Global Smart Security Keypad Market Size, Share and Analysis Report By Component (Hardware, Software, Services), By Technology (Touchscreen Keypads, Button-based Keypads, Biometric-integrated Keypads, Others), By Connectivity (Wired, Wireless (Wi-Fi, Z-Wave, Zigbee), By Application (Residential Security Systems, Commercial Access Control, Industrial & Perimeter Security, Others), By Sales Channel (Professional Security Installers & Dealers, Retail & Online Stores, Direct Sales from Manufacturer), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177217

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- By Component

- By Technology

- By Connectivity

- By Application

- By Sales Channel

- Regional Perspective

- Trends and Disruptions Impacting Customers

- Emerging Trends Analysis

- Growth Factors Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

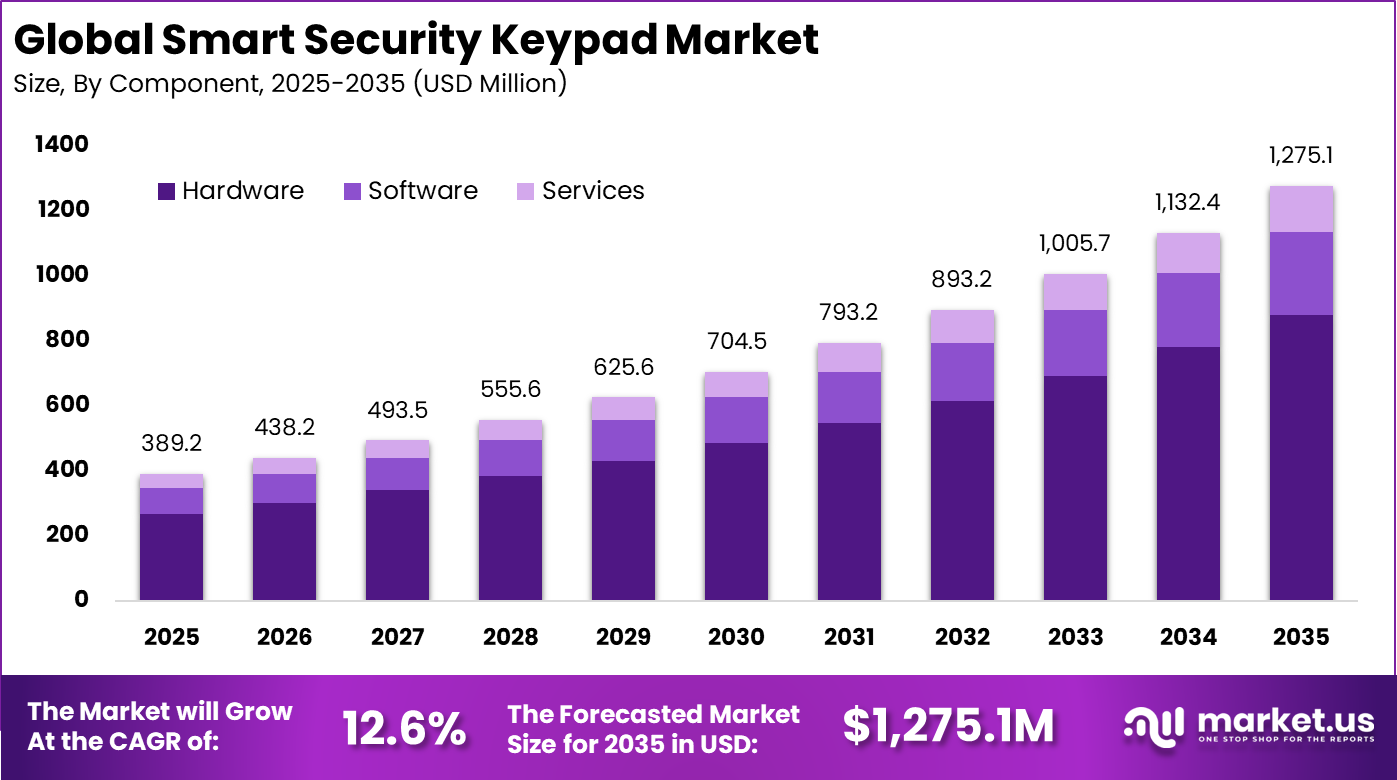

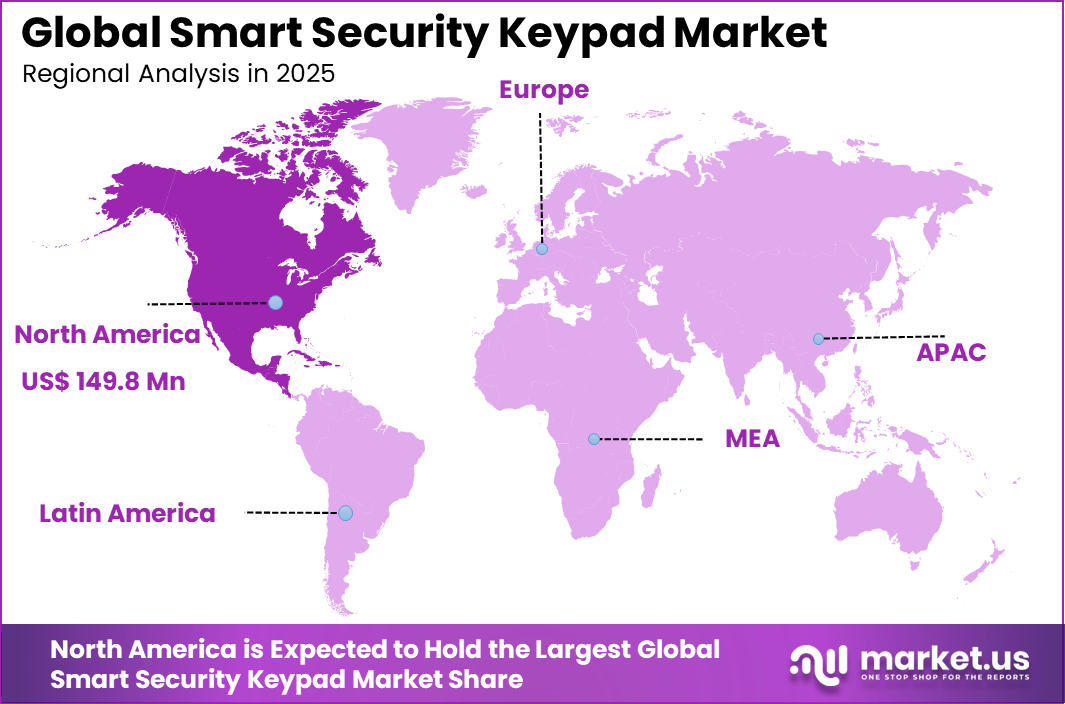

The Global Smart Security Keypad Market size is expected to be worth around USD 1,275.1 million by 2035, from USD 389.2 million in 2025, growing at a CAGR of 12.6% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 38.5% share, holding USD 149.8 million in revenue.

The smart security keypad market covers electronic access control devices that enable secure entry through PIN codes, touch interfaces, and connected authentication features. These keypads are widely used in residential buildings, commercial facilities, industrial sites, and smart infrastructure environments. Modern smart keypads are increasingly integrated with alarm systems, smart locks, and building management platforms to support centralized security control.

Key driver factors shaping this market include rising concerns over unauthorized access, growing adoption of smart home and smart building technologies, and increasing preference for keyless entry systems. As physical security systems become more connected and software driven, smart security keypads are evolving into an essential interface layer for access management.

According to industry survey, Security remains the primary decision factor for smart lock adoption. Around 90% of consumers consider a high level of security, particularly protection against burglary, to be very important when selecting a smart lock. This preference highlights the need for reliable encryption, access control, and tamper resistance in connected door lock solutions.

Despite strong smart home penetration of 69% in the United States, smart lock adoption remains relatively low at approximately 10%, indicating substantial room for market expansion. Pricing sensitivity also influences adoption, as about 34% of U.S. consumers are willing to spend between USD 1 and USD 250 on home security products, while only 9% are willing to spend more than USD 1,250.

Demand for smart security keypads is increasing across residential and commercial segments. Homeowners value ease of access and the ability to assign temporary codes. Property managers and businesses require structured access control for employees and tenants. Studies suggest that access related incidents drop by more than 30% when digital entry systems replace traditional locks.

For instance, in November 2025, SimpliSafe refined its smash-safe wireless keypad for SS3 systems, enabling one-click arming and silent alarms. With up to 1-year battery life and peel-and-stick install, it caters to DIY users seeking robust, wireless home protection.

Key Takeaway

- By component, hardware dominated the Smart Security Keypad Market with a 68.9% share, reflecting strong demand for physical access control devices.

- By technology, touchscreen keypads accounted for 52.4% of adoption, supported by ease of use and modern interface preferences.

- By connectivity, wireless solutions led the market with a 73.5% share, driven by flexible installation and compatibility with smart home systems.

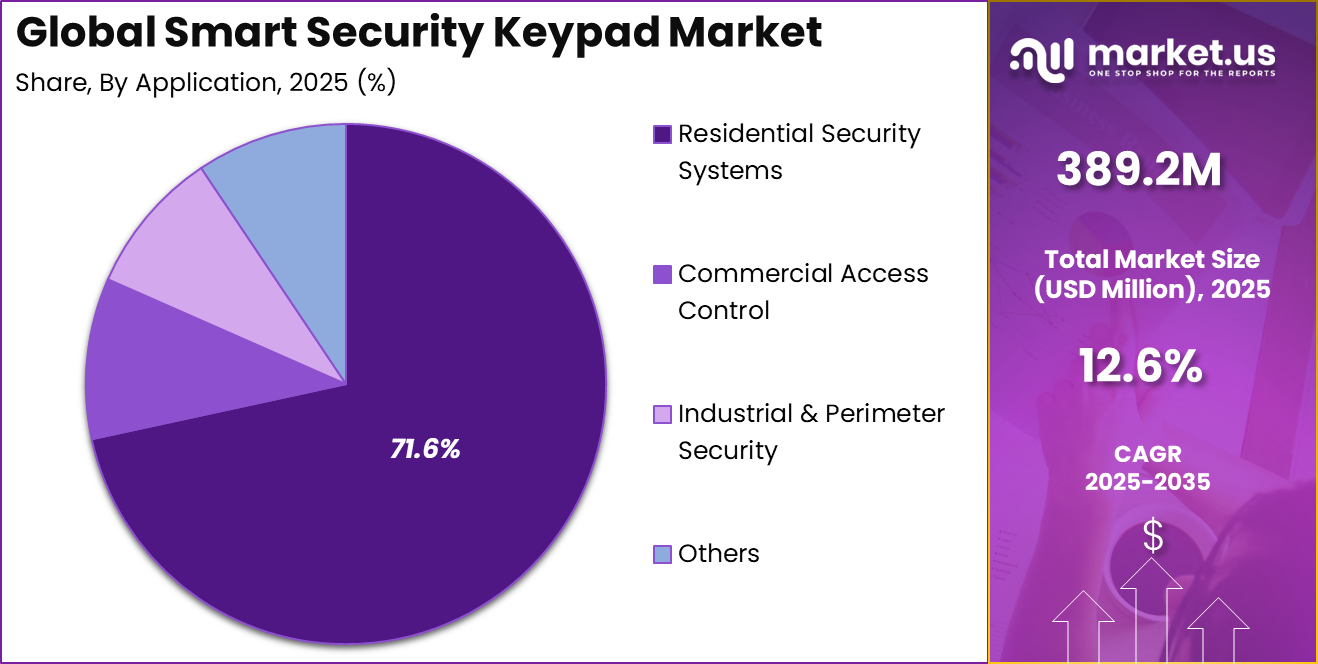

- By application, residential security systems represented 71.6% of total demand, highlighting growing focus on home safety.

- By sales channel, professional security installers held a 58.3% share, supported by demand for expert installation and system integration.

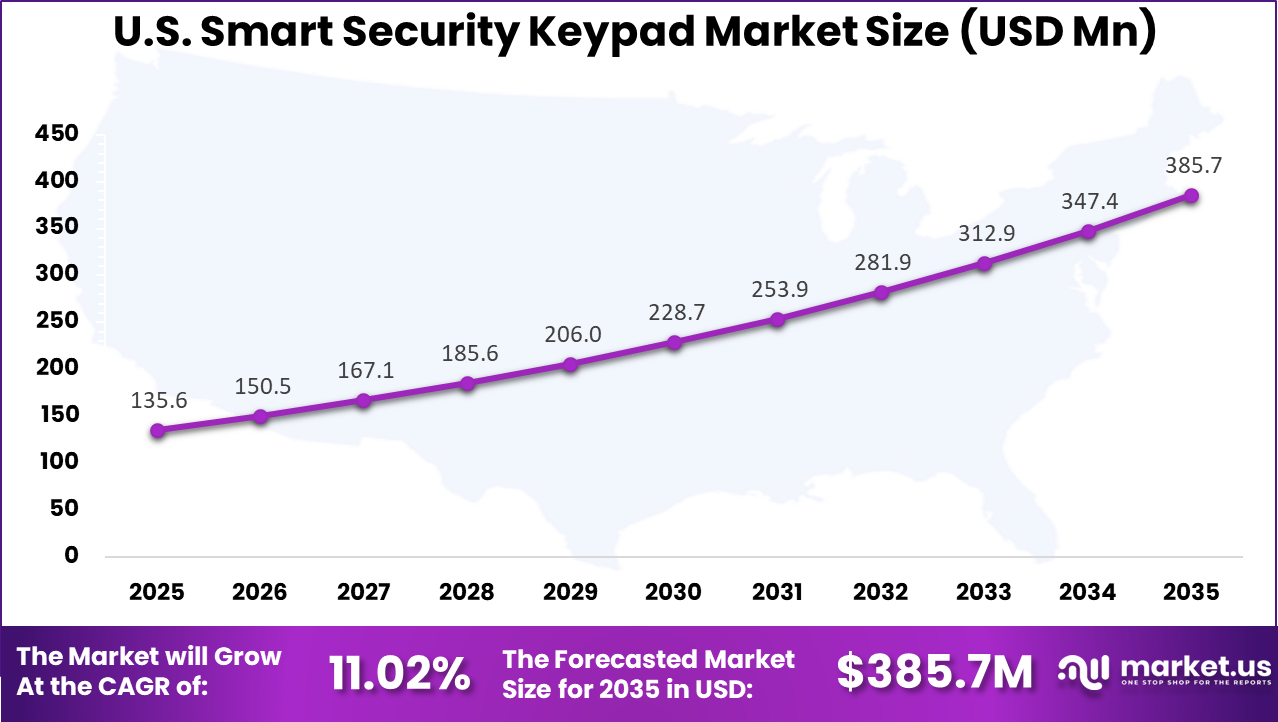

- Regionally, North America accounted for 38.5% of the market, with the US valued at USD 135.6 million and recording a CAGR of 11.02%, supported by rising smart security adoption.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rising adoption of smart home and smart building security solutions +3.4% North America, Europe Short to medium term Increasing demand for keyless and contactless access control +2.9% Global Medium term Growth in residential and commercial security installations +2.4% Asia Pacific, North America Medium term Integration of smart keypads with IoT and home automation platforms +2.0% Global Medium to long term Rising security awareness among homeowners and businesses +1.9% Global Long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Higher cost compared to traditional mechanical keypads -2.3% Emerging Markets Short to medium term Cybersecurity and hacking concerns in connected devices -2.0% North America, Europe Medium term Interoperability issues across smart home ecosystems -1.7% Global Medium term Dependence on power supply and connectivity -1.4% Global Medium term Limited awareness in price-sensitive residential markets -1.2% Asia Pacific, Latin America Medium to long term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Smart home security device manufacturers High Medium Global Strong product-led growth Access control and building automation providers High Medium North America, Europe Integrated security solutions Residential security service providers Medium Low to Medium Global Recurring service revenue Private equity firms Medium Medium North America, Europe Consolidation opportunities Venture capital investors Medium High North America Innovation in IoT security Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline Touchscreen and capacitive keypad interfaces +3.1% Improved user experience Global Short term Integration with mobile apps and cloud platforms +2.7% Remote access management Global Medium term Biometric and multi-factor authentication support +2.3% Enhanced security North America, Europe Medium term Wireless connectivity including Wi-Fi, Bluetooth, and Zigbee +2.0% Seamless integration Global Medium to long term AI-driven access pattern analysis +1.6% Proactive security alerts North America Long term By Component

Hardware accounts for 68.9% of total adoption in the Smart Security Keypad Market. This dominance reflects the essential role of physical keypads, sensors, and embedded controllers in access control systems. Consumers and security providers prioritize durable and reliable hardware for long term usage.

The demand for hardware components is further supported by replacement and upgrade cycles. Older mechanical or basic electronic keypads are increasingly replaced with smart variants. This transition sustains steady demand for hardware products.

Hardware also directly influences system performance and user experience. Build quality, responsiveness, and durability are critical factors. These considerations continue to reinforce hardware as the leading component segment.

For Instance, in April 2025, Honeywell Home showcased advanced hardware keypads at ISC West, highlighting durable touchscreen units integrated with AI access control. These panels emphasize robust builds for everyday reliability, reducing failures in high-traffic areas. Dealers praised the sturdy design that supports multiple sensors, boosting system longevity and user trust in core hardware components.

By Technology

Touchscreen keypads represent 52.4% of technology adoption within the market. This leadership is driven by user preference for modern interfaces that offer ease of use and aesthetic appeal. Touchscreen systems allow customizable access codes and intuitive operation.

The popularity of touchscreen technology is also linked to enhanced functionality. Features such as visual feedback, multi user access, and integration with mobile applications improve usability. These capabilities support higher adoption.

Touchscreen keypads are increasingly viewed as standard in smart home ecosystems. Their compatibility with other smart devices strengthens their market position. This sustains strong demand for touchscreen based systems.

For instance, in May 2025, Johnson Controls launched the IQ Keypad LTX, a sleek touchscreen model for IQ Panels with intuitive touch response. It resists dirt and dust for consistent performance, appealing to modern users seeking phone-like interfaces. The keypad pairs seamlessly with diverse devices, driving adoption through enhanced usability and quick navigation.

By Connectivity

Wireless connectivity accounts for 73.5% of total market adoption. Wireless systems offer flexible installation and reduced wiring complexity. This makes them suitable for both new installations and retrofitting existing properties.

The preference for wireless connectivity is also influenced by smart home integration trends. Wireless keypads can easily connect with alarms, cameras, and mobile devices. This interoperability enhances overall security system value.

Reliability improvements in wireless communication further support adoption. Secure protocols and stable connectivity reduce performance concerns. These factors maintain wireless connectivity as the dominant option.

For Instance, in November 2025, Assa Abloy introduced the Yale Smart Keypad 2, featuring wireless fingerprint and PIN access with one-touch locking. It connects via Wi-Fi for remote control and integrates with smart hubs effortlessly. Homeowners appreciate the wire-free install and proximity lighting, making it ideal for flexible home setups.

By Application

Residential security systems account for 71.6% of application based demand. Homeowners increasingly invest in smart security solutions to protect property and personal safety. Smart keypads provide controlled access without traditional keys. The growth of residential adoption is supported by rising smart home penetration.

Consumers prefer integrated solutions that combine security with convenience. Keypads serve as a central access point within these systems. Residential users also value ease of management. Features such as temporary access codes and remote control increase appeal. These benefits sustain strong demand in residential applications.

For Instance, in September 2025, Vivint promoted its wireless keypad door locks for residential use, emphasizing keyless entry and app integration. These enhance home protection with custom codes and auto-lock features, perfect for families. The seamless tie-in with alarms and cameras strengthens everyday residential safety without added complexity.

By Sales Channel

Professional security installers represent 58.3% of total sales channel activity. Many consumers rely on professionals for proper installation and system configuration. This ensures reliability and optimal performance. Professional installers also provide guidance on system selection and placement. Their expertise reduces installation errors and improves system effectiveness.

This supports continued reliance on professional channels. Installer partnerships further strengthen market adoption. Security providers often bundle hardware with installation services. This integrated approach reinforces the dominance of professional installers.

Regional Perspective

North America holds a leading position in the Smart Security Keypad Market, accounting for 38.5% of total activity. The region benefits from high smart home adoption and strong awareness of residential security solutions. Consumers actively invest in connected security technologies. Regulatory standards and insurance considerations also influence adoption. Home security improvements are often encouraged. These factors support North America’s strong regional presence.

For instance, in January 2026, NAPCO Security Technologies unveiled its next-generation XK5 Slimline Keypad and Touchscreen2R at ISC West 2025, enhancing its Gemini alarm systems with sleek designs, wireless receivers, and cloud integration via MVP EZ and MVP Access platforms. These innovations support rapid installations and drive recurring revenue growth, reinforcing North America’s leadership in smart security keypad technology.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 135.6 Mn and a growth rate of 11.02% CAGR. Growth is supported by increasing residential construction and smart home upgrades. Wireless and touchscreen keypads are widely adopted.

Consumer focus on convenience and safety continues to drive adoption. Integration with broader smart home platforms is a key factor. These dynamics collectively support steady growth in the U.S. market segment.

For instance, in November 2025, Napco Security Technologies, Inc. unveiled new MVP ecosystem products including the slimline XK5 keypad and 2R touchscreen at ISC East 2025, designed for Gemini system upgrades and cloud integration. These innovations reinforce U.S. dominance in scalable, dealer-friendly smart keypads.

Trends and Disruptions Impacting Customers

The Smart Security Keypad Market is influenced by growing concerns around property protection and controlled access across residential and commercial spaces. Property related crimes continue to represent over 30% of reported offenses in many urban areas, which has increased demand for reliable access control systems.

Smart keypads reduce dependence on physical keys and lower risks linked to loss or duplication. Customer expectations are changing due to lifestyle shifts and technology adoption. More than 65% of smart home users show a preference for keyless entry because it offers convenience and better control over access permissions.

The growth of short term rentals and shared workspaces has further increased demand, with over 40% of urban rental properties now using keyless access solutions. At the same time, rising awareness of connected device security has led nearly 58% of buyers to prioritize encrypted systems and certified security features, directly shaping purchasing decisions in this market.

Emerging Trends Analysis

An emerging trend in the smart security keypad market is integration with broader access control and identity systems. Smart keypads are increasingly combined with mobile credentials, biometric verification, and centralized access platforms. This integration supports layered security models and improves oversight. Multi modal authentication is gaining traction.

Another trend is increased focus on analytics and access logging. Smart keypads now provide usage data that helps property managers monitor access patterns and detect anomalies. This data driven insight supports proactive security management. Analytics enabled access control is becoming more relevant.

Growth Factors Analysis

One of the key growth factors for the smart security keypad market is rising investment in smart infrastructure. New residential complexes and commercial developments increasingly include digital access systems as standard features. Early integration of smart keypads reduces long term security costs. This construction driven adoption supports steady growth.

Another growth factor is increasing awareness of physical security risks. Businesses and homeowners are prioritizing preventive security measures. Smart security keypads offer a cost effective entry point into advanced access control systems. This growing risk awareness reinforces long term demand.

Opportunity Analysis

A significant opportunity in the smart security keypad market lies in growing demand for contactless and hygienic access solutions. Touchless entry options, remote code management, and temporary access credentials are increasingly valued in shared spaces. Smart keypads support these needs by enabling flexible and controlled access without physical key exchange. This trend expands application in hospitality, offices, and multi tenant properties.

Another opportunity is increased use of smart keypads in industrial and infrastructure settings. Warehouses, data centers, and utility facilities require controlled access with audit trails. Smart keypads provide secure authentication combined with logging and monitoring capabilities. Expansion into these use cases supports broader market growth.

Challenge Analysis

A major challenge for the smart security keypad market is balancing ease of use with strong security. Simple PIN based systems may be vulnerable to observation or code sharing. Enhancing security through multi factor authentication can add complexity. Designing systems that remain user friendly while improving protection is an ongoing challenge.

Another challenge is ensuring durability and reliability across environments. Keypads deployed outdoors or in industrial settings face exposure to weather, dust, and heavy usage. Maintaining performance and accuracy under harsh conditions requires robust hardware design. Reliability expectations remain high in security critical applications.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Technology

- Touchscreen Keypads

- Button-based Keypads

- Biometric-integrated Keypads

- Others

By Connectivity

- Wired

- Wireless (Wi-Fi, Z-Wave, Zigbee)

By Application

- Residential Security Systems

- Commercial Access Control

- Industrial & Perimeter Security

- Others

By Sales Channel

- Professional Security Installers & Dealers

- Retail & Online Stores

- Direct Sales from Manufacturer

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Global building security and automation leaders such as Honeywell International, Inc., Johnson Controls International plc, and Bosch Security Systems, Inc. dominate the smart security keypad market through integrated alarm and access control portfolios. Their keypads are designed for residential, commercial, and industrial environments. Strong focus on reliability, encryption, and system compatibility supports large-scale deployments. These companies benefit from long-term installer relationships and global distribution networks.

Smart lock and home security specialists such as Allegion plc, Assa Abloy AB, and Napco Security Technologies, Inc. focus on user-friendly and connected keypad solutions. Resideo Technologies, Inc. and DSC support professional-grade installations. These players emphasize touch interfaces, mobile integration, and multi-factor access. Adoption is supported by growing demand for smart access control in homes and small businesses.

Consumer-focused and monitored security service providers such as ADT, Inc., Ring LLC, and Vivint Smart Home, Inc. expand keypad adoption through bundled security offerings. SimpliSafe, Inc., Frontpoint Security Solutions, LLC, and Brinks Home Security address the DIY and subscription-based market. Other vendors increase competition and innovation. This landscape supports steady growth of smart security keypads across residential and commercial sectors.

Top Key Players in the Market

- Honeywell International, Inc.

- Johnson Controls International plc

- Allegion plc (Schlage)

- Assa Abloy AB (Yale)

- Napco Security Technologies, Inc.

- Vivint Smart Home, Inc.

- SimpliSafe, Inc.

- Frontpoint Security Solutions, LLC

- Brinks Home Security

- Ring LLC (an Amazon company)

- ADT, Inc.

- Resideo Technologies, Inc.

- Bosch Security Systems, Inc.

- DSC (Digital Security Controls)

- 2GIG Technologies

- Others

Recent Developments

- In January 2026, Honeywell continues to lead with its ProSeries customizable wireless keypads, featuring bright alpha displays for easy arming/disarming. These keypads integrate seamlessly into smart home ecosystems, offering voice control and remote access via the Total Connect app, solidifying Honeywell’s position in professional-grade residential security.

- In November 2025, Napco showcased the XK5 slimline keypad and 2R touchscreen at ISC, designed for easy upgrades to Gemini systems across North America. These modern interfaces support profitable dealer migrations with enhanced user prompts and zone control.

Report Scope

Report Features Description Market Value (2025) USD 389.2 Mn Forecast Revenue (2035) USD 1,275.1 Mn CAGR(2026-2035) 12.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Technology (Touchscreen Keypads, Button-based Keypads, Biometric-integrated Keypads, Others), By Connectivity (Wired, Wireless (Wi-Fi, Z-Wave, Zigbee), By Application (Residential Security Systems, Commercial Access Control, Industrial & Perimeter Security, Others), By Sales Channel (Professional Security Installers & Dealers, Retail & Online Stores, Direct Sales from Manufacturer) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Honeywell International, Inc., Johnson Controls International plc, Allegion plc (Schlage), Assa Abloy AB (Yale), Napco Security Technologies, Inc., Vivint Smart Home, Inc., SimpliSafe, Inc., Frontpoint Security Solutions, LLC, Brinks Home Security, Ring LLC (an Amazon company), ADT, Inc., Resideo Technologies, Inc., Bosch Security Systems, Inc., DSC (Digital Security Controls), 2GIG Technologies, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Security Keypad MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Smart Security Keypad MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Honeywell International, Inc.

- Johnson Controls International plc

- Allegion plc (Schlage)

- Assa Abloy AB (Yale)

- Napco Security Technologies, Inc.

- Vivint Smart Home, Inc.

- SimpliSafe, Inc.

- Frontpoint Security Solutions, LLC

- Brinks Home Security

- Ring LLC (an Amazon company)

- ADT, Inc.

- Resideo Technologies, Inc.

- Bosch Security Systems, Inc.

- DSC (Digital Security Controls)

- 2GIG Technologies

- Others