Global Single-Origin Coffee Market Size, Share, And Business Benefits By Type (Ground Coffee, Whole Bean Coffee, Single-Serve Pods), By Processing Method (Washed, Natural, Honey, Pulped Natural), By Distribution Channel (Supermarkets, Online Retail, Specialty Coffee Shops, Convenience Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165543

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

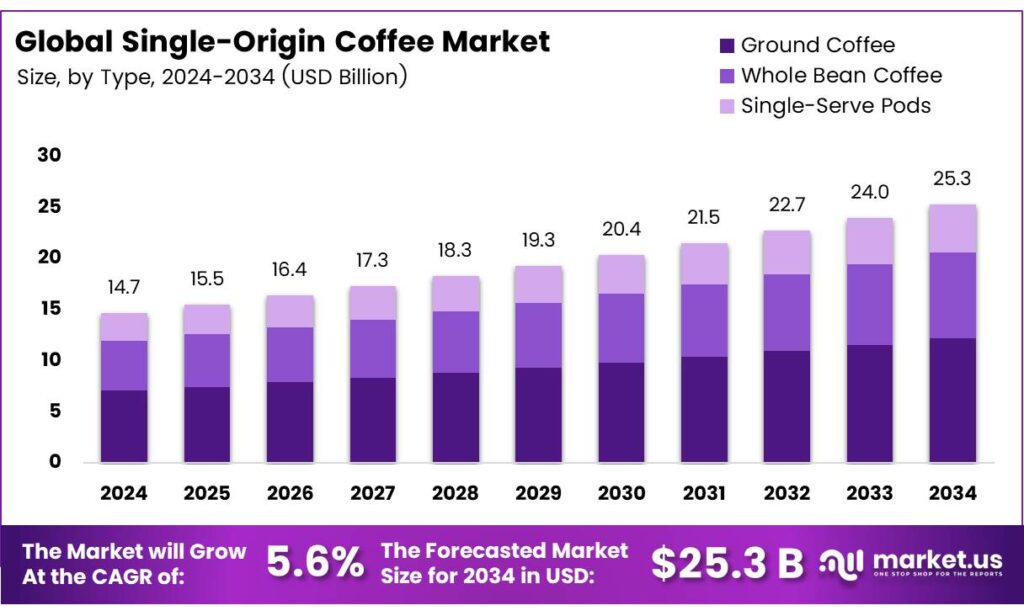

The Global Single-Origin Coffee Market size is expected to be worth around USD 25.3 billion by 2034, from USD 14.7 billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

Single-origin coffee refers to beans sourced from one specific farm, farmer, producer, crop, or region within a single country, allowing for full traceability to that distinct area. In contrast, blend coffee combines beans from multiple origins to create a consistent flavor profile. While blends achieve balance and year-round availability through this mixing, single-origin coffees remain seasonal and limited in quantity, highlighting the beans at their peak freshness and delivering an unaltered taste tied directly to their place of origin.

The unique flavor of single-origin coffee stems from the region’s climate, soil, and the producer’s processing methods, often resulting in bolder, more robust, and exotic notes compared to the harmonious balance of blends. The Coffee Bean & Tea Leaf offers options like Brazil Dark Ground Single Origin Coffee from the Cerrado region, featuring a full-bodied dark roast with bold aroma, earthy flavor, and bittersweet finish, or Organic Guatemala Single Origin Medium Roast from Finca Aurora Xolhuitz in Nuevo San Carlos, which provides a robust.

- A scientific study analyzed the aroma profiles of 10 single-origin Arabica coffees from eight locations across Central America to Indonesia using Headspace SPME-GC-MS. Roasting conditions were customized for each sample to optimize sensory characteristics, identifying 138 volatile compounds—primarily furans 24–41% and pyrazines 25–39% formed via the Maillard reaction, many of which are key coffee odorants.

Roast degree had a stronger impact on coffee volatile composition than geographical origin, separating samples into light and dark roast groups via principal component analysis 73.66% variance and hierarchical cluster analysis. This focus aligns with rising consumer demand, as the International Coffee Organization projects a 1.9% increase in global consumption to 167.5 million 60-kg bags, with European buyers increasingly favoring labeled origins and specific sensory profiles.

Key Takeaways

- The Global Single-Origin Coffee Market is expected to grow from USD 14.7 billion in 2024 to USD 25.3 billion by 2034 at a 5.6% CAGR.

- Ground Coffee dominates By Type with a 48.2% share in 2024 due to quick prep and consistent flavor.

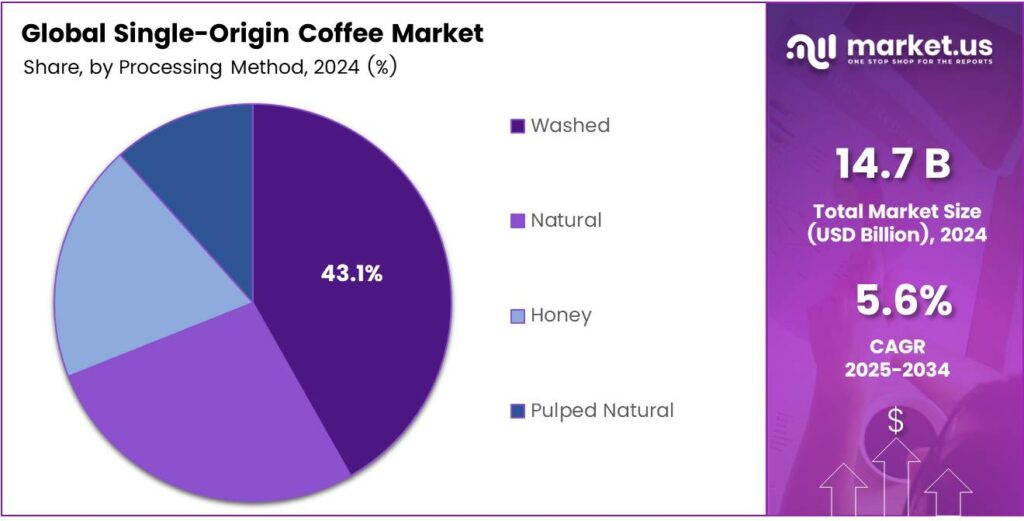

- Washed processing leads By Processing Method with a 43.1% share in 2024 for bright acidity and controlled fermentation.

- Supermarkets hold the top spot By Distribution Channel with a 26.9% share in 2024 via one-stop shopping and promotions.

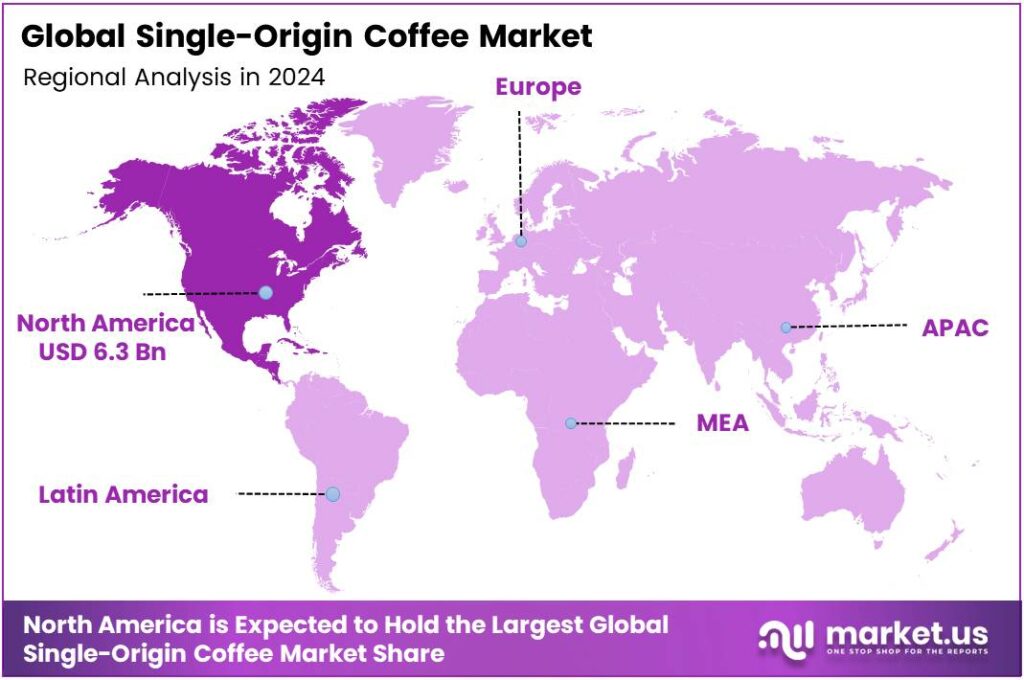

- North America commands 42.9% market share of USD 6.3 billion in 2024, driven by specialty culture and home brewing.

By Type Analysis

Ground Coffee dominates with 48.2% due to its convenience and ready-to-brew appeal.

In 2024, Ground Coffee held a dominant market position in the By Type Analysis segment of the Single-Origin Coffee Market, with a 48.2% share. Consumers prefer it for quick preparation. This format suits busy lifestyles. It offers consistent flavor extraction. It aligns with homebrewing trends. Whole Bean Coffee follows as a premium choice.

Buyers grind beans fresh for maximum aroma. This appeals to coffee enthusiasts. It preserves essential oils longer. It supports artisanal roasting preferences. Single-Serve Pods gain traction for portability. They provide hassle-free single cups. Ideal for offices and travel. However, environmental concerns arise from packaging. Yet, convenience drives steady adoption.

By Processing Method Analysis

Washed dominates with 43.1% due to its clean taste and consistent quality.

In 2024, Washed held a dominant market position in the By Processing Method Analysis segment of the Single-Origin Coffee Market, with a 43.1% share. Water removes mucilage post-harvest. This yields bright acidity. Farmers control fermentation precisely.

Thus, it ensures uniform profiles. Natural processing dries cherries intact. Sun exposure develops fruity notes. It requires less water. Consequently, it’s eco-friendly in dry regions. Flavors turn bold and wine-like. The honey method retains some mucilage.

Partial drying creates sweetness. It balances body and acidity. Producers vary in stickiness levels. This crafts nuanced cups. Pulped Natural removes skin only. Beans dry with mucilage. It blends washed clarity and natural sweetness. Popular in Brazil. Yields smooth, full-bodied coffee.

By Distribution Channel Analysis

Supermarkets dominate with 26.9% due to their accessibility and wide reach.

In 2024, Supermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Single-Origin Coffee Market, with a 26.9% share. One-stop shopping attracts families. Shelves display varied origins. Promotions boost impulse buys. Furthermore, loyalty programs encourage repeat. Online Retail expands rapidly. Platforms offer detailed origin stories.

Subscriptions ensure fresh deliveries. Consumers compare prices easily. Hence, it caters to tech-savvy buyers. Specialty Coffee Shops focus on experience. Baristas educate on brews. Tastings highlight unique flavors. Loyalty builds community. Convenience Stores serve on-the-go needs. Grab-and-go pods fit quick stops. Limited selection targets commuters. Availability near fuel stations aids impulse purchases.

Key Market Segments

By Type

- Ground Coffee

- Whole Bean Coffee

- Single-Serve Pods

By Processing Method

- Washed

- Natural

- Honey

- Pulped Natural

By Distribution Channel

- Supermarkets

- Online Retail

- Specialty Coffee Shops

- Convenience Stores

- Others

Emerging Trends

Growing demand for transparent, traceable single-origin beans

Single-origin coffee sits at the centre of this shift. In the US, specialty coffee has become mainstream: National Coffee Association data show that 52% of adults drank specialty coffee in the previous week, rising to 62% among 25–39-year-olds. This tells us younger drinkers are actively trading up to quality and origin-driven cups, which naturally favours single-origin offers.

- At the same time, more farmers are entering certification schemes that make origin and farm practices visible. The Rainforest Alliance reports 1.9 million hectares of certified coffee involving around 1.9 million farmers and workers across 29 countries, giving roasters a huge certified pool for single-origin lines. Single-origin also links strongly to fairness.

Member coffee cooperatives sold on average 35% of their coffee on Fairtrade terms, a share that has been rising as weaker performers leave the scheme and remaining co-ops focus on higher-value, traceable sales. Together, these numbers show a clear trend: consumers want to know who grew their coffee and under what conditions, while farmers and cooperatives are reorganising around certified, origin-specific channels.

Drivers

Premium at-home brewing culture lifting single-origin demand

Single-origin coffee used to be something you discovered only in a specialty bar. Now it’s increasingly brewed in home kitchens. The National Coffee Association’s Spring 2025 National Coffee Data Trends report shows that 66% of Americans had a coffee in the past day, confirming coffee as the country’s favourite daily drink and a huge base for trading up to better beans.

- Globally, this lifestyle shift sits on top of a steadily expanding coffee market. The International Coffee Organization estimated world consumption at 177 million 60-kg bags, up 2.2% year-on-year, underlining that demand is still rising even in a mature category.

Governments and public agencies are pushing quality improvements that directly benefit single-origin offerings. The USDA’s 2025 Coffee: World Markets and Trade circular highlights national replanting and productivity programmes in origin countries such as Ethiopia, where output was revised up by 2.3 million bags to 10.6 million thanks to higher-yielding varieties.

Restraints

Climate stress and price volatility are threatening single-origin stability

The romance of single-origin coffee often hides a harder truth: concentrating on one region or farm makes buyers more exposed to local shocks. Climate-driven stress in key origins is already visible. Brazil lost about 737,000 hectares of forest linked to coffee, with roughly 312,803 hectares directly cleared for coffee.

This land-use change is now feeding back into the sector via declining rainfall and water stress. NASA data referenced in the same report indicate a 25% drop in soil moisture over six years in parts of Minas Gerais, Brazil’s main coffee state. Weather shocks and tight stocks translate into price swings that are hard to absorb in tightly specified single-origin contracts.

- Using International Coffee Organization data, analysts noted the ICO composite price index spiking to around 299.61 US cents per pound in 2024. USDA data show that world coffee production for 2024/25 was revised down by 500,000 bags to 174.4 million, reflecting vulnerability to weather and agronomic issues even before factoring in demand growth.

Opportunity

Fair pricing and impact storytelling around single-origin coffees

Single-origin coffee is perfectly positioned to carry a richer story about price, income, and impact back to the farm. Fairtrade and similar schemes are building the tools to make that story concrete. Coffee Impact at a Glance: member coffee cooperatives sold on average 35% of their coffee on Fairtrade terms, and raising this share is now a strategic priority to maximise benefits for farmers.

- Alongside this, Living Income Reference Prices for coffee were introduced. It had set 12 such reference prices across four products and 11 countries, giving buyers a benchmark for what farmers actually need to earn a decent living. Consumer willingness to pay for these values is also visible. The consumer value of Fairtrade-certified products reached about €331 million, a 6% rise on the previous year.

Single-origin coffee tied to a cooperative that follows these pricing and impact frameworks, it becomes much easier to explain to drinkers why the bag costs what it does and how that money is used. This opens space for higher-margin, relationship-driven products such as micro-lot single origins, long-term purchasing programmes, and direct-trade style partnerships backed by recognised standards.

Regional Analysis

North America leads with a 42.9% share and a USD 6.3 Billion market value.

North America holds the dominating position in the global Single-Origin Coffee Market, accounting for 42.9% share valued at around USD 6.3 billion. The region’s leadership is rooted in its mature specialty coffee culture, strong café network, and rapidly growing at-home brewing segment.

Consumers in the U.S. and Canada are highly receptive to premium, origin-specific coffees, driven by interest in flavour notes, brewing methods, and transparency on where beans are grown. This has encouraged roasters to build deep sourcing relationships with single farms and cooperatives, enabling a consistent pipeline of micro-lot and limited-edition offerings.

Supermarkets, online platforms, and subscription services increasingly allocate more space to single-origin lines, helping these products move from niche to mainstream shelves. At the same time, a younger, urban consumer base is willing to pay more for ethical sourcing, traceability, and sustainability, which aligns naturally with single-origin storytelling.

North America also benefits from a dense ecosystem of specialty roasters, barista schools, coffee festivals, and equipment brands that collectively educate consumers and reinforce value perception. Together, these factors keep North America at the forefront of innovation and volume growth in single-origin coffee, supporting its status as the key revenue-generating region in the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Peet’s leverages its heritage to champion single-origin coffees. It focuses on direct trade, building long-term relationships with growers to ensure quality and ethical sourcing. Their strategy emphasizes educating a mainstream audience about terroir and roast profiles through accessible retail locations and a strong online presence. Peet’s uses its single-origin offerings to reinforce its brand identity as a purveyor of complex.

Intelligentsia is revered for its direct-trade model and obsessive focus on traceability and quality. Its baristas are highly trained ambassadors who meticulously brew and serve single-origin lots, highlighting unique flavor notes. The company’s strategy is built on exclusivity, seasonality, and deep partnerships with farms, positioning its single-origins as premium, culinary-grade products for coffee connoisseurs and professionals.

Lavazza’s single-origin line offers consumers an entry into terroir-driven coffee with the convenience of supermarket availability and a trusted brand name. Their strategy focuses on curated selections from renowned regions, providing a consistent and approachable single-origin experience that complements their core blended products, thus capturing both traditional and curious new customers.

Top Key Players in the Market

- Peet’s Coffee

- Intelligentsia Coffee

- Lavazza

- Onyx Coffee Lab

- Stumptown Coffee Roasters

- Dunkin

- Blue Bottle Coffee

- Starbucks

- Heart Coffee Roasters

- Kraft Heinz

Recent Developments

- In 2025, Keurig Dr Pepper acquired JDE Peet’s (Peet’s parent company), aiming to create a global coffee giant. This move enhances Peet’s distribution for single-origin coffees like those from Guatemala and Kenya, potentially increasing access to traceable, terroir-specific beans.

- In 2025, Intelligentsia unveiled a state-of-the-art roastery in Chicago, featuring Probat and Gothot machines for flexible batch roasting of over 50 annual single-origins. This enhances traceability for coffees like Ethiopia Alaka Natural (berry-forward) and Bolivia Sol de la Mañana from sustainability award-winning projects.

Report Scope

Report Features Description Market Value (2024) USD 14.7 Billion Forecast Revenue (2034) USD 25.3 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ground Coffee, Whole Bean Coffee, Single-Serve Pods), By Processing Method (Washed, Natural, Honey, Pulped Natural), By Distribution Channel (Supermarkets, Online Retail, Specialty Coffee Shops, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Peet’s Coffee, Intelligentsia Coffee, Lavazza, Onyx Coffee Lab, Stumptown Coffee Roasters, Dunkin, Blue Bottle Coffee, Starbucks, Heart Coffee Roasters, Kraft Heinz Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Single-Origin Coffee MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Single-Origin Coffee MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Peet's Coffee

- Intelligentsia Coffee

- Lavazza

- Onyx Coffee Lab

- Stumptown Coffee Roasters

- Dunkin

- Blue Bottle Coffee

- Starbucks

- Heart Coffee Roasters

- Kraft Heinz