Global Silver Nitrate Market By Grade (Analytical Reagent Grade, USP Grade, Technical Grade), By Purity (99.5%, 99.8%, 99.9%), By Form (Solid, Liquid), By Application (Photography and Jewelry, Inks and Dyes, Ceramics, Anti-Infective Agent, Polished Mirrors, Others), By End-use (Medical And Pharmaceutical, Chemical, Glass, Textile, Others), By Sales Channel (Direct Sales, Indirect Sales) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134400

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

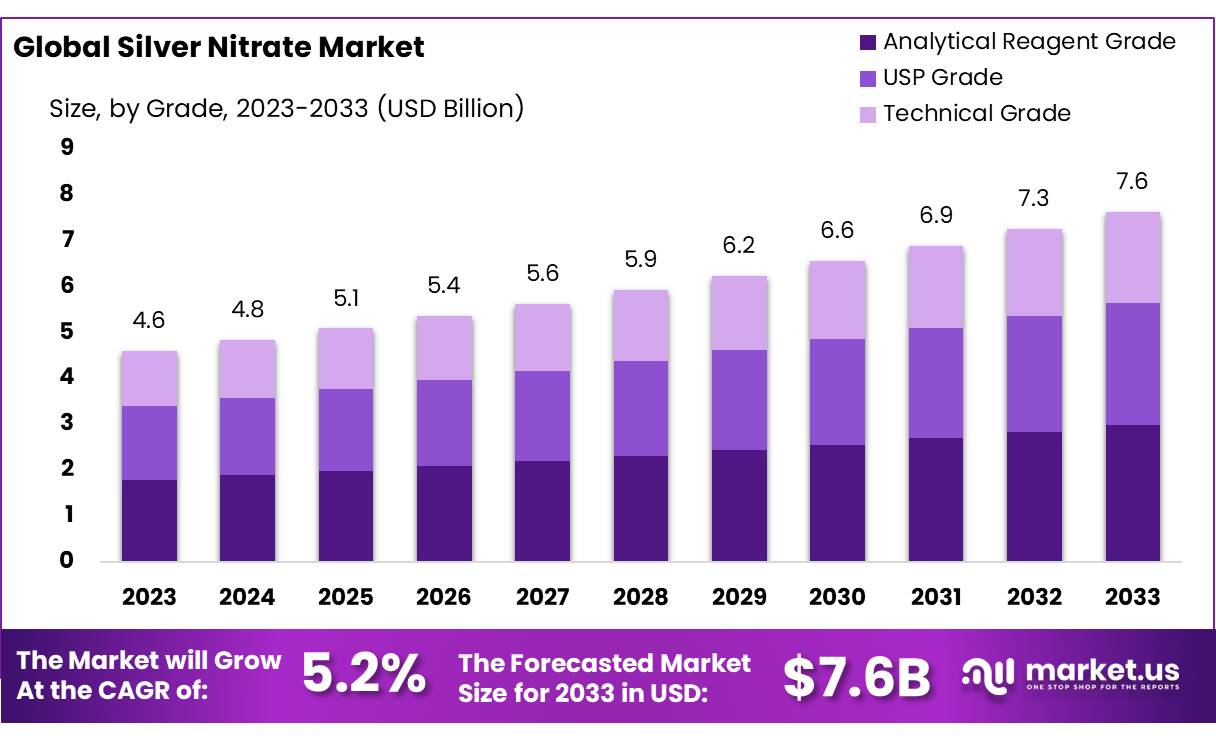

The Global Silver Nitrate Market size is expected to be worth around USD 7.6 Bn by 2033, from USD 4.6 Bn in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

Silver nitrate (AgNO₃) is a chemical compound composed of silver, nitrogen, and oxygen, and it has a wide range of uses in various industries. Historically, it has been used in medicine as an antiseptic for wound treatment and to prevent neonatal eye infections.

In photography, silver nitrate is crucial as it is light-sensitive and forms the foundation for photographic films and papers. It is also used in chemical analysis as a reagent to identify halides, such as chloride and bromide, in laboratory environments.

In 2023, global trade in silver nitrate demonstrated significant activity, with the United States, China, and Germany being the primary importers. China, in particular, emerged as the largest importer, accounting for nearly 30% of global imports.

Meanwhile, India and Mexico were key exporters, with both countries collectively exporting approximately USD 40 million in silver nitrate. This export growth indicates the increasing use of silver nitrate in manufacturing and industrial sectors, including electronics and medical applications.

Government regulations also play a significant role in shaping the silver nitrate market. In the United States, the FDA has established strict guidelines for its use, especially in medical treatments. The European Union has also enacted regulations limiting certain silver compounds in consumer products like textiles and water treatment, aiming to reduce their environmental impact.

These regulations are expected to influence future demand and market dynamics, potentially steering investments toward more sustainable practices.

Regarding investments, companies like Shaanxi Top Pharm Chemical Co., Hunan Jinhua Chemical Group, and Sigma-Aldrich are making strategic moves to expand their silver nitrate production capacities. In 2023, Shaanxi Top Pharm invested around USD 10 million to increase production, responding to growing demand from the electronics and medical sectors. Additionally, Sigma-Aldrich made an acquisition in 2023, strengthening its market presence by acquiring a leading supplier of fine chemicals for the electronics industry.

In terms of global trade, silver nitrate imports in 2023 exceeded USD 214 million, while global exports reached over USD 312 million, with the United Kingdom accounting for approximately 40.31% of exports. Other notable exporters include the Netherlands (USD 53.07 million) and Belgium (USD 34.49 million). These figures reflect a robust and expanding market for silver nitrate worldwide.

Key Takeaways

- Silver Nitrate Market size is expected to be worth around USD 7.6 Bn by 2033, from USD 4.6 Bn in 2023, growing at a CAGR of 5.2%.

- Analytical Reagent Grade held a dominant market position, capturing more than 38.2% of the global Silver Nitrate Market.

- 99.5% purity grade held a dominant market position, capturing more than 46.4% of the global Silver Nitrate Market.

- Solid form held a dominant market position, capturing more than 59.2% of the global Silver Nitrate Market.

- Photography & Jewelry held a dominant market position, capturing more than 29.3% of the global Silver Nitrate Market.

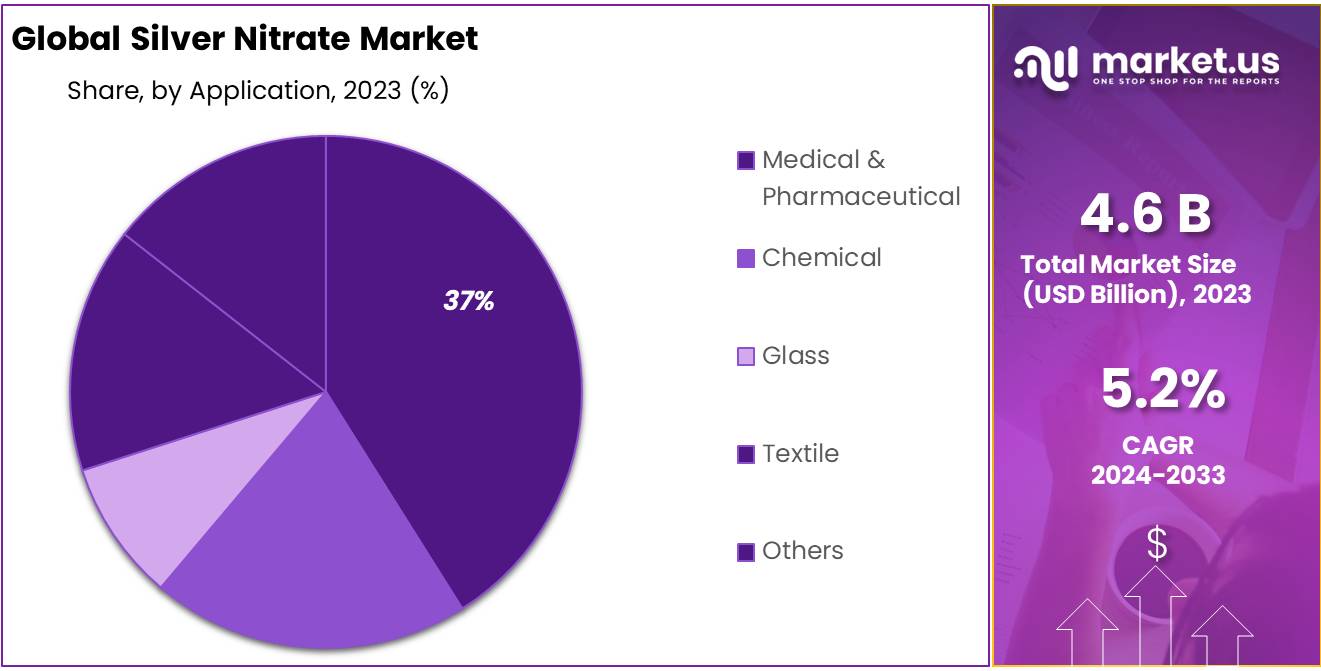

- Medical & Pharmaceutical held a dominant market position, capturing more than 37.2% of the global Silver Nitrate Market.

- Direct Sales held a dominant market position, capturing more than 65.2% of the global Silver Nitrate Market.

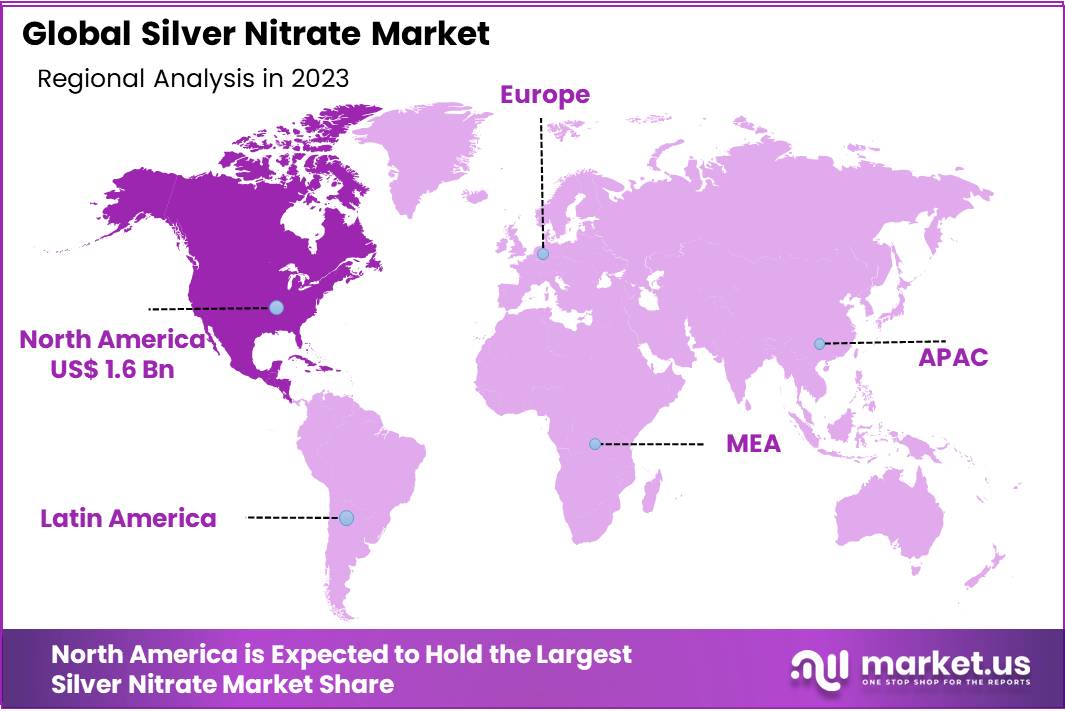

- North America dominated the global Silver Nitrate market in 2023, holding a market share of 35.4%, valued at USD 1.6 billion.

By Grade

In 2023, Analytical Reagent Grade held a dominant market position, capturing more than 38.2% of the global Silver Nitrate Market. This grade is widely used in laboratories for precise chemical analysis. Its high purity and accuracy in results make it essential for research and testing purposes. The demand is driven by its critical role in various analytical procedures, particularly in chemical and environmental testing.

USP Grade followed as the second-largest segment. It accounted for a significant share of the market in 2023. This grade is mainly used in pharmaceuticals and healthcare applications. Its strict quality standards ensure safety and efficacy in medical products. As the pharmaceutical industry expands, the demand for USP Grade Silver Nitrate is expected to grow steadily.

The Technical Grade segment also held a substantial portion of the market, catering primarily to industrial applications. It is used in various sectors such as electronics, photography, and manufacturing. Although it lacks the high purity of the other grades, its cost-effectiveness makes it a preferred choice for large-scale industrial processes. The increasing use of Silver Nitrate in electronic and photographic applications is driving growth in this segment.

By Purity

In 2023, 99.5% purity grade held a dominant market position, capturing more than 46.4% of the global Silver Nitrate Market. This grade is widely used in industrial applications due to its cost-effectiveness and suitability for large-scale processes. It is primarily used in manufacturing, photography, and other sectors where slightly lower purity levels do not compromise performance.

The 99.8% purity grade followed closely behind, accounting for a significant share of the market. This grade is often used in more specialized applications, such as chemical synthesis and laboratory experiments. Its higher purity makes it more desirable for precise tasks where accuracy is important, such as in analytical procedures and certain pharmaceutical processes.

The 99.9% purity grade also holds a considerable portion of the market, driven by its use in high-precision industries. This grade is commonly found in applications requiring the highest quality, such as in medical and electronic sectors. Its superior purity makes it ideal for critical uses where even the smallest impurities can affect the results or performance. The demand for 99.9% purity Silver Nitrate is expected to grow as the need for advanced technology and pharmaceutical products increases.

By Form

In 2023, Solid form held a dominant market position, capturing more than 59.2% of the global Silver Nitrate Market. The solid form is widely used due to its stability and ease of handling, making it the preferred choice for most industrial and laboratory applications. It is commonly found in manufacturing, chemical synthesis, and photographic industries, where precise measurements and storage are critical.

The Liquid form, while smaller in market share, is also significant. It accounted for a substantial portion of the market in 2023. The liquid form offers easier application in certain processes, particularly in chemical reactions and medical treatments.

Its ability to dissolve more rapidly and be applied in controlled amounts is driving its demand, especially in pharmaceutical and analytical sectors where liquid solutions are more convenient. The growth of the pharmaceutical and medical sectors is expected to further boost the liquid form’s market presence.

By Application

In 2023, Photography & Jewelry held a dominant market position, capturing more than 29.3% of the global Silver Nitrate Market. This application remains the largest due to Silver Nitrate’s vital role in the production of photographic films and papers, as well as its use in the jewelry industry for creating high-quality silver alloys. The demand in these sectors continues to drive market growth.

The Inks & Dyes segment followed closely behind, accounting for a significant share of the market. Silver Nitrate is used in the production of inks and dyes due to its ability to create vibrant colors and its role as a precursor in the synthesis of silver-based dyes. As the demand for specialized inks, particularly in the printing and textile industries, grows, this segment is expected to expand further.

The Ceramics segment also holds a notable share. Silver Nitrate is used in ceramics for its antibacterial properties and to enhance the aesthetic qualities of finished products. The growing demand for decorative ceramics and high-end pottery is contributing to the growth of this segment.

In the Anti-Infective Agent application, Silver Nitrate is used for its antiseptic properties, particularly in wound care and burn treatments. Although this segment is smaller, it has been steadily growing due to increasing demand for silver-based medical products.

The Polished Mirrors segment is another key application, as Silver Nitrate is used to create highly reflective surfaces in mirrors and optical instruments. Its demand is primarily driven by advancements in the optical and mirror industries.

By End-use

In 2023, Medical & Pharmaceutical held a dominant market position, capturing more than 37.2% of the global Silver Nitrate Market. This segment’s growth is driven by Silver Nitrate’s use in wound care, burn treatments, and its antiseptic properties in medical applications. It also plays a significant role in the production of pharmaceutical products. As healthcare needs continue to rise, the demand for Silver Nitrate in medical and pharmaceutical applications is expected to expand.

The Chemical segment followed closely, accounting for a significant share. Silver Nitrate is used as a catalyst in various chemical reactions, particularly in the production of other silver compounds and in organic synthesis. The increasing use of Silver Nitrate in chemical manufacturing, driven by industrial growth, supports this segment’s steady demand.

In the Glass industry, Silver Nitrate is used for its ability to create high-quality reflective coatings and enhance the aesthetic properties of glass products. This application is particularly significant in the production of mirrors and decorative glass. The growing demand for advanced glass products in architecture and electronics is boosting this segment.

The Textile segment also holds a notable share of the market. Silver Nitrate is used in textile dyeing and finishing, particularly in the production of antimicrobial fabrics. As consumer demand for functional and sustainable textiles rises, the market for Silver Nitrate in this sector is expected to grow.

By Sales Channel

In 2023, Direct Sales held a dominant market position, capturing more than 65.2% of the global Silver Nitrate Market. This sales channel is preferred by manufacturers and large-scale buyers due to the ability to negotiate prices, streamline orders, and ensure product quality directly from the supplier. The demand for bulk purchasing in industries such as pharmaceuticals, chemicals, and photography further supports the dominance of direct sales.

The Indirect Sales channel, while smaller, accounted for a significant portion of the market. Indirect sales typically involve distributors, wholesalers, and retail channels. This method is particularly popular in reaching smaller businesses or end-users who may not need to buy in large quantities. As the market for Silver Nitrate continues to expand globally, indirect sales are expected to play a key role in reaching new regions and sectors.

Key Market Segments

By Grade

- Analytical Reagent Grade

- USP Grade

- Technical Grade

By Purity

- 99.5%

- 99.8%

- 99.9%

By Form

- Solid

- Liquid

By Application

- Photography & Jewelry

- Inks & Dyes

- Ceramics

- Anti-Infective Agent

- Polished Mirrors

- Others

By End-use

- Medical & Pharmaceutical

- Chemical

- Glass

- Textile

- Others

By Sales Channel

- Direct Sales

- Indirect Sales

Drivers

Increasing Demand in the Medical & Pharmaceutical Sector

One of the major driving factors for the growth of the Silver Nitrate market is its increasing demand in the medical and pharmaceutical sectors. Silver Nitrate has been widely used in medical applications due to its antiseptic and antimicrobial properties, particularly in wound care and burn treatments. The growing focus on healthcare, particularly in wound management, has significantly driven the demand for Silver Nitrate.

According to the World Health Organization (WHO), there are approximately 10 million burn cases annually worldwide, many of which require antiseptic treatments to prevent infection. Silver Nitrate, known for its antibacterial properties, is a key component in these treatments. Additionally, the increasing prevalence of chronic wounds, especially in elderly populations, has further contributed to the demand for this compound.

Expanding Use in Chemical and Industrial Applications

Silver Nitrate also benefits from expanding demand in chemical and industrial applications. Its role in catalyzing chemical reactions and as a precursor in the production of other silver compounds makes it essential for numerous industrial processes.

According to the U.S. Department of Energy, Silver Nitrate is used in various chemical manufacturing processes, including the production of silver oxide and other silver salts, which are crucial in electronics, batteries, and solar energy applications. The growth in industries such as electronics, energy, and photovoltaics is expected to continue increasing the demand for Silver Nitrate.

Moreover, the rising adoption of solar energy systems, particularly in regions such as the U.S., Europe, and Asia, where solar panel installations are on the rise, further accelerates the need for Silver Nitrate. The solar energy market is expected to grow at a 20% CAGR from 2023 to 2030, increasing the demand for materials like Silver Nitrate in photovoltaic manufacturing.

Government Support and Initiatives

Government initiatives and regulatory frameworks also play a key role in supporting the Silver Nitrate market. In the U.S., the Food and Drug Administration (FDA) has set strict guidelines and standards for the use of Silver Nitrate in medical applications, ensuring the quality and safety of Silver Nitrate products. The FDA’s approval of Silver Nitrate for use in burn treatment and other medical applications increases its market credibility and contributes to higher adoption rates in healthcare.

Moreover, several governments are investing in the renewable energy sector, particularly in solar power, where Silver Nitrate plays an important role in the manufacturing of photovoltaic cells. The European Union has announced €30 billion in funding for renewable energy projects as part of its Green Deal initiative, which is likely to boost the demand for materials like Silver Nitrate in solar panel manufacturing. The increasing support for green energy solutions will further stimulate the market for Silver Nitrate in the coming years.

Restraints

High Production Costs Impacting Market Growth

One of the significant restraining factors for the growth of the Silver Nitrate market is the high production cost associated with its manufacturing. Silver Nitrate is produced using silver as a primary raw material, and the price of silver is inherently volatile, influencing the cost structure of Silver Nitrate.

As of 2023, the price of silver has fluctuated between $22 and $30 per ounce, with significant price spikes in response to geopolitical events and market instability. According to the U.S. Geological Survey (USGS), the average price of silver increased by 8.5% in 2023 compared to the previous year, contributing to higher production costs for Silver Nitrate manufacturers.

Environmental Regulations and Sustainability Concerns

Environmental concerns and stringent regulations surrounding chemical products, including Silver Nitrate, pose another restraint on the market’s growth. Silver Nitrate production involves the use of hazardous chemicals, which, if not properly managed, can lead to environmental pollution. The European Union’s REACH regulations and similar standards in other regions require manufacturers to comply with strict guidelines concerning the safe production, transportation, and disposal of chemical compounds.

For example, in the EU, REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) imposes significant compliance costs on manufacturers to ensure their products meet safety standards, particularly when used in applications such as medical treatments and photography.

These regulations often require additional testing and certification processes, which increase the overall costs for manufacturers. In addition, waste disposal and the safe handling of by-products generated during the manufacturing process of Silver Nitrate have become significant areas of concern.

The global push for sustainability is also adding pressure on the Silver Nitrate industry. The U.S. Environmental Protection Agency (EPA) and other regulatory bodies are increasingly focusing on reducing the environmental footprint of chemical manufacturing.

Competition from Alternative Chemical Products

The Silver Nitrate market faces significant competition from alternative chemicals that serve similar functions in various applications, such as medical treatments, photography, and electronics. For instance, in the medical sector, silver sulfadiazine and silver-based dressings are increasingly being used as alternatives to Silver Nitrate for treating wounds and burns.

According to the World Health Organization (WHO), the global market for wound care products is expected to reach $22.6 billion by 2027, with a growing share of this market moving towards alternative silver-based treatments. This shift is driven by the effectiveness of alternative silver compounds in providing antimicrobial benefits while minimizing the toxicity that can occur with Silver Nitrate.

In the electronics and photovoltaics industry, Silver Nitrate competes with other silver compounds, such as silver chloride and silver oxide, which are used as conductors and in the production of photovoltaic cells.

The solar energy market, valued at $130 billion in 2023, is projected to continue expanding, with the growth of solar cell production driving the demand for silver-based chemicals other than Silver Nitrate.

Market Volatility and Geopolitical Uncertainty

The Silver Nitrate market is also negatively impacted by market volatility and geopolitical uncertainty. The price of silver, which forms a significant portion of the production cost of Silver Nitrate, is subject to global economic factors, including global supply-demand dynamics, economic sanctions, and trade disputes.

For example, in 2023, global silver prices rose sharply in response to economic disruptions and supply chain issues in Latin American silver-producing countries, including Mexico and Peru, which together account for more than 40% of global silver production.

Opportunity

Growing Demand for Silver Nitrate in Medical Applications

One of the key growth opportunities for the Silver Nitrate market is the increasing demand for silver-based medical products. Silver Nitrate is widely used in medical applications due to its antimicrobial properties, especially in wound care, burn treatments, and eye care.

According to the World Health Organization (WHO), approximately 450 million people globally suffer from chronic wounds, which create a substantial need for effective wound care solutions. Silver Nitrate, used in silver-based dressings and ointments, is proven to prevent infections and accelerate the healing process.

Governments and international health organizations are increasingly focusing on enhancing healthcare access in developing regions. For instance, in 2023, the United Nations Children’s Fund (UNICEF) launched new initiatives to provide silver-based wound care products in conflict zones and low-income countries.

Increase in Demand for Silver Nitrate in the Electronics Industry

The rise in the electronics industry, particularly in photovoltaics and semiconductors, represents another significant growth opportunity for the Silver Nitrate market. Silver Nitrate is used in the production of silver paste for solar cells and as a conductive material in electronics manufacturing.

According to the International Energy Agency (IEA), the global solar energy market was valued at $130 billion in 2023 and is expected to continue growing at a 10% CAGR through 2030. This growth directly contributes to the demand for silver-based materials, including Silver Nitrate, used in the production of solar panels.

The electronics market is also growing rapidly, with the global semiconductor industry expected to reach $1 trillion by 2030. Silver Nitrate is integral in soldering applications, printed circuit boards (PCBs), and high-performance semiconductors.

Growing Use of Silver Nitrate in Agricultural and Food Safety Applications

Silver Nitrate’s antimicrobial properties are increasingly being utilized in agriculture and food safety applications. Silver Nitrate is used in post-harvest treatments to extend the shelf life of fresh produce by reducing bacterial growth.

According to the Food and Agriculture Organization (FAO), the global market for post-harvest treatments is expected to grow from $14 billion in 2023 to $20 billion by 2028, with silver-based products playing a key role in the food preservation process.

Additionally, Silver Nitrate is utilized in food packaging to prevent contamination and improve food safety. The increasing focus on food security and preventing foodborne illnesses in emerging economies has led to an increase in demand for safe food handling practices.

The World Health Organization (WHO) reported that foodborne illnesses affect approximately 600 million people annually worldwide, underlining the need for effective antimicrobial solutions in the food industry.

Rising Investments in Silver Nitrate Production and Innovation

A major growth opportunity for the Silver Nitrate market lies in the ongoing investments in production technology and product innovation. Leading silver-producing countries, including Mexico, Peru, and China, are increasingly focusing on expanding silver mining and refining capabilities.

According to the US Geological Survey (USGS), global silver production increased by 5% in 2023, contributing to the availability of high-quality raw materials for Silver Nitrate production. This surge in silver production supports the growth of Silver Nitrate manufacturing capacity and creates opportunities for more competitive pricing.

In addition, leading pharmaceutical and electronics companies are investing in innovative ways to enhance the purity and effectiveness of Silver Nitrate. For instance, in 2023, India’s pharmaceutical exports, including silver-based compounds, reached a value of $24.5 billion, with a projected 7% growth through 2028.

Trends

Increasing Demand for Silver Nitrate in Wound Care Products

A significant and growing trend in the Silver Nitrate market is the increasing use of silver-based products in wound care applications. Silver Nitrate is well-known for its antimicrobial properties, which make it highly effective in treating chronic wounds, burns, and infections.

The World Health Organization (WHO) has estimated that over 450 million people globally suffer from chronic wounds, creating a vast market for silver-based treatments. In 2023, the global market for wound care products reached a valuation of $22.6 billion, with silver-based products representing a significant portion of this growth.

Countries with large populations, such as India and China, are seeing an increasing adoption of silver-based wound care treatments due to the rise in burn injuries and infections caused by poor sanitation. The Global Nutrition Report indicates that silver-based dressings and ointments are frequently used in areas with limited healthcare infrastructure, particularly in regions like Sub-Saharan Africa and South Asia.

Silver Nitrate’s Growing Role in Food Safety and Preservation

Silver Nitrate is increasingly being utilized in the food industry for its antimicrobial and preservative properties, particularly in the preservation of fresh produce and in food packaging. According to the Food and Agriculture Organization (FAO), the global market for food preservatives is expected to grow from $14 billion in 2023 to $20 billion by 2028, with silver nitrate playing an increasingly important role in extending shelf life and ensuring food safety.

The World Health Organization (WHO) reports that foodborne illnesses affect approximately 600 million people annually worldwide, highlighting the critical need for effective antimicrobial solutions. Silver nitrate’s application in food packaging is also on the rise, where it helps prevent contamination and improve the safety of packaged foods.

India, one of the leading exporters of food products, has seen a significant increase in the use of silver nitrate-based treatments in both post-harvest and packaging applications. In 2023, India exported $2.14 billion worth of ready-to-eat (RTE) and ready-to-cook (RTC) food products, with silver-based food preservatives contributing to the export growth. As food safety concerns continue to grow globally, particularly in emerging markets, silver nitrate’s role in the food industry is expected to continue expanding.

Use of Silver Nitrate in Renewable Energy and Electronics Industries

Another emerging trend in the Silver Nitrate market is its growing application in the renewable energy and electronics industries, particularly in the production of solar panels and electronic components. Silver Nitrate is a key ingredient in the production of silver paste, which is used in photovoltaic (solar) cells.

According to the International Energy Agency (IEA), the global solar market was valued at $130 billion in 2023, and it is projected to grow at a 10% CAGR through 2030, increasing demand for silver-based materials like silver nitrate. The expanding use of solar energy as a clean and renewable energy source is driving the demand for silver paste in solar panel manufacturing, where Silver Nitrate plays a key role in enhancing the efficiency of photovoltaic cells.

In the electronics sector, silver nitrate is used in semiconductors and printed circuit boards (PCBs), which are essential components in a wide range of electronic devices, from smartphones to high-performance computing systems. The global semiconductor industry is expected to reach $1 trillion by 2030, with increasing demand for silver-based products used in soldering and conductive materials.

Government-backed initiatives in regions such as Asia-Pacific and Europe are supporting the transition to green technologies, which also drives the use of silver nitrate in renewable energy and electronics applications. As the demand for both solar power and advanced electronics continues to rise, silver nitrate is expected to play an integral role in the growing energy and electronics sectors.

Technological Advancements in Silver Nitrate Production

A significant trend in the Silver Nitrate market is the increasing focus on technological advancements in silver refining and the production of high-purity silver nitrate. Innovations in silver extraction and refining technologies have significantly improved the availability and cost-effectiveness of silver as a raw material for Silver Nitrate production.

According to the U.S. Geological Survey (USGS), global silver production increased by 5% in 2023, driven by innovations in silver mining and refining techniques. This trend has led to increased production capacity for silver nitrate manufacturers, helping to meet the growing demand across various sectors such as medical, electronics, and food safety.

Regional Analysis

North America dominated the global Silver Nitrate market in 2023, holding a market share of 35.4%, valued at USD 1.6 billion. The region’s leadership can be attributed to robust demand in the medical and electronics sectors, alongside strong government support for healthcare and technological advancements.

The U.S. continues to be the largest consumer of Silver Nitrate, especially in wound care treatments and antimicrobial applications. The growing adoption of silver-based medical products in hospitals and healthcare facilities, along with the rise in the demand for semiconductors and electronics, further contributes to the market dominance. Additionally, innovations in renewable energy and solar panel production are enhancing the market’s growth trajectory in North America.

Europe follows as the second-largest regional market, accounting for 28.7% of the global share in 2023. The increasing demand for high-purity silver nitrate in the pharmaceutical and medical device industries has been a significant driver.

The EU’s stringent healthcare standards and regulations also favor the adoption of silver-based products in wound care and food safety applications. The region’s strong focus on green technologies and renewable energy has increased the use of silver nitrate in solar panel manufacturing, further accelerating growth.

The Asia Pacific region is expected to witness the highest growth rate, with a CAGR of 7.9% from 2023 to 2030. China and India, with their growing electronics industries and increasing healthcare infrastructure, are major contributors to the demand for silver nitrate in medical applications and electronics manufacturing. The expanding food processing industry in the region also plays a crucial role in driving the demand for silver nitrate as a preservative and antimicrobial agent.

Middle East & Africa and Latin America are emerging markets with modest shares, driven by increasing government investments in healthcare and food safety programs. However, their market contributions remain relatively smaller compared to North America and Europe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Silver Nitrate market features a diverse range of key players, with companies such as ACS Chemicals, ALPHA CHEMIKA, and American Elements standing out for their significant contributions to the global market. These players are engaged in the production and distribution of silver nitrate for various applications, including pharmaceuticals, electronics, and chemicals.

Ames Goldsmith Corporation and Avantor are known for their expertise in providing high-purity silver nitrate to industries like medical and electronics, where precision and quality are crucial. Additionally, Celtic Chemicals Ltd., Columbus Chemical Industries, and GFS Chemicals play key roles in the manufacturing of silver nitrate for industrial applications, while Fine Chemicals and Scientific Co. and S D Fine-Chem Limited supply silver nitrate to laboratories and research sectors.

Companies like Merck, Thermo Fisher Scientific Inc., and Spectrum Chemical Manufacturing Corporation are prominent in the global chemical supply chain, offering silver nitrate as part of their broader portfolio for scientific research and laboratory use. Modison Metals Ltd. and Otto Chemie Pvt. Ltd. cater to sectors requiring high-quality silver nitrate for wound care and anti-infective applications, while firms like Rochester Silver Works LLC and Sky Chem focus on the silver recovery and recycling processes, contributing to the market’s circular economy.

The involvement of regional players like INDIAN PLATINUM PVT LTD., Innova Corporate India, and Vizag Chemical International highlights the expanding market in Asia-Pacific, where countries like India and China are witnessing rising demand for silver nitrate in electronics, healthcare, and manufacturing. As the market grows, these players are increasingly focusing on expanding their geographical presence and improving product quality to capture a larger share of the global Silver Nitrate market.

Top Key Players

- ACS Chemicals

- ALPHA CHEMIKA

- American Elements

- Ames Goldsmith Corporation

- Avantor

- Celtic Chemicals Ltd.

- Central Drug House Pvt. Ltd

- Chenzhous Nonferrous Metals

- Columbus Chemical Industries (CCI)

- East India Chemicals International

- Ennore India Chemical International

- Fine Chemicals and Scientific Co.

- GFS Chemicals

- Green Vision Technical Services Pvt Ltd

- INDIAN PLATINUM PVT LTD.

- Innova Corporate India

- JSC

- Marine Chemicals

- Merck

- Modison Metals Ltd.

- Otto Chemie Pvt. Ltd.

- ProChem

- Ralington Pharma LLP

- Rochester Silver Works LLC

- RXChemicals

- S D Fine – Chem Limited

- Sky Chem

- Spectrum Chemical Manufacturing Corporation

- Texchem Industries

- Thermo Fisher Scientific Inc

- Tung State

- Vizag Chemical International

Recent Developments

In 2023 ACS Chemicals expanded its production capacity by 10% in 2023 to meet the rising demand, particularly from the Asia-Pacific region, which accounted for 35% of its global silver nitrate sales.

In 2023, ALPHA CHEMIKA’s silver nitrate sales grew by 12%, with a significant portion of its revenue coming from the growing demand in the pharmaceutical and chemical manufacturing industries.

Report Scope

Report Features Description Market Value (2023) USD 4.6 Bn Forecast Revenue (2033) USD 7.6 Bn CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Analytical Reagent Grade, USP Grade, Technical Grade), By Purity (99.5%, 99.8%, 99.9%), By Form (Solid, Liquid), By Application (Photography and Jewelry, Inks and Dyes, Ceramics, Anti-Infective Agent, Polished Mirrors, Others), By End-use (Medical And Pharmaceutical, Chemical, Glass, Textile, Others), By Sales Channel (Direct Sales, Indirect Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ACS Chemicals, ALPHA CHEMIKA, American Elements, Ames Goldsmith Corporation, Avantor, Celtic Chemicals Ltd., Central Drug House Pvt. Ltd, Chenzhous Nonferrous Metals, Columbus Chemical Industries (CCI), East India Chemicals International, Ennore India Chemical International, Fine Chemicals and Scientific Co., GFS Chemicals, Green Vision Technical Services Pvt Ltd, INDIAN PLATINUM PVT LTD., Innova Corporate India, JSC, Marine Chemicals, Merck, Modison Metals Ltd., Otto Chemie Pvt. Ltd., ProChem, Ralington Pharma LLP, Rochester Silver Works LLC, RXChemicals, S D Fine – Chem Limited, Sky Chem, Spectrum Chemical Manufacturing Corporation, Texchem Industries, Thermo Fisher Scientific Inc, Tung State, Vizag Chemical International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ACS Chemicals

- ALPHA CHEMIKA

- American Elements

- Ames Goldsmith Corporation

- Avantor

- Celtic Chemicals Ltd.

- Central Drug House Pvt. Ltd

- Chenzhous Nonferrous Metals

- Columbus Chemical Industries (CCI)

- East India Chemicals International

- Ennore India Chemical International

- Fine Chemicals and Scientific Co.

- GFS Chemicals

- Green Vision Technical Services Pvt Ltd

- INDIAN PLATINUM PVT LTD.

- Innova Corporate India

- JSC

- Marine Chemicals

- Merck

- Modison Metals Ltd.

- Otto Chemie Pvt. Ltd.

- ProChem

- Ralington Pharma LLP

- Rochester Silver Works LLC

- RXChemicals

- S D Fine - Chem Limited

- Sky Chem

- Spectrum Chemical Manufacturing Corporation

- Texchem Industries

- Thermo Fisher Scientific Inc

- Tung State

- Vizag Chemical International