Global Silicone Market By Product (Fluids, Gels, Resins, Elastomers, and Other Products), By End-User Industry (Electronics, Transportation, and Other End-User Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032.

- Published date: Oct 2023

- Report ID: 29323

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

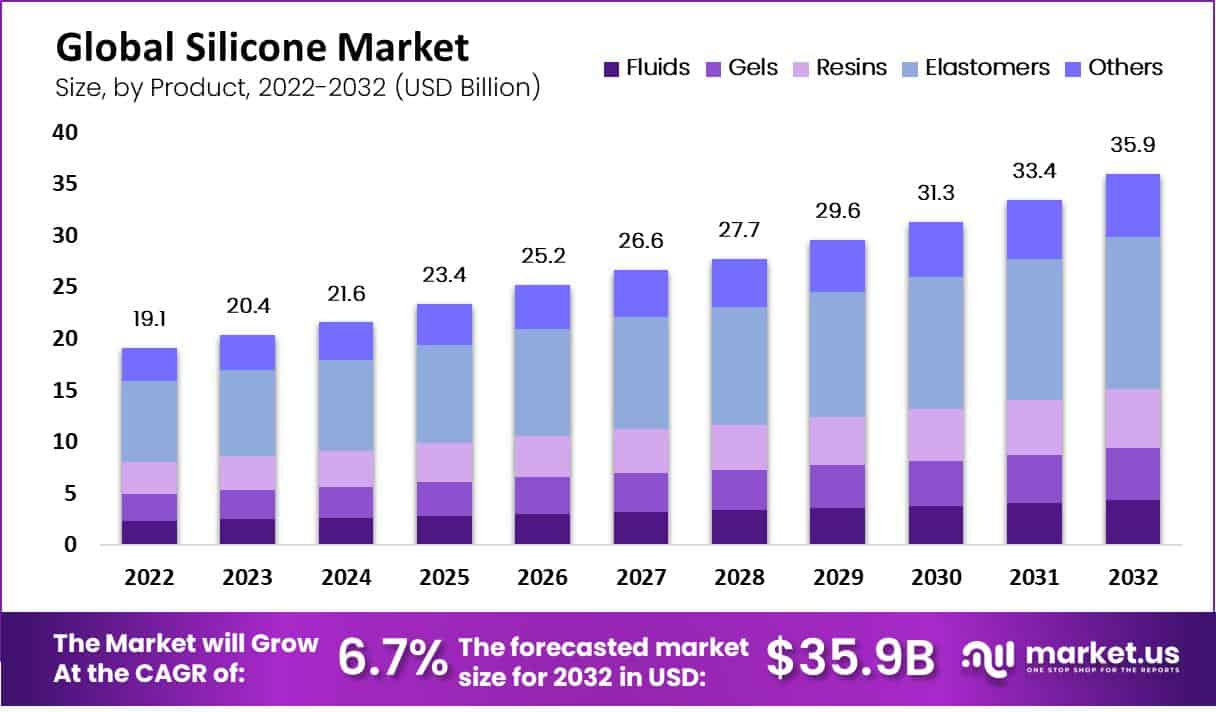

In 2022, the Global Silicone Market size was valued at USD 19.1 Billion and is expected to reach USD 35.9 Billion in 2032. This market is estimated to register the highest CAGR of 6.7% between 2023 and 2032. Industry growth is expected to be driven by the increasing demand for silicone in many end-user industries, including construction, personal care, and industrial processes.

Due to the limited market opportunities and market maturity in both the manufacturing industry in general as well as silicones, the U.S. market is expected to perform moderately. But, product innovation and technological advancements will continue to encourage silicone use in emerging markets like Electric Vehicles (EVs) and health & personal.

Silicones can be polymers or higher-oligomers that have many physical forms, starting from solids to liquids to semi-viscous pastes, oils, greases, and pastes. You can find a variety of properties in silicones, including sealing, lubricating and bonding, release, defoam, and encapsulating. Silicones conduct electricity, so they don’t harden or crack, peel, crumble, or rot with age. Also, they can be insulated, waterproofed, and coated.

Key Takeaways

- Market Growth: The silicone market was valued at USD 19.1 billion in 2022 and is projected to experience compound annual growth rates of 6.7% between now and 2032.

- Silicone Products Are Versatile: Silicone products come in all forms imaginable – fluids, gels, resins, and elastomers are just some of the forms found within silicone’s broad spectrum of forms; with over 41% of global revenue going toward this sector alone! Elastomers dominated this particular industry.

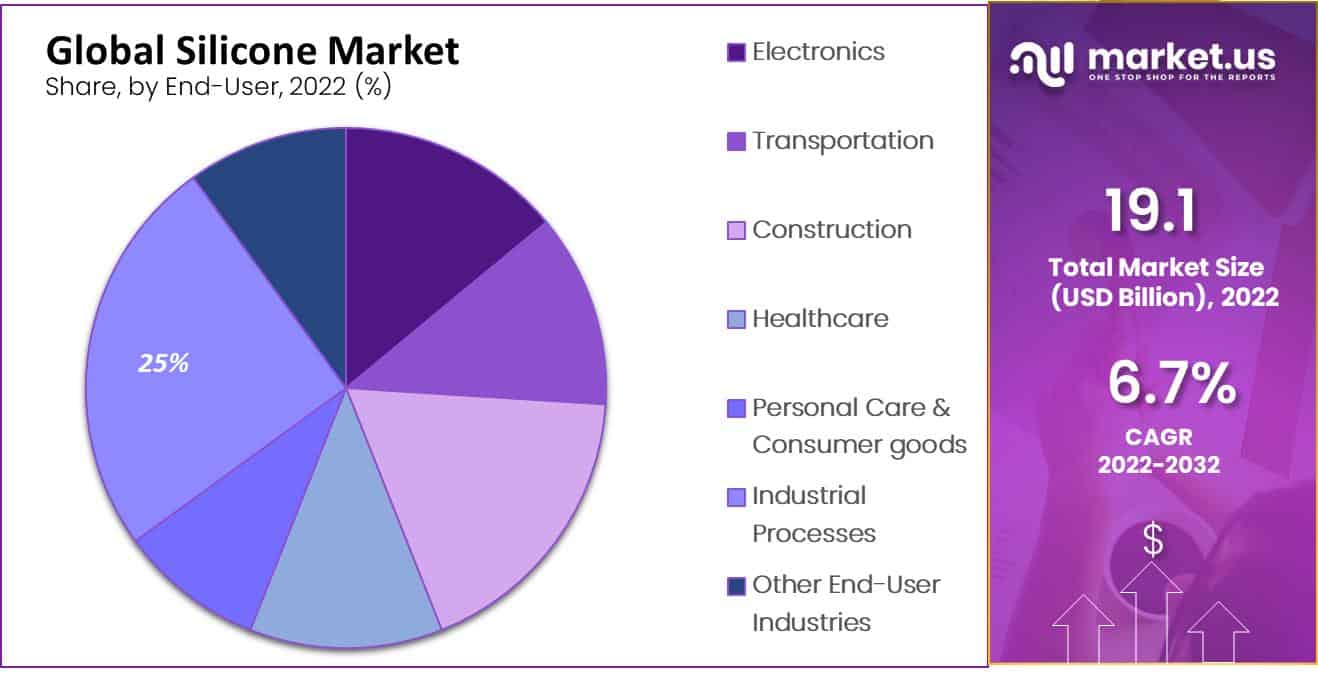

- End-User Industries: Silicone consumption can be found across multiple sectors, including electronics, transportation, construction, healthcare, and personal care as well as industrial processes – the latter accounting for more than 25% of worldwide revenue in 2015.

- Silicone Demand for Construction and Healthcare Applications: Silicones have gained increasing usage within construction and healthcare applications due to their unique properties, such as superior thermal conductivity and resistance against extreme temperatures.

- Electronic Applications: Silicone’s ability to conduct electricity makes it an attractive material choice for electronic applications such as semiconductors, electronic products, and circuitry that require sensitive wiring systems.

- Challenges in the Market: Fluctuations in raw material prices and stringent regulations in healthcare pose obstacles to the silicone market’s expansion.

- Elastomers Dominance: Elastomers such as room-temperature vulcanized (RTV) silicone rubber play a prominent role in the silicone market and are especially advantageous when applied in electric vehicle applications.

- Use in Industrial Process: Silicone can be found across numerous industrial processes, from antifoaming agents and lubricants to protective coatings in multiple applications.

- Transportation Industry Growth: Transportation industries such as electric vehicles are an influential force driving silicone demand; automotive parts and electric vehicle components make up much of this segment’s silicone applications.

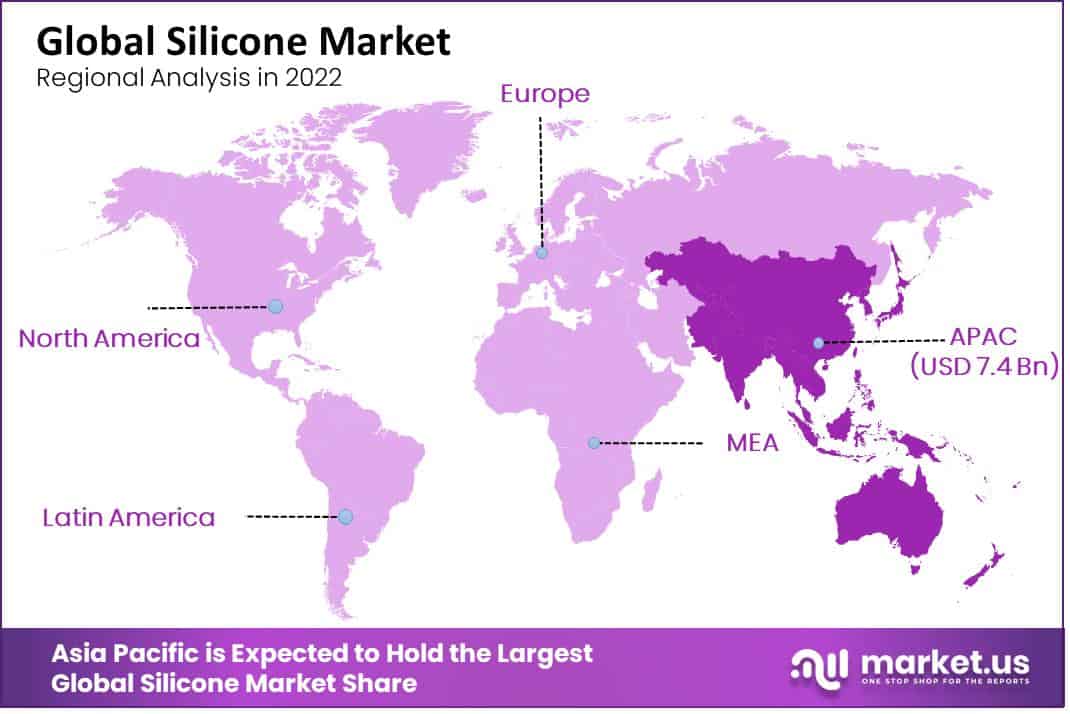

- Regional Dominance: Asia Pacific dominates the silicone market globally, followed by Europe and North America. Asia Pacific’s growth can be attributed to factors like raw material availability and market penetration opportunities; Asia Pacific represented over 38.7% of total worldwide revenue as the dominant industry segment.

- Market Players: Major silicone market participants include Supreme Silicones, Elkay Chemicals Pvt Ltd, Shin-Etsu Chemical Co Ltd Shin, and Wacker Chemie AG among many more. Each of these players employs strategies such as mergers, acquisitions, and product releases in their strategies to dominate this sector of the global silicone market.

Driving Factors

Demand for Silicone in the Construction and Healthcare Sector is driving the Silicone Market

Because of its high thermal conductivity, ability to withstand high and low temperatures, and flame-retardant qualities, Silicone is increasingly being used in electronic applications. Silicone is used primarily in semiconductor applications, electronics products, and highly sensitive circuits.

It also serves as an ignition, heater, and refrigerator wire. Silicone is used in electrical circuits to provide strong insulation properties for surfaces that act as heat, dust, and dirt protectors on screens of computers, televisions, airplane displays, etc. The projected increase in Silicone demand is due to global demand for electronics, semiconductors, and consumer goods.

Silicone is highly weather-resistant, stable, inert, and high-water repellent. That’s why silicone is a widely used material in the construction industry. It can be used to combine with many materials, including concrete, marble, aluminum, steel, and other polymers. This is useful in both residential and commercial constructions. They are also used to build roads, bridges, pipelines, and industrial units.

The need to develop infrastructure and construction has increased due to increasing population and industrial growth. The Asia Pacific region is seeing significant growth in the construction sector. The region’s key factors driving construction expansion are the growing middle-class population, increasing industrialization & urbanization, improved living conditions, and increasing infrastructure spending. The forecast period will see a rise in infrastructure spending in China, which is expected to drive the industry’s growth.

Restraining Factors

Fluctuating Prices and Severe Regulations Hinders the Silicone Market Growth

The market for silicones is severely constrained by fluctuating raw material prices. The price of raw materials is affected by many factors, including currency exchange rates, environmental protection measures, and energy prices. The increased prices of raw materials are passed onto customers by silicon manufacturing companies. In most cases, an increase in raw material prices is temporary. Manufacturers reduce silicone prices once they are back at their previous levels.

Manufacturers are not able to plan for the long term due to fluctuations in raw materials or increased prices. China, for example, is a major supplier and manufacturer of silicones raw materials. In many cases, however, market players in China do not meet environmental protection regulations. They often stop producing silicones while under investigation by the government and then restart production once they are done. This has a direct but temporary effect on raw material prices.

Several regulatory agencies regulate silicone use. For instance, the European Chemicals Agency (ECHA) limits the use of two silicone materials, D4 and D5, in personal care products. Personal care products can only use these substances at a 0.1% weight limit. Manufacturers must comply with the ASTM D1418-81 standard to produce silicone elastomer in America. Healthcare is one of the most tightly regulated industries.

Medical-grade silicone is approved silicone that is USP Class VI. Before any medical-grade silicones are made available for commercialization, they must be approved by regulatory bodies.

By Product Analysis

Elastomers Cover Most of the Silicone Market Share

The elastomers sector dominated the industry, accounting for more than 41.0% of global revenue. Silicone elastomers consist of vulcanized silicone-based elastomers. They are formed by combining cross-linkers and reinforcing agents with linear polymers. These elastomers are classified according to the temperature at which they were processed and the type and amount of basic straight-chain molecules used. RTV silicone rubber is composed of two components.

It’s available in a soft-to-medium-hardness range. It can adhere to most surfaces with great force and can be removed from them without heating. It has excellent thermal resistance and dielectric qualities. It can seal and fill between surfaces and act as a gasket in various EV applications. It is widely used in EVs and other industries, including aerospace, energy, consumer electronics, and the electronics industry.

By End-User Analysis

Industrial Process Generates Major Revenue in the End-User Segment of Silicone Market.

The industrial process segment accounted for over 25.0% of global revenue. Silicones are used extensively in a variety of industrial processes. They are used for various purposes, including antifoaming and lubricants, offshore drilling, paper production, industrial coatings, and paint additives.

Silicone is used in paints and coatings to improve performance. It offers different components with improved durability, thermal resistance, and resistance to corrosion & chemicals, which reduces unplanned maintenance and maintenance costs for machinery and industrial infrastructure.

Construction is the second largest end-user segment in terms of revenue. To ensure that important structural materials remain in place, silicone sealants are used for expansion, construction, connection, and movement joints. These sealants can also give buildings more flexibility, allowing materials to absorb the stress and movement of wind and earthquakes. Buildings with silicone sealants can be more energy efficient by keeping humidity and cold air out of cracks and joints.

Silicone adhesives are used to maintain the façades of buildings. They also help industrial and commercial structures. Silicones, for example, are part of the glazing of large glass expanses, a characteristic of modern architectural buildings. These facades rely on silicone sealant or glazing to protect the glass panels from UV radiation. That’s why the construction sector is expected to increase at a substantial CAGR between 2023 and 2032.

Silicones are used extensively in medical applications such as extracorporeal equipment for kidney dialysis, contact lenses, finger and foot joints, catheters and drains, breast implants, tubing and heart valves, ophthalmological implants, and drug delivery systems. Because they are chemically inert and stable against thermal or oxidative influences, they are often called biocompatible.

Because of their unique properties, medical-grade silicones are important to many medical and healthcare devices. They can also be used to make flexible medical devices and monitor health. Silicones are used to enhance absorption and function in skin medication. In addition, silicone materials are easy to sterilize, which helps to lower the risk of developing bacterial infections. The growing healthcare sector is estimated to boost the growth of silicone in the healthcare sector too.

Silicone gel market is a transparent jelly-like sheet that is used in personal care to reduce scarring from newly healed wounds and prevent the appearance of immature scars. Silicone gels can also be used to encapsulate electronic equipment, including solar cells and LEDs. They are highly water-resistant, have high dielectric strength, and can dampen mechanical vibrations, and with all these factors, silicone gel is expected to grow during the forecast period. The growing personal care market is due to rising concerns about appearance and the aging population.

This will increase the demand for silicone gels within the personal care sector. Silicone resins, which are polymers, have a low molecular weight and a three-dimensional network structure. They are suitable for use as binders in paints, varnishes, and other impregnation products due to their excellent thermal stability, heat resistance, weatherability, dielectric properties, and water-repellency. Therefore, the segment will see a rise in demand from the paints and coatings industry for silicone resins to improve heat resistance in coating and rendering.

Key Market Segments

Product

- Fluids

- Straight Silicone Fluids

- Modified Silicone Fluids

- Gels

- Resins

- Elastomers

- High-Temperature Vulcanized (HTV)

- Liquid Silicone Rubber (LSR)

- Room Temperature Vulcanized (RTV)

- Others

- Adhesives

- Emulsions

End-User Industry

- Electronics

- Transportation

- Construction

- Healthcare

- Personal Care & Consumer goods

- Energy

- Industrial Processes

- Other End-User Industries

Growing Opportunities

Increasing Demand for Electric Vehicles Opens the Opportunities for Silicone Market.

The transportation industry is expected to increase silicone used in the future significantly. The industry is constantly developing new silicone applications. Silicones are used in all areas of the transportation industry, Automotive silicone market share, marine, aerospace, etc. Silicones are used to make automotive parts such as airbags, ignition coils, engine gaskets, turbochargers, hoses, radiator gaskets, hoses, and engine gaskets. It can also be used to make components such as windshields and deck cleats. Silicones are used to encapsulate electronic components and to seal instruments or as sealants in aircraft structures.

Electronic vehicles have seen a rise in demand worldwide in the last few years. This has encouraged manufacturers to include electric vehicles in their product lines. This has led to a rise in demand for silicone components for electric vehicle components. Silicon elastomers protect the components of electric cars from heat dissipation and electromagnetic interference. The battery’s heat can accelerate battery degradation and reduce charging efficiency. This can have a negative impact on vehicle performance. Elastomers allow for effective thermal management of the lithium-ion battery, an essential component of electric vehicles.

Silicone resins have many benefits, such as weather ability, water resistance, and flame retardancy. They also possess dielectric properties. This is why silicone resins are used in coil impregnation. The type of organic substitutes used and their molecular mass determines silicone resins’ hardness and cure speed. Because of their superior heat resistance and dielectric properties, silicone resins can also be used as binders to mold with other materials. In the next few years, the silicone market will grow because of the rising demand for electric cars worldwide.

Latest Trends

In the silicone market trends, Silicones are used in the construction industry for weatherproofing and structural glazing. They also contribute to energy efficiency. They can also increase shop productivity, reduce material waste, prolong building life, and lower lifecycle costs. Silicones can also be used to seal joints in construction applications (including attaching glass or metal panels), roofing, flashing penetrations, terminations, building material expansion joints, and the interior perimeters of doors and baseboards.

India has seen an increase in residential construction. The country will likely see an approximately USD 1.3 trillion investment in housing in the next seven years. This is expected to boost the market. Inflows from FDI totaling USD 81.72 billion were 13% of all. The US’s total construction output is USD 1625.88 million. The non-residential construction sector in the United States was also estimated at USD 825.88 billion. This is an increase of 3.4% compared to last year.

Regional Analysis:

Asia Pacific Covers Major Share in the Global Silicone Market.

Asia Pacific was the world’s dominant industry, accounting for more than 38.7% of the total global revenue. Many small, medium, and large companies are located in the region, which explains the high proportion of the region’s revenue. Due to market players shifting their production from North America and Europe to Asia, the region’s silicone production is expected to grow over the forecast period.

This is due to factors such as greater raw material availability, cheaper labor, increased market penetration opportunities in end-use industries like transportation, construction and, personal care and consumer products, electronics, and healthcare. Accelerating price growth is expected to drive the region’s fastest growth. Silicones are expected to be a major market in the areas of transportation, electronics, construction, and personal care.

Europe is second, with the rising demand for lightweight silicones in construction and transportation as the main driver of Europe’s silicone market. The expansion of the construction industries in France, Germany, Spain, and the United Kingdom is expected to drive product demand during the forecast period.

The region’s construction industry is expected to grow due to a combination of EU financing and supportive policies (such as tax breaks, incentives, or subsidies) adopted by multiple governments. The spread of COVID-19 has hindered product demand in the building and construction, transportation, as well as consumer goods sectors. The rising use of silicone material in electric vehicles is driving the demand for transportation.

North America is the third largest region. This is due to the increasing use of silicone in many applications in transportation and construction, personal care, manufacturing, industrial process, and energy. North America is a major market for silicone additives due to its high demand for plastics and composites as well as manufacturing chemicals, paints, coatings, and food & beverage.

The region is also a strong market for medical-grade silicones due to the high demand from the healthcare sector and large regional manufacturers. The positive growth factors for the future include rising demand for minimally invasive surgery, advanced implant devices, and the availability of sophisticated healthcare infrastructure in the United States.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

Globally, the industry is fragmented by the presence of large manufacturing companies worldwide. These players compete primarily based on the technology used to produce silicone and the quality of their products. The key players tend to adopt marketing strategies such as mergers and acquisitions, product launches, and expansions. For example, Evonik Industries AG, joint venture partner Wynca, established a fumed silica facility in Zhenjiang (China).

The facility will be able to meet local demand for silicones and coatings. Wacker Chemie AG launched new silicone sealants made from renewable raw materials in December 2020. The new product is known as ELASTOSIL eco. With the launch of this product, the company will be able to offer products made from bio-based methanol that are compatible with silicone sealant suppliers.

Key Players Silicone Market

- Supreme Silicones

- Elkay Chemicals Pvt. Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Silchem Inc.

- Silteq Ltd

- Amul Polymers

- Wacker Chemie AG

- Specialty Silicone Products, Inc.

- Illinois Tool Works Inc.

- Evonik Industries AG

- Nano Tech Chemical Brothers Private Ltd.

- Other Key Players

Recent Developments

- In October 2022, Shin-Etsu Chemical Co. Ltd. President Yasuhiko Saidoh developed the first silicone film-forming oil in the world for fiber-treatment applications. This product was developed in response to customer requests.

- In October 2021, Evonik Industries AG and Wynca partnered in a joint venture to create a new fumed silicon plant in Zhenjiang (China) to meet the growing demand.

Report Scope:

Report Features Description Market Value (2022) USD 19.1 Bn Forecast Revenue (2032) USD 35.9 Bn CAGR (2023-2032) 6.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product – Fluids (Straight Silicone Fluids and Modified Silicone Fluids), Gels, Resins, Elastomers (HTV, LSR, and RTV), and Other Products (Adhesives, and Emulsions); By End-User Industry – Electronics, Transportation, Construction, Healthcare, Personal care and Consumer Goods, Energy, Industrial Processes, and Other End-User Industries Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Supreme Silicones, Elkay Chemicals Pvt. Ltd., Shin-Etsu Chemical Co., Ltd., Silchem Inc., Silteq Lt, Amul Polymers, Wacker Chemie AG, Specialty Silicone Products, Inc., Illinois Tool Works Inc., Evonik Industries AG, Nano Tech Chemical Brothers Private Ltd., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Silicone Market in 2032?In 2032, the Silicone Market will reach USD 35.9 billion.

What CAGR is projected for the Silicone Market?The Silicone Market is expected to grow at 6.7% CAGR (2023-2032).

Name the major industry players in the Silicone Market.Supreme Silicones, Elkay Chemicals Pvt. Ltd., Shin-Etsu Chemical Co., Ltd., Silchem Inc., Silteq Ltd, Amul Polymers, Wacker Chemie AG and Other Key Players are the main vendors in this market.

List the segments encompassed in this report on the Silicone Market?Market.US has segmented the Silicone Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Product, market has been segmented into Fluids, Gels, Resins, Elastomers, and Others. By End-User, the market has been further divided into, Electronics, Transportation, Construction, Healthcare, Personal Care & Consumer goods, Energy, Industrial Processes and Other End-User Industries.

-

-

- Supreme Silicones

- Elkay Chemicals Pvt. Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Silchem Inc.

- Silteq Ltd

- Amul Polymers

- Wacker Chemie AG

- Specialty Silicone Products, Inc.

- Illinois Tool Works Inc.

- Evonik Industries AG

- Nano Tech Chemical Brothers Private Ltd.

- Other Key Players