort and high profit margins. This segment helps companies diversify beyond traditional retail channels and achieve consistent sales.

Regional Analysis

North America Dominates the Soup Market with a Market Share of 38.1%, Valued at USD 6.9 Billion

North America leads the global soup market, holding a substantial 38.1% share and generating around USD 6.9 billion in 2025. The region’s dominance is supported by strong demand for ready-to-eat, canned, and premium soup varieties driven by convenience-oriented consumers. Rising health-focused preferences encourage higher adoption of low-sodium, organic, and protein-rich soup formulations.

Europe remains a mature and steadily expanding soup market, driven by traditional consumption habits and increasing interest in gourmet and clean-label products. Growing demand for plant-based and allergen-free soups supports product diversification across major countries. Expanding private-label offerings and strong winter-season consumption patterns enhance regional performance.

Asia Pacific is one of the fastest-growing regions, supported by rising urbanization, busy lifestyles, and growing acceptance of Western-style packaged foods. The demand for instant, cup-based, and flavorful broth soups continues to gain traction among young consumers. Additionally, rapid retail expansion and rising middle-class income levels amplify overall category growth.

The Middle East & Africa soup market is expanding gradually as consumers shift toward convenient meal options and international food categories. Growth is driven by increased modern trade penetration and rising expat populations, which influence soup consumption patterns. Seasonal demand and rising interest in fortified soup products further support category development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, the global soup market reflects steady transformation as manufacturers expand ready-to-eat offerings, reformulate healthier recipes, and strengthen distribution networks. Leading companies continue to enhance product portfolios through modernization, flavour innovation, and packaging upgrades to match rising consumer preferences for convenience and clean-label foods.

Associated British Foods plc maintains a stable competitive position by leveraging its strong grocery brands and efficient supply chains. The company continues to invest in packaged meal solutions, helping it secure consumer trust in both retail and foodservice channels.

Baxters Food Group Limited strengthens its premium soup presence by focusing on high-quality ingredients and recipe diversification. Its traditional positioning, combined with consistent innovation in healthier and artisanal variants, keeps the brand relevant across mature markets.

Campbell Soup Company remains one of the most influential global players, supported by its broad ready-to-serve and condensed soup portfolio. The company’s strategic push toward wellness-oriented formulations and value-driven packaging supports deeper penetration across North American households.

Conagra Brands, Inc. continues to scale its presence through strong retail partnerships and investments in modern shelf-stable offerings. Its focus on improving flavour profiles and expanding meal-solution categories aligns with current consumer demand for convenient and affordable options.

Top Key Players in the Market

- Associated British Foods plc

- Baxters Food Group Limited

- Campbell Soup Company

- Conagra Brands, Inc.

- General Mills, Inc.

- Hindustan Unilever Limited

- Nestlé S.A

- Ottogi Co., Ltd

- Premier Foods Group Limited

- The Kraft Heinz Company

Recent Developments

- In 2025, Campbell Soup Company, now officially renamed The Campbell’s Company following shareholder approval in November 2024, launched its next chapter of growth at the Fiscal 2025 Investor Day in September 2024. This includes a new strategy, mission, and focus on setting industry performance standards, reflecting its evolution beyond traditional soups to a broader portfolio.

- In 2025, Conagra Brands, Inc. continued portfolio optimization, divesting non-core brands like Chef Boyardee, Van de Kamp’s, and Mrs. Paul’s in Q1 fiscal 2026 to focus on growth in frozen and healthy snacking. The company acquired Sweetwood Smoke & Co. and divested its stake in Agro Tech Foods Limited, emphasizing better-for-you snacks.

Report Scope

Report Features Description Market Value (2024) USD 18.3 Billion Forecast Revenue (2034) USD 25.8 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Canned, Dried, UHT, Others), By Category (Non-Vegetarian Soup, Vegetarian Soup), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Associated British Foods plc, Baxters Food Group Limited, Campbell Soup Company, Conagra Brands, Inc., General Mills, Inc., Hindustan Unilever Limited, Nestlé S.A, Ottogi Co., Ltd, Premier Foods Group Limited, The Kraft Heinz Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Associated British Foods plc

- Baxters Food Group Limited

- Campbell Soup Company

- Conagra Brands, Inc.

- General Mills, Inc.

- Hindustan Unilever Limited

- Nestlé S.A

- Ottogi Co., Ltd

- Premier Foods Group Limited

- The Kraft Heinz Company