Global Ship Leasing Market Size, Share, Growth Analysis By Lease Type (Financial Lease, Full-Service Lease), By Type (Bareboat Charter, Real-Time Lease, Periodic Tenancy, Other Types), By Application (Container Ships, Bulk Carriers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151158

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

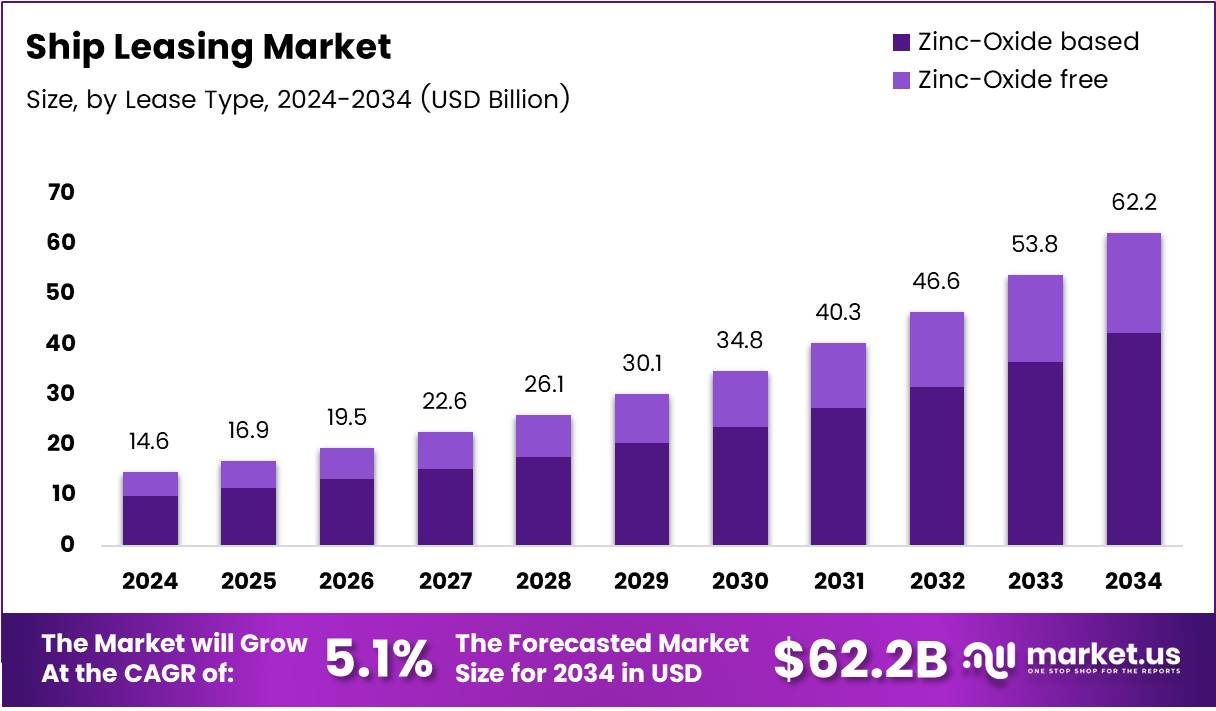

The Global Ship Leasing Market size is expected to be worth around USD 62.2 Billion by 2034, from USD 14.6 Billion in 2024, growing at a CAGR of 15.6% during the forecast period from 2025 to 2034.

The ship leasing market is a crucial component of the global shipping industry, offering flexible financing options for businesses that need vessels but may not have the capital to purchase them outright. Ship leasing includes both long-term and short-term agreements, allowing companies to access ships for container shipping, bulk carriers, and more. According to Global Ship Lease, in 2024, the company owned a fleet of 68 containerships with a total capacity of 376,723 TEU as of June 30.

The growth of the ship leasing market is driven by increasing global trade and demand for cost-effective transportation solutions. The rise of e-commerce, especially during the pandemic, has led to greater demand for shipping vessels. As a result, businesses are increasingly turning to leasing as a way to scale their fleets without the hefty capital outlay required for purchasing ships.

Leasing ships offers businesses greater operational flexibility. Companies can respond to changes in demand without being tied to long-term ownership. This flexibility is particularly attractive in an uncertain market, where businesses need to adapt quickly to shifting conditions. Ship leasing also allows companies to access the latest vessel technologies, which helps them stay competitive while minimizing their financial risks.

The expansion of global trade routes and improvements in shipping infrastructure present significant growth opportunities for the ship leasing market. Additionally, there is increasing demand for leasing in emerging economies where access to capital may be limited. Digital technologies in the maritime sector are also opening new doors for ship leasing companies, driving further growth.

Government investment and regulatory changes play a significant role in the ship leasing market’s future. Many governments are offering incentives to promote sustainable shipping, such as subsidies for eco-friendly vessels. Furthermore, regulatory measures like the IMO 2020 sulfur cap are pushing companies to adopt greener shipping solutions. Ship leasing provides an avenue for companies to comply with these regulations without the financial burden of purchasing new vessels.

As financial institutions show greater interest in the ship leasing market, this sector is likely to continue its upward trajectory. With increasing demand for vessels and a supportive regulatory environment, the ship leasing market is positioned for long-term growth. Leasing offers a flexible, cost-effective way for businesses to keep up with the evolving global shipping landscape.

Key Takeaways

- The Global Ship Leasing Market is expected to reach USD 62.2 billion by 2034, growing at a CAGR of 15.6% from 2025 to 2034.

- Financial Lease dominated the By Lease Type Analysis segment in 2024, driven by its structured ownership pathway.

- Bareboat Charter held the dominant position in the By Type Analysis segment in 2024 due to its flexibility and control over vessel operations.

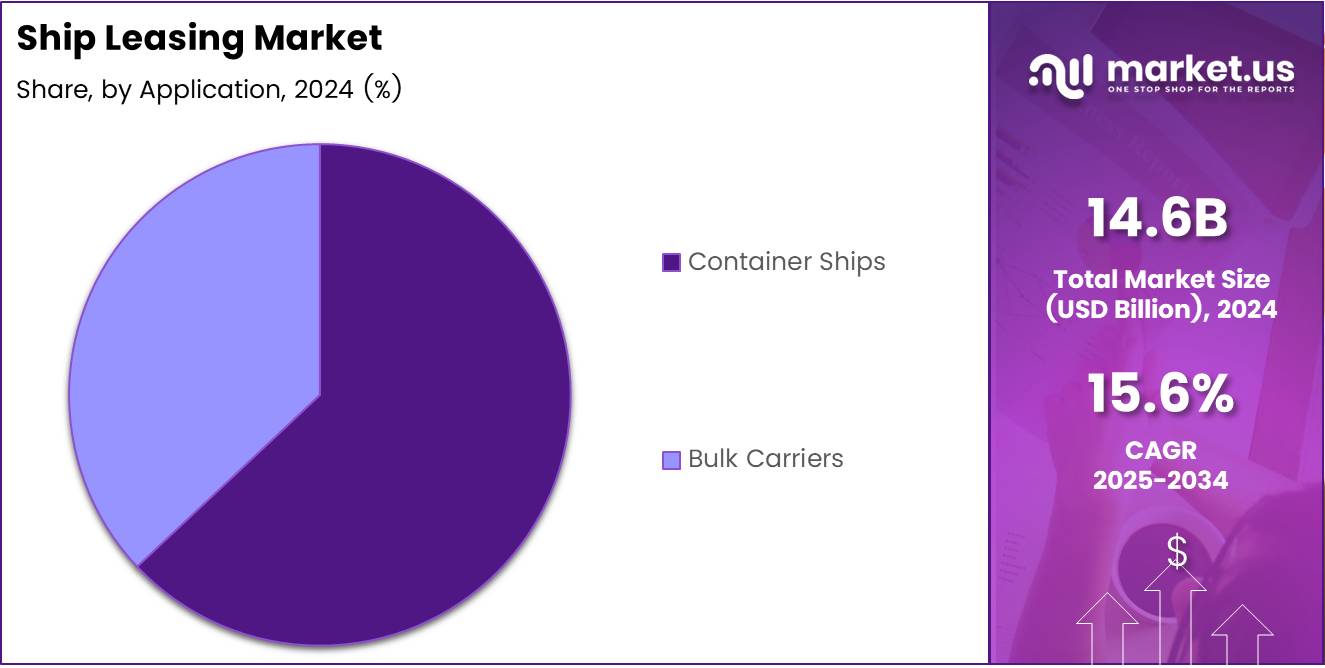

- Container Ships led the By Application Analysis segment in 2024, reflecting their essential role in global trade.

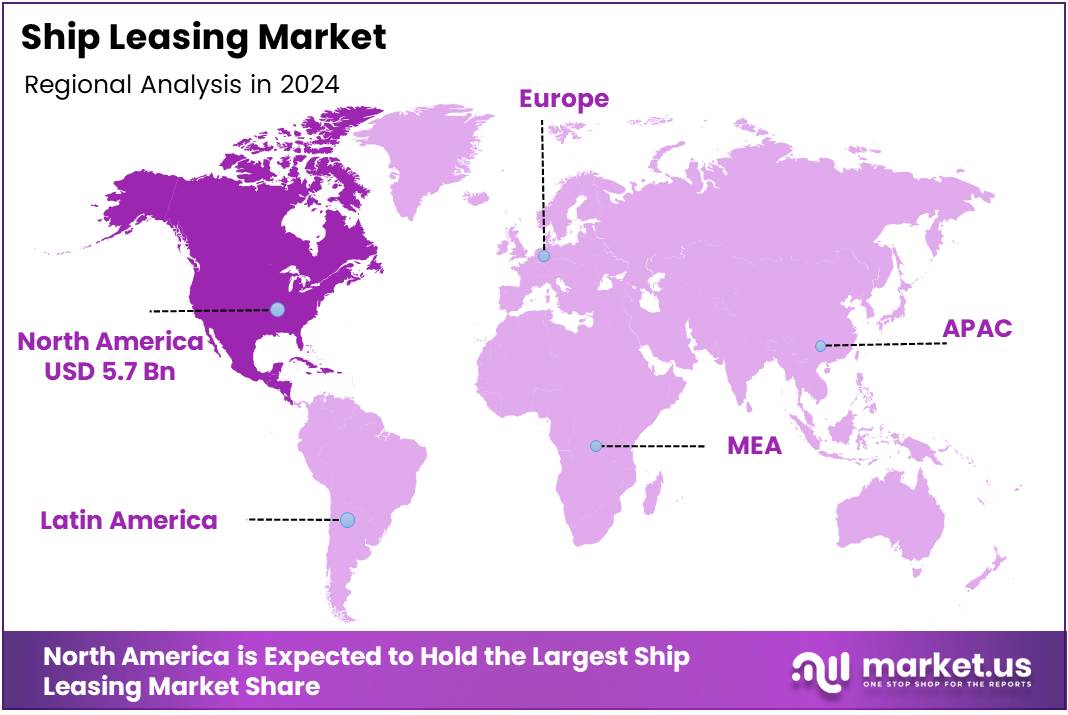

- North America accounted for 39.6% of the global ship leasing market, valued at USD 5.7 billion, due to advanced maritime infrastructure and significant investments.

Lease Type Analysis

Financial Lease dominates due to its structured ownership benefits and long-term cost efficiency.

In 2024, Financial Lease held a dominant market position in the By Lease Type Analysis segment of the Ship Leasing Market. The preference for Financial Leases is primarily driven by their structured ownership pathway, which allows lessees to eventually acquire the vessel. This model is attractive for companies seeking long-term control over their fleet without the immediate capital burden of full ownership.

Full-Service Lease, while gaining traction, occupied a relatively smaller portion of the market. This leasing type appeals to firms looking for an all-inclusive arrangement where maintenance, crew management, and operational services are bundled. Although convenient, the higher operational costs often deter price-sensitive operators from opting for this model.

As shipping companies continue to prioritize asset control and long-term planning, Financial Lease is expected to maintain its lead, reinforcing its role as a preferred leasing strategy across global maritime operations.

Type Analysis

Bareboat Charter dominates due to its operational flexibility and cost advantages.

In 2024, Bareboat Charter held a dominant market position in the By Type Analysis segment of the Ship Leasing Market. This charter type remains popular among operators due to its flexibility, allowing charterers full control over vessel operations, crewing, and routing, while avoiding capital-intensive ownership.

Real-Time Lease, designed for short-term and often urgent needs, held a modest share. Its popularity is mainly tied to its responsiveness in high-demand periods but is limited by higher per-use costs.

Periodic Tenancy has seen limited application, typically used in niche or transitional scenarios. Though offering more flexible termination clauses, it lacks the long-term assurance preferred by large shipping operators.

Other Types of leases, though existing, captured a minor market share. These include custom leasing models tailored for specific routes or commodity transport needs. However, due to standardization challenges, they remain on the periphery.

Application Analysis

Container Ships dominate due to global trade volume and intermodal efficiency.

In 2024, Container Ships held a dominant market position in the By Application Analysis segment of the Ship Leasing Market. The dominance of container ships is a direct reflection of their essential role in global trade, offering high-frequency shipping routes and integration with intermodal logistics systems.

These vessels are central to transporting consumer goods, electronics, and perishable items, making them a preferred asset for leasing. Their standardized cargo handling and port compatibility further enhance their leasing appeal.

Bulk Carriers, though significant in the market, held a comparatively lower share. Typically used for transporting raw materials such as coal, ore, and grain, their demand is more cyclical and tied to commodity market fluctuations. Leasing these vessels often involves longer charter durations with lower frequency, which limits their market share growth compared to container ships.

As trade routes evolve and e-commerce drives higher container volumes, container ships are expected to remain at the forefront of ship leasing demand globally.

Key Market Segments

By Lease Type

- Financial Lease

- Full-Service Lease

By Type

- Bareboat Charter

- Real-Time Lease

- Periodic Tenancy

- Other Types

By Application

- Container Ships

- Bulk Carriers

Drivers

Growing Demand for Long-Term Leasing Solutions Drives Market Growth

Ship leasing is becoming a preferred option for many companies due to the growing demand for long-term leasing solutions. Instead of buying ships, companies now lease them to save on upfront costs. Long-term leases offer better financial planning and reduce the risk of asset depreciation.

The expansion of global trade and maritime transportation also fuels the ship leasing market. As international trade grows, the need for more vessels rises, and leasing provides a flexible way to meet this demand without the heavy investment needed to purchase ships outright.

Another important driver is the rising investment in eco-friendly and fuel-efficient vessels. Shipowners are looking to upgrade fleets with greener technologies, and leasing gives them a way to access modern ships without taking on high capital expenditures. This shift supports sustainability goals while keeping operations cost-effective.

Restraints

Fluctuating Fuel Prices and Operational Costs Limit Market Stability

Fuel prices often change due to global market trends, and these fluctuations directly affect the operating costs of leased ships. When fuel becomes expensive, it can lower the profitability of leasing operations and make companies hesitant to commit to long-term contracts.

Operational costs, including maintenance, crew salaries, and insurance, also vary and are hard to predict. These rising expenses can make leasing less attractive, especially for smaller players with limited budgets.

Regulatory challenges are another restraint in the market. Governments are introducing stricter environmental laws, and complying with these regulations often means upgrading equipment or installing new systems. These changes can be expensive and affect the leasing value of older ships, making it tough for lessors to keep their fleets compliant and profitable.

Growth Factors

Emergence of Digital Platforms for Ship Leasing Transactions Unlocks Market Potential

Digital platforms are transforming the ship leasing market by making transactions faster and more transparent. These platforms allow lessees and lessors to connect directly, compare options, and sign contracts online, which simplifies the process and reduces paperwork.

The growing use of autonomous shipping solutions also opens new doors. Companies are testing unmanned vessels that require less crew and promise lower operating costs. As this technology matures, leasing companies can offer more advanced fleets to meet future demand.

There is also a surge in demand for specialized vessels used in niche markets like offshore wind energy or Arctic exploration. These ships are expensive and unique, making leasing a more practical option for operators who need them temporarily or occasionally. Leasing firms that focus on these areas could see strong growth in the coming years.

Emerging Trends

Shift Towards Green Shipping and Sustainable Vessel Operations Influences Market Trends

The ship leasing market is seeing a strong trend toward green shipping. Companies now prefer vessels that produce fewer emissions and follow sustainability guidelines. Leasing helps them upgrade to eco-friendly ships without a big upfront investment.

Artificial Intelligence and Big Data are also playing a bigger role in managing leased fleets. These technologies help predict maintenance needs, track performance, and improve fuel efficiency. Leasing companies using smart tools can offer better service and attract more clients.

Blockchain is gaining popularity for managing leasing contracts. It offers transparency, reduces fraud, and speeds up contract approvals. By adopting blockchain, leasing companies can build more trust with clients and simplify legal processes, making the entire leasing system more reliable and efficient.

Regional Analysis

North America Dominates the Ship Leasing Market with a Market Share of 39.6%, Valued at USD 5.7 Billion

North America leads the global ship leasing market, accounting for a 39.6% share and valued at USD 5.7 billion. This dominance is primarily driven by the presence of advanced maritime infrastructure, well-established shipping routes, and significant investments in commercial fleet expansion. The region’s strong financial institutions and favorable leasing frameworks continue to support the growth of long-term leasing contracts.

Europe Ship Leasing Market Overview

Europe follows North America with a mature ship leasing environment supported by its extensive coastline and strong regulatory frameworks. The presence of leading port hubs and cross-border maritime trade plays a pivotal role in market stability. Increasing emphasis on green shipping initiatives and modernization of fleets is expected to bolster leasing demand across the region.

Asia Pacific Ship Leasing Market Trends

Asia Pacific is a rapidly emerging region in the ship leasing market due to expanding seaborne trade and manufacturing activities. Nations such as China, South Korea, and Japan are driving demand with large-scale shipbuilding capabilities and rising intra-regional trade. Continued investments in port development and shipping infrastructure are anticipated to fuel market growth.

Middle East and Africa Ship Leasing Market Outlook

The Middle East and Africa region is showing steady progress in the ship leasing sector, underpinned by growing oil and gas exports and port development projects. Strategic maritime corridors such as the Suez Canal enhance the leasing potential in this geography. While the market is still developing, increasing trade volumes are expected to stimulate leasing activity.

Latin America Ship Leasing Market Insights

Latin America’s ship leasing market is gradually expanding, driven by its growing maritime trade and focus on enhancing regional port infrastructure. The demand for leased vessels is primarily linked to the energy and agricultural export sectors. However, regulatory uncertainties and limited leasing ecosystems currently pose challenges to accelerated growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Ship Leasing Company Insights

In 2024, the global Ship Leasing Market is being significantly influenced by several key players, each contributing uniquely to the sector’s growth and dynamics.

Zodiac Maritime, a major private player, maintains a strong market presence through its diversified fleet and long-term leasing strategies. Its operational efficiency and adaptability to shifting global trade routes have kept it competitive.

Teekay Corporation remains a crucial force in tanker and LNG shipping, leveraging its expertise in energy transport to secure stable lease contracts. The company’s focus on innovation and fleet modernization supports its consistent performance.

Navios Maritime Partners continues to solidify its role in the dry bulk and container segments, utilizing its expansive fleet to meet rising charter demands. Strategic acquisitions and long-term time charters have enhanced its position in global shipping.

Horizon Shipowners is gaining attention for its agile management approach and emphasis on environmentally efficient vessels. Though smaller than some competitors, its niche focus enables it to respond quickly to market needs, particularly in sustainable shipping solutions.

Together, these companies are shaping the trajectory of ship leasing by blending operational resilience with strategic investments. As the market responds to regulatory shifts, fuel innovations, and fluctuating global trade patterns, the role of these key players in balancing supply and demand will be critical.

Their performance in 2024 underscores a broader industry trend toward consolidation, digitalization, and sustainability, setting the tone for future growth and competition in the maritime leasing landscape.

Top Key Players in the Market

- Zodiac Maritime

- Teekay Corporation

- Navios Maritime Partners

- Horizon Shipowners

- Star Bulk Carriers

- Danaos Corporation

- Atlas Corp

- Seaspan Corporation

- Global Ship Lease

- TBS International

- Costamare

- Euroseas

- Brokers’ Circle

Recent Developments

- In April 2025, Asian leasing models are reshaping maritime funding, opening up new avenues for collaboration and investment in the sector. These models are seen as increasingly viable for funding ships, offering flexibility and reducing capital requirements for ship owners.

- In March 2025, DP World plans to launch its ship-leasing operations in India, specifically at GIFT City, aiming to tap into the growing maritime trade. This move is expected to enhance India’s role as a global shipping hub while attracting significant international investments.

- In September 2023, Alphard Maritime announced its intention to set up a $500 million shipping fund in IFSC GIFT City, aimed at boosting maritime infrastructure. The fund is expected to foster growth in the Indian maritime sector, enhancing its global competitiveness.

Report Scope

Report Features Description Market Value (2024) USD 14.6 Billion Forecast Revenue (2034) USD 62.2 Billion CAGR (2025-2034) 15.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Lease Type (Financial Lease, Full-Service Lease), By Type (Bareboat Charter, Real-Time Lease, Periodic Tenancy, Other Types), By Application (Container Ships, Bulk Carriers) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Zodiac Maritime, Teekay Corporation, Navios Maritime Partners, Horizon Shipowners, Star Bulk Carriers, Danaos Corporation, Atlas Corp, Seaspan Corporation, Global Ship Lease, TBS International, Costamare, Euroseas, Brokers’ Circle Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zodiac Maritime

- Teekay Corporation

- Navios Maritime Partners

- Horizon Shipowners

- Star Bulk Carriers

- Danaos Corporation

- Atlas Corp

- Seaspan Corporation

- Global Ship Lease

- TBS International

- Costamare

- Euroseas

- Brokers' Circle