Global Smart City Cloud Infrastructure Market, Size, Share, Growth Analysis By Component (Hardware, Software, Services), By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), By Application (Smart Transportation, Smart Utilities, Public Safety, Smart Governance, Others), By End-User (Government Municipalities, Enterprise, Citizens) - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec. 2025

- Report ID: 170539

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Cloud Adoption in Smart Cities

- Usage Statistics by Application

- Future Projections

- Role of Generative AI

- U.S. Market Size

- Component Analysis

- Deployment Model Analysis

- Application Analysis

- End-User Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

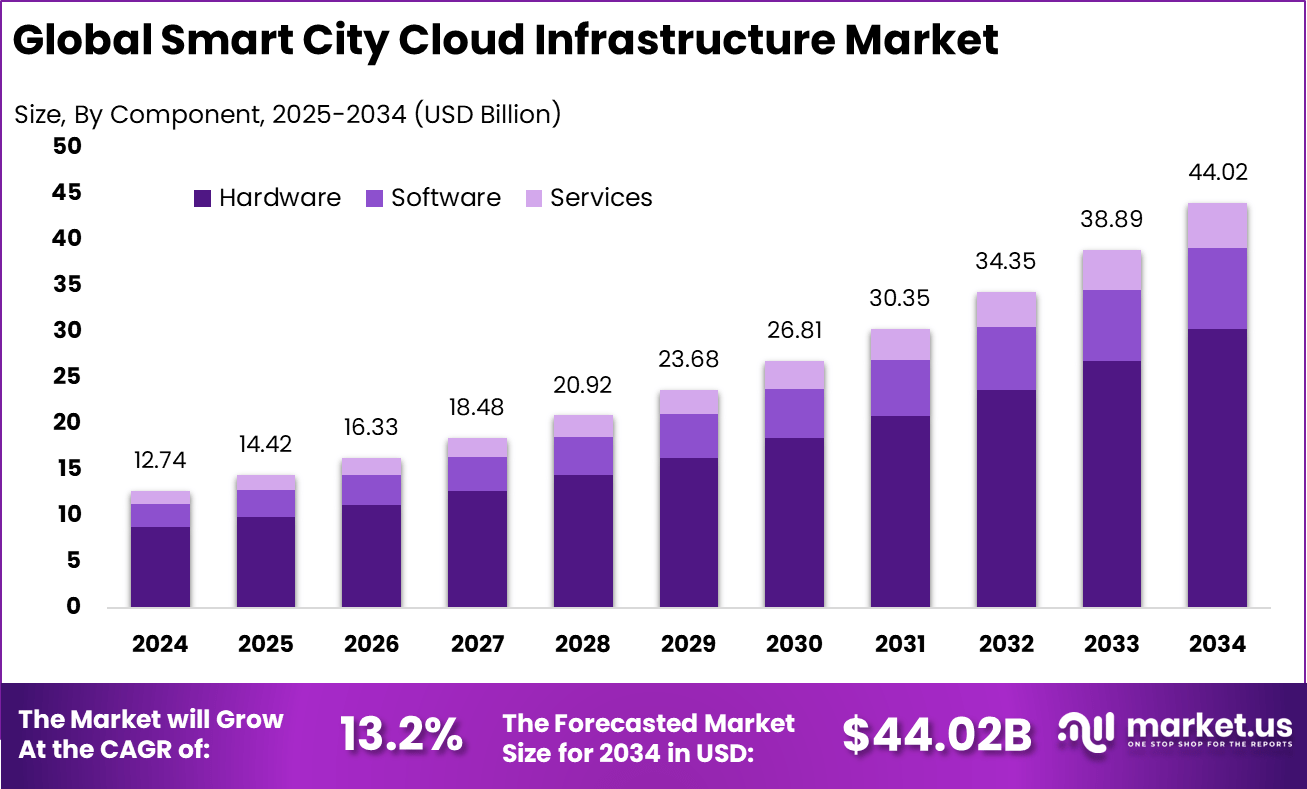

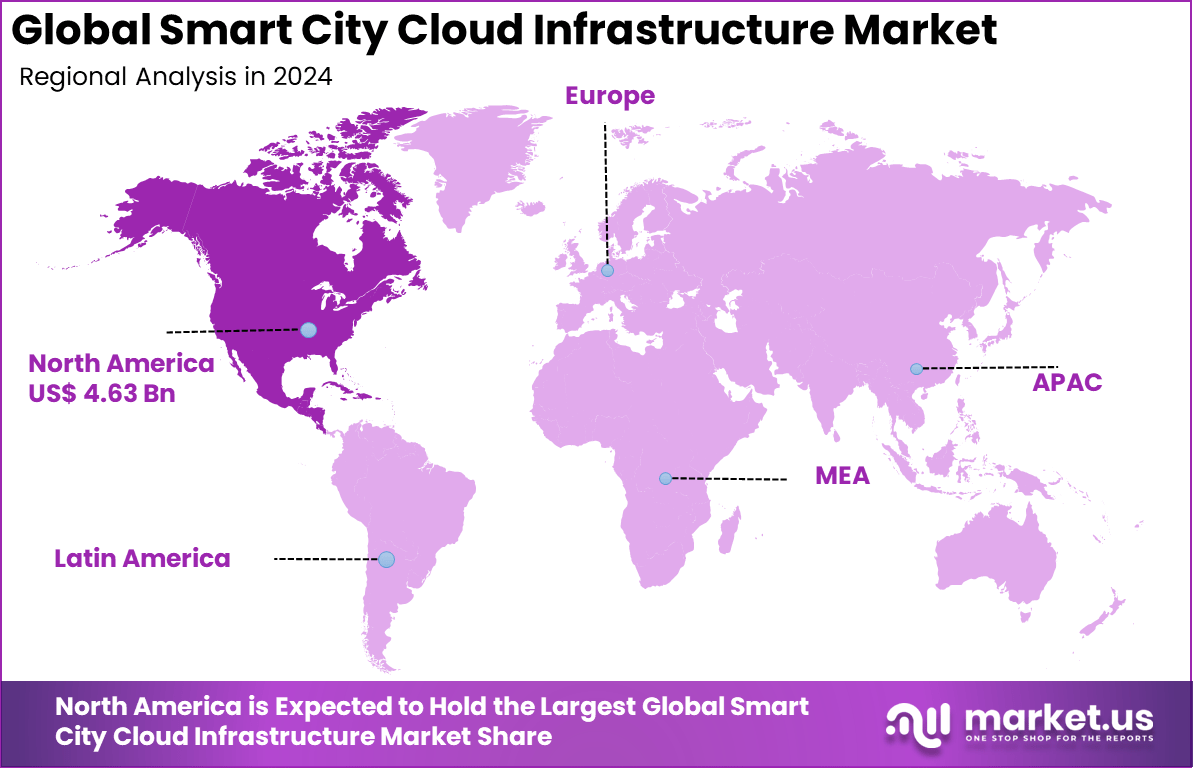

The Global Smart City Cloud Infrastructure Market size is expected to be worth around USD 44.02 billion by 2034, from USD 12.74 billion in 2024, growing at a CAGR of 13.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 36.4% share, holding USD 4.63 billion in revenue.

The smart city cloud infrastructure market focuses on cloud platforms that support data storage, processing, and integration for connected urban systems. These platforms act as the digital backbone for smart transportation, public safety, utilities, energy management, healthcare services, and citizen engagement tools. Cloud infrastructure allows city authorities to collect and analyze data from sensors, cameras, meters, and connected devices in real time.

According to the United Nations, over 55% of the global population lives in urban areas, creating demand for smarter city management systems. Governments are focusing on digital governance, efficient public services, and better resource utilization. Rising use of Internet of Things devices in traffic systems, utilities, and surveillance has increased the need for scalable cloud platforms. Data security and disaster recovery requirements are also pushing cities toward centralized and secure cloud environments.

Based on data from market.us, The global smart city market was valued at USD 762.7 billion in 2023 and is projected to reach approximately USD 4,605.7 billion by 2033, expanding at a CAGR of 19.7% during the forecast period. Growth is driven by rising urbanization, increasing pressure on city infrastructure, and strong government investment in digital transformation initiatives.

Top Driving Factors fueling the adoption of smart city cloud infrastructure include rapid urbanization, which increases demand for efficient resource management and improved public services. The growing deployment of IoT devices generates massive data that requires scalable storage and real-time analytics, which only cloud platforms can handle effectively. Improved wireless coverage and communication technologies are driving cities to adopt cloud infrastructure for connecting and managing smart urban systems efficiently.

For instance, in October 2025, IBM partnered with AWS to boost cloud infrastructure for smart city projects in the Middle East, including Saudi Arabia and the UAE. This collaboration addresses data localization, sustainable infrastructure, cybersecurity compliance, and AI adoption to help governments implement smart city technologies at scale.

Key Takeaway

- Hardware led with a 68.9% share, driven by large-scale deployment of sensors, edge devices, and networking equipment across smart city projects.

- Public cloud accounted for 38.6%, reflecting city governments’ preference for scalable and cost-efficient cloud platforms.

- Public safety applications captured 32.8%, supported by growing investment in surveillance, emergency response, and traffic monitoring systems.

- The enterprise segment held 53.8%, as system integrators and technology providers play a central role in smart city implementation.

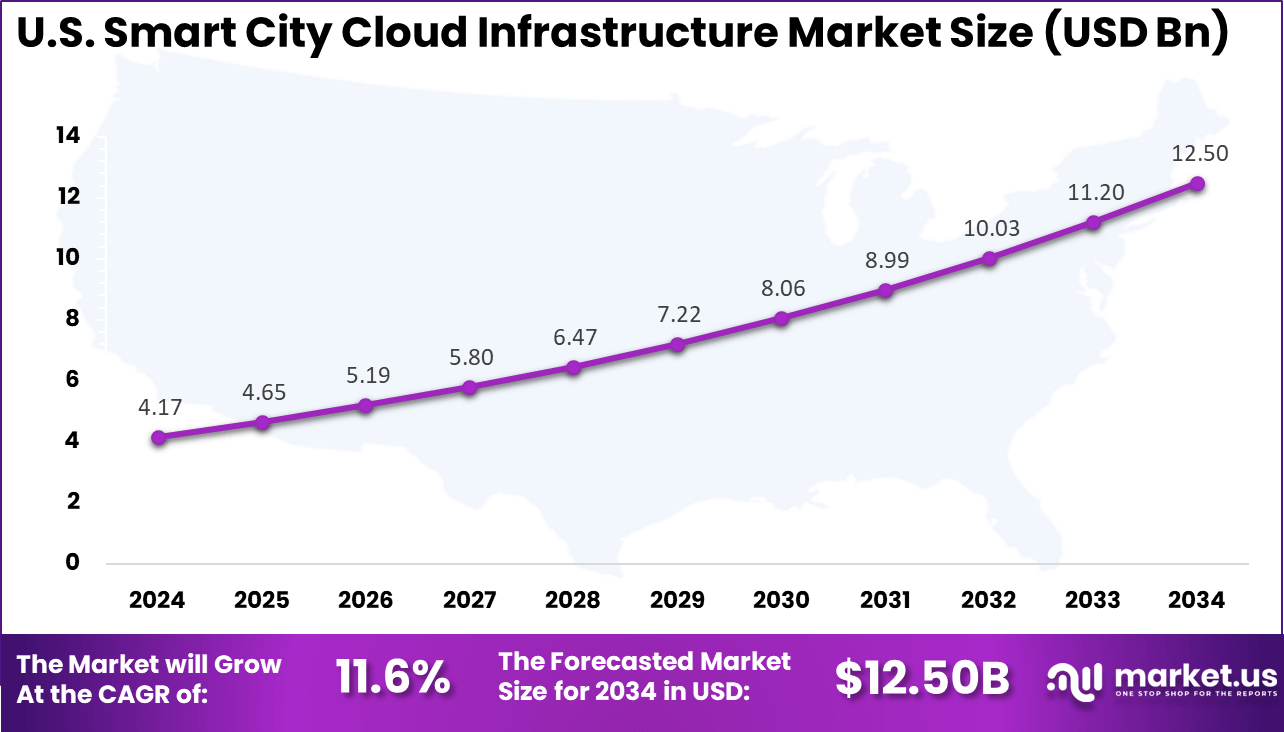

- The U.S. market reached USD 4.17 billion in 2024, expanding at a steady 11.6% CAGR due to ongoing urban digitization initiatives.

- North America dominated globally with over 36.4% share, backed by advanced infrastructure, strong public funding, and early adoption of smart city technologies.

Cloud Adoption in Smart Cities

- Cloud infrastructure adoption in smart cities is expanding rapidly, driven by the need to manage large data volumes from transport, utilities, and public services.

- 94% of enterprises globally already use cloud services, showing that cloud-first strategies are now standard across public and private sectors.

- More than 75% of cloud users are highly dependent on advanced cloud services for core functions like databases and application platforms.

- 82% of IoT applications rely on the cloud, supporting smart traffic lights, street lighting, waste systems, and environmental sensors.

- 85% of AI projects are built and operated on cloud platforms due to high computing and analytics requirements.

Usage Statistics by Application

- Smart utilities heavily depend on cloud analytics, with AI-driven systems capable of reducing energy consumption by 80-87%.

- In smart transportation, 75% of traffic management systems are expected to be AI-powered by 2025, increasing cloud dependency.

- Cloud platforms are central to e-governance and public safety, enabling real-time monitoring, surveillance, and emergency response systems.

- Around 60% of all organizational data is now stored in the cloud, including data generated by urban sensors and municipal operations.

Future Projections

- By 2025, about 51% of IT spending is expected to shift from traditional systems to public cloud platforms.

- Edge computing adoption is rising to support low-latency needs, working alongside cloud infrastructure for real-time city operations.

- The rollout of 5G is accelerating cloud usage, with 68% of organizations planning to deploy 5G-enabled cloud solutions for smart city services.

Role of Generative AI

Generative AI is becoming a powerful tool in smart city cloud infrastructure by automating complex city operations and improving data-driven decision-making. It can predict traffic patterns and energy demand by analyzing vast amounts of real-time data, which helps cities dynamically optimize resources.

For example, generative AI models hosted on cloud platforms enable cities to reduce traffic congestion and improve energy efficiency, contributing to smoother urban living. Studies show that cities using such AI-driven systems experience up to a 30% improvement in energy management and traffic flow optimization.

Another key role of generative AI is automating infrastructure management itself, such as scaling cloud resources based on predicted needs and quickly fixing technical issues without human intervention. This supports smarter resource allocation and reduces downtime in critical city services. Research indicates that integrating generative AI into cloud operations can reduce operational costs by over 20% while enhancing overall service reliability and speed.

U.S. Market Size

The market for Smart City Cloud Infrastructure within the U.S. is growing tremendously and is currently valued at USD 4.17 billion, the market has a projected CAGR of 11.6%. This growth is driven by increasing investments in advanced technologies like IoT, AI, and 5G, which enable cities to optimize operations and improve public services.

Federal initiatives supporting digital transformation and cloud-first strategies further accelerate adoption, while the rise of hybrid and multi-cloud environments offers flexibility and security for diverse urban applications. Additionally, the growing demand for scalable, cost-efficient IT solutions is pushing enterprises and municipalities to migrate from traditional infrastructure to cloud platforms.

The need for real-time data processing, enhanced public safety, efficient resource management, and sustainable urban development fuels expansion. Increasing involvement from major cloud service providers and technology companies also plays a key role in advancing smart city infrastructure across the country.

For instance, in October 2025, IBM collaborated with AWS to expand cloud infrastructure for smart city projects in the Middle East, showcasing IBM’s commitment to delivering scalable, compliant cloud solutions. This also reflects technology leadership stemming from the U.S. with global impacts on smart city cloud infrastructure.

In 2024, North America held a dominant market position in the Global Smart City Cloud Infrastructure Market, capturing more than a 36.4% share, holding USD 4.63 billion in revenue. This dominance is due to the region’s advanced innovation ecosystems and significant investments in cutting-edge technologies such as IoT, AI, and 5G. Major cities have adopted intelligent traffic management and energy-efficient systems that enhance urban life.

Furthermore, strong government initiatives, including smart city programs and digital transformation policies, drive adoption. Collaboration between public and private sectors accelerates development, while robust R&D and infrastructure investments bolster North America’s competitive edge in smart city technologies. These factors combine to sustain the region’s market dominance.

For instance, in October 2025, Oracle expanded its AI and distributed cloud offerings with integrations involving NVIDIA AI Enterprise. This advancement supports sovereign AI solutions with higher security and operational control, key for smart city applications like digital payments and smart grid management in North America.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 68.9% share of the Global Smart City Cloud Infrastructure Market. Hardware includes physical elements such as smart sensors, surveillance cameras, data centers, and communication towers that form the essential backbone of smart city networks.

The dominance arises from the critical need for robust, tangible infrastructure to support increasing urbanization, IoT deployments, and 5G connectivity. This hardware foundation enables seamless data collection and real-time communication, critical for city-wide services and operations.

Investment in hardware infrastructure is driven by large-scale public projects and the rising demand for efficient urban management systems. As cities evolve, physical infrastructure becomes smarter through modular designs and energy-efficient technologies that ensure reliability and scalability. This segment remains prominent due to its direct role in enabling other digital solutions and software ecosystems.

For Instance, in October 2025, Amazon Web Services (AWS) continues to bolster smart city hardware infrastructure by promoting its AWS Smart City Competency Program. This initiative helps cities deploy proven, reliable hardware and cloud services to create efficient and sustainable urban environments. AWS supports integration of sensors, data centers, and communication devices essential for smart city functionality, emphasizing real-time data flow and analytics to enhance urban living.

Deployment Model Analysis

In 2024, the Public Cloud segment held a dominant market position, capturing a 38.6% share of the Global Smart City Cloud Infrastructure Market. Public cloud platforms offer cities scalable, easily accessible resources to store and manage data centrally. This model’s affordability and flexibility allow municipalities to deploy and expand services rapidly without significant upfront hardware costs.

Public cloud solutions facilitate collaboration across various city departments and stakeholders, enabling real-time data sharing for efficient decision-making. Their adaptability to emerging technologies like AI and IoT is a key driver for public cloud adoption. Municipalities prefer public cloud models as they simplify infrastructure management while supporting a wide range of smart city applications.

For instance, in April 2025, Microsoft Azure expanded its public cloud capabilities with AI-driven services embedded across various smart city applications. Azure’s seamless integration of AI and machine learning enhances public cloud deployment by offering scalable, flexible platforms that support diverse city services. Their hybrid cloud solutions now enable local governments and enterprises to manage data securely on the cloud while meeting regulatory requirements.

Application Analysis

In 2024, The Public Safety segment held a dominant market position, capturing a 32.8% share of the Global Smart City Cloud Infrastructure Market. Smart city infrastructures use cloud technology to enhance surveillance, emergency response, and crime prevention through comprehensive monitoring systems and data analytics.

Technologies in this domain include video surveillance cameras, sensors, and communication tools that help authorities react quickly to incidents. The demand for smarter public safety solutions is increasing as urban areas face challenges like crime, traffic accidents, and natural disasters.

Data-driven insights allow for proactive safety measures and faster emergency handling. Thus, public safety applications are seen as crucial components that improve the quality of life and trust in city management.

For Instance, in December 2024, Google Cloud Platform (GCP) showcased advancements in public safety applications by leveraging AI-powered data analytics. GCP’s tools allow cities to process data from cameras, sensors, and social media to detect and respond to public safety threats quickly. This includes AI-driven predictive models that aid emergency response and optimize resource allocation for safer urban environments.

End-User Analysis

In 2024, The Enterprise segment held a dominant market position, capturing a 53.8% share of the Global Smart City Cloud Infrastructure Market. These organizations use smart city cloud infrastructure to optimize a wide range of operations such as building management, supply chain logistics, and resource allocation. Enterprises benefit from the cloud’s ability to deliver scalable and flexible solutions that align with their business goals in urban environments.

The growth in enterprise adoption of smart city infrastructure is fueled by their need to enhance operational efficiency and reduce costs while meeting regulatory and sustainability requirements. Enterprises are active partners in smart city development, deploying cloud-based platforms to foster innovation and improve service delivery for citizens and businesses alike.

For Instance, in March 2025, IBM introduced enhancements to enterprise cloud infrastructure through its AI Gateway and Watsonx platforms. These tools help enterprises build scalable, interconnected smart city services that improve operational efficiency. IBM’s real-time data streaming and AI capabilities enable businesses to adapt quickly to urban challenges, making enterprise adoption of cloud infrastructure more intelligent and secure.

Emerging trends

Hybrid cloud systems are gaining traction as smart cities look for ways to balance security needs and scalability. These systems mix public and private cloud setups to give cities the power to keep sensitive data secure while benefiting from the flexibility of the public cloud. Currently, hybrid clouds represent a growing share in city infrastructure technology as municipalities handle expanding amounts of data.

Another key trend is the rise of 5G and edge computing technologies. These allow data to be processed closer to where it is generated, reducing delays and enabling faster city responses. Over 40% of smart city projects are expected to leverage these technologies soon, which will improve services such as emergency response and urban monitoring by delivering timely information.

Growth Factors

The surge in connected devices throughout cities requires data platforms that scale easily and share information fluidly. About 42% of smart city cloud infrastructures are built to support this growing IoT ecosystem, which helps city departments work together efficiently and respond swiftly to urban needs. This capability drives faster development of smart services while keeping IT costs manageable.

Demand for intelligent urban services like predictive infrastructure upkeep and enhanced public safety is another growth engine. These AI-powered applications depend on advanced cloud systems for their analytics and management. Year-over-year investments in these technologies have increased by more than 20%, showing a steady rise in their adoption for improving city efficiencies.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Application

- Smart Transportation

- Smart Utilities

- Public Safety

- Smart Governance

- Others

By End-User

- Government Municipalities

- Enterprise

- Citizens

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increasing Urbanization and Infrastructure Demand

Rapid urbanization is a key driver of the smart city cloud infrastructure market, as growing city populations increase pressure on transport, utilities, and public safety systems. Cloud infrastructure enables scalable and flexible management of large data volumes, supporting real time services and more efficient use of urban resources.

Sustainability goals further strengthen this demand, as cloud platforms support energy efficiency, smarter resource allocation, and lower carbon impact through data analytics and IoT integration. As governments focus on resilient and future ready cities, cloud infrastructure is becoming a core foundation for smart urban development.

For instance, in October 2025, Amazon Web Services demonstrated how cities use its cloud platform for smart city applications such as automated queue management and remote utility monitoring. These deployments show how cloud infrastructure helps cities scale services efficiently while addressing rapid population growth.

Restraint

High Initial Investment and Deployment Costs

One significant restraint in adopting smart city cloud infrastructure is the high upfront cost. Implementation involves substantial investments in IoT devices, cloud services, network expansion, and integration with existing city systems. For many municipalities and governments, securing funding and managing these initial expenses can be challenging, limiting rapid adoption, especially in developing regions.

Additionally, deploying and maintaining cloud infrastructure requires specialized skills and ongoing operational costs. These financial and resource burdens often delay projects or reduce the scale of implementation. Such cost barriers hinder smaller cities or regions from fully leveraging cloud-powered smart city solutions until prices become more affordable or alternative funding models emerge.

For instance, in October 2025, IBM and AWS announced a joint Innovation Hub focused on accelerating cloud adoption in the Middle East. Despite the initiative’s promise, the launch highlighted the costly nature of deploying cloud-based smart city infrastructure, especially in regions requiring localized data centers and customization for compliance. These financial and operational requirements remain a key barrier for many cities confronting tight budgets.

Opportunities

Integration of AI and Edge Computing

The smart city cloud infrastructure market has vast opportunities through integrating AI and edge computing. AI analytics embedded within cloud platforms allow cities to gain real-time insights from massive data streams, improving decision-making in traffic control, energy management, and public safety. This integration enhances automation and predictive maintenance, reducing downtime and operational costs.

Edge computing complements this by processing data near the source, minimizing latency and bandwidth usage, which ensures faster responses for critical urban services. Together, AI and edge computing unlock smarter, more responsive city ecosystems. Growing investments and technological advancements in these areas create new business models and services within the smart city cloud infrastructure space.

For instance, in September 2025, Alibaba Cloud announced upgrades to its AI and cloud infrastructure, introducing tools like Qwen3-Max to support advanced model training and rapid AI development. This progress demonstrates how smart city cloud platforms can harness AI for real-time analytics, driving smarter urban operations from traffic management to energy optimization.

Challenges

Data Privacy and Cybersecurity Concerns

A major challenge facing smart city cloud infrastructure is protecting sensitive data and ensuring cybersecurity. Cloud systems collect vast amounts of personal and operational data, raising risks of unauthorized access, breaches, and potential misuse. These security vulnerabilities can erode public trust and deter stakeholders from full adoption.

Cities must implement stringent security protocols, including encryption, access controls, and continuous monitoring. Regulatory compliance and data governance also add complexity to managing cloud infrastructures. Balancing the openness necessary for smart city functionality with robust data privacy safeguards remains an ongoing, demanding challenge for policymakers and technology providers.

For instance, in October 2025, IBM and AWS stressed cybersecurity as a central pillar in their Middle East Innovation Hub project. They focused on providing tailored cloud security frameworks compliant with regional data privacy standards, highlighting the ongoing challenge of safeguarding sensitive urban data within smart city infrastructures.

Key Players Analysis

One of the leading players in October 2025, AWS strengthened its role in smart city cloud infrastructure by committing USD 30 billion to expand AI and cloud facilities in Pennsylvania and North Carolina. The launch of second generation accelerated networking EC2 instances and the expansion of local zones, including New York City, improved low latency performance and edge computing capabilities, supporting real time and AI driven urban services at scale.

Top Key Players in the Market

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform

- IBM

- Oracle

- Alibaba Cloud

- Cisco Systems

- Siemens

- Huawei

- SAP

- VMware

- Salesforce

- Bosch

- Hitachi

- Schneider Electric

- Others

Recent Developments

- In October 2025, IBM partnered with AWS to boost cloud infrastructure for smart city projects in the Middle East, including Saudi Arabia and the UAE. This collaboration addresses data localization, sustainable infrastructure, cybersecurity compliance, and AI adoption to help governments implement smart city technologies at scale.

- In September 2025, Siemens committed €750 million over the next decade to a large-scale smart city regeneration project in Berlin, integrating its digital twin technology platform to manage urban infrastructure and energy use. This project aims to create a model for industrial digitalization and urban sustainability, supporting business, residential, and social housing developments.

Report Scope

Report Features Description Market Value (2024) USD 12.7 Bn Forecast Revenue (2034) USD 44.02 Bn CAGR(2025-2034) 13.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), By Application (Smart Transportation, Smart Utilities, Public Safety, Smart Governance, Others), By End-User (Government Municipalities, Enterprise, Citizens) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, IBM, Oracle, Alibaba Cloud, Cisco Systems, Siemens, Huawei, SAP, VMware, Salesforce, Bosch, Hitachi, Schneider Electric, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart City Cloud Infrastructure MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Smart City Cloud Infrastructure MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform

- IBM

- Oracle

- Alibaba Cloud

- Cisco Systems

- Siemens

- Huawei

- SAP

- VMware

- Salesforce

- Bosch

- Hitachi

- Schneider Electric

- Others