Global Smart Labelling in Logistics Market Size, Share, Growth Analysis By Component (Hardware, Software, Services), By Product (RFID Labels, NFC Labels, Electronic Shelf Labels (ESL), Others), By Application (Inventory Management, Asset Tracking, Parcel Tracking & Delivery, Cold Chain Monitoring, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155473

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

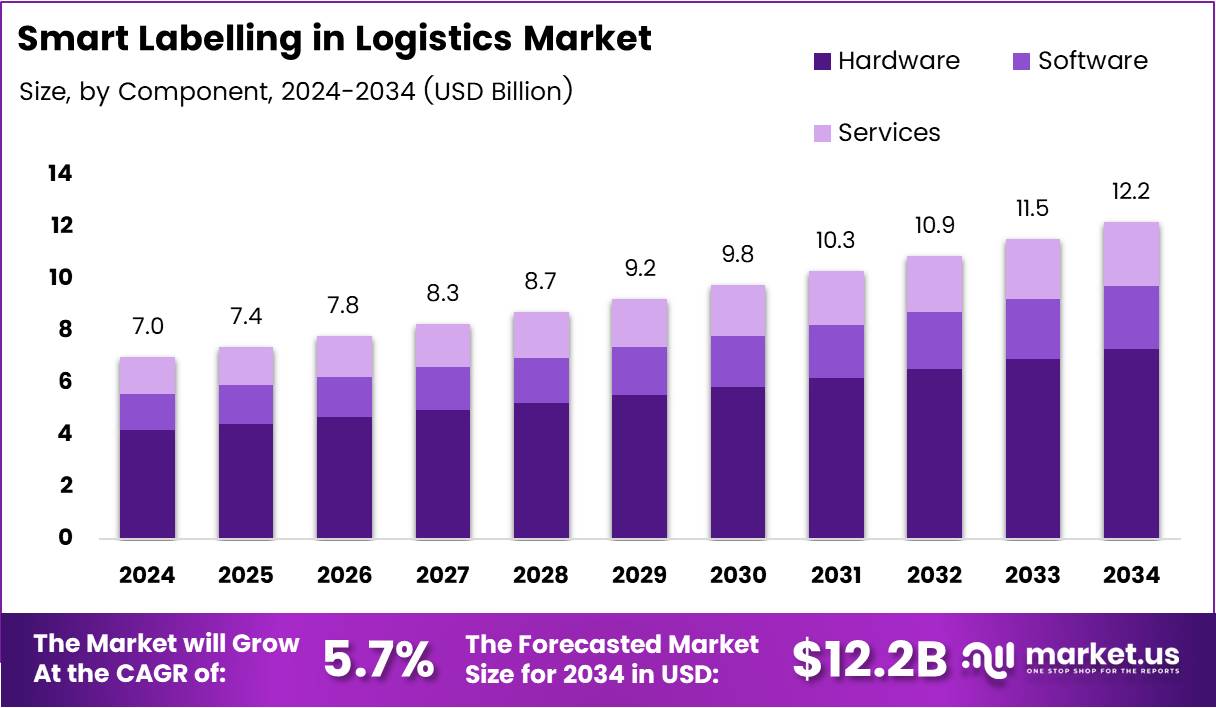

The Global Smart Labelling in Logistics Market size is expected to be worth around USD 12.2 Billion by 2034, from USD 7.0 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

The Smart Labelling in Logistics Market is gaining traction as companies seek to enhance operational efficiency, reduce errors, and optimize their supply chain operations. Smart labeling incorporates advanced technologies such as RFID, IoT, and QR codes to improve the tracking, identification, and management of goods. This innovation is transforming logistics by enabling real-time data exchange, improving accuracy, and streamlining processes.

Growth in the Smart Labelling in Logistics Market is largely driven by the rising demand for automation and precision in supply chains. As businesses focus on optimizing their logistics operations, smart labeling systems offer solutions that ensure accurate inventory management and improved product traceability. These systems help companies reduce manual intervention, thus minimizing human errors and operational delays.

Moreover, opportunities in the market are expanding with the increasing adoption of e-commerce. Online retail platforms need to handle a high volume of shipments efficiently, making smart labeling essential for ensuring accurate order fulfillment and timely delivery. Additionally, the demand for contactless and automated systems post-pandemic has created further growth opportunities in the logistics sector.

Governments around the world are also contributing to the market’s expansion by investing in infrastructure and regulatory frameworks that support technological innovations in logistics. These investments are designed to enhance efficiency, reduce environmental impact, and promote sustainability. Policies aimed at improving supply chain management through smart technologies are paving the way for widespread adoption of smart labeling solutions.

Furthermore, regulations surrounding product safety, traceability, and data privacy are prompting logistics companies to adopt smart labeling systems. These regulations are ensuring that businesses meet international standards while adhering to local laws. Consequently, companies are increasingly integrating smart labeling technologies to comply with these requirements, enhancing overall business operations.

According to a survey, 60% of organizations identified labeling errors as a significant cause of delayed shipments and increased costs. This statistic highlights the importance of accurate labeling systems in the logistics industry. By reducing errors, smart labeling technology can improve the speed and efficiency of logistics operations, ultimately enhancing customer satisfaction.

Key Takeaways

- The Global Smart Labelling in Logistics Market is projected to reach USD 12.2 Billion by 2034, growing at a CAGR of 5.7%.

- In 2024, the Hardware segment dominates the market, with a 57.9% share.

- RFID Labels lead the market with a 49.7% share in 2024.

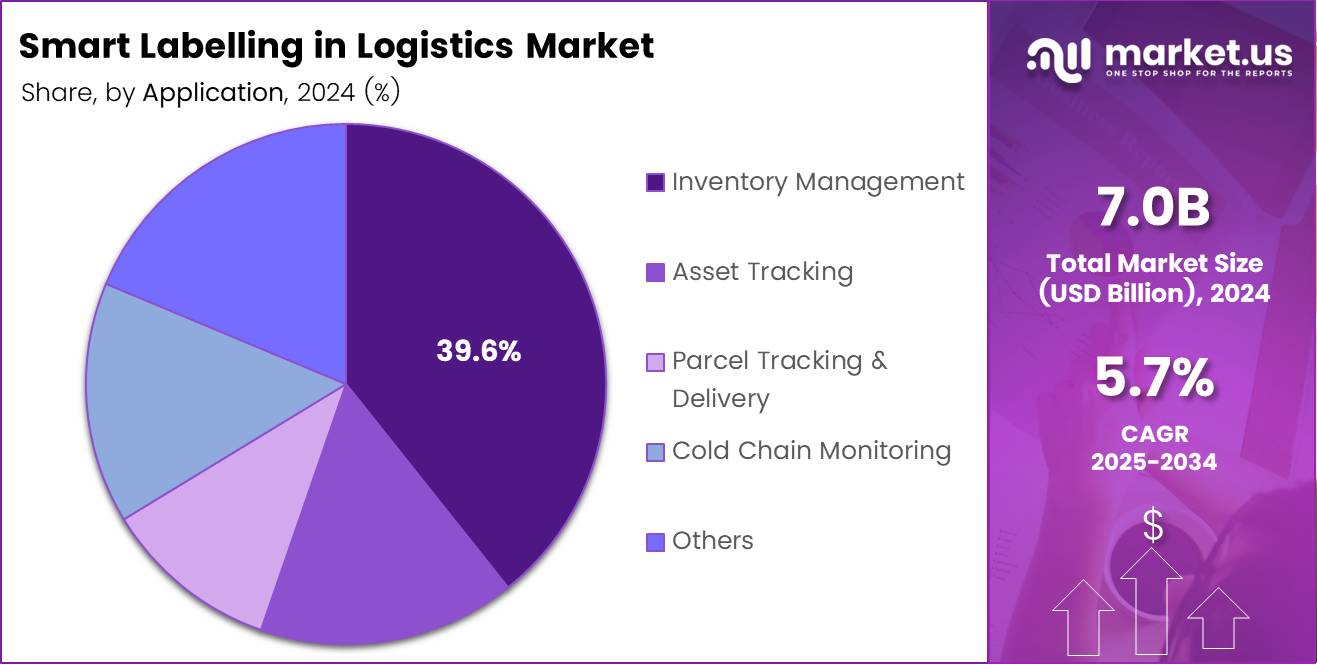

- Inventory Management is the leading application in the market, holding a 39.3% share in 2024.

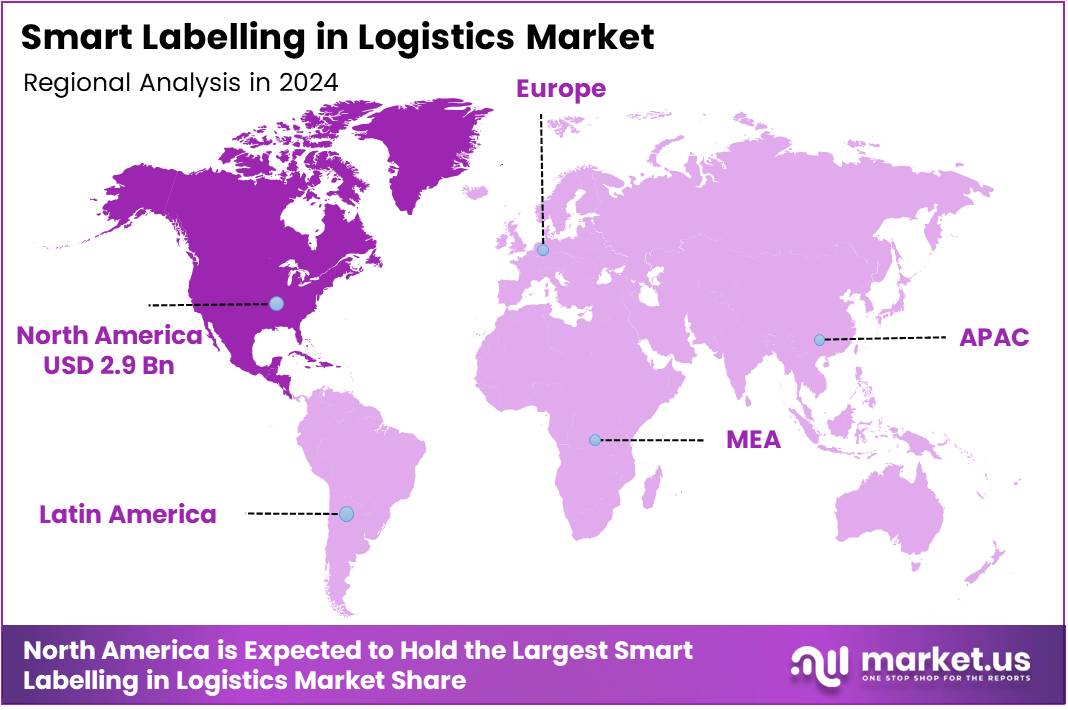

- North America holds the largest market share at 41.8%, valued at USD 2.9 billion.

Component Analysis

In 2024, Hardware held a dominant market position in By Component Analysis segment of Smart Labelling in Logistics Market, with a 57.9% share.

In 2024, the Hardware segment maintained a significant lead in the Smart Labelling in Logistics market, capturing an impressive 57.9% market share. The widespread use of RFID tags, scanners, and printers in logistics has driven this dominance. Hardware provides essential infrastructure for the efficient operation of labelling systems, making it indispensable for supply chain processes.

The Software segment, while important, holds a smaller portion of the market compared to Hardware. Software solutions are designed to manage data and enhance the efficiency of smart labelling systems. However, it accounts for a smaller share due to the high upfront cost of hardware installation and the growing preference for hardware-centric solutions in the logistics sector.

Services, which include installation, support, and maintenance, play a supporting role in ensuring the smooth operation of hardware and software systems. However, Services remain a niche market within the broader Smart Labelling ecosystem, contributing to the growth but not overtaking hardware-based solutions in terms of revenue.

Product Analysis

In 2024, RFID Labels held a dominant market position in By Product Analysis segment of Smart Labelling in Logistics Market, with a 49.7% share.

RFID Labels lead the Smart Labelling in Logistics market, with a 49.7% share in 2024. RFID tags are highly efficient, providing seamless tracking and identification of goods, making them a preferred solution in logistics operations. Their wide adoption in inventory management and real-time tracking has contributed significantly to their dominance.

NFC Labels are gaining traction but remain behind RFID Labels in terms of market share. NFC technology provides a more interactive approach to logistics labelling, yet its adoption is limited in comparison to the more widely used RFID system.

Electronic Shelf Labels (ESL) are emerging as a modern solution, particularly in retail logistics, but have a smaller market presence. Their ability to dynamically display price and product information through digital screens offers value but is still a developing technology.

Other product types, while innovative, account for a small portion of the market. Their niche applications have not yet resulted in mass adoption, limiting their market share.

Application Analysis

In 2024, Inventory Management held a dominant market position in By Application Analysis segment of Smart Labelling in Logistics Market, with a 39.3% share.

Inventory Management is the leading application in the Smart Labelling in Logistics market, capturing a 39.3% share in 2024. With the increasing need for efficient tracking and stock control, smart labelling technology plays a pivotal role in enhancing inventory management operations, reducing errors, and ensuring accurate stock levels across supply chains.

Asset Tracking follows closely behind, leveraging smart labels to monitor valuable assets throughout the logistics process. This application supports businesses in reducing losses and improving asset utilization, though it does not dominate as much as inventory management.

Parcel Tracking & Delivery is another growing segment. It ensures transparency and visibility across the delivery process. However, it faces tough competition from more established applications, limiting its overall share in the market.

Cold Chain Monitoring remains a critical niche application, particularly in sectors like pharmaceuticals and perishable goods. While essential, its smaller focus compared to inventory management limits its share in the overall market.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Product

- RFID Labels

- NFC Labels

- Electronic Shelf Labels (ESL)

- Others

By Application

- Inventory Management

- Asset Tracking

- Parcel Tracking & Delivery

- Cold Chain Monitoring

- Others

Drivers

Increasing Demand for Real-Time Tracking and Monitoring Drives Growth in Smart Labelling in Logistics Market

The Smart Labelling in Logistics Market is witnessing growth due to the rising demand for real-time tracking and monitoring in supply chains. Companies are increasingly seeking ways to track their goods from the moment they leave the warehouse to when they reach the customer. Real-time tracking ensures transparency and improves the overall efficiency of the supply chain, helping businesses avoid costly delays.

Another key driver is the growing adoption of the Internet of Things (IoT) in supply chain management. IoT devices and smart labels can provide instant updates about a product’s condition, location, and status throughout the journey. This enables better decision-making and a more streamlined process.

Smart labels also offer enhanced data accuracy, which is crucial for logistics companies. The ability to store and transmit precise information improves inventory management and reduces human errors, ultimately enhancing overall productivity.

Furthermore, the explosive growth of e-commerce has placed a significant strain on logistics systems. Efficient logistics, facilitated by smart labelling, is essential for ensuring that products are delivered on time. This increasing demand for faster and more accurate deliveries contributes significantly to the growth of the smart labelling market.

Restraints

Technological Challenges and Regulatory Barriers Restrain Smart Labelling in Logistics Market

Despite the potential benefits, the Smart Labelling in Logistics Market faces several restraints, with technological challenges being a major concern. Integrating smart labelling solutions with existing systems can be complex and costly for many logistics providers. This integration requires considerable investment in technology and resources, which may discourage smaller players from adopting these solutions.

In addition to integration issues, regulatory hurdles and standardization challenges are also hindering the growth of smart labelling. Many countries have varying regulations and standards for labeling, which complicates the adoption of universal solutions. This lack of uniformity in standards can create barriers for global supply chains, as businesses must navigate different compliance requirements across regions.

Growth Factors

Growth Opportunities in Smart Labelling in Logistics Market Driven by Sustainability and Technological Advancements

Smart labelling in logistics presents several growth opportunities, especially in the context of rising demand for sustainability and eco-friendly packaging solutions. Consumers and companies alike are becoming more environmentally conscious, driving the need for packaging that is both smart and sustainable. Smart labels can facilitate recycling and reduce waste, aligning with global sustainability goals.

Another opportunity lies in the expansion of smart logistics in developing economies. As countries in Asia, Africa, and Latin America invest in logistics infrastructure, the adoption of smart labelling solutions is expected to increase. This provides a significant opportunity for companies offering these technologies to tap into new and emerging markets.

Technological advancements in RFID and QR code solutions also present growth opportunities. These technologies offer higher efficiency, faster data transmission, and improved tracking capabilities, making them more appealing for logistics providers seeking to enhance their operations.

Finally, the integration of artificial intelligence (AI) and machine learning (ML) for predictive analytics can revolutionize the logistics industry. By leveraging these technologies, companies can optimize their supply chains, predict potential disruptions, and enhance overall efficiency, opening up new growth avenues in the smart labelling market.

Emerging Trends

Trending Factors Shaping Smart Labelling in Logistics Market

The Smart Labelling in Logistics Market is being shaped by several trending factors, with blockchain emerging as a significant technology. Blockchain offers secure and transparent supply chains, enabling businesses to track goods and verify their authenticity. This technology helps ensure that products reach consumers without being tampered with, improving trust and security.

There is also an increasing popularity of contactless and digital solutions, driven by the ongoing digital transformation of supply chains. These technologies provide faster, safer, and more convenient ways of tracking and managing goods, improving efficiency and customer satisfaction.

As customer expectations evolve, there is a growing demand for enhanced consumer experiences through personalized logistics. Smart labels enable companies to offer more personalized services, such as tailored product information and real-time updates, improving the overall customer experience.

Lastly, the focus on supply chain transparency and authenticity verification continues to grow. Consumers are more concerned than ever about the origin of their products, and businesses are responding by using smart labels to provide clear, transparent information about their goods. This trend is reshaping the way companies engage with their customers and manage their supply chains.

Regional Analysis

North America Dominates the Smart Labelling in Logistics Market with a Market Share of 41.8%, Valued at USD 2.9 Billion

North America holds a dominant position in the Smart Labelling in Logistics Market, commanding 41.8% of the market share, valued at USD 2.9 billion. This region’s market growth is driven by advanced technological adoption, such as RFID and IoT-based solutions, which significantly improve supply chain transparency and efficiency. Strong demand from industries like retail and pharmaceuticals contributes to the sustained market leadership.

Europe Smart Labelling in Logistics Market Trends

Europe holds a significant share in the Smart Labelling in Logistics Market, benefiting from strong regulatory frameworks and technological advancements in smart labelling solutions. The region is adopting advanced IoT, RFID, and NFC technologies in logistics for enhanced traceability and efficiency. The growing demand from e-commerce and retail sectors further supports the market’s expansion.

Asia Pacific Smart Labelling in Logistics Market Trends

Asia Pacific is witnessing rapid adoption of smart labelling technologies, with increased demand driven by logistics growth, especially in countries like China and India. The region’s market is expanding due to the increasing need for real-time tracking and inventory management in the booming e-commerce and manufacturing industries. The market is also supported by government initiatives to modernize logistics infrastructure.

Middle East and Africa Smart Labelling in Logistics Market Trends

The Middle East and Africa region is seeing gradual but steady growth in the Smart Labelling in Logistics Market. Enhanced infrastructure in key markets like the UAE and Saudi Arabia is fostering the adoption of smart labelling technologies. The increasing demand for efficient logistics solutions, along with government-backed development initiatives, is driving market growth in the region.

Latin America Smart Labelling in Logistics Market Trends

In Latin America, the Smart Labelling in Logistics Market is growing steadily, driven by the region’s expanding e-commerce industry. The adoption of smart labelling solutions is increasing as businesses seek to improve supply chain visibility and reduce operational costs. The market is also benefiting from an increase in trade and logistics activity, particularly in Brazil and Mexico.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Smart Labelling in Logistics Company Insights

The Zebra Technologies Corporation is a dominant player in the global Smart Labelling in Logistics Market, offering comprehensive solutions that enhance tracking and inventory management. Known for its RFID technology, Zebra’s innovative labeling systems are widely used across industries, particularly in retail and healthcare.

CCL Industries Inc. plays a significant role in the smart labelling market with its advanced pressure-sensitive labels and RFID products. The company focuses on sustainable and highly efficient labeling solutions, catering to a wide range of sectors, including logistics, automotive, and consumer goods.

Toshiba Tec Corporation provides integrated printing and labeling solutions that improve operational efficiency in logistics. Toshiba’s innovative label printers and smart technology contribute to real-time asset tracking, reducing costs and improving supply chain visibility.

Cognex Corporation is known for its machine vision systems, which complement smart labeling solutions. The company’s vision systems offer advanced barcode and RFID reading technologies, supporting seamless integration into logistics operations for better inventory management and asset tracking.

These companies continue to innovate and expand their product offerings to meet the increasing demand for smart labeling solutions in logistics. Their efforts to integrate RFID technology, barcode systems, and machine vision are key drivers in enhancing supply chain visibility, accuracy, and overall efficiency.

Top Key Players in the Market

- Zebra Technologies Corporation

- CCL Industries Inc.

- Toshiba Tec Corporation

- Cognex Corporation

- Sato Holdings Corporation

- Checkpoint Systems Inc.

- Avery Dennison

- Oracle Corporation

- Impinj

- Sato Holdings

Recent Developments

- In February 2025, Tive raised a $40 million round of funding to drive innovation in global supply chains, focusing on expanding its real-time visibility platform and enhancing its capabilities in supply chain management.

- In October 2024, MCC acquired Starport Technologies, a smart labels solutions provider, as part of its strategic move to bolster its position in the smart labeling market, aiming to improve its logistics and supply chain offerings.

- In July 2025, IN Groupe successfully completed the acquisition of IDEMIA Smart Identity, solidifying its leadership in secure identity solutions globally and enhancing its portfolio in identity verification and authentication technologies.

Report Scope

Report Features Description Market Value (2024) USD 7.0 Billion Forecast Revenue (2034) USD 12.2 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Product (RFID Labels, NFC Labels, Electronic Shelf Labels (ESL), Others), By Application (Inventory Management, Asset Tracking, Parcel Tracking & Delivery, Cold Chain Monitoring, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Zebra Technologies Corporation, CCL Industries Inc., Toshiba Tec Corporation, Cognex Corporation, Sato Holdings Corporation, Checkpoint Systems Inc., Avery Dennison, Oracle Corporation, Impinj, Sato Holdings Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Labelling in Logistics MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Labelling in Logistics MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zebra Technologies Corporation

- CCL Industries Inc.

- Toshiba Tec Corporation

- Cognex Corporation

- Sato Holdings Corporation

- Checkpoint Systems Inc.

- Avery Dennison

- Oracle Corporation

- Impinj

- Sato Holdings