Global Smart Robots Market By Component (Hardware, Software), By Application (Material Handling, Assembling and Disassembling, Inspection and Maintenance, Cleaning, Security, Other Applications), By End-Use (Industrial Use, Commercial Use, Residential Use), By End-Use Industry (Electronics, Automotive, Food & Beverages, Retail, Healthcare, Education, Other End-Use Industries), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: March 2024

- Report ID: 116158

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

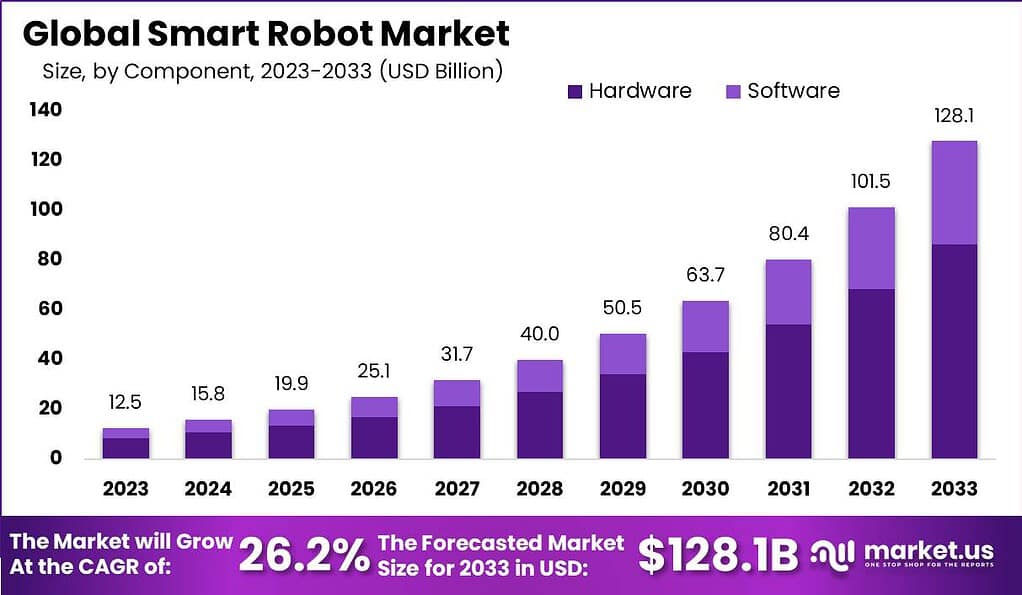

The Global Smart Robots Market size is expected to be worth around USD 128.1 Billion by 2033, from USD 12.5 Billion in 2023, growing at a CAGR of 26.2% during the forecast period from 2024 to 2033.

Smart robots, characterized by their ability to learn from their environment and experience, adapt to new tasks, and perform complex operations, represent a significant advancement in automation technology. These robots, equipped with artificial intelligence (AI), machine learning algorithms, and sophisticated sensors, are increasingly becoming integral in various sectors including manufacturing, healthcare, services, and logistics.

The smart robots market is experiencing robust growth, propelled by technological innovations and increasing adoption across multiple industries. The driving factors behind the expansion of the smart robots market include the surge in demand for automation solutions that enhance efficiency, reduce operational costs, and mitigate human error.

Additionally, the advancements in AI and robotics technology have dramatically increased the capabilities of smart robots, making them more versatile and effective in performing complex tasks. The integration of Internet of Things (IoT) devices has further enhanced the utility of smart robots, enabling them to operate in interconnected and dynamic environments.

Furthermore, the opportunities presented by smart robots are vast and diverse. In the healthcare sector, smart robots can assist in surgeries, provide elderly care, and improve patient monitoring and rehabilitation. In agriculture, they can automate farming processes, optimize crop yield, and reduce the need for manual labor. In logistics, smart robots can streamline warehouse operations, improve inventory management, and enhance order fulfillment.

Key Takeaways

- The Smart Robots Market is projected to reach a substantial value of USD 128.1 billion by 2033, showcasing a robust Compound Annual Growth Rate (CAGR) of 26.2% throughout the forecast period.

- Hardware components dominate the Smart Robots Market, capturing more than a 67.5% share in 2023. These components, such as sensors and control systems, are vital for the functionality and efficiency of smart robots, driving their demand across industries.

- Material handling emerges as a prominent application segment, capturing over 26% of the market share in 2023. The automation of tasks like picking, placing, and packaging in industries like manufacturing and logistics boosts the adoption of smart robots for material handling purposes.

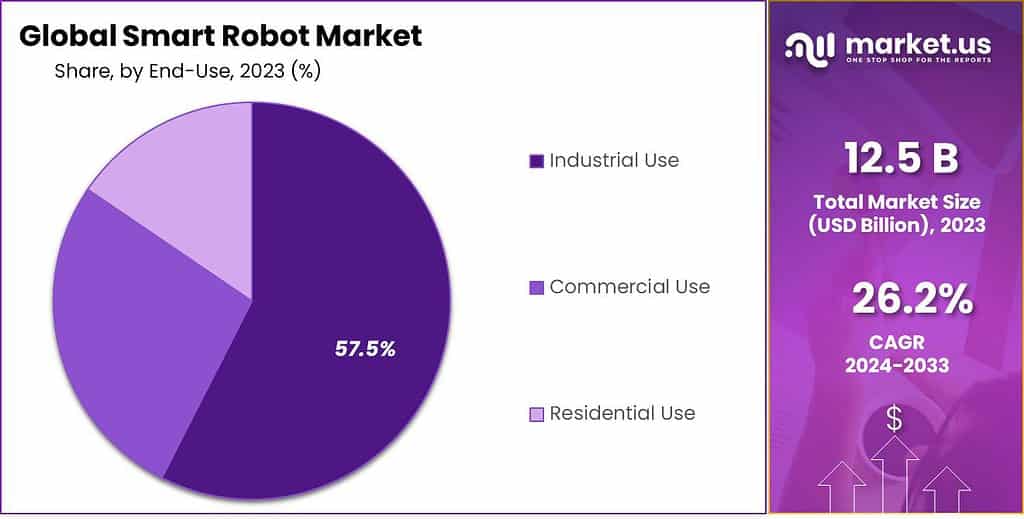

- The industrial sector holds a dominant market position, capturing over 57.5% share in 2023. The integration of AI and machine learning with robotics enhances efficiency, reduces operational costs, and improves product quality in industries like automotive, electronics, and food & beverages.

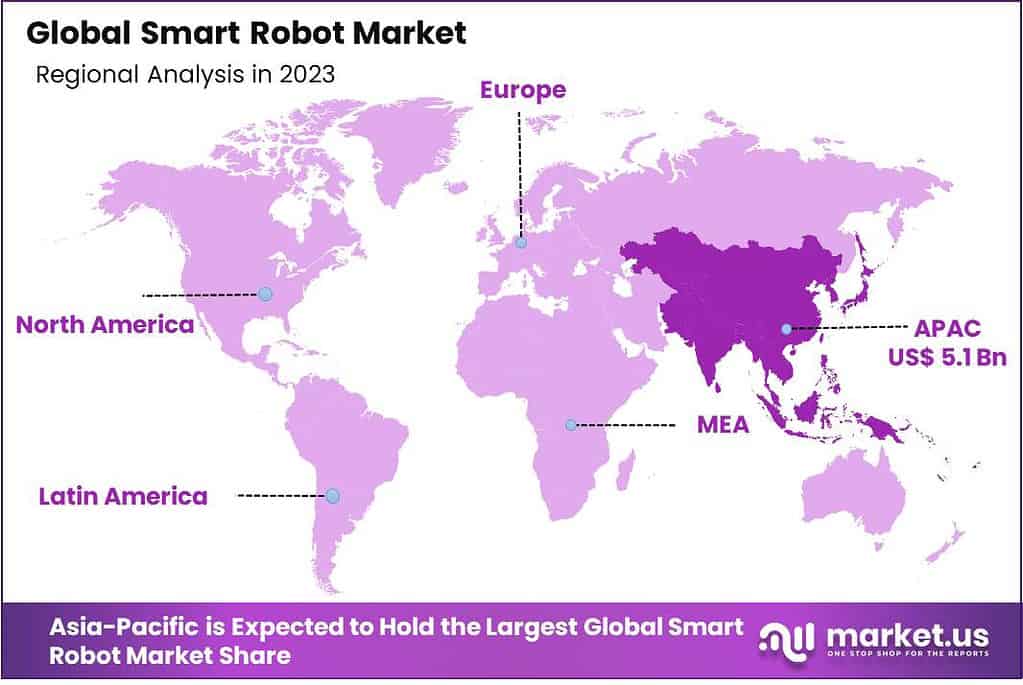

- Asia-Pacific (APAC) emerges as the leading player in the Smart Robots Market, capturing over 40.9% market share in 2023. Rapid industrialization, technological advancements, and a large population base contribute to the region’s dominance, particularly in countries like China, Japan, and South Korea.

- Over ~60% of smart robots deployed in industrial settings were equipped with advanced sensors, machine learning capabilities, and autonomous decision-making abilities.

- The adoption of collaborative robots (cobots) in manufacturing and industrial applications grew by over ~40% in 2023, driven by their ability to work safely alongside human workers.

- Over ~35% of smart robots deployed in 2023 were equipped with natural language processing (NLP) capabilities, enabling seamless human-robot interaction.

- In 2023, the use of smart robots in healthcare settings, such as hospital logistics and patient assistance, grew by over ~50%, driven by labor shortages and the need for efficiency.

- The adoption of smart robots in the logistics and warehousing industry grew by over ~35% in 2023, enabling automated material handling and inventory management.

- Major tech companies like Amazon, Google, and Microsoft invested heavily in smart robotics research and development in 2023, aiming to develop advanced robotic systems for various applications.

- The adoption of smart robots in the construction industry grew by over ~25% in 2023, enabling automated tasks like bricklaying, welding, and material handling.

- Over ~40% of smart robots deployed in 2023 were equipped with advanced navigation and mapping capabilities, enabling autonomous navigation in complex environments.

- In 2023, over ~30% of smart robots deployed in retail settings were equipped with computer vision and facial recognition capabilities for customer analytics and personalized experiences.

- The use of smart robots in agriculture and precision farming grew by over ~45% in 2023, enabling tasks like crop monitoring, harvesting, and automated irrigation.

- The adoption of smart robots in the entertainment and gaming industry grew by over ~30% in 2023, enabling interactive and immersive experiences.

Component Analysis

In 2023, the Hardware Segment held a dominant market position in the Smart Robots Market, capturing more than a 67.5% share. This significant market share can be attributed to the essential role hardware components play in the functionality and efficiency of smart robots.

Hardware components, such as sensors, actuators, power supplies, and control systems, form the backbone of smart robotics, enabling these machines to interact with their environment, navigate autonomously, and perform a wide array of tasks ranging from industrial automation to customer service. The surge in demand for robotics across various sectors, including manufacturing, healthcare, and logistics, has underscored the critical importance of advanced, durable, and highly efficient hardware.

The leadership of the Hardware Segment is further reinforced by continuous technological advancements and investments in R&D. Innovations in materials science, miniaturization, and energy efficiency have led to the development of more sophisticated and capable robotics hardware. These advancements not only enhance the performance of smart robots but also extend their operational life and reliability, making them increasingly attractive to industries aiming for automation and efficiency.

Furthermore, the rising adoption of IoT and AI technologies necessitates robust hardware platforms to support complex algorithms and data processing, driving the segment’s growth. The increasing integration of smart robots into everyday life and industrial processes has propelled the demand for high-quality hardware components. As robots become more embedded in critical operations, the need for durable and reliable hardware that can withstand challenging conditions and deliver precise results becomes paramount.

Application Analysis

In 2023, the Material Handling Segment held a dominant market position in the Smart Robots Market, capturing more than a 26% share. This prominence is primarily due to the increasing automation in industries such as manufacturing, logistics, and warehousing. Material handling robots streamline operations, reduce manual labor, and enhance efficiency by automating tasks such as picking, placing, packaging, and palletizing.

The growing e-commerce sector, coupled with the demand for faster and more efficient order fulfillment processes, has significantly driven the adoption of smart robots for material handling. The rise of the Material Handling Segment is also supported by advancements in robotics technology, including improved sensor capabilities, machine learning algorithms, and connectivity.

These technological enhancements enable robots to perform complex material handling tasks with higher precision, flexibility, and speed. Furthermore, the integration of AI allows these robots to learn and adapt to new tasks, improving their efficiency over time. The ability to operate in diverse environments, from tightly packed warehouses to outdoor logistics hubs, further underscores the versatility and value of material handling robots.

Moreover, the push for safer working environments and the reduction of workplace injuries have emphasized the importance of automating physically demanding tasks. Material handling robots not only minimize the risk of injuries associated with heavy lifting and repetitive tasks but also contribute to a more sustainable operation by optimizing workflows and reducing waste.

End-Use Analysis

In 2023, the Industrial Use segment held a dominant market position in the Smart Robots Market, capturing more than a 57.5% share. This leadership can be attributed to the increasing automation of manufacturing processes and the rising adoption of robots for tasks such as assembly, packaging, and material handling. Industries are keenly investing in smart robots to enhance efficiency, reduce operational costs, and improve product quality.

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) with robotics has further propelled the growth of this segment. These smart robots are capable of learning from their environment and improving their performance over time, making them highly valuable in industrial settings.

Furthermore, the demand for smart robots in the industrial sector is fueled by the growing need for precision and the ability to perform complex tasks with minimal human intervention. The automotive, electronics, and food and beverage industries, in particular, have shown significant interest in deploying smart robots to streamline production lines and ensure consistent output quality.

The availability of customizable robotic solutions that can be tailored to specific industrial needs has also played a crucial role in the widespread adoption within this segment. Moreover, regulatory support and initiatives promoting the use of advanced technologies in manufacturing processes have bolstered the industrial use of smart robots.

Governments around the world are providing subsidies and tax incentives to encourage industries to adopt automation, which in turn is driving the growth of the smart robots market. With the ongoing technological advancements and increasing emphasis on sustainable manufacturing practices, the Industrial Use segment is expected to maintain its leading position in the Smart Robots Market.

End-Use Industry Analysis

In 2023, the Electronics segment held a dominant market position within the Smart Robots Market, capturing more than a 21.4% share. This prominence is largely due to the intricate and precise nature of electronic manufacturing processes, which require high levels of accuracy and efficiency.

Smart robots, equipped with advanced sensors and AI capabilities, are ideally suited to meet these demands, facilitating the assembly of tiny electronic components, quality control, and packaging with unparalleled precision. The push towards miniaturization of electronic devices and the rapid pace of innovation in consumer electronics further necessitate the adoption of smart robotics solutions to maintain competitive advantage and scalability in production.

The surge in demand for electronic goods, driven by advancements in technology and an increasing reliance on electronic devices in daily life, underscores the critical role of smart robots in this sector. These robots enhance operational efficiencies, reduce production times, and ensure safety in environments that may be hazardous to human workers. Additionally, the ability to quickly reprogram and adapt to new production lines makes smart robots invaluable for electronics manufacturers facing constant product updates and short product life cycles.

Moreover, the electronics industry’s drive towards sustainability and reducing its environmental footprint has also favored the adoption of smart robots. These robotic systems can optimize resource use, minimize waste, and ensure precise application of materials, contributing to more sustainable manufacturing practices. With ongoing technological advancements and the growing complexity of electronic products, the demand for smart robots in the electronics segment is expected to continue its upward trajectory, reinforcing its leadership position in the market.

Key Market Segments

By Component

- Hardware

- Software

By Application

- Material Handling

- Assembling and Disassembling

- Inspection and Maintenance

- Cleaning

- Security

- Other Applications

By End-Use

- Industrial Use

- Commercial Use

- Residential Use

End-Use Industry

- Electronics

- Automotive

- Food & Beverages

- Retail

- Healthcare

- Education

- Other End-Use Industries

Driver

Rising integration of IoT in robots for cost-efficient predictive maintenance

IoT technology enables robots to collect and analyze data from their surroundings, enhancing their capability to perform predictive maintenance. This integration not only increases operational efficiency by minimizing downtime but also significantly reduces maintenance costs. Predictive maintenance facilitated by IoT allows for the timely detection and rectification of potential issues before they escalate, ensuring the smooth functioning of robots in various applications.

This advancement is particularly beneficial in manufacturing and industrial sectors, where equipment uptime is critical. The cost-efficiency and improved productivity resulting from IoT integration are compelling factors driving the adoption of smart robots across multiple industries.

Restraint

Data privacy concerns and stringent regulations

As robots become more integrated into daily operations, they collect vast amounts of data, raising concerns about data security and privacy. The potential for sensitive information to be compromised or misused is a significant worry for both organizations and individuals.

Furthermore, governments worldwide are implementing rigorous regulations to protect data privacy, complicating the deployment of smart robots. These regulations require companies to adhere to strict guidelines regarding data collection, storage, and processing, adding complexity and potentially limiting the scope of smart robot applications in certain industries or regions.

Opportunity

COVID-19 pandemic prompting several industries to adopt automation technologies

The COVID-19 pandemic has unexpectedly served as a catalyst for several industries to accelerate their adoption of automation technologies, presenting a substantial opportunity for the smart robots market. The need for social distancing and reduced human workforce on-site has highlighted the benefits of deploying smart robots for various tasks, including disinfection, delivery services, and even performing diagnostic procedures.

This shift towards automation is not merely a temporary response to the pandemic but is anticipated to have long-lasting implications. Industries are recognizing the efficiency, scalability, and resilience that automation brings, especially in the face of challenges such as labor shortages and the need for stringent hygiene practices. The pandemic has underscored the versatility and potential of smart robots, setting the stage for sustained growth in their adoption.

Challenge

Inaccurate results impeding use in critical operations

One of the significant challenges facing the smart robots market is the issue of inaccurate results, particularly when these robots are employed in critical operations. Despite advancements in AI and machine learning, smart robots can still encounter difficulties in interpreting complex or unstructured data, leading to errors or suboptimal decisions.

In environments where precision and reliability are paramount, such as healthcare or safety-critical industrial processes, these inaccuracies can have serious repercussions. This limitation not only hampers the trust in and deployment of smart robots for critical tasks but also necessitates ongoing research and development to enhance their decision-making capabilities. Overcoming this challenge is crucial for the broader acceptance and integration of smart robots in operations where their performance directly impacts safety and outcomes

Regional Analysis

In 2023, the Asia-Pacific (APAC) region emerged as the dominant player in the smart robots market, capturing a significant market share of over 40.9%. The demand for Smart Robots in Asia-Pacific was valued at US$ 5.1 billion in 2023 and is anticipated to grow significantly in the forecast period.

Several factors have contributed to APAC’s leading position in the market. Firstly, APAC has witnessed rapid industrialization and a strong focus on technological advancements, particularly in countries like China, Japan, and South Korea. These countries are known for their robust manufacturing sectors and have been early adopters of smart robots in industries such as automotive, electronics, and consumer goods. The demand for automation and the need for increased productivity have driven the adoption of smart robots in these markets.

Moreover, APAC has a large population base, which has created a demand for smart robots in various sectors, including healthcare and services. The region has been actively investing in the development of healthcare robots to cater to its aging population. These robots assist in tasks such as patient care, rehabilitation, and medication management, thereby addressing the growing need for healthcare services.

Additionally, the presence of leading technology companies and research institutes in APAC has significantly contributed to the growth of the smart robots market. These institutions have been at the forefront of research and development, driving innovation in the field of robotics. The region has witnessed substantial investments in startups and collaborations between industry players and academia, fostering the development and commercialization of advanced smart robots.

Looking ahead, APAC is expected to maintain its dominant position in the smart robots market. The region’s strong manufacturing base, continuous technological advancements, and increasing adoption of automation across industries will drive the demand for smart robots. Furthermore, the rising investments in research and development, along with supportive government initiatives, will further propel the growth of the smart robots market in APAC.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In analyzing the key players in the smart robots market, it’s crucial to discern those entities driving innovation, shaping trends, and influencing the industry’s trajectory. Smart robots, equipped with artificial intelligence and advanced sensors, are increasingly revolutionizing various sectors, from manufacturing and healthcare to logistics and consumer electronics.

Top Market Leaders

- ABB Ltd.

- KUKA AG

- FANUC Corporation

- Omron Corporation

- Honda Motor Co., Ltd.

- Yaskawa Electric Corporation

- Kawasaki Robotics

- Hanson Robotics Ltd.

- DeLaval

- Samsung Electronics Co., Ltd.

- Puresight Systems Pvt. Ltd.

- Intuitive Surgical, Inc.

- Other Key Players

Recent Developments

1. ABB Ltd.:

- In February 2023, ABB unveiled its latest offerings, the “GoFa™ and SWIFTI™ cobots.” These next-generation collaborative robots boast higher payloads and speeds, expanding ABB’s smart cobot portfolio to meet evolving industry demands.

- During June 2023, ABB forged a strategic partnership with Microsoft. This collaboration aims to fuse ABB’s robotics expertise with Microsoft’s Azure cloud platform, with the goal of enhancing the intelligence and capabilities of smart robots through innovative solutions.

2. KUKA AG:

- Throughout 2023, KUKA maintained its focus on developing and offering a diverse range of smart robot solutions. These offerings included robots integrated with advanced AI and machine learning capabilities, reflecting KUKA’s commitment to staying at the forefront of robotics innovation.

3. FANUC Corporation:

- February 2023 saw the launch of FANUC’s “DR-3iB Series” collaborative robots. These robots come equipped with improved safety features and ease of use, catering to the growing demand for smart cobots in various industries.

- In October 2023, FANUC announced a strategic partnership with NVIDIA. This collaboration aims to leverage NVIDIA’s cutting-edge AI technology to further enhance the intelligence and capabilities of FANUC’s robots, positioning them at the forefront of robotics innovation.

4. Omron Corporation:

- In January 2023, Omron introduced its groundbreaking “innovative AI hand.” This robotic gripper utilizes AI algorithms to enhance grasping and manipulation capabilities, showcasing significant advancements in smart robot components and contributing to the evolution of robotic technology.

Report Scope

Report Features Description Market Value (2023) USD 12.5 Bn Forecast Revenue (2033) USD 128.1 Bn CAGR (2024-2033) 26.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software), By Application (Material Handling, Assembling and Disassembling, Inspection and Maintenance, Cleaning, Security, Other Applications), By End-Use (Industrial Use, Commercial Use, Residential Use), By End-Use Industry (Electronics, Automotive, Food & Beverages, Retail, Healthcare, Education, Other End-Use Industries) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ABB Ltd., KUKA AG, FANUC Corporation, Omron Corporation, Honda Motor Co. Ltd., Yaskawa Electric Corporation, Kawasaki Robotics, Hanson Robotics Ltd., DeLaval, Samsung Electronics Co. Ltd., Puresight Systems Pvt. Ltd., Intuitive Surgical Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are smart robots?Smart robots are advanced robotic systems equipped with artificial intelligence (AI), sensors, and other technologies that enable them to perceive, learn, adapt, and perform tasks autonomously or semi-autonomously.

How big is Smart Robots Market?The Global Smart Robots Market size is expected to be worth around USD 128.1 Billion by 2033, from USD 12.5 Billion in 2023, growing at a CAGR of 26.2% during the forecast period from 2024 to 2033.

What is driving the growth of the smart robots market?Factors driving growth include advancements in AI and sensor technologies, increasing demand for automation across industries, rising labor costs, the need for precision and efficiency, and the expansion of applications in sectors like healthcare and logistics.

What are the challenges facing the smart robots market?Challenges include concerns about job displacement, safety and regulatory issues, high initial costs, complexity of implementation, interoperability among different systems, and ethical considerations regarding AI and automation.

Who are the major players operating in the Smart Robots Market?ABB Ltd., KUKA AG, FANUC Corporation, Omron Corporation, Honda Motor Co. Ltd., Yaskawa Electric Corporation, Kawasaki Robotics, Hanson Robotics Ltd., DeLaval, Samsung Electronics Co. Ltd., Puresight Systems Pvt. Ltd., Intuitive Surgical Inc., Other Key Players

Which region will lead the global Smart Robots Market?In 2023, the Asia-Pacific (APAC) region emerged as the dominant player in the smart robots market, capturing a significant market share of over 40.9%.

-

-

- ABB Ltd.

- KUKA AG

- FANUC Corporation

- Omron Corporation

- Honda Motor Co., Ltd.

- Yaskawa Electric Corporation

- Kawasaki Robotics

- Hanson Robotics Ltd.

- DeLaval

- Samsung Electronics Co., Ltd.

- Puresight Systems Pvt. Ltd.

- Intuitive Surgical, Inc.

- Other Key Players