Global Small Bore Connectors Market By Product (Liquid bore connectors and Gas bore connectors), By Application (Enteral, Intravascular, Respiratory, and others), By End-User (Hospitals, Home-care, and others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169298

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

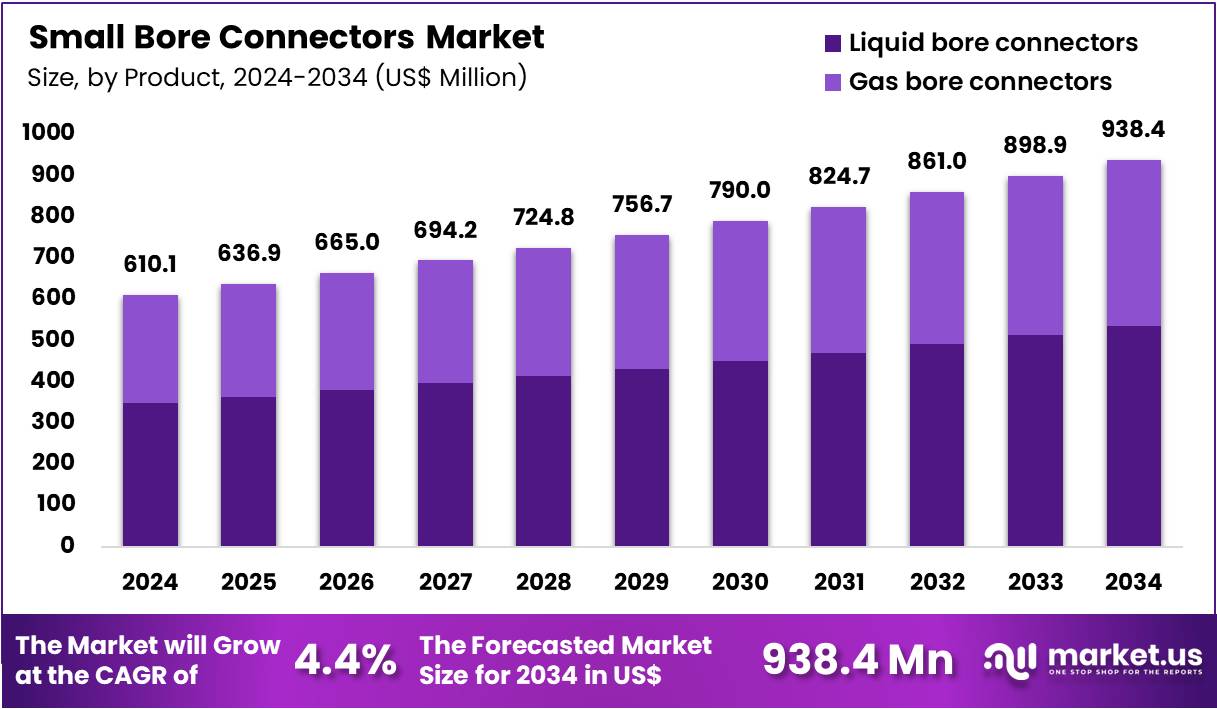

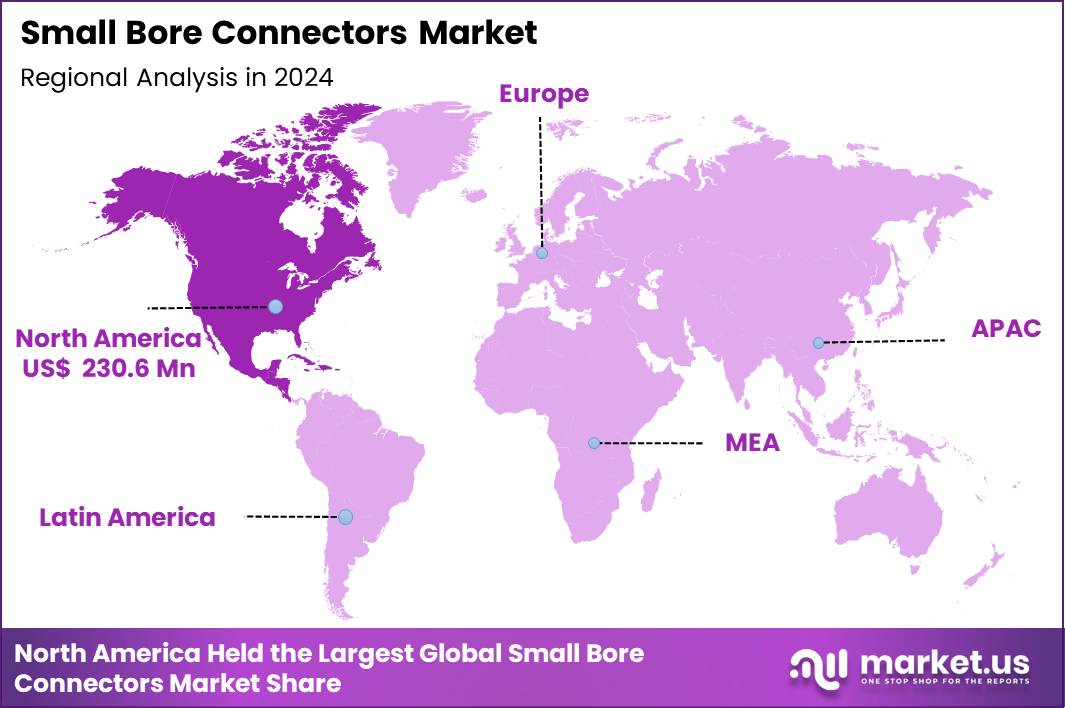

Global Small Bore Connectors Market size is expected to be worth around US$ 938.4 Million by 2034 from US$ 610.1 Million in 2024, growing at a CAGR of 4.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.8% share with a revenue of US$ 230.6 Million.

The Small Bore Connectors Market is expected to expand steadily as global healthcare systems increasingly prioritize standardized connector systems for safe fluid, gas, enteral, and intravascular delivery. The market grows due to rising procedural volumes, increased emphasis on patient safety, and regulatory frameworks such as ISO 80369, which mandate the use of non-interchangeable connectors to reduce medical tubing misconnections.

Hospitals, ambulatory facilities, and home-care settings rely on small-bore connectors across IV therapy, enteral feeding, respiratory care, and drug delivery. Manufacturers continue to introduce improved designs with enhanced leak-resistance, material durability, and compatibility with automated infusion and monitoring systems.

Growing adoption of minimally invasive procedures and increasing chronic disease prevalence strengthen market consumption across IV therapy and respiratory applications. The transition toward standardized enteral connectors has accelerated adoption in nutrition delivery and long-term care settings.

Advancements in polymer engineering, along with manufacturing improvements, further support reliable, pressure-stable connectors suited for high-acuity hospital environments. The market benefits from continuous product development by leading companies offering liquid and gas bore connector systems for safe clinical workflows.

Key Takeaways

- In 2024, the market generated a revenue of US$ 610.1 million, with a CAGR of 4.4%, and is expected to reach US$ 938.4 million by the year 2034.

- The Product segment is divided into Liquid bore connectors and Gas bore connectors, with Liquid bore connectors dominating with an estimated 57.1% share.

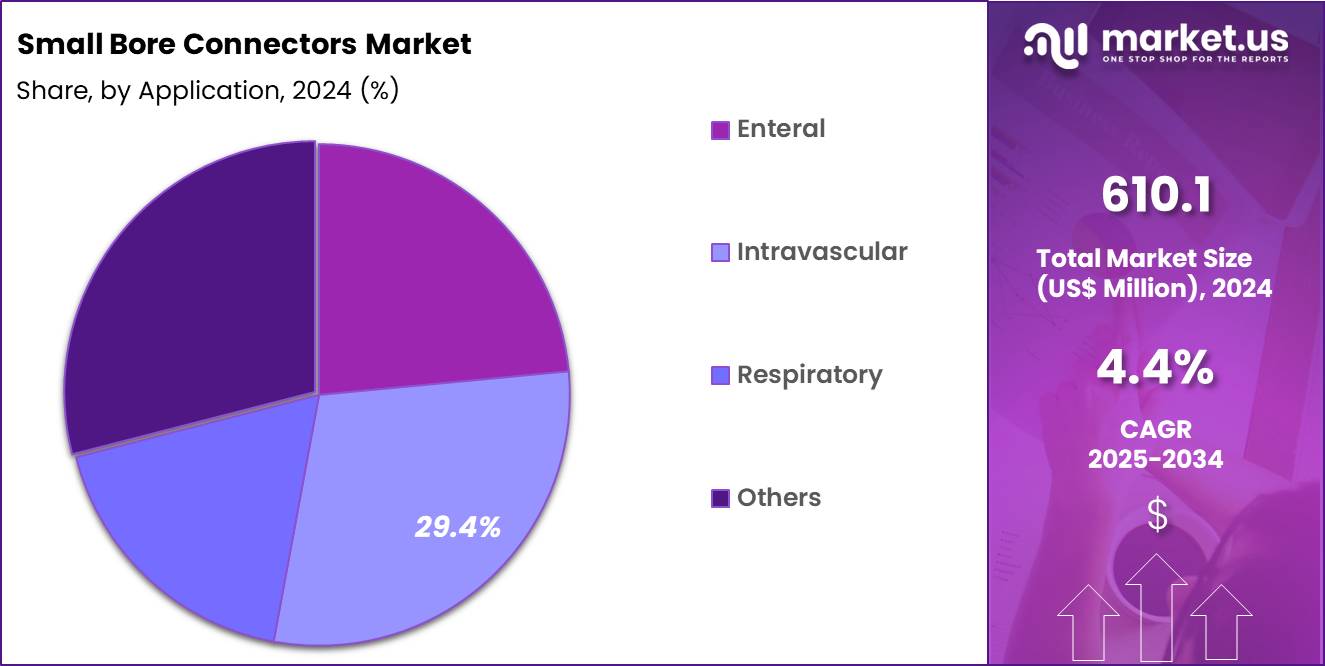

- The Application segment includes Enteral, Intravascular, Respiratory, and Others, with Intravascular leading at an estimated 29.4% share.

- The End-User segment includes Hospitals, Home-care, and Others, with Hospitals contributing an estimated 47.4% share.

- North America led the market by securing a market share of 37.8% in 2024.

Product Analysis

Liquid bore connectors dominate the market with an estimated 57.1% share, driven by extensive use in IV therapy, enteral feeding, drug infusion, and nutrition delivery. These connectors are integral to daily hospital operations and chronic-care management, supporting precise and leak-free fluid administration across infusion pumps, syringe systems, and enteral devices.

Their adoption strengthens as healthcare facilities shift to ISO 80369-compliant, non-interchangeable connector formats to reduce the risk of cross-connection errors. Continuous design optimization for improved flow stability, torsional strength, and compatibility with automated delivery setups reinforces the dominance of liquid bore connectors.

Gas bore connectors, serve respiratory and medical-gas applications, including ventilators, oxygen therapy devices, nebulizers, and anesthesia systems. Growth is driven by increased respiratory disease prevalence and expansion of critical-care resources worldwide. Gas connectors are engineered for secure sealing and pressure resistance, ensuring safe oxygen and gas transport in high-acuity and emergency-care environments.

Application Analysis

Intravascular applications represent the largest segment with an estimated 29.4% share due to extensive usage in IV therapy, drug infusion, hydration, and vascular access procedures. Hospitals depend heavily on standardized connectors across infusion lines, syringe pumps, and catheter systems to ensure reliable fluid delivery and reduce adverse events. High prevalence of chronic illnesses, rising surgical procedures, and increased demand for long-term parenteral therapy support segment growth.

Enteral applications is growing as global adoption of ISO-compliant enteral connectors accelerates. These connectors reduce misconnections and support nutritional therapy in neonatal, pediatric, geriatric, and chronic-care patients. Greater focus on patient safety in feeding tube systems and expanded use in home-care nutrition programs contribute to segment expansion.

Respiratory applications, benefit from rising respiratory disorder incidence and increased use of ventilators, CPAP/BiPAP, and oxygen delivery systems. Standardized connectors for medical gas transport ensure secure and contamination-free connections, essential for acute and long-term respiratory care.

End-User Analysis

Hospitals account for an estimated 47.4% share, making them the largest end-user segment due to high patient volumes and widespread use of connectors across ICU, emergency, surgical, nutrition, and respiratory departments. Hospitals continue transitioning to standardized connector systems to enhance patient safety and support fully compatible infusion and monitoring workflows.

Home-care, grows as chronic disease management shifts toward home settings. Enteral feeding, oxygen therapy, and long-term hydration therapy drive adoption of safe, easy-to-use connectors in portable systems. Others, including clinics, ambulatory surgical centers, and specialty care facilities. These facilities adopt standardized connectors to enhance workflow safety across outpatient IV therapy, ambulatory respiratory care, and day-procedure units.

Key Market Segments

By Product

- Liquid bore connectors

- Gas bore connectors

By Application

- Enteral

- Intravascular

- Respiratory

- Others

By End-User

- Hospitals

- Home-care

- Others

Drivers

Growing prevalence of chronic diseases and increased demand for long-term therapies

The imperative of patient safety has emerged as a primary driver for the Small Bore Connectors Market. Standards such as ISO 80369 covering connectors for liquids and gases in healthcare push healthcare providers and device manufacturers toward adoption of small-bore connectors that are physically incompatible across application types.

This reduces risk of misconnections (for example connecting an enteral feeding tube to an IV line), which historically led to serious adverse events. Healthcare systems increasingly require compliance with such standards to mitigate medical errors, prompting widespread replacement of legacy fittings, thus boosting demand.

Rising volume of minimally invasive procedures, intravenous therapies, enteral nutrition, and respiratory interventions also drives demand. As hospitals, ambulatory centres, and home-care settings increase their procedural throughput, requirement for reliably leak-free, standardized connectors for fluid and gas delivery escalates. According to one recent market estimate, global small-bore connector market size reached USD 623.2 million in 2024 and is forecast to grow further.

Restraints

Regulatory and compliance burden associated with connector standardization

One key restraint is the regulatory and compliance burden associated with connector standardization. Manufacturers must design to satisfy strict standards (such as ISO 80369 parts) including dimensional, material, leakage and compatibility specifications which increases product development time and cost. This raises the barrier for smaller suppliers and increases product cost for end-users, which in price-sensitive markets may hinder adoption.

Another restraint arises from legacy infrastructure and device compatibility issues. Many existing medical devices especially in emerging markets or older hospitals are built around older connector standards (e.g. traditional Luer fittings). Transitioning to small-bore connectors requires replacing or retrofitting existing systems (IV tubing, pumps, enteral sets, gas lines), which involves CAPEX.

In facilities with constrained budgets, this may delay or limit full adoption, especially for gas-bore connectors or less common application types. Moreover, performance constraints in demanding clinical settings (e.g. high-pressure gas delivery, repeated connection cycles, sterilization requirements) may challenge some small-bore designs.

Opportunities

Expanding home-care, long-term care, and outpatient settings

Significant opportunity exists in expanding home-care, long-term care, and outpatient settings. As chronic disease management, enteral nutrition therapy, and home-based oxygen or infusion therapy become more common globally, demand for easy-to-use, safe, standardized small-bore connectors in home-care kits and portable devices is rising. One market analysis specifically notes home healthcare and wearable/portable therapy devices as growth drivers in the broader medical connectors space.

Another opportunity lies in innovation including development of connectors with enhanced safety features (anti-misconnection design, needle-free connectors), advanced materials (biocompatible polymers, antimicrobial coatings), leak-proof seals, and compatibility with automated infusion or monitoring systems. As hospitals and clinics upgrade equipment, product differentiation via improved performance and compliance could be a competitive advantage.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical conditions shape the Small Bore Connectors Market by influencing consumer spending patterns, supply chain reliability, and access to critical diagnostic materials. During periods of economic slowdown, household budgets tend to prioritize essential healthcare needs. This shift supports the adoption of at-home testing, as it is perceived as a cost-effective alternative to clinic-based diagnostics.

Inflationary pressures, however, elevate the costs of raw materials and logistics, which may lead to higher kit prices and reduced affordability in price-sensitive regions. Geopolitical tensions further affect the availability of assay components, microfluidic cartridges, reagents, and lateral-flow materials, many of which are sourced from multiple international suppliers. Any disruption in trade routes or restrictions on the movement of chemical inputs can extend production lead times and constrain inventory levels across online and retail distribution channels.

Changes in public health policies linked to geopolitical developments also influence market demand. Uncertainties related to global energy and food supply increase consumer focus on immunity, fatigue, and overall wellness, thereby encouraging greater self-monitoring. Evolving labor dynamics, including the expansion of remote work, continue to support the use of home-based diagnostics over clinical visits. Meanwhile, growing regulatory attention to cross-border data flows and digital health privacy may influence how testing providers manage, store, and process user information.

Latest Trends

Shift towards application-specific, non-interconnectable connectors under ISO 80369

A strong trend is the shift from traditional, generic fittings (e.g. older Luer-type connections) to application-specific, non-interconnectable connectors under ISO 80369. This transition is particularly evident in enteral, respiratory, and intravascular devices to prevent misconnections; connectors are now often color-coded, dimension-standardized, and designed to be physically incompatible with fittings for other applications.

Another trend is increasing adoption of single-use and disposable small-bore connectors, especially in infection-sensitive settings and home-care devices, to ensure sterility and reduce cross-contamination risk. Combined with rising demand for minimally invasive and outpatient procedures, this supports growth of compact, sterile connector systems. Market forecasts project continued growth at a CAGR of ~4–4.5% over coming years.

Integration of smart materials and manufacturing methods e.g. antimicrobial plastics, connectors designed for automated assembly, improved leak resistance, ergonomic fittings is shaping next-generation products. As healthcare facilities upgrade infrastructure and invest in quality and safety, demand for such enhanced connectors increases, creating a shift from low-cost generic fittings to premium, compliance-ready solutions.

Regional Analysis

North America is leading the Small Bore Connectors Market

The largest region in the Small Bore Connectors Market is North America accounting for over 37.8% market share in 2024. The region leads due to its advanced and extensive healthcare infrastructure, high procedural volumes (IV therapies, surgeries, respiratory and enteral therapies), and early adoption of safety standards such as ISO 80369. Regulatory awareness, hospital accreditation requirements, and high compliance levels drive replacement of legacy connectors with standardized small-bore connectors. One report notes North America as the region holding the largest share currently.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The fastest-growing region is Asia‑Pacific, driven by rapid expansion of healthcare infrastructure, rising chronic disease burden, increasing hospitalisation rates, and growing demand for home-care solutions. Emerging economies within this region are investing in upgrading medical facilities and adopting international safety norms.

At the same time, rising public and private healthcare spending, expanding patient population requiring long-term care, and increasing use of respiratory, enteral, and intravenous therapies support accelerated demand growth. One forecast projects Asia-Pacific to register the highest CAGR over the forecast period.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include B. Braun Melsungen AG, Becton, Dickinson and Company (BD), ICU Medical Inc., Merck KGaA, Smiths Medical (Smiths Group), Baxter International Inc., Merit Medical Systems Inc., Nordson Corporation, Elcam Medical, Qosina Corp., CardioMed Supplies Inc., other key players.

- Braun strengthens its portfolio through ISO-compliant small bore connectors supporting IV therapy, enteral delivery, and drug infusion. Its focus on leakage prevention, compatibility, and clinical safety helps hospitals standardize systems and reduce tubing misconnection risks across critical-care environments.

BD offers advanced small bore connector systems integrated across infusion therapy, vascular access, and medication administration. Its engineering emphasizes secure sealing, needle-free operation, and misconnection prevention, aligning with global safety standards and supporting large-volume hospital use and long-term patient management.

ICU Medical delivers specialized small bore connectors designed for closed, needle-free, and leak-resistant IV systems. Their solutions support infection control, prevent misconnections, and enhance medication delivery accuracy, making them widely adopted across acute-care, oncology, and infusion therapy settings.

Top Key Players

- Braun Melsungen AG

- Becton, Dickinson and Company (BD)

- ICU Medical Inc.

- Merck KGaA

- Smiths Medical (Smiths Group)

- Baxter International Inc.

- Merit Medical Systems Inc.

- Nordson Corporation

- Elcam Medical

- Qosina Corp.

- CardioMed Supplies Inc.

- Other key players

Recent Developments

- In September 2025, ICU Medical Inc. announced a new FDA 510(k) clearance for its Clave™ needle‑free connector portfolio, citing data that use of Clave connectors in acute-care hospitals was associated with a 19% reduced relative risk of central line–associated bloodstream infection (CLABSI) compared with non-Clave connectors.

- In 2023, Fortune Medical Instrument Corp. introduced its silicone gastrostomy tube and silicone nasogastric tube, both equipped with ENFit connectors designed in accordance with the ISO 80369-3 standard for liquid and gas small-bore connections.

Report Scope

Report Features Description Market Value (2024) US$ 610.1 Million Forecast Revenue (2034) US$ 938.4 Million CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Liquid bore connectors and Gas bore connectors), By Application (Enteral, Intravascular, Respiratory, and others), End-User (Hospitals, Home-care, and others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape B. Braun Melsungen AG, Becton, Dickinson and Company (BD), ICU Medical Inc., Merck KGaA, Smiths Medical (Smiths Group), Baxter International Inc., Merit Medical Systems Inc., Nordson Corporation, Elcam Medical, Qosina Corp., CardioMed Supplies Inc., other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Small Bore Connectors MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Small Bore Connectors MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Braun Melsungen AG

- Becton, Dickinson and Company (BD)

- ICU Medical Inc.

- Merck KGaA

- Smiths Medical (Smiths Group)

- Baxter International Inc.

- Merit Medical Systems Inc.

- Nordson Corporation

- Elcam Medical

- Qosina Corp.

- CardioMed Supplies Inc.

- Other key players