Global Small Off-Road Engines Market Size, Share, Growth Analysis By Engine Displacement (100-500cc, Upto 100cc, 500cc to 800cc), By No. of Cylinders (Single, Double, Multi), By Engine Type (Internal Combustion Engine, Electric Engine, Hybrid Engine), By Drive Shaft Orientation (Horizontal, Vertical), By End Use (Agriculture, Domestic, Gardening/ Landscaping, Residential, Commercial, Industrial, Automotive, Construction, Others), By Distribution Channel (OEM, Aftermarket) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156778

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

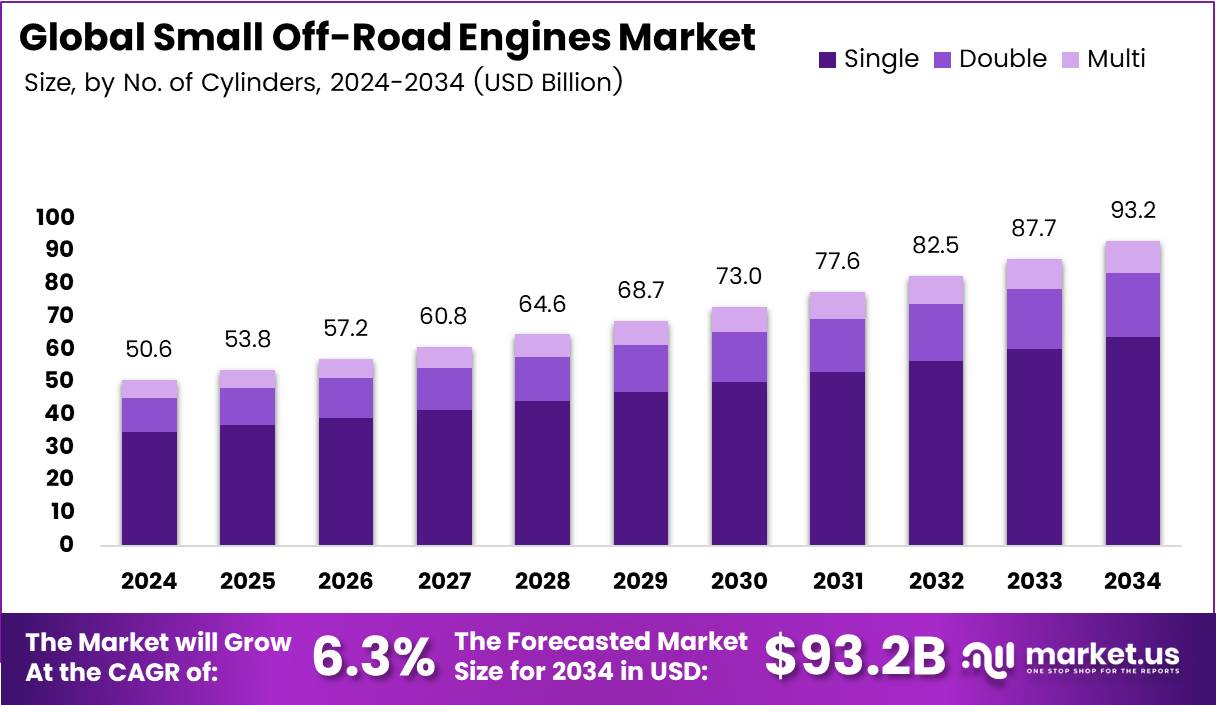

The Global Small Off-Road Engines Market size is expected to be worth around USD 93.2 Billion by 2034, from USD 50.6 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

The Small Off-Road Engines market represents a specialized segment focused on compact power units used in lawnmowers, generators, chainsaws, and construction tools. These engines drive essential activities in residential, commercial, and industrial applications. Their versatility and affordability continue to make them a critical component of landscaping, agriculture, and light construction industries.

Growth in the Small Off-Road Engines market is supported by rising demand for compact machinery in gardening, landscaping, and urban construction. Manufacturers are enhancing efficiency and emissions compliance, ensuring engines remain relevant amid sustainability pressures. Transitioning technology adoption, particularly hybrid and electric alternatives, adds further momentum while strengthening market penetration across diverse applications.

Opportunities are emerging from increasing mechanization in emerging economies, where affordable equipment adoption is accelerating. Governments are encouraging low-emission technologies, while OEMs are investing in next-generation engines. These dynamics are fostering replacement demand and enabling innovation in lightweight engines that balance durability, cost-effectiveness, and environmental standards.

Government regulations are shaping the market’s direction by promoting low-emission and energy-efficient solutions. Funding incentives for cleaner technologies encourage OEMs to integrate hybrid or electric options. Moreover, compliance with emission norms across North America, Europe, and Asia Pacific pushes companies to innovate, thereby opening pathways for sustainable product positioning.

According to the California Air Resources Board (ARB), on June 1, 2024, the program allocated $538M, with 1,700 zero-emission off-road units deployed. This initiative delivered quantified lifetime reductions of 174.4 tons NOx, 78.6 tons ROG/HC, and 235,000 tCO₂e. These figures highlight strong government funding tailwinds supporting zero-emission equipment adoption in the Small Off-Road Engines market.

Key Takeaways

- The global market is projected to reach USD 93.2 Billion by 2034 from USD 50.6 Billion in 2024, at a CAGR of 6.3%.

- In 2024, 100-500cc engines dominated by engine displacement, capturing a 51.4% share due to balanced power and fuel efficiency.

- Single cylinder engines led the market with a 68.5% share, supported by cost-effectiveness and suitability across multiple applications.

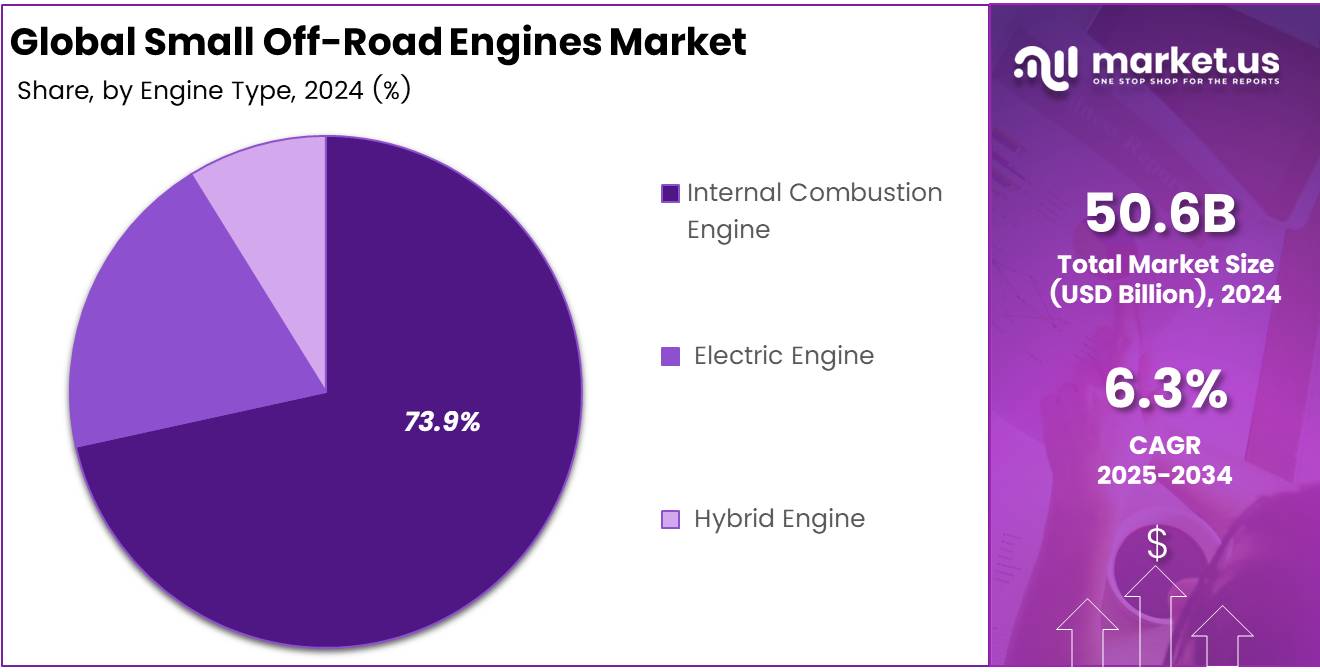

- The Internal Combustion Engine segment held a strong 73.9% share, driven by reliability and wide applicability in outdoor environments.

- Horizontal shaft engines secured a 61.1% share, favored for efficient power transfer and adaptability in heavy-duty equipment.

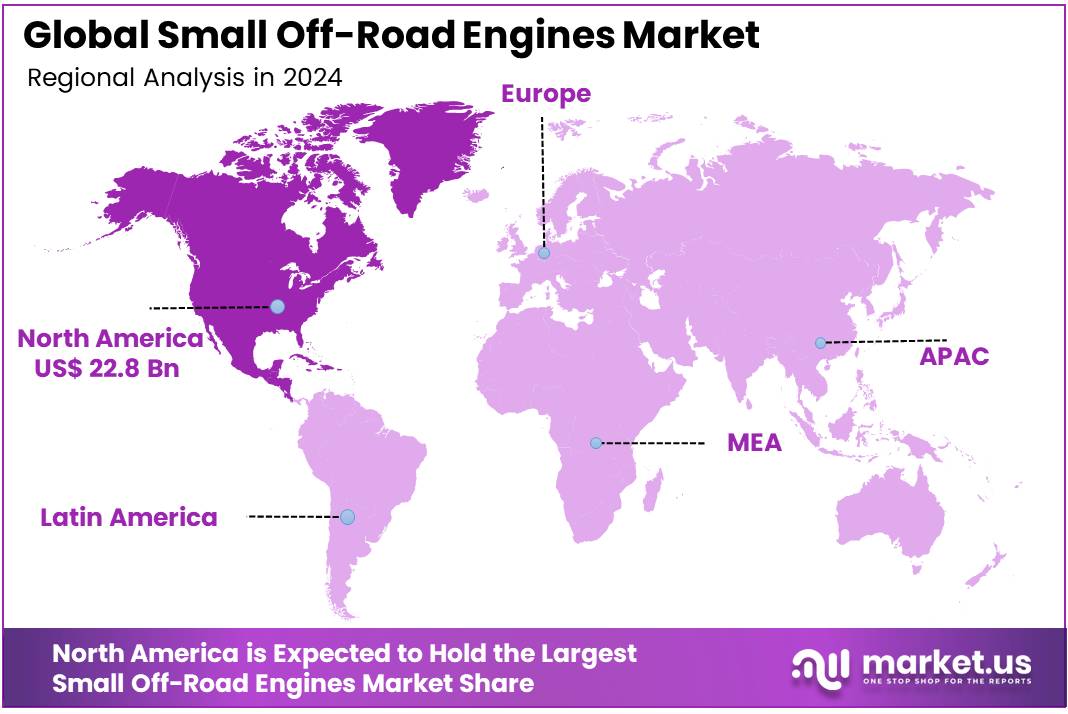

- North America was the largest regional market with a 45.2% share, valued at USD 22.8 Billion, supported by landscaping, construction, and recreational demand.

Engine Displacement Analysis

100-500cc dominates with 51.4% due to balanced performance and versatile applications.

In 2024, 100-500cc held a dominant market position in the Small Off-Road Engines Market under engine displacement, capturing a 51.4% share. This leadership stems from its ability to deliver adequate power for a wide range of tasks while remaining fuel-efficient, making it the preferred choice in agriculture, construction, and light commercial use.

The Upto 100cc segment accounted for a significant portion of the market, driven by affordability and adoption in domestic and residential applications. These engines are commonly integrated into equipment such as small mowers and light gardening tools, where compact size and lower running costs matter most.

The 500cc to 800cc category remained a niche but important segment, serving end users requiring higher torque and reliability for heavy-duty equipment. Demand in this segment is anticipated to be supported by industrial and large-scale construction applications, where robust performance is critical. Overall, the dominance of 100-500cc reflects its adaptability and practical balance between performance and operating efficiency.

No. of Cylinders Analysis

Single Cylinder dominates with 68.5% due to cost-effectiveness and widespread compatibility.

In 2024, Single cylinder engines led the Small Off-Road Engines Market by cylinder configuration, accounting for a commanding 68.5% share. Their dominance is explained by lower cost, simpler design, and widespread suitability across multiple small off-road machines, making them a universal choice in agriculture, gardening, and residential tools.

The Double cylinder category recorded a moderate share, finding demand in applications where additional power is required while still maintaining manageable fuel consumption. They are increasingly being adopted in specialized commercial machinery where enhanced reliability is essential.

The Multi cylinder segment represented a smaller portion of the market, mainly catering to heavy-duty off-road equipment in industrial and construction operations. While its adoption is limited, the segment is anticipated to attract steady attention from end users with higher performance needs. The overall share emphasizes the cost-efficiency and broad adaptability of Single cylinder engines in off-road markets.

Engine Type Analysis

Internal Combustion Engine dominates with 73.9% due to proven reliability and strong market penetration.

In 2024, the Internal Combustion Engine category commanded the Small Off-Road Engines Market, capturing a dominant 73.9% share. The segment’s strength lies in its extensive application range, well-established distribution, and unmatched reliability in outdoor environments. This ensures sustained demand across agriculture, landscaping, and industrial uses.

The Electric Engine segment, although smaller, showed increasing adoption, propelled by rising demand for zero-emission solutions and government incentives to reduce carbon footprints. End users seeking quieter operations for residential and urban settings are expected to drive future demand in this category.

The Hybrid Engine segment remained nascent but attracted attention from manufacturers exploring efficiency improvements and emission reductions. While adoption is currently limited, hybrid engines are anticipated to find opportunities in markets balancing performance with sustainability goals. The dominance of Internal Combustion Engine highlights its practicality, but gradual transitions toward electric and hybrid formats signal an evolving competitive landscape.

Drive Shaft Orientation Analysis

Horizontal Orientation dominates with 61.1% due to efficiency and ease of integration.

In 2024, Horizontal shaft engines held a strong position in the Small Off-Road Engines Market, securing a 61.1% share. Their popularity comes from efficient power transfer and adaptability, making them highly suitable for commercial lawnmowers, agricultural machinery, and industrial-grade equipment where durability and stability are priorities.

The Vertical shaft segment, while smaller, maintained relevance for specific use cases such as residential lawn mowers and compact landscaping tools. Their compact design and ease of alignment with blade systems make them attractive in household applications.

The continued preference for Horizontal shaft orientation demonstrates its technical advantages in handling heavy workloads, supporting high durability, and ensuring compatibility with a wider range of machinery. This segment’s dominance reflects its essential role in balancing efficiency with operational reliability across multiple end-use sectors.

Key Market Segments

By Engine Displacement

- 100-500cc

- Upto 100cc

- 500cc to 800cc

By No. of Cylinders

- Single

- Double

- Multi

By Engine Type

- Internal Combustion Engine

- Electric Engine

- Hybrid Engine

By Drive Shaft Orientation

- Horizontal

- Vertical

By End Use

- Agriculture

- Domestic

- Gardening/ Landscaping

- Residential

- Commercial

- Industrial

- Automotive

- Construction

- Others

By Distribution Channel

- OEM

- Aftermarket

Drivers

Expansion of Landscaping and Gardening Activities in Residential and Commercial Spaces Drives Market Growth

The rise in landscaping and gardening projects across residential neighborhoods has fueled demand for small off-road engines. Homeowners are increasingly investing in outdoor beautification, requiring equipment such as lawnmowers, trimmers, and tillers. This consistent demand strengthens the position of small off-road engines as essential power sources for household outdoor tools.

Commercial spaces including resorts, golf courses, and office complexes are also adopting landscaping practices to enhance their appeal. These facilities rely heavily on small off-road engines for turf management and upkeep. The adoption rate is rising steadily, contributing to long-term market expansion in both developed and emerging regions.

Compact construction and agricultural equipment have seen higher acceptance in both rural and urban projects. Small off-road engines support mini excavators, portable generators, and tillers, enabling contractors and farmers to perform tasks efficiently. Their affordability and ease of use make them a preferred choice in cost-sensitive environments.

Recreational off-road vehicle adoption is another important driver. All-terrain vehicles and utility terrain vehicles powered by small engines are gaining popularity among adventure enthusiasts. Growing participation in outdoor recreational activities has created a strong consumer base, further boosting demand in the market.

Restraints

Stringent Emissions and Noise Regulations on Small Engines Restrains Market Expansion

Environmental policies remain a key restraint for the small off-road engines market. Stringent regulations related to carbon emissions and noise pollution have created challenges for manufacturers. Compliance often increases production costs, making it difficult for some players to maintain competitive pricing while meeting regulatory standards.

The rising availability of electric alternatives is further limiting growth. Battery-powered lawnmowers, trimmers, and compact vehicles are gaining traction due to their eco-friendly profile. These alternatives not only meet emission standards but also reduce noise levels, attracting consumers away from combustion-based small engines.

Fluctuations in raw material supply present another obstacle for engine manufacturers. Volatility in steel, aluminum, and fuel prices can disrupt the production process and elevate costs. This uncertainty creates barriers for consistent manufacturing output and impacts profitability for producers across multiple regions.

Small engine manufacturers are also facing pressure from evolving consumer preferences toward sustainable options. The growing push for green technologies has made it harder for combustion-driven engines to compete effectively in urban markets, where regulatory oversight is strictest.

Growth Factors

Development of Hybrid and Biofuel-Powered Small Engines Creates Growth Opportunities

The introduction of hybrid and biofuel-powered small engines presents strong opportunities for manufacturers. These eco-friendly alternatives help meet emission standards while ensuring reliable performance. By investing in alternative fuel solutions, companies can appeal to environmentally conscious consumers and regulatory bodies simultaneously.

The integration of small off-road engines into smart agriculture and precision farming equipment is gaining traction. Farmers are increasingly adopting mechanized solutions for soil preparation, irrigation, and harvesting. Engine-powered equipment combined with digital tools can significantly improve agricultural productivity, creating a promising growth pathway.

Aftermarket services and maintenance solutions are also expanding rapidly. With the rising number of deployed small engines, demand for repair, servicing, and replacement parts has surged. This aftermarket expansion not only strengthens brand loyalty but also ensures recurring revenue streams for manufacturers and distributors.

Integration of IoT-enabled monitoring and performance systems into small engines is a transformative opportunity. Real-time data on engine health, fuel efficiency, and maintenance needs allow for predictive servicing. This enhances user convenience and prolongs engine life, strengthening the overall value proposition in both consumer and commercial markets.

Emerging Trends

Shift Towards Lightweight and Fuel-Efficient Engine Designs Shapes Market Trends

The market is witnessing a shift toward lightweight and fuel-efficient small off-road engines. Manufacturers are prioritizing compact designs that reduce fuel consumption while delivering sufficient power. This trend aligns with consumer demand for efficient equipment in both residential and commercial applications.

Advanced fuel injection and cooling technologies are increasingly being adopted to improve performance. These technologies enhance combustion efficiency, reduce emissions, and extend engine life. As environmental standards tighten, such innovations are becoming mainstream across the market.

Partnerships between OEMs and rental equipment providers are reshaping distribution channels. Rental services are gaining popularity among contractors, landscapers, and farmers who prefer access to modern equipment without heavy ownership costs. This trend is expanding the user base for small engines significantly.

Rising consumer preference for multi-functional outdoor power equipment is also a notable factor. Users are opting for versatile tools that can perform multiple tasks using the same engine platform. This demand for multifunctionality is encouraging product innovation and boosting sales volumes.

Regional Analysis

North America Dominates the Small Off-Road Engines Market with a Market Share of 45.2%, Valued at USD 22.8 Billion

North America held the largest share in the small off-road engines market, accounting for 45.2% in 2024, valued at USD 22.8 billion. The region benefits from a well-established landscaping and construction sector, alongside high recreational vehicle ownership. Strong government focus on emission standards is also driving investments in efficient and hybrid off-road engines.

Europe Small Off-Road Engines Market Trends

Europe is characterized by stringent environmental regulations that are accelerating the adoption of cleaner engine technologies. The region’s agricultural mechanization and rising demand for compact construction machinery are fostering market growth. Additionally, European countries are investing heavily in sustainable landscaping solutions, creating favorable conditions for advanced small engine technologies.

Asia Pacific Small Off-Road Engines Market Trends

Asia Pacific is witnessing rapid expansion driven by increasing mechanization in agriculture and infrastructure development. Countries such as China and Japan are emerging as high-demand markets due to urbanization and growing commercial landscaping activities. Moreover, the shift toward cost-effective yet durable equipment is influencing adoption across diverse applications.

Middle East and Africa Small Off-Road Engines Market Trends

The Middle East and Africa region is gradually expanding with demand mainly driven by construction activities and urban landscaping projects. Rising government investment in infrastructure and tourism-related landscaping supports engine utilization. However, adoption is slower compared to other regions due to limited industrial mechanization.

Latin America Small Off-Road Engines Market Trends

Latin America is experiencing steady growth with rising agricultural mechanization, particularly in countries such as Brazil and Argentina. Expanding residential and commercial landscaping projects are boosting small off-road engine adoption. However, economic fluctuations and supply chain constraints present challenges for consistent market expansion.

United States Small Off-Road Engines Market Trends

The United States dominates within North America due to its mature agriculture, construction, and recreational vehicle sectors. Federal and state-level initiatives promoting zero-emission equipment are accelerating the shift toward cleaner small off-road engines. Consumer preference for technologically advanced, fuel-efficient, and low-noise equipment further supports market momentum.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Small Off-Road Engines Company Insights

In 2024, the global Small Off-Road Engines Market reflected a competitive dynamic shaped by innovation, efficiency, and adaptability among leading players. Briggs & Stratton maintained strong brand recognition with its extensive distribution network and product reliability. The company focused on sustainability initiatives, including engines designed for reduced emissions, which aligned with tightening global regulations and shifting customer demand.

Greaves Cotton Ltd. demonstrated agility by enhancing its portfolio of compact engines, catering to agriculture and small-scale mechanization in emerging markets. Its emphasis on affordable and durable solutions allowed the company to capture demand from regions where mechanization adoption is accelerating.

Honda Motor Co., Ltd. retained its leadership position through technological innovation and diverse product offerings across residential, commercial, and industrial applications. Honda’s emphasis on fuel efficiency, coupled with strong after-sales support, bolstered its competitive edge and reinforced consumer trust globally.

Kawasaki Heavy Industries, Ltd. leveraged its engineering expertise to supply high-performance engines suited for construction and landscaping equipment. With a reputation for durability and power, Kawasaki continued to appeal to professional users requiring robust solutions, particularly in North America and Europe, where demand for premium equipment remains steady.

Top Key Players in the Market

- Briggs & Stratton

- Greaves Cotton Ltd.

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Kohler Co.

- Kubota Corporation

- Lifan Industry (Group) Co., Ltd.

- Mitsubishi Heavy Industries Engine & Turbocharger, Ltd.

- Yamaha Motor Co., Ltd.

Recent Developments

- In Aug 2025, Tata Motors announced its plan to acquire Iveco Group’s commercial vehicle (CV) business in a landmark deal valued at over ₹38,000 crore. The acquisition strengthens Tata’s global footprint and enhances its presence in the European and Latin American CV markets.

- In Aug 2025, PHINIA completed the strategic acquisition of SEM, reinforcing its portfolio in advanced fuel systems and aftermarket solutions. The deal enhances PHINIA’s technology capabilities and supports its transition towards cleaner and more efficient mobility solutions.

- In Jan 2024, CFMOTO finalized the acquisition of the European off-road brand GOES, expanding its international market presence. The move allows CFMOTO to broaden its product lineup and strengthen its competitive position in the recreational off-road vehicle segment.

Report Scope

Report Features Description Market Value (2024) USD 50.6 Billion Forecast Revenue (2034) USD 93.2 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Engine Displacement (100-500cc, Upto 100cc, 500cc to 800cc), By No. of Cylinders (Single, Double, Multi), By Engine Type (Internal Combustion Engine, Electric Engine, Hybrid Engine), By Drive Shaft Orientation (Horizontal, Vertical), By End Use (Agriculture, Domestic, Gardening/ Landscaping, Residential, Commercial, Industrial, Automotive, Construction, Others), By Distribution Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Briggs & Stratton, Greaves Cotton Ltd., Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Kohler Co., Kubota Corporation, Lifan Industry (Group) Co., Ltd., Mitsubishi Heavy Industries Engine & Turbocharger, Ltd., Yamaha Motor Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Small Off-Road Engines MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Small Off-Road Engines MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Briggs & Stratton

- Greaves Cotton Ltd.

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Kohler Co.

- Kubota Corporation

- Lifan Industry (Group) Co., Ltd.

- Mitsubishi Heavy Industries Engine & Turbocharger, Ltd.

- Yamaha Motor Co., Ltd.