Sexual Health Supplements Market Analysis By Composition (Natural, Synthetic, Blend), By End-User (Men, Women, Unisex), By Age Group (Teenagers & Young Adults, Middle-aged Adults, Older Adults (60+)), By Formulation (Capsules, Tablets, Liquids, Powders, Others), By Application (Libido Enhancement, Sexual Dysfunction, Stamina and Endurance, Fertility, Others), By Distribution Channel (Online, Offline (Hypermarkets/Supermarkets, Pharmacies & Drug Stores, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150163

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

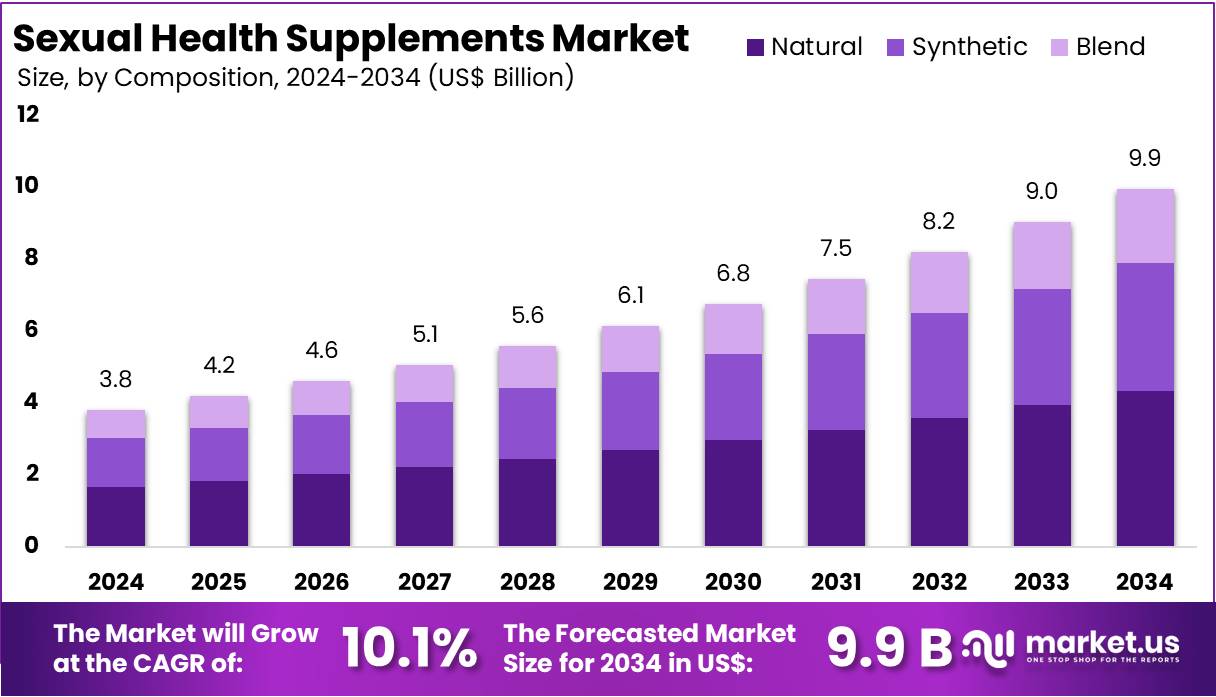

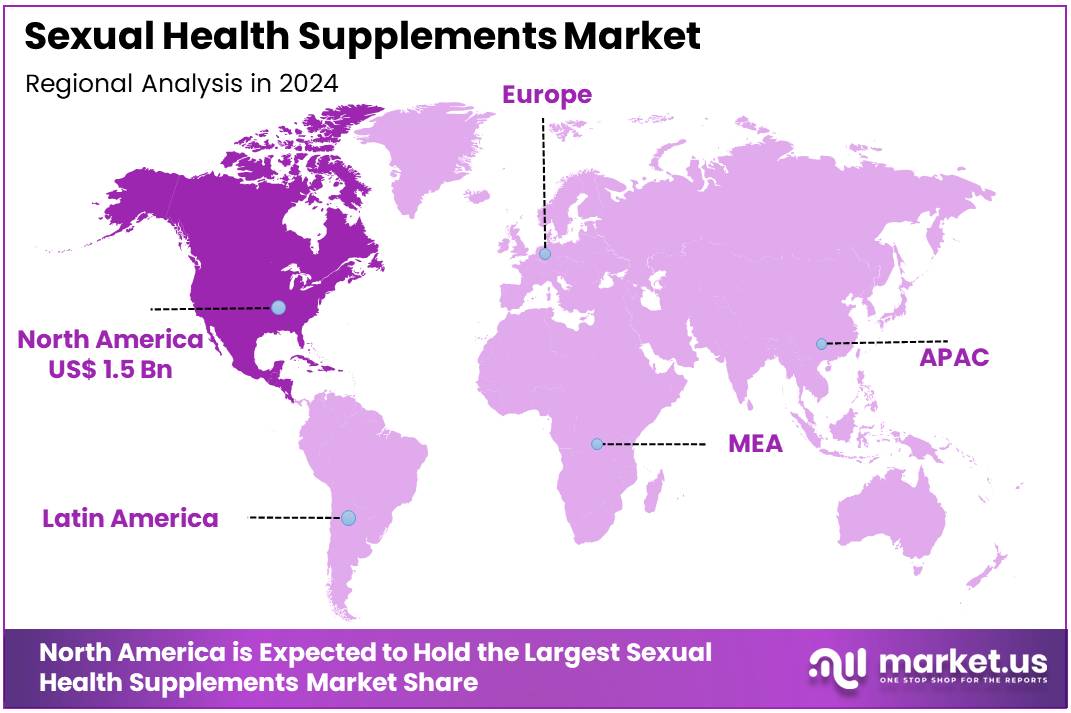

The Global Sexual Health Supplements Market size is expected to be worth around US$ 9.9 Billion by 2034, from US$ 3.8 Billion in 2024, growing at a CAGR of 10.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.3% share and holds US$ 1.5 Billion market value for the year.

Sexual health supplements are nutritional formulations developed to support various aspects of sexual wellness. These supplements are commonly used by both men and women to improve libido, stamina, hormonal balance, and reproductive function. Typically available over the counter, they are often preferred for their natural ingredients and non-prescription status. According to the World Health Organization (WHO), self-care interventions, including supplement use, play a key role in promoting sexual and reproductive health globally.

Aging populations and increased global health awareness are major factors driving the demand for sexual health supplements. As people grow older, conditions such as erectile dysfunction and reduced libido become more prevalent. For example, older adults increasingly turn to supplements to manage these age-related concerns. Additionally, rising awareness of preventive health encourages the use of vitamins and herbal products to enhance sexual function. This shift is aligned with WHO’s initiatives promoting sexual health as a crucial component of overall well-being.

Accessibility to supplements has significantly improved through the rise of e-commerce platforms. Online retail provides a discreet, convenient method for purchasing these products. For instance, digital channels now allow consumers to bypass potential embarrassment or stigma often associated with in-person purchases. Cultural shifts are also influencing market growth. Conversations around sexual health are becoming more open, leading to a greater willingness to seek effective, natural support products.

Scientific studies highlight the efficacy of key supplement ingredients such as L-arginine and ashwagandha. For example, L-arginine, which supports nitric oxide (NO) production, improves blood flow and erectile function. Clinical trials have shown that doses between 2.5 and 5 grams per day enhance erectile performance in men with mild to moderate dysfunction. Additionally, ashwagandha, taken at 225 mg/day or 400 mg/day, has been shown to reduce cortisol levels and stress, both of which affect sexual performance.

Micronutrients like zinc, selenium, vitamin C, and vitamin E are also essential for reproductive and immune health. According to nutritional guidelines, adult men require 11 mg/day of zinc, while women need 8 mg/day. For selenium, the recommended intake is 55 µg/day. Vitamin C is advised at 90 mg/day for men and 75 mg/day for women, while vitamin E is recommended at 15 mg/day. Deficiencies in these nutrients are linked to reduced sperm quality, fertility issues, and immune dysfunction.

Regulatory oversight remains critical to the supplement landscape. For instance, the U.S. FDA and the National Center for Complementary and Integrative Health (NCCIH) have flagged several sexual enhancement products for containing unlisted pharmaceutical substances. These findings emphasize the need for consumers to consult healthcare professionals before using supplements. Trustworthy sourcing, quality control, and verified claims are vital for the continued growth and credibility of the sexual health supplements sector.

Key Takeaways

- The global sexual health supplements market is projected to reach approximately US$ 9.9 billion by 2034, rising from US$ 3.8 billion in 2024.

- This market is anticipated to grow at a compound annual growth rate (CAGR) of 10.1% during the forecast period from 2025 to 2034.

- In 2024, natural-based supplements led the composition segment, accounting for over 43.7% of the total market share.

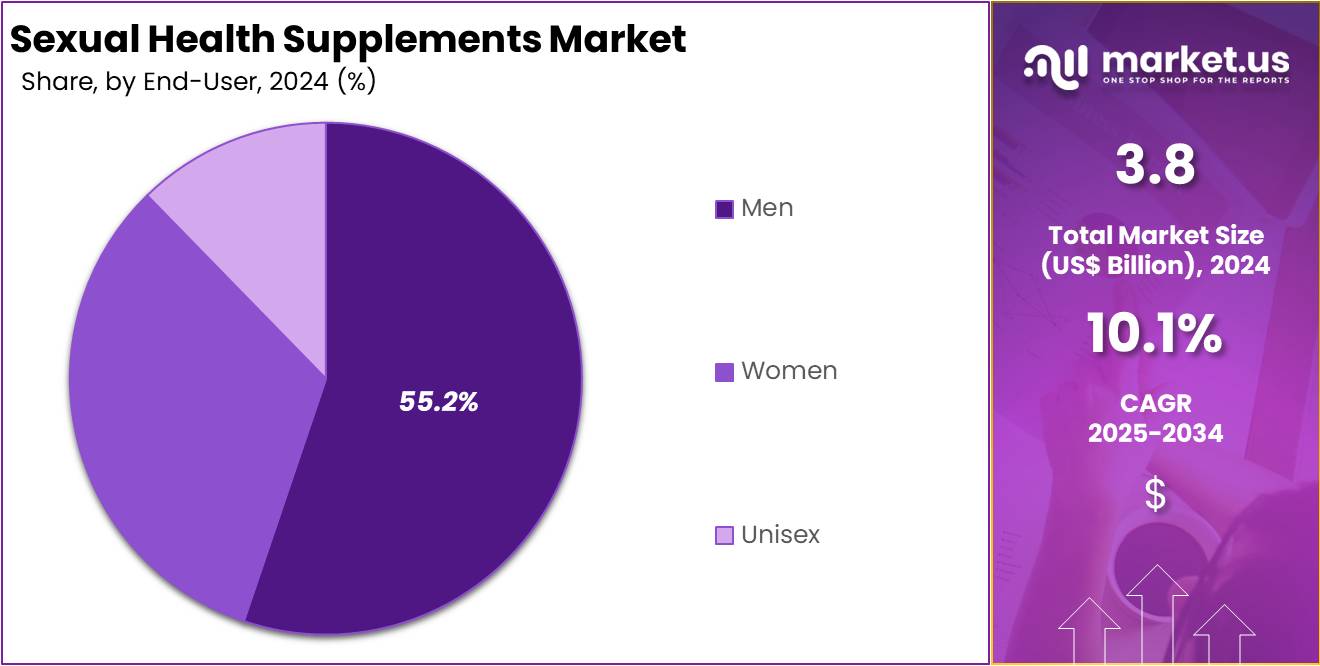

- Male consumers held the largest end-user share in 2024, representing more than 55.2% of the sexual health supplements market.

- Middle-aged adults emerged as the dominant age group in 2024, contributing over 46.2% to the overall market share.

- Capsules were the most preferred formulation in 2024, capturing more than 32.0% of the market.

- Libido enhancement remained the top application segment, holding over 28.3% share of the global market in 2024.

- Offline channels, including pharmacies and retail stores, led distribution in 2024, with a market share exceeding 56.6%.

- North America dominated the global landscape in 2024, capturing over 39.3% share and reaching a market value of US$ 1.5 billion.

Composition Analysis

In 2024, the Natural Section held a dominant market position in the Composition Segment of Sexual Health Supplements Market, and captured more than a 43.7% share. This was mainly due to rising consumer interest in plant-based and herbal products. People are increasingly choosing natural supplements for their perceived safety and minimal side effects. Ingredients such as maca root, ginseng, and tribulus are becoming more popular. The shift toward organic and traditional remedies continues to influence consumer buying behavior worldwide.

The Synthetic Section also accounted for a significant portion of the market. These supplements are often preferred for their fast-acting results and standardized dosages. They are frequently used in clinical settings or under medical advice. However, growing concerns about long-term use and potential health risks have limited their broader appeal. Regulatory authorities in many countries have imposed strict guidelines, which has affected the market presence of synthetic formulations. As a result, consumer trust remains cautious in this segment.

The Blend Section, which includes both natural and synthetic ingredients, has shown steady growth. These formulations aim to offer a balanced approach by combining natural extracts with synthetic compounds. Many consumers view these blends as effective and safer than fully synthetic alternatives. The growing demand for targeted and reliable performance solutions is supporting this trend. Manufacturers are also promoting these products as advanced formulas, further boosting their market adoption in both developed and emerging regions.

End-User Analysis

In 2024, the Men’s Section held a dominant market position in the End-User Segment of Sexual Health Supplements Market, and captured more than a 55.2% share. This strong presence was linked to rising concerns among men about declining testosterone levels and sexual performance. Increased openness in discussing male health issues led to higher product adoption. Many men also turned to supplements for stamina and energy. Accessibility through online platforms further boosted sales in this segment across both urban and semi-urban regions.

The Women’s Segment is projected to grow steadily due to greater awareness about hormonal balance and sexual wellness. More women are now using supplements for issues related to menopause, libido, and reproductive health. Products that include natural ingredients such as maca root, ginseng, and ashwagandha are preferred for their safety and benefits. Public health initiatives focused on women’s health also contributed to product visibility. Changing lifestyle patterns and stress-related hormonal issues are pushing more women toward preventive supplement use.

The Unisex Segment showed consistent growth, especially among couples and wellness-focused individuals. These supplements are often marketed as general enhancers for energy, circulation, and mood. Shared use simplifies purchase decisions, and growing trust in herbal and non-prescription products supports adoption. The rise of e-commerce and influencer marketing played a role in expanding this category. Consumers increasingly seek solutions that address stress and fatigue, which are common factors affecting sexual health across genders.

Age Group Analysis

In 2024, the Middle-aged Adults section held a dominant market position in the Age Group Segment of Sexual Health Supplements Market and captured more than a 46.2% share. This group, aged between 40 and 59, showed the highest demand due to age-related health concerns. Common issues like hormonal imbalance and reduced sexual function led to increased supplement use. Consumers in this group preferred natural and plant-based formulations. Easy access to non-prescription products further supported growth in this segment.

Older adults aged 60 and above represented the second-fastest-growing segment. This trend was influenced by rising awareness about sexual health in older populations. Improved life expectancy and focus on maintaining quality of life supported higher supplement consumption. Products designed for energy, stamina, and hormone support were especially popular. Support from healthcare professionals for select supplements also encouraged usage. As a result, this age group contributed significantly to the market’s expansion in the sexual wellness category.

Teenagers and young adults formed the smallest share but showed growing interest. Males aged 18 to 30 sought supplements for boosting energy, reducing stress, and enhancing libido. Social media trends and digital marketing played a big role in influencing this group. Despite their rising interest, strict regulations and safety concerns limited market penetration. Still, the segment gained attention from brands targeting lifestyle-conscious youth. The long-term potential of this segment depends on evolving regulatory clarity and product safety validation.

Formulation Analysis

In 2024, the Capsules Section held a dominant market position in the Formulation Segment of Sexual Health Supplements Market, and captured more than a 32.0% share. This growth can be linked to their ease of use and accurate dosage delivery. Consumers often prefer capsules due to better absorption and long shelf life. These benefits make capsules a favored option among adults seeking privacy and convenience. The availability of herbal and natural capsule-based supplements has also contributed to their increasing adoption.

Tablets accounted for a considerable market share after capsules. Their longer shelf life and low production costs support wide usage. Many consumers choose tablets for multivitamin-based sexual wellness products. However, their slower absorption compared to capsules may deter younger users seeking quicker results. Despite this, tablets remain a reliable and cost-effective choice. Manufacturers continue to offer diverse formulations in tablet form, which helps maintain their market relevance across different consumer groups.

Liquids and powders are emerging as alternatives, especially for those who prefer fast-acting or customizable options. Liquid supplements appeal to older adults who may have difficulty swallowing pills. Powders are gaining popularity in fitness-related sexual health products. The Others segment, including gummies and sprays, is growing steadily. This growth is supported by product innovation and increasing demand from younger consumers. These novel forms offer convenience and variety, attracting new users in the evolving sexual health supplement market.

Application Analysis

In 2024, the Libido Enhancement section held a dominant market position in the Application Segment of Sexual Health Supplements Market and captured more than a 28.3% share. This segment benefited from growing awareness of sexual wellness and increasing consumer comfort with natural supplements. Digital health platforms and social media campaigns promoted openness around libido concerns. Products targeting both men and women contributed to strong sales. The demand was also supported by rising interest in non-prescription and herbal alternatives for improving intimacy.

The Sexual Dysfunction segment recorded significant growth due to the high prevalence of issues like erectile dysfunction and hormonal imbalance. According to the U.S. National Institutes of Health, over 30 million men are affected by erectile dysfunction. Consumers are turning to supplements that help with hormone support and blood circulation. These products offer a convenient option for individuals avoiding prescription medications. This segment continues to grow as aging populations seek accessible and effective solutions to manage sexual health.

The Stamina and Endurance segment also saw increasing popularity, especially among fitness-focused individuals and younger users. These supplements are widely used for boosting energy, improving performance, and enhancing physical endurance. Meanwhile, the Fertility segment expanded due to delayed parenthood and growing infertility concerns. Demand for natural fertility boosters increased across both genders. The Others segment includes products aimed at stress, mood, and energy, all of which influence sexual well-being. These combined trends suggest growing acceptance of supplements as part of holistic sexual health.

Distribution Channel Analysis

In 2024, the Offline Section held a dominant market position in the Distribution Channel Segment of Sexual Health Supplements Market and captured more than a 56.6% share. This stronghold was largely due to the presence of well-established pharmacies, drug stores, and hypermarkets. These outlets offered consumers easy access and personalized buying experiences. Many customers, especially older individuals, preferred in-store purchases for privacy and professional guidance. The trust in pharmacists and the ability to verify products physically also played a key role.

Pharmacies and drug stores contributed heavily to offline sales through professional consultation and convenient locations. These stores stocked a wide range of products, making them a preferred choice for regular buyers. Hypermarkets and supermarkets added value by offering discounts, product bundles, and educational in-store displays. Seasonal campaigns and promotional events helped increase product visibility. The ability to compare brands in person encouraged customer loyalty and boosted sales across different supplement categories.

Despite the rise of e-commerce, the offline model continued to dominate due to consumer habits and immediate product access. While online channels offered convenience, many buyers still opted for traditional stores. Offline channels remain essential, particularly in regions with limited digital infrastructure. The need for discreet, trustworthy purchasing environments supports the offline channel’s growth. The consistent supply chain, face-to-face support, and physical product presence make offline platforms a cornerstone in the expansion of the sexual health supplements market.

Key Market Segments

By Composition

- Natural

- Synthetic

- Blend

By End-User

- Men

- Women

- Unisex

By Age Group

- Teenagers & Young Adults

- Middle-aged Adults

- Older Adults (60+)

By Formulation

- Capsules

- Tablets

- Liquids

- Powders

- Others

By Application

- Libido Enhancement

- Sexual Dysfunction

- Stamina and Endurance

- Fertility

- Others

By Distribution Channel

- Online

- Offline

- Hypermarkets/Supermarkets

- Pharmacies & Drug Stores

- Others

Drivers

Growing Demand for Natural and Herbal Sexual Health Solutions

The demand for natural and herbal products is significantly shaping the sexual health supplements market. A notable shift toward plant-based alternatives is being observed, particularly among middle-aged adults seeking safer, non-prescription options. According to the National Center for Complementary and Integrative Health (NCCIH), 17.7% of U.S. adults use herbal supplements. This trend reflects a growing acceptance of natural wellness approaches. Herbal supplements are being favored over synthetic treatments for improving libido, hormonal balance, and stamina, boosting their market share in sexual health.

The rising prevalence of sexual health concerns globally is further accelerating this demand. Health agencies estimate that the number of individuals experiencing sexual health issues will exceed 320 million by 2025. This growing burden has encouraged the adoption of herbal and alternative therapies. Many consumers prefer supplements perceived as safer and free from side effects compared to pharmaceutical solutions. As awareness spreads, herbal formulations are becoming a trusted option for managing sexual health conditions.

Moreover, widespread dietary supplement use supports this growth. According to CDC data from 2017–2018, 57.6% of U.S. adults reported taking supplements, with usage higher among women (63.8%) than men (50.8%). This widespread behavior indicates a strong consumer base already engaged in wellness supplementation. As awareness increases around sexual health and natural remedies, this foundation will likely foster greater adoption. The integration of sexual health supplements into daily routines continues to drive sustained market expansion.

Restraints

Insufficient Regulatory Oversight and Product Adulteration Risks

The absence of mandatory FDA pre-market approval for dietary supplements, including those for sexual health, has resulted in significant safety concerns. Under the DSHEA of 1994, supplements are classified as food products. This limits the FDA’s authority to post-market interventions. Manufacturers are responsible for product safety and labeling, but there is no consistent enforcement before market entry. This regulatory gap has allowed many unverified sexual health supplements to enter the market, raising questions about product reliability and consumer protection.

Between 2007 and 2016, the FDA found 776 dietary supplements adulterated with unapproved drugs, with 353 linked to sexual enhancement. Many of these products contained undeclared pharmaceutical ingredients such as sildenafil and dapoxetine. These substances pose serious health risks, especially when users unknowingly consume them. The inclusion of these drugs without disclosure can cause dangerous interactions with prescribed medications. This prevalence of adulteration highlights a critical public health issue related to unregulated sexual health products.

Consumers often believe these supplements are safe due to their natural claims. However, inadequate labeling and a lack of transparency contribute to accidental consumption of harmful substances. From 2004 to 2021, over 79,000 adverse event reports were linked to dietary supplements, signaling widespread health implications. The absence of clear regulatory checks undermines trust and may deter potential users. Stronger oversight, including pre-market testing and accurate labeling, is necessary to ensure safety in the sexual health supplements sector.

Opportunities

Rising Emphasis on Reproductive Health and Self-Care Interventions

A growing emphasis on sexual and reproductive health education is positively influencing the demand for sexual health supplements. Public health bodies, including the CDC, are actively promoting awareness around fertility, hormonal disorders, and sexual wellness. This shift has created favorable market conditions for products that support testosterone, menopausal health, and fertility. With over 40% of U.S. adolescents reporting sexual activity, the awareness of reproductive health needs is translating into increasing demand for accessible, over-the-counter health solutions.

Access to reproductive healthcare among youth also supports this trend. Between 2006 and 2010, more than 76.5% of sexually experienced females and 62.5% of males aged 15–19 in the U.S. received reproductive health services. This access promotes early engagement with health interventions and supplements. As adolescents and young adults increasingly seek non-prescription alternatives, sexual health supplements stand to benefit from this proactive health behavior.

Furthermore, the World Health Organization (WHO) recognizes self-care as a critical element of public health strategy. It supports the use of over-the-counter aids, including supplements, for contraception and fertility. This institutional backing further validates the role of natural supplements in addressing hormonal and sexual health needs. Products targeting menopausal symptoms and testosterone support are now better positioned to gain consumer trust and regulatory acceptance.

Trends

Rising Demand for Online and Direct-to-Consumer (DTC) Channels in Sexual Health Supplements

The digital transformation of healthcare is driving significant change in how consumers access sexual health supplements. Increasing numbers of individuals, especially younger adults, are purchasing these products online for privacy and ease. Online platforms allow users to avoid stigma or discomfort often associated with in-person shopping. As a result, brands that offer online shopping with discreet packaging and secured payment systems are witnessing higher engagement and customer retention, especially in urban and digitally connected regions.

Telehealth integration has further accelerated the popularity of direct-to-consumer models. Many platforms now offer virtual consultations, allowing users to receive expert recommendations without visiting a clinic. This model provides an end-to-end service, from diagnosis to product delivery. Such integration enhances trust and convenience, which are key purchase drivers for sexual wellness products. The trend is particularly evident in North America, where healthcare digitization and consumer tech adoption are comparatively more advanced.

Subscription-based models are also gaining momentum. These services provide regular, automated delivery of sexual health supplements, ensuring consistent usage. This model supports long-term wellness and improves adherence to supplementation regimens. Additionally, companies benefit from predictable revenue and stronger customer relationships. As digital health infrastructure expands, the demand for online and DTC sexual health products is expected to rise further, making this a dominant trend in the coming years.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 39.3% share and holds US$ 1.5 Billion market value for the year. This growth has been supported by high awareness about sexual wellness across the region. Many adults are turning to dietary and herbal supplements to manage age-related and lifestyle-induced issues. In the U.S. and Canada, the availability of over-the-counter products has made it easier for consumers to access these solutions without the need for prescriptions.

Consumer behavior in North America has also shifted toward preventive health. People are now more open to discussing sexual wellness. As a result, demand for sexual health supplements continues to grow. The market is further strengthened by trust in local regulatory systems. This ensures safety and quality for most products sold in the region. Brand recognition and customer loyalty are also helping drive repeat purchases, especially for gender-specific formulations.

E-commerce has played a key role in expanding access to supplements. Many companies use digital platforms to market directly to consumers. This allows for better targeting and broader reach. Rising disposable incomes and a large aging population are additional contributors. These groups often prefer natural alternatives over pharmaceutical treatments. As a result, North America remains the leading region in the global sexual health supplements sector, supported by favorable economic and social factors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global sexual health supplements market is highly fragmented, with multiple players competing through innovation and expansion. Key companies are introducing natural and safe products to meet the growing demand for sexual wellness, energy, and hormonal balance. GNC Holdings LLC leads with a wide range of male enhancement and stamina supplements. Its scientific formulations and retail network help maintain its stronghold in North America. Meanwhile, Himalaya Drug Company stands out in the Ayurvedic segment, backed by clinical validation and traditional medicine, with growth driven from Asia-Pacific and the Middle East.

Amway plays a major role through its Nutrilite brand, targeting premium consumers across global markets. Its vast direct-selling network enhances consumer access, while R&D investments support personalized health offerings. Nature’s Bounty appeals to both men and women with its transparent, herbal-based supplements. Its wide distribution in pharmacies and wellness stores strengthens its position across North America and Europe. Strategic collaborations and third-party testing further enhance brand trust and consumer engagement.

Metagenics caters to the clinical segment, focusing on practitioner-prescribed, functional supplements. Its hormone-balancing and sexual wellness formulations are grounded in clinical research. This science-backed approach helps the brand gain acceptance among health professionals. NOW Foods, on the other hand, offers value-based solutions with clean-label products such as vegan and non-GMO supplements. Its pricing strategy and quality control ensure steady growth in North America and expanding access in Europe and Asia.

Other regional players contribute to intense market fragmentation, especially in emerging economies. These include local brands offering traditional supplements or region-specific formulas. Many new entrants rely on online platforms and influencer marketing to target younger consumers. Direct-to-consumer (DTC) models are increasingly popular, driven by digital engagement and health transparency. Overall, strategic focus on natural ingredients, clinical backing, and broad market access defines the competitive landscape for sustained growth.

Market Key Players

- GNC Holdings LLC

- Himalaya Drug Company

- Amway

- Nature’s Bounty

- Metagenics

- NOW Foods

- Life Extension

- Source Naturals

- Twinlab

- Force Factor LLC

- Nutraceutical Corporation

- Swisse Wellness

- Solgar

- BioXgenic

- Irwin Naturals

Recent Developments

- In March 2025: Amway reported a 3% decline in its overall revenue for the year 2024, totaling $7.4 billion USD. Despite this downturn, the company experienced a 2% increase in sales of its Nutrilite brand of supplements. This growth in the nutritional segment highlights a consumer shift towards health and wellness products, which could encompass sexual health supplements, although specific product categories were not detailed.

- In October 2024: Nature’s Bounty expanded its women’s wellness portfolio by introducing the Intimacy Booster, a supplement designed to enhance sexual pleasure and support overall intimate well-being. This product combines clinically studied ingredients such as KSM-66® Ashwagandha and Panax Ginseng, which have been associated with improved arousal, lubrication, and stress reduction. The formulation aims to address common concerns related to women’s sexual health and is available through major retailers including Amazon, CVS, and Kroger.

- In May 2024: Metagenics introduced the HerWellness™ product line, focusing on women’s hormonal health. This line includes formulations combining botanicals like saffron and green tea extract with activated Vitamin B6, aiming to support hormone balance and alleviate symptoms associated with perimenopause and menopause. The launch underscores Metagenics’ commitment to science-based, natural solutions for women’s health.

- In 2023: GNC launched “GNC Men’s ArginMax,” an advanced sexual health supplement formulated to enhance sexual desire and performance. This patented formula includes a blend of L-arginine, ginseng, and ginkgo biloba, ingredients known to support nitric oxide production and improve blood flow. The product aims to address common sexual health concerns among men, reflecting GNC’s focus on evidence-based solutions in the wellness market.

Report Scope

Report Features Description Market Value (2024) US$ 3.8 Billion Forecast Revenue (2034) US$ 9.9 Billion CAGR (2025-2034) 10.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Composition (Natural, Synthetic, Blend), By End-User (Men, Women, Unisex), By Age Group (Teenagers & Young Adults, Middle-aged Adults, Older Adults (60+)), By Formulation (Capsules, Tablets, Liquids, Powders, Others), By Application (Libido Enhancement, Sexual Dysfunction, Stamina and Endurance, Fertility, Others), By Distribution Channel (Online, Offline (Hypermarkets/Supermarkets, Pharmacies & Drug Stores, Others)) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GNC Holdings LLC, Himalaya Drug Company, Amway, Nature’s Bounty, Metagenics, NOW Foods, Life Extension, Source Naturals, Twinlab, Force Factor LLC, Nutraceutical Corporation, Swisse Wellness, Solgar, BioXgenic, Irwin Naturals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sexual Health Supplements MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Sexual Health Supplements MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GNC Holdings LLC

- Himalaya Drug Company

- Amway

- Nature's Bounty

- Metagenics

- NOW Foods

- Life Extension

- Source Naturals

- Twinlab

- Force Factor LLC

- Nutraceutical Corporation

- Swisse Wellness

- Solgar

- BioXgenic

- Irwin Naturals