Global Smart Grid Market By Component(Hardware, Software, Services), By Technology(Advanced Metering Infrastructure (AMI), Distribution Automation (DA), Demand Response (DR), Grid Optimization, Others), By Application(Generation, Transmission, Distribution, Consumption), By End-Use(Utility, Industrial, Residential, Commercial), , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116136

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

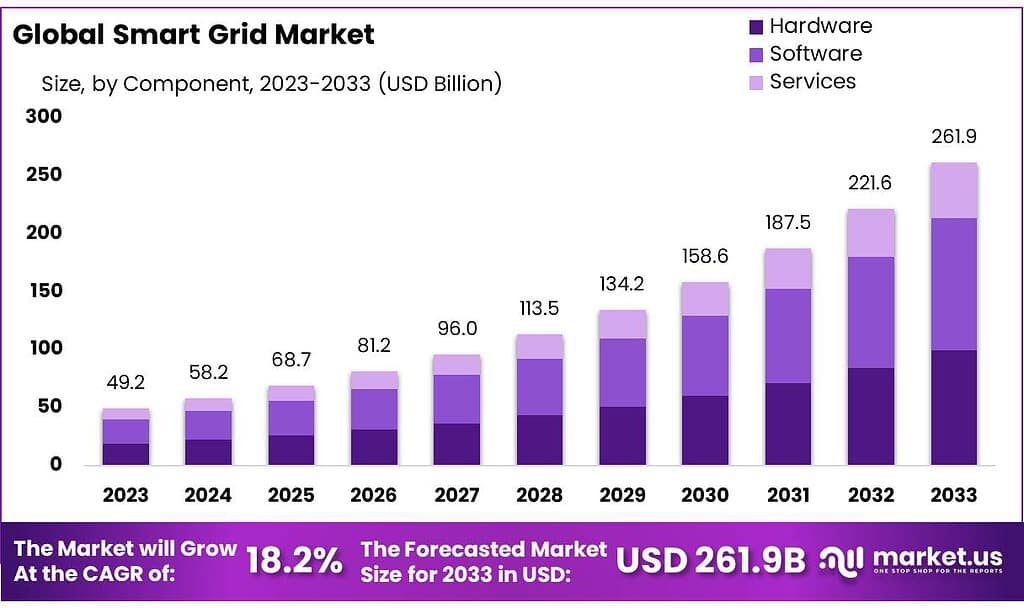

The global Smart Grid Market size is expected to be worth around USD 261.9 billion by 2033, from USD 49.2 billion in 2023, growing at a CAGR of 18.2% during the forecast period from 2023 to 2033.

A smart grid is like a super-smart electricity system. It uses fancy technology, like computers and communication tools, to make the way we get and use electricity much better. The main idea is to make everything work smoother and be more reliable, so we can have electricity that’s not only efficient but also good for the environment.

In simple terms, a smart grid wants to make sure we produce, distribute, and use electricity in the best possible way. It’s like upgrading our old electrical system to a super cool and efficient version, where everything talks to each other and works together for a more reliable and eco-friendly power supply.

Key Takeaways

- Projected Growth: The Smart Grid market is to reach USD 261.9 billion by 2033, growing at 18.2% CAGR from USD 49.2 billion in 2023.

- Software Dominance: Software accounted for 43.5% of the market in 2023, crucial for smart grid operations.

- AMI Leadership: Advanced Metering Infrastructure (AMI) held over 28.4% market share in 2023, ensuring smart monitoring efficiency.

- Distribution Prominence: Distribution applications led with 36.4% market share, vital for seamless electricity delivery.

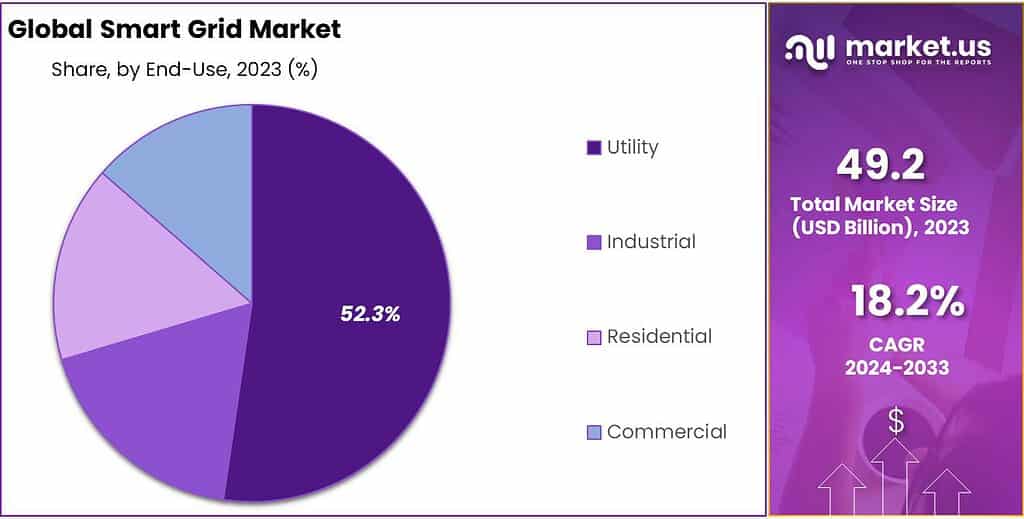

- Utility Sector Dominance: The utility sector commanded 52.3% market share in 2023, pivotal in electricity production and delivery management.

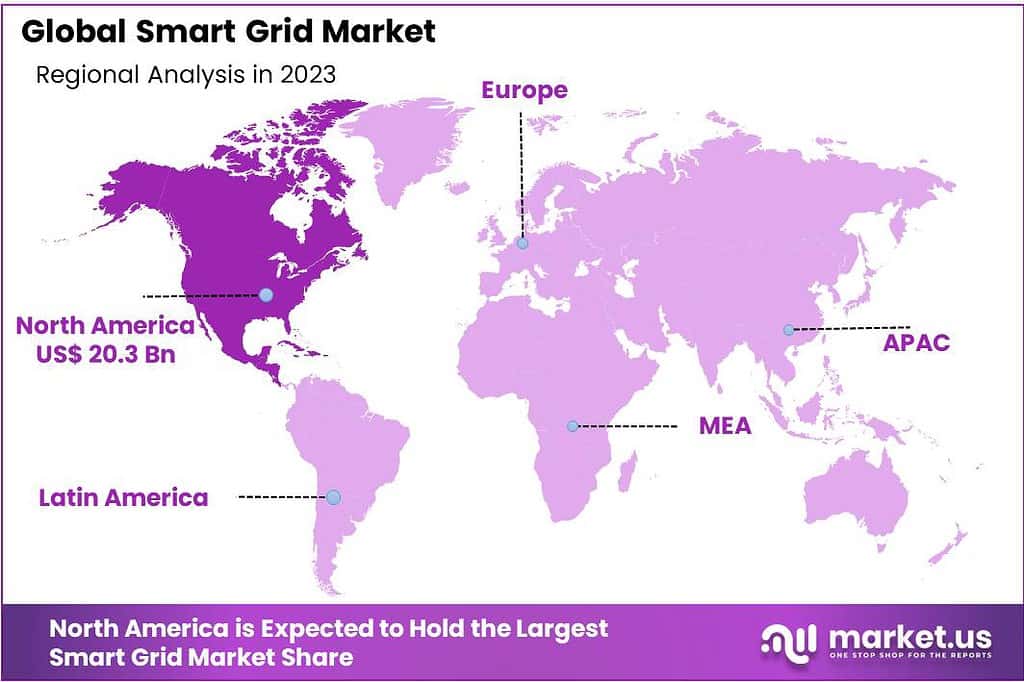

- North America’s Lead: North America contributed 41.2% of total revenue in 2023, driven by energy efficiency initiatives.

By Component

In 2023, Software was the big player in the Smart Grid market, taking up more than 43.5% of the whole scene. It’s like the brain of the operation, making everything smart and connected. Smart software helps manage and control the electricity system efficiently.

Hardware was also a key player, doing the physical stuff like setting up smart meters and equipment. It had a significant chunk of the market, making up a substantial portion of the smart grid landscape.

Services played a crucial role too. Think of them as the support team. They help with installation, maintenance, and making sure everything runs smoothly. Services made up a solid part of the market, ensuring that the smart grid works well for everyone involved.

So, in the smart grid world of 2023, Software was the star player, but Hardware and Services were right there, playing their essential roles in making our electricity system smarter and better.

By Technology

In 2023, Advanced Metering Infrastructure (AMI) was the big player in the Smart Grid market, grabbing more than a 28.4% slice. Picture it as the superhero of the tech world, helping us keep track of our electricity use smartly and efficiently.

Distribution Automation (DA) also had a solid role, making sure electricity moves smoothly from one place to another. It was a significant part of the market, ensuring that power gets where it needs to go without any hiccups.

Demand Response (DR) played a cool role too, helping us manage electricity use during peak times. It’s like having a smart system that adjusts based on when we need power the most. DR had a good share in the market, contributing to a more balanced and efficient grid.

Grid Optimization was another tech star, optimizing the whole electricity system for better performance. It had a noteworthy position in the market, making sure everything worked together seamlessly.

And there were others – the unsung heroes, playing their unique roles in making the smart grid even smarter.

So, in the world of smart grid tech in 2023, AMI was the lead character, but DA, DR, and Grid Optimization, along with other tech buddies, were right there, each doing their part to make our electricity system top-notch.

By Application

In 2023, when it comes to where the action was happening in the Smart Grid market, Distribution was the star player, owning more than a hefty 36.4% share. It’s like the quarterback of the team, ensuring that electricity smoothly gets to our homes and businesses.

Generation also had a notable role, being in charge of creating the power we use. It had a solid share in the market, making sure we had enough electricity in the first place.

Transmission played its part too, acting like the relay runner, passing the electricity from where it’s generated to where it’s needed. It held a significant position in the market, ensuring a smooth flow of power across the grid.

Consumption, the end-user in this game, also had its say. It’s all about how we use electricity at our homes and businesses. While it didn’t dominate the market share like Distribution, it was a crucial player, influencing how the smart grid benefits us directly.

So, in the Smart Grid world of 2023, Distribution took the lead, but Generation, Transmission, and Consumption were all vital players, each contributing to a smarter and more efficient electricity system.

By End-Use

In 2023, when it comes to who was calling the shots in the Smart Grid market, Utility was the undisputed leader, holding over 52.3% of the market share. It’s like the captain of the team, overseeing the big picture of how electricity is produced and delivered.

Industrialization also played a heavyweight role, in managing power needs for big factories and industries. It had a significant share, ensuring a steady and efficient supply of electricity for large-scale operations.

Residential, the homes we live in, had its influence too. While not dominating like Utility, it held a substantial position, shaping how everyday households interacted with the smart grid for their energy needs.

Commercial, the businesses we rely on, also had a slice of the pie. It contributed to a well-balanced market, considering the specific energy requirements of various commercial enterprises.

So, in the Smart Grid scene of 2023, Utility was at the forefront, but Industrial, Residential, and Commercial were all key players, each playing a vital role in making the smart grid work for different aspects of our daily lives.

Market Key Segments

By Component

- Hardware

- Software

- Services

By Technology

- Advanced Metering Infrastructure (AMI)

- Distribution Automation (DA)

- Demand Response (DR)

- Grid Optimization

- Others

By Application

- Generation

- Transmission

- Distribution

- Consumption

By End-Use

- Utility

- Industrial

- Residential

- Commercial

Drivers

Increasing Demand for Energy Efficiency

The growing global demand for energy efficiency is a significant driver propelling the Smart Grid market. As populations increase and urbanization continues, the consumption of electricity rises substantially. Smart Grids offer a solution by optimizing the generation, distribution, and consumption of electricity. Advanced technologies, such as smart meters and sensors, enable real-time monitoring and control, allowing utilities to manage energy resources more efficiently.

Additionally, the integration of renewable energy sources, a key component of smart grids, aligns with the increasing emphasis on sustainable practices. Governments and organizations worldwide are pushing for a transition to cleaner energy, and smart grids facilitate the seamless integration of solar, wind, and other renewable sources. This not only meets environmental goals but also addresses concerns about resource depletion and climate change.

Technological Advancements and Digitalization

The rapid advancements in information and communication technologies (ICT) play a pivotal role in driving the Smart Grid market. The evolution of smart meters, grid automation, and data analytics has transformed traditional power systems into highly intelligent and interconnected networks. These technological enhancements enable utilities to gather and analyze vast amounts of data, providing insights into energy consumption patterns, equipment health, and grid performance.

Restraints

High Initial Implementation Costs

One of the primary restraints affecting the Smart Grid market is the high initial implementation costs associated with upgrading and modernizing existing infrastructure. The deployment of smart meters, sensors, communication networks, and other advanced technologies requires significant upfront investments. Many utilities and organizations may be hesitant to undertake such large-scale projects due to budget constraints and uncertainties about the return on investment.

Moreover, the transition from traditional grids to smart grids often involves complex planning, regulatory approvals, and potential disruptions to existing operations. The financial burden of implementing new technologies and ensuring a seamless transition poses a challenge, particularly for smaller utilities with limited resources. Overcoming these cost-related barriers is crucial to unlocking the full potential of smart grid technologies.

Interoperability Challenges and Standardization

Interoperability challenges and the lack of standardized protocols present a restraint in the Smart Grid market. As smart grid components come from various manufacturers, ensuring seamless communication and integration between different devices and systems becomes a complex task. Lack of standardized communication protocols can lead to compatibility issues, hindering the smooth operation of the entire grid.

Opportunity

Global Transition to Renewable Energy

A significant opportunity for the Smart Grid market lies in the global transition to renewable energy sources. As countries worldwide commit to reducing carbon emissions and mitigating climate change, there is a growing emphasis on increasing the share of renewable energy in the overall energy mix. Smart grids play a pivotal role in integrating and managing the variability of renewable sources like solar and wind power.

The opportunity arises from the need to create a flexible and adaptive grid infrastructure that can accommodate the intermittent nature of renewable energy generation. Smart grids enable effective demand response, energy storage, and real-time monitoring, ensuring a stable and reliable power supply from renewable sources. This aligns with the broader goal of achieving a sustainable and environmentally friendly energy landscape.

Integration of Artificial Intelligence (AI) in Grid Management

The integration of Artificial Intelligence (AI) presents a promising opportunity for the Smart Grid market. AI technologies, such as machine learning and predictive analytics, can analyze vast amounts of data generated by smart grids to optimize grid operations. AI-driven insights can enhance predictive maintenance, fault detection, and load forecasting, contributing to improved grid reliability and efficiency.

Trends

Increasing Focus on Grid Resilience and Security

An emerging trend in the Smart Grid market is the heightened focus on grid resilience and security. With the increasing frequency of cyber threats and natural disasters, there is a growing awareness of the need to fortify energy infrastructure against potential disruptions. Smart grids incorporate advanced cybersecurity measures to protect against cyberattacks, ensuring the integrity and confidentiality of sensitive data.

Grid resilience involves designing the system to withstand and rapidly recover from unexpected events, such as extreme weather conditions or physical attacks. The integration of smart technologies allows for predictive maintenance and quick response to minimize downtime. This trend aligns with the industry’s commitment to providing a reliable and secure energy supply, especially as dependence on interconnected systems continues to rise.

Decentralization and Distributed Energy Resources

Another notable trend shaping the Smart Grid market is the move towards decentralization and the integration of distributed energy resources (DERs). Traditional centralized power generation is gradually giving way to a more decentralized model, where energy is generated closer to the point of consumption. Smart grids accommodate this shift by efficiently managing the variability of energy production from sources like rooftop solar panels and small-scale wind turbines.

Regional Analysis

In 2023, North America took the lead in the Smart Grid market, contributing a significant share of over 41.2% in total revenue. This dominant position is fueled by the region’s grappling with escalating energy costs and unpredictable fluctuations in petrochemical prices, sparking a heightened demand for biofuels.

The growth trajectory of the Smart Grid market in North America is further propelled by increasing demands across diverse end-use sectors. This includes construction, electronics, electrical appliances, furniture, and interiors, highlighting the widespread adoption and application of smart grid technologies across various industries.

Turning our attention to the European landscape, Germany emerges as a key player, particularly standing out as a crucial hub in the automotive industry. As the leading European producer of passenger vehicles, accounting for more than 30% of the EU member countries, Germany plays a pivotal role in sustaining the growth of the Smart Grid market throughout the forecast period.

The production of natural oils polyol in the European market is poised to experience benefits from low manufacturing costs and the robust expansion of the manufacturing sector. Major international companies strategically enhancing their regional production capacity further fortify the production landscape of the Smart Grid market in Europe.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Smart Grid market boasts a diverse landscape of key players contributing to its dynamic growth and innovation. These key players collectively drive innovation, set industry benchmarks, and contribute significantly to the evolution of smart grids globally. Their strategic initiatives, technological advancements, and collaborative efforts underscore their commitment to revolutionizing the energy landscape through smart grid solutions.

Market Key Players

- General Electric Company

- Siemens AG

- ABB Group

- Schneider Electric SE

- IBM Corporation

- Honeywell International Inc.

- Itron Inc.

- Cisco Systems, Inc.

- Eaton Corporation

- Landis+Gyr AG

- Oracle Corporation

- Trilliant Holdings, Inc.

- S&C Electric Company

- Silver Spring Networks

- Aclara Technologies LLC

Recent Developments

General Electric Company (GE) 2023: GE Renewable Energy entered into a strategic partnership to co-develop and deploy advanced grid solutions for large-scale offshore wind farms, aiming to improve grid integration and efficiency.

ABB Group 2023: ABB secured a contract to supply a digital substation automation system and related protection relays for the world’s first commercial-scale 500 kV high-voltage direct current (HVDC) converter station in China.

Report Scope

Report Features Description Market Value (2022) US$ 49.2 Bn Forecast Revenue (2032) US$ 261.9 Bn CAGR (2023-2032) 18.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Hardware, Software, Services), By Technology(Advanced Metering Infrastructure (AMI), Distribution Automation (DA), Demand Response (DR), Grid Optimization, Others), By Application(Generation, Transmission, Distribution, Consumption), By End-Use(Utility, Industrial, Residential, Commercial) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape General Electric Company, Siemens AG, ABB Group, Schneider Electric SE, IBM Corporation, Honeywell International Inc., Itron Inc., Cisco Systems, Inc., Eaton Corporation, Landis+Gyr AG, Oracle Corporation, Trilliant Holdings, Inc., S&C Electric Company, Silver Spring Networks, Aclara Technologies LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

what is the size of Smart Grid Market?Smart Grid Market size is expected to be worth around USD 261.9 billion by 2033, from USD 49.2 billion in 2023

What is the CAGR for the Smart Grid Market?The Smart Grid Market expected to grow at a CAGR of 18.2% during 2023-2032.

Who are the key players in the Smart Grid Market?General Electric Company, Siemens AG, ABB Group, Schneider Electric SE, IBM Corporation, Honeywell International Inc., Itron Inc., Cisco Systems, Inc., Eaton Corporation, Landis+Gyr AG, Oracle Corporation, Trilliant Holdings, Inc., S&C Electric Company, Silver Spring Networks, Aclara Technologies LLC

-

-

- General Electric Company

- Siemens AG

- ABB Group

- Schneider Electric SE

- IBM Corporation

- Honeywell International Inc.

- Itron Inc.

- Cisco Systems, Inc.

- Eaton Corporation

- Landis+Gyr AG

- Oracle Corporation

- Trilliant Holdings, Inc.

- S&C Electric Company

- Silver Spring Networks

- Aclara Technologies LLC