Global Smart Wearable Band Market Size, Share, Statistics Analysis Report By Type (Wellness Monitoring, Fitness Management), By Operating System (Android, iOS), By End-User (Adult, Children), By Distribution Channel (Online Stores, Offline Stores), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 133037

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

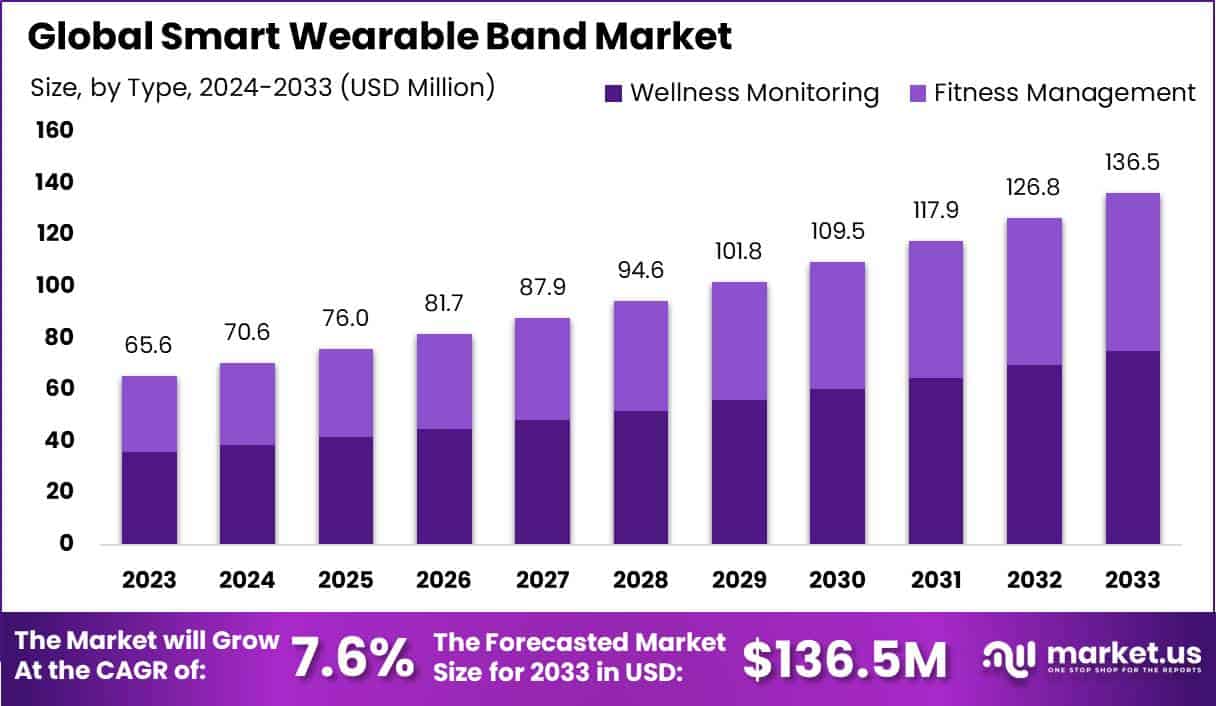

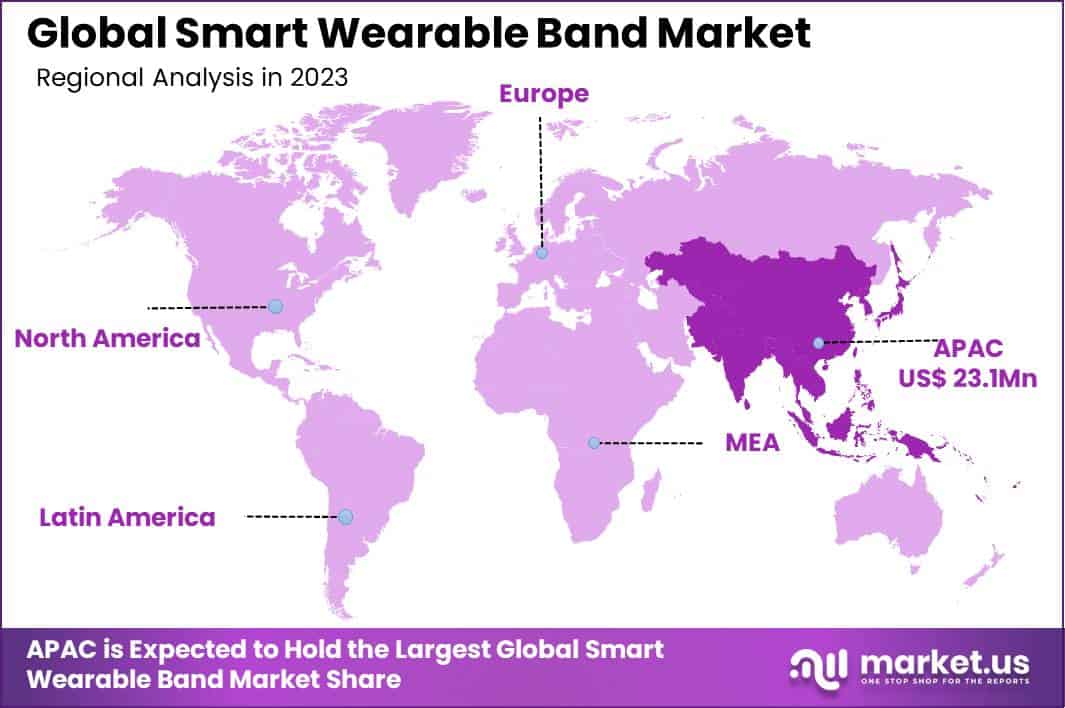

The Global Smart Wearable Band Market size is expected to be worth around USD 136.5 Billion By 2033, from USD 65.6 Billion in 2023, growing at a CAGR of 7.60% during the forecast period from 2024 to 2033. In 2023, the Asia-Pacific region led the Smart Wearable Band Market, accounting for over 35.2% of the market share and generating USD 23.1 billion in revenue.

Smart wearable bands are a subset of wearable technology primarily designed to track and measure physical activity and health metrics such as heart rate, steps taken, sleep patterns, and calorie consumption. These devices are typically more lightweight and affordable compared to smartwatches, focusing on basic functionality without extensive additional features.

Smart bands are designed for ease of use and durability, often featuring weatherproof and sweat-resistant qualities, making them ideal for continuous wear during various physical activities. The market for smart wearable bands is growing, driven by an increasing awareness of health and fitness. These devices are marketed as essential tools for anyone looking to monitor their physical activity and manage their personal health proactively.

The appeal of smart bands also lies in their affordability and simplicity, attracting consumers who may not wish for the complexity or higher cost associated with smartwatches. As technology evolves, these bands are incorporating more advanced features like NFC payments and Bluetooth connectivity, which broadens their utility beyond mere fitness tracking.

The growth of the smart wearable band market is significantly driven by the rising prevalence of lifestyle diseases and a growing inclination towards fitness and healthy living. Technological advancements that allow for more accurate tracking and monitoring of health metrics also contribute to the market’s expansion. Furthermore, the integration of features like mobile notifications and music control, even in simpler devices, enhances user convenience, making these bands appealing to a broader audience.

Recent advancements in smart wearable technology include improved battery life, enhanced display readability, and the incorporation of sensors that provide more granular data on health and fitness. The development of proprietary apps that sync seamlessly with smartphones has made it easier for users to track their progress and maintain engagement with their health metrics.

Future innovations are likely to focus on increasing the accuracy of health data and integrating more smartphone-like features into these devices, potentially bridging the gap between smart bands and smartwatches. Market demand for smart wearable bands is bolstered by the trend of quantified self, where individuals use technology to track their personal data to enhance health and productivity.

The versatility and evolving capabilities of these bands, such as sleep tracking and heart rate monitoring, cater to various user needs, from casual fitness enthusiasts to serious athletes. There is a substantial opportunity for growth in developing regions where awareness and affordability are aligning more with the global trends in health technology

Key Takeaways

- The Global Smart Wearable Band Market is projected to reach USD 136.5 billion by 2033, up from USD 65.6 billion in 2023, growing at a compound annual growth rate (CAGR) of 7.60% from 2024 to 2033.

- In 2023, the Wellness Monitoring segment dominated the smart wearable band market, capturing over 55% of the market share.

- The Android segment held a dominant position in the market in 2023, accounting for more than 65% of the market share.

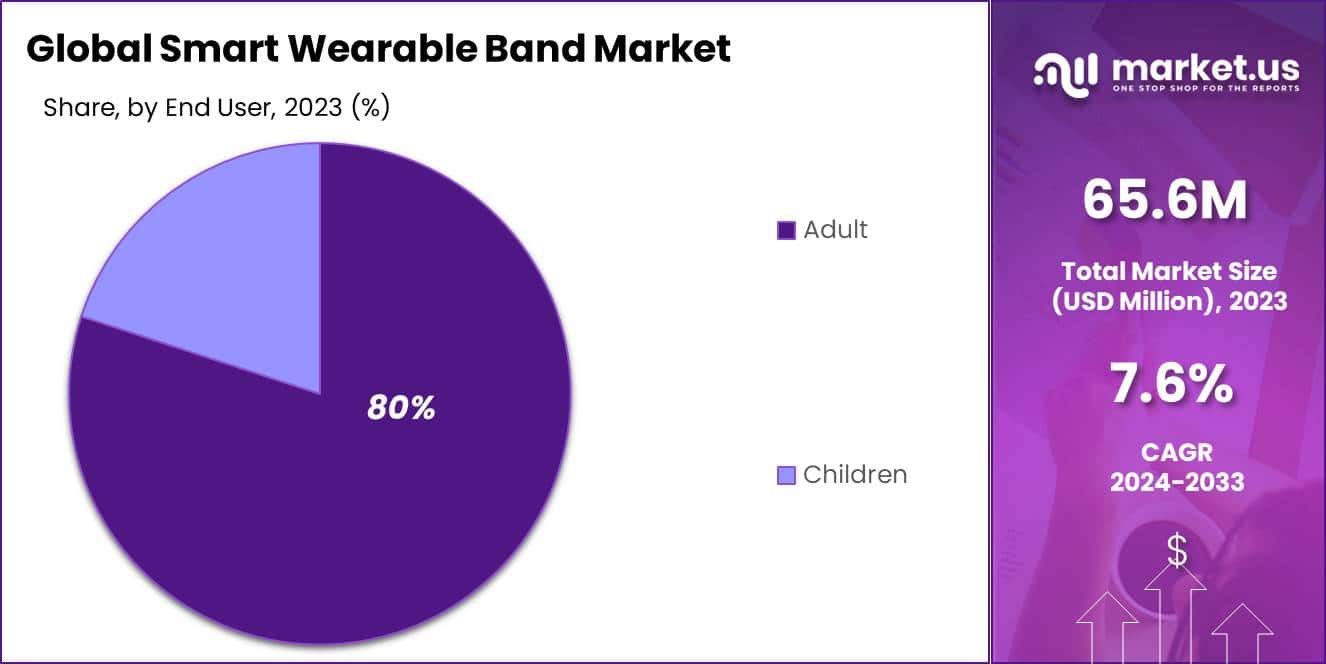

- The Adult segment led the market in 2023, capturing more than 80% of the share within the smart wearable band sector.

- The Online Stores segment was the largest sales channel for smart wearable bands in 2023, holding more than 58% of the market share.

- In 2023, the Asia-Pacific region held a dominant market share of over 35.2%, generating USD 23.1 billion in revenue from smart wearable band sales.

Type Analysis

In 2023, the Wellness Monitoring segment held a dominant market position within the smart wearable band market, capturing more than a 55% share. This segment primarily focuses on health-related metrics such as heart rate monitoring, sleep analysis, and stress tracking.

The increasing consumer emphasis on health and preventive care has propelled the demand for wellness monitoring devices. As people become more health-conscious, especially in the wake of the pandemic, there is a growing preference for devices that offer detailed insights into one’s daily health and well-being.

The leadership of the Wellness Monitoring segment can also be attributed to technological advancements that have enhanced the accuracy and functionality of these devices. Innovations in sensor technology and data analysis have enabled these wearables to provide more precise and useful health metrics.

Many healthcare providers and insurers are now partnering with wearable technology companies to incorporate these devices into their preventive and monitoring programs. This integration has helped boost the credibility and perceived value of wellness monitoring bands, further driving their adoption among consumers looking for reliable health monitoring tools.

Operating System Analysis

In 2023, the Android segment held a dominant market position in the smart wearable band market, capturing more than a 65% share. This substantial market share can be attributed primarily to Android’s widespread adoption across multiple device manufacturers, offering consumers a wide array of products at various price points.

Android’s open-source platform allows for greater customization and integration with a multitude of apps and devices, enhancing user experience and accessibility.

The compatibility of Android with various hardware manufacturers also means that consumers are not restricted to a specific brand, making Android wearable bands highly appealing. Additionally, Android devices often provide more options in terms of features and price, making them accessible to a broader audience.

Moreover, continuous improvements and updates to the Android operating system have kept it at the forefront of wearable technology. Features such as improved battery life, enhanced health tracking capabilities, and seamless integration with Android smartphones have made these wearable bands highly functional and desirable.

End-User Analysis

In 2023, the Adult segment held a dominant market position in the smart wearable band market, capturing more than an 80% share. This significant market share can primarily be attributed to the increasing health awareness among adults and their higher spending power compared to other age groups.

Adults, particularly those in midlife, are increasingly prioritizing health and fitness, making them more inclined to invest in these devices. Also, the integration of advanced technology in wearable bands are tailored for adults. These devices often include features like stress tracking, advanced workout modes, and integration with smartphones and other smart devices, appealing particularly to tech-savvy consumers and fitness enthusiasts.

Marketing strategies also play a crucial role in the dominance of this segment. Manufacturers and marketers specifically target adult consumers with campaigns that emphasize lifestyle enhancement, health improvement, and connectivity. Such targeted marketing effectively taps into the lifestyle aspirations and health goals of adult consumers, driving further adoption.

Distribution Channel Analysis

In 2023, the Online Stores segment held a dominant market position in the smart wearable band market, capturing more than a 58% share. This dominance is largely due to the convenience and widespread accessibility of online shopping platforms.

Consumers increasingly prefer the ease of comparing prices, features, and reviews from the comfort of their homes, which online stores readily facilitate. Additionally, the ability to access a broader range of products than is typically available in physical stores has made online purchasing more appealing.

The growth of e-commerce infrastructure and the enhancement of secure payment systems have also played pivotal roles in the success of online stores. Improvements in logistics and delivery services, including faster shipping options and easy return policies, have made online shopping for smart wearable bands a more reliable and satisfying experience for consumers.

Exclusive online discounts and promotions further propel the attractiveness of the online segment. Many manufacturers partner with online platforms to offer exclusive deals, early access to new products, and bundles that are not available in offline stores driving huge sales.

Key Market Segments

By Type

- Wellness Monitoring

- Fitness Management

By Operating System

- Android

- iOS

By End-User

- Adult

- Children

By Distribution Channel

- Online Stores

- Offline Stores

Driver

Growing Health Awareness and Fitness Tracking

The rising global awareness of health and wellness is a significant driver for the adoption of smart wearable bands. More people are becoming conscious of their physical fitness, with an increasing emphasis on tracking daily activities, heart rate, sleep patterns, and other health metrics.

Smart bands offer real-time health monitoring and personalized insights, making it easier for users to maintain healthier lifestyles. This trend is particularly strong among millennials and Gen Z, who prioritize fitness and technology integration into their daily routines.Moreover, healthcare providers are starting to incorporate wearable data into preventive care and chronic disease management.

Restraint

Privacy and Data Security Concerns

Privacy and data security concerns are significant restraints for the smart wearable band market. As these devices continuously collect sensitive health and personal data, consumers are increasingly worried about how this information is being stored, shared, and protected. Smart bands often sync with mobile applications and cloud services, which introduces potential vulnerabilities.

High-profile data breaches and concerns over misuse of personal health data have made users cautious. Inadequate regulations and inconsistencies in data protection laws across different regions add to the complexity. Many people fear that their data could be sold to third parties without their consent, leading to targeted advertising or worse, identity theft. Moreover, smaller and newer companies may not have the resources or expertise to implement robust security measures, further intensifying these concerns.

Opportunity

Integration with IoT Ecosystems

The integration of smart wearable bands with broader Internet of Things (IoT) ecosystems presents a significant market opportunity. As IoT becomes increasingly mainstream, there is a growing demand for devices that seamlessly connect and communicate with each other.

Smart wearable bands, when paired with smart home systems, health devices, and virtual assistants, offer a more comprehensive and personalized user experience. For example, a wearable band can automatically adjust a smart thermostat based on the user’s physical activity level, or remind them to hydrate based on body metrics.

This interconnected experience appeals to tech-savvy consumers who value convenience and efficiency. The trend extends to healthcare, where wearable bands can sync with medical devices, providing doctors with real-time patient data and enabling remote monitoring. The potential for creating a connected, health-centric lifestyle encourages further adoption, driving market growth.

Challenge

Limited Battery Life and Comfort Issues

One of the key challenges faced by smart wearable bands is balancing battery life with device functionality and user comfort. Advanced features, such as continuous health monitoring, GPS tracking, and real-time data processing, consume significant battery power, often requiring frequent recharging. This can be inconvenient for users who expect their wearables to last for extended periods without disruption.

At the same time, efforts to extend battery life often involve trade-offs, such as bulkier designs, which may reduce the comfort and aesthetic appeal of the device. Many users prioritize lightweight and comfortable designs, as smart bands are typically worn for long durations, including during sleep. Achieving a slim form factor without compromising on essential features or battery longevity remains a technical hurdle for manufacturers.

Emerging Trends

Smart wearable bands have evolved significantly, integrating advanced technologies to offer users comprehensive health and fitness insights. A notable trend is the shift from basic activity tracking to more sophisticated health monitoring. Modern devices now measure metrics such as heart rate variability, blood oxygen levels, and sleep patterns, providing users with a holistic view of their well-being.

Another emerging trend is the miniaturization and diversification of wearable devices. Beyond traditional wristbands, smart rings and other forms of jewelry are gaining popularity. These devices offer similar functionalities in a more discreet form factor, appealing to users who prefer subtlety.

Integration with artificial intelligence (AI) is also enhancing the capabilities of wearable bands. AI algorithms analyze collected data to offer personalized health recommendations, predict potential health issues, and suggest lifestyle adjustments. This intelligent feedback loop empowers users to make informed decisions about their health.

Business Benefits

- Enhanced Employee Productivity: Wearables can boost productivity by reducing non-essential activities, allowing employees to focus on their core tasks. For instance, smartwatches enable timely notifications, helping staff stay informed and responsive.

- Streamlined Communication and Notifications: Wearable bands allow employees to receive instant notifications for important emails, messages, or meeting reminders, keeping them connected while reducing the need to check other devices.

- Health and Wellness Monitoring: Wearables can track vital health metrics such as heart rates, sleep patterns, and physical activity, enabling businesses to invest in wellness programs that promote employee health.

- Safety Enhancements: In industries like manufacturing, wearable devices play a crucial role in enhancing safety by monitoring environmental conditions and tracking worker movements. These devices can alert employees to potential hazards preventing accidents and improve safety protocols.

- Cost Efficiency and Sustainability: Integrating wearable devices into business operations can lead to cost savings by reducing the need for more expensive equipment. Additionally, these devices contribute to sustainability goals by reducing paper usage and promoting healthier lifestyles among employees.

Regional Analysis

In 2023, the Asia-Pacific region held a dominant position in the Smart Wearable Band Market, capturing more than a 35.2% share and generating USD 23.1 billion in revenue. This region’s leadership in the market can be attributed to several factors that have synergistically propelled its growth.

Asia-Pacific benefits from a rapidly expanding consumer base that is increasingly tech-savvy and health-conscious, driving demand for smart wearable technology that can monitor health metrics like heart rate, calories burned, and sleep quality.

Another key driver for the Asia-Pacific market is the strong presence of leading electronics manufacturers in countries such as China, South Korea, and Japan. These countries are home to major players in the electronics industry, who are at the forefront of research and development in wearable technology. This regional cluster of high-tech manufacturing and design innovation enables rapid iterations and improvements in wearable devices.

Governmental support in the region for digital and health technology sectors also plays a crucial role. Many governments in the Asia-Pacific region have initiatives in place that promote the adoption of fitness and health monitoring technologies, which are seen as tools to reduce healthcare costs and improve the quality of life for their populations.

Overall, the trend towards a more connected lifestyle and the integration of wearable devices with smartphones and IoT devices are particularly strong in Asia-Pacific. The integration enhances the functionality of wearable bands, making them more appealing to consumers looking to manage their health and fitness through digital means.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

Latin America

- Brazil

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the smart wearable band market, Apple Inc. stands out as a leading player. Known for its innovative Apple Watch series, Apple has consistently pushed the boundaries of what wearable technology can do. Apple’s emphasis on aesthetics, coupled with robust functionality, makes it a popular choice among consumers who seek both style and substance in their devices.

Samsung Electronics Co., Ltd. is another significant contributor, with its Galaxy Watch series. Samsung’s wearable devices are renowned for their integration with Android and other Samsung devices, offering features like heart rate monitoring, sleep tracking, and a customizable watch face.

Fitbit, Inc., now part of Google LLC, has been a pioneer in the fitness tracking industry. Fitbit’s range of products is known for their simplicity, affordability, and effective fitness tracking capabilities. With a strong focus on health metrics such as step counting, heart rate monitoring, and sleep tracking, Fitbit has carved out a niche for itself among fitness enthusiasts.

Top Key Players in the Market

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Fitbit, Inc. (now part of Google LLC)

- Garmin Ltd.

- Xiaomi Corporation

- Huawei Technologies Co., Ltd.

- Polar Electro

- WHOOP

- Sony Corporation

- Amazfit (Zepp Health Corporation)

- TicWatch (Mobvoi)

- Other Key Players

Recent Developments

- In September 2023, Huawei held its “Wearable Strategy and New Product Launch” event in Barcelona, introducing a new line of wearables under the “Fashion Forward” proposition, aiming to integrate technology with fashion.

- In October 2024, Xiaomi introduced the Smart Band 9 Pro, offering a 1.74-inch AMOLED display and multiple health monitoring features.

- In November 2024, WITHit launched new smartwatch bands and committed to sourcing materials from Leather Working Group-certified tanneries..These new bands emphasize quality and reduce environmental impact, allowing users to express individuality while positively impacting society.

Report Scope

Report Features Description Market Value (2023) USD 65.6 Mn Forecast Revenue (2033) USD 136.5 Mn CAGR (2024-2033) 7.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Wellness Monitoring, Fitness Management), By Operating System (Android, iOS), By End-User (Adult, Children), By Distribution Channel (Online Stores, Offline Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Samsung Electronics Co., Ltd., Fitbit, Inc. (now part of Google LLC), Garmin Ltd., Xiaomi Corporation, Huawei Technologies Co., Ltd., Polar Electro, WHOOP, Sony Corporation, Amazfit (Zepp Health Corporation), TicWatch (Mobvoi), Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Wearable Band MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Smart Wearable Band MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Fitbit, Inc. (now part of Google LLC)

- Garmin Ltd.

- Xiaomi Corporation

- Huawei Technologies Co., Ltd.

- Polar Electro

- WHOOP

- Sony Corporation

- Amazfit (Zepp Health Corporation)

- TicWatch (Mobvoi)

- Other Key Players