Global Softgel capsule Market By Type(Gelatin-Based/Animal-Based, Non-Animal-Based) By Application(Antacid and Anti-Flatulent Preparation, Anti-Anemic Preparations, Anti-Inflammatory Drugs, and other)By End-use-(Pharmaceutical Companies, Nutraceutical Companies, Cosmeceutical Companies, Contract Manufacturing Organization) by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 29378

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

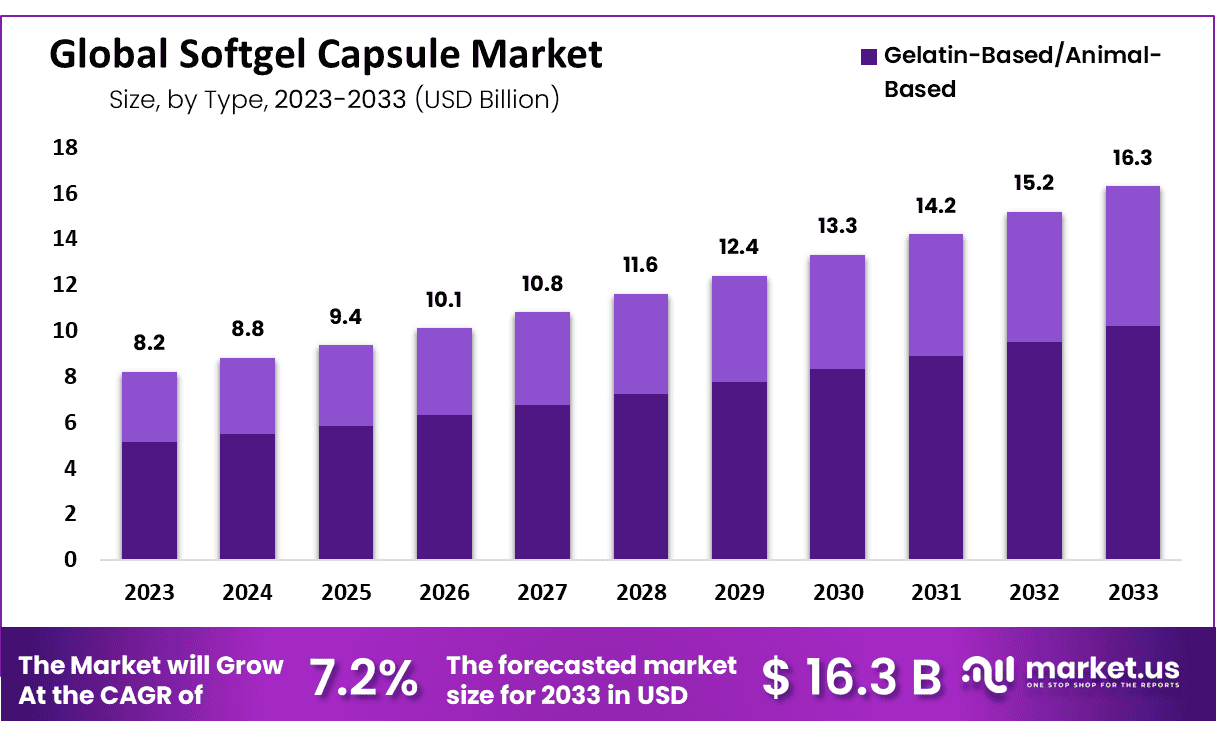

The Global Softgel Capsule Market size is expected to be worth around USD 16.3 Billion by 2033 from USD 8.2 Billion in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

Softgel capsules are used to transport liquid or powdered medications quickly through their dissolution rate compared with hard gelatin capsules, typically administered orally and consisting of gelatin films infused with plasticizers such as sorbitol or similar polyols such as glycerine for rapid disintegration. Common forms are oval, round, oblong tub and suppository forms and their popularity continues to increase, particularly among individuals experiencing difficulty swallowing medications in alternative forms, such as children or the elderly – their consumption making them increasingly desirable among patients alike.

Softgel capsules have many advantages, including ease of swallowing, taste, and odor masking as well as increased bioavailability, atmospheric stability, improved absorption, and bioavailability. Modern manufacturing technology allows for more benefits to traditional capsules. These benefits include controlled drug release, tamper-evident, and the ability to articulate potent APIS. They also have attractive aesthetics and longer shelf life.

Softgel manufacturers have been concentrating on the development of non-gelatin-based capsules that use plant-based polymers in recent years. Starch, HPMC, and gums like Pullulan are all important ingredients. Vegetarians can take gelatin-free capsules for their medicinal needs.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Size & Growth: Softgel Capsule Market size is expected to be worth around USD 16.3 Billion by 2033 from USD 8.2 Billion in 2023, growing at a CAGR of 7.2%.

- Type Analysis: Gelatin-Based/Animal-Based excipients were at the top of this market dominate 62.5 % market share in 2023

- Application Analysis: The largest share, 36.6%, was attributed to the vitamins & dietary supplement segment in 2023

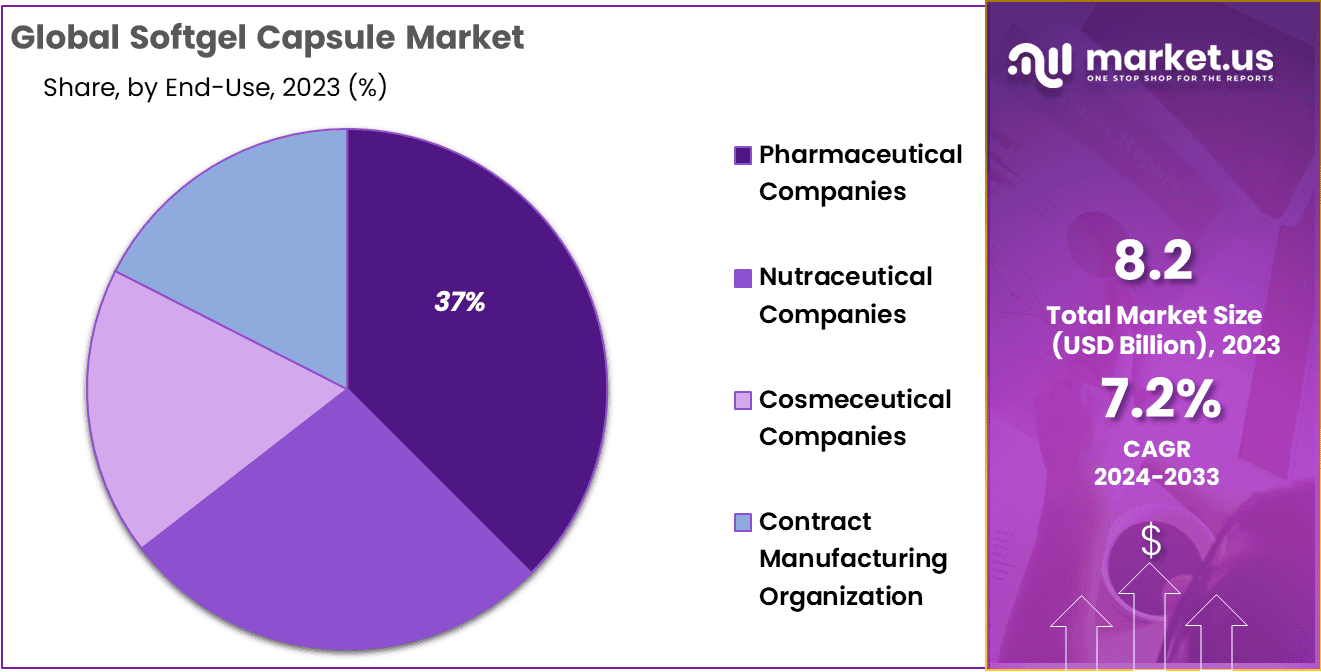

- End-Use Analysis: In 2023, the nutraceutical sector accounted for 37.5% of the total market

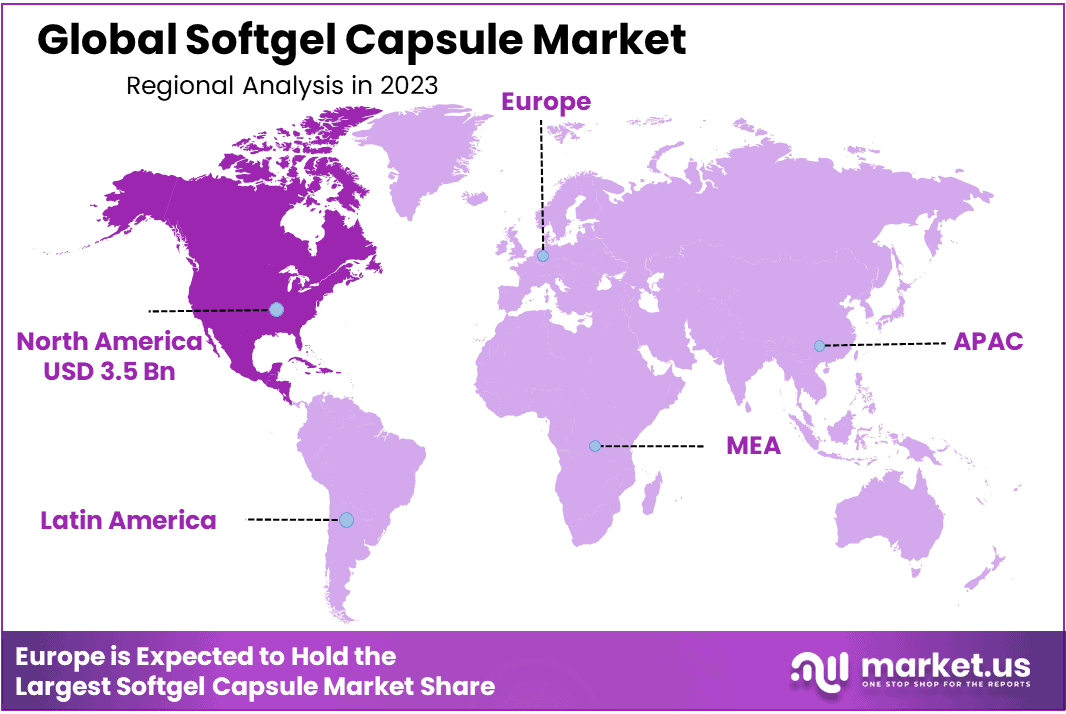

- Regional Analysis: North America holds the largest market share, 42.7 % and holding USD 3.5 Bn market revenuein Soft gels in 2023

- Advantages and Innovations: Softgel capsules have many advantages that include improved absorption, easier swallowing and enhanced bioavailability. Tamperproof features as well as plant-based formulations are among their many innovations.

- Pharmaceutical and Nutraceutical Applications: Softgel capsules’ versatility has long made them popular with pharmaceutical and nutraceutical producers, contributing to their widespread adoption.

- Personalization and Customization: One notable trend involves customizing softgel capsules specifically to meet individual patient requirements as part of healthcare’s move toward precision medicine.

Type Analysis

Gelatin-Based/Animal-Based excipients were at the top of this market dominate 62.5 % market share in 2023, providing manufacturers with distinct advantages over its long history as an excipient. Attributes such as easy digestion, efficient production of tamper-evident capsules, superior mechanical resistance, superior seal quality seals, patient compliance, abundance availability and its clean label nature have led to its wide adoption.

Gelatin remains a top excipient choice in pharmaceutical formulations due to its many desirable characteristics, making it the go-to excipient. Modern practices involve mixing bovine and porcine gelatin sources together for maximum effect: bovine sources provide additional firmness while porcine-sourced gelatin adds plasticity and clarity for improved formulation performance.

Manufacturers are now using a mixture of porcine and bovine gelatin to create capsules. This is because of their classic features. Bovine gelatin increased capsule firmness while porcine gelatin added plasticity and clarity to the articulation. Non-animal capsules showed an 10.2% CAGR despite the benefits of gelatin-based capsules. Market growth will be boosted by increased demand for vegan medication, especially after the COVID-19 pandemic.

Application Analysis

The largest share, 36.6%, was attributed to the vitamins & dietary supplement segment in 2023. Vitamins can be affected by atmospheric oxidation and degrading when they are packaged as tablets or gummies. Softgel capsules are the best choice because they protect from UV radiation and oxidation, thus increasing their shelf life.

Research shows that vitamins taken in soft gel capsules are more easily absorbed into the bloodstream than those in tablet form. Softgel capsules are a popular form of the vitamin, which has led to a large market share in this application segment. This segment saw the highest CAGR (8%) during the forecast period. The pandemic triggered a surge in Vitamin D and C sales in countries like India and USA.

Because of the increased acceptance of healthy lifestyles among the masses in order to combat the pandemic, health supplements occupied second place in the application segment. Pre- and post-natal soft gel capsules were well received, which led to an increase in sales, which aided in the growth of the pregnancy market. Market share for antibacterial and antibacterial drugs, anti-flatulent and antacid preparations, anti-inflammatory drugs, and anti-emetic preparations has been descending.

End-use Analysis

In 2023, the nutraceutical sector accounted for 37.5% of the total market. Nutraceutical companies are primarily focused on the development of vitamins, minerals, health supplements, and other nutritional products. Softgel formulations are a major part of the development of nutraceutical products. These formulations make up nearly 32% of all nutraceutical manufacturers’ total revenue.

Its high market shares and growth has been because of its large market share and increasing awareness among developing countries about health supplements. Because of the increased collaboration with SMEs, outsourcing of soft gel capsules, and the increase in sales, Pharma occupied the second largest market share. This directly influenced the growth of the Contract Manufacturing Organization (CMO). Softgel capsule production has increased in the cosmeceutical sector because of the growing demand for hair and skin care products.

*Actual Numbers Might Vary In The Final Report

Kеу Маrkеt Ѕеgmеntѕ

Type

- Gelatin-Based/Animal-Based

- Non-Animal-Based

Application

- Antacid and Anti-Flatulent Preparation

- Anti-Anemic Preparations

- Anti-Inflammatory Drugs

- Antibiotic and Antibacterial

- Cough and Cold

- Health Supplement

- Vitamin and Dietary Supplement

- Pregnancy

End-use

- Pharmaceutical Companies

- Nutraceutical Companies

- Cosmeceutical Companies

- Contract Manufacturing Organization

Drivers

Consumer-Friendly Dosage Forms

Softgel capsules have become increasingly popular due to their consumer-friendly features. Their user-friendliness, including easy swallowing and lack of an unpleasant flavor makes them popular with patients, particularly children and elderly individuals. As more users seek user-friendly medications, demand increases driving market growth for softgel capsules.

Advancements in Drug Delivery Technologies

Technological innovations in drug delivery systems have had an immediate effect on softgel capsule markets. Softgels offer an efficient and user-friendly means for dispensing both pharmaceutical and nutraceutical products; innovating in formulation technologies enables better bioavailability and sustained release capabilities that increase market appeal thereby driving their use across therapeutic disciplines.

Trends

Involve Nutraceuticals and Dietary Supplements Rising Preference

Softgel capsules provide the optimal delivery system for nutraceuticals and dietary supplements designed to promote prevention of illness and wellness worldwide, with softgels providing improved bioactive compound absorption. Increased awareness about nutrition’s role in maintaining overall health is fuelling this trend toward including softgels in nutraceutical formulations.

Personalizing softgel capsules is possible through customization and personalization services

Market trends indicate a shift toward customizing and personalizing softgel capsules for specific patient needs, using personalized medicine concepts. This movement aligns with healthcare’s shift towards precision medicine – opening opportunities for niche markets and specialty formulations.

Restrictions

Raw Materials Fluctuations

Softgel capsule markets can be susceptible to fluctuations in raw material prices, particularly gelatin which forms the core ingredient for softgel formulation. Any changes in supply and pricing of gelatin could have detrimental ramifications on manufacturing costs as well as decreasing profits margins for market players.

Stringent Regulatory Requirements

Compliance with regulatory standards and requirements presents one of the main obstacles for companies operating in the softgel capsule industry. Meeting stringent regulations related to product quality, safety and labeling demands significant investments in research & development and quality control – but adherence may impose restrictions for smaller firms with limited resources.

Opportunities

Expanding Applications within Pharmaceutical Sector

Pharmaceutical sectors present immense growth prospects for softgel capsules as the versatile nature of softgels enables targeted drug delivery, improved bioavailability and enhanced patient compliance. As pharmaceutical companies explore novel therapeutic formulations, softgel demand should increase accordingly.

Softgel Capsules Containing Cannabis-derived Ingredients Gain Incredibility in Demand

As legalization spreads and acceptability increases for medicinal and recreational cannabis use, softgel capsules present an outstanding opportunity in the cannabis industry. Softgels allow a reliable means of administering cannabis-based products with accurate dosing control ensuring ease-of-use – this may increase as demand for reliable softgel formulations grow over time.

Regional Analysis

North America holds the largest market share, 42.7 % and holding USD 3.5 Bn market revenuein Soft gels in 2023. The region has major players and improved production technology. They also have increased R&D spending to expand their product range. The largest market share is also because of the presence in the region of pharma leaders and health-conscious consumers.

APAC, however, is the fastest-growing market with a CAGR of 8.7%. Its high growth is because of the large presence of generic medicine producers in China and India, rising demand for cost-efficient therapies, rapidly growing economic conditions, and rise in contract manufacturing organizations within the region.

European market growth will be boosted by the increase in personalized medicine spending and the adoption of high-tech processing to produce soft gels more efficiently.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Due to the existence of contract producers and SMEs around the world, the market is extremely fragmented. Large manufacturers are increasingly outsourcing soft gel capsules to reduce their equipment costs and ensure a fair price for the market. Market leaders conduct research to develop capsules, tablets in capsules, and controlled-release medication to protect their market position.

Market leaders are focused on strengthening their manufacturing capabilities to acquire a strong position. purchased an Oxfordshire facility to increase biologics capabilities within the U.K. Europe and the Middle

Market Key Players

- Fuji Capsule

- Sirio Pharma Co., Ltd.

- CAPTEK Softgel International Inc.

- Thermo Fisher Scientific Inc.

- EyePoint Pharmaceuticals, Inc.

- Catalent, Inc.

- EuroCaps

- Aenova Group

- Lonza Capsules & Health Ingredients

- ProCaps Laboratories, LLC

- Soft Gel Technologies, Inc.

Recent Developments

- February 2023: Thermo Fisher Scientific Inc. Announced the acquisition of Aenova Group, a leading provider of softgel capsule manufacturing services.

- March 2023: Fuji Capsule Announced the launch of its new F-Series softgel encapsulators, offering improved automation and production efficiency.

- May 2023: EyePoint Pharmaceuticals, Inc. Received FDA approval for its YUTIQ® (fluocinolone acetonide) intravitreal implant in a softgel delivery system.

- October 2023: Catalent, Inc. Announced a new partnership with Lonza Capsules & Health Ingredients to develop and commercialize new innovative softgel technologies.

Report Scope

Report Features Description Market Value (2023) USD 8.2 Billion Forecast Revenue (2033) USD 16.3 Billion CAGR (2024-2033) 7.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type-(Gelatin-Based/Animal-Based, Non-Animal-Based;By Application-(Antacid and Anti-Flatulent Preparation, Anti-Anemic Preparations, Anti-Inflammatory Drugs, Antibiotic and Antibacterial, Cough and Cold, Health Supplement, Vitamin and Dietary Supplement, Pregnancy);By End-use-(Pharmaceutical Companies, Nutraceutical Companies, Cosmeceutical Companies, Contract Manufacturing Organization) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Fuji Capsule, Sirio Pharma Co., Ltd., CAPTEK Softgel International Inc., Thermo Fisher Scientific Inc., EyePoint Pharmaceuticals, Inc., Catalent, Inc., EuroCaps, Aenova Group, Lonza Capsules & Health Ingredients, ProCaps Laboratories, LLC, Soft Gel Technologies, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a softgel capsule?A softgel capsule is a type of capsule designed to contain liquid or powdered medications. It dissolves more quickly than hard gelatin capsules and is often preferred for its ease of swallowing.

How big is the Softgel Capsule Market?The global Softgel Capsule Market size was estimated at USD 34.0 Billion in 2023 and is expected to reach USD 56.4 Billion in 2033.

What is the Softgel Capsule Market growth?The global Softgel Capsule Market is expected to grow at a compound annual growth rate of 5.2%. From 2024 To 2033

Who are the key companies/players in the Softgel Capsule Market?Some of the key players in the Softgel Capsule Markets are Fuji Capsule, Sirio Pharma Co., Ltd., CAPTEK Softgel International Inc., Thermo Fisher Scientific Inc., EyePoint Pharmaceuticals, Inc., Catalent, Inc., EuroCaps, Aenova Group, Lonza Capsules & Health Ingredients, ProCaps Laboratories, LLC, Soft Gel Technologies, Inc.

What are the key advantages of softgel capsules?Softgel capsules offer advantages such as improved absorption, enhanced bioavailability, ease of swallowing, and effective taste and odor masking.

How are softgel capsules made?Softgel capsules are primarily made from gelatin films that have been plasticized with substances like sorbitol, glycerine, or similar polyols. Advances in technology also allow for the production of plant-based softgel capsules.

What shapes do softgel capsules come in?Softgel capsules come in various shapes, including oval, round, oblong, tubs, and suppository forms.

-

-

- Fuji Capsule

- Sirio Pharma Co., Ltd.

- CAPTEK Softgel International Inc.

- Thermo Fisher Scientific Inc.

- EyePoint Pharmaceuticals, Inc.

- Catalent, Inc.

- EuroCaps

- Aenova Group

- Lonza Capsules & Health Ingredients

- ProCaps Laboratories, LLC

- Soft Gel Technologies, Inc.