Global Smart Contracts Market By Platform (Ethereum, Cardano, Polkadot, BNB Chain, Other Platforms), By Blockchain Type (Private, Public, Hybrid), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By End-Use Industry (BFSI, Logistics, Real Estate, Healthcare, Retail and Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 112089

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

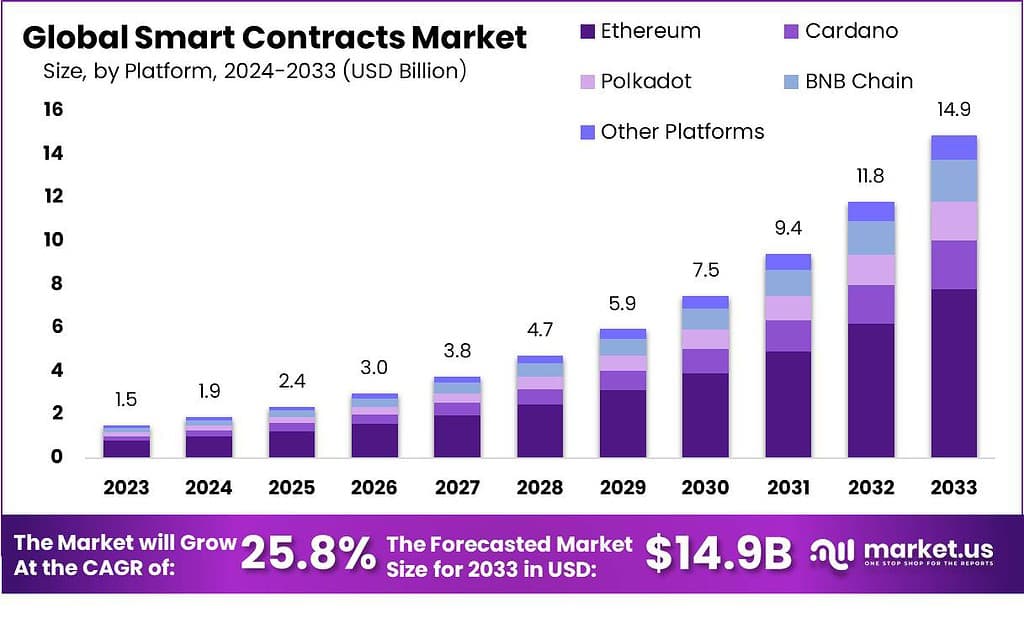

The Global Smart contracts Market size is poised for significant growth, reaching USD 1.9 Billion in 2024. The sales are expected to witness a robust CAGR of 25.8% from 2024 to 2033. By 2033, the smart contracts demand is anticipated to reach a valuation of USD 14.9 Billion.

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. The code and the agreements contained therein exist across a distributed, decentralized blockchain network.

Smart contracts allow trusted transactions and agreements to be carried out among disparate, anonymous parties without the need for a central authority, legal system, or external enforcement mechanism. They render transactions traceable, transparent, and irreversible. For instance, a report by Deloitte highlighted that blockchain technology, which underpins smart contracts, could potentially save the healthcare industry up to $100-$150 billion per year by 2025 through reduced fraud, counterfeit products, and administrative costs.

Note: Actual Numbers Might Vary In The Final Report

The global smart contracts market is expected to grow rapidly over the coming years as blockchain technology sees increasing real-world adoption. Key drivers of the smart contract market include the need for automation of manual processes, cost reduction, improved transactional security, and transparency. Major end-user industries for smart contracts include BFSI, government, healthcare, supply chain, manufacturing, and real estate.

Smart contracts often involve gathering and using personal information. This information might be protected by laws like the General Data Protection Regulation (GDPR) in the European Union or the California Consumer Privacy Act (CCPA) in the United States. Smart contract developers need to make sure their contracts follow these rules and have the right protection for data.

Key Takeaways

- Market Size and Growth: The Smart Contracts Market is expected to reach approximately USD 14.9 billion by 2033, with a robust Compound Annual Growth Rate (CAGR) of 25.8% projected from 2024 to 2033.

- Smart Contracts Definition: Smart contracts are self-executing agreements coded into blockchain networks. They enable trustful transactions and agreements among anonymous parties without central authorities, ensuring transparency and traceability.

- Market Drivers: The adoption of blockchain technology is a significant driver, leading to efficiency, transparency, and trust. Automation of manual processes, cost reduction, transactional security, and transparency are key factors promoting smart contracts adoption.

- Platform Insights: Ethereum dominated the market in 2023, holding over 52.4% market share. Cardano, Polkadot, and BNB Chain are also significant players, each offering unique features and attracting adoption.

- Blockchain Types: Public blockchains held a dominant market share of 64.1% in 2023 due to their transparency and security. Private blockchains cater to organizations requiring confidentiality, while hybrid blockchains offer a balance between the two.

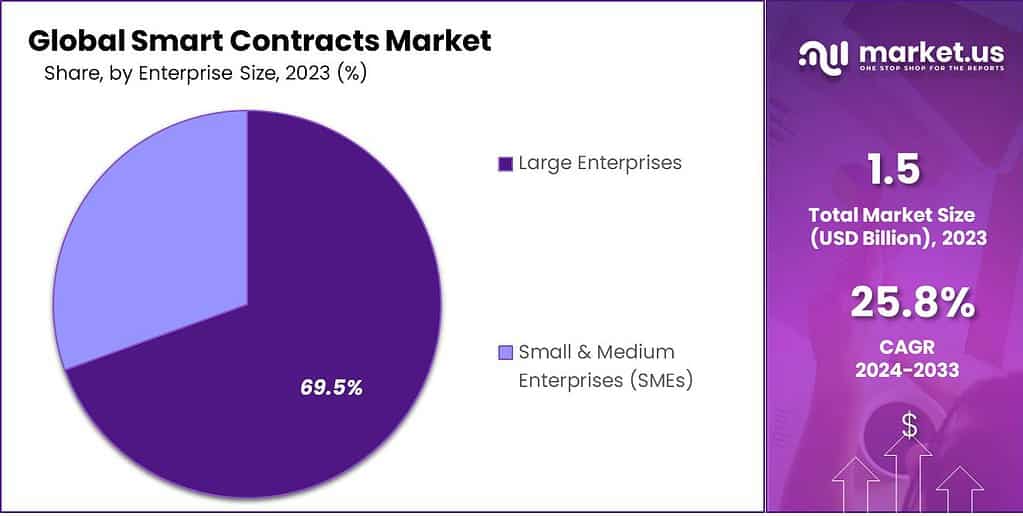

- Enterprise Adoption: Large enterprises led the adoption of smart contracts in 2023, capturing over 69.5% of the market. They leveraged smart contracts for supply chain management, financial transactions, and contract management.

- SMEs Adoption: Small and Medium Enterprises (SMEs) are gradually embracing smart contracts to streamline operations, reduce manual work, and improve efficiency.

- End-Use Industries: The Banking, Financial Services, and Insurance (BFSI) sector dominated the market in 2023, followed by logistics, real estate, healthcare, retail, and other industries. Smart contracts are revolutionizing traditional processes in these sectors.

- Market Growth Factors: The increasing adoption of blockchain technology, cost and time savings, digital transformation initiatives, and the rise of decentralized applications (DApps) are key growth factors.

- Challenges: Challenges include scalability limitations, regulatory complexities, security concerns, and the lack of standardized frameworks for smart contracts.

- Growth Opportunities: Opportunities include integrating smart contracts with emerging technologies, expanding into new industries, developing user-friendly interfaces, and facilitating cross-border transactions.

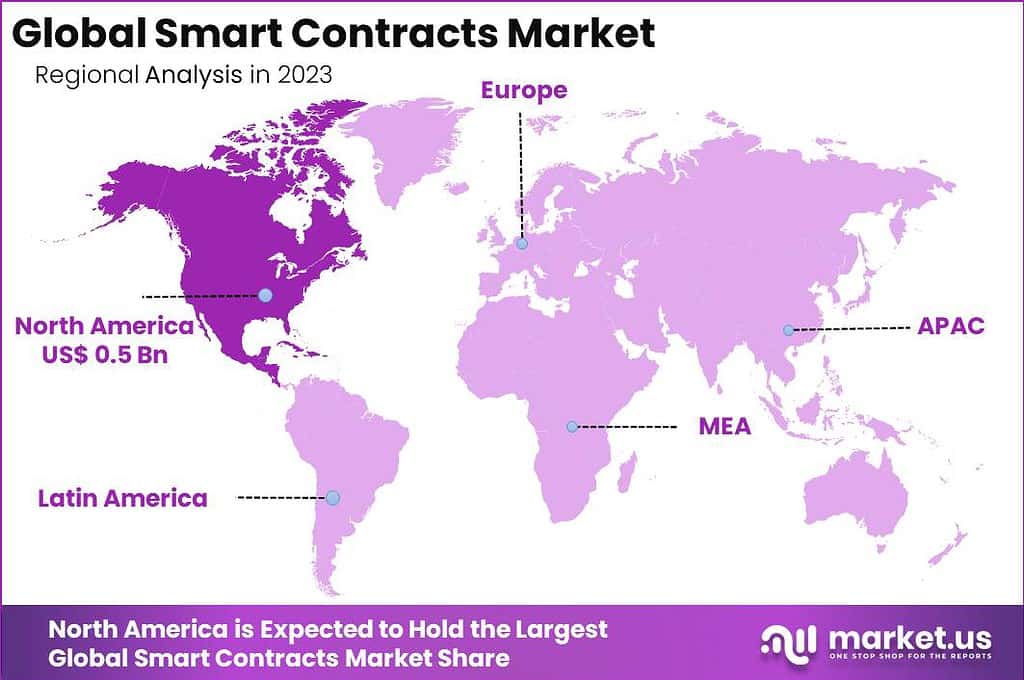

- Regional Analysis: North America led the market in 2023, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Each region has unique factors driving smart contracts adoption.

- Key Market Players: Key players in the smart contracts market include IBM Corporation, Tata Consultancy Services Limited, Amazon Web Services, Oracle Corporation, and others.

Platform Insights

In 2023, the Ethereum segment held a dominant market position in the smart contracts market, capturing more than a 52.4% share. Ethereum, as one of the pioneering blockchain platforms, has been widely adopted for smart contract development and deployment. Its robust infrastructure, flexibility, and large developer community have contributed to its market dominance. Ethereum’s native programming language, Solidity, allows developers to create and execute complex smart contracts with ease. The platform’s established ecosystem and broad industry support have made it a go-to choice for organizations across various sectors.

However, other platforms have also emerged as significant players in the smart contracts market. Cardano, known for its focus on scalability, security, and sustainability, has gained traction due to its advanced proof-of-stake consensus mechanism. Polkadot, with its interoperability features, allows different blockchain networks to communicate and share data, enabling seamless interaction between smart contracts on different platforms. BNB Chain, the native blockchain of Binance, offers a fast and secure environment for deploying smart contracts and executing decentralized applications.

While Ethereum dominates the market, these alternative platforms are experiencing growing adoption and market share. Their unique features and technological advancements cater to specific industry needs and provide alternatives for organizations seeking different capabilities and performance characteristics from their smart contract platforms.

Furthermore, the smart contracts market is not limited to these specific platforms alone. There are other emerging platforms and blockchain networks that offer smart contract capabilities, each with its own strengths and value propositions. This diversity in the market allows organizations to evaluate and choose the platform that best aligns with their specific requirements, industry focus, and strategic goals.

Blockchain Type Analysis

In 2023, the Public segment held a dominant market position in the Smart Contracts Market, capturing more than a 64.1% share. Public blockchains are synonymous with openness and transparency, allowing anyone to participate and view transactions. This segment’s dominance is largely due to the widespread adoption of platforms like Ethereum, which support an extensive range of decentralized applications and services. Public blockchains are particularly favored for their robust security and decentralized nature, appealing to a broad audience seeking transparent and tamper-proof systems.

The Private segment, on the other hand, caters to organizations seeking more control and privacy. While it comprises a smaller portion of the market, its significance cannot be overlooked. Private blockchains offer a closed network where access is restricted, making them ideal for businesses that require confidentiality and faster transaction speeds due to fewer participants. They are often preferred by enterprises that need to maintain privacy while leveraging the benefits of blockchain technology for internal processes or among a defined consortium.

Hybrid blockchains combine the best of both public and private worlds, offering a flexible solution that can be customized according to specific needs. They allow transactions and records to be kept private among a closed group while still communicating with the broader public blockchain. This segment is gaining traction as organizations look for tailored solutions that offer the transparency of public blockchains and the privacy and efficiency of private networks.

Enterprise Size Outlook

In 2023, the large enterprises segment held a dominant market position in the smart contracts market, capturing more than a 69.5% share. Large enterprises, with their substantial resources and complex business operations, have been early adopters of smart contract technology. They have recognized the potential of smart contracts to streamline their processes, enhance efficiency, and reduce costs.

The implementation of smart contracts enables large enterprises to automate various aspects of their operations, such as supply chain management, financial transactions, and contract management. These organizations can leverage the benefits of increased transparency, immutability, and trust provided by smart contracts to optimize their workflows and improve overall business performance.

On the other hand, small and medium enterprises (SMEs) are also recognizing the value of smart contracts and are gradually embracing this technology. While the adoption among SMEs is relatively lower compared to large enterprises, it is expected to grow significantly in the coming years.

SMEs can leverage smart contracts to streamline their operations, improve transactional efficiency, and reduce manual paperwork. Smart contracts enable SMEs to automate processes such as invoicing, payment settlements, and compliance management, leading to time and cost savings. As awareness about the benefits of smart contracts increases among SMEs and the technology becomes more accessible, the segment is poised for notable growth in the smart contracts market.

Note: Actual Numbers Might Vary In The Final Report

End-Use Industry

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Smart Contracts Market, capturing more than a 35.7% share. This significant portion is attributed to the financial sector’s rapid adoption of blockchain technology for enhancing the security, transparency, and efficiency of transactions.

Smart contracts in BFSI are revolutionizing traditional banking operations, from loan processing to claims handling in insurance, by automating agreements and eliminating the need for intermediaries. As the sector continues to prioritize trust and efficiency, the adoption of smart contracts is expected to rise further.

The Logistics segment is also leveraging smart contracts to transform supply chain management. By automating workflows and ensuring real-time, tamper-proof records, these contracts significantly reduce disputes, enhance tracking, and streamline operations from manufacturing to delivery. While its market share is growing, the potential for smart contracts in logistics is vast, promising more efficient, transparent, and reliable supply chains.

In Real Estate, smart contracts are simplifying transactions by automating property sales, leases, and records. They minimize the risk of fraud, reduce paperwork, and speed up processes, making real estate transactions more secure and efficient. As the industry continues to embrace digital transformation, the adoption and impact of smart contracts are set to expand.

The Healthcare industry is increasingly adopting smart contracts to manage patient data securely and automate billing and claims. By ensuring data integrity and automating time-consuming processes, smart contracts can significantly enhance operational efficiency and patient care. As the sector focuses on data security and efficient service delivery, the role of smart contracts is becoming more prominent.

Retail businesses are turning to smart contracts for supply chain transparency, inventory management, and automated transactions. By providing a reliable and automated way to track products from the manufacturer to the consumer, smart contracts help retailers reduce fraud, ensure authenticity, and improve customer trust.

Other End-Use Industries, including entertainment, government, and education, are exploring smart contracts to improve transparency, security, and efficiency. Each industry is finding unique applications, from automating royalty payments in entertainment to streamlining administrative processes in government and education.

Key Market Segments

Platform

- Ethereum

- Cardano

- Polkadot

- BNB Chain

- Other Platforms

Blockchain Type

- Private

- Public

- Hybrid

Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

End-Use Industry

- BFSI

- Logistics

- Real Estate

- Healthcare

- Retail

- Other End-Use Industries

Driving Factors

- Increasing adoption of blockchain technology: The rising adoption of blockchain across industries is a significant driving factor for the smart contracts market. Blockchain provides the necessary infrastructure and security for executing and enforcing smart contracts, leading to improved efficiency, transparency, and trust in transactions.

- Cost and time savings: Smart contracts automate manual processes, reducing the need for intermediaries and paperwork. This translates to cost savings and faster transaction processing times. Organizations are drawn to smart contracts due to the potential for streamlining operations, minimizing human error, and accelerating business processes.

- Rise in digital transformation initiatives: The global digital transformation wave has led organizations to explore innovative technologies like smart contracts. Companies are increasingly seeking digital solutions to optimize their workflows, enhance customer experiences, and gain a competitive edge. Smart contracts align with this goal by providing a secure and efficient means of executing agreements and transactions.

- Growing demand for decentralized applications (DApps): The increasing popularity of decentralized applications built on blockchain platforms is driving the adoption of smart contracts. Smart contracts enable the functionality of DApps by automating the execution of code and ensuring trust and transparency in interactions within the decentralized ecosystem. The demand for DApps across various sectors is fueling the growth of the smart contracts market.

Restraining Factors

- Scalability limitations: The scalability of blockchain networks and smart contracts remains a significant challenge. As the number of transactions increases, blockchain networks may face issues with processing speed and capacity. Scaling solutions are being developed, but limitations in scalability can hinder the widespread adoption of smart contracts, particularly for high-volume applications.

- Regulatory challenges: The regulatory landscape surrounding smart contracts is still evolving. Different jurisdictions have varying approaches to legal recognition and enforcement of smart contracts. Uncertainty or inconsistency in regulations can create barriers to adoption, particularly for industries with stringent compliance requirements.

- Security concerns: While blockchain technology provides inherent security features, vulnerabilities in the smart contract code or implementation can lead to potential risks. Smart contracts are subject to hacking attempts, bugs, or coding errors that can result in financial loss or legal disputes. Ensuring robust security measures and conducting thorough audits are crucial to mitigate these risks.

- Lack of standardized frameworks: The absence of standardized frameworks for smart contracts can be a challenge. Interoperability between different blockchain platforms and the ability to seamlessly communicate and execute smart contracts across networks is still a developing area. The lack of standardization can create complexities when integrating or migrating smart contracts between platforms.

Growth Opportunities

- Integration with emerging technologies: Smart contracts can be integrated with other emerging technologies such as Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML). This integration opens up opportunities for innovative use cases, such as automated supply chain management, autonomous transactions, and predictive analytics based on smart contract data.

- Expansion into new industries: While smart contracts have found initial adoption in sectors like finance and supply chain, there is potential for expansion into other industries. Areas such as healthcare, real estate, energy, and government services can benefit from the transparency, efficiency, and security offered by smart contracts. Exploring new industry verticals presents significant growth opportunities for the market.

- Development of user-friendly interfaces: Simplifying the user experience and creating user-friendly interfaces for smart contract development and execution can drive wider adoption. User-friendly tools and platforms that require minimal coding knowledge can encourage individuals and businesses to engage with smart contracts and create a broader user base.

- Cross-border transactions and international trade: Smart contracts can facilitate secure and efficient cross-border transactions and international trade. The automation, transparency, and immutability of smart contracts can reduce friction in global trade and simplify complex legal processes. As international trade continues to grow, smart contracts offer opportunities to streamline and digitize cross-border transactions.

Challenges

- Education and awareness: One of the key challenges in the smart contracts market is the lack of widespread understanding and awareness of the technology. Educating stakeholders, including businesses, legal professionals, and consumers, about the benefits, risks, and implementation of smart contracts is essential to drive adoption.

- Legal and regulatory complexities: The legal and regulatory landscape surrounding smart contracts is complex and varies across jurisdictions. Smart contracts may challenge traditional legal frameworks, and it is crucial to navigate the legal implications, enforceability, and compliance requirements to ensure widespread acceptance and adoption.

- Interoperability and standardization: The lack of interoperability between different blockchain platforms and smart contract protocols can pose challenges. Developing standardized frameworks and protocols that enable seamless communication and execution of smart contracts across platforms is necessary for scalability and widespread adoption.

- Privacy and data protection: Smart contracts operate on a public blockchain, which raises concerns about privacy and data protection. Ensuring appropriate measures for data privacy and protection, especially for sensitive and personal information, is crucial for the broader adoption of smart contracts, particularly in industries with strict privacy regulations.

Key Market Trends

- Hybrid blockchain solutions: Hybrid blockchain solutions, combining public andprivate blockchains, are gaining traction in the smart contracts market. These solutions offer a balance between transparency and privacy, allowing organizations to leverage the benefits of blockchain technology while maintaining control over sensitive data.

- Integration of oracle services: Oracle services, which provide external data inputs to smart contracts, are becoming increasingly important. Smart contracts often require real-time data from off-chain sources to execute conditions or trigger actions. Integrating reliable and secure oracle services ensures the accuracy and integrity of data used in smart contracts.

- Emergence of cross-chain interoperability protocols: Cross-chain interoperability protocols are being developed to enable seamless communication and data exchange between different blockchain networks. These protocols facilitate the interoperability of smart contracts across platforms, reducing fragmentation and expanding the potential applications of smart contracts.

- Focus on sustainability and energy efficiency: With growing concerns about the environmental impact of blockchain technology, there is a trend towards developing more sustainable and energy-efficient smart contract platforms. Efforts are being made to optimize consensus mechanisms, reduce energy consumption, and explore alternative approaches to minimize the carbon footprint associated with smart contract execution.

Regional Analysis

In 2023, North America held a dominant market position in the smart contracts market, capturing more than a 34.3% share. The region’s leadership can be attributed to several factors, including the strong presence of major technology companies, high adoption of blockchain technology, and favorable regulatory frameworks. The demand for Smart Contracts in North America was valued at US$ 0.5 billion in 2023 and is anticipated to grow significantly in the forecast period.

North America is home to prominent blockchain startups and established enterprises that have embraced smart contracts to enhance operational efficiency, automate business processes, and foster innovation. The region’s advanced IT infrastructure, skilled workforce, and robust financial sector contribute to the widespread adoption of smart contracts across various industries.

Europe also emerged as a significant market for smart contracts, accounting for a substantial market share in 2023. The region’s well-developed regulatory environment and initiatives promoting digital transformation have played a crucial role in the adoption of smart contracts. European countries have been actively exploring blockchain applications, and smart contracts have gained traction in sectors such as finance, supply chain management, and healthcare. The presence of major financial hubs, such as London and Frankfurt, has further facilitated the adoption of smart contracts in the region’s financial services industry.

The Asia-Pacific (APAC) region witnessed rapid growth in the smart contracts market, driven by the increasing digitization efforts and the adoption of blockchain technology. Countries such as China, Japan, South Korea, and Singapore are leading the way in blockchain innovation and investment. APAC’s large population, thriving e-commerce sector, and government support for blockchain initiatives have fueled the demand for smart contracts. The region is witnessing significant use cases in cross-border trade, logistics, and supply chain management, where smart contracts offer transparency, traceability, and automation.

Latin America is also experiencing growth in the smart contracts market, driven by factors such as improving internet infrastructure, increasing smartphone penetration, and the need for secure and transparent digital transactions. Countries like Brazil, Mexico, and Argentina have witnessed a surge in blockchain adoption, with smart contracts being deployed in areas such as real estate, legal services, and government applications. The region’s evolving regulatory landscape and initiatives to promote blockchain technology are expected to further drive the growth of smart contracts in Latin America.

The Middle East and Africa (MEA) region are witnessing a gradual but steady adoption of smart contracts. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are leading the way in blockchain implementation and digital transformation initiatives. Smart contracts are being explored in areas such as government services, supply chain management, and finance. The region’s focus on smart cities, fintech innovation, and digitalization of key sectors provides opportunities for the growth of smart contracts.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Thailand

- Singapore

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The smart contracts market is characterized by the presence of various key players that contribute to its growth and development. These players include technology companies, blockchain platforms, consulting firms, and startups.

Top Key Players

- IBM Corporation

- Tata Consultancy Services Limited

- Innowise Group

- Amazon Web Services, Inc.

- Oracle Corporation

- Infosys Limited

- Waves

- Algorand

- Monax Industries Ltd.

- Chainlink Docs

- ScienceSoft

- ELEKS

- Other Key Players

Recent Developments

- In March 2023, Chainlink, a company providing web3 services, launched Chainlink Functions. It’s a platform that lets developers easily connect their smart contracts and decentralized applications (dApps) to Web 2.0 APIs. This platform allows builders to perform customized computations on Web 2.0 APIs through Chainlink’s network.

- In October 2022, Equinor started using Data Gumbo’s smart contract platform to automate payment calculations and processes. By using Data Gumbo’s smart contract, users can make their payment systems more efficient through automation.

- In the October 2022, iQIYI, a Chinese streaming platform, started using ERC-3475, an Ethereum-based smart contract created by DeBond, to handle copyright-related issues. This smart contract lets users store extra details, values, metadata, and transaction information, improving how copyright is managed.

Report Scope

Report Features Description Market Value (2023) USD 1.5 Bn Forecast Revenue (2033) USD 14.9 Bn CAGR (2024-2033) 25.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Platform (Ethereum, Cardano, Polkadot, BNB Chain, Other Platforms), By Blockchain Type (Private, Public, Hybrid), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By End-Use Industry (BFSI, Logistics, Real Estate, Healthcare, Retail and Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, Tata Consultancy Services Limited, Innowise Group, Amazon Web Services, Inc., Oracle Corporation, Infosys Limited, Waves, Algorand, Monax Industries Ltd., Chainlink Docs, ScienceSoft, ELEKS, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are smart contracts?Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically enforce and execute contractual clauses when predefined conditions are met.

How big is the smart contracts market?The Global Smart contracts Market size is poised for significant growth, reaching USD 1.9 Billion in 2024. The sales are expected to witness a robust CAGR of 25.8% from 2024 to 2033. By 2033, the smart contracts demand is anticipated to reach a valuation of USD 14.9 Billion.

What is the significance of the smart contracts market?The smart contracts market is crucial for enabling decentralized, trustless transactions. It plays a key role in industries such as finance, real estate, supply chain, and more by automating and securing complex processes.

Which industries are adopting smart contracts?Industries like finance, insurance, healthcare, real estate, and supply chain are increasingly adopting smart contracts to streamline processes, reduce costs, and enhance security.

What is the most popular smart contract platform?Currently, Ethereum stands out as the most popular smart contract platform. Its widespread adoption and developer community make it a leading choice for deploying and executing smart contracts. However, other platforms like Binance Smart Chain and Solana are gaining traction.

Who runs smart contracts?Smart contracts run on decentralized networks, typically blockchain platforms. They operate autonomously, executing code when predefined conditions are met. The decentralized nature ensures trust, security, and resilience, as no single entity has control over the entire network.

Who are the key players in the smart contracts market?Some key players operating in the smart contracts market include IBM Corporation, Tata Consultancy Services Limited, Innowise Group, Amazon Web Services, Inc., Oracle Corporation, Infosys Limited, Waves, Algorand, Monax Industries Ltd., Chainlink Docs, ScienceSoft, ELEKS, Other Key Players

-

-

- IBM Corporation

- Tata Consultancy Services Limited

- Innowise Group

- Amazon Web Services, Inc.

- Oracle Corporation

- Infosys Limited

- Waves

- Algorand

- Monax Industries Ltd.

- Chainlink Docs

- ScienceSoft

- ELEKS

- Other Key Players