Global Smart Healthcare Market By Product Type (Telemedicine (Software, Hardware, and Others), RFID Smart Cabinets, RFID Kanban Systems, Electronic Health Records (EHR) (Client-server Based EHR, and Web-based EHR), mHealth (Diagnosis Services, Healthcare Systems Strengthening, Monitoring Services, and Others), Smart Pills, and Smart Syringes), By End-user (Hospitals, Home Care Settings, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 100918

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

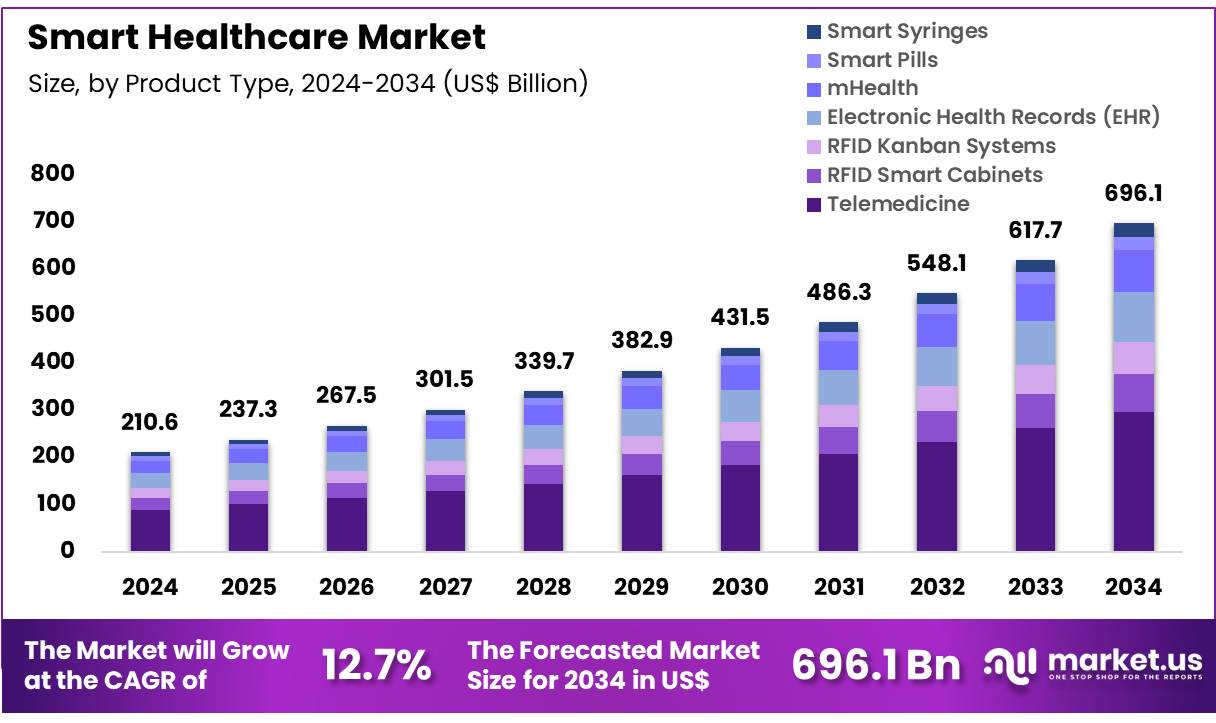

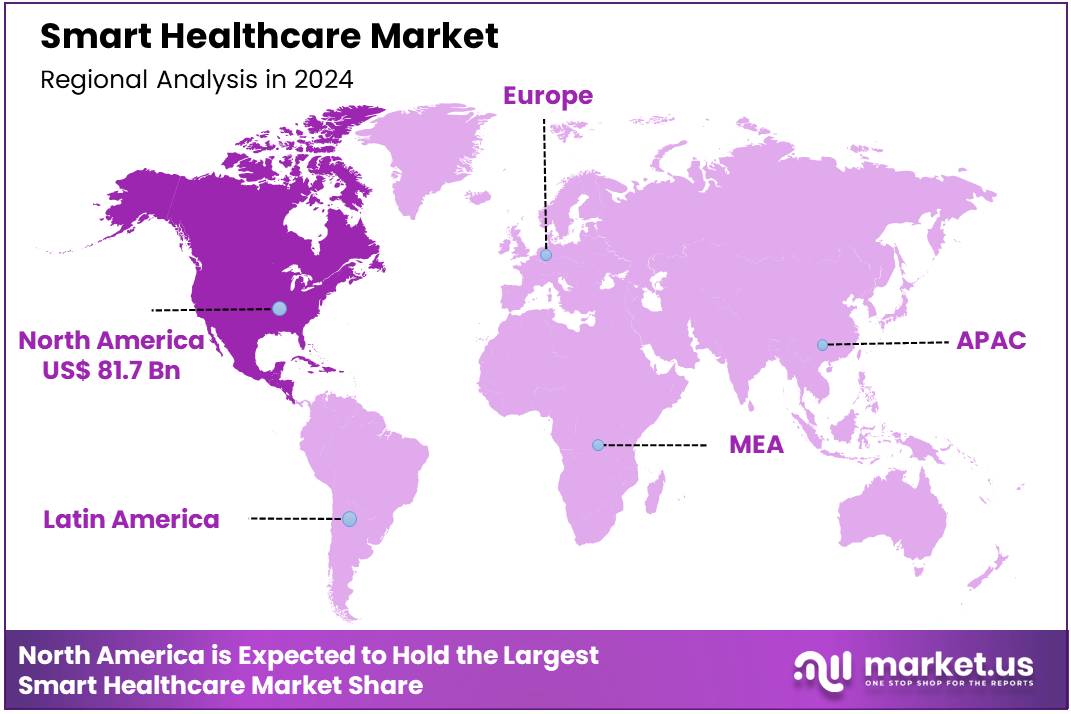

Global Smart Healthcare Market size is expected to be worth around US$ 696.1 Billion by 2034 from US$ 210.6 Billion in 2024, growing at a CAGR of 12.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 81.7% share with a revenue of US$ 81.7 Billion.

Rising chronic disease burdens and the global aging population are primary drivers of the smart healthcare market. This market leverages technologies like the Internet of Things (IoT), artificial intelligence (AI), and mobile health (mHealth) to provide more connected, efficient, and patient-centric care.

The Centers for Disease Control and Prevention (CDC) reports that approximately six in ten Americans live with at least one chronic disease, a reality that necessitates continuous monitoring and personalized treatment. Smart healthcare applications, from remote patient monitoring systems to smart hospital infrastructure, are uniquely positioned to address these challenges by enabling real-time data collection and automated health management.

Growing technological integration and a focus on virtual care are key trends shaping the market. Healthcare providers and tech companies are increasingly collaborating to create comprehensive digital health ecosystems. A prime example is the Cedars-Sinai Connect mobile app, which leverages AI to offer same-day primary care scheduling and round-the-clock access to specialists for urgent medical consultations.

These platforms are not only improving patient access to care but are also increasing operational efficiencies. A 2024 survey by Deloitte’s US Center for Health Solutions found that over 70% of C-suite healthcare executives across five countries prioritize productivity gains and improved operational efficiency, goals that smart healthcare solutions are designed to deliver.

Increasing investment in infrastructure and a drive towards supply chain optimization are creating significant opportunities for market expansion. Companies are strengthening their manufacturing and distribution capabilities to meet the rising demand for smart devices and components. For instance, in January 2023, Avery Dennison inaugurated a new manufacturing facility in Mexico to increase its production capacity and strengthen its supply chain footprint in the Americas. This focus on localizing production and enhancing logistical resilience ensures a steady supply of essential smart healthcare products.

Furthermore, government initiatives like the FDA’s Digital Health Center of Excellence are actively promoting responsible innovation and the adoption of these technologies in clinical settings, further solidifying the market’s growth trajectory.

Key Takeaways

- In 2024, the market for smart healthcare generated a revenue of US$ 210.6 Billion, with a CAGR of 12.7%, and is expected to reach US$ 696.1 Billion by the year 2034.

- The product type segment is divided into telemedicine, RFID smart cabinets, RFID kanban systems, electronic health records (EHR), mhealth, smart pills, and smart syringes, with telemedicine taking the lead in 2023 with a market share of 42.5%.

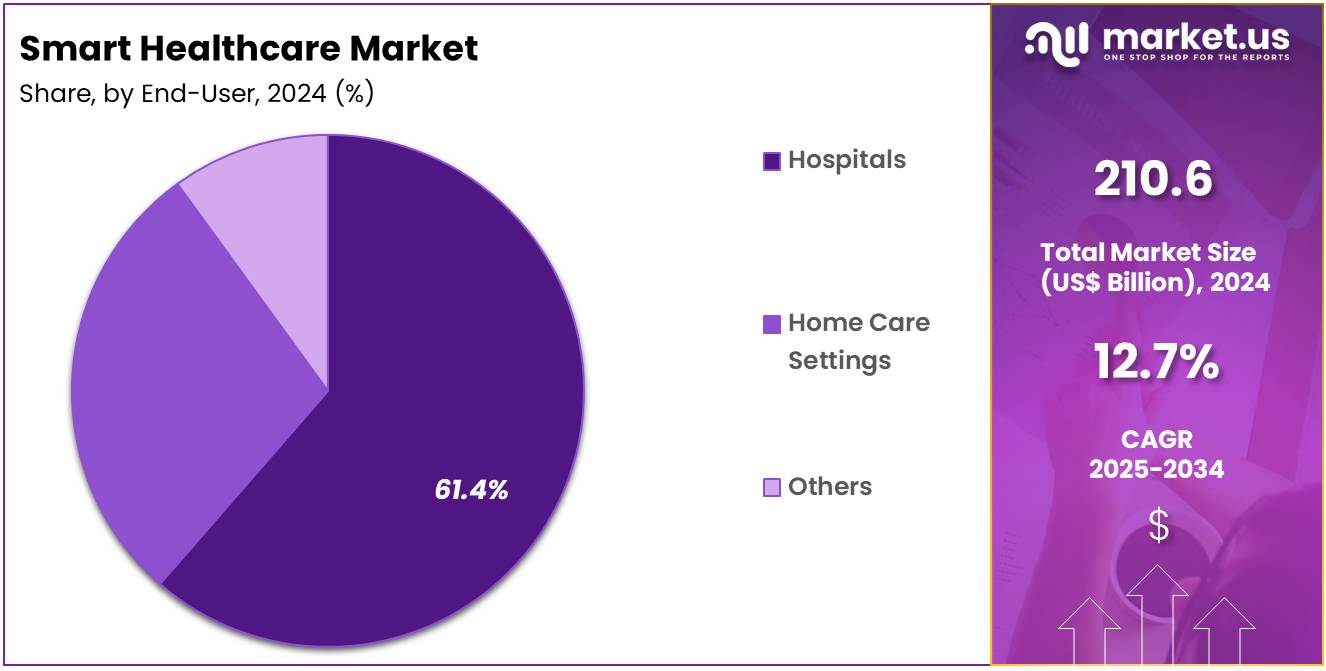

- Considering end-user, the market is divided into hospitals, home care settings, and others. Among these, hospitals held a significant share of 61.4%.

- North America led the market by securing a market share of 38.8% in 2023.

Product Type Analysis

Telemedicine leads the product type segment with a 42.5% share. Growing demand for remote healthcare services is projected to drive adoption. Hospitals and clinics are anticipated to expand teleconsultation programs to reduce patient congestion. Government healthcare initiatives and reimbursement policies are likely to support telemedicine growth. COVID-19 accelerated the adoption of virtual care platforms. Major players such as Teladoc Health and Amwell are expected to enhance AI-driven consultation tools.

Integration with electronic health records is projected to improve efficiency. Mobile app-based consultations are anticipated to increase patient reach. Rural healthcare access challenges are likely to favor telemedicine solutions. Telemedicine training for healthcare providers is projected to expand adoption. Chronic disease management through remote monitoring is expected to boost usage. Teletriage and remote diagnostics are likely to reduce operational costs for hospitals. Partnerships between technology firms and hospitals are projected to accelerate deployment.

Health insurance coverage for virtual consultations is anticipated to improve accessibility. Cross-border telehealth services are likely to increase. Patient demand for convenience and time savings is projected to drive growth. Advanced data security and HIPAA compliance are expected to enhance trust. Overall, telemedicine is projected to dominate due to convenience, policy support, and technological integration.

End-User Analysis

Hospitals dominate the end-user segment with a 61.4% share. Rising patient inflow and demand for efficient care delivery are projected to drive adoption. Hospitals are anticipated to implement telemedicine and mHealth solutions extensively. Smart cabinets and EHR integration are likely to optimize hospital workflows. Government health IT programs, including the US HITECH Act, are expected to accelerate digital adoption. Hospitals are projected to invest in AI-enabled patient monitoring tools. Aging populations with chronic diseases are likely to increase hospital visits.

Telehealth and remote consultation platforms are anticipated to reduce patient burden. Hospitals are expected to adopt smart syringes and pills for medication safety. Digital health training programs are projected to enhance staff efficiency. Interoperability of medical devices is likely to improve operational effectiveness. Hospital accreditation standards are projected to encourage technology adoption. Partnerships with technology providers are expected to expand infrastructure.

Data-driven decision-making in hospitals is likely to improve clinical outcomes. IoT-enabled tracking systems are projected to enhance inventory management. Hospitals are anticipated to leverage analytics for patient flow optimization. Overall, hospitals are projected to drive the market due to large-scale adoption, regulatory support, and focus on efficiency.

Key Market Segments

By Product Type

- Telemedicine

- Software

- Hardware

- Others

- RFID Smart Cabinets

- RFID Kanban Systems

- Electronic Health Records (EHR)

- Client-server Based EHR

- Web-based EHR

- mHealth

- Diagnosis Services

- Healthcare Systems Strengthening

- Monitoring Services

- Others

- Smart Pills

- Smart Syringes

By End-user

- Hospitals

- Home Care Settings

- Others

Drivers

The rising prevalence of chronic diseases and an aging population are driving the market.

The smart healthcare market is experiencing robust growth, propelled by the twin forces of an increasingly aging global population and the escalating incidence of chronic diseases. This demographic shift is creating a significant and sustained demand for sophisticated, technology-enabled healthcare solutions. As a greater percentage of the population enters retirement, the need for continuous and accessible care becomes paramount, as chronic conditions such as diabetes, cardiovascular disease, and chronic respiratory illnesses become more prevalent.

Smart healthcare technologies, including remote patient monitoring devices and connected health platforms, are uniquely positioned to address this need by enabling continuous oversight of patients outside of traditional clinical settings. According to the US Centers for Disease Control and Prevention (CDC), 6 in 10 adults in the US have at least one chronic disease, and 4 in 10 have two or more. This substantial patient base represents a foundational element of the smart healthcare market, providing a large and growing user base for solutions designed to manage these conditions effectively and improve quality of life.

Restraints

Data security and privacy concerns are restraining the market.

A significant headwind for the smart healthcare market is the persistent and growing risk of data breaches and cyberattacks. The very nature of smart healthcare, which involves the collection, transmission, and storage of highly sensitive patient data, makes it a prime target for malicious actors. Any perceived or actual breach of protected health information (PHI) can severely erode patient trust and expose healthcare providers and technology companies to significant legal and financial liability.

The complexity of these systems, often involving multiple interconnected devices and cloud platforms, creates numerous potential vulnerabilities. This is a critical risk factor that requires substantial investment in cybersecurity infrastructure. According to the US Department of Health and Human Services (HHS) Office for Civil Rights, there were 725 reported data breaches in 2023, impacting or exposing more than 133 million patient records.

These figures underscore the immense scale of the privacy challenge, which is forcing stakeholders across the smart healthcare ecosystem to dedicate extensive resources to compliance and risk mitigation, thereby acting as a significant restraint on market acceleration.

Opportunities

The expansion of remote patient monitoring and telehealth is creating growth opportunities.

A key growth vector for the smart healthcare market lies in the expanding adoption of remote patient monitoring (RPM) and telehealth solutions. The global healthcare landscape is rapidly evolving beyond the confines of physical clinics, driven by a desire for more convenient, cost-effective, and continuous care.

RPM technologies, which allow for the seamless transmission of biometric data from a patient’s home to their care provider, are particularly valuable for managing chronic conditions and post-operative recovery. This paradigm shift offers a strategic advantage by reducing the burden on overstretched healthcare facilities and improving patient outcomes through proactive interventions.

The American Hospital Association’s (AHA) 2024 Fact Sheet notes that in the last quarter of 2023, 12.6% of Medicare beneficiaries received a telehealth service. This demonstrates a clear and lasting integration of remote care into the mainstream healthcare system, creating a fertile ground for the development and commercialization of new smart devices and services that support this virtual care model.

Impact of Macroeconomic / Geopolitical Factors

The smart healthcare market faces significant macroeconomic and geopolitical challenges that impact its technology development and market access. In the US, Medicare telehealth policy is at a crucial juncture, with many of the pandemic-era flexibilities on patient location and services set to expire in late 2025. This uncertainty threatens to disrupt patient access and provider reimbursement.

Geopolitical factors also present a major hurdle, with new EU regulations requiring that medical device imports must contain no more than 50% of their components from China to qualify for certain public procurement contracts. This measure affects the global supply chain for a wide range of electronic health devices. Despite these headwinds, the market is poised for growth.

The World Health Organization (WHO) has made significant investments in digital health strategies, and the number of connected medical devices in healthcare facilities is projected to grow to over 94 million by the end of 2024, reflecting a strong global demand for digital health solutions and continued innovation in the sector.

Latest Trends

The rise of AI and machine learning for diagnostics and predictive analytics is a recent trend.

A defining trend of 2024 and 2025 is the accelerated integration of artificial intelligence (AI) and machine learning into smart healthcare applications. These technologies are moving beyond simple data collection to enable sophisticated analysis that can identify patterns, predict health crises, and personalize treatment pathways with a level of precision previously unattainable. This trend is transforming smart devices from passive tools into intelligent diagnostic aids.

AI-enabled platforms are now being used to analyze a wide range of data, from diagnostic images to continuous physiological data from wearables, providing clinicians with actionable insights in real-time. This is reflected in the regulatory landscape, where the US Food and Drug Administration (FDA) has authorized a growing number of AI-enabled medical devices.

In fact, by mid-2025, the FDA’s list of authorized AI/ML-enabled medical devices had surpassed 1,000, with a significant portion of these having been cleared in 2023 and 2024. This exponential growth signals that AI is no longer a futuristic concept in healthcare but a present-day reality, fundamentally reshaping clinical workflows and patient care.

Regional Analysis

North America is leading the Smart Healthcare Market

The North American smart healthcare market held a commanding 38.8% share of the global market in 2024. This leadership is directly attributable to the region’s advanced digital infrastructure, significant investment in health technology, and a high consumer adoption rate of connected devices. The United States has been a major driver of this growth due to the widespread integration of telehealth and remote patient monitoring systems into routine clinical practice.

According to data from the Centers for Medicare & Medicaid Services (CMS), telehealth usage among Medicare beneficiaries was substantial and sustained in late 2023, with over 12.6% of beneficiaries receiving at least one telehealth service. This high usage is a clear indicator of the market’s maturity and the acceptance of digital health solutions by both patients and providers.

Furthermore, the market is propelled by a favorable regulatory environment and a strong focus on chronic disease management, where smart devices play a critical role. For example, the Centers for Disease Control & Prevention (CDC) stated that six in ten adults in the US have at least one chronic illness, a major driver for the development and adoption of smart health technologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The adoption of advanced medical technologies in the Asia Pacific region is expected to accelerate significantly during the forecast period. Governments and key healthcare providers are increasingly embracing digital infrastructure, which is likely to propel the market forward.

South Korea, for example, under its “Digital Strategy of Korea” announced in September 2022, is focusing investments on six innovative digital technologies, including AI and 5G/6G communication, with a goal of establishing an AI-based new drug development platform by 2023 and a blockchain trust framework by 2024, as per the official press release from the Ministry of Science and ICT.

The World Health Organization (WHO) notes that in October 2024, they collaborated with TikTok to share science-based information on health and wellbeing, reflecting a shift towards leveraging social platforms for public health communication in the region. Furthermore, India’s Union Ministry of Health and Family Welfare launched telemedicine services in December 2024 to all AIIMS and Postgraduate Institute of Medical Education and Research (PGI) institutions, as part of a nationwide initiative to reduce hospital burdens.

These strategic investments and partnerships are driving substantial change. The World Health Organization’s report from 2024 also highlighted that digital health is playing a pivotal role in the Western Pacific Region, despite variations in adoption, as governments are increasingly regulating the use of digital solutions, which, in turn, is encouraging greater private sector investment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the smart healthcare market are fueling growth by incorporating technologies such as artificial intelligence and machine learning to enhance data analytics and improve patient care. Additionally, these companies are pursuing strategic collaborations, mergers, and acquisitions to expand their portfolios and tap into new therapeutic areas and market segments.

Many are also focusing on developing scalable, comprehensive platforms that cater to a wide range of healthcare providers, from large hospitals to small clinics. This blend of innovation and business expansion is essential for staying competitive in the market.

Koninklijke Philips N.V., a global leader in technology, has cemented its position as a major innovator in the smart healthcare sector. The company’s business strategy revolves around a wide range of solutions covering the entire healthcare continuum, from healthy living and prevention to diagnosis and home care.

Philips uses its extensive clinical expertise and consumer insights to build integrated systems that enhance patient outcomes and improve healthcare workflows. With a strong emphasis on connected care and a solid R&D pipeline, Philips remains a key partner in advancing digital health solutions worldwide.

Top Key Players

- RamSoft

- Oracle (Cerner Corporation)

- Olympus Corporation

- Medtronic

- MedStar Health

- McKesson Corporation

- GE Healthcare

- Cisco

- BROOKS AUTOMATION

- AMD Global Telemedicine

Recent Developments

- In October 2024, AMD Global Telemedicine joined forces with Carefluence, a specialist in healthcare interoperability solutions, to strengthen its telehealth platform, improve care continuity, and optimize patient outcomes across its network.

- In April 2024, MedStar Health, headquartered in Columbia, Maryland, collaborated with DispatchHealth, an in-home acute care provider, to extend post-discharge services to patients from MedStar facilities in Washington, D.C., ensuring timely medical support outside the hospital setting.

- In March 2024, RamSoft, a cloud-based PACS/RIS provider, signed a 5-year contract with Premier Radiology Services to deploy its OmegaAI and PowerServer PACS solutions across more than 1,000 teleradiology sites, enhancing imaging workflow efficiency and diagnostic capabilities.

Report Scope

Report Features Description Market Value (2024) US$ 210.6 Billion Forecast Revenue (2034) US$ 696.1 Billion CAGR (2025-2034) 12.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Telemedicine (Software, Hardware, and Others), RFID Smart Cabinets, RFID Kanban Systems, Electronic Health Records (EHR) (Client-server Based EHR, and Web-based EHR), mHealth (Diagnosis Services, Healthcare Systems Strengthening, Monitoring Services, and Others), Smart Pills, and Smart Syringes), By End-user (Hospitals, Home Care Settings, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape RamSoft, Oracle (Cerner Corporation), Olympus Corporation, Medtronic, MedStar Health, McKesson Corporation, GE Healthcare, Cisco, BROOKS AUTOMATION, AMD Global Telemedicine. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- RamSoft

- Oracle (Cerner Corporation)

- Olympus Corporation

- Medtronic

- MedStar Health

- McKesson Corporation

- GE Healthcare

- Cisco

- BROOKS AUTOMATION

- AMD Global Telemedicine