Global Silico Manganese Market, By Product (Low Carbon, Medium Carbon), By Application (Carbon Steel, Stainless Steel, Alloy Steel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 20720

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

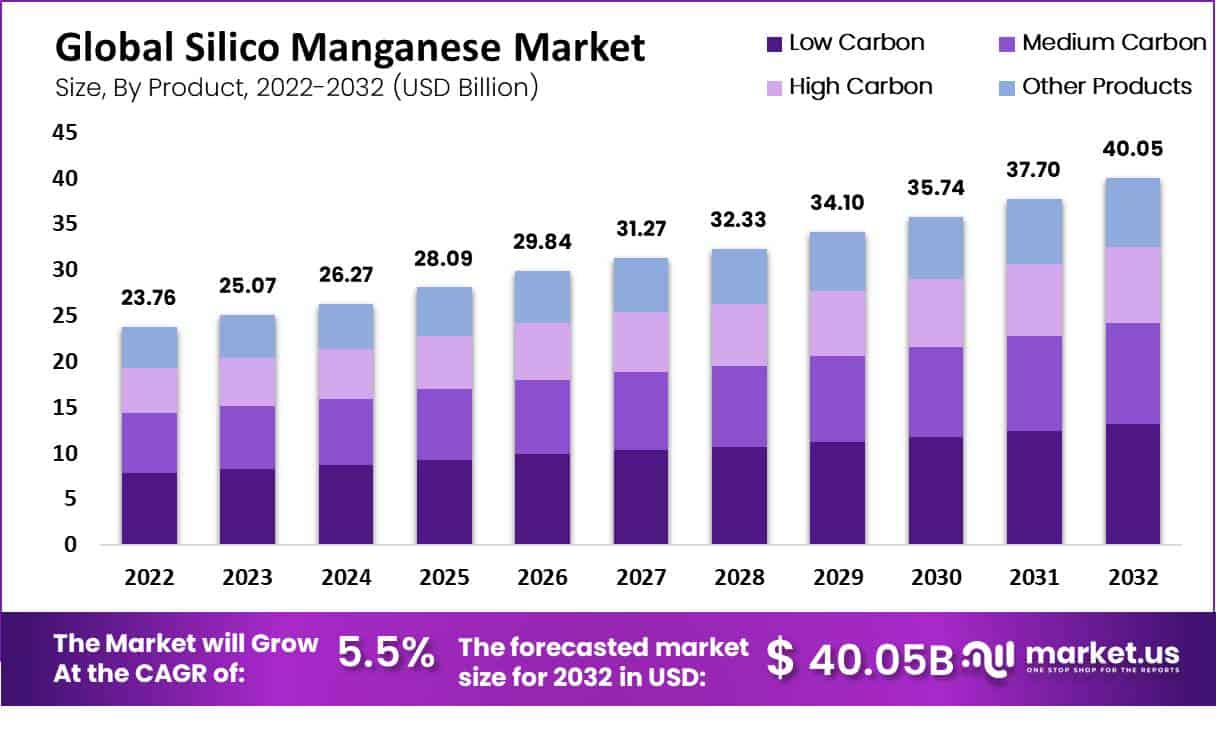

Global Silico Manganese Market size is expected to be worth around USD 40.05 Bn by 2032 from USD 23.76 Bn in 2022, growing at a CAGR of 5.5% during the forecast period from 2022 to 2032.

The market is expected to grow because of the rising demand for steel products in the infrastructure and construction sectors. Silico manganese is utilized in the production process to increase the strength, flexibility, and corrosion resistance of steel.

It is also used for non-metallic inclusion refinement and deoxidization. Thus, increasing steel production and consumption are expected to benefit market expansion.

Increasing investments in steel production plants are predicted to drive growth for silico manganese in the United States over the course of the forecast timeframe.

Moreover, it is projected that growing expenditures in both residential and non-residential development projects would boost demand for steel in the United States.

Key Takeaways

Developments in the Markets: The global silico manganese market is Estimated at USD 23.76 billion as of 2022 and with compound annual growth at 5.5% between 2023-2032 expected, this industry sector could potentially reach a total value of USD 40.05 billion by 2032.

Infrastructure Demands: With increased urbanization, industrialization, and population growth comes rising demand for silico manganese which necessitates infrastructure projects such as roads, bridges, dams, tunnels, and offshore structures that use this element for reliable performance.

Product Analysis: In 2022, low-carbon silico manganese constituted a significant share, exceeding 33.0% of the global market, primarily due to its extensive utilization in the manufacturing of stainless steel.

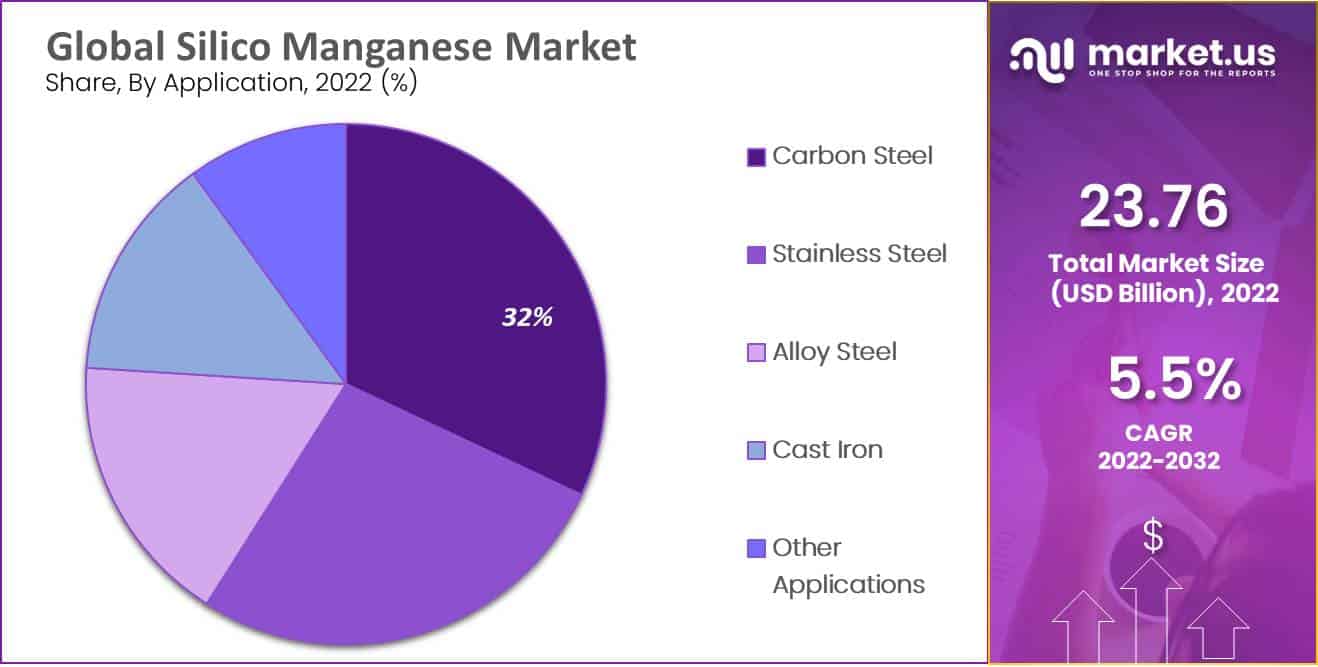

Application Analysis: In 2022, carbon steel represented a substantial portion, exceeding 32.0% of the global market in terms of revenue. Projections suggest that the stainless steel sector will experience the swiftest revenue growth of 6.8% during the forecast period.

Market Drivers: Key drivers of the silico manganese market include the rising demand for high-quality steel, growth in the construction and automotive industries, and the continuous development of infrastructure projects worldwide.

Restraints: Challenges faced by the silicon manganese market include fluctuations in raw material prices, environmental regulations, and geopolitical uncertainties impacting the supply chain.

Opportunities: Opportunities for growth in the silicon manganese market include investing in sustainable production technologies, expanding market presence in emerging economies, and strategic partnerships for securing raw material supply.

Trends: Emerging trends in the silicon manganese market encompass innovations in production processes, focus on sustainable and eco-friendly manufacturing, and increasing applications in electric vehicles and renewable energy sectors.

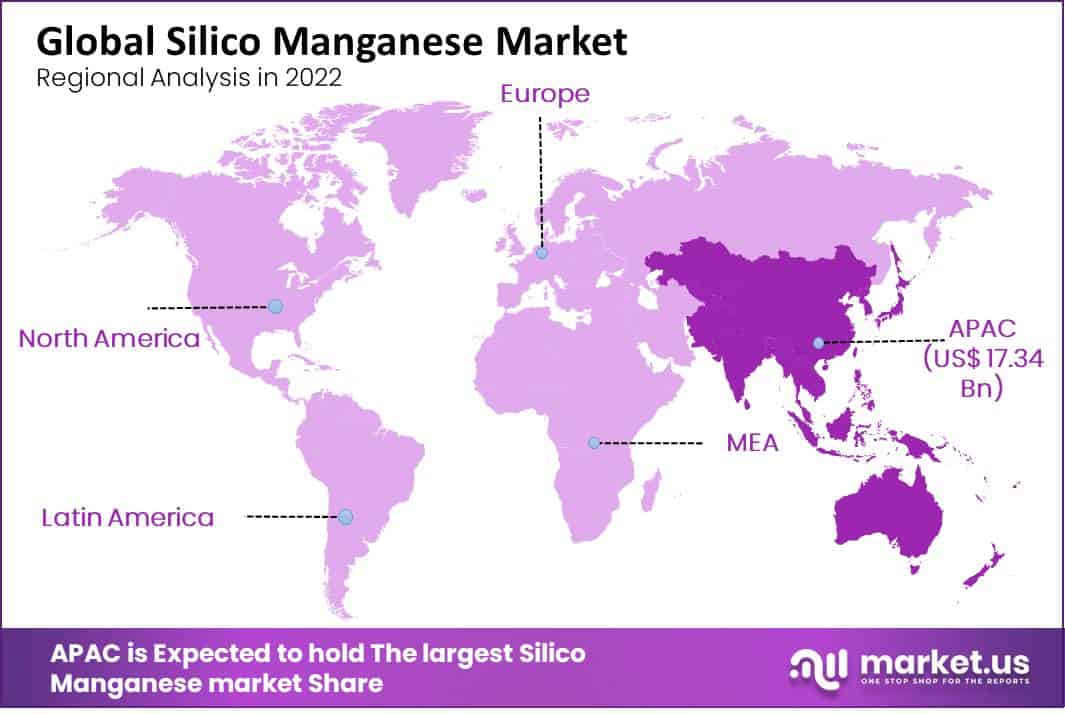

Regional Analysis: Asia Pacific dominated the market with a significant share of over 73.0% in global revenue. This dominance is a result of extensive investments by nations in infrastructure development projects to revive their economies during the pandemic. In the forecast period, the Middle East and Africa are anticipated to experience a solid CAGR of 5.8% in revenue.

Key Players: Major companies in the silico manganese market are focusing on strategic initiatives such as technological advancements, capacity expansions, and collaborations to strengthen their market position and meet the growing demand for silico manganese.

Market Scope

Product Analysis

In 2022, the low carbon revenue share was larger than 33.0% of the global market. The manufacturing of stainless steel constantly makes use of low-carbon silico manganese. Throughout the forecast period, it is expected that the segment’s growth will be supported by the production of stainless steel at the global level.

Revenue growth for high carbon is expected to average 6.6% during the forecast period. The growth in demand for cast iron is likely to be driven by increased investments in a wide range of industries, including kitchenware, machinery & tool manufacturing, and construction. As a result, it is predicted that segment growth will be favorable over the forecast period.

Application Analysis

In terms of silicon manganese market revenue, carbon steel accounted for more than 32.0% of the global market, in 2022. The product’s high strength makes it ideal for use in the construction of buildings, railroad tracks, and machinery parts. Market expansion is anticipated to be driven by rising investments in these industries. Over the forecast period, the stainless steel sector is anticipated to see the fastest revenue growth of 6.8%.

In the upcoming years, segment expansion is anticipated to be driven by increasing electric vehicle use and growing construction industry investment. Cast iron is likewise a significant market application sector. Cast iron is widely used in a variety of sectors, including the manufacturing of equipment and machinery as well as automobiles, due to its high strength, high thermal conductivity, wear resistance, and superior machinability.

Key Market Segments

Based on Product

- Low Carbon

- Medium Carbon

- High Carbon

- Other Products

Based on Application

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Cast Iron

- Other Applications

Drivers

Rising demand from the steel industry: Silico manganese is a crucial alloy used in the steel industry to enhance the strength and durability of steel, and demand from this sector continues to rise. Demand for silico manganese rises along with the growth of the steel industry worldwide

Increasing use in the construction sector: The construction sector is another significant user of silico manganese. The alloy is used to make reinforcing bars, construction materials, and structural steel.

Technical developments: Using electric furnaces, for instance, technological advances in the manufacture of Silico Manganese can improve efficiency and cut costs, encouraging the expansion of the sector.

Restraints

The expansion of this market may be restricted by limited supply and high transportation expenses. Although silico manganese is extensively used in many industries, it does have some drawbacks, such as the variable accessibility of it in different geographical regions, which increases the cost of transportation and logistics and might slightly slow the silico manganese market growth.

In addition to all the other considerations, safe delivery of the product is also important as utilizing this product has higher costs.

Opportunity

Increasing demand for electric vehicles: To minimize carbon emissions, the automobile industry is moving towards electric vehicles. The manufacture of electric cars necessitates the use of silico manganese-containing specialty steel alloys. The demand for silico manganese will rise as the market for electric cars expands.

Research & development: Continuing work in the areas of metallurgy and material science is opening the way for the creation of new silico manganese uses and markets. For instance, new markets are opening up in the aerospace, military, and other industries because of the creation of new steel alloys utilizing silico manganese.

Trends

Rising need for high-grade silico manganese: High-grade silico manganese is the better option among manufacturers due to its higher quality, which increases the strength and ductility of the steel, as well as lower consumption rate and cost-effectiveness.

Increasing demand for refined silico manganese: Due to its lower carbon content and subsequent reduction in greenhouse gas emissions during manufacture, refined silico manganese is gaining popularity. As more strict environmental rules are implemented by governments there will probably be an increase in the demand for silico manganese.

Regional Analysis

In 2022, Asia Pacific led the market and accounted for over 73.0% share of global revenue. The market’s dominance is attributed to the investments made by the nations in various infrastructure development projects to boost their economies just after the pandemic era. The Middle East and Africa are projected to experience a CAGR of 5.8% in terms of revenue during the forecast period.

The increased private investment to increase steel production in the area is attributed to this expansion. Over the forecast period, Central & South America is anticipated to experience a CAGR of 4.9% in terms of revenue. Investments in oil and gas projects are expected to raise the region’s demand for steel, which is likely to accelerate the expansion of the silicon manganese market over the duration of the forecast.

Key Regions

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Iron, silicon, and manganese are the main ingredients of the alloy known as silico manganese. It is a component of the steel-making process, hence the steel sector has a significant impact on demand. One of the top silico manganese manufacturers worldwide is Ferroglobe.

With operations around the globe, the corporation is present in the US, Europe, and Asia. Steel, aluminum, and chemical industries among others use Ferroglobe’s silico manganese products. Production of silica manganese is carried out by Sakura Ferroalloys Sdn Bhd in Malaysia.

Market Key Players

- Brahm Group

- EMCO (Bahrain Ferro Alloys BSC)

- Eramet

- Ferroglobe

- Nippon Denko Co.Ltd.

- OM Holdings Ltd.

- Sabayek

- Sakura Ferroalloys

- Steel force

- Tata Steel Ltd.

- Sheng Yan Group

- PJSC Nikopol

- Glencore

- Jinneng Group

- Other key players

Recent Developments

In January 2021- the Indian government imposed anti-dumping duties on imports of Silico Manganese from China, Vietnam, and Ukraine in an effort to protect their domestic industry.

In March 2021– Georgian Manganese LLC, a major producer of Silico Manganese in Georgia, announced plans to invest $30 million to modernize and expand their production facilities.

In August 2020– the European Union implemented anti-dumping duties on imports of Silico Manganese from Russia and China to safeguard their European industry.

In December 2020– Tata Steel revealed its plans to sell its stake in a Silico Manganese manufacturing plant located in Odisha, India to its joint venture partner.

Report Scope

Report Features Description Market Value (2022) USD 23.76 Bn Forecast Revenue (2032) USD 40.05 Bn CAGR (2023-2032) 5.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Product ,Low Carbon,Medium Carbon,High Carbon,Other Products ,Based on Application,Carbon Steel ,Stainless Steel,Alloy Steel,Cast Iron ,Other Applications Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Brahm Group, EMCO (Bahrain Ferro Alloys BSC), Eramet, Ferroglobe, Nippon Denko Co.Ltd., OM Holdings Ltd., Sabayek, Sakura Ferroalloys, Steelforce, Tata Steel Ltd., Sheng Yan Group, PJSC Nikopol, Glencore, Jinneng Group, Other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How much is the Global Silico Manganese Market worth?Global Silico Manganese Market market size is Expected to Reach USD 40.05 Bn by 2032.

What was the Market Segmentation of the Silico Manganese Market?Based on Product ,Low Carbon,Medium Carbon,High Carbon,Other Products ,Based on Application,Carbon Steel ,Stainless Steel,Alloy Steel,Cast Iron ,Other Applications

What is the CAGR of Silico Manganese Market?The Silico Manganese Marketis growing at a CAGR of 5.5% during the forecast period 2022 to 2032.

Who are the major players operating in the Silico Manganese Market?Brahm Group, EMCO (Bahrain Ferro Alloys BSC), Eramet, Ferroglobe, Nippon Denko Co.Ltd., OM Holdings Ltd., Sabayek, Sakura Ferroalloys, Steelforce, Tata Steel Ltd., Sheng Yan Group, PJSC Nikopol, Glencore, Jinneng Group, Other key players.

Which region will lead the Global Silico Manganese Market?Asia Pacific is estimated to be the fastest-growing region during the forthcoming years.

-

-

- Brahm Group

- EMCO (Bahrain Ferro Alloys BSC)

- Eramet

- Ferroglobe

- Nippon Denko Co.Ltd.

- OM Holdings Ltd.

- Sabayek

- Sakura Ferroalloys

- Steel force

- Tata Steel Ltd.

- Sheng Yan Group

- PJSC Nikopol

- Glencore

- Jinneng Group

- Other key players