Global Smart Airport Market By Technology Type (Security Systems, Communication Systems, Passenger Cargo Baggage Control, Air/Ground Traffic control, Others), By Solution (Airside, Terminal Side, and Landside), By Application (Aeronautical, Non-aeronautical), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 63486

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

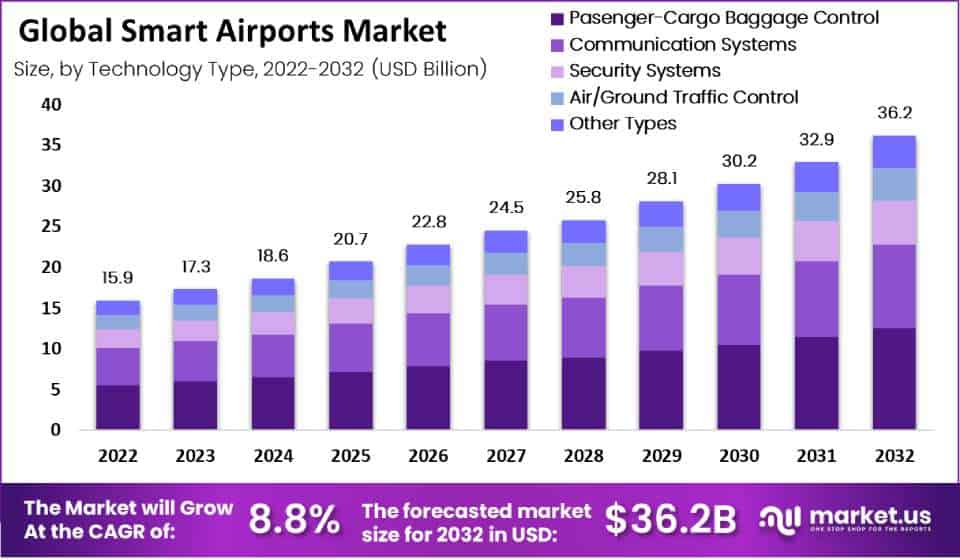

The Global Smart Airport Market size is expected to be worth around USD 36.2 Billion By 2032, from USD 17.3 Billion in 2023, growing at a CAGR of 8.8% during the forecast period from 2024 to 2033.

The smart airport market refers to the adoption and implementation of advanced technologies and solutions in airport operations to enhance efficiency, improve passenger experience, and ensure safety and security. This market has been witnessing significant growth in recent years, driven by various factors.

One of the key drivers of the smart airport market is the increasing air travel demand worldwide. As the number of air passengers continues to rise, airports face challenges in managing congestion, ensuring smooth operations, and providing a seamless travel experience. Smart airport solutions, such as automated check-in processes, self-service kiosks, and real-time flight information systems, help streamline operations and reduce passenger wait times.

Advancements in technology, particularly in areas like Internet of Things (IoT), artificial intelligence (AI), and automation, have revolutionized airport operations. IoT-enabled sensors and devices can be deployed throughout the airport infrastructure to collect and analyze data in real-time. This data can be used to optimize various processes, including baggage handling, security screening, and aircraft maintenance, leading to improved efficiency and cost savings.

Moreover, the focus on enhancing passenger experience has been a significant driver in the smart airport market. Airports are investing in technologies such as biometric authentication systems, facial recognition, and mobile applications to provide a seamless and personalized travel experience. These technologies enable passengers to check-in, pass through security, and board planes more efficiently, reducing stress and enhancing overall satisfaction.

Another important factor contributing to the growth of the smart airport market is the increasing emphasis on safety and security. Airports are adopting advanced surveillance systems, access control solutions, and threat detection technologies to ensure the safety of passengers and airport facilities. These systems leverage AI and machine learning algorithms to identify potential threats and respond rapidly to security incidents.

Despite the positive growth prospects, the smart airport market faces challenges as well. Integration of various technologies and systems from different vendors can be complex, requiring careful planning and coordination. Additionally, ensuring data privacy and cybersecurity is crucial, as airports handle sensitive passenger information and need to protect against potential cyber threats.

For instance, In September 2023, Rezcomm, a Devon-based company, introduced AI-driven technology to revolutionize airports. Their vision is to seamlessly integrate AI business solutions for services like lounges, parking, and more, providing travelers with a streamlined journey. This innovative approach aims to modernize airport operations, improving efficiency and transforming the passenger experience by redefining interactions with airport and transportation services.

Key Takeaways

- Market Growth: The global smart airport market is expected to reach USD 36.2 billion by 2032. This projected value can be explained by several factors including an increasing need to improve airport efficiency as well as greater acceptance of emerging technologies.

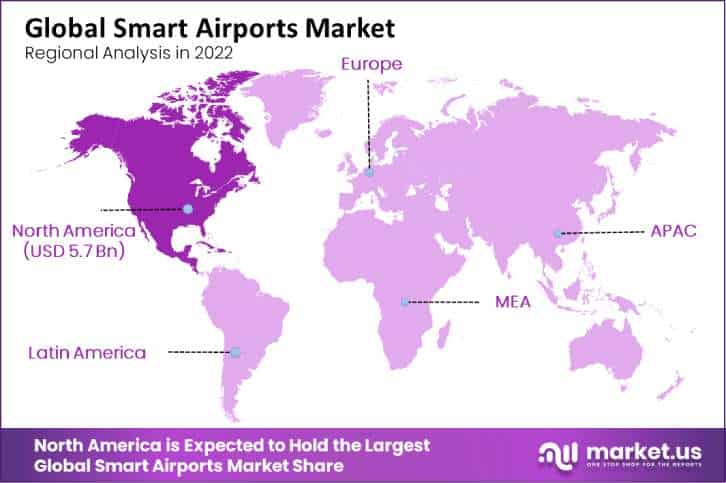

- Market Overview: The smart airport market is an international one with participants hailing from various continents worldwide. APAC region currently accounts for the majority of smart airports followed by North America and Europe respectively.

- Rising Demands: Demand for smart airports has steadily been on the increase due to factors including an increasing passenger count, improved security needs and improving customer experiences.

- Increasing Uses: Smart airport technologies are being applied across a range of applications, from passenger processing and security measures, through operations management, sustainability goals and sustainability reporting.

- Rising Popularity: Smart airports have experienced increasing popularity as media coverage expands on them and passengers experience them first-hand. Furthermore, travelers desire for a smoother travel experience as more passengers experience them every year.

- Drivers: The key drivers for smart airport market are increasing demand for air travel, the need to improve airport efficiency and the widespread adoption of innovative technologies.

- Restraints: The main restraining factors in this market include high costs associated with installing smart airport technologies, lack of standardization, and the requirement of skilled workers in order to operate and maintain these technologies.

- Opportunity: Opportunity in the smart airport market lies in its potential to improve efficiency, safety and sustainability of airports. Smart airport technologies enable airports to handle more passengers efficiently while improving security measures and decreasing environmental impact.

- Trends: In the smart airport market, key trends include increasing adoption of artificial intelligence and big data analysis tools as well as development of innovative new smart airport technologies.

- Regional Analysis: Although smart airport markets exist worldwide, certain regions are particularly dynamic in this space. The APAC region is the fastest-growing market for smart airports, followed by North America and Europe.

- Key Players: The key players in the smart airport market are technology companies, airport operators and government agencies. Key companies profiled in smart airport market are Amadeus IT Group SA, CISCO System Inc., Collins Aerospace, Daifuku Co. Ltd., Ascent Technologies, Honeywell International Inc., Huawei Technologies Co. Ltd. and More

Technology Type Analysis

In 2022, the Passenger Cargo Baggage Control segment held a dominant market position within the smart airport market, capturing more than a 34.6% share. This segment’s leadership can be attributed primarily to its critical role in enhancing passenger experience and operational efficiency at airports. Innovations in this segment have focused on streamlining processes through automation and advanced scanning technologies, which significantly reduce waiting times and improve security and handling accuracy.

The prominence of the Passenger Cargo Baggage Control segment is further supported by rising passenger volumes globally and heightened security protocols. Airports are increasingly investing in smart technologies that integrate artificial intelligence and machine learning to manage baggage and cargo operations more effectively. These technologies not only help in tracking and managing luggage from check-in to final delivery but also play a crucial role in reducing instances of lost or mishandled baggage, thereby boosting customer satisfaction and operational reliability.

Furthermore, the growing demand for self-service solutions, such as kiosks for self-baggage check-in and RFID baggage reconciliation systems, has propelled this segment’s growth. These advancements align with the broader trend towards creating more digitized, contactless travel experiences, which have become particularly valuable in the post-pandemic era. As airports continue to evolve into smarter hubs, the Passenger Cargo Baggage Control segment is expected to maintain its lead, driven by technological innovations that cater to the needs of a rapidly changing travel landscape.

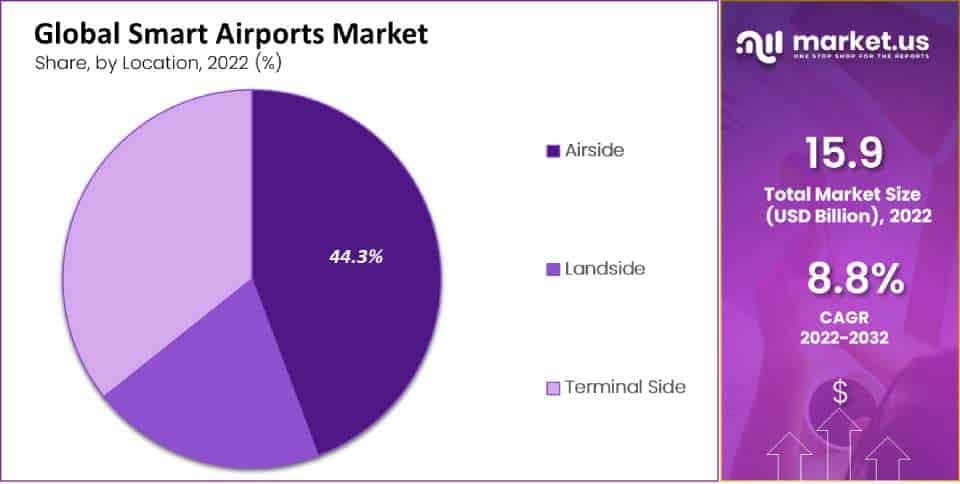

Location Analysis

In 2022, the Airside segment held a dominant market position within the smart airport market, capturing more than a 44.3% share. This leadership is largely due to its critical importance in ensuring operational efficiency and safety, which are paramount in airport management. Airside solutions, which include technologies for aircraft landing and takeoff, baggage handling, and other ground support operations, are vital for maintaining smooth airport operations.

These technologies are designed to minimize turnaround times, enhance safety, and improve the overall airport capacity, which is essential in handling the increasing volume of air traffic. The growth of the Airside segment is further fueled by the adoption of IoT and AI technologies, which are integrated to optimize the scheduling and management of air traffic.

For instance, automated baggage systems and advanced runway lighting systems have significantly improved the handling speeds and safety of airside operations. Furthermore, the rise in global air traffic demands robust systems that can quickly adapt to changing conditions and ensure the effective movement of aircraft and baggage, which has led to substantial investments in this segment.

Moreover, the push towards reducing carbon emissions and increasing operational sustainability has made the Airside segment a focal point for innovation. Technologies that facilitate more efficient fuel management and reduced airplane idling times contribute to lowering the environmental impact of airside operations. As airports continue to focus on sustainability and efficiency, the Airside segment is expected to sustain its lead, bolstered by continuous advancements in technology that address both ecological and operational priorities.

Application Analysis

In 2022, the Non-aeronautical segment held a dominant market position within the smart airport market, capturing a significant share. This segment includes revenue streams from retail, parking, rentals, and other services offered within airport premises that are not directly related to air travel but are crucial for overall profitability. The leadership of this segment is primarily driven by the diversification of revenue sources, which helps airports reduce their dependency on aeronautical income and stabilize financial performance, especially in times when air traffic is volatile.

The increase in smart technologies has significantly enhanced the efficiency and customer experience in non-aeronautical services. Innovations such as digital payment systems, personalized retailing through apps, and enhanced connectivity have transformed how consumers interact with airport services, thereby increasing spending and satisfaction levels. For example, the integration of AI to analyze consumer behavior has enabled airports to offer tailored shopping and dining experiences, effectively boosting revenue in these areas.

Furthermore, as airports expand their roles from travel hubs to leisure and business centers, the non-aeronautical segment is expected to continue its growth. The development of airport cities and the enhancement of facilities such as conference centers, spas, and hotels within or near airports contribute to the increasing importance of this segment. This evolution is supported by the global trend of making airports a part of a larger travel experience, which is anticipated to sustain the prominence of non-aeronautical services in the smart airport market.

Key Market Segments

Based on Technology Type

- Security Systems

- Communication Systems

- Passenger Cargo Baggage Control

- Air/Ground Traffic control

- Others

Location Analysis

- Airside

- Terminal side

- Landside

Based Application

- Aeronautical

- Non-aeronautical

Driver

Increased Demand for Efficient and Automated Systems

The smart airport market is experiencing significant growth due to the rising demand for more efficient and automated systems to handle increasing air traffic and enhance passenger experience. This includes the integration of IoT, biometrics, and AI to streamline airport operations from security checks to baggage handling. Investments are being channeled into upgrading airport infrastructure to accommodate these advanced systems, ensuring faster and more secure processing which is crucial as air travel volumes continue to grow.

Restraint

High Implementation Costs

A major restraint in the smart airport market is the high cost associated with implementing new technologies. For many airports, especially smaller regional ones, the financial burden of upgrading to smart technologies is significant.

This includes costs for hardware, software, and necessary renovations to existing infrastructure. The initial investment required can be a barrier to adoption, slowing down the integration of advanced technologies that drive efficiency and improve passenger experiences.

Opportunity

Enhancement of Passenger Experience and Operational Efficiency

Smart airports offer considerable opportunities to enhance the passenger experience and operational efficiency. Technologies like self-service kiosks, automated passport controls, and real-time baggage tracking not only reduce waiting times but also improve overall satisfaction.

Additionally, these technologies allow for better resource management and operational workflows, leading to cost savings and improved airport performance. The focus on creating more personalized and seamless travel experiences is expected to drive further innovations in this sector.

Challenge

Integration and Cybersecurity Concerns

One of the primary challenges facing smart airports is the integration of new technologies with existing systems. Many airports operate on legacy systems that are not readily compatible with new technologies, creating hurdles in achieving a fully integrated smart system.

Moreover, the increased connectivity and data processing capabilities required for smart airports raise significant cybersecurity concerns. Protecting passenger data and ensuring the security of airport operations from cyber threats are critical issues that require ongoing attention and investment to address.

Growth Factors

- Increased Air Traffic: The continuous rise in global air passenger traffic drives the need for efficient airport operations, prompting investments in smart technologies to handle the increased load and enhance throughput capacity.

- Demand for Enhanced Passenger Experience: As customer expectations rise, airports are investing in technologies that streamline everything from check-in to boarding, aiming to deliver a seamless and personalized travel experience.

- Government Initiatives for Infrastructure Improvement: Many governments worldwide are initiating programs to improve airport infrastructure, which often includes integrating smart technologies to enhance security and operational efficiency.

- Technological Advancements: Rapid advancements in IoT, AI, and biometrics are making it feasible and beneficial for airports to adopt smart solutions that improve safety and operational effectiveness.

- Sustainability and Eco-Friendly Initiatives: There is a growing trend towards making airport operations more sustainable. This includes implementing green technologies like energy-efficient systems and waste management solutions, which also fall under the smart airport framework.

Emerging Trends

- Biometric and Facial Recognition Technologies: Increasingly, airports are adopting biometric systems for identity verification, which speeds up the authentication process and enhances security protocols.

- Artificial Intelligence in Operations: AI is being used to predict airport congestion, optimize flight schedules, and manage airport resources more effectively, leading to decreased wait times and improved passenger flow.

- Mobile Integration and Personalization: Airports are developing more apps that provide real-time flight updates, terminal maps, and even opportunities for personalized shopping and dining, all accessible from a passenger’s mobile device.

- Automated and Self-Service Solutions: From kiosks for self-check-in to automated baggage handling systems, these technologies reduce the need for human interaction, streamline operations, and improve customer satisfaction.

- Smart Airport Security Systems: Enhanced surveillance and smarter security protocols using advanced video analytics and sensors are being deployed to ensure higher safety levels while minimizing the inconvenience to passengers.

Regional Analysis

In 2022, North America held a dominant position in the smart airport market, capturing more than a 35.9% share with revenues amounting to approximately USD 5.7 billion. This leadership is primarily due to the region’s early adoption of advanced technologies and substantial investments in airport infrastructure. North American airports have been pioneers in integrating technologies such as IoT, biometrics, and data analytics into their operations, aiming to enhance the efficiency and security of airport processes.

The market dominance of North America is also supported by strong government support and initiatives that encourage the adoption of smart technologies in airports. These initiatives not only improve the passenger experience but also boost operational efficiencies. Moreover, the presence of major technology providers in the region, such as IBM, Cisco, and Honeywell, facilitates ongoing innovation and development within the sector.

Furthermore, the push towards sustainability and reduced environmental impact continues to drive investments in smart airport solutions across North America. Airports in the region are increasingly focusing on implementing green technologies, which include energy-efficient systems and waste management solutions, aligning with global environmental targets and enhancing the overall sustainability of airport operations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The smart airport market is characterized by a competitive and technologically advanced environment, with several key players driving innovation and growth. Amadeus IT Group SA is a leading player, renowned for its comprehensive solutions ranging from passenger services to operational management systems. Amadeus excels in integrating cutting-edge technology to enhance airport efficiency and passenger experience.

CISCO System Inc. is pivotal in transforming airport infrastructures with its robust networking and security solutions. CISCO’s technologies facilitate seamless data flow and connectivity, essential for smart airport operations. Collins Aerospace, a unit of Raytheon Technologies, offers advanced airport solutions including baggage management and airside services. Their technology is crucial in improving the efficiency and security of airport operations.

Daifuku Co., Ltd. stands out in the smart airport market for its automated material handling systems. Their expertise in baggage handling systems significantly contributes to airport efficiency. Honeywell International Inc. is another major player, offering a wide range of products that enhance airport safety and operational efficiency, from building solutions to airside systems.

Top Key Players in the Market

- Amadeus IT Group SA

- CISCO System Inc

- Collins Aerospace

- Daifuku Co. Ltd.

- Ascent Technologies

- Honeywell International Inc.

- Huawei Technologies Co. Ltd

- IBM Corporation

- Indra Sistemas S.A.

- ITA

- L3Harris Technologies Inc.

- Raytheon Company

- RESA, Rockwell Collins Inc.

- Lufthansa Systems GmbH & Co. KG.

- Sabre Corporation

- Siemens AG

- SITA

- Thales Group

- T-Systems

- Vision-Box

- Wipro Limited

- Ascent Technology Inc.

- Amadeus IT Group

- Huawei Investment & Holding Co. Ltd.

- Ascent technology, inc.

- Other Key Players

Recent Developments

- In February 2024, Honeywell announced the deployment of its Smart Runway and SmartLanding systems in several major airports. These systems improve situational awareness and operational efficiency, reducing the risk of runway incursions and excursions.

- In January 2024, Collins Aerospace launched the ARINC SelfPass™, an advanced biometric identity management solution designed to streamline passenger processing and enhance security at smart airports.

- In 2024, Amadeus launched a comprehensive report in collaboration with Accenture, highlighting key investment trends in travel technology, including airports. This initiative focuses on leveraging emerging technologies to enhance operational efficiency and passenger experience at smart airports.

- In 2023, Cisco acquired Fluidmesh Networks to enhance its industrial IoT portfolio, which includes smart airport solutions. This acquisition aims to bolster Cisco’s capabilities in providing reliable and secure wireless communication in airport environments.

Report Scope

Report Features Description Market Value (2023) US$ 17.3 Bn Forecast Revenue (2032) US$ 36.2 Bn CAGR (2023-2032) 8.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology- Security Systems, Communication Systems, Passenger Cargo Baggage Control, Air/Ground Traffic Control, and Others; By Solution- Airside, Terminal side, and Landside; and By Application- Aeronautical Applications and Non-aeronautical Applications Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Amadeus IT Group SA, CISCO System Inc., Collins Aerospace, Daifuku Co. Ltd., Ascent Technologies, Honeywell International Inc., Huawei Technologies Co. Ltd., IBM Corporation, Indra Sistemas S.A., ITA, L3Harris Technologies Inc., Raytheon Company, RESA, Rockwell Collins Inc., Lufthansa Systems GmbH & Co. KG., Sabre Corporation, Siemens AG, SITA, Thales Group, T-Systems, Vision-Box, Wipro Limited, Zensors, Ascent Technology Inc., Adelte, Amadeus IT Group, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the expected value of the smart airports market by 2032?The smart airports market is expected to reach a value of USD 36.2 billion by 2032.

What is the highest CAGR expected for the smart airports market during the forecast period?The smart airports market is estimated to register the highest CAGR of 8.8% during the forecast period from 2023 to 2032.

What is driving the growth of the smart airports market?The growth of the smart airports market is being driven by technological advancements and the focus on green initiatives in the aviation industry.

What is the dominant technology type in the smart airports market?The passenger-cargo baggage control segment is the dominant technology type in the smart airports market, accounting for the majority share of 34.6%.

What is the biggest opportunity for key players in the smart airports market?The growing air passenger travelling is the biggest opportunity for the smart airports market, as air travel has become an increasingly popular option for tourists, resulting in significant growth in the tourism sector.

-

-

- Amadeus IT Group SA

- CISCO System Inc

- Collins Aerospace

- Daifuku Co. Ltd.

- Ascent Technologies

- Honeywell International Inc.

- Huawei Technologies Co. Ltd

- IBM Corporation

- Indra Sistemas S.A.

- ITA

- L3Harris Technologies Inc.

- Raytheon Company

- RESA, Rockwell Collins Inc.

- Lufthansa Systems GmbH & Co. KG.

- Sabre Corporation

- Siemens AG

- SITA

- Thales Group

- T-Systems

- Vision-Box

- Wipro Limited

- Ascent Technology Inc.

- Amadeus IT Group

- Huawei Investment & Holding Co. Ltd.

- Ascent technology, inc.

- Other Key Players