Global Smart Home Security Camera Market Size, Share, Growth Analysis Report By Type (Wired Cameras, Wireless Cameras), By Application (Indoor, Outdoor, Doorbell), By Distribution Channel (Online Platforms, Offline Stores), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132873

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

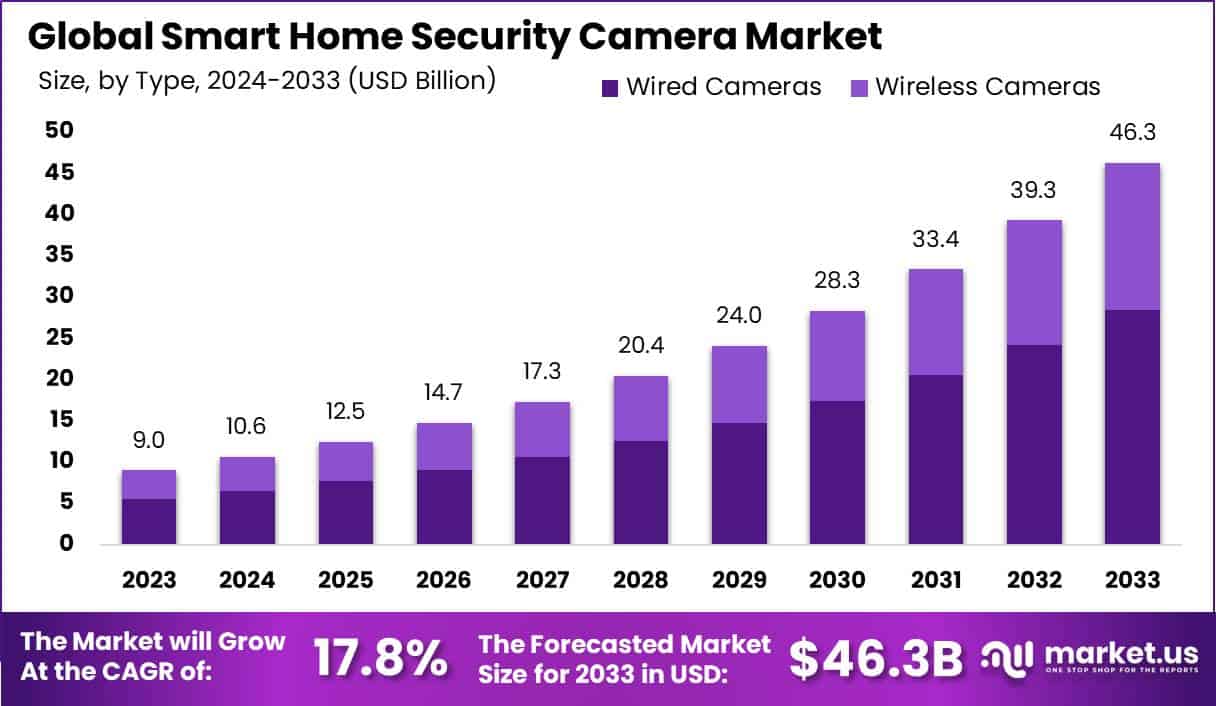

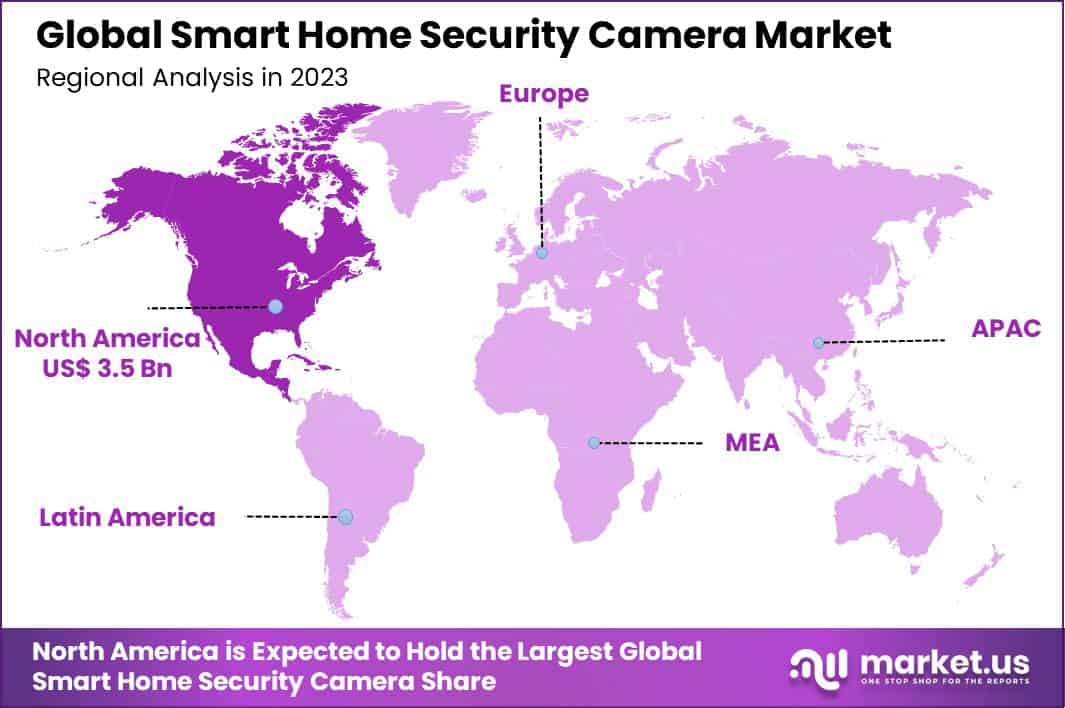

The Global Smart Home Security Camera Market size is expected to be worth around USD 46.3 Billion By 2033, from USD 9.0 Billion in 2023, growing at a CAGR of 17.80% during the forecast period from 2024 to 2033. North America was the leading region in 2023, holding more than 38.8% of the global market share, with revenues reaching USD 3.5 billion.

Smart home security cameras are advanced devices that enhance the security of your home through digital technology, allowing you to monitor your property remotely. These cameras connect to the internet, enabling you to access live or recorded footage via your smartphone, tablet, or computer. Features typically include high-definition video capture, motion detection, night vision, and two-way audio communication, offering homeowners a robust tool for ensuring their property’s safety while they are away or inside their homes

The market for smart home security cameras is rapidly expanding as more consumers look to bolster home security and leverage smart technology for everyday convenience. Several factors are driving the growth of the smart home security camera market such as the increasing consumer awareness regarding home security and the rising incidence of property crimes thus homeowners seek effective and accessible ways to monitor their homes.

Key factors driving the market include the growing consumer awareness of safety and security, the rising popularity of smart homes equipped with integrated devices, and the increasing urbanization that supports the adoption of sophisticated security solutions.

Additionally, the integration of advanced technologies such as artificial intelligence and the Internet of Things enhances the functionality and effectiveness of security cameras, further stimulating their adoption. The demand for smart home security cameras is significantly high in regions like North America, where there is a rapid integration of IoT technology within smart homes.

Moreover, the Asia Pacific region is expected to witness the fastest growth due to its increasing urban population and rising technological adoption. Opportunities are particularly notable in applications that facilitate remote monitoring for elderly care and pet monitoring, driven by functionalities that allow for real-time interaction and emergency management.

According to a recent study by Bunning’s, a leading retailer of home improvement and outdoor living products in Australia and New Zealand, the adoption of smart home technology is on the rise across Australia. Remarkably, 49% of Australians now use some form of smart home technology.

The study reveals that half of these users interact with their devices on a daily basis. The primary motivation for most users is enhanced home security, with 61% citing general security concerns and 44% looking to protect against intruders as their main reasons for investing in smart technology.

According to Market.us, the global smart home security market size is projected to grow from USD 28.4 billion in 2023 to approximately USD 107.1 billion by 2033, reflecting a robust CAGR of 14.2% during the forecast period from 2024 to 2033. Rising adoption of technologies such as smart cameras and speakers has been instrumental in reshaping home security solutions globally.

The widespread adoption of smart home devices is particularly evident in China, where more than 90% of individuals own at least one smart home device, According to industry report. Globally, the smart home market is forecasted to reach USD 155 billion in 2023, driven by the growing preference for integrated and user-friendly technologies.

By 2024, the number of smart homes worldwide is expected to surpass 400 million, emphasizing the expanding role of smart devices in enhancing convenience and safety. Smart home security cameras, especially indoor models, are gaining traction, holding 39.3% of the market share.

The number of households adopting smart security cameras is set to grow by 81.84 million, achieving a remarkable growth rate of 82.79%. In the United States, 51% of households have already embraced smart cameras, underscoring the increasing importance of these devices in modern homes.

Key Takeaways

- The global smart home security camera market is expected to reach a value of USD 46.3 billion by 2033, up from USD 9.0 billion in 2023, growing at a compound annual growth rate (CAGR) of 17.80% during the forecast period from 2024 to 2033.

- In 2023, the wired cameras segment led the smart home security camera market, holding a dominant share of over 61.5%. Wired cameras are often preferred for their stable and consistent connection, which appeals to consumers seeking reliable, high-quality surveillance for their homes.

- The indoor segment also captured a major portion of the market in 2023, accounting for more than 42.6% of the overall share.

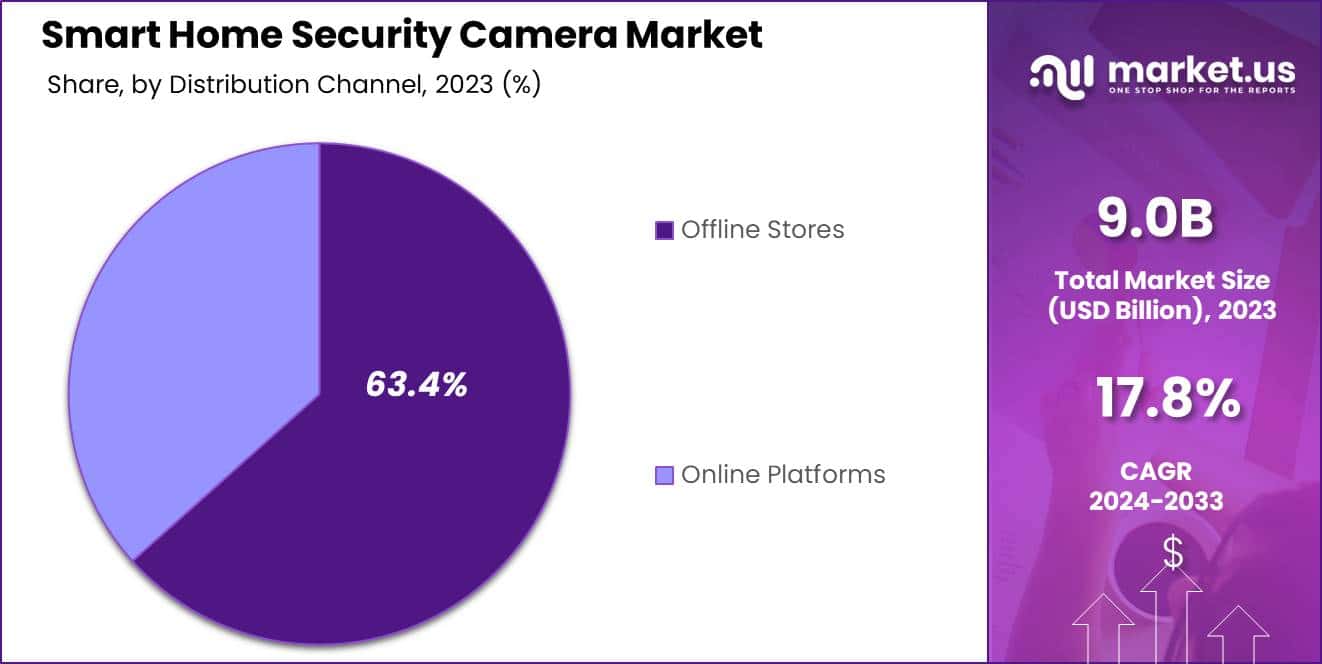

- Offline stores remained the dominant distribution channel for smart home security cameras in 2023, holding more than 63.4% of the market share. Consumers continue to favor in-person shopping experiences where they can physically inspect products before purchase, making offline retail outlets the primary source for buying security cameras.

- North America maintained its leadership position in the global smart home security camera market in 2023, capturing over 38.8% of the market share. The region generated substantial revenue, reaching USD 3.5 billion, thanks to strong consumer demand driven by increasing awareness of security concerns and the adoption of smart home technologies.

Type Analysis

In 2023, the Wired Cameras segment held a dominant market position in the smart home security camera market, capturing more than a 61.5% share. This prominence can primarily be attributed to the reliability and stability that wired cameras offer.

Wired cameras are not susceptible to interference from other wireless devices, which can be a significant advantage in densely populated urban areas where wireless traffic is heavy. They provide continuous power supply and do not depend on batteries, making them more reliable for continuous, long-term surveillance.

Another reason for the lead of wired cameras is their reputation for providing higher-quality video feeds with less susceptibility to hacking. Wired connections are generally considered more secure than wireless ones because they are less exposed to the vulnerabilities associated with Wi-Fi connections.

Furthermore, innovations such as Power over Ethernet (PoE) have simplified the installation process by allowing both power and data to be transmitted over a single cable. Such technological enhancements not only improve the functionality of wired cameras but also enhance their appeal by reducing the complexity and cost of installation.

Application Analysis

In 2023, the Indoor segment held a dominant market position in the smart home security camera market, capturing more than a 42.6% share. This leadership can be attributed to the increasing consumer preference for indoor monitoring systems that offer real-time surveillance, motion detection, and integration with other smart home devices.

The rise in demand for indoor security cameras is further supported by their multifunctional applications. Beyond security, these cameras are used for monitoring children, elderly family members, or pets, and for overseeing household activities while residents are away. This versatility makes them an attractive option for a broad range of consumers looking to enhance their home security and monitoring systems.

Moreover, advancements in technology have significantly improved the appeal of indoor cameras. Features like Wi-Fi connectivity, two-way audio, and compatibility with smartphones and voice assistants have streamlined the way users interact with their security systems.

Distribution Channel Analysis

In 2023, the Offline Stores segment held a dominant market position in the smart home security camera market, capturing more than a 63.4% share. This dominance is largely due to consumer preference for physically inspecting products before purchasing, which is particularly important for security devices.

Additionally, offline stores offer the immediate gratification of taking a product home the same day, which is a significant advantage over online shopping. The presence of established retail brands and chain stores that consumers trust also plays a crucial role in driving sales through this channel.

The personal interaction in offline stores provides another layer of trust, as consumers can receive tailored recommendations based on their specific needs and the layout of their homes. Sales personnel can offer insights into the most suitable products and explain installation processes or compatibility with other smart home devices, enhancing the overall customer experience.

Moreover, offline channels often feature exclusive in-store promotions and discounts, attracting a broader customer base looking for value in their purchases. This strategy not only boosts foot traffic in physical stores but also strengthens customer loyalty and satisfaction, further cementing the leading position of offline stores in the distribution of smart home security cameras.

Key Market Segments

By Type

- Wired Cameras

- Wireless Cameras

By Application

- Indoor

- Outdoor

- Doorbell

By Distribution Channel

- Online Platforms

- Offline Stores

Driver

Consumer Demand for Home Security and Safety Solutions

One of the major drivers for the Smart Home Security Camera market is the rising consumer demand for advanced home security and safety solutions. Homeowners increasingly seek to protect their families, properties, and belongings using technology that provides real-time monitoring, remote access, and robust deterrents against intrusions and thefts.

With the growing awareness of potential security threats, consumers have come to expect more proactive solutions for safeguarding their homes. Smart security cameras offer a seamless way to achieve this by combining the latest advancements in artificial intelligence (AI), motion detection, and connectivity. The ability to monitor homes from anywhere through smartphones, receive instant alerts, and have high-definition footage has elevated their perceived value.

Restraint

Concerns About Privacy and Data Security

One of the main restraints is the growing concern over privacy and data security. As more households adopt internet-connected security cameras, many consumers worry about the potential for unauthorized access, data breaches, and misuse of sensitive footage. These concerns are not unfounded; there have been instances of hackers gaining access to home cameras, leading to privacy violations and compromising trust in the devices.

Privacy concerns extend beyond hacking. Many security cameras store video footage in the cloud, which can make this data susceptible to breaches or misuse if not adequately protected by the service provider. Consumers have raised issues with data retention policies, where footage is sometimes kept longer than necessary, adding another layer of potential vulnerability.

Opportunity

Integration with AI and Smart Home Ecosystems

The integration of artificial intelligence (AI) with smart home security cameras presents a significant opportunity for market growth. By incorporating AI capabilities, manufacturers can offer enhanced features such as facial recognition, anomaly detection, automatic alerts, and behavior analysis.

AI-driven security cameras can also work as part of broader smart home ecosystems, enhancing convenience and utility. Integrating these devices with other connected home solutions, such as lighting, thermostats, or voice-controlled assistants, can provide a seamless and comprehensive approach to home automation and security.

Moreover, the growing interest in smart city initiatives and connected infrastructure offers opportunities for manufacturers of smart home security cameras to collaborate with municipalities, utility providers, and security firms.

Challenge

Interoperability and Compatibility Issues

One of the key challenges facing the smart home security camera market is the issue of interoperability and compatibility with other smart home devices. The smart home ecosystem is still fragmented, with many devices manufactured by different companies often operating on proprietary platforms and protocols. As a result, users may face difficulties integrating a new security camera with their existing devices, causing frustration and potentially limiting adoption.

Devices that were once fully compatible may become less functional or unsupported over time as newer devices emerge or existing software is updated. This results in additional costs for consumers who need to upgrade or replace older devices, and it poses a challenge for manufacturers to ensure their products remain compatible with evolving technologies.

Emerging Trends

The landscape of smart home security cameras is rapidly evolving, driven by technological advancements and growing consumer demand for enhanced safety. A notable trend is the integration of artificial intelligence (AI) into these devices. Modern cameras now feature AI-powered capabilities that can distinguish between humans, animals, and vehicles, reducing false alarms and providing more accurate notifications.

Another significant development is the seamless integration of security cameras with broader smart home ecosystems. Companies like Apple are planning to introduce smart security cameras that work harmoniously with their existing products, such as Siri and HomeKit, aiming to offer users a cohesive and user-friendly experience.

Additionally, the rise of DIY (do-it-yourself) security systems has made advanced surveillance more accessible. Affordable and easy-to-install cameras allow homeowners to set up and monitor their security systems without professional assistance, catering to a growing market of tech-savvy individuals seeking cost-effective solutions.

Business Benefits

For businesses, investing in smart security cameras offers a multitude of advantages that extend beyond mere surveillance. One of the primary benefits is the deterrence of theft and vandalism. Visible cameras can discourage criminal activities, thereby reducing losses and enhancing the safety of both employees and customers.

Moreover, these cameras provide real-time monitoring capabilities, allowing business owners to oversee operations remotely. This feature is particularly beneficial for multi-location businesses, as it enables centralized oversight and quick response to any incidents.

Smart cameras can contribute to operational efficiency. By analyzing footage, businesses can identify bottlenecks, monitor customer behavior, and optimize staffing levels. For example, understanding peak hours through video analysis can help in scheduling adequate staff, thereby improving customer service and satisfaction.

Moreover, in the unfortunate event of an incident, recorded footage serves as valuable evidence. It can aid in investigations, support legal proceedings, and provide clarity in disputes, thereby protecting the business from potential liabilities.

Regional Analysis

In 2023, North America held a dominant market position in the smart home security camera market, capturing more than a 38.8% share, with revenues reaching USD 3.5 billion. This leading stance can be attributed to several key factors that underscore the region’s advanced infrastructure and consumer behavior dynamics.

The high level of technological adoption and integration in residential spaces across North America drives a substantial demand for smart home devices, including security cameras. Households in this region exhibit a strong preference for advanced security solutions due to heightened awareness about home security and the availability of disposable income to invest in premium products.

Additionally, the presence of major industry players in the U.S. and Canada, who are continually innovating and expanding their product offerings, contributes significantly to the growth and dominance of this market. Their focus on developing high-definition, reliable, and network-integrated security solutions ensures that market standards remain high and technologically progressive.

According to a report from New-Gen Apps, the United States has made significant strides in energy conservation. By integrating smart homes and sensors, the country has managed to reduce household energy consumption by 20%. Additionally, forecasts from the Thales Group indicate that by 2024, around 63 million U.S. households are expected to be equipped with a home security system. This substantial increase in adoption is likely to fuel further growth in the market.

Furthermore, the increasing rate of crime in urban areas within the region has also propelled the demand for effective and reliable home security solutions. Smart home security cameras offer a deterrent to home invasions and burglaries, with features like remote monitoring, real-time alerts, and video recording capabilities that appeal to security-conscious homeowners.

The regional market is also supported by favorable government initiatives aimed at enhancing residential security, which encourage consumers to adopt such advanced security solutions. This combination of technological leadership, innovation, and heightened security concerns uniquely positions North America as the leader in the smart home security camera market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the smart home security camera market, several key players stand out due to their innovative products and strategic market presence.

Google LLC has made significant strides in the smart home security camera segment through its Nest product line. Google Nest cameras are renowned for their integration with other Google home products, providing a seamless user experience. Their strength lies in the incorporation of advanced AI technology, which enables features like person alerts and activity zones.

Amazon.com, Inc. has also captured a significant portion of the market with its Ring security cameras. Amazon’s approach focuses on ease of use and community security features, such as the Neighbors app, which allows users to share videos and security alerts with nearby residents.

Arlo Technologies, Inc. specializes in wireless security cameras, making them a leader in flexible home security solutions. Arlo’s cameras are highly valued for their robust design, superior video quality, and exceptional battery life. Their product portfolio caters to both indoor and outdoor security needs, providing versatility that is attractive to a broad range of consumers.

Top Key Players in the Market

- Google LLC

- Amazon.com, Inc.

- Arlo Technologies, Inc.

- Wyze Labs, Inc.

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Anker Innovations

- Logitech

- Vivint, Inc.

- Lorex Corporation

- Other Key Players

Recent Developments

- February 2024: Motorola Solutions acquired Silent Sentinel, a UK-based provider of specialized, long-range cameras. This acquisition aims to enhance Motorola’s portfolio in the security sector.

- July 2024: Despite earlier indications of a potential phase-out, Logitech confirmed that its Circle View Doorbell and Circle View Camera remain in production and available for purchase.

- November 2024: Apple is reportedly planning to enter the smart home market with the launch of a smart security camera in 2026. This device is expected to integrate seamlessly with other Apple products and leverage Apple’s AI capabilities.

- November 2024: Eufy (Anker Innovations) introduced the Floodlight Camera E30, priced at $149.99. This device features a 2K camera with 360-degree pan, along with 2,000-lumen LED floodlights. It offers local video capture without subscription fees and includes AI-powered detection for monitoring vehicles and humans.

Report Scope

Report Features Description Market Value (2023) USD 9.0 Bn Forecast Revenue (2033) USD 46.3 Bn CAGR (2024-2033) 17.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Wired Cameras, Wireless Cameras), By Application (Indoor, Outdoor, Doorbell), By Distribution Channel (Online Platforms, Offline Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google LLC, Amazon.com, Inc., Arlo Technologies, Inc., Wyze Labs, Inc., Panasonic Corporation, Samsung Electronics Co., Ltd., Anker Innovations, Logitech, Vivint, Inc., Lorex Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Home Security Camera MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Smart Home Security Camera MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Google LLC

- Amazon.com, Inc.

- Arlo Technologies, Inc.

- Wyze Labs, Inc.

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Anker Innovations

- Logitech

- Vivint, Inc.

- Lorex Corporation

- Other Key Players