Global Small Molecule Inhibitors Market Analysis By Drug Class (Kinase Inhibitors (Tyrosine Kinase Inhibitors (TKIs) (EGFR inhibitors, ALK inhibitors, BTK inhibitors, VEGFR/FGFR inhibitors), Serine/Threonine Kinase Inhibitors (CDK inhibitors, mTOR/PI3K/AKT inhibitors, MEK/BRAF inhibitors)), Proteasome Inhibitors, MMPs and HSPs inhibitors, Small molecule inhibitors targeting the apoptosis, Immunomodulatory Small Molecule Inhibitors, Others), By Therapeutic Area (Oncology, Immunology & Autoimmune Disorders, Infectious Diseases, Neurology, Rare Diseases & Genetic Disorders, Others), By Route of Administration (Oral, Intravenous), By Distribution Channel (Hospital pharmacies, Retail pharmacies, Online pharmacies) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167650

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

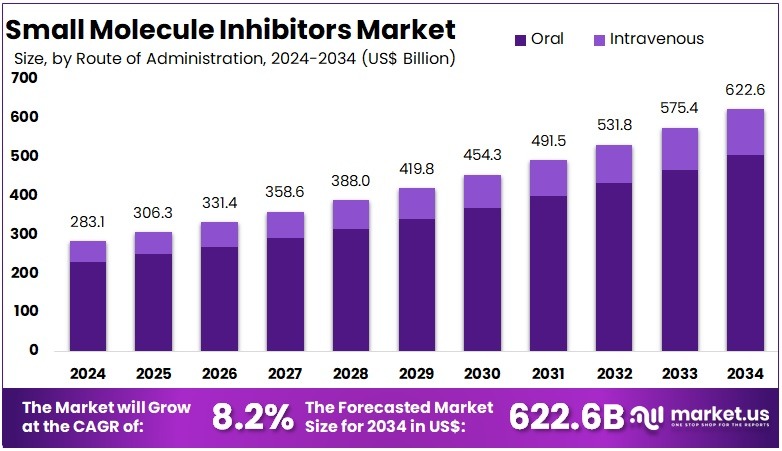

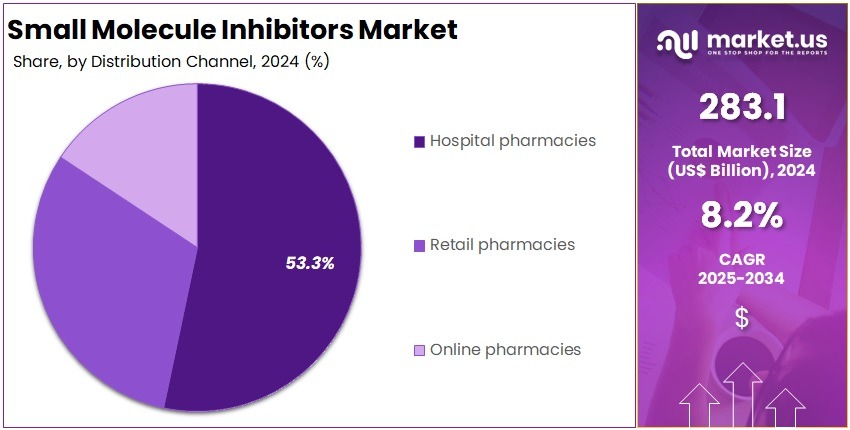

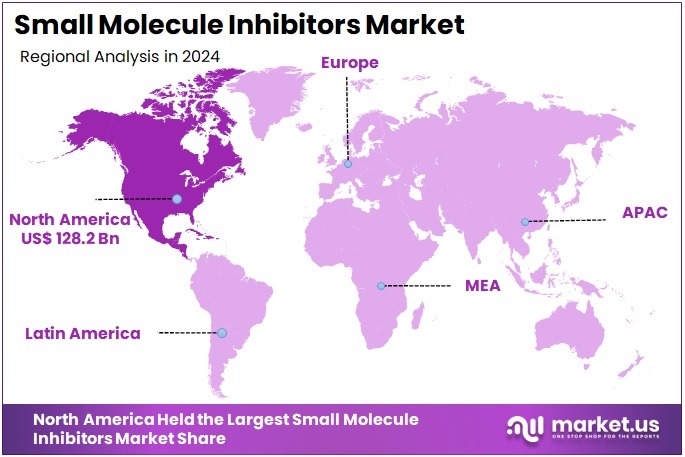

The Global Small Molecule Inhibitors Market size is expected to be worth around US$ 622.6 Billion by 2034, from US$ 283.1 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 45.3% share and holds US$ 128.2 Billion market value for the year.

Small molecule inhibitors hold a central position in modern therapeutic development because they can enter cells and act on intracellular targets with high precision. Their use has expanded across oncology, immunology, and infectious diseases due to predictable pharmacokinetics and oral dosing. According to industry observations, the shift toward precision medicine has strengthened demand for these agents. This trend is supported by pharmaceutical strategies that prioritize targeted, scalable, and cost-effective treatments for chronic and rare disorders.

The rising burden of chronic and cancer diseases continues to stimulate market expansion. Health systems are adopting targeted agents as long-term care needs increase. According to the World Health Organization, about 20 million new cancer cases and 9.7 million deaths were recorded in 2022, and cases are projected to reach 35 million by 2050. For example, noncommunicable diseases account for 74–75% of global deaths, and this large disease share reinforces demand for accessible small-molecule therapies.

Regulatory momentum also strengthens the outlook. Study by the US FDA indicates consistent approvals of novel drugs, which supports investor confidence. For instance, the FDA’s Center for Drug Evaluation and Research cleared 55 novel products in 2023, one of the highest totals in decades. A related analysis published in Nature Reviews Drug Discovery reported 50 approvals in 2024, while the 10-year rolling average reached 46.5 approvals per year. This approval environment encourages new mechanisms and accelerates market entry for small-molecule inhibitors.

Growth is further supported by strong R&D investment and scientific diversification. According to the International Federation of Pharmaceutical Manufacturers & Associations, almost 12,700 medicines are currently in development worldwide, and about half are small-molecule candidates. The same source confirms that 69 novel active substances were launched in 2023. In oncology alone, 88 small molecule inhibitors had been approved by the FDA by August 2022, covering pathways ranging from kinase signaling to DNA repair and tumor-metabolism regulation.

Pipeline Expansion, Policy Drivers and Future Outlook

Expanding pipelines in infectious-disease research highlight new opportunities for small-molecule innovation. For example, Study by WHO shows that 10.6 million people developed tuberculosis in 2022, with 1.3 million deaths. Drug-resistant TB remains a major threat, and WHO now recommends shorter oral regimens that rely heavily on small-molecule inhibitors. A WHO review also identified 217 antibacterial candidates in preclinical stages in 2021, including 90 direct-acting and 23 indirect-acting small-molecule agents.

Health-system spending patterns reinforce consistent adoption. Retail pharmaceutical expenditure forms a stable share of national budgets. According to OECD’s Health at a Glance 2025, retail medicines accounted for one-sixth of total health spending in 2023 across OECD economies. Average per-capita spending reached USD 766, adjusted for purchasing power. More than 75% of this spending was directed toward prescription drugs, indicating sustained demand for small-molecule treatments for NCDs and infectious diseases.

Policy initiatives also influence market growth. For instance, the WHO Model List of Essential Medicines contains more than 2,500 medicines, and around 40% address noncommunicable diseases. Most are small-molecule drugs used in oncology, cardiology, endocrinology, and respiratory care. As low- and middle-income countries expand insurance coverage and align national lists with WHO guidance, uptake of small-molecule inhibitors is expected to accelerate, especially in underserved therapeutic areas.

Technological advances continue to open new therapeutic space. Study findings show that only 5% of human protein kinases have been successfully targeted, which leaves broad room for pipeline expansion. For example, proteins once considered “undruggable,” such as RAS, are increasingly tractable due to structure-based design and advanced computational tools. These methods support selective, orally available inhibitors with improved safety. Collectively, these scientific and policy factors indicate that small-molecule inhibitors will maintain a leading role in future treatment strategies across global markets.

Key Takeaways

- The global small molecule inhibitors market is projected to reach about US$ 622.6 billion by 2034, rising from US$ 283.1 billion in 2024 at an 8.2% CAGR.

- Kinase inhibitors were described as the leading drug class in 2024, accounting for over 36.8% of total market share due to strong therapeutic adoption.

- Oncology was highlighted as the dominant therapeutic area in 2024, securing more than 48.1% share owing to extensive utilization of targeted small-molecule therapies.

- Oral administration was noted as the preferred route in 2024, representing above 81.2% share because of higher patient convenience and strong clinical acceptance.

- Hospital pharmacies were reported as the primary distribution channel in 2024, capturing over 81.2% share supported by high-volume procurement and specialist-driven dispensing.

- North America was identified as the leading regional market in 2024, holding more than 45.3% share and generating an estimated US$ 128.2 billion in value.

Drug Class Analysis

In 2024, the Kinase Inhibitors held a dominant market position in the Drug Class Segment of the Small Molecule Inhibitors Market, and captured more than a 36.8% share. Their growth was driven by broad clinical use. Strong adoption occurred in oncology and immune-related disorders. TKIs such as EGFR, ALK, BTK, and VEGFR/FGFR inhibitors supported high demand. Serine/Threonine Kinase Inhibitors like CDK and mTOR/PI3K/AKT agents also advanced. Their use grew with precision medicine and biomarker-based therapies.

Proteasome inhibitors maintained a stable share. Their use remained concentrated in hematological cancers. Moderate growth was recorded due to new oral candidates. MMP and HSP inhibitors remained in early development. Their progress was slower because of toxicity concerns. However, selective next-generation molecules indicated renewed interest. Apoptosis-targeting inhibitors also gained traction. BCL-2 and MDM2 inhibitors improved treatment options for resistant tumors. Their development strengthened the overall small molecule inhibitor pipeline.

Immunomodulatory small molecule inhibitors recorded consistent uptake. Their oral delivery and strong activity in immune disorders supported demand. Cancer therapies using lenalidomide analogs showed continued adoption. The “Others” category included various emerging agents. Many targeted new intracellular pathways and showed early promise. Strong research funding encouraged development. Strategic industry partnerships also accelerated innovation. Ongoing progress in structure-based discovery and combination therapies supported future expansion. These factors were expected to drive long-term market growth.

Therapeutic Area Analysis

In 2024, the ‘Oncology’ held a dominant market position in the Therapeutic Area Segment of the Small Molecule Inhibitors Market, and captured more than a 48.1% share. The segment grew due to rising cancer cases. Strong demand for targeted therapies supported this trend. The use of oral inhibitors increased adoption. Precision medicine also strengthened uptake. A steady rise in clinical programs expanded treatment options. These factors helped the oncology segment maintain clear leadership in the market.

Immunology and autoimmune disorders formed a significant portion of the market. Growth was driven by the rising burden of chronic conditions. Long-term therapy needs supported the use of oral inhibitors. New approvals improved treatment access. Infectious diseases also showed steady demand. The need for antiviral and antibacterial agents remained high. Research efforts addressed resistant pathogens. Neurology followed with moderate growth as disorders increased. Better CNS-targeting molecules improved treatment outcomes and supported ongoing adoption.

Rare diseases and genetic disorders showed rapid expansion. Growth was driven by incentives for targeted therapies. New mutation-specific inhibitors supported this rise. The segment remained small but promising. Additional uptake came from treatments in metabolic, respiratory, and cardiovascular diseases. These areas benefited from broad clinical usage. Innovation in small-molecule design improved treatment profiles. Higher demand for chronic disease management supported market stability. Overall, these segments enhanced the long-term development outlook for small molecule inhibitors.

Route of Administration Analysis

In 2024, the ‘Oral’ held a dominant market position in the Route of Administration segment of the Small Molecule Inhibitors Market, and captured more than an 81.2% share. The oral route was supported by high patient adherence and simple dosing needs. It also benefited from strong acceptance in chronic therapies. Broad use in oncology and autoimmune disorders strengthened market traction. Improved stability and ease of storage further encouraged adoption. These factors helped maintain consistent demand across global markets.

The oral segment advanced due to its non-invasive nature and reliable treatment convenience. The availability of once-daily and twice-daily formulations increased adherence. Several leading inhibitors in cancer care and metabolic diseases remained oral, which reinforced segment growth. Progress in enhancing solubility and absorption also expanded clinical use. These improvements addressed earlier delivery challenges. Strong development pipelines for targeted therapies supported additional uptake. The segment is expected to retain leadership as innovation continues.

The intravenous route accounted for a smaller share but remained essential in acute and hospital settings. It offered rapid therapeutic action and precise dosing control. Clinician supervision ensured accurate administration, which supported its use in severe cases. However, invasive procedures and higher costs limited broader adoption. Demand is expected to remain steady in critical care areas. New infusion technologies may strengthen efficiency. A balanced shift between oral and intravenous use reflects an evolving treatment landscape.

Distribution Channel Analysis

In 2024, the ‘Hospital pharmacies’ held a dominant market position in the Distribution Channel Segment of the Small Molecule Inhibitors Market, and captured more than a 81.2% share. This segment was driven by high treatment volumes in hospital settings. Strong clinician oversight supported steady dispensing. Advanced facilities improved patient access. Complex therapeutic protocols increased reliance on hospital pharmacies. Continuous adoption of targeted therapies reinforced this channel’s dominance. Growing demand for oncology care strengthened overall distribution trends.

Retail pharmacies recorded moderate participation in the market. Their growth was supported by wider access to prescription therapies. Convenient locations improved patient reach. Chronic disease management needs increased footfall. Availability of generic inhibitors enhanced affordability. Retail chains expanded their presence in urban regions. However, limited capacity to dispense high-risk oncology drugs restricted deeper penetration. Rising awareness of preventive care supported demand across community outlets and stabilized market engagement. Overall performance grew.

Online pharmacies achieved steady advancement in the distribution landscape. Digital platforms improved access to essential therapies. Home-delivery services increased consumer preference. Transparent pricing supported the uptake of generic inhibitors. Streamlined digital prescriptions enhanced service efficiency. Broader internet access in emerging regions improved coverage. Regulatory limits on critical drug dispensing slowed faster expansion. Trust in verified online channels increased gradually. Rising adoption of remote care models strengthened this segment’s outlook and encouraged continued market participation.

Key Market Segments

By Drug Class

- Kinase Inhibitors

- Tyrosine Kinase Inhibitors (TKIs)

- EGFR inhibitors

- ALK inhibitors

- BTK inhibitors

- VEGFR/FGFR inhibitors

- Serine/Threonine Kinase Inhibitors

- CDK inhibitors

- mTOR/PI3K/AKT inhibitors

- MEK/BRAF inhibitors

- Tyrosine Kinase Inhibitors (TKIs)

- Proteasome Inhibitors

- MMPs and HSPs inhibitors

- Small molecule inhibitors targeting the apoptosis

- Immunomodulatory Small Molecule Inhibitors

- Others

By Therapeutic Area

- Oncology

- Immunology & Autoimmune Disorders

- Infectious Diseases

- Neurology

- Rare Diseases & Genetic Disorders

- Others

By Route of Administration

- Oral

- Intravenous

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Drivers

Expansion Of Ai And Computational Methods In Small-Molecule Discovery

The expansion of advanced computational methods has been identified as a major driver supporting the development of small-molecule inhibitors. The adoption of artificial intelligence, deep-learning frameworks, and predictive modelling has improved the accuracy of molecular design. Faster screening and reduced dependence on traditional trial-and-error approaches have been achieved. As a result, the discovery and optimization of potential inhibitory compounds have become more efficient. The growth of these digital capabilities has accelerated the pace at which novel SMI candidates enter early research pipelines.

AI-enabled chemistry platforms have been used to narrow chemical search spaces and improve hit-to-lead progression. According to industry assessments, these technologies help in predicting molecular interactions and refining compound libraries in less time. Improved structural insights and modelling accuracy contribute to higher discovery success. These computational gains reduce development bottlenecks, leading to more consistent identification of viable targets. The overall effect strengthens the innovation cycle for small-molecule inhibitors and supports broader commercial expansion within the biopharmaceutical landscape.

According to a 2024 commentary published by the American Chemical Society, the growing use of computational approaches is reshaping small-molecule drug design. The report highlighted that deep-learning systems and generative chemistry techniques have been applied to accelerate hit-to-lead optimization. These systems reduce the exploratory burden and guide researchers toward higher-probability candidates. Such improvements enhance discovery efficiency and contribute to stronger pipelines. The incorporation of these capabilities has been viewed as an important factor supporting continued growth in the small-molecule inhibitor segment.

A study by Nature in 2025 further demonstrated the impact of advanced generative-AI tools on SMI innovation. For instance, a generative-AI platform was used to design a novel small-molecule inhibitor targeting TNIK for anti-fibrotic applications in preclinical development. The ability to produce a viable compound for a complex target illustrates the potential of these technologies. This evidence reinforces how computational design is enabling differentiated candidates, supporting stronger R&D productivity, and ultimately contributing to the expanding market potential for small-molecule inhibitors.

Restraints

High Specificity/Resistance Challenges Despite High Numbers Of Approved Kinase Inhibitors

The growth of the small-molecule inhibitor market continues to be constrained by persistent resistance challenges and limited clinical durability. The development pipeline is affected because many candidates show strong initial responses but lose effectiveness over time. This creates uncertainty for manufacturers and investors. The restraint is reinforced by the high cost of advancing molecules that may deliver only short-term therapeutic benefit. As a result, sustained market expansion is slowed, and strategic risk increases for companies attempting to introduce new competitive therapies.

Concerns about long-term treatment outcomes remain significant. The constraint emerges because small-molecule inhibitors often achieve regulatory approval yet demonstrate restricted applicability in real-world populations. This reduces commercial potential and places pressure on companies to invest further in next-generation molecules. The market must manage these hurdles while demand for precision therapies grows. Limited durability also affects pricing strategies and reimbursement decisions, making adoption more complex across multiple therapeutic areas.

According to ScienceDirect, around 80 small-molecule protein-kinase inhibitors had received approval from the U.S. Food & Drug Administration by 1 January 2024. For example, this expansion signaled meaningful scientific progress. However, the high number of approvals did not eliminate clinical challenges. The presence of numerous marketed products has not translated into broad patient coverage because many therapies exhibit specific target profiles. This has created competitive saturation without proportional gains in therapeutic sustainability or patient accessibility.

Study by Nature reported that many approved inhibitors continue to face acquired resistance, low durable response rates, and narrow patient groups. For instance, the emergence of adaptive mutations reduces drug effectiveness and requires continuous development of follow-up molecules. These scientific barriers increase development costs and prolong timelines. For example, companies must invest heavily in monitoring resistance pathways and redesigning molecules. This ongoing cycle acts as a restraint on overall market growth because risk, uncertainty, and financial burden remain elevated.

Opportunities

Increasing Representation Of Smis In Disease-Areas Beyond Oncology

The rising presence of small-molecule inhibitors (SMIs) in non-oncology research has created a clear market opportunity. Strong demand for treatments in neurology, fibrosis, and chronic diseases has increased interest in therapies with favorable delivery and penetration profiles. The growth of SMIs in these areas has been supported by their ability to cross complex biological barriers and achieve targeted activity. These characteristics have allowed SMIs to enter segments that were previously dominated by biologics, which indicates a widening commercial landscape.

The opportunity is reinforced by the need for disease-modifying treatments in high-unmet-need markets. Many therapeutic areas, particularly neurodegenerative disorders, require products that combine efficacy with ease of administration. SMIs are positioned well because they can be formulated for oral use and are often easier to manufacture compared to biologics. As a result, demand for such compounds has increased in both early-stage and late-stage pipelines. This trend signals long-term commercial potential for companies investing in SMI innovation.

According to a 2025 review published in Alzheimer’s journals, nearly 59% of Alzheimer’s disease (AD) disease-modifying therapies in development were small molecules. The study reported that 60 out of approximately 102 pipeline candidates were based on small-molecule mechanisms. This shift demonstrates that oral and CNS-penetrant molecules are becoming central to drug development strategies. For example, the rapid inclusion of SMIs in neurodegenerative pipelines suggests that developers are prioritizing assets capable of reaching the central nervous system.

For instance, the expansion of SMIs into Alzheimer’s research reflects broader adoption across high-unmet-need therapeutic fields. Study by various industry analysts has noted similar movement in chronic disease and fibrotic disorder pipelines, where ease of delivery and cost-efficient production create advantages. The growing acceptance of SMIs across multiple disease segments indicates strong potential for future portfolio diversification. This expansion is expected to support higher market penetration and sustained growth for companies developing next-generation inhibitors.

Trends

SMIs Increasingly Feature In New Molecular Entity (Nme) Approvals And Dominate Portions Of Approvals

Small molecule inhibitors (SMIs) have continued to secure a significant share within the drug-development ecosystem. The rising presence of SMIs in regulatory approvals has reflected their established role, mature development pathways, and strong commercial relevance. The trend has been reinforced by consistent approval activity across therapeutic areas. The growth of SMI approvals has been attributed to predictable pharmacology, scalable manufacturing, and broad applicability across disease categories. This ongoing momentum has positioned SMIs as a strategic modality for developers seeking efficient, high-value therapeutic outputs.

The pattern observed in recent approval cycles has demonstrated that SMIs maintain a dominant portion of overall new molecular entities (NMEs). Their share within FDA approvals has remained high, indicating sustained innovation in this class. The modality has benefited from clearer regulatory expectations and well-defined discovery frameworks. As a result, SMIs continue to be prioritised when rapid development timelines and strong clinical validation are required. This steady performance highlights their continued relevance in competitive therapeutic markets.

According to a 2025 DrugHunter analysis, 62% of NMEs approved by the FDA in 2024 were small-molecule drugs. This finding illustrates the persistent preference for SMIs in broader pharmaceutical pipelines. For example, the high proportion of SMI approvals has suggested that companies strategically invest in modalities with manageable risk profiles and established safety precedents. The concentration of approvals has further indicated that SMIs continue to align with regulatory expectations, particularly in indications where molecular targeting and oral delivery provide strategic advantages.

A study by Frontiers in 2025 reported 31 oncologic NMEs, representing 14% of approvals attributed to small-molecule drugs during the period assessed. For instance, this demonstrates that SMIs remain influential even in complex therapeutic segments such as oncology. The presence of SMIs in these specialised categories has reinforced their adaptability and scientific relevance. The distribution across oncology illustrates how this modality continues to support precision-driven treatment strategies, thereby strengthening the broader trend of sustained uptake and utilisation of small molecule inhibitors.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 45.3% share and holds US$ 128.2 Billion market value for the year. The region benefited from strong R&D capacity and steady growth in targeted therapies. High spending on healthcare supported rapid adoption. Clinical trial activity remained robust and boosted innovation. Rising chronic disease cases increased demand for advanced inhibitors. Regulatory support also improved approval timelines. These factors strengthened the region’s leadership.

Europe remained the second-largest regional market and showed stable expansion. Growth was supported by structured healthcare systems and active participation in research programs. Strong collaboration networks encouraged scientific development. Adoption increased due to demand for targeted and cost-effective therapies. However, longer approval timelines restricted faster uptake. Asia-Pacific showed rapid growth. Improved access to healthcare, rising disease prevalence, and expanding manufacturing capacity supported regional progress and improved long-term potential.

Latin America reported moderate growth due to rising awareness and improving private healthcare facilities. Adoption remained stronger in key countries with better treatment access. Slow regulatory procedures limited faster expansion. The Middle East and Africa showed smaller shares but steady improvement. Investments in specialized centers supported adoption. Limited affordability restricted wider availability. Despite this, partnerships with global firms encouraged progress. These combined trends positioned North America as the most influential region in the global landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The small molecule inhibitors market is shaped by major pharmaceutical companies with strong global portfolios. Pfizer, Novartis, and AstraZeneca have maintained leading positions due to continuous R&D spending and steady product advancements. Their focus on oncology, respiratory diseases, and precision medicine supports sustained market expansion. The growth of these companies has been driven by targeted therapies, strategic collaborations, and successful clinical programs. Their broad commercial reach has ensured stable demand and reinforced their competitive advantage across key therapeutic categories, contributing to the market’s long-term development.

Bristol-Myers Squibb and Merck have strengthened the market through extensive pipelines and strong commercialization capabilities. Their contributions in oncology, infectious diseases, and cardiovascular disorders remain significant. These companies have invested heavily in small-molecule platforms to expand treatment options. Regulatory approvals and global partnerships have also supported their growth. Their commitment to targeted therapies has enhanced innovation in the market. As a result, their portfolios continue to influence clinical trends and shape competitive dynamics across major regions.

Other key players, including Eli Lilly, GlaxoSmithKline, and Johnson & Johnson, have contributed to steady market advancement. Their research activities in metabolic, inflammatory, and rare diseases have supported new product development. Each company has used strategic collaborations to expand its footprint. Their strong presence in global markets has reinforced confidence in small-molecule inhibitors. Their efforts in next-generation therapies and clinical optimization have strengthened long-term growth. These companies remain essential to maintaining innovation and supporting broader therapeutic adoption.

Companies such as Takeda, Amgen, Sanofi, and Bayer also play an important role in the competitive landscape. Their activities in oncology, gastrointestinal diseases, and immune-mediated conditions continue to expand treatment choices. Strong pipelines and investments in targeted inhibition technologies have supported market resilience. Their global operations and strategic alliances have enhanced access to advanced therapies. Steady product launches and portfolio diversification have added to the market’s stability. These companies are expected to support continued innovation and market expansion over the forecast period.

Market Key Players

- Pfizer Inc.

- Novartis AG

- AstraZeneca plc

- Bristol-Myers Squibb Company

- Merck & Co. Inc.

- Eli Lilly and Company

- GlaxoSmithKline plc

- Johnson & Johnson

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Sanofi S.A.

- Bayer AG

Recent Developments

- December 2024: The U.S. FDA granted approval for Pfizer’s BRAFTOVI® (encorafenib), an oral small-molecule BRAF V600E kinase inhibitor, in combination with cetuximab for previously treated BRAF V600E-mutated metastatic CRC. This represents a key label expansion for a targeted small-molecule inhibitor regimen in solid tumors and strengthens Pfizer’s precision oncology portfolio in small molecules.

- October 2024: AstraZeneca entered a licensing agreement with CSPC Pharmaceutical Group worth up to USD 1.92 billion for an early-stage, novel small-molecule lipoprotein(a) [Lp(a)] disruptor, YS2302018. The compound is being developed as an oral lipid-lowering therapy and is expected to be evaluated alongside AstraZeneca’s oral PCSK9 inhibitor AZD0780 in dyslipidaemia patients. The deal strengthens AstraZeneca’s cardiovascular portfolio of small-molecule inhibitors.

- In June 2024: The U.S. FDA granted accelerated approval for KRAZATI® (adagrasib) in combination with cetuximab for adults with previously treated KRASG12C-mutated locally advanced or metastatic colorectal cancer. KRAZATI is described as a highly selective and potent oral small-molecule KRASG12C inhibitor optimized for sustained target inhibition.

- December 2023: The U.S. FDA approved Fabhalta® (iptacopan) as the first oral monotherapy for adults with paroxysmal nocturnal hemoglobinuria (PNH). Iptacopan is a small-molecule Factor B inhibitor acting proximally in the alternative complement pathway, providing comprehensive control of intra- and extravascular hemolysis. This represents a major small-molecule inhibitor milestone in complement-mediated rare diseases.

Report Scope

Report Features Description Market Value (2024) US$ 283.1 Billion Forecast Revenue (2034) US$ 622.6 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Kinase Inhibitors (Tyrosine Kinase Inhibitors (TKIs) (EGFR inhibitors, ALK inhibitors, BTK inhibitors, VEGFR/FGFR inhibitors), Serine/Threonine Kinase Inhibitors (CDK inhibitors, mTOR/PI3K/AKT inhibitors, MEK/BRAF inhibitors)), Proteasome Inhibitors, MMPs and HSPs inhibitors, Small molecule inhibitors targeting the apoptosis, Immunomodulatory Small Molecule Inhibitors, Others), By Therapeutic Area (Oncology, Immunology & Autoimmune Disorders, Infectious Diseases, Neurology, Rare Diseases & Genetic Disorders, Others), By Route of Administration (Oral, Intravenous), By Distribution Channel (Hospital pharmacies, Retail pharmacies, Online pharmacies) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pfizer Inc., Novartis AG, AstraZeneca plc, Bristol-Myers Squibb Company, Merck & Co. Inc., Eli Lilly and Company, GlaxoSmithKline plc, Johnson & Johnson, Takeda Pharmaceutical Company Limited, Amgen Inc., Sanofi S.A., Bayer AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Small Molecule Inhibitors MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Small Molecule Inhibitors MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer Inc.

- Novartis AG

- AstraZeneca plc

- Bristol-Myers Squibb Company

- Merck & Co. Inc.

- Eli Lilly and Company

- GlaxoSmithKline plc

- Johnson & Johnson

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Sanofi S.A.

- Bayer AG