Global Smart Card Market By Type (Contact Cards, Contactless Cards and Dual Interface Smart Cards), By Application (Banking and Financial Services, Telecommunications, Healthcare, Transportation, Government and Public Sector, Retail and Loyalty Programs, Other Applications), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2025

- Report ID: 19653

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

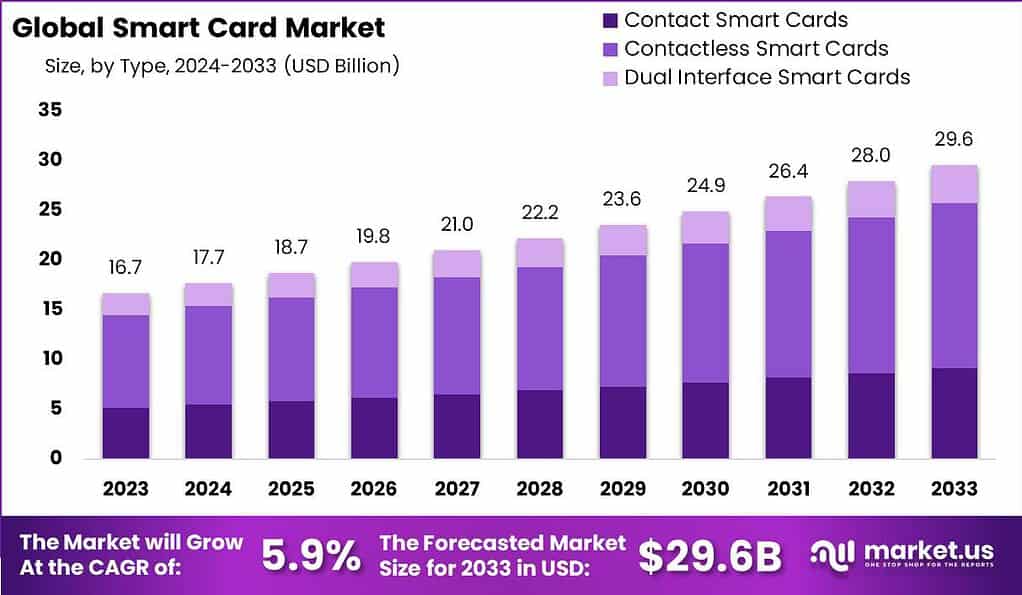

The Global Smart Card Market size is expected to be worth around USD 29.6 Billion by 2033, from USD 16.7 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

The smart card market is experiencing substantial growth, driven by the increasing adoption of secure and efficient digital solutions across various industries. Key growth factors include the rising demand for contactless payment systems, enhanced security features for identification and authentication, and the expanding use of smart cards in sectors such as healthcare, transportation, and banking. Additionally, the integration of smart card technology with mobile and IoT devices is propelling market expansion.

Despite these challenges, there are significant opportunities in the smart card market. The increasing demand for biometric smart cards and the integration of smart cards with IoT devices present new avenues for growth. Furthermore, emerging markets are adopting smart card technology at a rapid pace, offering vast potential for market expansion. The development of more sophisticated encryption technologies also promises to enhance the security of smart cards, increasing consumer trust and driving further adoption.

A report published by the World Bank on June 29, 2022, 40% of adults in low- and middle-income economies used a card, phone, or the internet to make merchant in-store or online payments for the first time since the start of the pandemic.

According to data provided by WorldMetrics, the global shipment of smart cards exceeded 2.6 billion units in 2022. This substantial volume highlights the growing reliance on smart card technology across various sectors. Projections indicate that by 2025, smart card penetration in the transportation sector alone is anticipated to reach 78%.

Key Takeaways

- The Smart Card Market is anticipated to reach USD 29.6 billion by 2033, with a steady Compound Annual Growth Rate (CAGR) of 5.9% during the forecast period from 2024 to 2033.

- In 2023, Contactless Smart Cards held over 56% of the global smart card market share due to their convenience and security in transactions. They are widely used in retail, banking, and public transport sectors.

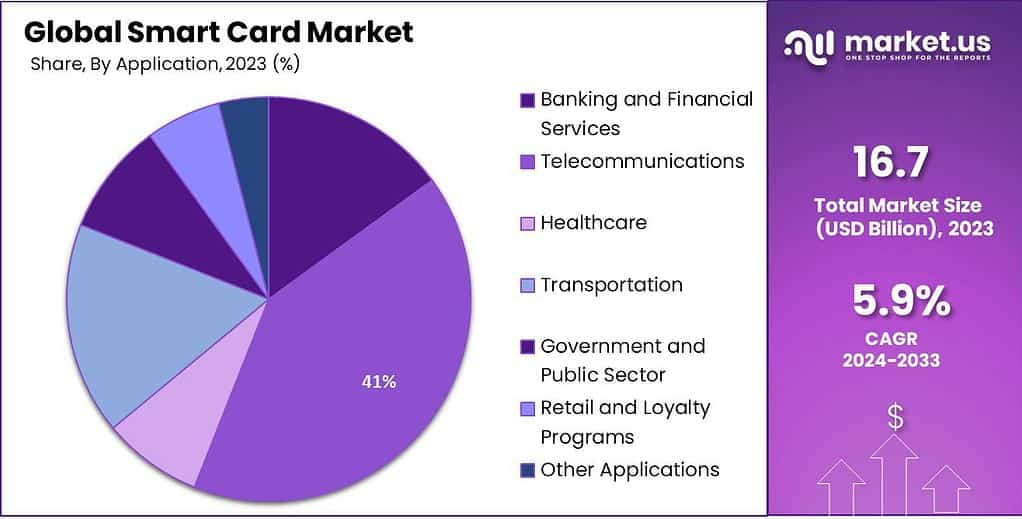

- In 2023, the Telecommunications segment dominated the market, capturing more than 41% share. Smart cards, particularly SIM cards, play a crucial role in mobile communications, subscriber authentication, and network connectivity.

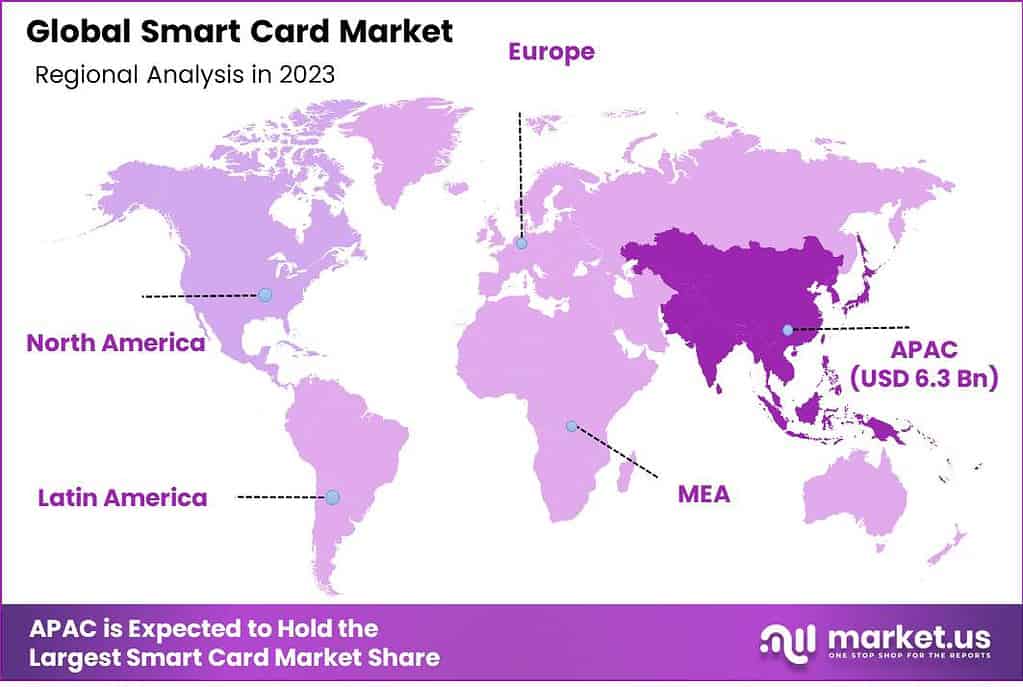

- Asia-Pacific held a dominant market position in 2023 (38% share), driven by technological advancements, digital transactions, and government initiatives.

Type Analysis

In 2023, the Contactless Smart Cards segment held a dominant market position, capturing more than a 56% share of the global Smart Card Market. This significant market share can be attributed to the numerous advantages offered by contactless technology, notably in terms of convenience and security. These cards enable swift and secure transactions by utilizing radio-frequency identification (RFID) technology and near-field communication (NFC), which facilitate seamless data transfer without the need for direct card-reader contact.

The escalating adoption of contactless payments in various sectors, including retail, banking, and public transport, has propelled the growth of this segment. The speed of transactions with contactless cards is a key factor driving their popularity; they significantly reduce the time spent at checkout points, enhancing customer experience. Moreover, the heightened focus on security features, such as encrypted data transmission and advanced authentication methods, bolsters consumer trust in this technology.

Another factor contributing to the dominance of Contactless Smart Cards is the growing integration of this technology into mobile devices. The increasing prevalence of NFC-enabled smartphones has expanded the scope of contactless applications, further augmenting market growth. The integration of contactless cards with digital wallets and mobile payment systems has also played a pivotal role in this segment’s expansion.

Furthermore, government initiatives in various countries promoting cashless transactions have positively impacted the contactless smart card market. Public sector applications such as e-passports, national identification cards, and public transportation systems increasingly incorporate contactless technology, demonstrating its growing significance.

Application Analysis

In 2023, the Telecommunications segment held a dominant market position in the Smart Card Market, capturing more than a 41% share. This substantial market share can be attributed to the pervasive use of smart cards in mobile communications. The integration of SIM (Subscriber Identity Module) cards, a type of smart card, into mobile devices is a primary factor driving this dominance. These cards are essential for storing subscriber information, providing secure authentication, and enabling connectivity to the network.

Moreover, the expansion of mobile networks and increasing smartphone penetration globally have further propelled the demand for SIM cards. The rise in mobile payments and digital transactions, often facilitated through smart cards, has also played a crucial role in this segment’s growth. Additionally, the ongoing development of 5G technology, requiring enhanced security and faster data processing, has led to the adoption of advanced smart cards in telecommunications.

The telecommunications segment’s growth is further bolstered by technological innovations such as embedded SIMs (eSIMs) and Near Field Communication (NFC) enabled cards, which offer improved security and convenience. These technologies have expanded the application scope of smart cards in the sector, from basic authentication to sophisticated applications like contactless payments and identity verification.

Key Market Segments

Type

- Contact Smart Cards

- Contactless Smart Cards

- Dual Interface Smart Cards

Application

- Banking and Financial Services

- Telecommunications

- Healthcare

- Transportation

- Government and Public Sector

- Retail and Loyalty Programs

- Other Applications

Driver

Increasing Adoption of Contactless Payment Solutions

The increasing adoption of contactless payment solutions is a significant driver for the global smart card market. Contactless payment methods, facilitated by smart cards, offer convenience, speed, and security in transactions. With the growing preference for cashless transactions and the proliferation of NFC-enabled devices, the demand for smart cards as payment tokens is expected to rise, driving the market’s growth.

Contactless payments have gained popularity due to their ease of use and efficiency. Smart cards equipped with near-field communication (NFC) technology allow users to make payments by simply tapping or waving the card near a contactless-enabled payment terminal. This eliminates the need for physical contact or the insertion of cards into payment machines, offering a faster and more convenient payment experience.

The COVID-19 pandemic has further accelerated the adoption of contactless payments as consumers seek safer alternatives to handle physical cash or touch payment terminals. The hygiene benefits of contactless payments have made them a preferred choice for both consumers and merchants.

Moreover, the integration of contactless payment technology into mobile devices, such as smartphones and smartwatches, has expanded the reach of smart card-based payments. Mobile payment solutions like Apple Pay, Google Pay, and Samsung Pay enable users to store their payment card information digitally and make secure contactless payments using their mobile devices. This convergence of smart cards and mobile technology has opened up new avenues for the growth of the global smart card market.

Restraint

Vulnerabilities and Security Concerns

One of the key restraints for the global smart card market is the presence of vulnerabilities and security concerns. As smart cards handle sensitive personal and financial information, any potential security breach or compromise can lead to identity theft, fraud, and financial loss. The continuous development of sophisticated hacking techniques poses a challenge to the market, requiring robust security measures to ensure the integrity and confidentiality of data stored in smart cards.

Smart card manufacturers and solution providers must invest in robust security features to protect against unauthorized access and data breaches. Encryption algorithms, secure key management, and tamper-resistant hardware are some of the security measures implemented in smart cards to safeguard sensitive information.

However, as security measures advance, so do the techniques employed by cybercriminals. Attacks such as card skimming, data interception, and unauthorized card cloning pose ongoing challenges to the smart card market. The industry must remain vigilant in staying ahead of evolving threats and constantly improving security mechanisms.

To address security concerns, standardization bodies and industry organizations work towards developing and promoting security standards for smart card technology. Compliance with internationally recognized security standards helps build trust among consumers and fosters wider adoption of smart card-based solutions.

Opportunity

Government Initiatives for Secure Identification

Government initiatives for secure identification, such as national identification programs and e-passports, present a significant opportunity for the global smart card market. Governments worldwide are adopting smart card-based solutions to enhance security, combat identity theft, and streamline identification processes. The implementation of smart cards in government-issued identification documents offers opportunities for smart card manufacturers and solution providers to cater to this growing demand.

National identification programs aim to provide citizens with secure and tamper-proof identification documents that can be used for various purposes, such as voting, accessing government services, and verifying identity in financial transactions. Smart cards embedded with microprocessors and cryptographic features offer a higher level of security compared to traditional identification documents like paper-based IDs or driver’s licenses.

E-passports, which incorporate smart card technology, store biometric and personal information digitally, enhancing the accuracy and security of passport verification processes. Smart card-based e-passports enable faster and more efficient immigration and border control procedures, improving the travel experience for individuals.

The implementation of smart cards in government identification initiatives also opens up opportunities for other sectors. For example, smart card-based healthcare identification can streamline patient record management, enable secure access to medical services, and prevent healthcare fraud. Similarly, smart cards can be utilized for secure access control in government facilities, ensuring only authorized individuals can enter restricted areas.

Challenge

Competition from Alternative Payment Technologies

One of the challenges faced by the global smart card market is the competition from alternative payment technologies. Mobile payment solutions, digital wallets, and emerging payment technologies like cryptocurrencies are gaining popularity among consumers. These technologies provide alternative payment options that bypass the need for physical smart cards. The challenge for the smart card market lies in adapting to the evolving payment landscape and staying competitive in a rapidly changing market environment.

Mobile payment solutions, such as Apple Pay, Google Pay, and Samsung Pay, enable users to make payments using their smartphones, eliminating the need for physical cards. These solutions leverage near-field communication (NFC) or other wireless technologies to facilitate contactless transactions. As consumers increasingly rely on their smartphones for various tasks, including payments, the demand for physical smart cards may experience a decline.

Another challenge faced by the smart card market is the emergence of cryptocurrencies and blockchain-based payment systems. Cryptocurrencies like Bitcoin and Ethereum enable peer-to-peer transactions without the need for intermediaries or traditional financial institutions. While cryptocurrencies are still in the early stages of adoption, their decentralized nature and potential for anonymity pose a competitive challenge to traditional payment methods, including smart card-based payments.

Regional Analysis

In 2023, Asia-Pacific held a dominant market position in the Smart Card market, capturing more than a 38% share. This significant market share is primarily attributed to the rapid technological advancements and the high adoption rate of smart cards in various sectors such as banking, telecommunications, and government services in this region. The proliferation of digital transactions, driven by a burgeoning middle-class population and increasing smartphone penetration, has been a key factor in this dominance.

The demand for Smart Card in North America reached US$ 6.3 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future. In January 2023, Delhi Metro Rail Corporation Limited joined forces with Airtel Payments Bank Ltd., an Indian payments bank, to introduce a smart card top-up service for commuters. The objective is to expand digital transaction services and elevate the convenience of public transportation in Delhi.

Countries like China, India, and Japan are at the forefront of this growth, with their governments actively promoting digitalization initiatives. For instance, India’s push towards a digital economy with programs like Digital India and the introduction of Aadhaar cards, a biometric-based unique identification system for citizens, have significantly contributed to the market growth. Additionally, China’s substantial investment in smart city projects, which incorporate smart cards for transportation, access control, and other services, further bolsters the market.

The market in Asia-Pacific is also characterized by the presence of several key players in the smart card industry, contributing to the region’s leading position. These companies are not only catering to the local demand but are also exporting smart card technologies globally.

The growth trend in Asia-Pacific is expected to continue, with forecasts indicating a steady rise in the market share, driven by ongoing technological innovations and government initiatives. This growth is further supported by the increasing awareness about the benefits of smart cards, such as enhanced security and convenience in transactions, making the region a critical hub for the global smart card market.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Companies in the worldwide smart card market are directing their efforts towards research and development investments. Such investments are anticipated to enhance the introduction of cutting-edge products, facilitating deeper market penetration in both established and untapped markets.

In May 2023, IDEX Biometrics ASA and AuthenTrend Technology Inc. collaborated to launch a cutting-edge biometric smart card, designed for digital authentication. The card aims to enhance identity access and secure cryptocurrency wallets.

Leading companies have adopted product launches and advancements, coupled with expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations, as their key business approach to enhance their market presence.

Top Key Players

- Gemalto (Thales Group)

- Giesecke+Devrient

- IDEMIA

- NXP Semiconductors

- Infineon Technologies

- CPI Card Group

- STMicroelectronics

- HID Global

- Oberthur Technologies (OT-Morpho)

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Other Key Players

Recent Developments

- Launch of SECORA Pay Bio (August 2023): Infineon launched the SECORA Pay Bio, a biometric card solution that combines fingerprint authentication with secure elements to provide an enhanced payment experience. This product aims to address the growing demand for secure and convenient payment solutions

- In 2023, Samsung Electronics: Focus on secure payment solutions: Launched the S3B464, a highly secure dual-interface smart card chip for contactless payments, leveraging secure element hardware and software to protect financial data.

- In 2023, Sony Corporation: Strengthened presence in NFC payment market: Introduced the FeliCa Lite-S contactless chip, targeting low-cost payments, loyalty programs, and access control applications.

- In 2023, Infineon Technologies: Introduced new secure microcontrollers: Launched the SLC26P chip specifically designed for payment cards, offering high performance, low power consumption, and advanced security features.

Report Scope

Report Features Description Market Value (2023) US$ 16.7 Bn Forecast Revenue (2033) US$ 29.6 Bn CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Contact Cards, Contactless Cards and Dual Interface Smart Cards), By Application (Banking and Financial Services, Telecommunications, Healthcare, Transportation, Government and Public Sector, Retail and Loyalty Programs, Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Gemalto (Thales Group), Giesecke+Devrient, IDEMIA, NXP Semiconductors, Infineon Technologies, CPI Card Group, STMicroelectronics, HID Global, Oberthur Technologies (OT-Morpho), Samsung Electronics Co., Ltd., Sony Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the Smart Card Market?The Global Smart Card Market size is expected to be worth around USD 29.6 Billion by 2033, from USD 16.7 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

What are the factors driving the smart cards market growth?The growing need for secure and convenient payment methods is a significant factor driving the smart cards market. Smart cards offer enhanced security features, making them ideal for payment transactions.

Which region accounted for the largest smart cards market share?In 2023, Asia-Pacific held a dominant market position in the Smart Card market, capturing more than a 38% share.

Who are the key players in smart card market?Gemalto (Thales Group), Giesecke+Devrient, IDEMIA, NXP Semiconductors, Infineon Technologies, CPI Card Group, STMicroelectronics, HID Global, Oberthur Technologies (OT-Morpho), Samsung Electronics Co., Ltd., Sony Corporation, Other Key Players

Which application held the maximum share in 2023?In 2023, the Telecommunications segment held a dominant market position in the Smart Card Market, capturing more than a 41% share.

-

-

- Gemalto (Thales Group)

- Giesecke+Devrient

- IDEMIA

- NXP Semiconductors

- Infineon Technologies

- CPI Card Group

- STMicroelectronics

- HID Global

- Oberthur Technologies (OT-Morpho)

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Other Key Players