Global Software as a Service (SaaS) Market Size, Share Analysis Report By Solution Type (Customer Relationship Management (CRM), Enterprise Resource planning (ERP), Human Capital Management, Content, Collaboration & Communication, BI & Analytics, Others), By Deployment (Public, Private), By Enterprise Size (Large Enterprises, SMEs), By Industry Vertical (BFSI, Retail & Consumer Goods, Healthcare, Education, Manufacturing, Travel & Hospitality, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152438

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

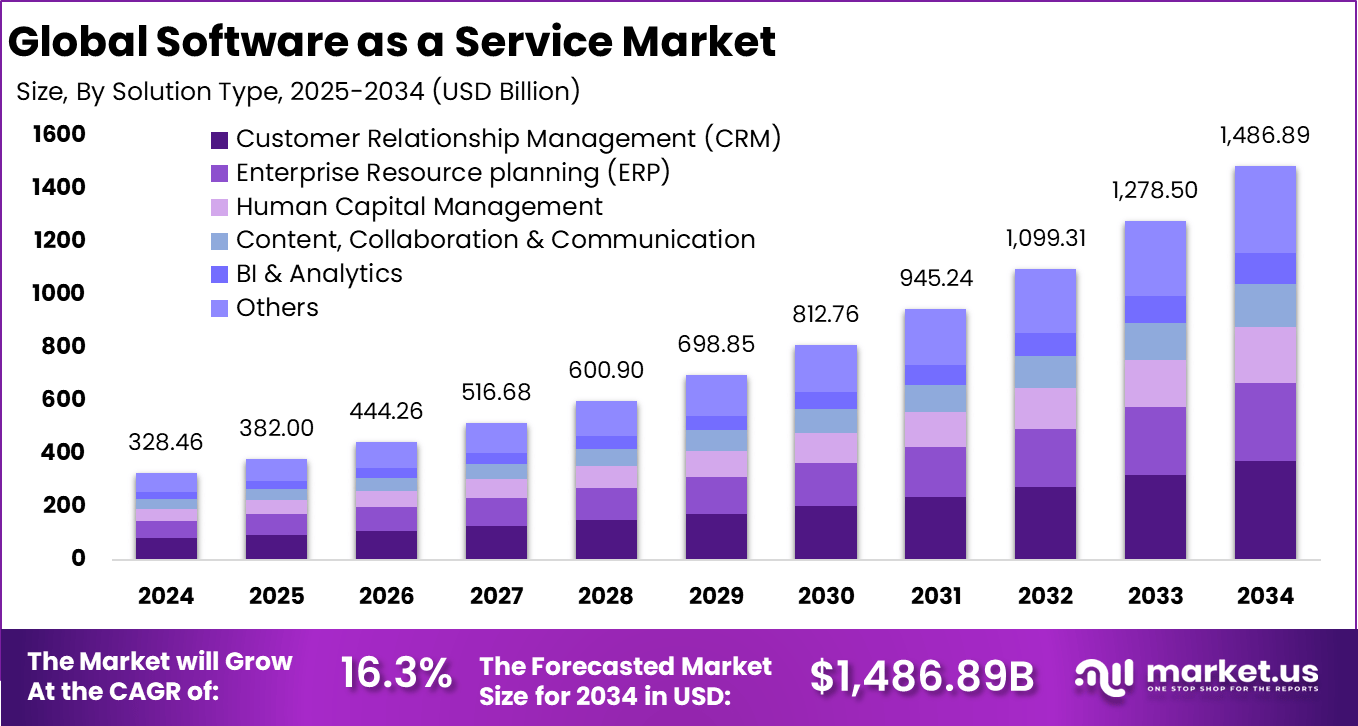

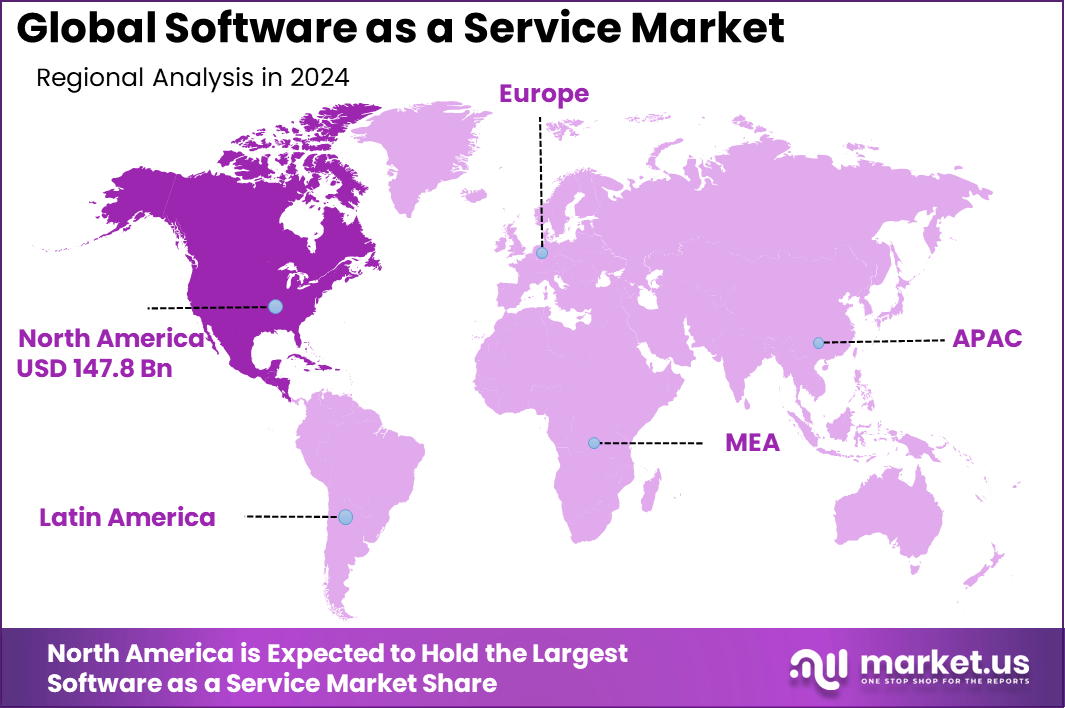

The Global Software as a Service Market size is expected to be worth around USD 1,486.89 billion by 2034, from USD 328.46 billion in 2024, growing at a CAGR of 16.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45% share, holding USD 147.8 billion in revenue.

The SaaS market comprises applications hosted in the cloud that users access via the internet on a subscription basis. End users benefit from centralized software management and reduced capital expenditure associated with on‑premises systems. The shift toward cloud‑based models has made SaaS the primary mode of deploying software solutions.

The market momentum is propelled by enterprise demand for scalable, cost‑effective tools. Organizations favor SaaS to minimize upfront investment, enable remote work, and achieve faster deployment timelines . Growth in mobile adoption, hybrid workforce trends, and digital transformation initiatives have further heightened market appeal.

Market Scope and Forecast

Report Features Description Market Value (2024) USD 328.46 Bn Forecast Revenue (2034) USD 1,486.89 Bn CAGR (2025-2034) 16.3% Largest market in 2024 North America [45% market share] For instance, In January 2024, Microsoft completed the acquisition of SoftChoice, a leading provider of SaaS solutions, for approximately USD 1.2 billion. The acquisition was aimed at reinforcing Microsoft’s position in the SaaS market while expanding its capabilities in cloud services and digital transformation, supporting its long-term growth strategy.

According to cropink, the United States leads the global SaaS landscape with 16,500 companies, nearly 9 times more than the United Kingdom, which has about 1,800. In 2024, approximately 95% of businesses had adopted SaaS solutions to optimize operations. Industry data indicate that even a 5% improvement in customer retention can raise company valuations by 25% to 95%, highlighting the critical role of retention.

Around 45% of SaaS firms identified AI accessibility as a pivotal factor driving adoption, while 92% of B2B leaders observed lower churn among customers using integrations, demonstrating integration’s tangible value. Notably, companies report it takes an average of 277 days to fully identify and contain a data breach, signaling an ongoing need for robust security practices in SaaS environments.

Based on explodingtopics, by 2023 the SaaS market had grown by about 500% over seven years and was valued at over $195 billion, making it one of the most vital technologies for business success. The U.S. continues to dominate globally with about 8 times more SaaS companies than any other nation, while cloud security has emerged as the fastest-growing segment within IT security, reflecting rising concerns around data protection and compliance.

Key Takeaway

- The global software as a service (SaaS) market is projected to reach USD 1,486.89 billion by 2034, rising from USD 328.46 billion in 2024, at a robust CAGR of 16.3% during the forecast period.

- In 2024, North America led with over 45% market share, generating approximately USD 147.8 billion in revenue, driven by strong enterprise cloud adoption.

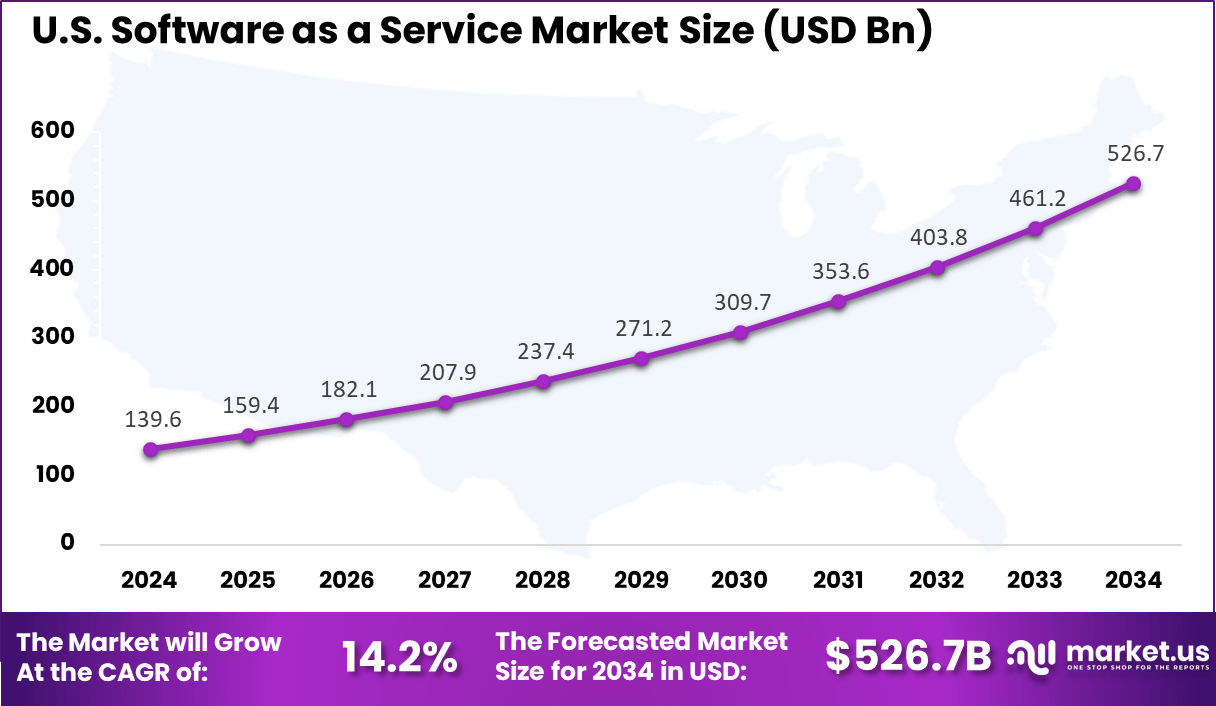

- The United States alone contributed USD 139.6 billion, growing at a CAGR of 14.2%, reflecting widespread use of SaaS in digital transformation initiatives.

- By solution type, customer relationship management (CRM) held 25% share, highlighting its critical role in customer engagement strategies.

- Public cloud deployment dominated with a 74% share, owing to scalability and lower upfront costs appealing to a wide range of businesses.

- Among enterprise sizes, large enterprises accounted for 58% share, given their higher budgets and complex operational needs.

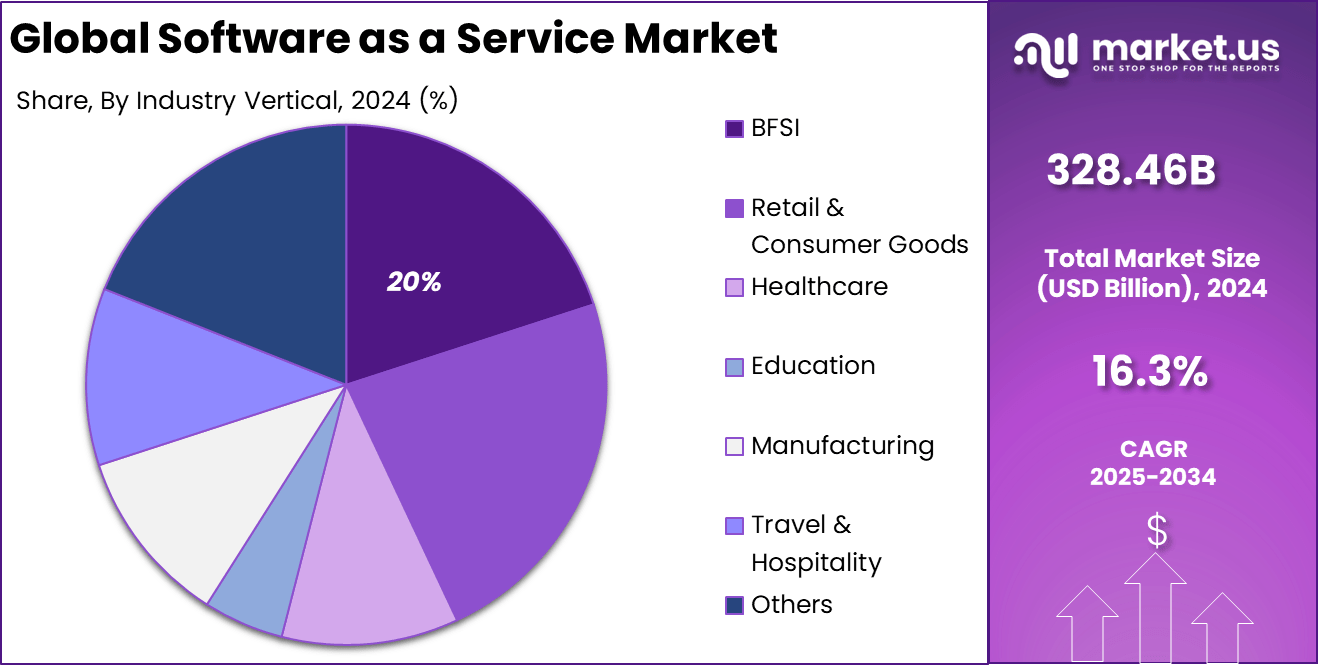

- By industry vertical, banking, financial services, and insurance (BFSI) led with 20% share, driven by demand for secure and compliant cloud services.

U.S. SaaS Market Size

The market for Software as a Service within the U.S. is growing tremendously and is currently valued at USD 139.6 billion, the market has a projected CAGR of 14.2%. The United States is experiencing a surge in demand for software as a service due to the adoption of cloud computing, strong IT infrastructure, and an emphasis on digital transformation.

The growth is fueled by the increasing demand for remote work, the need for scalable enterprise solutions, and the integration of AI-driven features. The emphasis on flexibility, safety, and innovation has led to the emergence of SaaS as an essential aspect of modern business practices and technology.

For instance, in April 2025, In April 2025, Ultimate Kronos Group expanded into India to boost global innovation and support. This move leverages India’s tech talent to enhance R&D, scale delivery, and develop enterprise SaaS solutions, strengthening U.S. leadership in the sector.

As of March 2023, the United States had approximately 17,000 SaaS companies, while Canada accounted for around 2,000. SaaS firms based in the U.S. serve nearly 14 billion customers globally, reflecting their vast reach. The U.S. SaaS industry is projected to achieve a value of about USD 225 billion by 2025, underscoring its strong growth trajectory.

In 2024, North America held a dominant market position in the Global Software as a Service Market, capturing more than a 45% share, holding USD 147.8 billion in revenue. This dominance is due to its advanced tech infrastructure, concentration of top SaaS providers, and dynamic startup ecosystem. With the rapid growth of AI, IoT, and cloud technology, coupled with strong venture capital support and a skilled workforce, innovation thrives.

The need for scalable IT solutions, extensive digital transformation, and an emphasis on cybersecurity and compliance are also contributing to advancements. With a strong cloud market presence and worldwide technology reputation, the region asserts its position as the leading player in SaaS development and deployment.

For instance, in April 2025, WHSmith implemented a cloud-based enterprise solution across its North American operations, leveraging SaaS infrastructure to enhance business agility and scalability. This initiative demonstrates the growing adoption of SaaS platforms by global retailers aiming to streamline operations, support omnichannel strategies, and drive efficiency in regional markets like North America.

Solution Type Analysis

In 2024, The Customer Relationship Management (CRM) segment held a dominant market position, capturing a 25% share of the Global Software as a Service Market. SaaS CRM is gaining popularity as companies seek to improve customer engagement, simplify sales operations, manage relationships, and extract valuable insights.

Its affordability, flexibility, and scalability make it more desirable than traditional systems. The ability to access remote areas and easily integrate with other teams makes it a practical choice. The adoption of SaaS CRM is attracting companies from diverse sectors, including retailing, healthcare, finance, IT, and telecommunications, who want to offer more personalized marketing and enhance customer engagement and support.

For instance, in February 2023, NextBigBox launched a new SaaS-based CRM platform aimed at enhancing sales and customer service operations. The solution featured intelligent automation, user-friendly design, and customizable workflows, targeting growing businesses seeking to optimize client interactions and streamline sales processes. This launch reflects the broader trend of SaaS providers delivering industry-specific tools to meet evolving enterprise needs.

Deployment Analysis

In 2024, the Public segment held a dominant market position, capturing a 74% share of the Global Software as a Service Market. This dominance is due to the public cloud’s cost-effectiveness, scalability, and ease of access, which have made it the preferred deployment model for SaaS solutions globally.

Enterprises increasingly rely on major providers like AWS, Microsoft Azure, and Google Cloud for their robust infrastructure, advanced AI capabilities, and broad geographic reach. The rise of generative AI, remote work adoption, and accelerated digital transformation across industries has further fueled demand for public cloud SaaS deployments.

For instance, In June 2025, at the Korea Innovation Convergence Summit, Korea and the U.S. reaffirmed their commitment to advancing collaboration in SaaS infrastructure and public sector innovation. The summit showcased how public cloud adoption is driving cross-border digital transformation in government and enterprise modernization.

Enterprise Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 58% share of the Global Software as a Service Market. This dominance is driven by large enterprises’ significant IT budgets, complex operational demands, and commitment to digital transformation. SaaS enables them to boost efficiency, reduce costs, and remain active in competitive markets.

Their use of multi-cloud and hybrid-cloud environments, along with PaaS solutions, supports faster innovation and efficient management of global, distributed systems. These capabilities reinforce large enterprises’ leadership in SaaS adoption and market share.

For instance, In March 2025, Zoho unveiled a global expansion strategy with a new platform model targeting large enterprises. This initiative reflects Zoho’s emphasis on providing scalable and customizable SaaS solutions tailored to complex organizational needs. By advancing its platform capabilities, Zoho aims to bolster its competitiveness in the enterprise SaaS market and drive digital transformation worldwide.

Industry Vertical Analysis

In 2024, The BFSI segment held a dominant market position, capturing a 20% share of the Global Software as a Service Market. This dominance rises from the BFSI sector’s reliance on SaaS to optimize key functions like CRM, risk management, fraud detection, and compliance.

The rise of digital banking, fintech innovation, and cloud-driven analytics has accelerated SaaS adoption. Moreover, the need for real-time data, improved customer experiences, and strong cybersecurity has made SaaS integral to the digital transformation efforts of banks and financial institutions globally.

For Instance, in June 2025, Startup Data Sutram secured $9 million in funding to expand its SaaS-based fraud detection solutions tailored for the BFSI sector. This move underscores the growing demand for advanced, cloud-native tools that enhance security and compliance in financial services. The funding will help Data Sutram scale its AI-driven analytics platform, supporting banks and financial institutions in mitigating risk and optimizing regulatory adherence.

Key Market Segments

By Solution Type

- Customer Relationship Management (CRM)

- Enterprise Resource Planning (ERP)

- Human Capital Management

- Content, Collaboration & Communication

- BI & Analytics

- Others

By Deployment

- Public

- Private

By Enterprise Size

- Large Enterprises

- SMEs

By Industry Vertical

- BFSI

- Retail & Consumer Goods

- Healthcare

- Education

- Manufacturing

- Travel & Hospitality

- Others

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of MEA

Drivers

Rapid Digital Transformation and Cloud Adoption

Enterprises globally are accelerating digital transformation to remain competitive in an increasingly data-driven economy. SaaS platforms are the key players in this shift, offering cloud-based, scalable solutions that improve operations in CRM, ERP, and collaboration domains. By enabling remote work, real-time data availability, and continuous innovation, SaaS has become a crucial factor in organizational flexibility.

For instance, in July 2024, Siemens and Panasonic announced a strategic collaboration to accelerate digital transformation through cloud-based SaaS solutions. This partnership focuses on integrating industrial software with advanced cloud infrastructure to streamline manufacturing operations and enhance scalability. It exemplifies the rapid adoption of SaaS platforms as enablers of agile, data-driven transformation across industrial sectors.

Restraint

Data Privacy and Security Concerns

Despite its benefits, the adoption of SaaS is often hindered by concerns about data security and privacy. Confidential business information stored on external servers can be vulnerable to data leaks, unauthorized access, and non-compliance with regulations. Companies in heavily regulated sectors, where data is tightly monitored and managed, face particular challenges that may hinder the momentum of SaaS adoption.

For instance, in April 2025, JPMorgan’s Chief Information Security Officer issued a warning regarding SaaS security risks, highlighting growing concerns over third-party data access and governance. As SaaS adoption accelerates across financial institutions, JPMorgan emphasized the need for stronger security frameworks, vendor transparency, and regulatory compliance to protect sensitive financial data.

Opportunities

Expansion into New Verticals

Software as a Service is becoming more prevalent in various sectors such as healthcare, finance, retail, and manufacturing. Various sectors are seeking customized, sector-specific solutions, such as online payment systems, electronic health records, and inventory control. This transition provides significant growth opportunities for providers to create specialized functionality tailored to industry and regulatory needs.

For instance, in April 2025, AI SaaS startup RapidClaims raised $8 million to advance healthcare automation. The funding will support the development and scaling of its AI-powered SaaS platform, designed to streamline claims processing and administrative workflows for healthcare providers. This reflects the growing investment in sector-specific SaaS solutions that leverage AI to drive efficiency, reduce costs, and enhance patient outcomes.

Challenges

Market Saturation and Intense Competition

There is a growing market for software as a service, especially in the areas of CRM and HRM, as well as project management. The proliferation of similar offerings has intensified competition, leading to pricing pressures and making it difficult for providers to differentiate their products. To maintain their customer base and market, SaaS companies must constantly present innovative and unique value propositions.

For instance, in November 2024, at SaaS North 2024, startups like Sonaro, Celestra, and Oasis Learning AI were named competition winners, showcasing innovation amid a saturated SaaS market. These emerging players reflect how startups are finding success by targeting niche verticals and leveraging AI to differentiate in a crowded landscape.

Latest Trends

SaaS companies are increasingly incorporating artificial intelligence and machine learning to enhance user experience and operational efficiency. By utilizing advanced analytics, intelligent automation, and highly personalized features, AI-powered SaaS solutions are creating new revenue streams for users. This change transforms AI from being just another add-on to being a critical competitive edge in an increasingly congested market.

For instance, in July 2025, Alekta Solutions, based in Hyderabad, unveiled its next-gen AI-powered SaaS platform, Pinaka, aimed at transforming enterprise automation and decision-making. This platform integrates advanced AI capabilities to deliver real-time analytics, intelligent workflow management, and enhanced scalability. The launch underscores the growing role of AI-driven SaaS solutions in supporting digital transformation and operational agility for businesses across sectors.

Key Players Analysis

Adobe Inc., Microsoft, and Google LLC dominate the SaaS market by offering advanced cloud-based productivity tools. Their growth is driven by AI integration, strong security, and seamless scalability. Strategic acquisitions and innovative solutions help them expand into new customer segments and strengthen enterprise adoption of cloud services.

Salesforce, Oracle, and SAP SE lead in enterprise SaaS with expertise in CRM, ERP, and analytics. Their success stems from customizable, industry-specific solutions and hybrid cloud capabilities. Investments in automation and data-driven insights continue to enhance operational efficiency and customer loyalty.

IBM, Alibaba Cloud, VMware, ServiceNow, Cisco, Atlassian, IONOS Cloud, Rackspace, and others focus on niche SaaS segments. They emphasize integration, flexibility, and technical support to attract enterprises and SMEs. Workflow automation, AI-powered platforms, and specialized services sustain their competitive edge in a dynamic global market.

Top Key Players in the Market

- Adobe Inc.

- Microsoft

- Alibaba Cloud International

- IBM Corporation

- Google LLC

- Salesforce, Inc.

- Oracle

- SAP SE

- Rackspace Technology, Inc.

- VMware Inc.

- IONOS Cloud Inc.

- Cisco Systems, Inc.

- Atlassian

- ServiceNow

- Other Key Players

Recent Developments

- In May 2025, Clearent by Xplor launched Xplor Capital, an embedded financing solution enabling SaaS providers to integrate merchant financing into their platforms. This innovation builds on the successful rollout of Xplor Capital for small businesses, enhancing financial accessibility within software ecosystems.

- In April 2025, SailPoint introduced its first SaaS instance in the Middle East, reinforcing its global expansion strategy and supporting digital transformation. This investment aims to address the rising demand for advanced identity security solutions across strategic international markets.

- In December 2024, Workiva announced seamless data integration across over 100 cloud, on-premise, and SaaS applications, including Oracle ERP Cloud and its Wdesk platform, improving enterprise connectivity and operational efficiency.

- In December 2024, TeraRecon unveiled a unified SaaS cloud platform combining its Intuition Advanced Visualization, Eureka Clinical AI, and CARAai. This platform offers healthcare organizations consistent, AI-enabled workflows and easier access to clinical tools across networks and locations.

- In November 2024, AppOmni partnered with Cisco’s Security Service Edge to deliver a zero-trust security solution for SaaS applications. This collaboration enhances visibility and protection of SaaS configurations and user behavior from endpoints to cloud platforms.

- In October 2024, Salesforce introduced Government Cloud Premium, a SaaS and PaaS solution tailored for U.S. national security and intelligence organizations. This platform provides a secure environment for application development with no-code, low-code, and pro-code capabilities, addressing sensitive mission-critical needs.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2033 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution Type (Customer Relationship Management (CRM), Enterprise Resource planning (ERP), Human Capital Management, Content, Collaboration & Communication, BI & Analytics, Others), By Deployment (Public, Private), By Enterprise Size (Large Enterprises, SMEs), By Industry Vertical (BFSI, Retail & Consumer Goods, Healthcare, Education, Manufacturing, Travel & Hospitality, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Adobe Inc., Microsoft, Alibaba Cloud International, IBM Corporation, Google LLC, Salesforce, Inc., Oracle, SAP SE, Rackspace Technology, Inc., VMware Inc., IONOS Cloud Inc., Cisco Systems, Inc., Atlassian, ServiceNow, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Software as a Service (SaaS) MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Software as a Service (SaaS) MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe Inc.

- Microsoft

- Alibaba Cloud International

- IBM Corporation

- Google LLC

- Salesforce, Inc.

- Oracle

- SAP SE

- Rackspace Technology, Inc.

- VMware Inc.

- IONOS Cloud Inc.

- Cisco Systems, Inc.

- Atlassian

- ServiceNow

- Other Key Players