Global Single-Cell Omics Market By Product Type (Genomics, Proteomics, Transcriptomics and Metabolomics), By Application (Oncology, Neurology, Cell Biology and Immunology), By End-User (Academic & Research Organizations, Pharmaceutical & Biotechnology Companies, Hospital & Diagnostic Laboratories and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177150

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

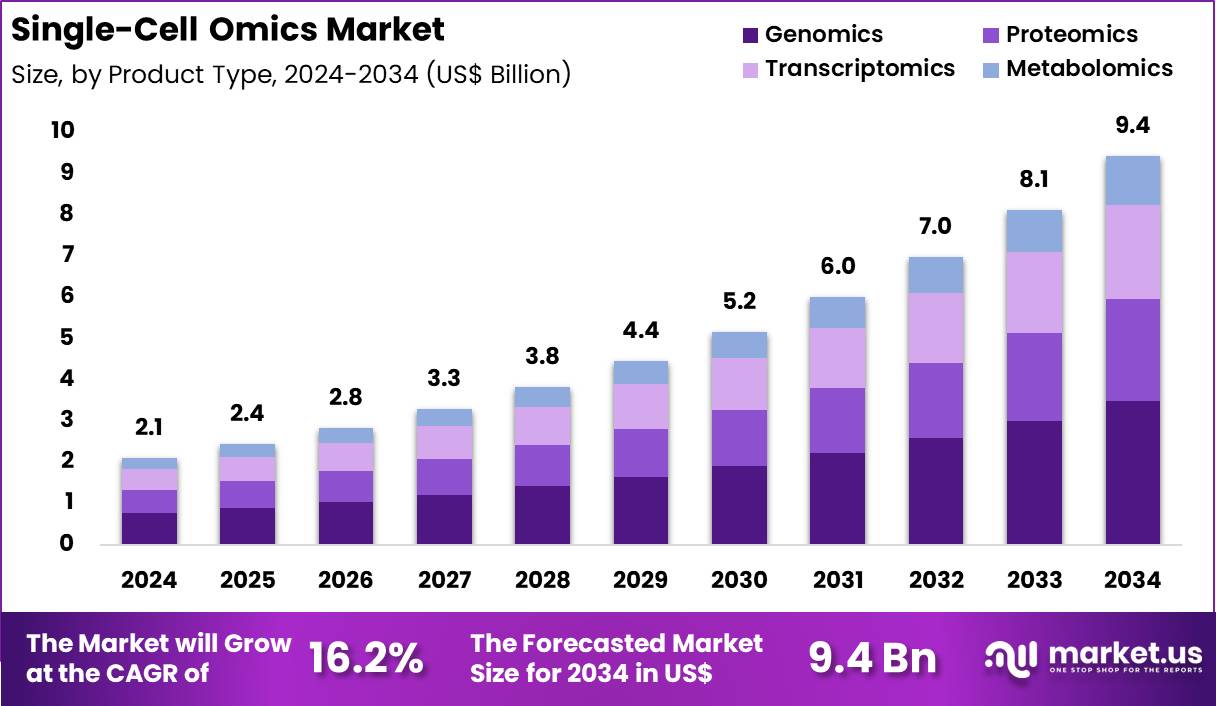

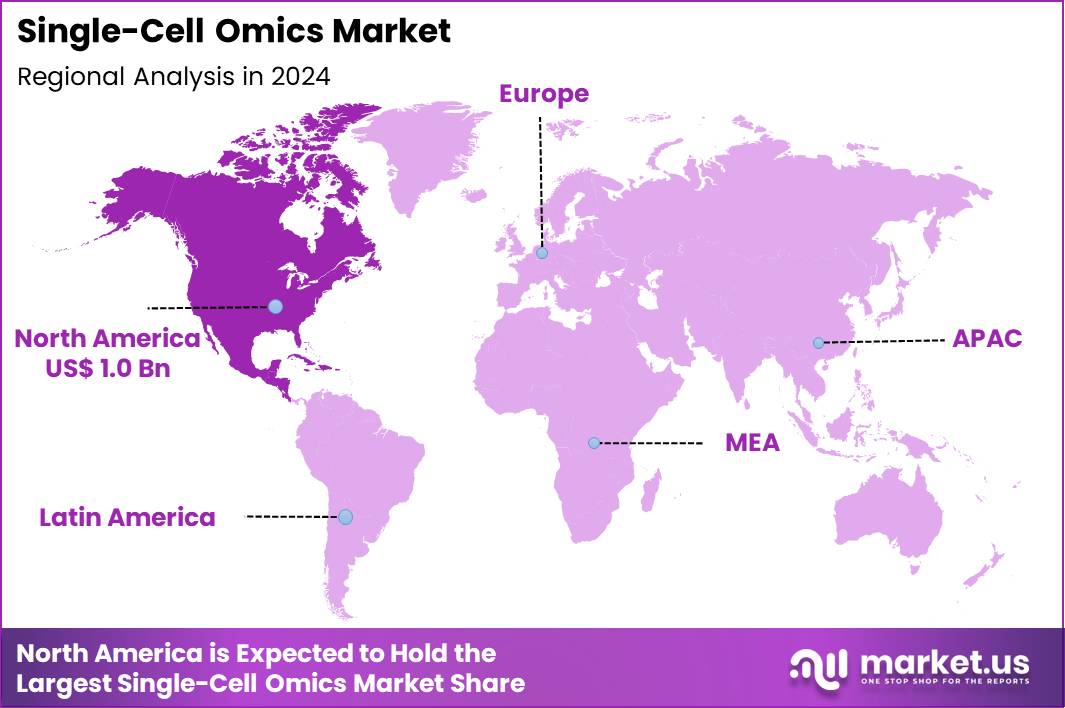

Global Single-Cell Omics Market size is expected to be worth around US$ 9.4 Billion by 2034 from US$ 2.1 Billion in 2024, growing at a CAGR of 16.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 46.1% share with a revenue of US$ 1.0 Billion.

Increasing demand for cellular heterogeneity insights accelerates the single-cell omics market as researchers prioritize techniques that dissect individual cell transcriptomes, proteomes, and epigenomes to uncover disease-specific subpopulations.

Scientists increasingly apply single-cell RNA sequencing to map immune cell diversity in tumor microenvironments, identifying exhausted T cells and guiding checkpoint inhibitor therapies in solid malignancies. These methods support spatial single-cell proteomics in neurodegenerative research, revealing protein expression gradients in brain tissues to pinpoint neuronal vulnerability in Parkinson’s and Alzheimer’s models.

Clinicians utilize single-cell epigenomics to profile chromatin accessibility in hematopoietic stem cells, informing stem cell transplantation strategies for blood disorders. Developmental biologists employ multi-omic single-cell approaches to trace lineage trajectories in embryogenesis, advancing regenerative medicine by identifying progenitor states for tissue engineering.

Pharmaceutical developers integrate single-cell genomics into drug screening assays, evaluating cellular responses at granular levels to optimize lead compounds for autoimmune conditions. Manufacturers pursue opportunities to develop integrated multi-omic platforms that combine transcriptomics with metabolomics, expanding applications in precision oncology where simultaneous profiling reveals metabolic dependencies in rare cancer subtypes.

Developers advance high-throughput droplet-based systems that scale cell isolation, broadening utility in large cohort studies of inflammatory diseases to correlate single-cell profiles with clinical outcomes. These innovations facilitate AI-driven data analysis pipelines that cluster cells and predict therapeutic responses, supporting companion diagnostic development.

Opportunities emerge in portable single-cell sequencers for field-based infectious disease monitoring, enabling rapid pathogen-host interaction mapping. Companies invest in user-friendly kits that minimize batch effects, enhancing reproducibility across collaborative research networks. Recent trends emphasize long-read single-cell sequencing that captures full-length isoforms, positioning the market for breakthroughs in alternative splicing studies and novel isoform-targeted therapies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.1 Billion, with a CAGR of 16.2%, and is expected to reach US$ 9.4 Billion by the year 2034.

- The product type segment is divided into genomics, proteomics, transcriptomics and metabolomics, with genomics taking the lead with a market share of 36.9%.

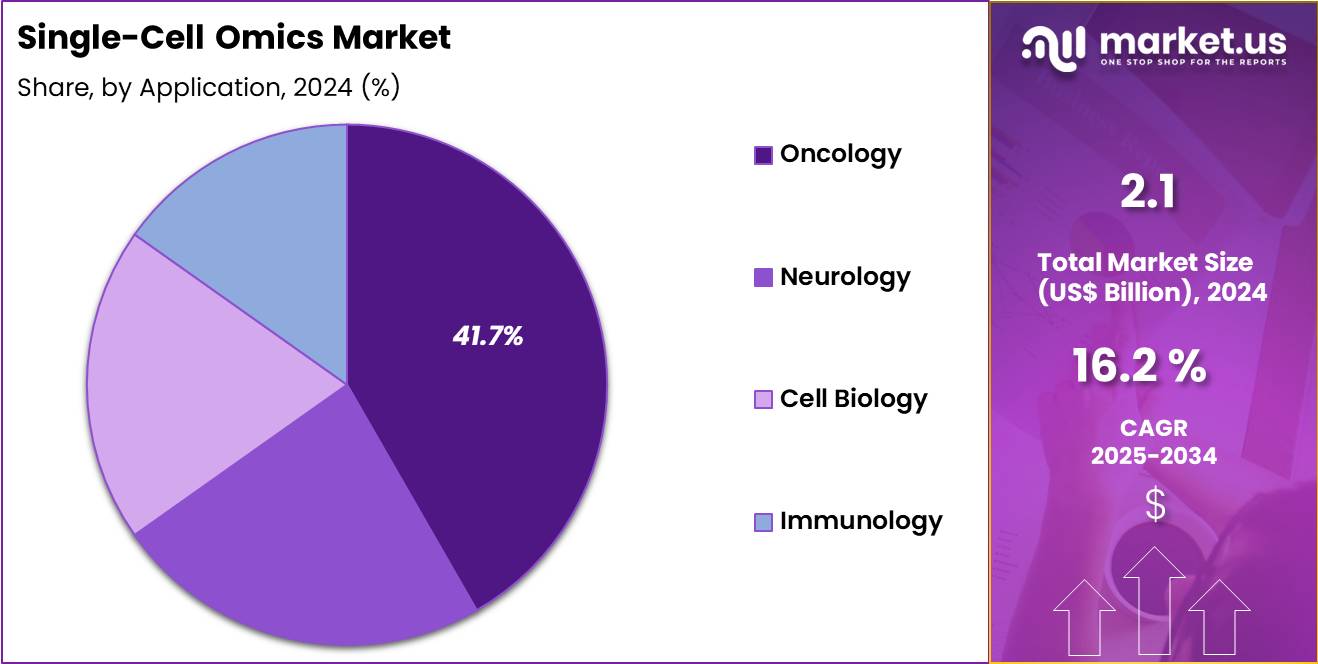

- Considering application, the market is divided into oncology, neurology, cell biology and immunology. Among these, oncology held a significant share of 41.7%.

- Furthermore, concerning the end-user segment, the market is segregated into academic & research organizations, pharmaceutical & biotechnology companies, hospital & diagnostic laboratories and others. The academic & research organizations sector stands out as the dominant player, holding the largest revenue share of 48.8% in the market.

- North America led the market by securing a market share of 46.1%.

Product Type Analysis

Genomics contributed 36.9% of growth within product type and led the single-cell omics market due to its foundational role in understanding cellular heterogeneity and genetic variation at single-cell resolution. Researchers rely on single-cell genomics to study mutation patterns, clonal evolution, and gene regulation across complex tissues.

Rapid adoption of next-generation sequencing platforms increases throughput and lowers per-sample cost, which expands study scale. Funding agencies prioritize genomics-focused projects because they deliver high-impact insights into disease mechanisms and developmental biology.

Growth strengthens as multi-omics studies increasingly anchor workflows around genomic data. Improved library preparation methods enhance sensitivity and data quality from low-input samples. Large consortium-driven projects drive recurring demand for genomic reagents and analysis tools.

Training programs and standardized protocols further reinforce adoption. The segment is expected to remain dominant as genomics continues to serve as the entry point for most single-cell investigations.

Application Analysis

Oncology generated 41.7% of growth within application and emerged as the leading segment due to the need to characterize tumor heterogeneity and treatment resistance at cellular resolution. Single-cell omics enables detailed profiling of cancer cell subpopulations and tumor microenvironments, which supports precision oncology research.

Researchers apply these tools to identify rare malignant clones and immune escape mechanisms. Rising cancer research funding and translational focus accelerate adoption across academic and clinical research settings.

Growth accelerates as drug development programs integrate single-cell data to guide target discovery and biomarker validation. Immuno-oncology studies increasingly depend on single-cell analysis to map immune responses within tumors.

Clinical trial design benefits from insights into response variability at the cellular level. Collaboration between academia and industry expands study volumes. The segment is anticipated to maintain leadership as oncology research continues to demand high-resolution cellular insights.

End-User Analysis

Academic and research organizations accounted for 48.8% of growth within end-user and dominated the single-cell omics market due to their central role in method development and exploratory research. Universities and research institutes lead large-scale cell atlas and systems biology projects that require extensive single-cell profiling. Grant-funded research supports early adoption of emerging platforms and workflows. Academic settings also drive innovation through protocol optimization and data interpretation.

Growth continues as governments and foundations expand funding for fundamental life science research. Shared core facilities increase access to advanced single-cell technologies across departments. Publication-driven research incentives reinforce sustained usage. Training of skilled researchers further accelerates technology diffusion. The segment is projected to remain the primary growth driver as academic institutions continue to anchor discovery-focused single-cell research.

Key Market Segments

By Product Type

- Genomics

- Proteomics

- Transcriptomics

- Metabolomics

By Application

- Oncology

- Neurology

- Cell Biology

- Immunology

By End-User

- Academic & Research Organizations

- Pharmaceutical & Biotechnology Companies

- Hospital & Diagnostic Laboratories

- Others

Drivers

Increasing adoption of single-cell technologies in research is driving the market.

The widespread implementation of single-cell omics tools in academic and industrial research has substantially boosted market expansion by enabling detailed cellular analysis for disease understanding and drug discovery. Enhanced resolution in profiling individual cells supports breakthroughs in oncology and immunology, attracting investments from biotechnology sectors.

Healthcare researchers utilize these technologies to uncover heterogeneity in tissues, facilitating targeted therapeutic development. Key players are expanding their product offerings to meet the rising demand for high-throughput sequencing platforms. The correlation between technological accessibility and research productivity further accelerates adoption rates across laboratories.

Government initiatives in genomics research contribute to the integration of single-cell methods in large-scale projects. 10x Genomics reported revenue of $618.7 million in 2023, a 19.81% increase from $516.4 million in 2022. This growth reflects the escalating utilization of single-cell solutions in experimental workflows. Overall, the adoption trend underpins sustained innovation and market progression in omics applications. This driver interconnects with global efforts to advance precision medicine through cellular insights.

Restraints

High complexity in data analysis is restraining the market.

The intricate nature of single-cell omics datasets requires advanced bioinformatics expertise, limiting accessibility for standard research facilities. Variations in data processing pipelines pose challenges to reproducible results across studies. Regulatory standards for validation in clinical applications add complexity to technology transfer.

Smaller institutions often lack computational resources for handling large-scale omics information. Pre-analytical factors, including cell isolation variability, complicate downstream interpretations. The absence of standardized algorithms hinders collaborative efforts in multi-center research. This restraint slows the translation of findings into practical applications.

Industry partnerships aim to develop user-friendly software to address these issues gradually. Despite scientific promise, analytical hurdles impede rapid market penetration. Ensuring data integrity remains critical for overcoming this limitation.

Opportunities

Rising investments in biotechnology research is creating growth opportunities.

The surge in funding for biotechnological advancements provides avenues for single-cell omics integration in novel therapeutic and diagnostic developments. Governmental allocations to life sciences support the deployment of omics technologies in precision medicine initiatives. Increasing collaborations between academia and industry facilitate the commercialization of single-cell platforms.

Bio-Rad Laboratories reported revenue of $2,671 million in 2023, a decrease from $2,802 million in 2022, yet maintaining focus on omics innovations. This financial commitment underscores opportunities for expanded research applications in diverse fields. Local incentives for biotech hubs enhance the adoption of single-cell tools in emerging projects.

The substantial research base in developed economies amplifies prospects for technology refinements. Reforms in funding policies strengthen infrastructure for omics studies. Primary corporations initiate expansions to capitalize on investment trends. This opportunity harmonizes with endeavors to advance personalized healthcare solutions.

Impact of Macroeconomic / Geopolitical Factors

Broader economic forces influence the single cell omics market by shaping research budgets, capital availability, and spending discipline across life science organizations. Persistent inflation and elevated interest rates reduce venture funding velocity and stretch grant timelines, which slows adoption of new platforms and consumables.

Geopolitical uncertainty affects access to microfluidic devices, specialty reagents, enzymes, and advanced computing components, adding supply risk and cost variability. Current US tariffs on imported instruments and subsystems increase upfront and operating expenses, which places pressure on vendor margins and buyer approvals. These challenges weigh most on early stage labs and smaller service providers.

On the positive side, tariff pressure accelerates local manufacturing, multi sourcing strategies, and cloud based analysis that reduces hardware dependence. Growing demand for high resolution cellular insights in precision medicine and drug development keeps strategic interest strong. With focused cost control, scalable workflows, and strong scientific pull, the market maintains a confident path forward.

Latest Trends

Integration of artificial intelligence in data analysis is a recent trend in the market.

In 2024, the incorporation of AI algorithms has advanced the interpretation of single-cell omics data by automating pattern recognition in complex datasets. These systems enhance the identification of cellular subtypes through machine learning techniques applied to multi-omics profiles. Manufacturers are prioritizing AI integrations to streamline workflows in high-throughput environments.

Clinical studies demonstrated improved accuracy in trajectory inference using AI-driven models. A comprehensive review published in 2024 highlighted foundation models revolutionizing multimodal integration in single-cell analysis. This innovation addresses challenges in handling data sparsity and batch effects.

Enterprises focus on scalable AI solutions for real-time processing of large-scale experiments. Regulatory considerations are evolving to validate AI outputs in biological research. Sector alliances refine models for enhanced predictive capabilities in disease modeling. These developments aim to elevate efficiency while maintaining analytical rigor in omics investigations.

Regional Analysis

North America is leading the Single-Cell Omics Market

North America holds a 46.1% share of the global Single-Cell Omics market, marking substantial advancement in 2024 due to burgeoning applications in immunology and neuroscience, where techniques like spatial transcriptomics elucidate cellular interactions at unprecedented granularity for disease modeling.

Prominent organizations such as 10x Genomics and Fluidigm have refined droplet-based platforms and microfluidic chips, enabling scalable analyses that support drug screening and biomarker identification in autoimmune disorders. The region’s dense ecosystem of venture-backed startups has accelerated commercialization of multi-omic integrations, combining proteomics with epigenomics to dissect stem cell differentiation pathways.

Federal mandates emphasizing data sharing through repositories like the NCBI have fostered collaborative studies, amplifying discoveries in viral pathogenesis. An influx of academic publications has validated machine learning algorithms for noise reduction in single-cell datasets, enhancing reproducibility across labs. Industry consortia have prioritized standardization of workflows, mitigating batch effects in large cohort studies for population genetics.

Furthermore, telemedicine integrations have extended omics insights to clinical decision-making, optimizing patient stratification in trials. The National Institutes of Health awarded approximately $207 million in 2024 to the High-Risk, High-Reward Research program, supporting innovative projects including single-cell technologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts predict considerable escalation in the high-resolution genomics arena throughout Asia Pacific over the forecast period, because officials prioritize infrastructure enhancements for precision diagnostics amid surging chronic illness rates. Corporations in Taiwan and Indonesia devise automated sequencing workflows that streamline sample processing for tumor heterogeneity mapping, while researchers in Cambodia align datasets with clinical outcomes to advance immunotherapy designs.

Healthcare systems in Laos procure cloud-based analytics tools that facilitate collaborative variant interpretations, targeting hereditary conditions in diverse ethnic groups. Contributors in Papua New Guinea subsidize lab expansions equipped with multiplexing kits, enabling cost-effective profiling of infectious agents.

Administrators in Fiji enact incentives for biotech firms to localize reagent production, ensuring supply chain resilience during regional shortages. Scientists in Timor-Leste experiment with hybrid assays that merge transcriptomics with metabolomics, refining models for environmental toxin impacts.

Producers in Macao calibrate instruments for high-throughput throughput, capturing market opportunities in aging societies. The Chinese government allocated at least CNY 20 billion to biotechnology research in 2023, propelling developments in advanced cellular analytics.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the single-cell omics market grow by advancing high-throughput platforms, enhancing multi-modal analytics, and optimizing workflows that deliver deeper cellular insight with greater speed and reproducibility for research and clinical applications. They also strengthen customer value by bundling instrumentation with cloud-based data tools and standardized reagents that accelerate study design and cross-project comparability.

Companies expand commercial reach by forming strategic alliances with academic consortia, biopharma innovators, and translational research centers to embed their solutions in flagship discovery programs. Geographic expansion into North America, Europe, and Asia Pacific broadens addressable demand and captures rising investments in precision medicine and cell biology.

10x Genomics exemplifies a specialized life sciences technology firm with a comprehensive portfolio of single-cell analysis products, a robust global distribution network, and a coordinated commercialization strategy that aligns innovation with evolving research priorities. The company sustains momentum through disciplined research and development funding, targeted collaborations, and a customer-centric approach that connects technological advances with real-world scientific needs.

Top Key Players

- 10x Genomics

- Thermo Fisher Scientific

- Illumina

- Becton Dickinson

- Bio-Rad Laboratories

- Agilent Technologies

- Fluidigm

- Standard BioTools

- Mission Bio

- Takara Bio

Recent Developments

- In October 2024, Pacific Biosciences expanded the reach of its PacBio Onso short-read sequencing system by introducing it within the 10x Genomics Compatible Partner Program. The move enables tighter interoperability with established single-cell and spatial genomics workflows, supporting broader adoption of the platform in multi-omics research.

- In October 2024, Vizgen and Ultivue announced a merger aimed at unifying their capabilities in spatial biology. By combining complementary technologies and expertise, the merged entity seeks to accelerate innovation and deepen analytical power across spatial multi-omics applications.

- In February 2024, Roche led a USD 257 million funding round for Freenome to advance early cancer detection initiatives. The investment supports the development and validation of Freenome’s multi-omics platform, which integrates molecular and immune-based signals for earlier and more accurate cancer screening.

Report Scope

Report Features Description Market Value (2024) US$ 2.1 Billion Forecast Revenue (2034) US$ 9.4 Billion CAGR (2025-2034) 16.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Genomics, Proteomics, Transcriptomics and Metabolomics), By Application (Oncology, Neurology, Cell Biology and Immunology), By End-User (Academic & Research Organizations, Pharmaceutical & Biotechnology Companies, Hospital & Diagnostic Laboratories and Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape 10x Genomics, Thermo Fisher Scientific, Illumina, Becton Dickinson, Bio-Rad Laboratories, Agilent Technologies, Fluidigm, Standard BioTools, Mission Bio, Takara Bio Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 10x Genomics

- Thermo Fisher Scientific

- Illumina

- Becton Dickinson

- Bio-Rad Laboratories

- Agilent Technologies

- Fluidigm

- Standard BioTools

- Mission Bio

- Takara Bio