Global Smart E-Drive Market By Vehicle Type(Passenger Cars, Commercial Vehicles, 2-Wheelers), By EV Type(Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs)), By Application(E-Axle, E-Wheel Drive), By Component(EV Battery, Electric Motor, Inverter System, E-Brake Booster, Power Electronics), By Drive Type(Front Wheel Drive, Rear Wheel Drive, All-Wheel Drive), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 128482

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

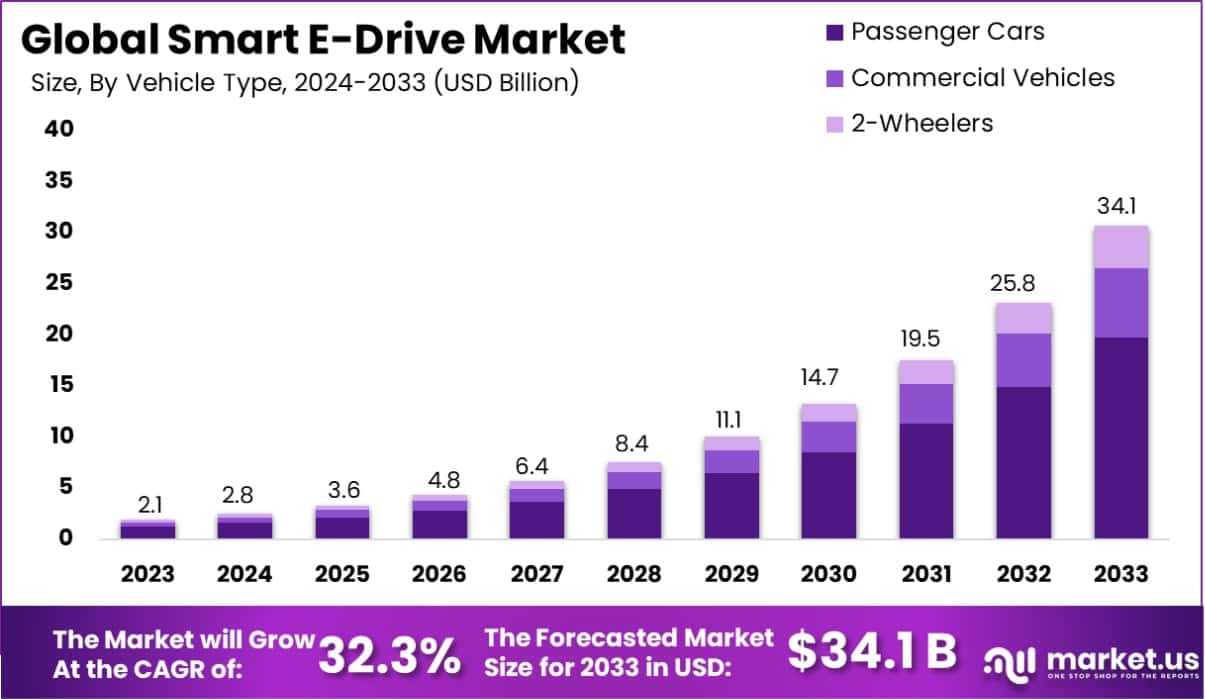

The Global Smart E-Drive Market size is expected to be worth around USD 34.1 billion By 2033, from USD 2.1 Billion in 2023, growing at a CAGR of 32.8% during the forecast period from 2024 to 2033. In 2023, Asia Pacific dominated the smart e-drive market with a 45% share, generating USD 0.93 billion in revenue.

Smart E-Drive refers to an advanced integrated electric drive system used in electric and hybrid vehicles. It combines the motor, controller, and other necessary components into a single system, which optimizes performance and enhances efficiency.

The Smart E-Drive market is experiencing significant growth, driven by the increasing demand for electric vehicles (EVs) and the push for cleaner transportation options. As governments worldwide implement stricter emissions regulations, automotive manufacturers are investing heavily in Smart E-Drive technologies to meet these standards and cater to consumer preferences for eco-friendly vehicles.

Growth factors for the Smart E-Drive market include technological advancements in battery technology, rising fuel prices, and growing consumer awareness about the environmental impacts of traditional combustion engines.

Top opportunities in this market lie in developing more cost-effective and efficient E-Drive systems, expanding into emerging markets where demand for electric vehicles is on the rise, and forming strategic partnerships with automakers to become integral suppliers in the EV production chain.

The Smart E-Drive market is poised for substantial growth, propelled by an accelerating shift towards electric vehicles (EVs), which promise lower greenhouse gas emissions and improved efficiency. Recent data from Mercedes-Benz underscores this trend, with a 73% increase in sales of fully electric passenger cars in a single year, totaling 222,600 units—representing 11% of the brand’s total sales and 19% when including plug-in hybrids.

The surge in sales is particularly notable in high-performance models such as the EQE Sedan, which saw a 120% increase globally, and a significant uptick in the U.S. market, where sales more than doubled, driven by the introduction of the new EQE SUV.

The enduring popularity of luxury models like the S-Class, which continues to dominate its segment with a 50% market share across key regions, also bodes well for the introduction of electric variants such as the upcoming electric G-Class.

According to the European Environment Agency, the life-cycle greenhouse gas emissions of electric vehicles are approximately 17-30% lower than those of their petrol and diesel counterparts. This differential is expected to widen as advancements in EV production processes and the decarbonization of electricity sources progress.

Forecasts suggest that by 2050, the life-cycle emissions of a typical electric vehicle could be reduced by at least 73%, underpinning the long-term sustainability and market potential of smart e-drives. This data not only illustrates the growing consumer appetite for electric vehicles but also highlights the evolving landscape of automotive technology, where smart e-drive systems are central to achieving efficiency and emissions targets.

Key Takeaways

- The Global Smart E-Drive Market size is expected to be worth around USD 34.1 billion By 2033, from USD 2.1 Billion in 2023, growing at a CAGR of 32.8% during the forecast period from 2024 to 2033.

- In 2023, Passenger Cars held a dominant market position in the by-vehicle type segment of the Smart E-Drive Market, capturing more than a 58% share.

- In 2023, Battery Electric Vehicles (BEVs) held a dominant market position in the By EV Type segment of the Smart E-Drive Market, capturing more than a 51% share.

- In 2023, E-Axle held a dominant market position in the By Application segment of the Smart E-Drive Market, capturing more than a 55% share.

- In 2023, EV Batteries held a dominant market position in the By Component segment of the Smart E-Drive Market, capturing more than a 36% share.

- In 2023, Front Wheel Drive held a dominant market position in the By Drive Type segment of the Smart E-Drive Market, capturing more than a 43% share.

- Asia Pacific dominated a 45% market share in 2023 and held USD 0.93 Billion in revenue from the Smart E-Drive Market.

By Vehicle Type Analysis

In 2023, Passenger Cars held a dominant market position in the “By Vehicle Type” segment of the Smart E-Drive Market, capturing more than a 58% share. This substantial market share underscores the increasing adoption of smart e-drive systems in passenger vehicles, driven by consumer demand for improved fuel efficiency, enhanced performance, and lower emissions. The integration of advanced technologies such as regenerative braking and high-efficiency power electronics has further propelled the popularity of smart e-drives in this segment.

Commercial Vehicles also made significant inroads, reflecting the industry’s focus on reducing carbon footprints and operational costs. The adoption of smart e-drive systems in commercial vehicles is supported by stringent environmental regulations and the growing logistical demand globally.

Meanwhile, 2-wheelers are rapidly catching up, driven by the surge in electric two-wheeler sales, especially in densely populated urban areas. This segment benefits from lower energy costs and maintenance, appealing to cost-conscious consumers and those seeking environmentally friendly transportation alternatives. The compact nature of e-drive systems aligns well with the design ethos of two-wheelers, making this integration increasingly seamless and efficient.

By EV Type Analysis

In 2023, Battery Electric Vehicles (BEVs) held a dominant market position in the “By EV Type” segment of the Smart E-Drive Market, capturing more than a 51% share. This leadership stems from the global shift towards zero-emission vehicles, with BEVs at the forefront due to their lack of tailpipe emissions and reduced dependency on fossil fuels. The surge in consumer preference for BEVs is supported by advancements in battery technology, which have significantly increased range and reduced charging times, making them more practical for everyday use.

Plug-in Hybrid Electric Vehicles (PHEVs) also command a substantial portion of the market, combining the benefits of gasoline and electric power to offer flexibility and extended driving range. PHEVs are particularly popular in markets where charging infrastructure is still developing, providing a bridge technology toward fully electric mobility.

Hybrid Electric Vehicles (HEVs) continue to be an essential part of the ecosystem, particularly in regions where consumers are transitioning from traditional internal combustion engines. HEVs offer improved fuel efficiency and lower emissions without the need for external charging, appealing to consumers not ready to fully commit to plug-in vehicles. This segment benefits from established technology and consumer familiarity, supporting its steady market presence.

By Application Analysis

In 2023, E-Axle held a dominant market position in the “By Application” segment of the Smart E-Drive Market, capturing more than a 55% share. The E-Axle’s prominence is largely due to its integral role in consolidating electric motors, power electronics, and transmission into a compact, efficient unit, enhancing vehicle architecture flexibility and improving overall vehicle performance. This technology is particularly favored in larger vehicle platforms, including SUVs and trucks, where its impact on efficiency and torque distribution is most beneficial.

Conversely, the E-Wheel Drive segment is rapidly emerging as a critical technology, especially in compact cars and urban electric vehicles. E-wheel drives enable individual wheel control, which can significantly improve handling, safety, and performance, making it ideal for smaller vehicles where space is at a premium and agility is paramount.

Both segments are driven by the automotive industry’s shift towards electrification, with manufacturers investing heavily in these technologies to meet stringent emission regulations and cater to the growing consumer demand for greener transportation solutions. As innovations continue to emerge, the scalability and integration capabilities of E-Axles and E-Wheel Drives are expected to play pivotal roles in shaping future vehicle designs and capabilities.

By Component Analysis

In 2023, the EV Battery held a dominant market position in the “By Component” segment of the Smart E-Drive Market, capturing more than a 36% share. This predominance reflects the critical role of EV batteries as the core component in electric vehicles, where advancements in battery technology, such as improved energy density and faster charging capabilities, have significantly enhanced the appeal and practicality of electric vehicles. The continuous development in lithium-ion technologies and the introduction of solid-state batteries are expected to further boost efficiency and performance, driving demand in this segment.

Electric Motors also account for a substantial market share, emphasizing their importance in converting electrical energy into mechanical power efficiently. The push towards higher-performance motors that offer greater torque and speed has been instrumental in the sector’s growth.

The Inverter System, E-Brake Booster, and Power Electronics components, although smaller in market share compared to EV batteries and electric motors, are crucial for the optimal performance of electric drivetrains. These components ensure the effective management and conversion of electrical power within the vehicle, contributing to advancements in vehicle control, safety, and energy efficiency. Their development continues to evolve, supporting the overall expansion and technological enhancement of the Smart E-Drive Market.

By Drive Type Analysis

In 2023, Front Wheel Drive held a dominant market position in the “By Drive Type” segment of the Smart E-Drive Market, capturing more than a 43% share. This dominance is largely due to the cost-effectiveness and simplicity of front-wheel-drive systems, which are particularly favored in compact and mid-sized vehicles.

The configuration not only reduces the complexity and weight of the vehicle but also improves fuel efficiency, a crucial factor in the consumer decision-making process. Its suitability for electric vehicles, where space optimization is critical, further enhances its market appeal.

Rear Wheel Drive also maintains a significant presence in the market, preferred for its performance advantages, such as better handling and acceleration, which are highly valued in sports and luxury vehicles. This drive type benefits from a balanced weight distribution, enhancing driving dynamics and stability.

All-wheel drive systems are increasingly popular, offering enhanced traction and control under various road conditions, making them ideal for regions with adverse weather. The integration of smart e-drive technology in all-wheel-drive systems allows for more precise power distribution to each wheel, improving safety and performance, which supports its growing adoption across multiple vehicle categories.

Key Market Segments

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- 2-Wheelers

By EV Type

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

By Application

- E-Axle

- E-Wheel Drive

By Component

- EV Battery

- Electric Motor

- Inverter System

- E-Brake Booster

- Power Electronics

By Drive Type

- Front Wheel Drive

- Rear Wheel Drive

- All-Wheel Drive

Drivers

Key Drivers in the Smart E-Drive Market

The smart e-drive market is gaining momentum due to several key factors. First and foremost, the increasing demand for electric vehicles (EVs) globally is a significant driver. As consumers become more environmentally conscious, the shift towards EVs is prominent, and smart e-drives are essential for these vehicles.

Furthermore, governments worldwide are introducing stricter emission regulations to combat climate change, which is pushing automotive manufacturers to adopt electric and hybrid technologies, where smart e-drives play a crucial role. Additionally, advancements in battery technology are making electric drivetrains more viable by enhancing their efficiency and lifespan, thus boosting the market for smart e-drives.

Lastly, the integration of smart technologies in vehicles for better performance and connectivity is encouraging the adoption of sophisticated e-drive systems. These factors collectively contribute to the robust growth of the smart e-drive market.

Restraint

Challenges Facing Smart E-Drive Market

One significant restraint in the smart e-drive market is the high cost associated with developing and integrating these advanced systems. Smart e-drives, which include sophisticated components like power electronics, e-motors, and battery systems, require substantial investment in research and development to enhance their efficiency and integration capabilities.

This increases the overall cost of vehicles, making them less affordable for a broad consumer base. Additionally, the dependency on critical raw materials, such as lithium and cobalt, for battery production can lead to supply chain vulnerabilities and price volatility, further complicating market dynamics.

These economic factors can slow down the adoption rate of smart e-drive technologies, particularly in price-sensitive markets, posing a significant challenge to the widespread growth of the smart e-drive sector.

Opportunities

Expanding Opportunities in E-Drive Market

The smart e-drive market presents numerous opportunities, primarily driven by the growing interest in sustainable and efficient transportation solutions. As global emphasis on reducing carbon emissions intensifies, the demand for electric and hybrid vehicles is expected to surge, providing a substantial market for smart e-drives.

Additionally, technological advancements in e-drive systems are opening up new possibilities for their application beyond passenger vehicles, including commercial vehicles and public transport systems. Innovations such as improved battery technology, more efficient motors, and advanced control systems are enhancing the performance and range of electric vehicles, making them more appealing to consumers and businesses alike.

Moreover, government incentives and supportive policies around the world aimed at promoting electric vehicle adoption are likely to bolster the market for smart e-drives significantly in the coming years.

Challenges

Navigating Smart E-Drive Challenges

The smart e-drive market faces several challenges that could hinder its growth. A major issue is the infrastructure readiness for electric vehicles (EVs), particularly the availability and distribution of charging stations, which is inconsistent across regions. This lack of charging infrastructure can deter consumers from adopting EVs, directly affecting the demand for smart e-drives.

Additionally, the complexity of integrating advanced e-drive technologies with existing vehicle architectures poses technical challenges for manufacturers. These complexities can increase production costs and extend development timelines, potentially delaying market entry for new products.

Furthermore, the rapid pace of technological change in the e-drive sector requires continuous innovation and adaptation, which can strain resources and complicate strategic planning for businesses involved in this market. These challenges require strategic focus and innovation to overcome, ensuring the continued growth of the smart e-drive industry.

Growth Factors

Driving Growth in the E-Drive Market

The smart e-drive market is poised for significant growth, spurred by several key factors. The increasing global push towards sustainable transportation is rapidly accelerating the adoption of electric vehicles (EVs), which are the primary users of smart e-drives.

This trend is further supported by governmental policies and subsidies promoting cleaner energy sources and reducing smart greenhouse gas emissions. Technological advancements in battery and motor technologies are making e-drives more efficient and affordable, enhancing vehicle performance and consumer appeal. Additionally, the rise in consumer awareness about the environmental benefits of EVs is boosting demand.

The expansion of charging infrastructure globally is also making it more convenient to own and operate electric vehicles, thereby encouraging more consumers to make the switch. Together, these factors are creating a fertile environment for the growth of the smart e-drive market.

Emerging Trends

Emerging Trends in E-Drive Market

The smart e-drive market is witnessing several emerging trends that are shaping its future. A significant trend is the integration of Internet of Things (IoT) technologies with e-drive systems, which enables real-time monitoring and optimization of vehicle performance. This connectivity not only improves vehicle efficiency but also enhances the user experience by providing detailed insights into vehicle health and driving patterns.

Another trend is the increasing use of artificial intelligence (AI) to automate driving functions, requiring more sophisticated e-drive systems that can handle complex computations and provide seamless control. Additionally, there is a growing shift towards lightweight and compact e-drive designs, which help improve the overall efficiency and range of electric vehicles.

These trends, driven by advances in technology and changing consumer preferences, are propelling the smart e-drive market toward more innovative and efficient solutions.

Regional Analysis

The smart e-drive market exhibits distinctive dynamics across various regions, reflecting differing levels of market penetration, technological adoption, and regulatory environments. In Asia-Pacific, the market is dominant, accounting for approximately 45% of the global share, valued at USD 0.93 billion. This region leads due to aggressive electric vehicle (EV) adoption policies, substantial investments in EV infrastructure, and significant production capacities in countries like China, Japan, and South Korea.

Europe follows, driven by stringent environmental regulations, high consumer awareness, and supportive government incentives promoting electric mobility. The European market is characterized by advanced technology integrations and strong collaborations between automotive OEMs and technology developers.

North America is also a key player, with a focus on innovation and the presence of major automotive and technology firms pushing advancements in e-drive technologies. The U.S. and Canada are seeing a steady increase in EV sales, supported by both policy initiatives and a growing preference for sustainable transportation options.

The markets in Latin America and the Middle East & Africa are emerging, with growth influenced by increasing urbanization, changing mobility patterns, and the gradual build-out of charging infrastructure. However, these regions currently represent a smaller portion of the global market, with growth potential linked to future policy developments and economic conditions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, three key players significantly influenced the global smart e-drive market: Robert Bosch GmbH, Continental AG, and ZF Friedrichshafen AG. Each company leveraged its technological prowess and strategic market positioning to capitalize on the growing demand for electric vehicles and advanced automotive technologies.

Robert Bosch GmbH has been at the forefront of innovation in the smart e-drive space, primarily through its investments in R&D and partnerships with automotive manufacturers. Bosch’s integrated e-drive systems, which combine motor, power electronics, and transmission into a single system, have set industry standards for efficiency and performance, making them a preferred choice for OEMs.

Continental AG has similarly made substantial strides, particularly in modular electric drive solutions, which are adaptable to a wide range of vehicle types. Continental’s focus on high-performance, scalable electric systems has allowed it to maintain a competitive edge, catering to both premium and volume markets.

ZF Friedrichshafen AG stands out with its emphasis on the next generation of mobility solutions, including highly integrated e-drive systems for hybrid and fully electric vehicles. ZF’s strategy focuses on enhancing vehicle dynamics and driving experience, aligning with the market’s shift towards more sustainable and advanced automotive technologies.

Together, these companies are pivotal in driving the smart e-drive market, each contributing unique innovations that meet evolving market demands and regulatory standards worldwide. Their efforts not only enhance their market position but also accelerate the industry’s transition to electrified transportation.

Top Key Players in the Market

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- ABB Ltd

- Nidec Corporation

- Magna International Inc.

- BorgWarner Inc.

- Schaeffler AG

- Siemens

- Aisin Seiki Co.Ltd.

- Hyundai Mobis Co. Ltd.

- Other Key Players

Recent Developments

- In August 2023, Nidec acquired a smaller motor company to expand its capacity for producing e-drive systems for electric cars.

- In July 2023, Magna introduced a revolutionary e-drive system that improves electric vehicle range by 15%, targeting luxury SUVs.

- In May 2023, ABB launched a new line of high-efficiency smart e-drives designed for commercial vehicles, aiming to reduce emissions.

Report Scope

Report Features Description Market Value (2023) USD 2.1 Billion Forecast Revenue (2033) USD 34.1 Billion CAGR (2024-2033) 32.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type(Passenger Cars, Commercial Vehicles, 2-Wheelers), By EV Type(Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs)), By Application(E-Axle, E-Wheel Drive), By Component(EV Battery, Electric Motor, Inverter System, E-Brake Booster, Power Electronics), By Drive Type(Front Wheel Drive, Rear Wheel Drive, All-Wheel Drive) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, ABB Ltd, Nidec Corporation, Magna International Inc., BorgWarner Inc., Schaeffler AG, Siemens, Aisin Seiki Co.Ltd., Hyundai Mobis Co. Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- ABB Ltd

- Nidec Corporation

- Magna International Inc.

- BorgWarner Inc.

- Schaeffler AG

- Siemens

- Aisin Seiki Co.Ltd.

- Hyundai Mobis Co. Ltd.

- Other Key Players