Global Smart Sensors Market By Sensor Type (Pressure Sensor, Temperature Sensor, Motion Sensor, and Others), By Technology (MEMS, CMOS, and Other Technologies), By Component (Analog-to-Digital Converters (ADC), Digital-to-Analog Converters (DAC) and Others), By End-Use Industry (Aerospace & Defense, Automotive, Biomedical & Healthcare and Other), By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 104887

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

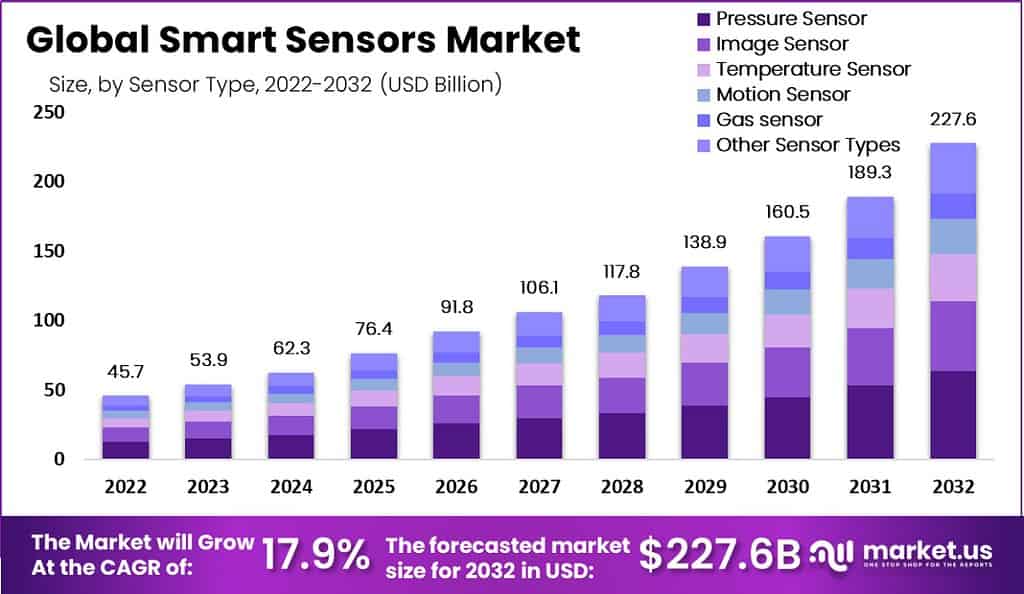

The Global Smart Sensors Market Expected to Achieve a Value of USD 227.6 Billion by 2032 From USD 53.9 Billion in 2023, rising at a CAGR of 17.9% from 2023 to 2032.

The smart sensors market has rapidly evolved and innovated in recent years. The growing advancements have completely transformed several industries and even made their way into daily life. Smart sensors have embedded computing functions allowing them to collect, analyze, and send data autonomously. This promotes smooth interaction and instantaneous data sharing between users, systems, and devices.

The technologies have significantly benefited the increasing need for automation and digitization in various industries such as manufacturing, automotive, healthcare, consumer electronics, and infrastructure. Smart sensors help to optimize operational efficiency, minimize downtime, and boost overall productivity. Therefore, several industries are using smart sensors.

Note: The figures presented here are subject to change in the final report.

Smart sensors allow the collecting of environmental data automatically and correctly, with less noise-interfering and error-causing information that is precisely collected. The smart sensor plays a pivotal part in the Internet of Things (IoT). This increasingly popular environment of the Internet of Things offers almost everything imaginable with a unique ability and identity to transmit data through the Internet or a similar network.

Key Takeaways

- The Global Smart Sensors Market is expected to reach a value of USD 227.6 billion by 2032, with a remarkable CAGR of 17.9% from 2023 to 2032, up from USD 45.7 billion in 2022.

- Smart sensors, with their embedded computing functions, have transformed various industries and daily life, enabling smooth interaction and data sharing between users, systems, and devices.

- The high penetration of Internet of Things (IoT) technology has driven the development of smart sensors across different industries, facilitating intelligent home systems, automated industrial operations, healthcare tracking, and urban infrastructure improvements.

- Pressure sensors lead the sensor type segment, primarily driven by concerns about automotive emissions reduction, comfort, and safety, creating significant growth opportunities for pressure sensor market players.

- MEMS technology dominates the technology segment, owing to advantages such as high reliability, quick operations, and minimal energy usage, fostering its growth throughout the forecast period.

- Analog-to-Digital Converters (ADC) lead the component segment, as they are crucial in converting analog sensor data into digital formats for processing and analysis, finding extensive applications across various industries like IoT devices, automotive, healthcare, and industrial automation.

- The automotive industry leads the end-use industry segment due to the increased adoption of smart sensors in automated vehicles, enhancing vehicle comfort and raising the overall level of automation.

- Asia Pacific holds the largest revenue share of the smart sensors market due to the concentration of major smart sensor manufacturing companies across countries like China, South Korea and Taiwan – creating an important manufacturing hub.

- Key players in the global smart sensors market include Siemens AG, Honeywell International, Texas Instruments, ABB Ltd., STMicroelectronics NXP Semiconductors Robert Bosch GmbH Infineon Technologies AG GE Measurement & Control Solutions Panasonic Corporation among many others.

Driving Factor

Wide Usage of Smart Sensors Across Various Industries are Driving the Growth of the Global Smart Sensors Market

The high penetration of Internet of Things (IoT) technology has boosted smart sensor development across industries. IoT is seamlessly integrating daily-use objects and devices with the Internet. These advanced sensors are now integral to an array of IoT implementations, including intelligent home systems, automated industrial operations, healthcare tracking, and urban infrastructure improvements, optimizing performance and facilitating informed decision-making.

Moreover, the mounting interest in wearable technologies like fitness bands, smartwatches, and health-tracking devices has fueled the requirement for smart sensors. These advanced devices use sensors to precisely monitor biometric statistics such as cardiac rhythm, body temperature, and motion patterns, offering users meaningful insights into their well-being and fitness status.

Restraining Factor

High Initial Investment and Data Security Concerns are Expected to Hinder the Growth of Global Smart Sensors Market

Implementing cutting-edge sensor technology comes with high initial investment, such as procuring the sensor hardware, establishing data processing systems, and integrating with pre-existing infrastructure. These financial considerations might discourage industries with stringent budgets from adopting such technologies, particularly in sectors operating on thin profit margins.

Moreover, the expanding volume of sensitive information collected by these advanced sensors brings concerns about data privacy and security. There’s concern among enterprises and end-users regarding potential data mishandling or breaches, causing unwillingness to adopt sensor-based solutions in organizations. These key factors are expected to restrict the growth of the global smart sensors market during the forecast period.

Sensor Type Analysis

Pressure Sensors Lead the Sensor Type Segment by Covering the Major Revenue Share in Account

Based on sensor type, the global smart sensors market is classified into touch, temperature, motion, image, gas, and other sensor types. Among these sensor types, the image sensor leads the segment by covering the major revenue share in the global smart sensors market. This pressure sensor growth is due to the growing worries about the reduction, comfort, and safety of automotive emissions. Pressure sensor market players would have many growth possibilities due to the regulatory requirements necessitating the installation of onboard diagnostics to reduce greenhouse gas emissions and the usage of pressure sensors in autonomous vehicles. These factors drive the pressure sensors in the sensor type segment of the global smart sensors market.

Technology Analysis

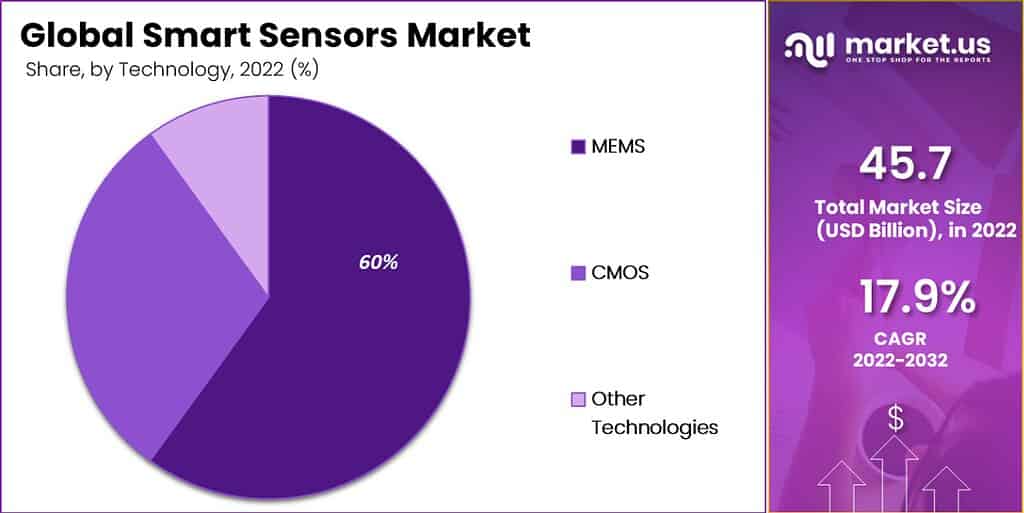

MEMS leads the Technology Segment in Global Smart Sensors Market by Holding the Major Revenue Share in Account

The global smart sensors market is classified into MEMS, CMOS, and other technologies based on technology. MEMS dominates the technology segment by holding the major revenue share into account from these technologies. This growth of MEMS technology is due to its many advantages, such as high reliability, quick operations, easy maintenance and replacement with improved accuracy, and minimal use of energy and materials. MEMS is expected to continue its growth throughout the forecast period with all these account advantages.

Note: The figures presented here are subject to change in the final report.

Component Analysis

Analog-to-Digital Converters (ADC) Dominate the Component Segment in Global Smart Sensors Market by Holding the Major Revenue Share in Account

Based on components, the global smart sensors market is classified into analog-to-digital converters (ADC), digital-to-analog converters (DAC), transceivers, amplifiers, microcontrollers, and other components. Among these components, analog-to-digital converters (ADC) lead the segment in global smart sensors. This growth of analog-to-digital converters (ADC) is due to ADCs being crucial components in smart sensors as they convert analog sensor data, that is, continuous voltage or current signals, into a digital format that can be processed and analyzed by microcontrollers or other digital systems. The high applications of ADCs across various industries like IoT devices, automotive, healthcare, industrial automation, and more are driving the growth of ADCs in the component segment of the global smart sensors market.

End-Use Industry Analysis

Automotive Industry Leads the End-Use Industry Segment in Global Smart Sensors Market by Securing Major Revenue Share in Account

Based on the end-use industry, the global smart sensors market is classified into aerospace & defense, automotive, biomedical & healthcare, building automation, consumer electronics, and other end-use industries. The automotive industry leads the segment from these end-use industries by holding the major revenue share into account. The automotive industry’s growth is due to the high usage of smart sensors in automated vehicles. Major vehicle-manufacturing businesses are installing more intelligent sensors in their vehicles to make their goods more comfortable, and raising the overall level of automation will boost the growth of the automotive industry in the end-use industry segment of the global smart sensors market.

Key Market Segments

Sensor Type

- Pressure Sensor

- Temperature Sensor

- Motion Sensor

- Image Sensor

- Gas sensor

- Other Sensor Types

Technology

- MEMS

- CMOS

- Other Technologies

Component

- Analog-to-Digital Converters (ADC)

- Digital-to-Analog Converters (DAC)

- Transceivers

- Amplifiers

- Microcontrollers

- Other Components

End-Use Industry

- Aerospace & Defense

- Automotive

- Biomedical & Healthcare

- Building Automation

- Consumer Electronics

- Other End-Use Industries

Growth Opportunity

High usage of Smart Sensors in the Automotive and Healthcare Sectors is expected to Create Many Opportunities in Global Smart Sensors Market

The automotive sector is seeing an exciting shift in integrating smart sensors for amplifying safety, operational efficiency, and the overall driving experience. Pioneering systems like ADAS, self-driven vehicles, and inter-vehicle communication largely depend on sophisticated sensors like LiDAR, radar, and visual sensors being the most prominent.

The health sector is also adopting the power of smart sensors, leading to revolutionary advances in wearables and distance-based patient supervision. These tiny yet powerful devices can record critical health metrics, chronicle physical activity, and oversee overall health, paving the way for preemptive health strategies and tailored medical interventions. All these factors are expected to create many lucrative opportunities in the global smart sensors market over the forecast period.

Latest Trends

Adoption of Industry 4.0 and Growing IoT Solutions are Supporting the Growth of the Global Smart Sensors Market

There is a noticeable surge in the uptake of IoT solutions across multiple sectors. This trend pushes the demand for sophisticated sensors, which are becoming indispensable for gathering pertinent data and ensuring seamless interconnectivity in IoT-related applications, ultimately boosting both automation and efficacy. Another noteworthy trend influencing the sensor market is the rise of the Fourth Industrial Revolution or Industry 4.0. By embedding these high-end sensors into their manufacturing workflows, industries can now conduct on-the-fly data scrutiny, preemptive machinery upkeep, and heighten their productivity metrics.

Regional Analysis

Asia Pacific region Leads the Smart Sensors market by Covering the Major Revenue Share in Account

The Asia Pacific region leads the global smart sensors market by holding the major revenue share into account. It is also expected to continue its growth at a CAGR of 15.6%. The growth of the Asia Pacific region can be attributed to the presence of major manufacturing companies in the region. Countries like China, South Korea, and Taiwan are major global manufacturing hubs in the Asia-Pacific region.

Their well-established electronics manufacturing sector naturally extends to producing smart sensors. These factors drive the growth of the Asia Pacific region in the global smart sensors market. After Asia Pacific, the North American region is expected to grow significantly over the forecast period. Growing demand for smart sensors from various industries is expected to drive the growth of the North American region in the global smart sensors market over the forecast period.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The global smart sensors market is fragmented into many companies offering smart sensors. However, key companies are adopting the strategies like mergers, acquisitions, partnerships, and collaboration to expand their market share through various regions and strengthen their position in the market. Some of the key players in global smart sensors market are Siemens AG, Honeywell International, Texas Instruments, ABB Ltd, STMicroelectronics, NXP Semiconductors, Robert Bosch GmbH, Infineon Technologies AG, GE Measurement & Control Solutions, Panasonic Corporation, and Other Key Players.

Top Key Players

- Siemens AG

- Honeywell International

- Texas Instruments

- ABB Ltd

- STMicroelectronics

- NXP Semiconductors

- Robert Bosch GmbH

- Infineon Technologies AG

- GE Measurement & Control Solutions

- Panasonic Corporation

- Other Key Players

Recent Developments

- In January 2023, a global AI software company, Elliptic Labs, and the world leader in AI Virtual Smart Sensors launched AI Virtual Distance Sensor. With the help of the AI Virtual Distance Sensor, devices can measure their distance from one place to another and provide relative location detection.

- In January 2022, Infineon launched its new CO2 sensor, the XENSIV PAS CO2 sensor. The sensor can provide innovative solutions for the growing demand for accurate indoor air quality.

Report Scope

Report Features Description Market Value (2023) US$ 53.9 Billion Forecast Revenue (2032) US$ 227.6 Billion CAGR (2023-2032) 17.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Sensor Type (Pressure Sensor, Temperature Sensor, Motion Sensor, Image Sensor, Gas sensor, and Other Sensor Types), By Technology (MEMS, CMOS, and Other Technologies), By Component (Analog-to-Digital Converters (ADC), Digital-to-Analog Converters (DAC), Transceivers, Amplifiers, Microcontrollers, Other Components), By End-Use Industry (Aerospace & Defense, Automotive, Biomedical & Healthcare, Building Automation, Consumer Electronics, Other) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Siemens AG, Honeywell International, Texas Instruments, ABB Ltd, STMicroelectronics, NXP Semiconductors, Robert Bosch GmbH, Infineon Technologies AG, GE Measurement & Control Solutions, Panasonic Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are smart sensors?Smart sensors are sensors that have embedded intelligence. This means that they can collect data, process it, and make decisions without the need for a human operator. Smart sensors are becoming increasingly popular because they can improve efficiency, safety, and productivity in a variety of industries.

What is the significance of smart sensors?Smart sensors offer several advantages, including real-time data analysis, remote monitoring, improved accuracy, and the ability to make autonomous decisions. They find applications in various industries, such as manufacturing, healthcare, automotive, and smart cities.

What industries utilize smart sensors?Smart sensors are used across a wide range of industries. They are commonly found in manufacturing for process optimization, in healthcare for patient monitoring, in automotive for advanced driver assistance systems (ADAS), and in environmental monitoring for smart cities.

What benefits do smart sensors bring to industrial processes?Smart sensors enhance industrial processes by providing real-time data on parameters such as temperature, pressure, and humidity. This data helps optimize production, reduce downtime, and improve product quality.

-

-

- Siemens AG

- Honeywell International

- Texas Instruments

- ABB Ltd

- STMicroelectronics

- NXP Semiconductors

- Robert Bosch GmbH

- Infineon Technologies AG

- GE Measurement & Control Solutions

- Panasonic Corporation

- Other Key Players