Global Solar Security Camera Market Size, Share and Analysis Report Analysis By Component (Hardware, Software, Services), By Product Type (Fixed Solar Security Cameras, PTZ (Pan-Tilt-Zoom) Solar Security Cameras), By Resolution (1080p Full HD, 2K / 4K Ultra HD), By Application (Residential Security, Commercial & Industrial Security, Public Infrastructure & Remote Monitoring, Agricultural & Wildlife Monitoring), By Sales Channel (Online Retail, Offline Retail (Security & Electronics Stores), Direct Sales from Manufacturer), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 176034

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Restraint Impact Analysis

- Regional Insights

- Regional Driver Comparison

- Component Analysis

- Product Type Analysis

- Resolution Analysis

- Application Analysis

- Sales Channel Analysis

- Investment Opportunities

- Investor Type Impact Matrix

- Business Benefits

- Emerging Trends Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

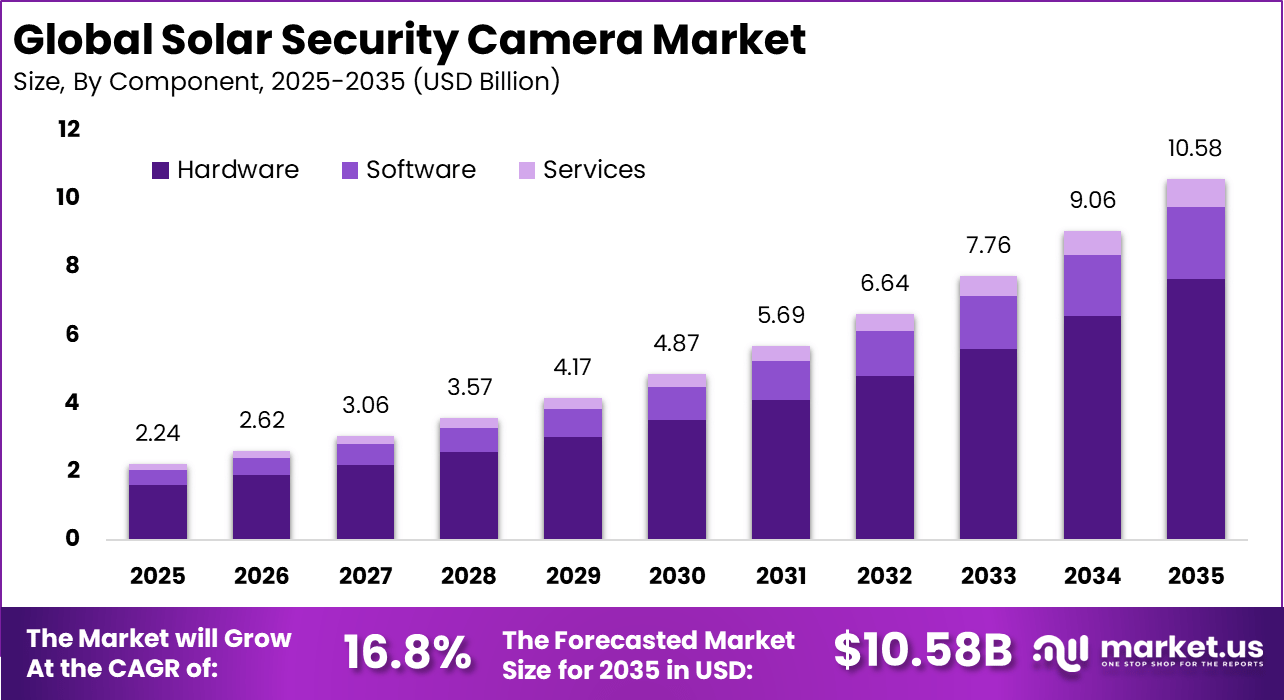

The Global Solar Security Camera Market is witnessing rapid expansion, projected to grow from USD 2.24 billion in 2025 to approximately USD 10.58 billion by 2035, registering a CAGR of 16.8% over the forecast period. North America dominated the market, capturing more than 34.63% share and generating USD 0.77 billion in revenue, reflecting strong demand for energy-efficient surveillance solutions and attractive long-term investment potential.

The solar security camera market refers to outdoor and semi outdoor video cameras that are powered mainly by a small solar panel and an internal rechargeable battery, instead of a fixed electrical connection. This product type is used for remote monitoring in homes, small businesses, farms, construction sites, and temporary locations where wiring is difficult or costly.

Most systems combine motion detection, night vision, and mobile alerts, so footage can be checked without being physically present at the site. Demand has expanded because buyers want surveillance coverage in areas with weak infrastructure, and because camera performance has improved while solar and battery components have become cheaper and easier to integrate.

Solar cameras are also increasingly positioned as a practical option for renters and short term sites, since they can be installed with fewer permanent changes. In parallel, security expectations have risen as more people rely on mobile apps for real time visibility of property and assets.

A key driver is the lower cost and higher availability of solar and battery hardware, which has made off grid monitoring more affordable for everyday users. For example, U.S. benchmarking work has documented large multi year declines in solar PV system costs, supporting broader adoption of solar powered devices beyond traditional energy projects.

Lower component costs also make it easier for brands to offer integrated kits that include the panel, battery, and camera in a single package. Battery and power management technology is one of the most important adoption accelerators. Global battery storage costs have fallen sharply over time, including an 89% decline in the cost of battery storage projects between 2010 and 2023 as reported by IRENA, reflecting scale and manufacturing efficiency gains.

For instance, in August 2025, Arlo Technologies, Inc. launched a new lineup of AI-powered security cameras, including solar-compatible models like the Essential Outdoor Solar Cam Gen 2, boosting 2K video with advanced motion detection and color night vision.

Key Takeaway

- Hardware dominated the market with a 72.4% share, driven by strong demand for integrated camera units, solar panels, batteries, and mounting systems.

- Fixed solar security cameras held 81.5% share, reflecting preference for permanent outdoor surveillance installations.

- 1080p Full HD resolution accounted for 58.3%, balancing image clarity with power efficiency in solar based systems.

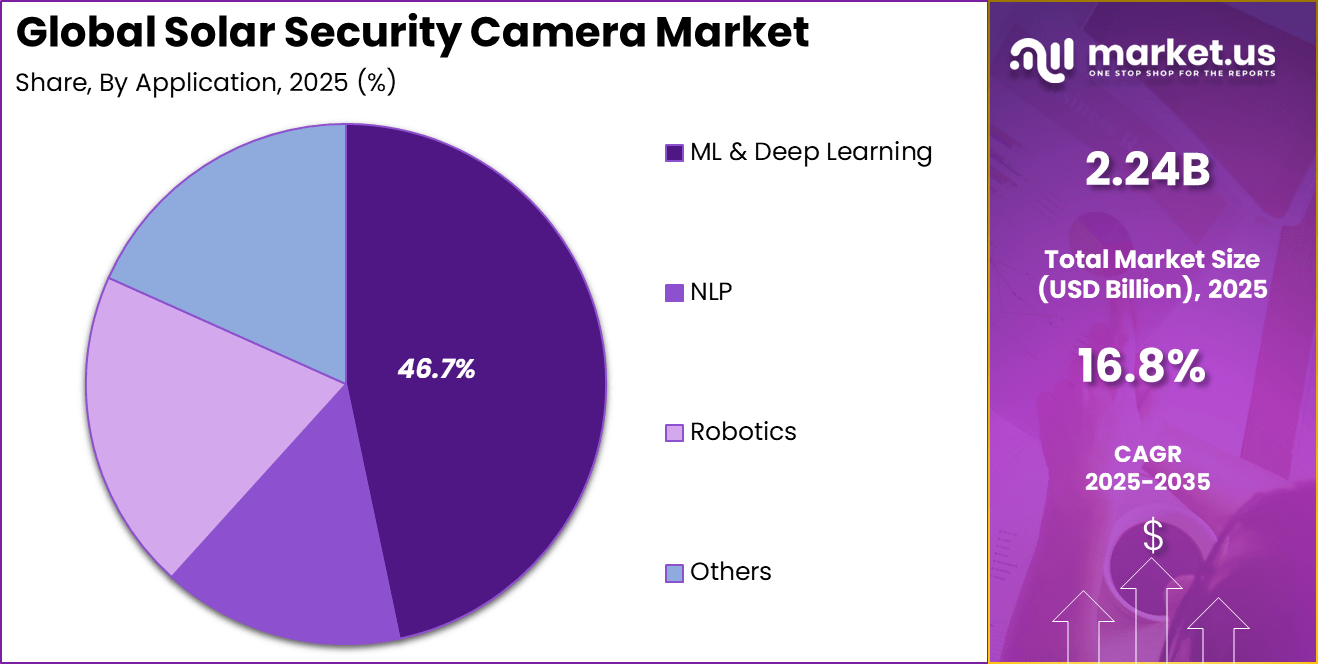

- Residential security led applications with 46.7%, supported by rising home safety concerns and smart home adoption.

- Online retail channels captured 63.8%, as consumers favored direct to consumer purchasing and DIY installation options.

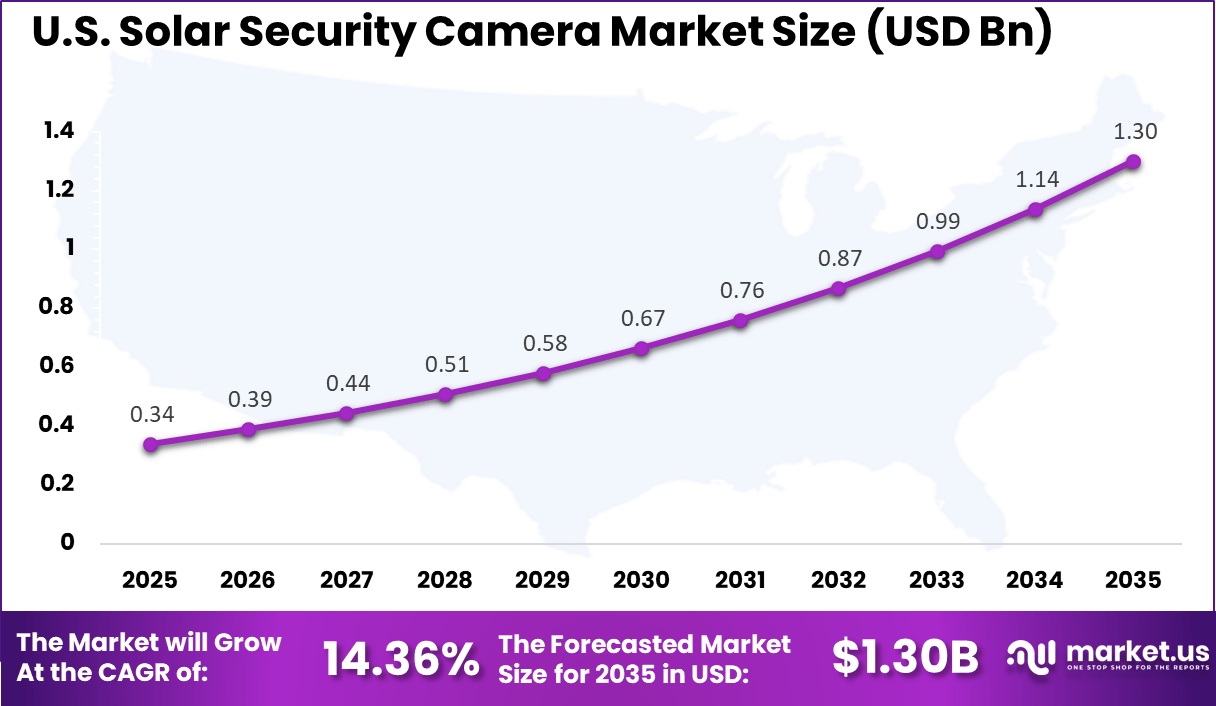

- The US market was valued at USD 0.34 billion in 2025 and is growing at a 14.36% CAGR.

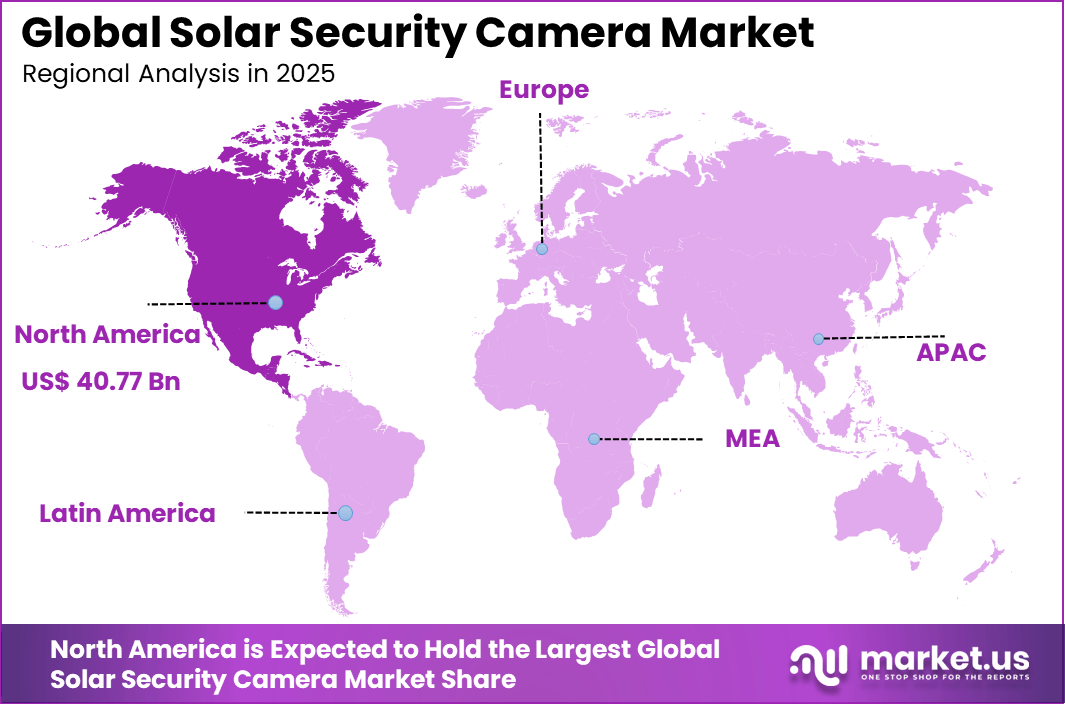

- North America held more than 34.63% of the global market, supported by strong smart home adoption and outdoor security demand.

Adoption and Usage Statistics

- A clear shift from wired to wireless solar powered systems accelerated during 2024 to 2025.

- AC powered devices held 72% of the home security market in 2024, but solar and battery powered models are growing faster at a 15.6% CAGR.

- Wireless systems represented 61% of the home security market in 2024, supported by easy DIY installation.

- US household adoption of security systems rose from 42% in 2023 to 52% in 2024, with solar cameras emerging as a preferred option among the 51 million households using video surveillance.

- Outdoor cameras accounted for 54% of the home security market in 2024, aligning strongly with solar powered use cases.

- Around 67% of users choose wireless and solar systems primarily for DIY convenience and lack of wiring requirements.

Key Usage Segments

- Residential and smart homes represent the fastest growing segment, expanding at a 20.8% CAGR through 2030.

- Remote and off grid locations rely heavily on solar cameras, especially at construction sites and rural areas using 4G, LTE, and 5G connectivity.

- High resolution demand is increasing, with growing adoption of 2K and 4K UHD solar cameras to offset lower power processing limits.

- Small and medium enterprises are the fastest growing commercial users, with around 1.8 million SMEs installing or upgrading surveillance systems in 2025.

Drivers Impact Analysis

Key Growth Driver Influence on Projected Growth (~)% Geographical Significance Expected Timeframe of Impact Rising demand for off grid and energy independent security systems +5.6% North America, Asia Pacific Short to medium term Growth in residential and commercial outdoor surveillance needs +4.8% Global Short term Expansion of smart home and smart city initiatives +4.2% North America, Europe, Asia Pacific Medium term Increasing focus on sustainability and renewable energy usage +3.6% Europe, North America Medium to long term Improved battery storage and low power camera technologies +2.9% Global Long term Restraint Impact Analysis

Key Restraint Influence on Projected Growth (~)% Geographical Significance Expected Timeframe of Impact High upfront cost compared to wired security cameras -2.7% Price sensitive markets Short to medium term Performance limitations in low sunlight regions -2.2% Europe, parts of Asia Pacific Medium term Battery degradation and maintenance concerns -1.9% Global Medium term Limited awareness among traditional security buyers -1.6% Emerging markets Medium to long term Data privacy and surveillance regulation challenges -1.3% Europe, North America Long term Regional Insights

U.S. Solar Security Camera Market Size

The market for Solar Security Cameras within the U.S. is growing tremendously and is currently valued at USD 0.34 billion, the market has a projected CAGR of 14.36%. The market grows due to rising home safety needs amid urban sprawl and remote properties without easy power access.

Solar models offer wire-free installs, slashing costs and fitting off-grid spots like big yards or farms perfectly. Eco-push from green policies boosts demand, as better panels and batteries ensure all-weather reliability. Smart home ties and AI alerts make them a smart pick for families, driving quick uptake nationwide.

For instance, in December 2025, Arlo Technologies, Inc. maintained its leadership in solar security cameras with the Arlo Pro 3 Floodlight Solar Security Camera, featuring 2K HDR video, 3000-lumen floodlights, and reliable solar charging for continuous outdoor protection. The Arlo Ultra 2 also excelled in 4K clarity and AI detection, solidifying U.S. market dominance in eco-friendly, high-performance solar surveillance solutions.

North America Solar Security Camera Market Size

In 2025, North America held a dominant market position in the Global Solar Security Camera Market, capturing more than a 34.63% share, holding USD 0.77 billion in revenue. This dominance is due to high adoption of smart home tech and a strong focus on green energy.

Tech-savvy buyers here snap up wire-free models for easy installs in sprawling homes and remote areas lacking power grids. Rising crime worries push demand, while rules favoring renewables and IoT growth speed things up. Advanced batteries and AI features make these cams reliable favorites across U.S. and Canadian homes.

For instance, in March 2025, Ring LLC launched the Outdoor Cam Plus with solar power option, 2K resolution, Low-Light Sight technology, and flexible installation for indoor/outdoor use, enhancing Amazon’s ecosystem and North American market share in versatile solar-powered security cameras.

Regional Driver Comparison

Region Core Demand Driver Growth Influence Level Market Maturity North America High adoption of smart security and rural surveillance Very High Mature Europe Sustainability focused security infrastructure High Developing to mature Asia Pacific Rapid urban expansion and off grid deployments Medium to High Developing Middle East Infrastructure security and remote asset monitoring Medium Developing Latin America Growing residential security concerns Low to Medium Early stage Africa Need for off grid security in remote areas Low Early stage Component Analysis

In 2025, The Hardware segment held a dominant market position, capturing a 72.4% share of the Global Solar Security Camera Market. Buyers focus on long-lasting solar panels, efficient batteries, durable housings, and stable mounting systems that can operate in outdoor conditions without frequent servicing. As more users install cameras in remote or off grid locations, dependable hardware becomes the core requirement, driving stronger demand for complete and rugged camera units.

Another reason for hardware growth is the rising preference for easy installation and low maintenance systems. Many customers want security solutions that work independently of wired power and complex infrastructure. Hardware led systems meet this need by offering self powered operation and minimal setup.

For Instance, in January 2026, Reolink Digital Technology Co., Ltd. unveiled a new solar-powered Floodlight Camera at CES 2026 with integrated hardware like advanced solar panels and high-capacity batteries. This eco-friendly addition to their lineup boosts hardware dominance by offering sustainable power without recharges.

Product Type Analysis

In 2025, the Fixed Solar Security Cameras segment held a dominant market position, capturing a 81.5% share of the Global Solar Security Camera Market. These cameras suit users who want continuous monitoring of a specific area, such as entrances, driveways, or perimeters. Once installed, fixed units require little adjustment, which appeals to users who prefer stable and predictable surveillance without regular repositioning or calibration.

Growth is also supported by cost effectiveness and durability. Fixed cameras typically have fewer moving parts, which lowers the risk of mechanical failure and reduces long term maintenance needs. As more buyers seek affordable and long lasting solar security solutions, fixed camera models remain the preferred option, reinforcing their dominant position in the market.

For instance, in October 2025, WYZE Labs, Inc. released the Solar Cam Pan, a fixed-position model with a built-in ETFE solar panel for steady coverage. It leads fixed types by needing just one hour of sun daily to run non-stop, perfect for porches or driveways. No battery swaps mean a simple setup and reliable watch over key spots without moving parts.

Resolution Analysis

In 2025, The 1080p Full HD segment held a dominant market position, capturing a 58.3% share of the Global Solar Security Camera Market. It offers a practical balance between image clarity and system efficiency. Users want clear footage for identifying people and activities, but they also want to avoid excessive storage use and battery drain. Full HD resolution meets everyday security needs without placing heavy demands on solar power and data storage.

Most displays, mobile apps, and storage systems support 1080p seamlessly, making it easy for users to view and manage footage. This familiarity and reliability encourage buyers to choose Full HD over higher resolutions, helping this segment grow steadily across residential and small commercial installations.

For Instance, in August 2025, Eufy launched the SoloCam E42 with 1080p HD resolution and a 3W removable solar panel. This pick grows 1080p share by balancing clear footage with low power use for color night vision. The app tracks energy in real-time, suiting budget users who want sharp details without 4K drain. It powers a full day from sunlight, drawing everyday buyers.

Application Analysis

In 2025, The Residential Security segment held a dominant market position, capturing a 46.7% share of the Global Solar Security Camera Market. Rising awareness about property protection and the desire for constant monitoring have pushed many households to adopt solar cameras. These systems appeal to homeowners because they work without wiring and can be installed in gardens, rooftops, or boundary walls.

Growth is further supported by lifestyle changes and smart home adoption. Many residents want security systems that integrate easily with mobile devices and allow remote access. Solar powered cameras align well with these needs while also supporting energy conscious choices, making them a popular option for residential users.

For Instance, in January 2026, Ring LLC (an Amazon company) introduced a $5,000 solar-powered surveillance trailer for home lots and yards. It pushes residential use with full solar hardware for off-grid family protection in driveways or backyards. Easy deploy and constant power fit homes far from outlets, giving alerts for kids or pets. Amazon ties make it seamless for daily home watch.

Sales Channel Analysis

In 2025, The Online Retail segment held a dominant market position, capturing a 63.8% share of the Global Solar Security Camera Market. This dominance is due to buyers prefer the convenience of digital purchasing. Customers can compare features, prices, and user feedback before making decisions. Online platforms also offer access to a wide range of models that may not be available in local stores, supporting higher adoption through this channel.

Another factor driving online sales is faster availability and doorstep delivery. Many buyers want quick installation without visiting physical outlets. Online channels meet this demand while also supporting promotional offers and easy returns. This purchasing behavior strongly supports the growth of online retail in the solar security camera market.

For Instance, in January 2026, Arlo Technologies, Inc. announced a new AI-powered Essential series lineup available first online. These solar-compatible cams with pan-tilt options boost e-sales via app previews and quick buys. Buyers compare 160-degree views and battery perks from home, with subscriptions starting low. Direct site preorders speed residential setups, fueling online growth over stores.

Investment Opportunities

Opportunities are emerging in integrated energy intelligence, where software improves how the camera balances recording quality, transmission frequency, and battery health based on expected sunlight and activity patterns. This can be positioned as a reliability feature for users in areas with seasonal weather changes or irregular sunlight.

Component level improvements in solar PV manufacturing continue to be documented, such as PV module pricing benchmarks showing major long term reductions, which supports further product innovation and margin planning for device makers. Another investment area is secure and interoperable device ecosystems, especially where multiple cameras and sensors are managed together.

Standards based security improvements such as TLS configuration and stronger authentication are being actively promoted in the IP video ecosystem, creating room for products that prioritize secure onboarding and encrypted remote access. In parallel, ruggedization linked to ingress protection expectations can be strengthened using recognized enclosure standards, which matters for outdoor devices exposed to dust and water.

Investor Type Impact Matrix

Investor Type Strategic Objective Risk Tolerance Market Influence Security hardware manufacturers Expansion into renewable powered surveillance Medium High Smart home solution providers Portfolio diversification and ecosystem growth Medium Medium to High Venture capital firms Scalable IoT and clean energy security platforms High Medium Private equity investors Long term growth in physical security infrastructure Medium Medium Infrastructure and utility investors Protection of remote and critical assets Low to Medium Medium Business Benefits

For small businesses and site operators, solar security cameras can reduce operating disruption by providing visibility without major electrical work. When incidents occur, recorded video can support internal reviews, coordination with local authorities, and dispute resolution with vendors or customers. Evidence based studies continue to report that CCTV can contribute to reductions in certain property crime contexts, reinforcing the value of surveillance as part of overall loss control.

Solar powered systems also improve coverage flexibility, which helps protect assets in locations that were previously unmonitored due to power constraints. Outdoor durability expectations are commonly tied to formal ingress protection concepts defined in IEC 60529, which supports clearer procurement requirements for dust and water resistance. Over time, these practical benefits can translate into fewer theft related losses, improved safety monitoring, and better accountability across distributed sites.

Emerging Trends Analysis

The solar security camera market is being influenced by technological convergence that enhances operational autonomy and sustainability. Innovations such as improved battery technologies, edge computing, artificial intelligence based object detection, and more powerful wireless communication protocols are increasingly incorporated into solar surveillance solutions.

These advancements enable cameras to function with reduced latency, higher detection accuracy, and extended operational durations without grid power reliance, which broadens their applicability across diverse geographic and environmental contexts. A second trend is the rising integration of solar security cameras into broader smart ecosystem portfolios that include cloud storage, remote monitoring, and mobile alert systems.

End users are evaluating systems not only on energy independence but also on how seamlessly they integrate with existing home, business, or public safety networks. This integration trend is contributing to increased demand for hybrid solutions that combine solar independence with advanced digital connectivity and analytics.

Opportunity Analysis

An important opportunity lies in expanding deployment in public infrastructure and smart city initiatives, where sustainable surveillance solutions align with broader environmental and urban safety objectives. Municipal and governmental projects are increasingly exploring solar powered options for monitoring traffic, public spaces, parks, and critical infrastructure sites, creating a steady demand channel beyond residential and business applications.

There is also prospect in tailoring products for the burgeoning wireless and connected security segment that includes mobile apps, cloud analytics, and third party integrations. As users value remote access and real time insights, solar security cameras that support robust digital interfacing and data analytics can capture interest from tech-savvy homeowners and enterprises seeking comprehensive security ecosystems.

Challenge Analysis

A fundamental challenge in the market is ensuring consistent performance across diverse environmental conditions. Solar powered systems must balance energy capture, storage, and consumption in environments that may experience prolonged periods of low sunlight or severe weather, which complicates design and reliability expectations. These operational demands can lead to more complex product specifications and support requirements for both vendors and customers.

Another challenge is the competitive pressure from established surveillance technologies that have deep penetration and price advantages. Traditional wired and plug-in wireless cameras continue to evolve in features such as resolution, analytics, and integration, which can make it difficult for solar based models to differentiate solely on energy independence. This competitive backdrop requires clear communication of the unique value offered by solar solutions to justify investment decisions.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Product Type

- Fixed Solar Security Cameras

- PTZ (Pan-Tilt-Zoom) Solar Security Cameras

By Resolution

- 1080p Full HD

- 2K / 4K Ultra HD

By Application

- Residential Security

- Commercial & Industrial Security

- Public Infrastructure & Remote Monitoring

- Agricultural & Wildlife Monitoring

By Sales Channel

- Online Retail

- Offline Retail (Security & Electronics Stores)

- Direct Sales from Manufacturer

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading consumer-focused brands such as Reolink Digital Technology Co., Ltd., Arlo Technologies, Inc., and Ring LLC hold strong positions in the solar security camera market. Their products combine solar charging, battery backup, and cloud-connected monitoring. AI-enabled motion detection and mobile app integration improve user experience. These companies benefit from strong brand recognition and wide online retail presence. Demand is driven by growing interest in wireless and low-maintenance home security systems.

Mid-range and value-oriented players such as Eufy, Lorex Technology, Inc., and Sunba, LLC focus on feature-rich cameras at competitive prices. Their offerings include higher resolution imaging, PTZ functionality, and local storage options. Hiseeu and ZUMIMALL strengthen adoption among cost-sensitive buyers. These players address residential and small commercial users seeking flexible outdoor surveillance.

Emerging and niche brands such as SOLIOM, Allweviee, and Victure expand product variety across regions. WYZE Labs, Inc. and Zmodo emphasize ease of use and app-based control. Other regional vendors add competitive intensity. This fragmented landscape supports rapid innovation, wider price accessibility, and growing adoption of solar-powered security cameras worldwide.

Top Key Players in the Market

- Reolink Digital Technology Co., Ltd.

- Arlo Technologies, Inc.

- Ring LLC (an Amazon company)

- Eufy (Anker Innovations)

- Lorex Technology, Inc.

- Sunba, LLC

- Hiseeu

- ZUMIMALL

- SOLIOM

- Allweviee

- Victure

- WYZE Labs, Inc.

- HeimVision

- Zmodo (Xiamen Huaxia Technology Co., Ltd.)

- SEHMUA

- Others

Recent Developments

- In March 2025, Lorex for Business launched a Mobile Solar-Powered Security Camera Trailer System through its Partner Program. The trailer boasts a 26-foot tower with 4 PTZ cameras offering 360° coverage and 25x optical zoom. Ideal for construction sites and remote areas, it runs fully off-grid, proving Lorex’s strength in rugged, temporary surveillance solutions.

- In September 2025, Eufy introduced a 3-lens security camera with a detachable 5.5W solar panel, enabling 50m pan-tilt-zoom tracking. Paired with HomeBase S380 for 99.9% accurate facial recognition and 16TB local storage, it emphasizes privacy and power independence. Eufy’s focus on multi-lens AI keeps pushing boundaries for smart, solar-powered home defense.

Report Scope

Report Features Description Market Value (2025) USD 2.2 Bn Forecast Revenue (2035) USD 10.5 Bn CAGR(2026-2035) 16.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Product Type (Fixed Solar Security Cameras, PTZ (Pan-Tilt-Zoom) Solar Security Cameras), By Resolution (1080p Full HD, 2K / 4K Ultra HD), By Application (Residential Security, Commercial & Industrial Security, Public Infrastructure & Remote Monitoring, Agricultural & Wildlife Monitoring), By Sales Channel (Online Retail, Offline Retail (Security & Electronics Stores), Direct Sales from Manufacturer) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Reolink Digital Technology Co., Ltd., Arlo Technologies, Inc., Ring LLC (an Amazon company), Eufy (Anker Innovations), Lorex Technology, Inc., Sunba, LLC, Hiseeu, ZUMIMALL, SOLIOM, Allweviee, Victure, WYZE Labs, Inc., HeimVision, Zmodo (Xiamen Huaxia Technology Co., Ltd.), SEHMUA, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Solar Security Camera MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Solar Security Camera MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Reolink Digital Technology Co., Ltd.

- Arlo Technologies, Inc.

- Ring LLC (an Amazon company)

- Eufy (Anker Innovations)

- Lorex Technology, Inc.

- Sunba, LLC

- Hiseeu

- ZUMIMALL

- SOLIOM

- Allweviee

- Victure

- WYZE Labs, Inc.

- HeimVision

- Zmodo (Xiamen Huaxia Technology Co., Ltd.)

- SEHMUA

- Others