Global Semiochemicals Market By Type(Pheromones, Allelochemicals), By Source(Animal, Plant, Chemically Synthesized, By Function, Detection and Monitoring, Mass Trapping, Mating Disruption), By Mode of Application(Traps, Sprays, Dispensers, Others), By Crop Type(Orchard Crops, Vegetables, Field Crops, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116841

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

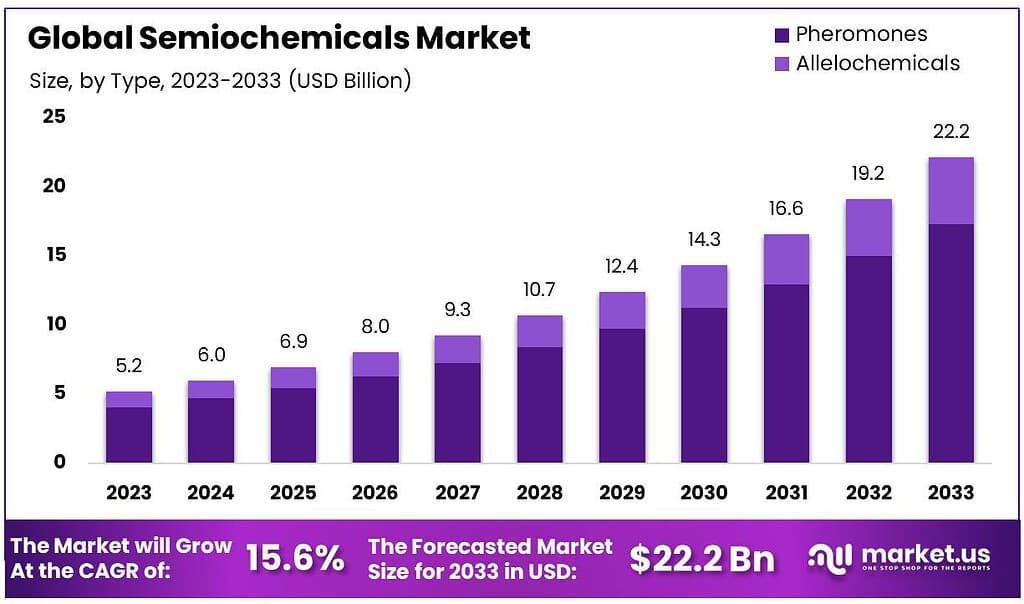

The global Semiochemicals Market size is expected to be worth around USD 22.2 Billion by 2033, from USD 5.2 Billion in 2023, growing at a CAGR of 15.6% during the forecast period from 2023 to 2033.

The Semiochemicals Market encompasses a specialized sector within the chemical industry, focusing on the study, development, and commercialization of semiochemicals. These substances are pivotal in communication among organisms, particularly within the context of agriculture and pest management.

Semiochemicals include a broad spectrum of pheromones and allelochemicals, substances that organisms use to interact with each other. Their applications span across various domains, but they are most prominently utilized in integrated pest management (IPM) strategies, aiming to reduce the reliance on synthetic pesticides and foster more sustainable agricultural practices.

The market’s growth can be attributed to increasing awareness of the environmental and health implications of conventional pesticides, driving the demand for eco-friendly alternatives. Semiochemicals, by their nature, offer targeted pest control solutions, minimizing harm to non-target species and reducing the ecological footprint of agricultural activities. This specificity not only contributes to their environmental benefits but also enhances their efficacy in pest management programs.

Key Takeaways

- Market Growth: Projected worth of USD 22.2 billion by 2033, with a CAGR of 15.6% from 2023 to 2033.

- Pheromone Dominance: Holds over 78.3% market share in 2023, crucial for targeted pest control in IPM strategies.

- Emerging Allelochemicals: Rapidly growing segment in organic agriculture, aligning with sustainable farming practices.

- Traps Preference: Dominant mode of application, capturing more than 50.6% market share in 2023.

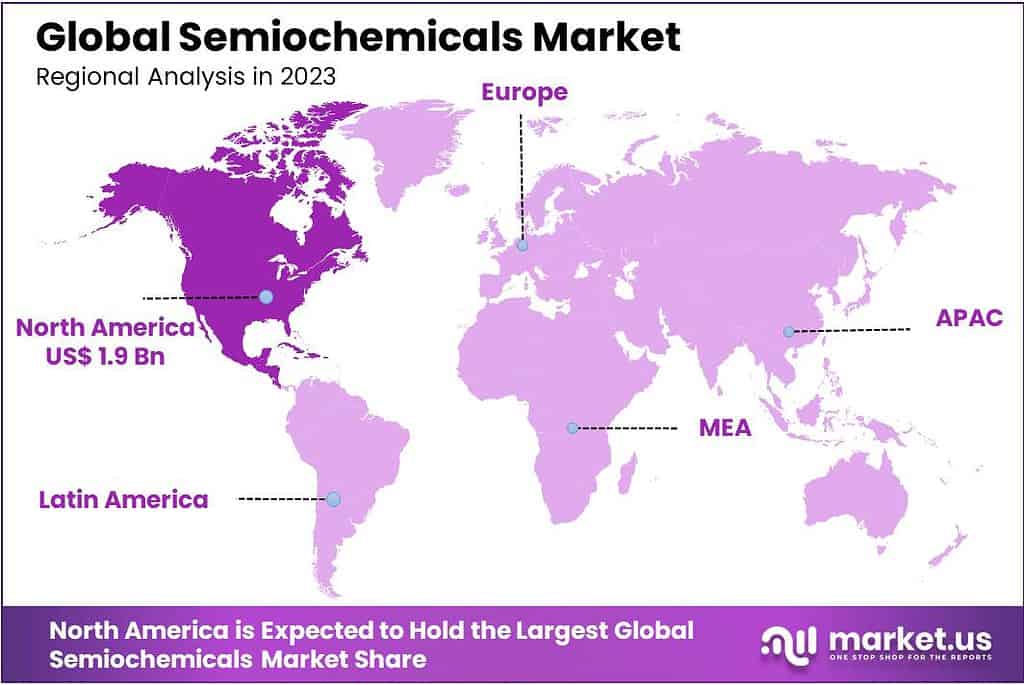

- Regional Leadership: North America leads with a 36.4% market share, driven by sustainable pest control awareness.

- As of 2024, over 1,700 plant volatile compounds have been identified as semiochemicals.

- As of 2024, over 30 semiochemical-based products are registered for use in conservation efforts worldwide.

- As of 2024, over 200 semiochemicals have been identified in marine ecosystems, with potential applications in aquaculture and reef conservation.

By Type

In 2023, Pheromones held a dominant market position, capturing more than a 78.3% share. This segment benefits from its crucial role in integrated pest management (IPM) strategies. Pheromones, as signaling chemicals, are pivotal for managing pest populations in agriculture and forestry, offering targeted control with minimal environmental impact.

Their effectiveness in attracting, repelling, or altering the behavior of pests underscores their value. The demand for pheromones has surged, driven by the global push towards sustainable farming practices and the need to reduce chemical pesticide usage. Innovation and research in this segment are vibrant, focusing on developing more efficient and species-specific pheromone products.

Allelochemicals, on the other hand, represent a smaller but rapidly growing segment of the market. These substances mediate interactions between plants and other organisms in their environment, including pests, pollinators, and neighboring plants. Their application in agriculture is expanding as an understanding of their potential grows.

Allelochemicals offer natural weed control and pest management solutions, aligning with the trend toward organic and sustainable agriculture. This segment is expected to see significant growth, fueled by ongoing research into novel applications and the development of allelochemical-based products that can enhance crop yield and resilience while reducing reliance on synthetic chemicals.

Both segments are propelled by the increasing demand for eco-friendly and sustainable agricultural inputs. As awareness and regulatory support for environmentally friendly farming practices continue to rise, the semiochemicals market is poised for further expansion. The focus on research and development within these segments is critical, ensuring that semiochemical-based solutions remain effective, cost-efficient, and accessible for global agricultural needs.

By Source

In 2023, Chemically Synthesized semiochemicals held a dominant market position. This segment leads due to its reliability and scalability in production, crucial for meeting the global demand for pest management solutions.

Chemically synthesized semiochemicals are favored for their consistency and effectiveness, allowing for precise control over pest populations in agriculture and forestry. Their wide availability and the ability to tailor them to specific pest targets contribute to their strong market presence.

Animal-derived semiochemicals also play an essential role in the market, particularly in areas like mating disruption and pest monitoring. These natural sources are valued for their authenticity and specificity, offering highly effective solutions for managing pest behavior. However, challenges related to sourcing and scalability have limited their market share compared to chemically synthesized counterparts.

Plant-based semiochemicals are emerging as a promising segment, driven by growing interest in organic and sustainable agriculture. These substances, extracted from plants, offer eco-friendly alternatives to synthetic chemicals. Their appeal lies in their natural origin and lower environmental impact, aligning with consumer preferences for greener agricultural practices. As research advances, this segment is expected to grow, reflecting an increasing shift towards sustainable farming solutions.

By Function

In 2023, Mass Trapping held a dominant market position, capturing more than a 42.6% share. This method is widely appreciated for its direct approach to controlling pest populations by physically removing them from the environment. Mass trapping, leveraging semiochemicals to lure pests into traps, is effective in reducing pest numbers without the use of harmful chemicals. Its popularity has grown due to its simplicity, eco-friendliness, and efficiency in various agricultural settings.

Mating Disruption, another key function of semiochemicals, also plays a significant role in the market. This strategy involves dispersing pheromones to confuse pests and prevent them from mating, thereby reducing future populations. It’s highly valued in integrated pest management for its non-toxic and species-specific approach. Mating disruption is especially effective in orchards and vineyards, where it helps maintain pest control with minimal environmental impact.

Detection & Monitoring, while holding a smaller share, is crucial for the early identification and management of pest outbreaks. This segment relies on semiochemicals to attract pests to traps for monitoring purposes, allowing for timely and informed decision-making in pest management strategies. As agriculturalists increasingly adopt data-driven approaches to pest control, the importance of detection and monitoring is expected to rise, offering significant growth opportunities within the semiochemicals market.

Each of these functions highlights the versatility and ecological benefits of semiochemicals in pest management. The increasing global focus on sustainable agriculture and the need for effective, environmentally friendly pest control solutions are driving growth across these segments, with innovation and research continuing to open new avenues for application and efficiency.

By Mode of Application

In 2023, Traps held a dominant market position, capturing more than a 50.6% share. This mode of application is favored for its effectiveness and eco-friendliness, offering a direct method for controlling pests without harming the environment.

Traps, integrated with semiochemicals, attract specific pests, making them highly efficient for targeted pest management. Their popularity stems from their ease of use and the minimal maintenance they require, proving particularly valuable in both agricultural and residential settings.

Sprays, utilizing semiochemicals in a liquid form, also play a significant role in the market. These are applied directly to crops or in the surrounding environment to disrupt pest behavior, including mating disruption or deterring pests from entering an area.

Sprays offer the advantage of covering large areas quickly, making them a go-to solution for immediate pest control needs. Ongoing innovations aim to improve their formulation and application methods to enhance effectiveness and reduce any potential non-target effects.

Dispensers are another key mode of application, designed to release semiochemicals slowly over time. This controlled release technology ensures a consistent and prolonged presence of the active compounds, making dispensers ideal for mating disruption and mass trapping strategies. Their use is particularly prevalent in large-scale agricultural operations where long-term pest management is critical.

The “Others” category encompasses various innovative and emerging application methods, including microencapsulation and genetic modification, broadening the scope of semiochemical usage. These novel technologies promise to offer more precise and sustainable pest management solutions, catering to the specific needs of different crops and environments.

The semiochemicals market, by mode of application, highlights the industry’s adaptability and commitment to environmental stewardship. As the demand for sustainable agricultural practices continues to rise, the development and refinement of these application methods are expected to drive market growth, offering effective solutions for pest control while minimizing ecological impact.

By Crop Type

In 2023, Orchard Crops held a dominant market position, capturing more than a 41.2% share. This segment benefits significantly from semiochemicals, especially in combating pests that threaten fruits and nuts. Orchard farmers rely on these eco-friendly solutions to protect their crops without compromising the quality of produce or the environment. The effectiveness of semiochemicals in maintaining pest control with minimal impact on beneficial insects makes them highly valued in orchards.

Vegetables, another key segment, also utilize semiochemicals to ensure healthy growth and yield. The application of semiochemicals in vegetable farming is crucial for managing pests in a way that keeps vegetables safe for consumption while preserving their nutritional value. Innovations in semiochemical applications are continually enhancing the safety and sustainability of vegetable production, catering to the growing consumer demand for organic produce.

Field Crops, including grains, cereals, and oilseeds, represent a vital area for semiochemical use. Given the vast areas these crops cover, semiochemicals offer an effective and environmentally responsible method for large-scale pest management. The adoption of semiochemical strategies in field crops is driven by the need to ensure food security and reduce dependency on chemical pesticides, aligning with global sustainability goals.

The “Other” category encompasses a range of crops, including ornamentals and specialty crops, where semiochemicals are finding increasing application. The versatility and targeted nature of semiochemicals make them suitable for diverse agricultural needs, supporting pest management in various crop types without harming the ecosystem.

Overall, the semiochemicals market, by crop type, demonstrates the broad applicability and growing importance of these eco-friendly pest control solutions across different agricultural sectors. As awareness and regulatory support for sustainable farming practices increase, the use of semiochemicals is expected to expand, offering effective pest management solutions that align with environmental conservation efforts.

Market Key Segments

By Type

- Pheromones

- Allelochemicals

By Source

- Animal

- Plant

- Chemically Synthesized

By Function

- Detection & Monitoring

- Mass Trapping

- Mating Disruption

By Mode of Application

- Traps

- Sprays

- Dispensers

- Others

By Crop Type

- Orchard Crops

- Vegetables

- Field Crops

- Others

Drivers

Increasing Demand for Sustainable Crop Protection Solutions to Drive Market Growth

According to the Food & Agricultural Organization (FAO). But, over the last few years, people have become more aware of how these chemicals can harm crops and, in turn, affect our health. This concern has made farmers worldwide look for better ways to farm.

They’re moving towards farming methods that are good for the planet, like using bio-pesticides and other green ways to keep crops healthy. This shift shows how important it is to farm in ways that are safe for both people and the environment.

Semiochemicals are natural pesticides that are safe for the environment and organic farming. Researchers are working hard to make more of these pesticides to help more farmers. This will make the semiochemicals market grow in the future.

Strong Demand for High-Value Crops to Boost Growth

These days, people are really into eating foods that are good for their health. They’re all about stuff like organic, clean-label, and pesticide-free foods. This shift in preferences is making farmers all over the world focus more on growing valuable crops like organic fruits and veggies. People are getting more careful about what they eat, so farmers are using fewer chemicals to grow their crops.

They’re also trying out farming methods that are nicer to the environment. As more folks in places like Europe start eating vegan diets, they’re munching on more of the good stuff like fruits, veggies, and nuts, which are considered high-value crops.

All this attention to healthier eating is causing big changes in the farming world. It’s not just about growing food anymore; it’s about growing food that’s good for people and the planet. Farmers are listening to what consumers want and are finding ways to grow crops that are safer and more sustainable. And as more people catch on to the benefits of quality crops, this trend is expected to keep on growing in the years to come.

Restraints

Lack of Awareness and High Cost of Active Ingredients to Hamper Market Growth

Even though biological pesticides are safer for crops and the environment, many farmers in developing countries like those in the Asia Pacific, the Middle East, and Africa don’t know much about them. This lack of knowledge is slowing down the growth of the market. Also, these biopesticides need a lot of care and cost more than regular pesticides. This makes it hard for small-scale farmers to use them. Plus, using these pesticides requires more workers, which adds to the cost and makes it even tougher for farmers to afford.

But, things might start looking up soon. Governments are starting to support farmers more, which could help them use these safer pesticides. This could solve some of the problems, making it easier for farmers to switch to healthier pest control methods in the future.

Opportunities

The rapid adoption of organic farming

The market for organic farming is booming because more and more farmers are choosing to grow food without using synthetic pesticides, fertilizers, or genetically modified ingredients. People all over the world are loving organic food because they think it’s safer and healthier. They’re becoming more aware of how harmful chemical pesticides and fertilizers can be, and they’re worried about their health. This growing demand for organic food is driving the market forward.

Plus, there’s a growing trend of people wanting to eat food that’s free from pesticides and other harmful chemicals. They’re into stuff like natural and clean-label foods. This trend, along with concerns about the negative effects of chemical pesticides, is also helping the market grow. So, as more people get into organic farming and organic food, the market is expected to keep on growing.

Trends

Surging Popularity of Organic Farming to Fuel Market Growth

Organic farming is becoming more popular worldwide because people like organic foods. They’re learning about how healthy organic food can be, and that’s driving the market. People are also getting more worried about the bad effects of chemical pesticides and fertilizers, so they’re choosing organic options more often.

According to the Institute of Organic Agriculture, the amount of land used for organic farming grew a lot from 2017 to 2018, reaching 71.5 million hectares. This increase in organic farming is making more farmers look for ways to control pests without using harmful chemicals.

In places like North America and Europe, where people are big fans of organic and clean-label foods, farmers are also getting more interested in sustainable farming methods. They’re realizing that these methods are better for the environment and for people’s health. This growing awareness among farmers in these regions is helping the market for organic farming to grow even more.

Regional Analysis

North America is expected to lead the way in the semiochemicals market.

As of 2023, North America holds the largest share of the global semiochemicals market, making up 36.4%. The United States, in particular, is driving the adoption of semiochemicals, driven by the growing need for safer and more reliable pest control solutions. This demand is fueled by concerns over aging agricultural practices and the increasing occurrence of pest-related issues.

There’s a growing awareness in North American agriculture and communities about the importance of sustainable pest control methods. This understanding is driving investment in advanced solutions like semiochemicals. People in this market understand the benefits that semiochemicals offer, such as improved pest management, cost efficiency, and reduced environmental impact, leading to increased willingness to invest in these alternatives.

North America benefits from a strong agricultural infrastructure, supported by a network of experts and technology providers. This environment encourages the development and integration of semiochemical solutions, with industry professionals advocating for their adoption. Many leading companies in semiochemical technology are based in North America, driving research and innovation and ensuring a wide range of high-quality products in the market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the semiochemicals market, several key players stand out for their contributions to pest management solutions and innovation. ISCA Technologies is a leading player known for its expertise in developing and commercializing semiochemical-based products, offering environmentally friendly alternatives to traditional pesticides

Market Key Players

- SEDQ Healthy Crops SL

- Pacific Biocontrol Corporation

- Bedoukian Research, Inc.

- Suterra LLC

- Shin-Etsu

- Corteva Agriscience

- Koppert Biological System

- Russell IPM Ltd.

- Pherobank B.V.

- ISCA Technologies, Inc.

- Biobest Group NV

- ISAGRO S.p.A.

- Troy Biosciences, Inc.

- International Pheromone Systems

- Agrisense BCS Ltd.

Recent Developments

2024 Koppert Biological Systems: Introduced novel semiochemical-based biocontrol products for organic farming practices, contributing to sustainable agriculture.

2024 Russell IPM Ltd.: Expanded its market presence by launching semiochemical-based pest management solutions tailored to specific regional pest challenges.

2024 Pherobank B.V.: Invested in the development of semiochemical libraries and pheromone-based formulations to address emerging pest threats in agriculture.

Report Scope

Report Features Description Market Value (2023) USD 5.2 Bn Forecast Revenue (2033) USD 22.2 Bn CAGR (2024-2033) 15.6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Pheromones, Allelochemicals), By Source(Animal, Plant, Chemically Synthesized, By Function, Detection and Monitoring, Mass Trapping, Mating Disruption), By Mode of Application(Traps, Sprays, Dispensers, Others), By Crop Type(Orchard Crops, Vegetables, Field Crops, Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape SEDQ Healthy Crops SL, Pacific Biocontrol Corporation, Bedoukian Research, Inc., Suterra LLC, Shin-Etsu, Corteva Agriscience, Koppert Biological System, Russell IPM Ltd., Pherobank B.V., ISCA Technologies, Inc., Biobest Group NV, ISAGRO S.p.A., Troy Biosciences, Inc., International Pheromone Systems, Agrisense BCS Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Name the major industry players in the Semiochemicals Market?SEDQ Healthy Crops SL, Pacific Biocontrol Corporation, Bedoukian Research, Inc., Suterra LLC, Shin-Etsu, Corteva Agriscience, Koppert Biological System, Russell IPM Ltd., Pherobank B.V., ISCA Technologies, Inc., Biobest Group NV, ISAGRO S.p.A., Troy Biosciences, Inc., International Pheromone Systems, Agrisense BCS Ltd.

What is the size of Semiochemicals Market?Semiochemicals Market size is expected to be worth around USD 22.2 billion by 2033, from USD 5.2 Billion in 2023

What CAGR is projected for the Semiochemicals Market?The Semiochemicals Market is expected to grow at 15.6% CAGR (2024-2033).

-

-

- SEDQ Healthy Crops SL

- Pacific Biocontrol Corporation

- Bedoukian Research, Inc.

- Suterra LLC

- Shin-Etsu

- Corteva Agriscience

- Koppert Biological System

- Russell IPM Ltd.

- Pherobank B.V.

- ISCA Technologies, Inc.

- Biobest Group NV

- ISAGRO S.p.A.

- Troy Biosciences, Inc.

- International Pheromone Systems

- Agrisense BCS Ltd.